Asia Pacific Data Analytics Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6141

December 2024

96

About the Report

Asia Pacific Data Analytics Market Overview

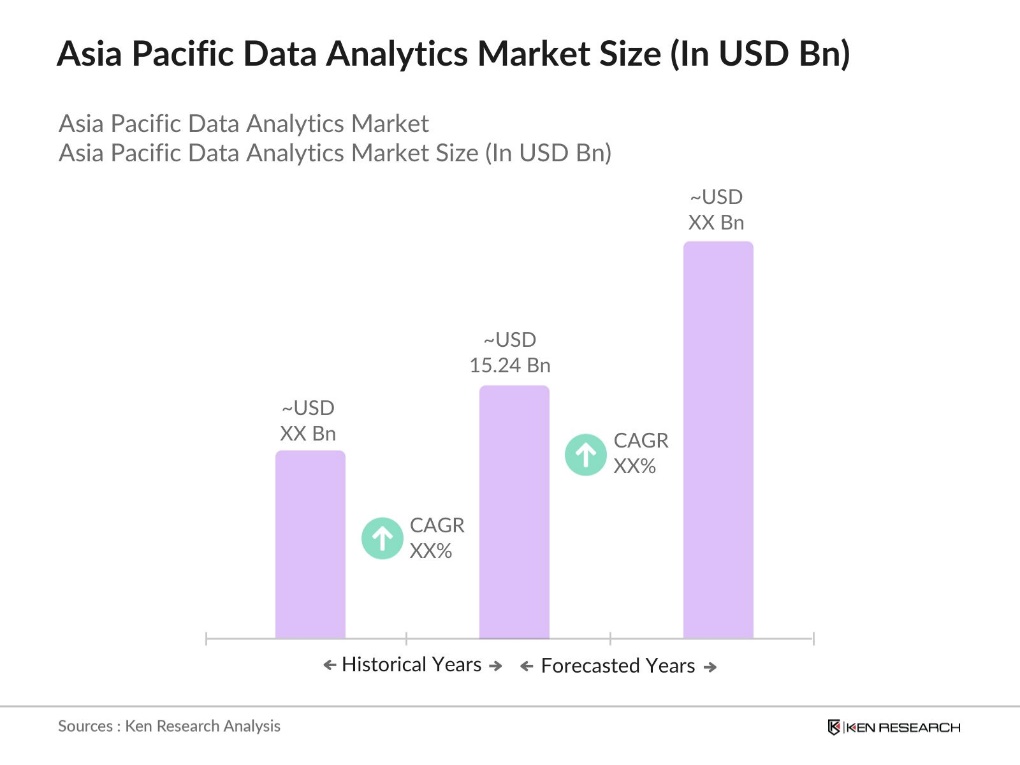

- The Asia Pacific Data Analytics Market is currently valued at USD 15.24 billion, based on a five-year historical analysis, with growth primarily driven by increased digital transformation initiatives and robust investments in big data infrastructure. This growth is also spurred by the rising adoption of analytics-driven solutions across various industries such as retail, finance, and healthcare, where data-centric decision-making is becoming a critical operational strategy.

- Countries such as China, Japan, and India dominate the data analytics market due to their strong economic structures, advanced technological adoption, and supportive governmental policies. China and Japan benefit from substantial investments in IT infrastructure and a proactive approach to artificial intelligence and data analysis, while Indias booming IT sector and workforce expertise further solidify its leading position within the market.

- In August 2023, India enacted the Digital Personal Data Protection Act (DPDPA), which includes provisions for local data storage. This law aims to enhance data privacy and security while enabling law enforcement access to data for investigations. Such policies are crucial for data sovereignty but require companies to adapt infrastructure and processes to meet legal standards, directly influencing data analytics operations.

Asia Pacific Data Analytics Market Segmentation

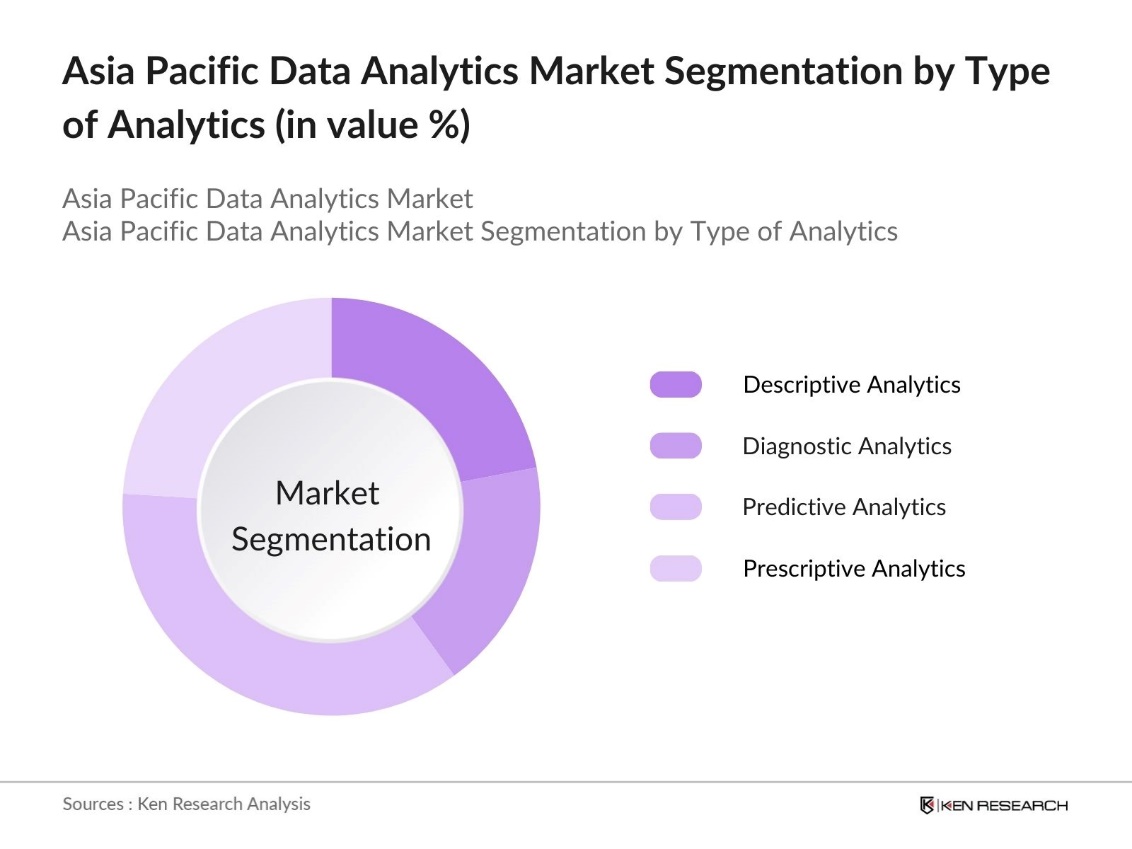

By Type of Analytics: The market is segmented by type of analytics into descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics. Predictive analytics holds a dominant market share in this segment due to its high demand across sectors like finance and healthcare for anticipating future trends and outcomes. This segment is primarily driven by the necessity to harness past data for making informed business predictions, helping organizations gain a competitive edge.

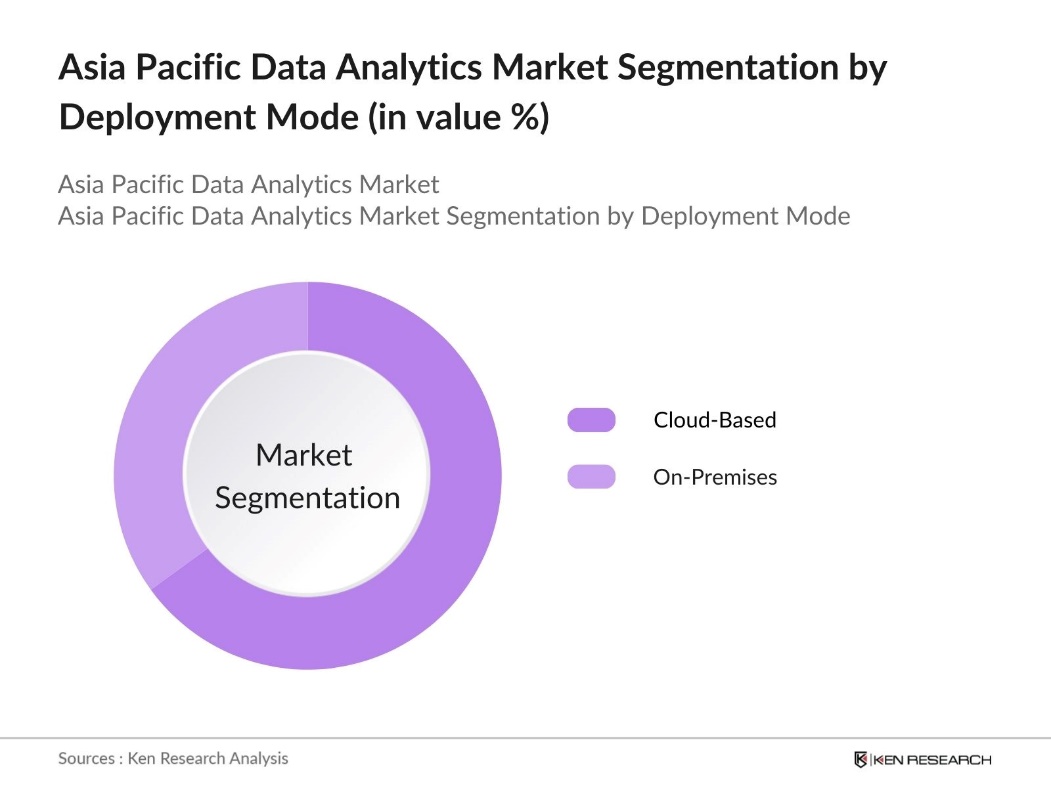

By Deployment Mode: The market is segmented by deployment mode into cloud-based and on-premises solutions. Cloud-based analytics leads this category, as organizations increasingly prefer flexible, scalable solutions with minimal infrastructure costs. The dominance of cloud-based analytics is largely due to the rapid digitalization across Asia Pacific, which has made cloud adoption more feasible and accessible, especially for small and medium-sized enterprises.

Asia Pacific Data Analytics Market Competitive Landscape

The Asia Pacific Data Analytics Market is dominated by several major players who bring advanced technological capabilities and significant regional presence. This competitive landscape is shaped by leading global firms with well-established reputations, such as Microsoft and IBM, along with local players like China-based Baidu, who leverage unique market knowledge and targeted solutions to enhance their position.

Asia Pacific Data Analytics Industry Analysis

Growth Drivers

- Digital Transformation Initiatives (Adoption Rates, IT Spending): Asia Pacific governments and enterprises have accelerated digital transformation initiatives, driven by IT spending that reached USD 560 billion in 2023, with further projections indicating stability in this range for 2024. Countries like India and China are leading this growth, leveraging digitalization to enhance service delivery and efficiency. These shifts position the region as a key player in the global data analytics landscape, making it a prime target for analytics solutions.

- Expanding E-commerce and Digital Economy (Transaction Volume, Digital Payment Growth): India has emerged as a global leader in digital payments, processing approximately 117.6 billion transactions through its Unified Payments Interface (UPI) in 2023, significantly surpassing other countries. This robust digital economy fuels data analytics demand, as e-commerce companies seek insights from extensive customer data to optimize user experiences and streamline operations.

- Rise in Cloud Data Solutions (Cloud Adoption Rate, Infrastructure Spending): The Asia Pacific region is witnessing a significant rise in cloud data solutions, driven by increased cloud adoption and substantial infrastructure investments. This trend is supported by ongoing infrastructure modernization efforts in countries such as Singapore and Australia, which are focused on enhancing scalability and accessibility for advanced data analytics tools. These investments enable businesses across the region to adopt big data and analytics more readily, creating a robust foundation for advanced analytics operations and expanding the potential for real-time, data-driven insights that support business growth and operational efficiency.

Market Challenges

- Data Privacy and Security Concerns (Compliance Issues, Cybersecurity Investments): The growing digital economy in the Asia Pacific region has intensified data privacy concerns, prompting stricter government regulations. Companies now face increased pressure to invest in cybersecurity to ensure compliance with these evolving standards. This regulatory landscape presents challenges for data analytics providers, who must continually invest in robust security frameworks to protect consumer data and meet compliance requirements, driving up operational costs.

- Shortage of Skilled Data Professionals (Skills Gap, Talent Retention Costs): A shortage of skilled data professionals in the Asia Pacific region is hindering the widespread adoption of data analytics. Countries like Japan, South Korea, and India are especially affected, where talent gaps elevate recruitment and retention costs. This skills gap limits companies ability to leverage data analytics effectively, impacting the regions overall competitiveness and growth potential in the analytics field.

Asia Pacific Data Analytics Market Future Outlook

Over the next five years, the Asia Pacific Data Analytics Market is expected to experience significant growth, driven by the rising adoption of artificial intelligence, expansion of data-intensive industries, and increased government focus on data localization and compliance. The regions expanding digital economy and innovations in cloud and edge computing solutions will further catalyze demand for data analytics, making it an integral component for both established and emerging businesses.

Market Opportunities

- Expansion of AI and ML Applications (Machine Learning Use Cases, AI Integration Rates): The Asia Pacific region is seeing rapid growth in the application of artificial intelligence and machine learning across industries, as more companies integrate these technologies to enhance operational efficiency and improve decision-making. Increased use cases in areas like predictive analytics for finance and real-time insights in retail are driving demand for advanced data analytics solutions, enabling businesses to better understand and serve their customers.

- Partnerships in Big Data Ecosystems (Strategic Alliances, Co-Innovation Projects): Collaborations between enterprises and analytics providers are expanding in the Asia Pacific region, with multinational firms increasingly forming strategic alliances and co-innovation projects. These partnerships enable companies to pool data resources and gain more comprehensive insights, especially in industries like finance and retail. This trend strengthens the role of data analytics in strategic business development, creating opportunities for new market entry and enhanced service offerings.

Scope of the Report

|

Type of Analytics |

Descriptive Analytics Diagnostic Analytics Predictive Analytics Prescriptive Analytics |

|

Deployment Mode |

Cloud-Based On-Premises |

|

Component |

Solutions Services |

|

Industry Vertical |

BFSI, Healthcare Retail and E-commerce Telecommunications Government and Public Sector |

|

Country |

China Japan India South Korea Australia

|

Products

Key Target Audience

Large Enterprises

Small and Medium Enterprises (SMEs in APAC Region)

Technology Industry

Healthcare Sector

Telecommunications Companies

Government and Regulatory Bodies (National Data Governance Authority, APAC Digital Council)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

IBM Corporation

Microsoft Corporation

Google LLC

SAP SE

Baidu, Inc.

Oracle Corporation

Amazon Web Services (AWS)

SAS Institute

Alteryx Inc.

Tableau Software

Table of Contents

1. Asia Pacific Data Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Data Analytics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Data Analytics Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Initiatives (Adoption Rates, IT Spending)

3.1.2. Expanding E-commerce and Digital Economy (Transaction Volume, Digital Payment Growth)

3.1.3. Rise in Cloud Data Solutions (Cloud Adoption Rate, Infrastructure Spending)

3.1.4. Increasing Government Focus on Data Policy (Data Privacy, Compliance Regulations)

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns (Compliance Issues, Cybersecurity Investments)

3.2.2. Shortage of Skilled Data Professionals (Skills Gap, Talent Retention Costs)

3.2.3. High Cost of Advanced Analytics Tools (Licensing Costs, TCO)

3.3. Opportunities

3.3.1. Expansion of AI and ML Applications (Machine Learning Use Cases, AI Integration Rates)

3.3.2. Partnerships in Big Data Ecosystems (Strategic Alliances, Co-Innovation Projects)

3.3.3. Growth in Edge Computing (Data Latency Reduction, IoT Adoption)

3.4. Trends

3.4.1. Increased Adoption of Real-Time Analytics (Low-Latency Solutions, Use Cases)

3.4.2. Development of Data Monetization Models (Data-Driven Revenue, Monetization Strategies)

3.4.3. AI-Driven Data Analysis (AI Penetration, Cognitive Analytics)

3.5. Government Regulations

3.5.1. Data Localization Requirements (Country-Specific Regulations, Implementation Rates)

3.5.2. Privacy Frameworks and Compliance (GDPR-Like Policies, National Data Laws)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Data Analytics Market Segmentation

4.1. By Type of Analytics (In Value %)

4.1.1. Descriptive Analytics

4.1.2. Diagnostic Analytics

4.1.3. Predictive Analytics

4.1.4. Prescriptive Analytics

4.2. By Deployment Mode (In Value %)

4.2.1. Cloud-Based

4.2.2. On-Premises

4.3. By Component (In Value %)

4.3.1. Solutions

4.3.2. Services

4.4. By Industry Vertical (In Value %)

4.4.1. Banking, Financial Services, and Insurance (BFSI)

4.4.2. Healthcare

4.4.3. Retail and E-commerce

4.4.4. Telecommunications

4.4.5. Government and Public Sector

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Data Analytics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. SAP SE

5.1.3. Oracle Corporation

5.1.4. Microsoft Corporation

5.1.5. Google LLC

5.1.6. Amazon Web Services (AWS)

5.1.7. SAS Institute

5.1.8. Alteryx Inc.

5.1.9. Tableau Software

5.1.10. Teradata Corporation

5.1.11. Splunk Inc.

5.1.12. Qlik Technologies

5.1.13. TIBCO Software Inc.

5.1.14. FICO (Fair Isaac Corporation)

5.1.15. Salesforce.com, Inc.

5.2. Cross Comparison Parameters

(Revenue, Market Share, R&D Investment, Regional Presence, Customer Base, Cloud Adoption, Proprietary Technology, Employee Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Data Analytics Market Regulatory Framework

6.1. Data Privacy Standards

6.2. Compliance and Certification Processes

6.3. Regional Data Protection Requirements

7. Asia Pacific Data Analytics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Data Analytics Future Market Segmentation

8.1. By Type of Analytics (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Component (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Data Analytics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by mapping the data analytics ecosystem in the Asia Pacific region, identifying significant stakeholders across industries. Desk research, supported by secondary sources, helps in defining key variables and trends shaping the market.

Step 2: Market Analysis and Construction

In this step, historical data is gathered and analyzed to understand market trends, revenue patterns, and technology adoption rates. Key insights into market penetration and customer demographics are used to refine the market construction.

Step 3: Hypothesis Validation and Expert Consultation

Proposed market hypotheses are validated through interviews with industry experts, using Computer-Assisted Telephone Interviews (CATIs). This consultation ensures that findings reflect real-time industry practices and financial insights.

Step 4: Research Synthesis and Final Output

The final stage integrates insights from key data analytics providers and consolidates findings. The outcome is a robust, data-driven report that reflects market dynamics and offers an actionable overview of the Asia Pacific Data Analytics Market.

Frequently Asked Questions

01. How big is the Asia Pacific Data Analytics Market?

The Asia Pacific Data Analytics Market, valued at USD 15.24 billion, is primarily driven by digital transformation initiatives and significant investment in big data infrastructure, with businesses increasingly integrating data analytics to support operational decision-making.

02. What are the challenges in the Asia Pacific Data Analytics Market?

Challenges in Asia Pacific Data Analytics Market include data privacy concerns, a shortage of skilled professionals, and the high cost of advanced analytics tools, which impact adoption rates, particularly among smaller firms.

03. Who are the major players in the Asia Pacific Data Analytics Market?

Key players in Asia Pacific Data Analytics Market include IBM, Microsoft, Google, SAP SE, and Baidu. These companies dominate due to their advanced technology offerings, strong market presence, and substantial R&D investments.

04. What are the growth drivers in the Asia Pacific Data Analytics Market?

The Asia Pacific Data Analytics Market growth is driven by expanding digital economies, increased cloud adoption, and government initiatives supporting digital transformation across industries. The shift towards data-driven insights is further propelling market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.