Asia Pacific Detox Drinks Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD4301

December 2024

86

About the Report

Asia Pacific Detox Drinks Market Overview

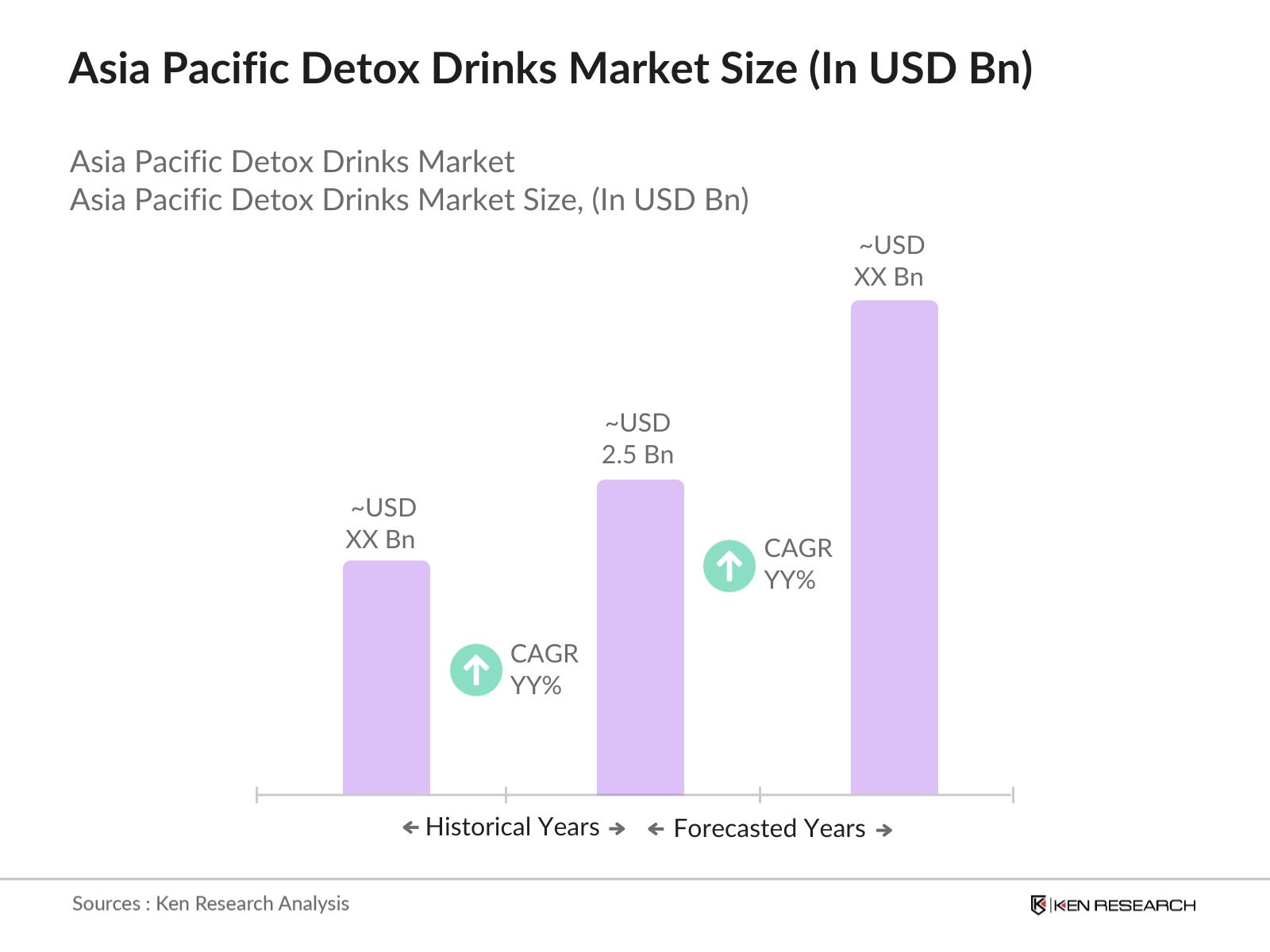

- The Asia Pacific detox drinks market is valued at USD 2.5 billion, with growth attributed to rising health consciousness and increased adoption of wellness trends. The expanding awareness of detox beverages' health benefits, driven by urban lifestyle changes and higher disposable income, has substantially boosted the market. Major urban centers across Asia are key growth areas as they reflect higher consumption rates due to concentrated health-conscious demographics.

- Prominent regions driving the market include China, India, and Japan. These countries lead due to their large populations and high rates of urbanization. The widespread popularity of traditional detox ingredients, combined with an increase in fitness and wellness trends, has made these regions dominant forces in the Asia Pacific market.

- The South Korean government has introduced programs like the National Health Promotion Act, encouraging citizens to opt for natural detox and wellness solutions. In 2024, this initiative reached over 15 million people and increased consumer awareness around detox products, subsequently aiding the growth of detox drinks in the market.

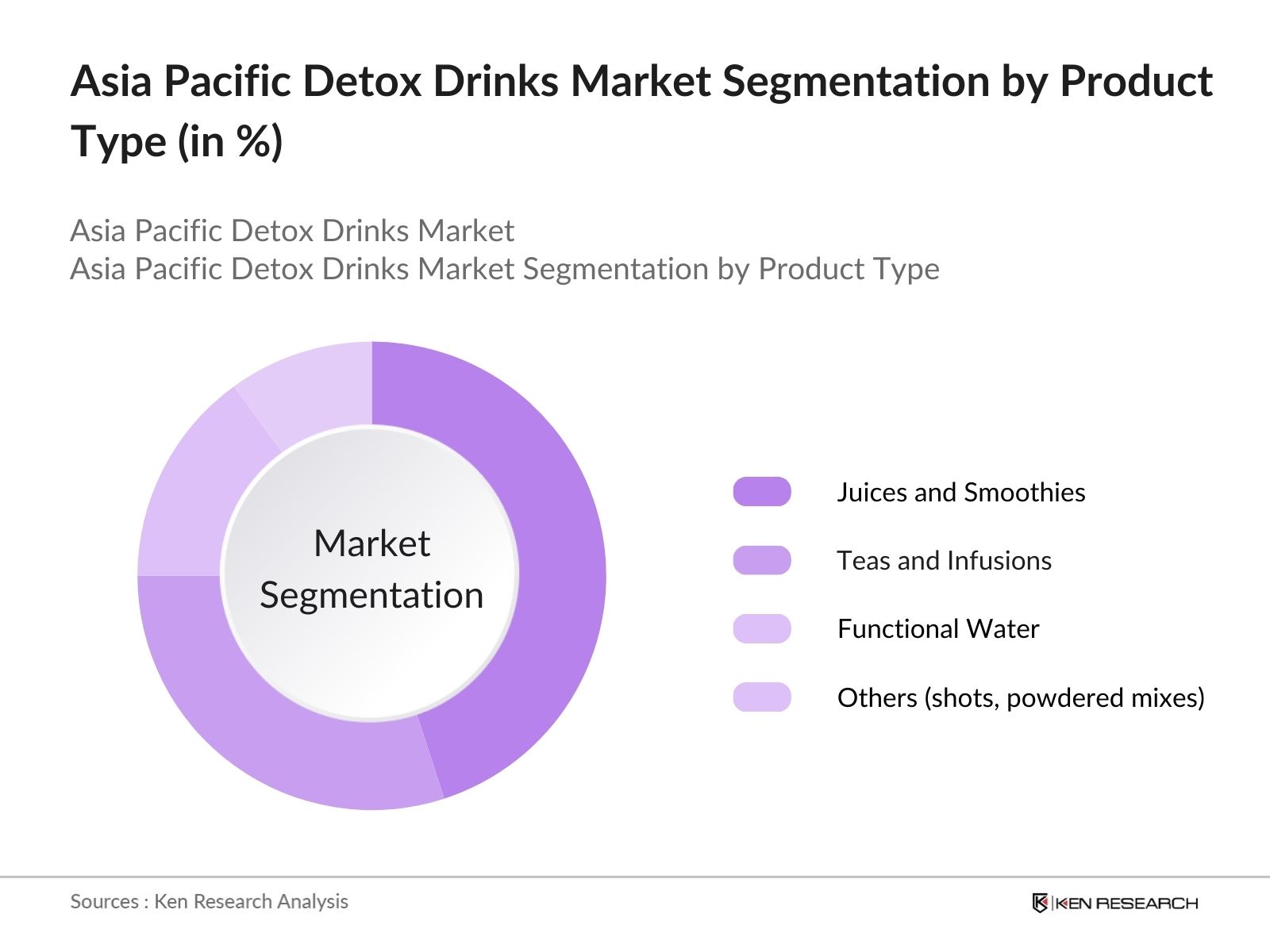

Asia Pacific Detox Drinks Market Segmentation

By Product Type: The market is segmented into juices and smoothies, teas and infusions, functional water, and other forms such as shots and powdered mixes. Among these, juices and smoothies have a dominant market share, mainly because of their rich flavors, accessibility, and perceived health benefits. The convenience of ready-to-drink products and their nutritional profile, particularly with natural detox ingredients like kale, ginger, and berries, contributes to the popularity of this sub-segment.

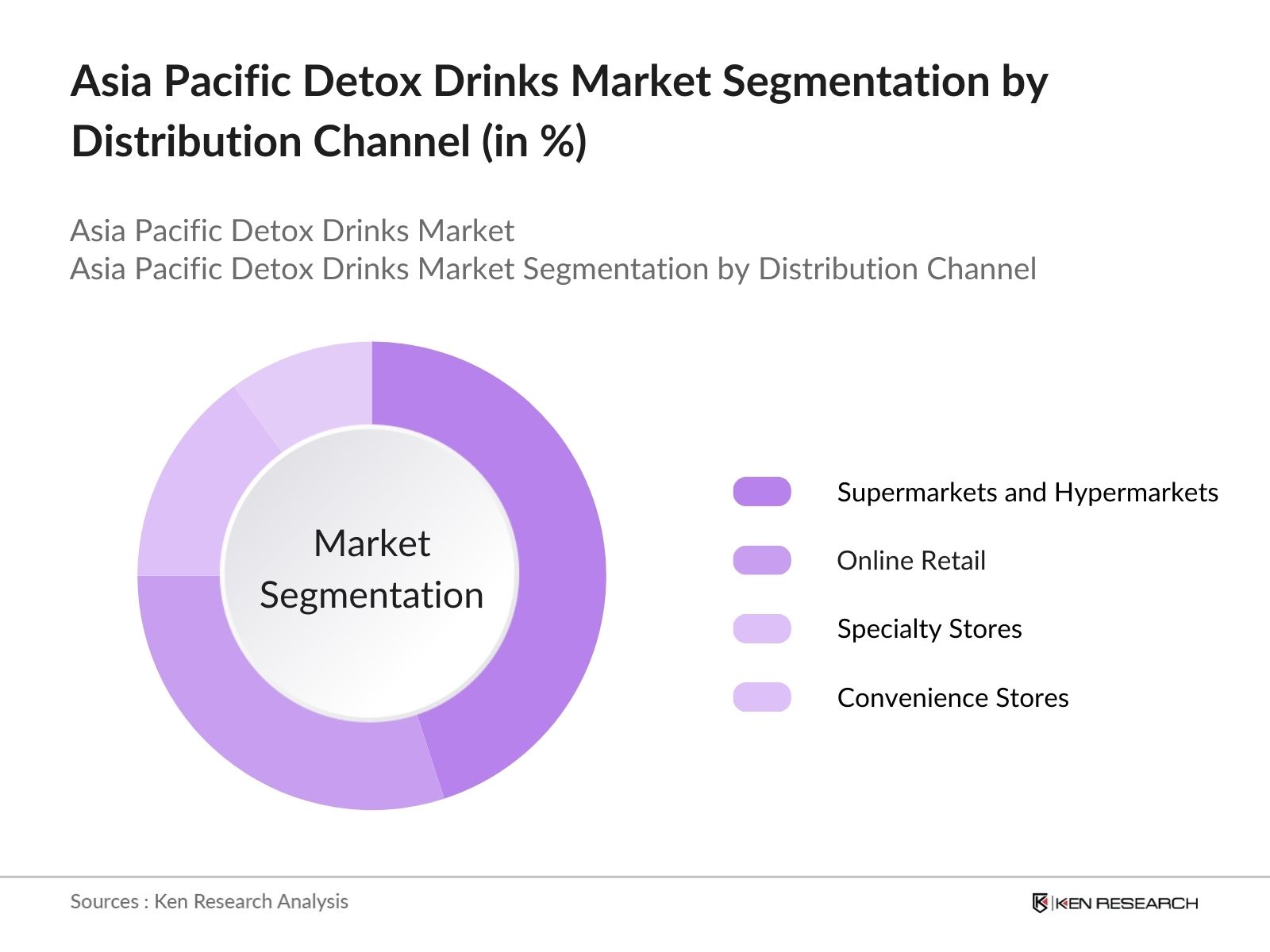

By Distribution Channel: The market is also segmented by distribution channels, including online retail, supermarkets and hypermarkets, specialty stores, and convenience stores. Supermarkets and hypermarkets currently hold the largest share of the market, driven by the availability of a wide range of detox products and the ability of consumers to make informed choices through in-store promotions and information. These retail outlets attract a broad customer base, ensuring easy access to various detox drinks.

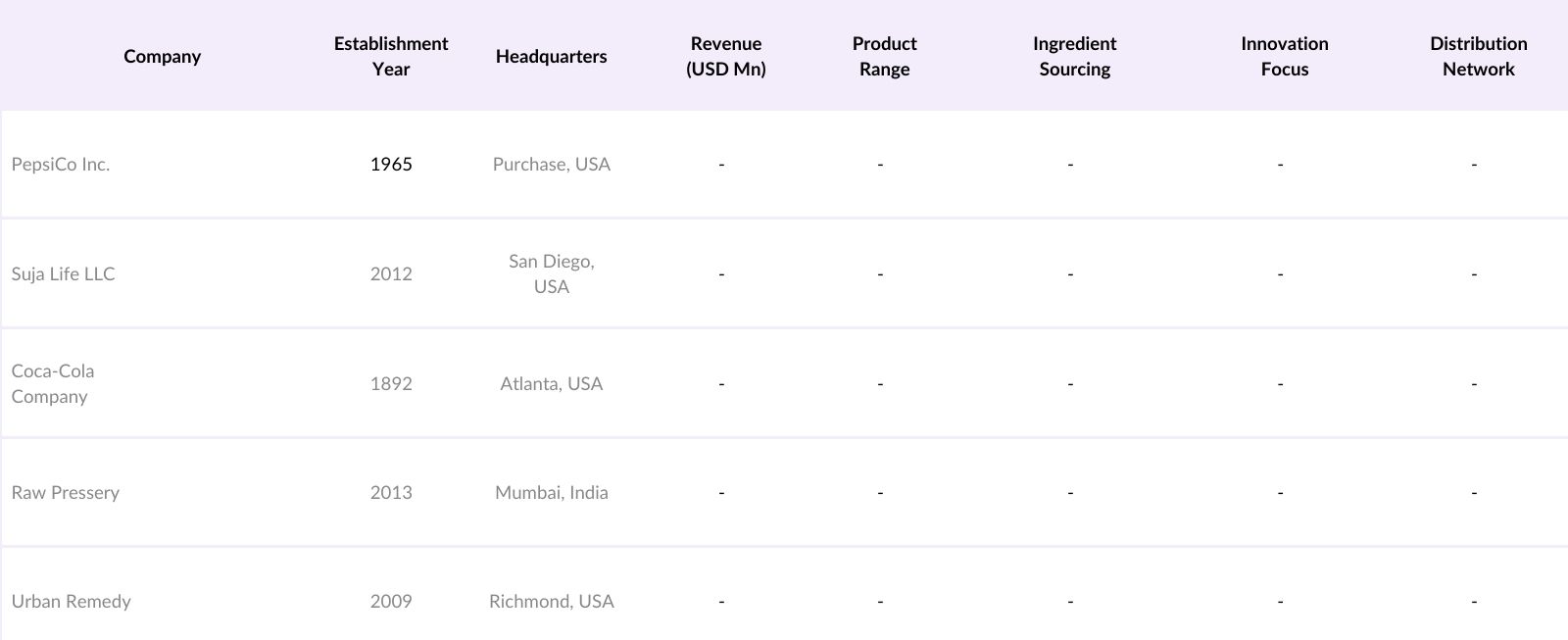

Asia Pacific Detox Drinks Market Competitive Landscape

The market is characterized by a mixture of global and regional players, fostering a competitive landscape focused on product differentiation, strategic partnerships, and branding. Leading companies are engaging in product innovations to cater to the specific demands of health-conscious consumers.

Asia Pacific Detox Drinks Market Analysis

Market Growth Drivers

- Increased Health Awareness: The Asia Pacific region is witnessing a surge in health consciousness, with over 400 million people actively participating in wellness and detox programs as of 2024. This increase has led to a greater demand for detox drinks, as these beverages are often marketed as natural solutions to cleanse and rejuvenate the body. Countries like Japan and South Korea have shown a higher per capita expenditure on health-related products, with detox drinks seeing a notable uptake due to public health campaigns promoting organic and natural wellness products.

- Expansion of Organized Retail Sector: The organized retail sector in Asia Pacific has expanded, with over 200,000 new retail outlets and supermarkets introduced across the region in the last five years, facilitating better distribution of detox drinks. The retail expansion, especially in countries like China and India, enables greater accessibility of premium detox drink brands, thus driving market growth.

- Rising Demand in Urban Centers: With over 50 million urban consumers in Asias key cities such as Tokyo, Beijing, and Mumbai now opting for detox drinks as a regular part of their diet, the market is seeing a significant demand surge. Many consumers report switching to these drinks as part of a healthier lifestyle regimen. As of 2024, reports indicate that urban areas contribute to over 60% of total detox drink sales in the region, a trend expected to rise as more consumers in metropolitan areas adopt health-centric diets.

Market Challenges

- High Production Costs: The inclusion of premium and organic ingredients, like acai berries and activated charcoal, has led to an increase in production costs, with many brands seeing up to 40% higher expenses compared to regular beverages. This cost is often transferred to the consumer, limiting market penetration among lower-income groups across Asia.

- Lack of Consumer Awareness in Rural Areas: Detox drinks are less recognized in rural areas, where around 600 million people reside across Asia Pacific. Studies in 2024 have shown that only a small fraction of rural populations in countries like India and Indonesia are aware of detox beverages and their benefits, hindering market expansion. Despite marketing efforts, limited consumer education remains a key challenge for reaching a broader audience.

Asia Pacific Detox Drinks Market Future Outlook

Over the next five years, the Asia Pacific detox drinks industry is expected to experience robust growth driven by expanding e-commerce penetration, continued demand for natural and functional beverages, and the rise of premium, health-oriented brands.

Future Market Opportunities

- Rising Adoption of AI in Manufacturing for Quality Control: Over the next five years, the market will see adoption of AI technologies to improve manufacturing processes and enhance product quality. By 2029, it is projected that over 100 major detox drink manufacturers will implement AI-driven quality control measures, ensuring consistency in taste and health benefits.

- Expansion of Subscription-Based Services: The demand for subscription-based models in the detox drinks market is expected to grow, with industry experts forecasting that by 2029, around 20 million consumers in Asia will prefer monthly or weekly detox drink deliveries. This model will cater to urban consumers looking for convenience and consistency in their detox routines.

Scope of the Report

|

Product Type |

Juices and Smoothies Teas and Infusions Functional Water Others (shots, powdered mixes) |

|

Distribution Channel |

Online Retail Supermarkets and Hypermarkets Specialty Stores Convenience Stores |

|

Consumer Group |

Millennials Gen Z Health-Conscious Adults Fitness Enthusiasts |

|

Ingredients |

Plant-Based Ingredients Activated Charcoal Probiotics Vitamins and Antioxidants |

|

Region |

China Japan India Australia South Korea |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Health and wellness retailers

Beverage manufacturers

Online retail platforms

Fitness and nutrition centers

Ingredient suppliers

Investor and venture capitalist firms

Government and regulatory bodies (such as FSSAI in India, CFDA in China)

Packaging and sustainable materials companies

Companies

Players Mentioned in the Report:

PepsiCo Inc.

Suja Life LLC

The Coca-Cola Company

Raw Pressery

Pukka Herbs Ltd.

Dr Pepper Snapple Group

Evolution Fresh (Starbucks)

Project Juice

Urban Remedy

Detox Organics

Table of Contents

1. Asia Pacific Detox Drinks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate and Volume Projections

1.4. Market Segmentation Overview

2. Asia Pacific Detox Drinks Market Size (In USD Bn)

2.1. Historical Market Size and Demand Trends

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Strategic Milestones

3. Asia Pacific Detox Drinks Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Health Consciousness (Consumer Behavior Patterns)

3.1.2. Increasing Urbanization and Wellness Trends (Demographic Analysis)

3.1.3. Government Initiatives Supporting Health Products

3.2. Market Challenges

3.2.1. High Price Sensitivity Among Consumers

3.2.2. Limited Product Awareness in Rural Areas

3.2.3. Competition from Alternative Health Beverages

3.3. Opportunities

3.3.1. Expansion in E-Commerce Channels

3.3.2. New Product Innovations and Functional Ingredients

3.3.3. Strategic Collaborations with Local Distributors

3.4. Trends

3.4.1. Popularity of Plant-Based Detox Ingredients

3.4.2. Focus on Ready-to-Drink (RTD) Formats

3.4.3. Clean Label and Transparency Trends in Product Labeling

3.5. Government Regulations

3.5.1. Regulatory Standards for Ingredient Safety

3.5.2. Import and Export Regulations for Health Products

3.5.3. Nutritional Labeling Requirements

4. Asia Pacific Detox Drinks Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Juices and Smoothies

4.1.2. Teas and Infusions

4.1.3. Functional Water

4.1.4. Others (shots, powdered mixes)

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets and Hypermarkets

4.2.3. Specialty Stores

4.2.4. Convenience Stores

4.3. By Consumer Group (In Value %)

4.3.1. Millennials

4.3.2. Gen Z

4.3.3. Health-Conscious Adults

4.3.4. Fitness Enthusiasts

4.4. By Ingredients (In Value %)

4.4.1. Plant-Based Ingredients

4.4.2. Activated Charcoal

4.4.3. Probiotics

4.4.4. Vitamins and Antioxidants

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. South Korea

5. Asia Pacific Detox Drinks Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo Inc.

5.1.2. Suja Life LLC

5.1.3. The Coca-Cola Company

5.1.4. Raw Pressery

5.1.5. Pukka Herbs Ltd.

5.1.6. Dr Pepper Snapple Group

5.1.7. Evolution Fresh (Starbucks)

5.1.8. Project Juice

5.1.9. Urban Remedy

5.1.10. Detox Organics

5.1.11. Lemonkind

5.1.12. BluePrint (Hain Celestial)

5.1.13. Tazo Tea Company

5.1.14. Rebbl Inc.

5.1.15. Suja Life

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Range, Sustainability Initiatives, Market Presence, Ingredient Sourcing, Innovation Focus, Distribution Network)

5.3. Market Share Analysis (Percentage Breakdown)

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Activity

6. Asia Pacific Detox Drinks Market Regulatory Framework

6.1. Standards for Labeling and Advertising

6.2. Quality Assurance and Safety Regulations

6.3. Certification Processes and Approvals

6.4. Import and Export Tariffs for Detox Products

7. Asia Pacific Detox Drinks Future Market Segmentation

71. By Product Type (In Value %)

7.2 By Distribution Channel (In Value %)

7.3 By Consumer Group (In Value %)

7.4 By Ingredients (In Value %)

7.5 By Region (In Value %)

8. Asia Pacific Detox Drinks Future Market Size (In USD Bn)

8.1. Projected Market Size and CAGR

8.2. Key Factors Influencing Future Market Growth

9. Asia Pacific Detox Drinks Market Analyst Recommendations

9.1. Total Addressable Market (TAM) and Serviceable Available Market (SAM) Analysis

9.2. Market Positioning and Brand Differentiation Strategies

9.3. White Space Opportunity and Product Gaps Analysis

9.4. Target Customer Segmentation and Penetration Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase includes mapping major stakeholders within the Asia Pacific Detox Drinks Market. Extensive desk research across secondary and proprietary databases is conducted to gather comprehensive information on critical factors influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed, examining market penetration rates, the balance between suppliers and distributors, and revenue generation from various product types and regions, ensuring the accuracy of estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, such as top executives and product managers, offering financial and operational insights essential for refining market data and trends.

Step 4: Research Synthesis and Final Output

This final phase involves direct engagement with detox drink producers, capturing detailed insights into product segments, sales patterns, and consumer preferences to verify and enhance the statistical data derived, ensuring a well-rounded market analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Detox Drinks Market?

The Asia Pacific detox drinks market is valued at USD 2.5 billion, driven by increasing health consciousness and lifestyle changes.

02. What are the growth drivers for the Asia Pacific Detox Drinks Market?

Growth in this Asia Pacific detox drinks market is fueled by the rising trend toward wellness, high demand for functional beverages, and a growing preference for natural ingredients.

03. Who are the major players in the Asia Pacific Detox Drinks Market?

Key players in the Asia Pacific detox drinks market include Coca-Cola, PepsiCo, Suja Life, Raw Pressery, and Urban Remedy, leveraging extensive product portfolios and established distribution networks.

04. What are the primary challenges in the Asia Pacific Detox Drinks Market?

Challenges in the Asia Pacific detox drinks market include competition from alternative beverages, limited consumer awareness in rural regions, and regulatory compliance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.