Asia Pacific Digital Camera Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10014

November 2024

81

About the Report

Asia Pacific Digital Camera Market Overview

- The Asia Pacific Digital Camera market is currently valued at USD 1.7 billion, driven primarily by the region's technological advancements and increasing demand for high-quality photography among both professionals and consumers. The rise of social media and vlogging culture, especially in countries like Japan, South Korea, and China, has significantly contributed to this growth. Additionally, the growing popularity of mirrorless and compact cameras, which offer both convenience and professional-grade quality, has bolstered market expansion based on a five-year historical analysis.

- Japan, China, and South Korea dominate the market due to their established manufacturing capabilities, innovative technology, and high consumer demand. Japan remains the leading manufacturer, home to giants like Canon, Sony, and Nikon, which consistently push the envelope in camera technology. Chinas vast consumer base and local manufacturing prowess, coupled with South Koreas innovation in mirrorless cameras, further enhance their dominant market position.

- Government policies concerning import and export tariffs play a significant role in the digital camera market in Asia Pacific. As of 2024, several countries, including India and China, have imposed tariffs on imported camera equipment ranging from 5% to 15%. These tariffs increase the overall cost of digital cameras in local markets, affecting both manufacturers and consumers. The fluctuating nature of these tariffs, influenced by trade relations and economic policies, continues to impact the market's growth, with manufacturers often shifting production to local facilities to mitigate the effects of tariffs.

Asia Pacific Digital Camera Market Segmentation

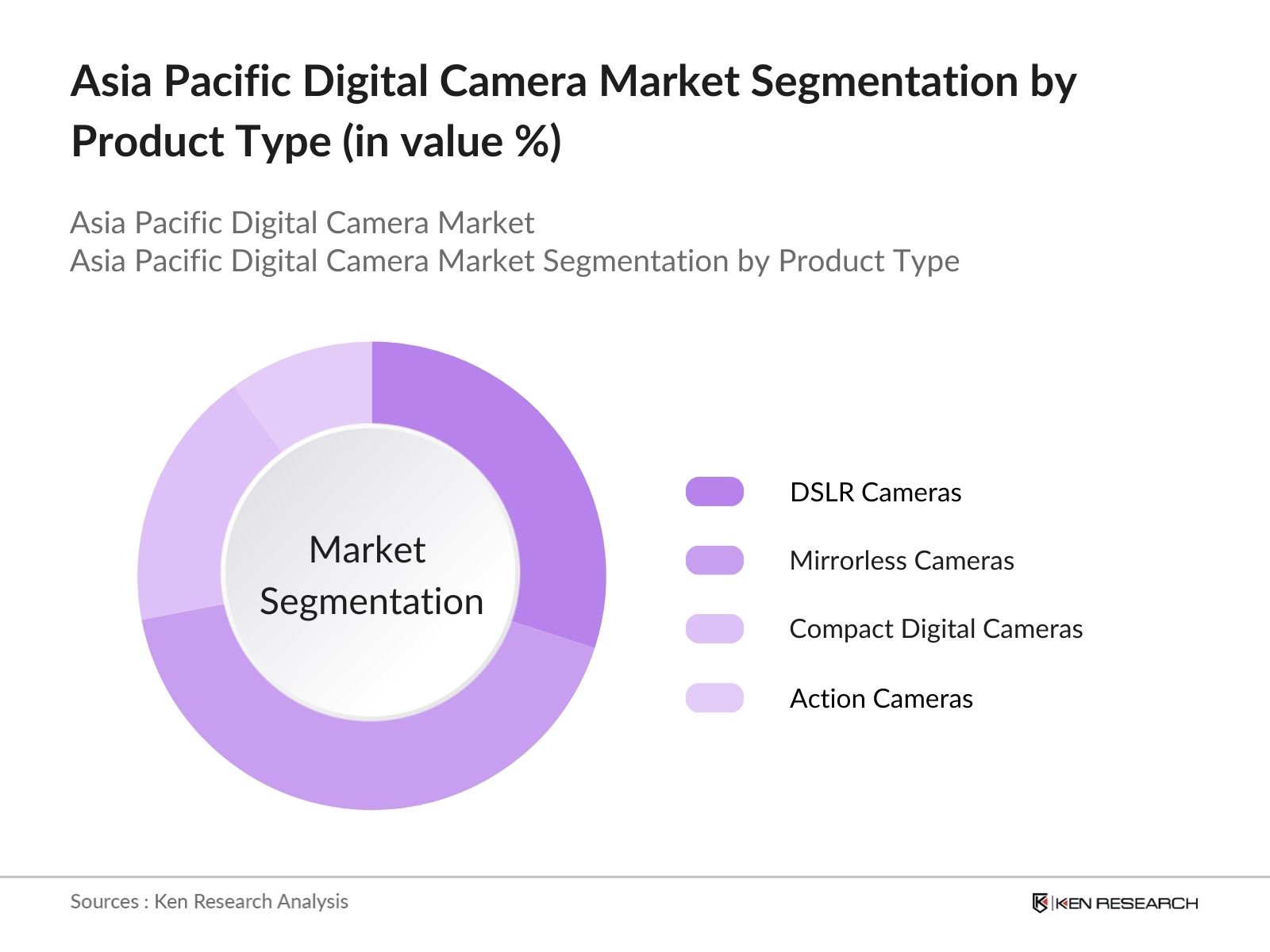

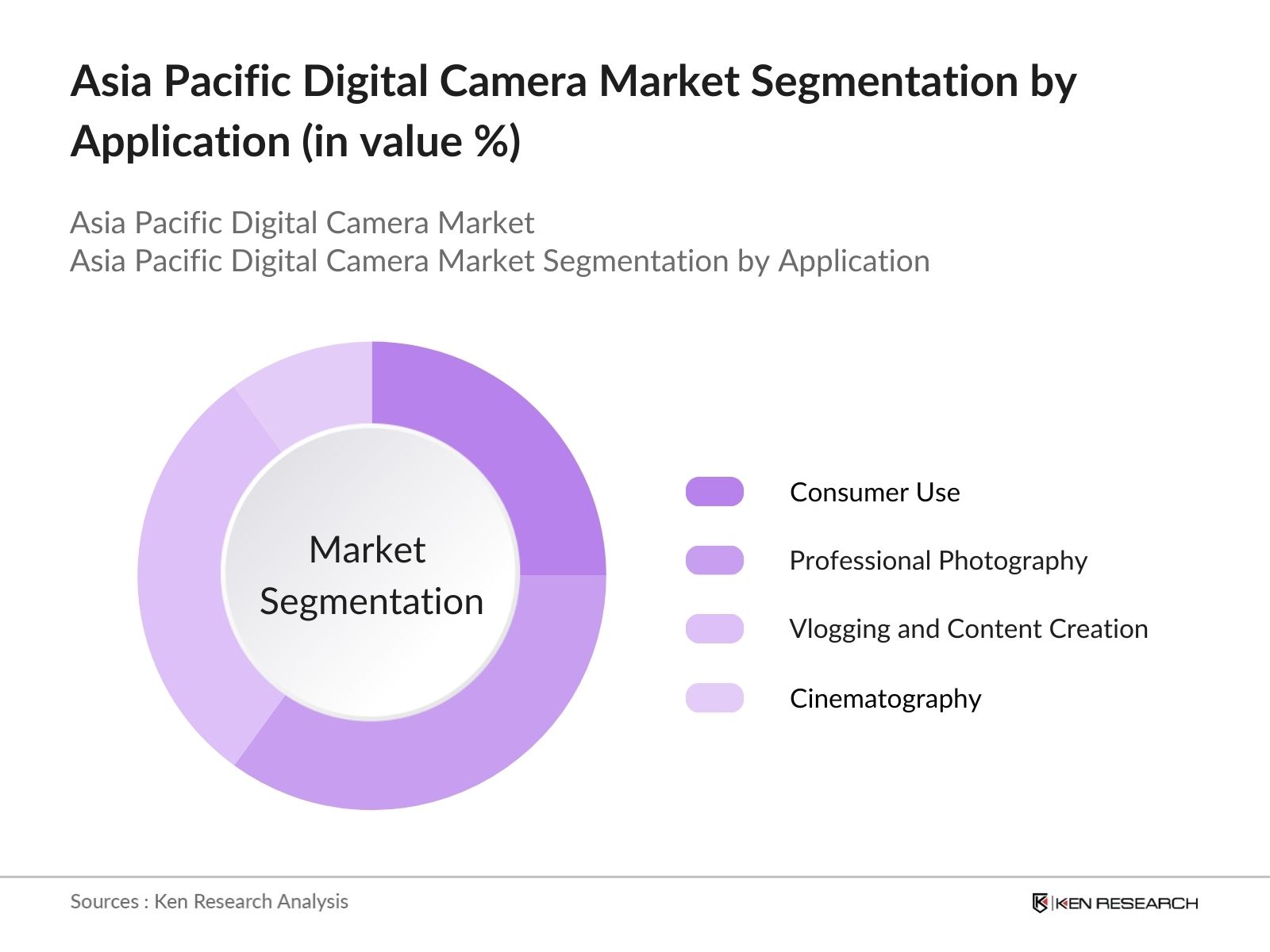

The Asia Pacific Digital Camera market is segmented by product type and by application.

- By Product Type: The market is segmented by product type into DSLR cameras, mirrorless cameras, compact digital cameras, and action cameras. In 2023, mirrorless cameras hold the dominant market share due to their superior image quality, portability, and rapid technological advancements in autofocus and video recording. The transition from DSLR to mirrorless cameras, driven by professional photographers and content creators seeking lighter, high-performance alternatives, has propelled the growth of this segment. Companies like Sony and Fujifilm have spearheaded the introduction of high-resolution mirrorless cameras, further solidifying this segments dominance.

- By Application:

The market is also segmented by application into consumer use, professional photography, vlogging and content creation, and cinematography. In 2023, vlogging and content creation hold a dominant share due to the rapid rise of social media platforms like YouTube, TikTok, and Instagram, where high-quality video content is a necessity. Influencers and independent content creators rely heavily on cameras that offer superior video capabilities, making products like mirrorless and action cameras highly desirable for this segment.

Asia Pacific Digital Camera Market Competitive Landscape

The Asia Pacific Digital Camera market is dominated by a few key players, including both global giants and local manufacturers. Japanese brands like Canon and Sony lead the charge with their innovative product offerings, followed closely by Nikon and Fujifilm. South Koreas Samsung and Chinas DJI have also carved out significant niches, especially in the action and compact camera segments. This consolidation of major players, coupled with technological superiority and extensive distribution networks, underscores the competitive nature of this market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Launches |

Technological Advancements |

Global Market Presence |

R&D Expenditure |

Strategic Partnerships |

|

Canon Inc. |

1937 |

Tokyo, Japan |

||||||

|

Sony Corporation |

1946 |

Tokyo, Japan |

||||||

|

Nikon Corporation |

1917 |

Tokyo, Japan |

||||||

|

Fujifilm Holdings Corporation |

1934 |

Tokyo, Japan |

||||||

|

DJI |

2006 |

Shenzhen, China |

Asia Pacific Digital Camera Industry Growth

Growth Drivers

- Technological Advancements in Camera Sensors (Megapixels, ISO Sensitivity): The digital camera market in the Asia Pacific is benefiting from rapid advancements in sensor technology. Recent innovations have led to the development of sensors with enhanced megapixel capacities and improved ISO sensitivity, allowing for high-quality image capture in low-light conditions. As of 2024, the latest sensors in professional cameras boast resolutions exceeding 60 megapixels, making them suitable for detailed commercial photography. The use of backside-illuminated (BSI) CMOS sensors, which reduce noise in images, is also becoming more common. The high precision of these sensors has driven increased adoption in the professional and commercial sectors.

- Increasing Adoption of Mirrorless Cameras (Unit Shipments, Pricing): Mirrorless cameras are witnessing strong demand in the Asia Pacific region due to their compact size and advanced features. In 2024, unit shipments of mirrorless cameras have surpassed 1.8 million, reflecting the increasing shift away from DSLR technology. The demand is particularly high in countries like Japan and China, driven by consumers seeking lightweight yet high-performing cameras. This trend is also supported by the continuous decline in prices for entry-level mirrorless cameras, making them accessible to amateur photographers while maintaining high-quality performance standards.

- Rising Demand for Action and Sports Cameras (Influence of Social Media, User Base Growth): The demand for action and sports cameras is rapidly growing in the Asia Pacific market, largely fueled by the rise of social media platforms like Instagram and TikTok. These cameras are popular among adventurers and athletes for capturing high-definition footage during extreme sports and outdoor activities. In 2024, it is estimated that over 5 million units of action cameras will be sold across the region, reflecting a growing base of users interested in capturing high-quality videos for online content creation. Social media influencers continue to drive this growth as they increasingly rely on these cameras for content creation.

Market Challenges

- Competition from Smartphones (Impact on Compact Digital Cameras): The growing capabilities of smartphone cameras pose a major challenge to compact digital cameras in the Asia Pacific market. In 2024, smartphone manufacturers have introduced models featuring 50 MP sensors, optical zoom, and AI-enhanced image processing. This has significantly reduced the demand for compact digital cameras, which traditionally catered to amateur users. Compact camera sales have seen a sharp decline, with unit sales dropping below 500,000 in 2024 as users increasingly prefer the convenience of smartphones with similar or superior photographic capabilities.

- High Cost of Professional-Grade Cameras (Pricing, Consumer Affordability): The cost of professional-grade digital cameras remains a key barrier to wider adoption among hobbyists and semi-professional photographers. In 2024, high-end models with full-frame sensors and advanced features can cost upwards of $5,000, making them unaffordable for many potential buyers. This pricing challenge is compounded by stagnant income growth in several Asia Pacific economies, limiting consumers' ability to invest in premium photography equipment. This affordability issue is contributing to a growing second-hand market for high-quality cameras

Asia Pacific Digital Camera Market Future Outlook

The Asia Pacific Digital Camera market is expected to witness steady growth over the next five years, driven by technological advancements in camera sensors, video recording capabilities, and growing demand for digital content creation tools. Increasing investments in R&D by major companies, coupled with the rise of AI-powered features and 8K video recording in mirrorless and compact cameras, are expected to fuel market expansion. The market will also benefit from the growth of social media platforms and the continuous popularity of high-quality photography and videography.

- Market Opportunities: Expansion in Consumer Segments (Entry-Level, Professional): The Asia Pacific digital camera market is seeing opportunities in both entry-level and professional segments. In 2024, the entry-level segment has seen increased demand from hobbyist photographers, with sales surpassing 1 million units across major economies like India and Indonesia. On the professional side, more photographers are upgrading to advanced models due to growing requirements for high-quality images in various industries such as advertising, fashion, and e-commerce. This expansion reflects the broadening consumer base willing to invest in digital camera technology for personal and commercial use.

- Growth in Vlogging and Content Creation Market (Influencer Marketing, Video Platforms): The rise of vlogging and content creation platforms is providing significant opportunities for digital camera manufacturers in the Asia Pacific region. As of 2024, over 3 million individuals are engaged in content creation as influencers on platforms such as YouTube and TikTok. This has led to increased demand for high-quality cameras with advanced video recording capabilities. Cameras offering features such as 4K video, stabilization, and wireless connectivity are particularly popular among vloggers, enabling them to produce professional-grade content. This trend is further supported by growing investments in influencer marketing across the region.

Scope of the Report

|

|||

|

By Distribution Channel |

Offline (Retail Stores, Camera Shops) Online (E-Commerce Platforms, Direct Sales) |

||

|

By Application |

|

||

|

By Resolution Type |

Below 12 Megapixels 12 to 24 Megapixels 25 to 50 Megapixels Above 50 Megapixels |

||

|

By Region |

North East West South |

Products

Key Target Audience

Digital Camera Manufacturers

Photography Equipment Distributors

Retailers and Wholesalers

Professional Photographers and Videographers

Vlogging and Content Creators

Government and Regulatory Bodies (Ministry of Information and Communications)

Investors and Venture Capitalist Firms

Electronic Retail Chains

Banks and Financial Institutes

Companies

Players Mention in the Report:

Canon Inc.

Nikon Corporation

Sony Corporation

Fujifilm Holdings Corporation

Panasonic Corporation

Olympus Corporation

GoPro Inc.

Leica Camera AG

Sigma Corporation

Ricoh Imaging Company Ltd.

Hasselblad

Blackmagic Design

Phase One A/S

DJI

Kodak Alaris

Table of Contents

1. Asia Pacific Digital Camera Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Region-wise breakdown: East Asia, Southeast Asia, Australasia, South Asia)

1.4. Market Segmentation Overview

2. Asia Pacific Digital Camera Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (In Value %)

2.3. Key Market Developments and Milestones

3. Asia Pacific Digital Camera Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements in Camera Sensors (Megapixels, ISO Sensitivity)

3.1.2. Increasing Adoption of Mirrorless Cameras (Unit Shipments, Pricing)

3.1.3. Rising Demand for Action and Sports Cameras (Influence of Social Media, User Base Growth)

3.1.4. Increased Usage of Digital Cameras in Professional Photography (Sales in Studio and Commercial Use)

3.2. Market Challenges

3.2.1. Competition from Smartphones (Impact on Compact Digital Cameras)

3.2.2. High Cost of Professional-Grade Cameras (Pricing, Consumer Affordability)

3.2.3. Supply Chain Disruptions (Component Shortages, Semiconductor Issues)

3.3. Opportunities

3.3.1. Expansion in Consumer Segments (Entry-Level, Professional)

3.3.2. Growth in Vlogging and Content Creation Market (Influencer Marketing, Video Platforms)

3.3.3. Development of AI and Smart Cameras (AI-powered Autofocus, Face Detection, Scene Recognition)

3.4. Trends

3.4.1. Growth of Full-Frame Mirrorless Cameras (Sensor Technology)

3.4.2. 4K and 8K Video Recording Capabilities (Adoption Rate, Consumer Demand)

3.4.3. Increased Demand for Compact, Portable Cameras (Travel, Adventure Use)

3.5. Government Regulation

3.5.1. Import and Export Tariffs on Camera Equipment

3.5.2. Regulations on Lithium-Ion Battery Usage in Cameras

3.5.3. Country-Specific Environmental Regulations for Digital Camera Waste Disposal

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, End-users)

3.8. Porters Five Forces Analysis (Supplier Bargaining Power, Buyer Bargaining Power, Threat of Substitutes, Threat of New Entrants, Competitive Rivalry)

3.9. Competition Ecosystem

4. Asia Pacific Digital Camera Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. DSLR Cameras

4.1.2. Mirrorless Cameras

4.1.3. Compact Digital Cameras

4.1.4. Action Cameras

4.1.5. Specialty Cameras (360-degree Cameras, Underwater Cameras)

4.2. By Application (In Value %)

4.2.1. Consumer (Home Use, Personal Photography)

4.2.2. Professional (Commercial Photography, Studio Use)

4.2.3. Vlogging and Content Creation

4.2.4. Sports and Adventure

4.2.5. Cinematography and Video Production

4.3. By Resolution Type (In Value %)

4.3.1. Below 12 Megapixels

4.3.2. 12 to 24 Megapixels

4.3.3. 25 to 50 Megapixels

4.3.4. Above 50 Megapixels

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Retail Stores, Camera Shops)

4.4.2. Online (E-Commerce Platforms, Direct Sales)

4.5. By Region (In Value %)

4.5.1. East

4.5.2. South

4.5.3. North

4.5.4. West

5. Asia Pacific Digital Camera Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Canon Inc.

5.1.2. Nikon Corporation

5.1.3. Sony Corporation

5.1.4. Fujifilm Holdings Corporation

5.1.5. Panasonic Corporation

5.1.6. Olympus Corporation

5.1.7. GoPro Inc.

5.1.8. Leica Camera AG

5.1.9. Sigma Corporation

5.1.10. Ricoh Imaging Company Ltd.

5.1.11. Hasselblad

5.1.12. Blackmagic Design

5.1.13. Phase One A/S

5.1.14. DJI

5.1.15. Kodak Alaris

5.2. Cross Comparison Parameters (Revenue, Market Share, Camera Shipments, Technological Advancements, New Product Launches, Strategic Alliances, Geographic Expansion)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Digital Camera Market Regulatory Framework

6.1. Certification Standards (ISO, BIS)

6.2. Safety and Compliance Requirements for Lithium Batteries

6.3. Environmental Regulations for Camera Waste and Disposal

7. Asia Pacific Digital Camera Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Digital Camera Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Resolution Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Digital Camera Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Targeting

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on constructing an ecosystem map, covering all major stakeholders in the Asia Pacific Digital Camera Market. Extensive desk research, using secondary and proprietary databases, helps identify and define key variables such as camera shipments, technological advancements, and market penetration rates.

Step 2: Market Analysis and Construction

In this stage, historical data related to the Asia Pacific Digital Camera Market is compiled and analyzed, covering market penetration, revenue generation, and sales performance. Additional evaluations are conducted to assess camera production statistics, ensuring a reliable basis for revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through computer-assisted telephone interviews (CATIs) with industry experts from camera manufacturing companies. This helps refine market data, offering insights into key factors like pricing trends, sales channels, and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves direct consultation with major camera manufacturers to acquire detailed information on product segments, consumer preferences, and sales performance. The data collected is synthesized to ensure accurate and comprehensive insights into the Asia Pacific Digital Camera market.

Frequently Asked Questions

01. How big is the Asia Pacific Digital Camera Market?

The Asia Pacific Digital Camera market was valued at USD 1.7 billion, driven by technological advancements and the growing popularity of photography and vlogging across the region.

02. What are the key drivers of the Asia Pacific Digital Camera Market?

Key drivers in Asia Pacific Digital Camera market include rising demand for mirrorless and action cameras, technological innovations such as AI autofocus, and the increasing influence of social media platforms that drive demand for high-quality video and photography equipment.

03. What challenges does the Asia Pacific Digital Camera Market face?

The Asia Pacific Digital Camera market faces challenges from the rising popularity of smartphones, which offer competitive camera features, and supply chain disruptions affecting the availability of key components like sensors and chips.

04. Who are the major players in the Asia Pacific Digital Camera Market?

Major players in this Asia Pacific Digital Camera market include Canon Inc., Nikon Corporation, Sony Corporation, Fujifilm Holdings, and DJI, known for their innovative camera technologies and strong market presence.

05. What are the growth prospects for the Asia Pacific Digital Camera Market?

The Asia Pacific Digital Camera market is poised for growth, driven by continuous technological advancements, increasing demand for professional-grade cameras, and the expanding influence of content creation in both professional and consumer segments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.