Asia Pacific Digital Pathology Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD1742

December 2024

86

About the Report

Asia Pacific Digital Pathology Market Overview

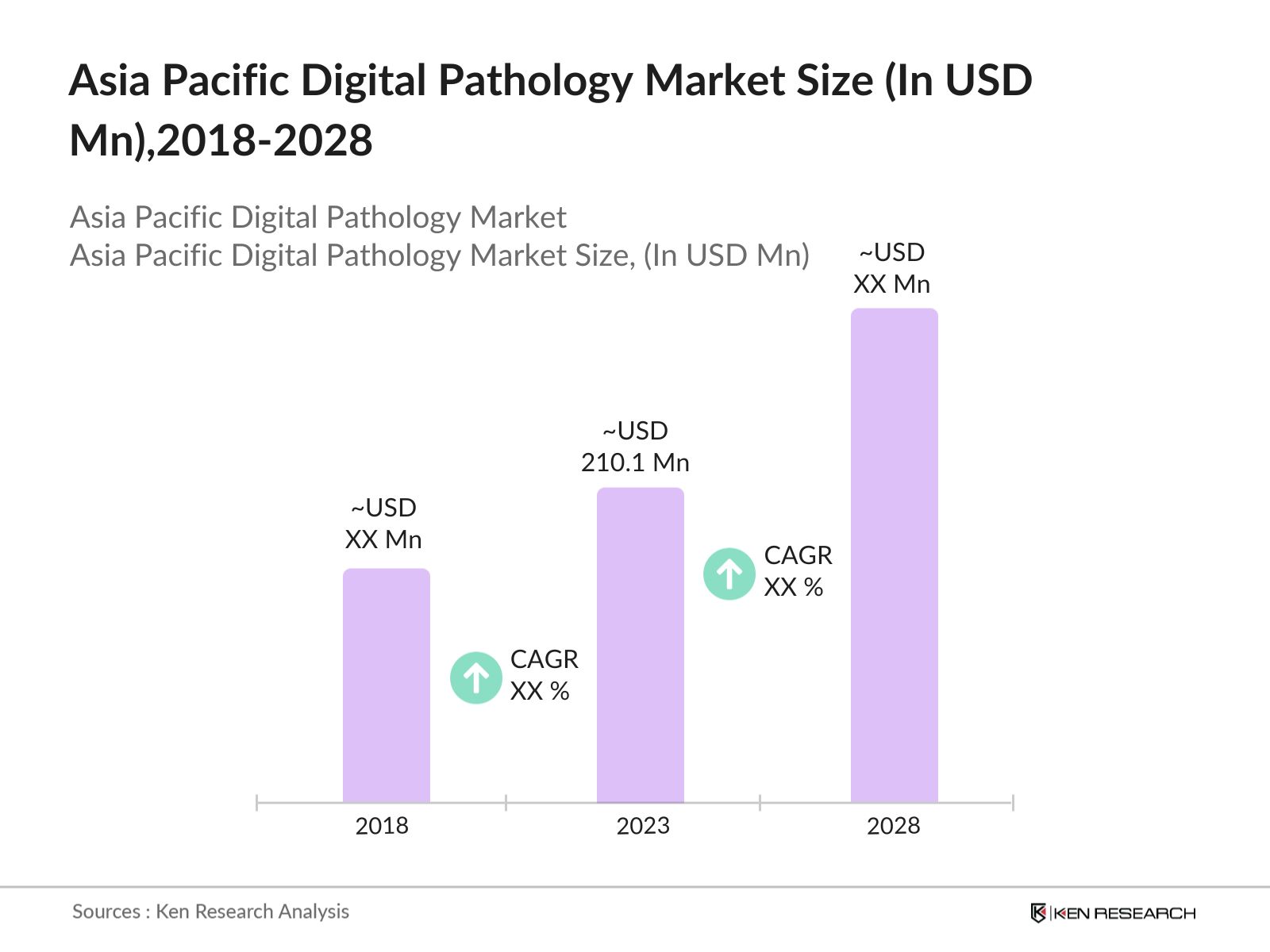

- The Asia Pacific Digital Pathology Market was valued at 0.1 million in 2023. This growth is driven by several factors, including the increasing prevalence of chronic diseases, the rising adoption of digital pathology in research and diagnostics, and the growing need for efficient and accurate diagnostic tools in the region. The integration of Artificial Intelligence (AI) in digital pathology workflows has also played a significant role in boosting market demand.

- The market is dominated by several key players who have a strong presence in the region. These include Leica Biosystems, Koninklijke Philips N.V., 3DHISTECH Ltd., Hamamatsu Photonics K.K., and Roche Diagnostics. These companies have established themselves through a combination of innovative product offerings, strategic partnerships, and extensive distribution networks, making them leaders in the Asia Pacific digital pathology landscape.

- In 2022, anned the strategic collaboration between Leica Biosystems and Indica Labs. This partnership aims to enhance digital pathology workflows by integrating Indica Labs' image analysis software with Leica Biosystems' digital pathology solutions. This collaboration is expected to accelerate the adoption of digital pathology across Asia Pacific, particularly in China and India, where the demand for advanced diagnostic tools is rapidly increasing.

- In 2023, Shanghai is the city dominating the digital pathology market. As a leading healthcare hub, Shanghai is home to several top-tier hospitals, research institutions, and healthcare technology companies. The city's advanced healthcare infrastructure and strong focus on innovation in medical technology have positioned it at the forefront of the digital pathology market in China.

Asia Pacific Digital Pathology Market Segmentation

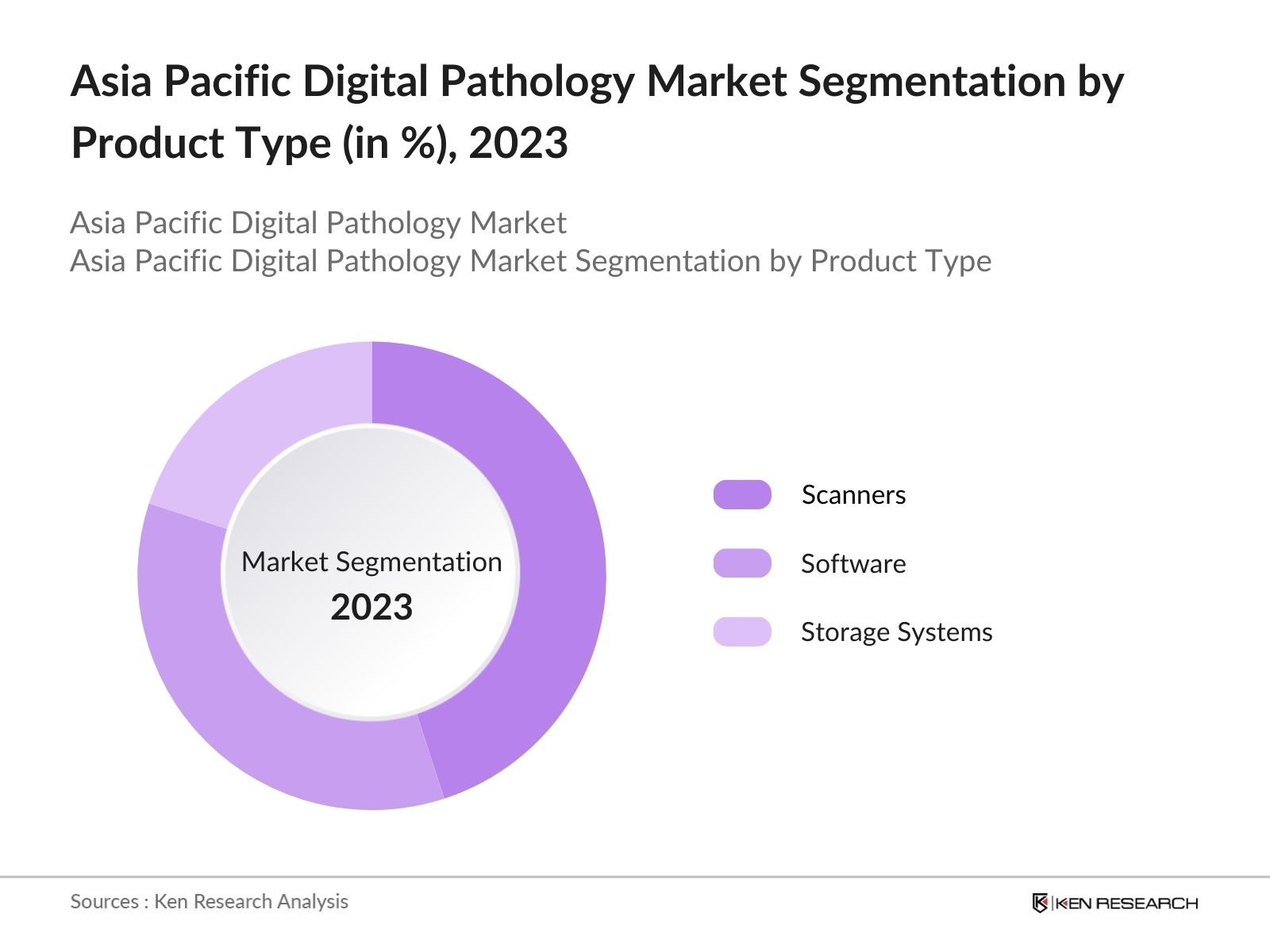

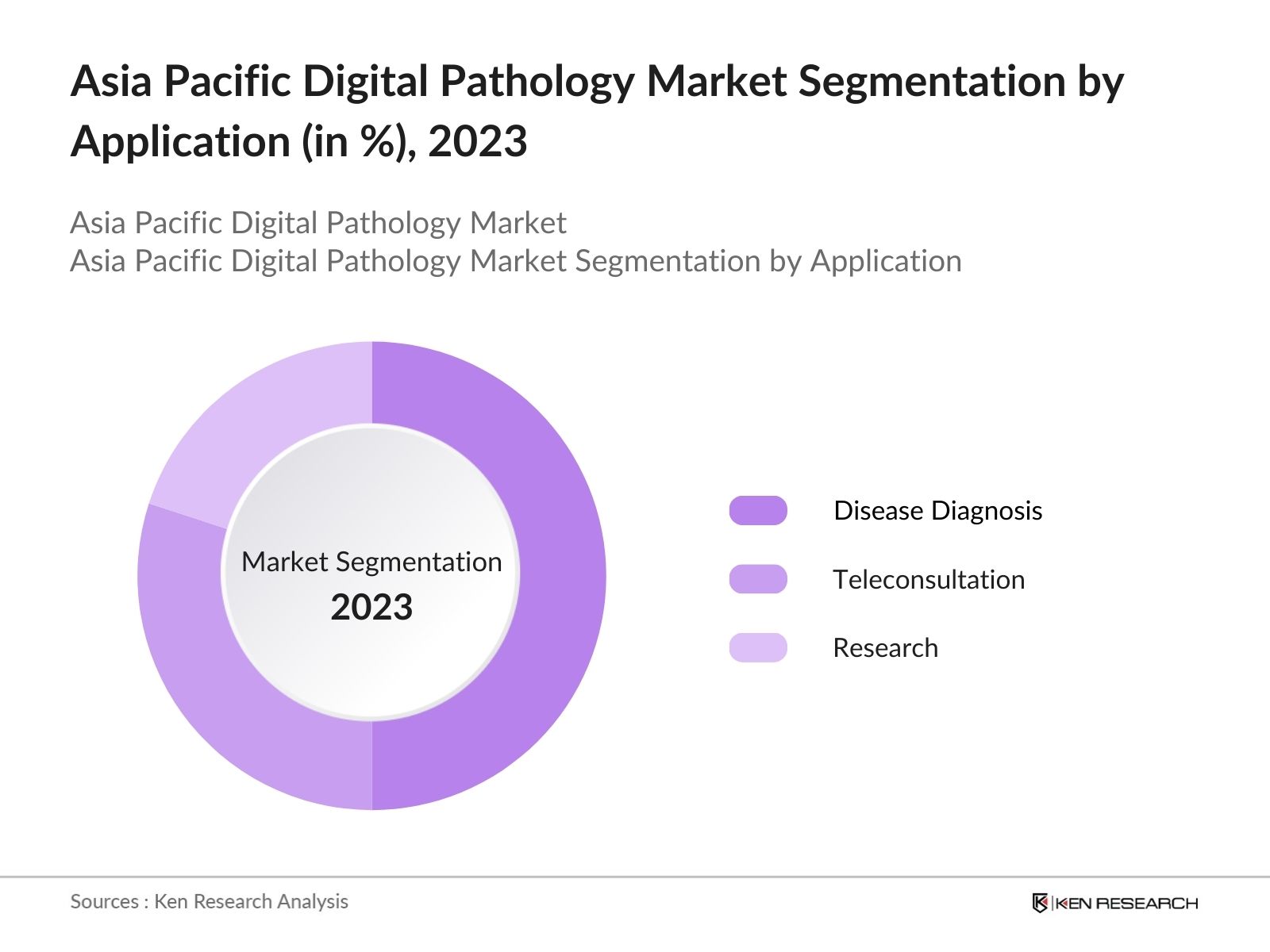

The Asia Pacific Digital Pathology Market is segmented into different factors like by product type, by application and region.

By Product Type: The Asia Pacific digital pathology market is segmented by product type into Scanners, Software, and Storage Systems. In 2023, Scanners were dominating the market due to the critical role scanners play in digitizing pathology slides, which are essential for subsequent analysis and storage. The demand for high-resolution and AI-integrated scanners has surged as healthcare providers seek to improve diagnostic accuracy and workflow efficiency By Application: The market is further segmented by application into Disease Diagnosis, Teleconsultation, and Research. In 2023, Disease Diagnosis was the leading segment in this market due to the increasing prevalence of chronic diseases, particularly cancer, which has driven the demand for accurate and efficient diagnostic tools. Digital pathology is becoming an integral part of the diagnostic process in hospitals and clinics, where it aids in the rapid analysis of tissue samples.

By Application: The market is further segmented by application into Disease Diagnosis, Teleconsultation, and Research. In 2023, Disease Diagnosis was the leading segment in this market due to the increasing prevalence of chronic diseases, particularly cancer, which has driven the demand for accurate and efficient diagnostic tools. Digital pathology is becoming an integral part of the diagnostic process in hospitals and clinics, where it aids in the rapid analysis of tissue samples.

- By Region: The market is segmented by region into China, South Korea, Japan, India, Australia, and the Rest of APAC. In 2023, China region was dominating the market, driven by its attribution to the country's significant investments in healthcare infrastructure, a large patient population, and the government's focus on digital health initiatives. China's dominance is expected to continue, driven by ongoing government support, technological advancements, and the presence of key market players.

Asia Pacific Digital Pathology Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Leica Biosystems |

1989 |

Wetzlar, Germany |

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

|

Roche Diagnostics |

1896 |

Basel, Switzerland |

|

3DHISTECH |

1996 |

Budapest, Hungary |

|

Hamamatsu Photonics |

1953 |

Shizuoka, Japan |

- Philips Healthcare: In 2024 recently strengthened its leadership in digital pathology by securing 510(k) clearance from the U.S. FDA for its latest version of the IntelliSite Pathology Solution (version 5.1). This solution enhances remote collaboration, improves diagnostic accuracy, and increases productivity, addressing current challenges like pathologist shortages. The system offers an integrated, end-to-end digital workflow that supports multidisciplinary clinical collaboration, ultimately leading to better patient outcomes and more efficient healthcare delivery.

- Roche Diagnostics: In 2024, Roche announced that its whole-slide imaging system, the Roche Digital Pathology Dx (VENTANA DP obtained 510(k) clearance from the U.S. Food and Drug Administration (FDA). The system is designed to assist pathologists in reviewing and interpreting digital images of scanned pathology slides to support patient diagnosis.

Asia Pacific Digital Pathology Market Analysis

Market Growth Drivers

- Rising Incidence of Chronic Diseases Requiring Digital Pathology: The increasing burden of chronic diseases such as cancer, cardiovascular diseases, and diabetes is driving the demand for digital pathology solutions that can facilitate early and precise diagnosis. Over 35 million new cancer cases are predicted globally in from the estimated 20 million cases in 2022, emphasizing the critical need for accurate and timely diagnostic solutions.

- Expansion of Healthcare Infrastructure Across Emerging Markets: Countries like India and Indonesia have significantly ramped up their healthcare infrastructure investments in 2024, with India alone allocating over USD 98.98 , diagnostic centers, and the integration of advanced technologies such as digital pathology in existing healthcare facilities. They have suggested increasing healthcare spending to 2.5 per cent of GDP, focusing on rural areas, and encouraging private investment in medical colleges and healthcare facilities.

- Increasing Adoption of AI-Powered Diagnostic Tools: The growing adoption of AI-powered diagnostic tools is transforming healthcare, particularly in regions like South Korea and the broader Asia Pacific. In 2024, over half of the leading hospitals in South Korea implemented AI-based digital pathology systems, significantly improving diagnostic precision and efficiency. AI integration allows faster, more accurate pathology analysis, reducing diagnostic errors and driving market growth. This shift reflects a broader recognition of AI’s potential in enhancing healthcare outcomes across the region.

Market Challenges

- Lack of Standardized Regulations Across the Region: In 2024, the Asia Pacific region faced significant regulatory challenges due to the lack of standardized guidelines for the implementation and use of digital pathology. Countries like India and Indonesia have different regulatory frameworks, creating hurdles for multinational companies trying to introduce their products in these markets. This regulatory inconsistency has led to delays in product approvals, increased compliance costs, and hindered the seamless adoption of digital pathology solutions across the region.

- Shortage of Skilled Personnel to Operate Digital Pathology Systems: In 2024, the Asia Pacific region faced a shortage of skilled pathologists and IT professionals capable of operating advanced digital pathology systems. This shortage is particularly acute in emerging markets like Vietnam and the Philippines, where the availability of trained personnel is limited. The lack of skilled professionals hinders the effective implementation and utilization of digital pathology solutions, slowing down market growth and adoption rates in these regions.

Market Government Initiatives

- India’s Ayushman Bharat Digital Mission (ABDM): In 2024, the Indian government expanded the Ayushman Bharat Digital Mission with an additional INR 500 billion investment to digitize healthcare records and integrate digital pathology solutions across public hospitals. This initiative is designed to enhance healthcare accessibility and efficiency by enabling the digital storage and sharing of pathology data. The expansion of ABDM is expected to significantly boost the adoption of digital pathology in India, particularly in rural and underserved areas.

- India’s Digital Health Incentive Scheme (DHIS): Launched on January 1, 2023, by the National Health Authority under the Ayushmthe Health Facility Registry earn incentives based on their digital transactions. By June 2023, over 1,200 facilities and 25 digital solution companies participated, receiving ?4.84 crore in incentives, fostering a stronger, digitally integrated healthcare ecosystem.

Asia Pacific Digital Pathology Market Future Outlook

The Asia Pacific Digital Pathology Market is projected to grow exponentially by 2028. The market will be driven by advancements in AI and machine learning, increasing investment in healthcare infrastructure, and the growing need for personalized medicine. The adoption of digital pathology will expand beyond major urban centers to more rural areas, driven by government initiatives aimed at improving healthcare access across the region.

Market Trends

- Growth in Personalized Medicine and Digital Pathology: By 2028, the digital pathology market in Asia Pacific will see a strong link with the growing field of personalized medicine. As personalized treatment plans become more prevalent, digital pathology will play a critical role in analyzing patient-specific pathology data. The increasing focus on personalized medicine will drive demand for advanced digital pathology systems capable of supporting detailed and individualized diagnostic processes.

- Adoption of Cloud-Based Digital Pathology Solutions: By 2028, cloud-based digital pathology solutions will become the norm in Asia Pacific, offering scalable and cost-effective alternatives to on-premise systems. The adoption of cloud-based solutions will facilitate the storage, sharing, and analysis of pathology data across multiple locations, improving collaboration between healthcare providers. Governments and private institutions will invest in cloud infrastructure to support the growing demand for digital pathology, leading to the widespread adoption of these solutions across the region.

Scope of the Report

|

By Product Type |

Scanners Software Storage Systems |

|

By Application |

Disease Diagnosis Teleconsultation Research |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Public and Private Hospitals

- Diagnostic Laboratories

- Biotechnology Companies

- Medical Device Manufacturing Companies

- Telemedicine Companies

- Pharmaceutical Companies

- Health Technology Assessors

- Investors and VC Firms

- Banks and Financial Firms

- Government Healthcare Agencies (National Health Commission of the People's Republic of China, Ministry of Health and Family Welfare, India)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mention in the Report:-

- Philips Healthcare

- Leica Biosystems

- Roche Diagnostics

- 3DHISTECH

- Hamamatsu Photonics

- Olympus Corporation

- Ventana Medical Systems (a member of the Roche Group)

- Mikroscan Technologies

- Huron Digital Pathology

- Corista

- Inspirata

- Sectra AB

- Visiopharm

- Indica Labs

- OptraSCAN

Table of Contents

1. Asia Pacific Digital Pathology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Digital Pathology Market Size (in USD Million), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Digital Pathology Market Analysis

3.1. Growth Drivers

3.1.1. Rising Incidence of Chronic Diseases

3.1.2. Expansion of Healthcare Infrastructure

3.1.3. Increasing Adoption of AI-Powered Tools

3.1.4. Government Support and Initiatives

3.2. Challenges

3.2.1. High Cost of Implementation

3.2.2. Lack of Standardized Regulations

3.2.3. Data Privacy Concerns

3.2.4. Shortage of Skilled Personnel

3.3. Opportunities

3.3.1. Technological Advancements in Pathology Tools

3.3.2. Expansion into Rural Areas

3.3.3. International Collaborations

3.3.4. Integration with Personalized Medicine

3.4. Trends

3.4.1. Growth in Personalized Medicine

3.4.2. Adoption of Cloud-Based Solutions

3.4.3. Expansion of Telepathology Services

3.4.4. AI and Machine Learning Integration

3.5. Government Regulation

3.5.1. National Health Strategies

3.5.2. Digital Health Initiatives

3.5.3. Compliance and Certification

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia Pacific Digital Pathology Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Scanners

4.1.2. Software

4.1.3. Storage Systems

4.2. By Application (in Value %)

4.2.1. Disease Diagnosis

4.2.2. Teleconsultation

4.2.3. Research

4.3. By End User (in Value %)

4.3.1. Hospitals

4.3.2. Diagnostic Laboratories

4.3.3. Academic Institutions

4.4. By Technology (in Value %)

4.4.1. AI-Based Analysis

4.4.2. Whole-Slide Imaging

4.4.3. Workflow Integration Tools

4.5. By Region (in Value %)

4.5.1. China

4.5.2. South Korea

4.5.3. Japan

4.5.4. India

4.5.5. Australia

5. Asia Pacific Digital Pathology Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Philips Healthcare

5.1.2. Leica Biosystems

5.1.3. Roche Diagnostics

5.1.4. 3DHISTECH

5.1.5. Hamamatsu Photonics

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia Pacific Digital Pathology Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Asia Pacific Digital Pathology Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Asia Pacific Digital Pathology Future Market Size (in USD Million), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia Pacific Digital Pathology Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By End User (in Value %)

9.4. By Technology (in Value %)

9.5. By Region (in Value %)

10. Asia Pacific Digital Pathology Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Asia Pacific Digital Pathology Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia Pacific Digital Pathology Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple healthcare device manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from healthcare device manufacturing companies.

Frequently Asked Questions

01 How big is Asia Pacific Digital Pathology Market?

The Asia Pacific Digital Pathology Market was valued at USD 210.1 million in 2023, driven by factors such as the rising prevalence of chronic diseases, increased adoption of AI in diagnostics, and the need for efficient diagnostic tools.

02 What are the challenges in the Asia Pacific Digital Pathology Market?

Challenges in Asia Pacific Digital Pathology Market include high implementation costs, lack of standardized regulations, data privacy concerns, and a shortage of skilled personnel to operate advanced digital pathology systems.

03 Who are the major players in the Asia Pacific Digital Pathology Market?

Key players in Asia Pacific Digital Pathology Market include Philips Healthcare, Leica Biosystems, Roche Diagnostics, 3DHISTECH, and Hamamatsu Photonics. These companies are leaders due to their innovation, strategic partnerships, and robust distribution networks.

04 What are the growth drivers of the Asia Pacific Digital Pathology Market?

Growth drivers in Asia Pacific Digital Pathology Market include the rising incidence of chronic diseases, expansion of healthcare infrastructure in emerging markets, increasing adoption of AI-powered diagnostic tools, and government support for digital health initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.