Asia Pacific Digital Signage Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD3675

October 2024

98

About the Report

Asia Pacific Digital Signage Market Overview

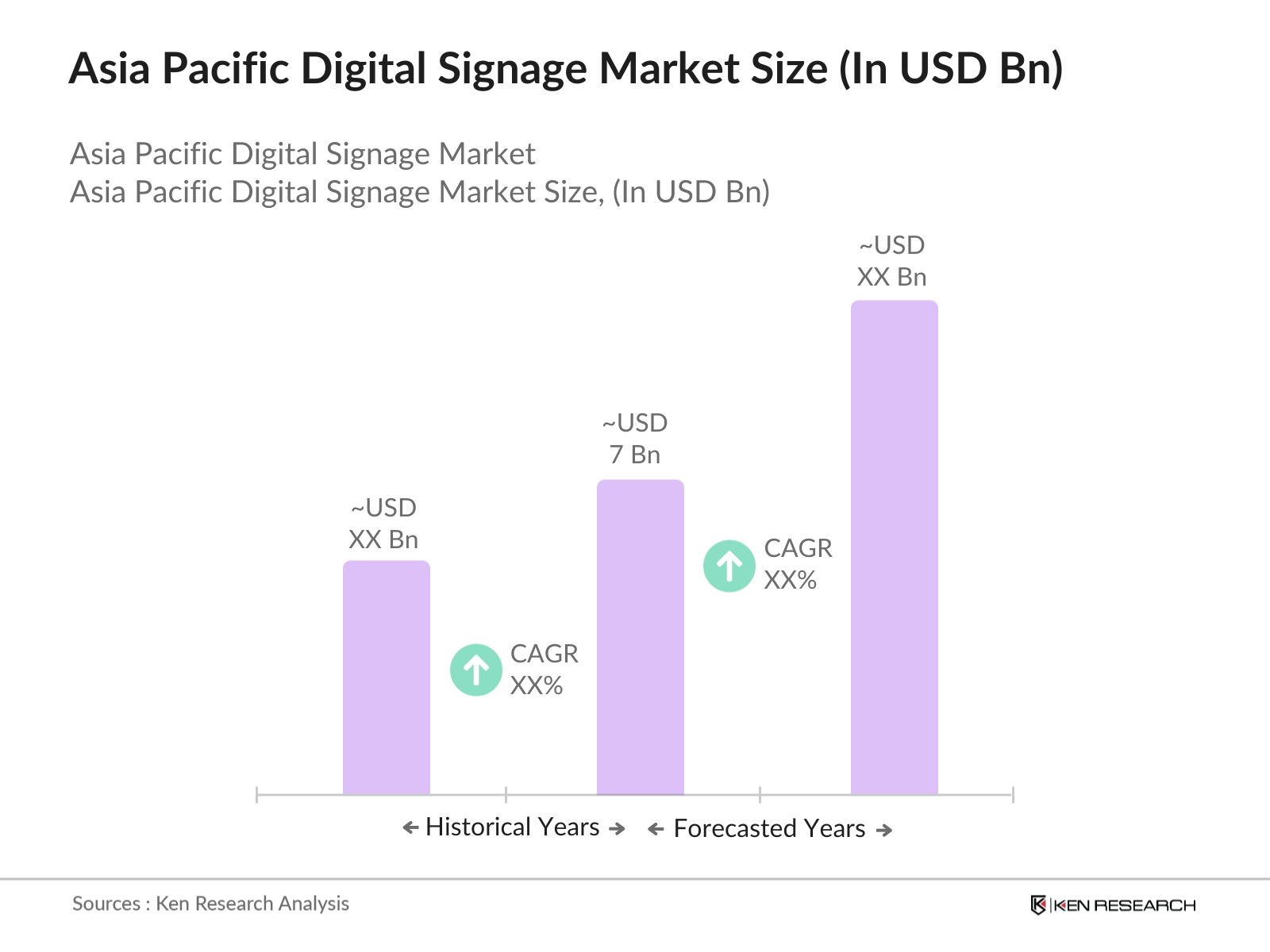

- Asia Pacific Digital Signage market is valued at USD 7 billion, based on a five-year historical analysis. The market has seen substantial growth due to the increasing demand for dynamic advertising solutions and the rapid adoption of digital technologies across multiple industries, particularly in retail, education, and hospitality. The need for better consumer engagement, coupled with the development of smart cities, has further fueled the demand for advanced digital signage solutions.

- Countries like China, Japan, and South Korea are leading the digital signage market in the Asia Pacific region. This dominance is largely due to their technological expertise, high urbanization rates, and government investments in smart city projects. China’s massive retail sector and public infrastructure investments make it the largest market for digital signage. Japan’s advanced electronics industry and South Korea’s innovative display technology sector further contribute to their strong market positions.

- Interactive displays are increasingly being adopted across the Asia Pacific region as businesses recognize their potential to enhance customer engagement. The Ministry of SMEs and Startups in South Korea reported that 45% of retail stores in Seoul now incorporate interactive signage for customer interaction, driving further innovation in the market. These displays are used for advertising, real-time updates, and interactive directories.

Asia Pacific Digital Signage Market Segmentation

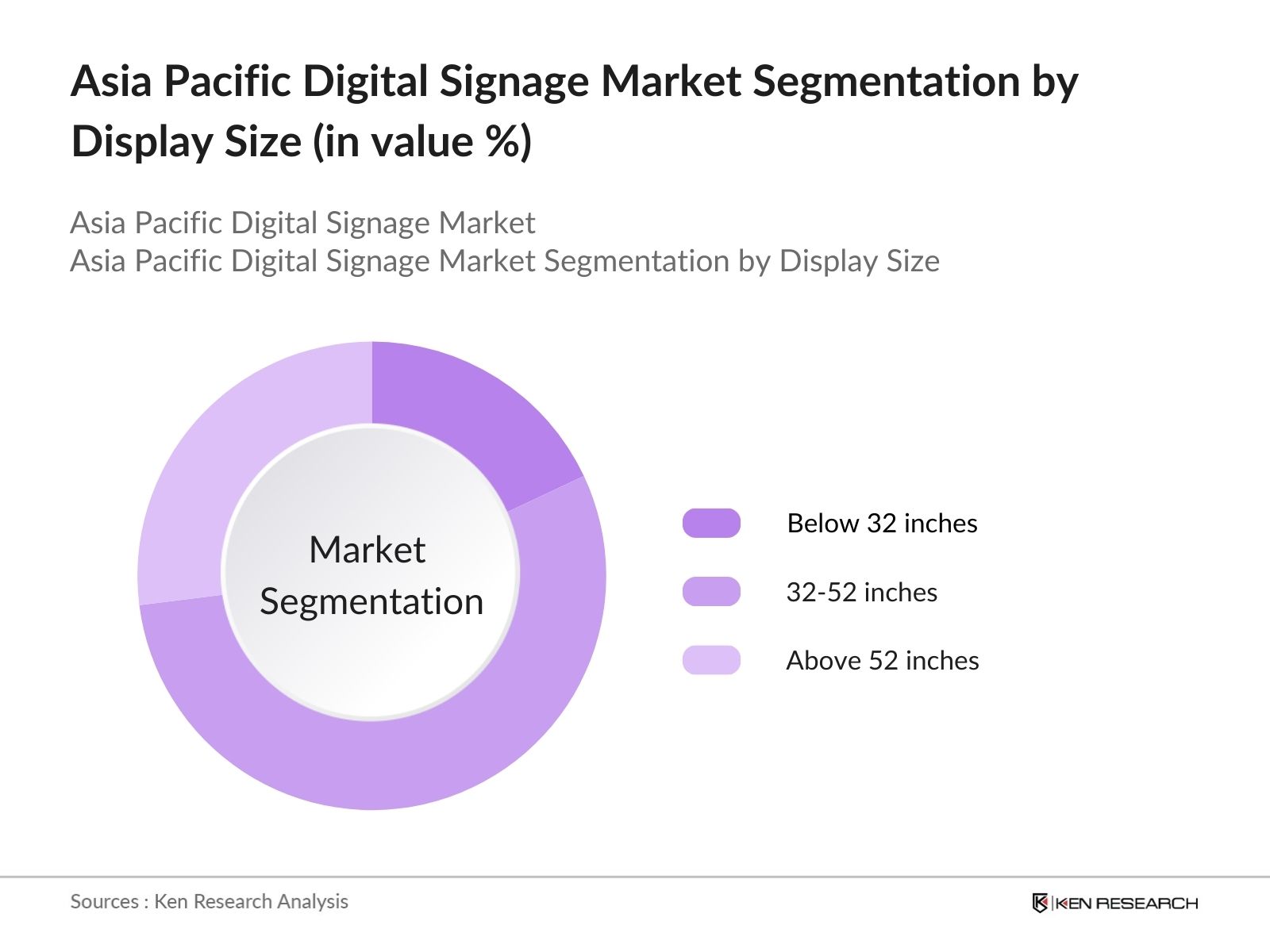

By Display Size: The Asia Pacific Digital Signage market is segmented by display size into below 32 inches, 32-52 inches, and above 52 inches. Among these, the 32-52 inches segment dominates the market, driven by its versatile application across retail outlets, educational institutions, corporate offices, and hospitality venues. This segment provides the perfect balance between visual clarity and affordability, making it a preferred choice for businesses looking to engage customers with dynamic advertising content. Additionally, its compatibility with modern interactive features such as touchscreens and gesture controls further boosts its adoption.

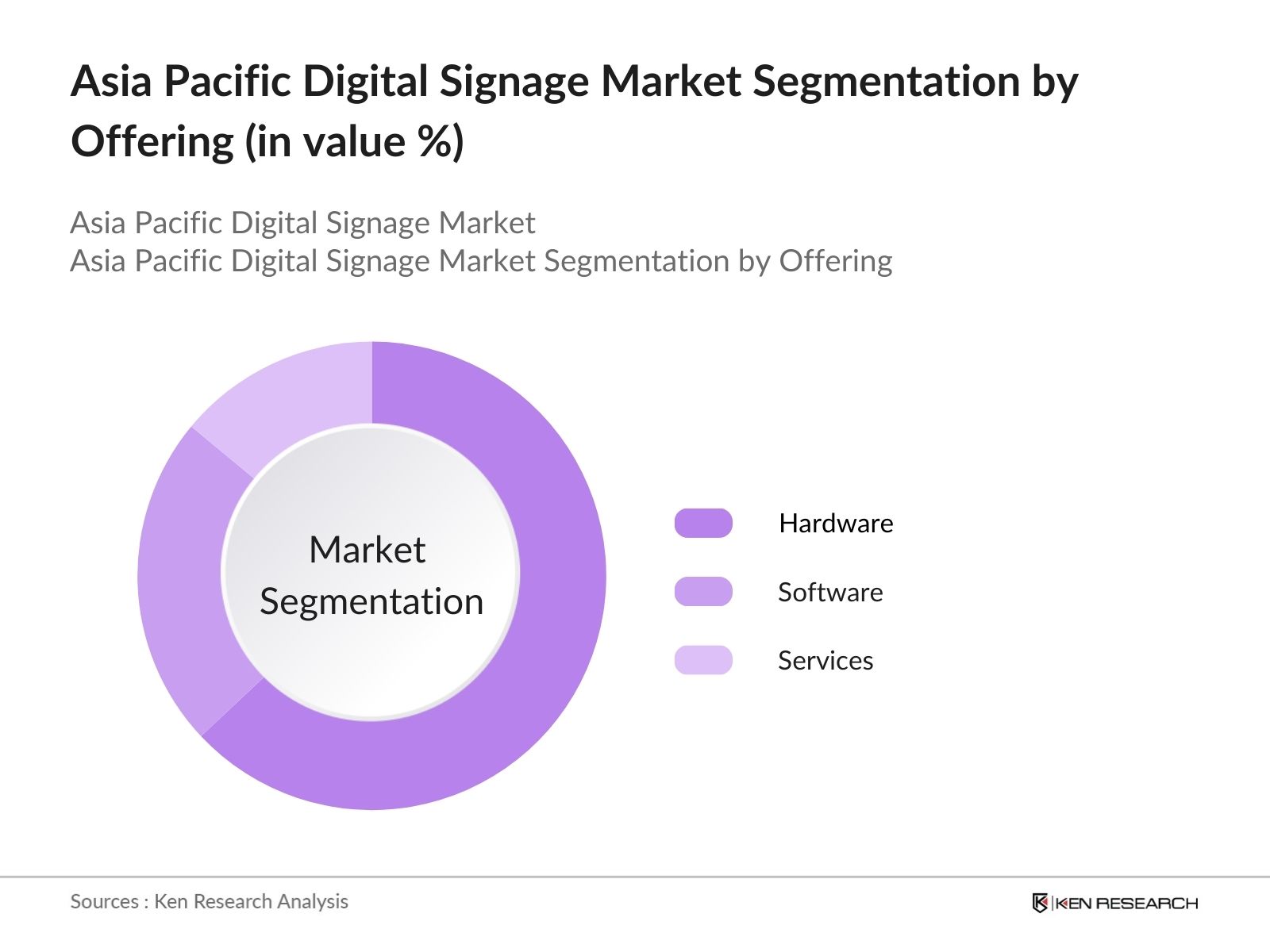

By Offering: The market is also segmented by offering into hardware, software, and services. The hardware segment holds the largest market share in 2023 due to the high demand for physical display units such as LED and OLED screens, media players, and mounting systems. Advanced display technologies like ultra-high-definition (UHD) screens are becoming more popular, contributing significantly to hardware sales. Additionally, the growing preference for energy-efficient, eco-friendly hardware solutions with superior visual quality supports the dominance of this segment.

Asia Pacific Digital Signage Market Competitive Landscape

The Asia Pacific Digital Signage market is characterized by the presence of several key players, including local manufacturers and multinational technology companies. Companies from Japan, South Korea, and China dominate the market due to their technological expertise and their strong presence in the broader electronics and display industries. These companies offer innovative products, ranging from basic display systems to advanced interactive signage solutions with integrated AI capabilities.

| Company | Establishment Year | Headquarters | Revenue | R&D Investment | Key Partnerships | Product Portfolio | Geographical Reach | Technological Innovations |

|---|---|---|---|---|---|---|---|---|

| Samsung Electronics | 1969 | Suwon, South Korea | - | - | - | - | - | - |

| LG Electronics | 1958 | Seoul, South Korea | - | - | - | - | - | - |

| NEC Display Solutions | 1899 | Tokyo, Japan | - | - | - | - | - | - |

| Sony Corporation | 1946 | Tokyo, Japan | - | - | - | - | - | - |

| Sharp Corporation | 1912 | Sakai, Japan | - | - | - | - | - | - |

Asia Pacific Digital Signage Market Analysis

Growth Drivers

- Infrastructure Development: The Asia Pacific region is undergoing extensive infrastructure development, with countries like China, India, and Japan investing heavily in smart cities and public infrastructure. According to the Asian Development Bank (ADB), Asia Pacific will require $1.7 trillion annually for infrastructure through 2030 to maintain growth momentum. Digital signage solutions are essential in these projects for transportation hubs, smart city monitoring, and public information displays.

- Technological Advancements: Technological advancements in LED and LCD display technologies are driving demand for digital signage. Displays with higher resolution and better energy efficiency are becoming more widely adopted. For instance, China invested $26.6 billion in 5G networks in 2023, a 5.7% increase from the previous year, will further boost the growth of cloud-based digital signage solutions.

- Corporate Demand: Large corporations in the Asia Pacific region are increasingly adopting digital signage for internal communication and customer engagement. With growing corporate investments in countries like India and Singapore, digital displays are becoming a common sight in office spaces and commercial buildings. The rising trend of corporate adoption is further driven by the need to enhance brand visibility and customer engagement in a competitive marketplace.

Challenges

- High Initial Cost: While digital signage presents numerous benefits, the high initial costs remain a barrier to widespread adoption, particularly for small and medium-sized enterprises (SMEs). In countries like Indonesia and the Philippines, where the average capital expenditure per SME ranges between $5,000 and $25,000 annually, investing in advanced signage systems is financially daunting. As reported by the World Bank, SMEs in developing nations often face difficulties securing the necessary funds for such technological upgrades, further limiting market expansion in these regions.

- Cybersecurity Risks: As digital signage systems are increasingly networked and cloud-based, cybersecurity threats have become a major concern. In 2023, there was a weekly average of 1,158 attacks per organization worldwide, with a total of 8.2 billion records breached during publicly disclosed attacks throughout the year. With more businesses adopting cloud-based signage solutions, the risk of data breaches and system hacks has grown, making it a significant barrier for further market adoption.

Asia Pacific Digital Signage Future Market Outlook

Over the next five years, the Asia Pacific Digital Signage market is expected to experience significant growth, driven by increased investments in smart city initiatives, technological advancements, and the expanding retail and hospitality sectors. The integration of AI, IoT, and cloud-based solutions in digital signage systems will enhance personalization and interactivity, making signage more engaging for end-users. The market will also benefit from the growing demand for energy-efficient, eco-friendly solutions in compliance with stringent environmental regulations.

Market Opportunities

- Smart City Projects: The rise of smart city projects across Asia Pacific represents a massive opportunity for digital signage market growth. China, for instance, plans to have 500 smart cities by 2025, which will incorporate advanced digital displays for public safety, traffic management, and information dissemination. Singapore is another leader in this space, having allocated $2.5 billion for smart infrastructure, including interactive signage for public information systems. Digital signage is a crucial component of these initiatives, providing real-time updates to citizens and improving overall city management.

- Integration with AI: Artificial Intelligence (AI) is transforming the digital signage landscape, enabling personalized content and predictive analytics. AI integration allows businesses to tailor messages based on customer demographics, driving more effective engagement. In Japan, the use of AI-powered digital signage systems has been introduced in Tokyo's Shibuya district, enhancing customer experiences by offering real-time, personalized content based on foot traffic and facial recognition.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Display Size |

Below 32 Inches |

|

32-52 Inches |

|

|

Above 52 Inches |

|

|

By Offering |

Hardware |

|

Software |

|

|

Services |

|

|

By Application |

Indoor |

|

Outdoor |

|

|

By Industry Vertical |

Retail |

|

Hospitality |

|

|

Education |

|

|

Healthcare |

|

|

Transportation |

|

|

By Region |

East Asia |

|

South Asia |

|

|

Southeast Asia |

|

|

Oceania |

Products

Key Target Audience

- Digital Signage Manufacturers

- Telecommunication and Networking Firms

- Digital Signage Solutions Providers

- Event Management Companies

- Outdoor Advertising Companies (OOH)

- Media & Entertainment Companies

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Smart City Councils, Urban Development Authorities)

Companies

Major Players

- Samsung Electronics

- LG Electronics

- NEC Display Solutions

- Sony Corporation

- Sharp Corporation

- Panasonic Corporation

- BrightSign LLC

- Planar Systems

- ViewSonic Corporation

- Intel Corporation

- AU Optronics

- AOPEN Inc.

- Scala

- Leyard Optoelectronic

- E Ink Holdings

Table of Contents

1. Asia Pacific Digital Signage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Revenue, and Volume)

1.4. Market Segmentation Overview (By Display Size, By Offering, By Application, By Industry Vertical, By Region)

2. Asia Pacific Digital Signage Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Digital Signage Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development

3.1.2. Technological Advancements

3.1.3. Government Initiatives

3.1.4. Corporate Demand

3.2. Market Challenges

3.2.1. High Initial Cost

3.2.2. Limited Awareness

3.2.3. Integration with Existing Systems

3.2.4. Cybersecurity Risks

3.3. Opportunities

3.3.1. Smart City Projects

3.3.2. Integration with AI

3.3.3. Expanding Retail and Hospitality Sectors

3.3.4. Content Personalization

3.4. Market Trends

3.4.1. Adoption of Interactive Displays

3.4.2. Cloud-Based Solutions

3.4.3. Green Digital Signage

3.4.4. 4K/8K Displays

3.5. Government Regulations

3.5.1. Digital Media Policies

3.5.2. Environmental Compliance for Display Technologies

3.5.3. Public-Private Partnerships for Smart Infrastructure

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Integrators, Software Developers, Service Providers)

3.8. Porter’s Five Forces (Supplier Power, Buyer Power, Threat of New Entrants, Threat of Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem

4. Asia Pacific Digital Signage Market Segmentation

4.1. By Display Size (In Value %)

4.1.1. Below 32 Inches

4.1.2. 32-52 Inches

4.1.3. Above 52 Inches

4.2. By Offering (In Value %)

4.2.1. Hardware

4.2.2. Software

4.2.3. Services

4.3. By Application (In Value %)

4.3.1. Indoor

4.3.2. Outdoor

4.4. By Industry Vertical (In Value %)

4.4.1. Retail

4.4.2. Hospitality

4.4.3. Education

4.4.4. Healthcare

4.4.5. Transportation

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. South Asia

4.5.3. Southeast Asia

4.5.4. Oceania

5. Asia Pacific Digital Signage Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Samsung Electronics

5.1.2. LG Electronics

5.1.3. NEC Display Solutions

5.1.4. Sony Corporation

5.1.5. Panasonic Corporation

5.1.6. Sharp Corporation

5.1.7. Scala

5.1.8. Planar Systems

5.1.9. ViewSonic Corporation

5.1.10. BrightSign LLC

5.1.11. AOPEN Inc.

5.1.12. Intel Corporation

5.1.13. Leyard Optoelectronic

5.1.14. AU Optronics

5.1.15. E Ink Holdings

5.2. Cross Comparison Parameters (Revenue, Market Share, Installed Base, Key Partnerships, Number of Patents, Product Offering, Geographic Reach, Employee Count)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, New Product Launches, Joint Ventures)

5.5. Investment Analysis (Private Equity, Venture Capital, Government Initiatives)

6. Asia Pacific Digital Signage Market Regulatory Framework

6.1. Compliance Standards (Energy Consumption, Display Safety, Electromagnetic Compatibility)

6.2. Industry Certifications (ISO Standards, Eco-Labels, Digital Media Standards)

6.3. Government Policies and Initiatives (Smart City Mandates, Digital Communication Guidelines, Incentives for Green Technology)

7. Asia Pacific Digital Signage Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Digital Signage Future Market Segmentation

8.1. By Display Size (In Value %)

8.2. By Offering (In Value %)

8.3. By Application (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Digital Signage Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product-Market Fit Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Digital Signage Market. This step is supported by extensive desk research, leveraging secondary and proprietary databases to gather comprehensive industry-level information. The key variables include display technology advancements, market demand, and industry trends.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data related to the digital signage market. The analysis includes market penetration rates, technological development, and industry vertical analysis. Furthermore, we evaluate data on geographic distribution, industry trends, and growth drivers to construct a holistic market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth and challenges are validated through expert consultations. These include interviews with executives from leading digital signage companies and other key stakeholders. The consultations provide valuable insights into operational strategies, revenue patterns, and challenges faced by businesses.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights to produce the report. A bottom-up approach is used to verify the statistical data, complemented by detailed interviews with digital signage solution providers. This ensures a comprehensive and validated analysis of the Asia Pacific Digital Signage Market.

Frequently Asked Questions

01 How big is the Asia Pacific Digital Signage Market?

The Asia Pacific Digital Signage Market was valued at USD 7 billion in 2023, driven by the rising demand for dynamic advertising and consumer engagement solutions, particularly in retail and hospitality sectors.

02 What are the challenges in the Asia Pacific Digital Signage Market?

Challenges in the Asia Pacific Digital Signage market include high initial costs of installation, cybersecurity concerns due to interconnected systems, and limited awareness in emerging markets, which slows the pace of adoption.

03 Who are the major players in the Asia Pacific Digital Signage Market?

The major players in Asia Pacific Digital Signage Market include Samsung Electronics, LG Electronics, NEC Display Solutions, Sony Corporation, and Sharp Corporation. These companies dominate due to their technological advancements and extensive product portfolios.

04. What are the growth drivers of the Asia Pacific Digital Signage Market?

Growth drivers of Asia Pacific Digital Signage Market include advancements in display technology, the rise of smart city projects, and increasing consumer demand for dynamic, interactive advertising solutions. Government initiatives supporting digital transformation also play a crucial role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.