Asia Pacific Digital Signal Processor (DSP) Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD7999

December 2024

88

About the Report

Asia Pacific Digital Signal Processor Market Overview

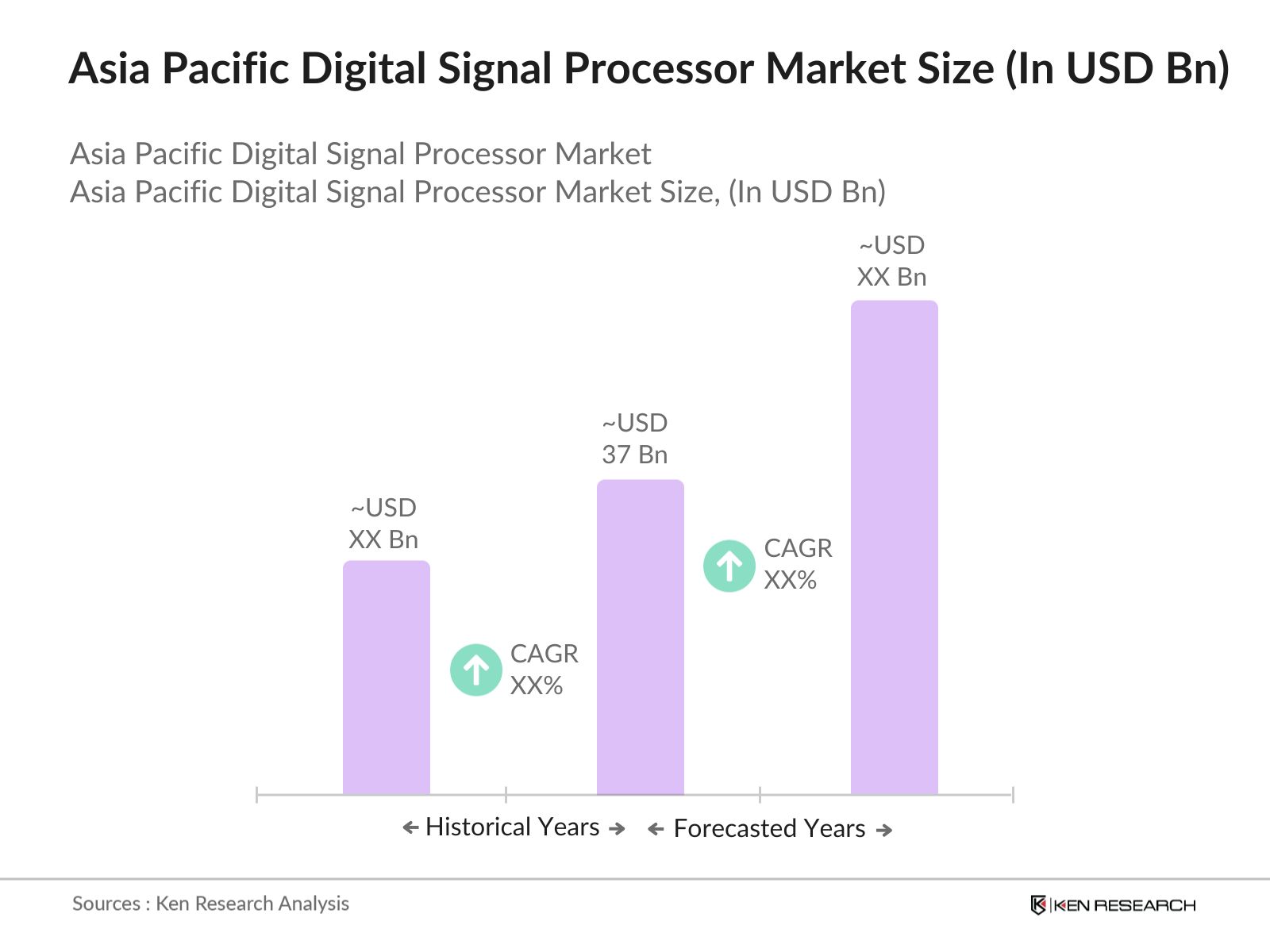

- The Asia Pacific Digital Signal Processor (DSP) market was valued at USD 37 billion based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of DSPs in various applications, such as automotive electronics, consumer electronics, and telecommunications.

- The leading countries dominating the Asia Pacific DSP market include China, Japan, and South Korea. China remains dominant due to its massive electronics manufacturing sector and significant investments in AI and 5G infrastructure. Japan's leadership in automotive and industrial automation, particularly in the development of automotive electronics and ADAS, fuels its stronghold.

- The regulatory landscape for DSP production in the Asia Pacific region is shaped by government policies aimed at fostering local semiconductor industries. Countries such as China, Japan, and India have established comprehensive frameworks to support DSP manufacturing, with initiatives like Chinas "Made in China 2025" and Indias Semicon India policy. In 2023, Japan introduced tax breaks and subsidies for semiconductor R&D, including DSP technologies, to boost local production. These policies are designed to reduce reliance on imports, enhance local capabilities, and drive innovation in DSP technologies across multiple sectors.

Asia Pacific Digital Signal Processor Market Segmentation

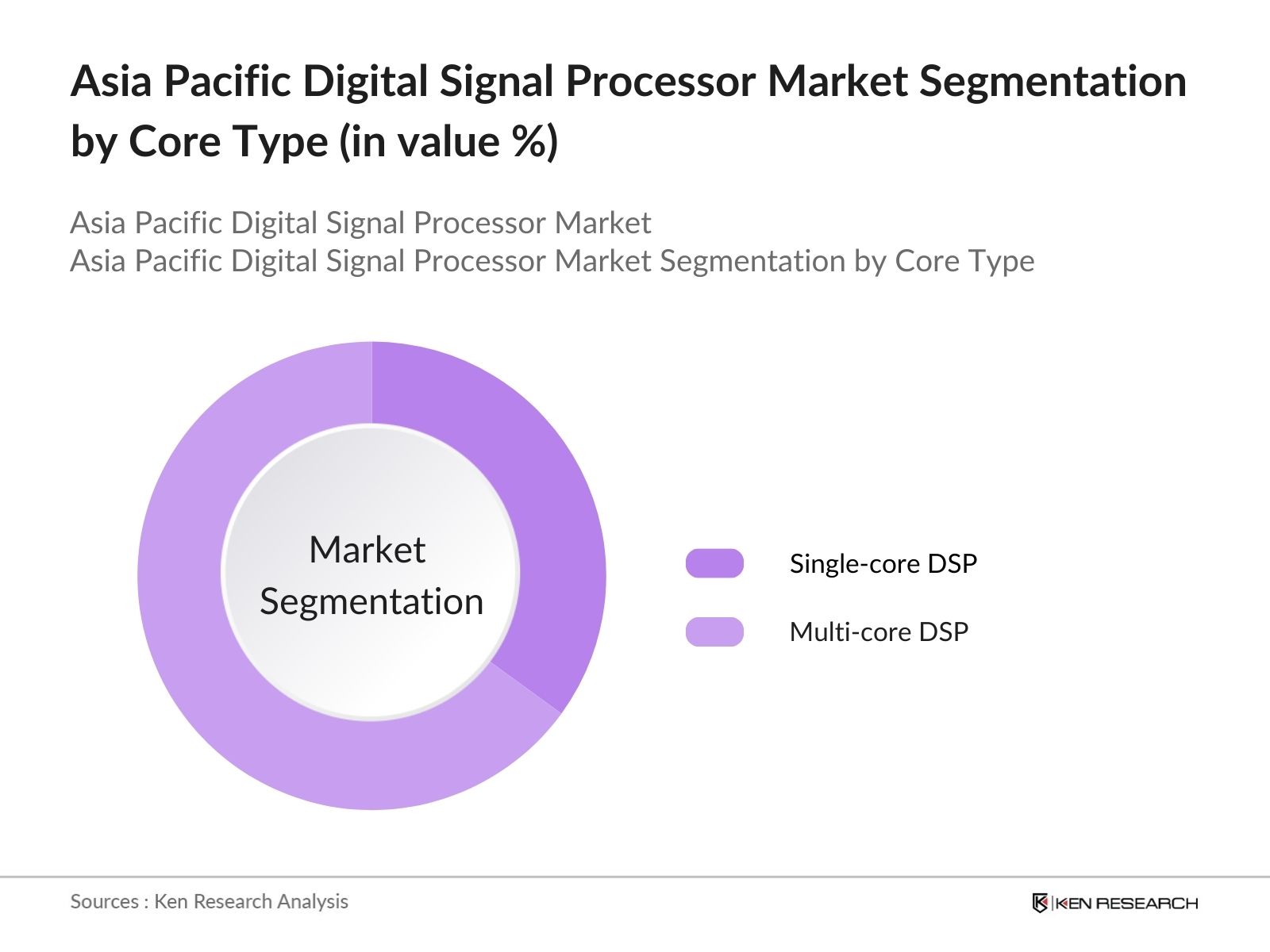

By Core Type: The Asia Pacific DSP market is segmented by core type into single-core DSP and multi-core DSP. Multi-core DSPs hold the dominant share within this segment due to their ability to process complex tasks at higher speeds, making them ideal for applications such as automotive systems, 5G base stations, and AI-driven technologies. The need for higher computational power and energy efficiency, especially in real-time data processing applications like image recognition and audio processing, has driven the demand for multi-core DSPs in this region.

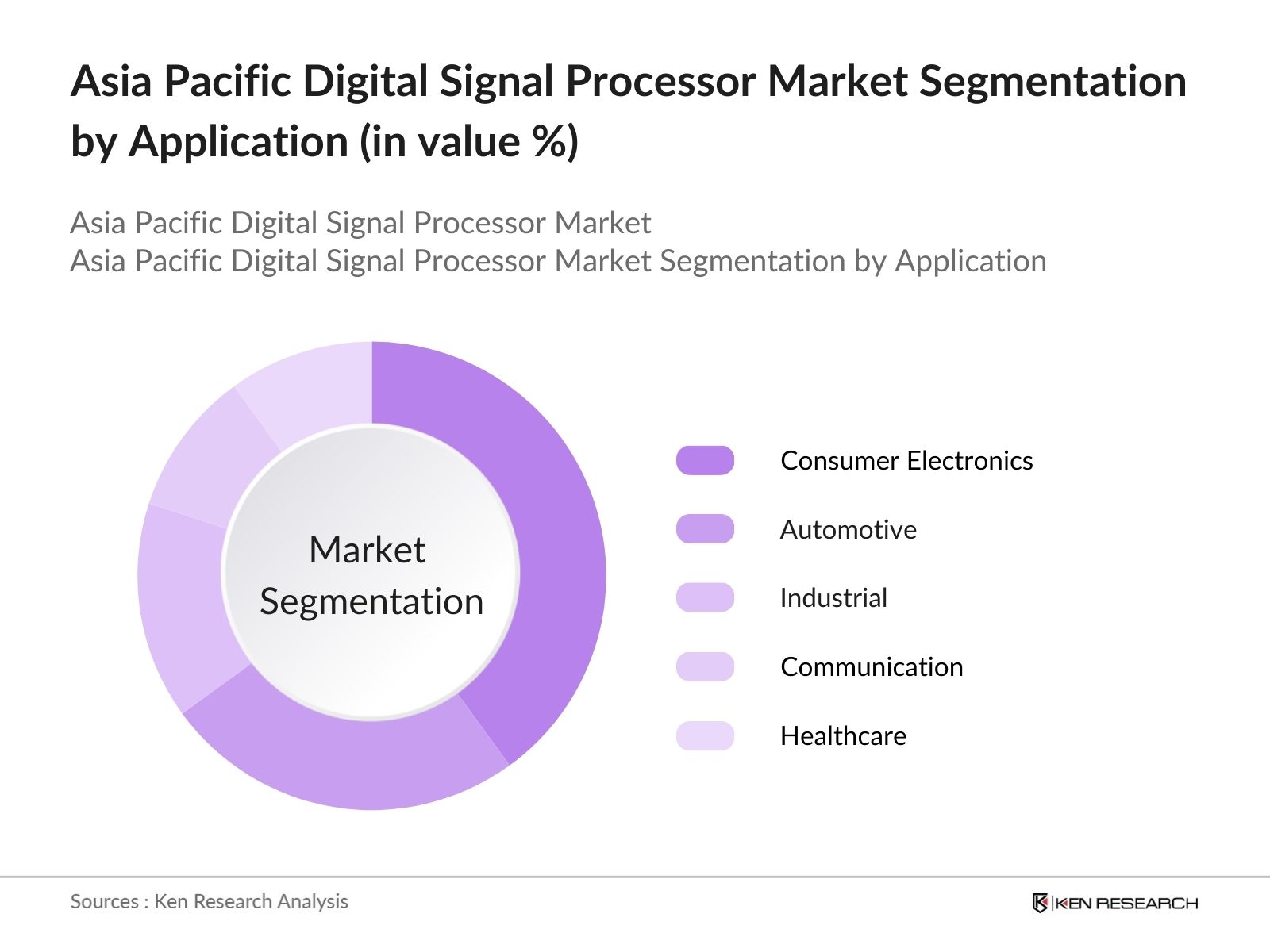

By Application: The DSP market is also segmented by application into consumer electronics, automotive, industrial, communication, and healthcare. Among these, the consumer electronics segment dominates the market, primarily due to the large-scale production of smartphones, tablets, and wearables in Asia Pacific. The widespread integration of DSPs in mobile devices for audio and image processing, as well as in wearables for health monitoring, has contributed to this dominance. Additionally, with the growing penetration of smart home devices and personal assistants, DSP applications are continually expanding in consumer electronics.

Asia Pacific Digital Signal Processor Market Competitive Landscape

The Asia Pacific DSP market is highly competitive, with key players focusing on innovation and advancements in AI-driven DSP technologies. The market is dominated by established companies with strong global presences and significant R&D investments. These companies are continuously improving their DSP product portfolios to cater to various industries such as automotive, telecommunications, and consumer electronics. The Asia Pacific DSP market is characterized by the presence of global giants like Texas Instruments, Qualcomm, and Analog Devices. These companies maintain a strong foothold in the region due to their advanced DSP solutions tailored for key applications like automotive and telecommunications.

|

Company Name |

Year of Establishment |

Headquarters |

No. of Employees |

R&D Spending (USD Mn) |

Product Portfolio |

Key Clients |

Geographical Reach |

Revenue (USD Bn) |

Manufacturing Facilities |

|

Texas Instruments |

1930 |

Dallas, USA |

- |

- |

- |

- |

- |

- |

- |

|

Qualcomm Incorporated |

1985 |

San Diego, USA |

- |

- |

- |

- |

- |

- |

- |

|

Analog Devices, Inc. |

1965 |

Massachusetts, USA |

- |

- |

- |

- |

- |

- |

- |

|

MediaTek Inc. |

1997 |

Hsinchu, Taiwan |

- |

- |

- |

- |

- |

- |

- |

|

Renesas Electronics |

2002 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Digital Signal Processor Market Analysis

Growth Drivers

- Proliferation of IoT Devices: The rapid expansion of IoT devices in the Asia Pacific region has significantly increased the demand for embedded digital signal processors (DSPs). As of 2024, there are over 12 billion IoT-connected devices globally, with a substantial portion originating from Asia Pacific economies like China, Japan, and South Korea. DSPs are critical for real-time data processing in these devices, making them essential for a wide range of applications, including smart home systems, industrial IoT, and wearable technology.

- Growing Demand for High-Speed Data Processing: Asia Pacific has been a leader in 5G rollout, particularly in countries like South Korea and China, which have advanced 5G network infrastructure. The integration of 5G into various industries has increased the need for high-speed data processing, where DSPs play a crucial role. By the end of June 2023, there were approximately1.27 billion5G package subscribers in China. The DSP technology's ability to process massive amounts of data in real-time supports applications such as augmented reality, autonomous vehicles, and real-time video streaming in 5G networks.

- Increased Adoption in Automotive Electronics: The Asia Pacific automotive industry, particularly in countries like Japan and South Korea, has seen a significant shift towards Advanced Driver Assistance Systems (ADAS), which rely heavily on DSPs. In 2024, Japan is expected to produce 7.7 million vehicles, many equipped with ADAS features such as automatic emergency braking and lane-keeping assistance. DSPs enable the real-time processing of sensor data in these systems, enhancing safety and driving experiences.

Challenges

- High Design Complexity: DSP chips need to process large volumes of data in real-time while meeting stringent power and performance requirements. This is particularly challenging in industries such as telecommunications and automotive, where real-time processing is critical. As of 2023, the cost of developing a high-performance DSP chip can reach USD 25 million, creating a barrier for small and medium-sized companies in the region looking to innovate in this space.

- Limited Processing Power for Advanced Applications: Although DSP technology has advanced significantly, there are still limitations in terms of processing power for highly complex applications such as autonomous driving and AI-powered systems. In 2024, high-end DSPs were capable of processing speeds up to 1 GHz, but real-time processing in complex environments, such as high-speed autonomous vehicles, still poses challenges.

Asia Pacific Digital Signal Processor Market Future Outlook

The Asia Pacific DSP market is set to witness robust growth over the next five years, driven by continuous technological advancements, increasing penetration of AI and machine learning applications, and the expansion of 5G infrastructure. The rising adoption of DSPs in automotive systems, such as ADAS and electric vehicles, coupled with the growing integration of DSPs in industrial automation, will further propel market growth. Additionally, the support from governments in the region to bolster semiconductor manufacturing will provide a conducive environment for market expansion.

Future Market Opportunities

- Technological Advancements in AI and ML: The Asia Pacific region is experiencing rapid advancements in artificial intelligence (AI) and machine learning (ML), creating significant opportunities for the integration of AI-optimized DSPs. As of 2024, countries such as China, Japan, and South Korea are investing heavily in AI infrastructure, with China alone allocating USD 30 billion to AI research and development. These investments fuel the demand for specialized DSPs capable of handling AI algorithms for applications such as image and speech recognition, autonomous systems, and smart factories.

- Growing Demand in Industrial Automation: The adoption of Industry 4.0 technologies across Asia Pacific is creating significant opportunities for DSP technology, particularly in industrial automation and IoT systems. DSPs are critical for processing data from connected sensors and machines in real-time, enabling predictive maintenance, process optimization, and enhanced efficiency. Countries like South Korea and Japan are also pushing Industry 4.0 initiatives, further driving the demand for high-performance DSPs in automated factories and smart industrial environments.

Scope of the Report

|

Core Type |

Single-core DSP Multi-core DSP |

|

Application |

Consumer Electronics Automotive Industrial Communication Healthcare |

|

Architecture Type |

Fixed Point DSP Floating Point DSP Hybrid DSP |

|

Processing Type |

Digital Signal Control (DSC) Audio Signal Processing Image Signal Processing Network Signal Processing |

|

Region |

China Japan South Korea India Southeast Asia |

Products

Key Target Audience

Automotive OEMs

Semiconductor Manufacturers

Consumer Electronics Companies

Healthcare Device Manufacturers

Telecommunications Equipment Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, China; Ministry of Economy, Trade and Industry, Japan)

Cloud and Edge Computing Providers

Companies

Players Mentioned in the Report

Texas Instruments Incorporated

Qualcomm Incorporated

Analog Devices, Inc.

MediaTek Inc.

Renesas Electronics Corporation

NXP Semiconductors N.V.

STMicroelectronics N.V.

Broadcom Inc.

Infineon Technologies AG

Xilinx, Inc.

Table of Contents

Asia Pacific Digital Signal Processor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Asia Pacific Digital Signal Processor Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Asia Pacific Digital Signal Processor Market Analysis

3.1. Growth Drivers

3.1.1. Proliferation of IoT Devices (Embedded DSP Use)

3.1.2. Growing Demand for High-Speed Data Processing (5G Integration)

3.1.3. Increased Adoption in Automotive Electronics (ADAS Systems)

3.1.4. Rising Demand in Consumer Electronics (Smartphones, Wearables)

3.2. Market Challenges

3.2.1. High Design Complexity (Design and Integration of DSP Systems)

3.2.2. Limited Processing Power for Advanced Applications (Real-Time Processing Limitations)

3.2.3. High Power Consumption (Energy Efficiency Constraints)

3.2.4. Limited Skilled Workforce (Talent Shortage in DSP Development)

3.3. Opportunities

3.3.1. Technological Advancements in AI and ML (Integration of AI DSPs)

3.3.2. Growing Demand in Industrial Automation (IoT and Industry 4.0 Adoption)

3.3.3. Expansion into Edge Computing (Edge AI and Cloud Integration)

3.3.4. Increasing Government Initiatives for Semiconductor Manufacturing (Government Subsidies and Incentives)

3.4. Trends

3.4.1. Integration with AI and Machine Learning (AI-based DSP Chipsets)

3.4.2. Miniaturization of DSP Chips (Advanced Manufacturing Processes)

3.4.3. Increasing Focus on Power-Efficient DSP Designs (Energy-Efficient Architectures)

3.4.4. Adoption of Open DSP Platforms (Collaborative Development and Standardization)

3.5. Government Regulation

3.5.1. Asia Pacific Semiconductor Policy and Regulation Framework (Regulatory Landscape)

3.5.2. Export Control Policies (Regulations Impacting DSP Exports)

3.5.3. Data Security Regulations (Impact on DSP Data Handling and Privacy)

3.5.4. Environmental Regulations (Sustainability and Energy Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

Asia Pacific Digital Signal Processor Market Segmentation

4.1. By Core Type (In Value %)

4.1.1. Single-core DSP

4.1.2. Multi-core DSP

4.2. By Application (In Value %)

4.2.1. Consumer Electronics

4.2.2. Automotive

4.2.3. Industrial

4.2.4. Communication

4.2.5. Healthcare

4.3. By Architecture Type (In Value %)

4.3.1. Fixed Point DSP

4.3.2. Floating Point DSP

4.3.3. Hybrid DSP

4.4. By Processing Type (In Value %)

4.4.1. Digital Signal Control (DSC)

4.4.2. Audio Signal Processing

4.4.3. Image Signal Processing

4.4.4. Network Signal Processing

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. Southeast Asia

Asia Pacific Digital Signal Processor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Texas Instruments Incorporated

5.1.2. Qualcomm Incorporated

5.1.3. Analog Devices, Inc.

5.1.4. Broadcom Inc.

5.1.5. Renesas Electronics Corporation

5.1.6. NXP Semiconductors N.V.

5.1.7. MediaTek Inc.

5.1.8. STMicroelectronics N.V.

5.1.9. Infineon Technologies AG

5.1.10. Xilinx, Inc.

5.2. Cross Comparison Parameters (Product Portfolio, Market Presence, Revenue, Market Positioning, Geographical Reach, Manufacturing Facilities, Key Clients, R&D Spending)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Asia Pacific Digital Signal Processor Market Regulatory Framework

6.1. Semiconductor Standards

6.2. Compliance Requirements

6.3. Certification Processes

Asia Pacific Digital Signal Processor Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Asia Pacific Digital Signal Processor Future Market Segmentation

8.1. By Core Type (In Value %)

8.2. By Application (In Value %)

8.3. By Architecture Type (In Value %)

8.4. By Processing Type (In Value %)

8.5. By Region (In Value %)

Asia Pacific Digital Signal Processor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we mapped the Asia Pacific Digital Signal Processor market ecosystem, identifying key stakeholders, including semiconductor manufacturers, OEMs, and telecommunications companies. Extensive desk research utilizing secondary and proprietary databases was conducted to outline the market dynamics and variables affecting DSP adoption.

Step 2: Market Analysis and Construction

Historical data on the market was gathered to evaluate DSP penetration across industries, particularly in automotive and telecommunications. This step involved analyzing DSP use in consumer electronics, examining production rates, and understanding revenue patterns within key segments.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including engineers and product managers from DSP manufacturing companies, were consulted through computer-assisted interviews. These consultations helped validate the market data and refine our analysis of DSP applications across multiple industries.

Step 4: Research Synthesis and Final Output

The final step involved direct engagement with semiconductor companies, DSP chip designers, and system integrators to gain in-depth insights into product innovations, sales performance, and customer preferences. The synthesis of these findings ensured a comprehensive and validated market analysis.

Frequently Asked Questions

01 How big is the Asia Pacific Digital Signal Processor Market?

The Asia Pacific Digital Signal Processor market was valued at USD 37 billion. The market is driven by increasing adoption in consumer electronics, automotive, and telecommunications applications.

02 What are the challenges in the Asia Pacific DSP Market?

Key challenges in Asia Pacific Digital Signal Processor market include the high complexity of designing advanced DSPs, energy efficiency concerns in high-performance systems, and the limited availability of skilled professionals specializing in DSP development.

03 Who are the major players in the Asia Pacific DSP Market?

Key players in Asia Pacific Digital Signal Processor market market include Texas Instruments, Qualcomm, Analog Devices, MediaTek, and Renesas Electronics. These companies are dominant due to their strong product portfolios, extensive R&D investments, and global customer bases.

04 What are the growth drivers in the Asia Pacific DSP Market?

The growth of Asia Pacific Digital Signal Processor market is driven by factors such as the proliferation of IoT devices, the expansion of 5G infrastructure, and the growing demand for automotive electronics, particularly in advanced driver-assistance systems (ADAS).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.