Asia Pacific Dimethyl Carbonate (DMC) Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD2205

November 2024

98

About the Report

Asia Pacific Dimethyl Carbonate (DMC) Market Overview

The Asia Pacific Dimethyl Carbonate (DMC) market is valued at USD 627 million, based on a comprehensive historical analysis. This market has been driven by the growing demand for DMC in the production of polycarbonate plastics, lithium-ion batteries, and green solvents. Key applications such as its use as a reactive solvent and electrolyte in energy storage have accelerated its adoption in the chemical, automotive, and electronics industries. Furthermore, sustainability trends and environmental policies across the region have amplified the usage of DMC in reducing CO2 emissions.

The dominant countries in the Asia Pacific DMC market include China, Japan, and South Korea. China holds a major share due to its large-scale chemical manufacturing infrastructure and increasing demand for lithium-ion batteries in electric vehicles. Meanwhile, Japan and South Korea lead due to their high concentration of battery manufacturers and stringent government regulations promoting the use of eco-friendly chemicals. These nations benefit from their advanced manufacturing capacities and well-established chemical industries.

Governments in Asia Pacific are implementing green chemistry policies to promote the use of environmentally friendly chemicals such as DMC. China, Japan, and South Korea have introduced legislation that encourages the substitution of hazardous solvents with green alternatives. Chinas National Green Development Policy, implemented in 2022, has accelerated the adoption of DMC in various industries, contributing to the reduction of toxic chemical usage. The policys impact is evident in Chinas chemical exports, which reached USD 1.5 trillion in 2023.

Asia Pacific Dimethyl Carbonate (DMC) Market Segmentation

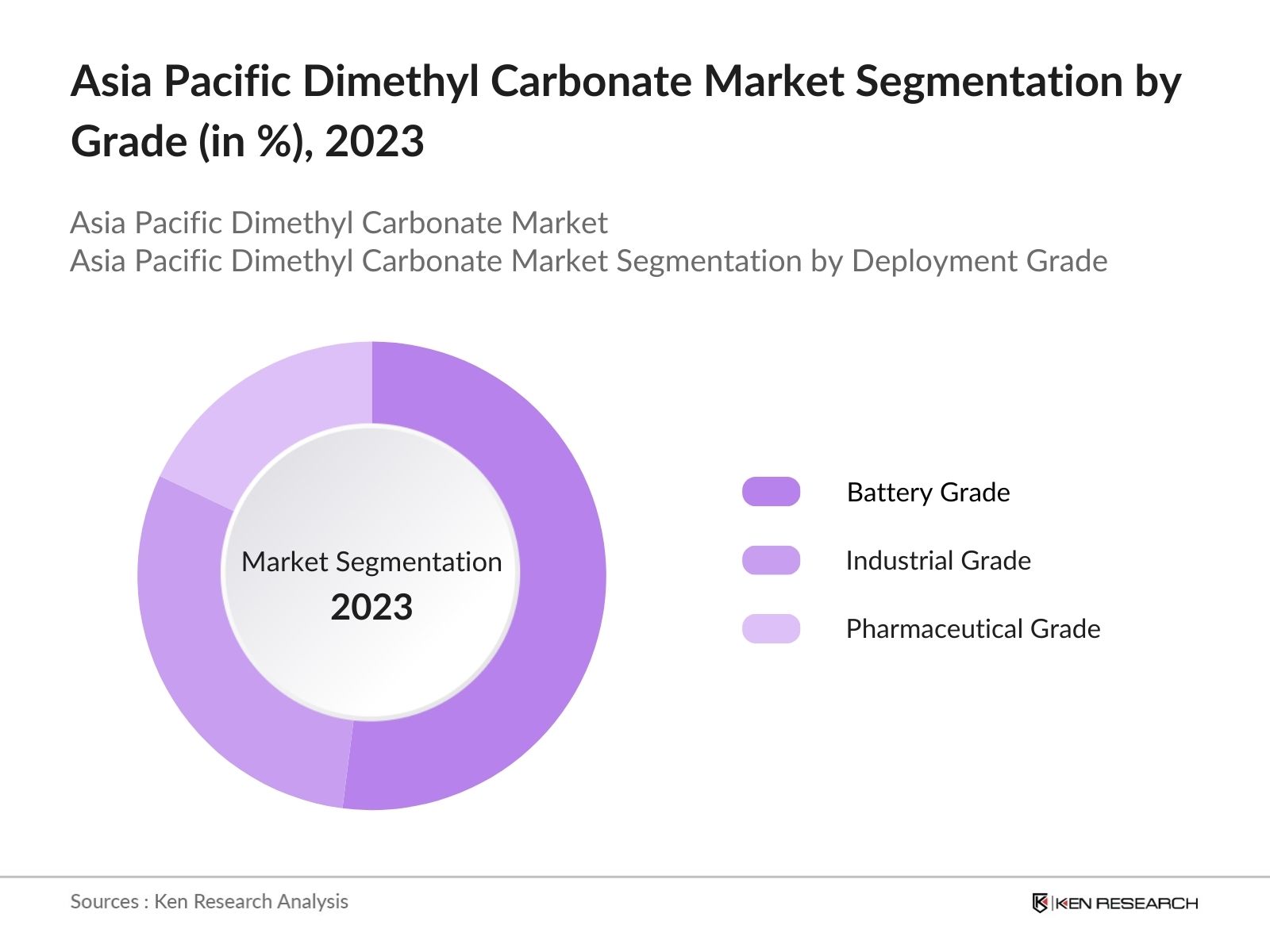

By Grade: The market is segmented by grade into industrial grade, pharmaceutical grade, and battery grade. Battery grade DMC dominates the market under this segmentation due to its extensive application in the rapidly growing lithium-ion battery market. The increasing penetration of electric vehicles (EVs) across the region, particularly in China, has driven the demand for battery-grade DMC. Additionally, technological advancements in battery technology and government incentives for EV adoption further contribute to the dominance of this sub-segment.

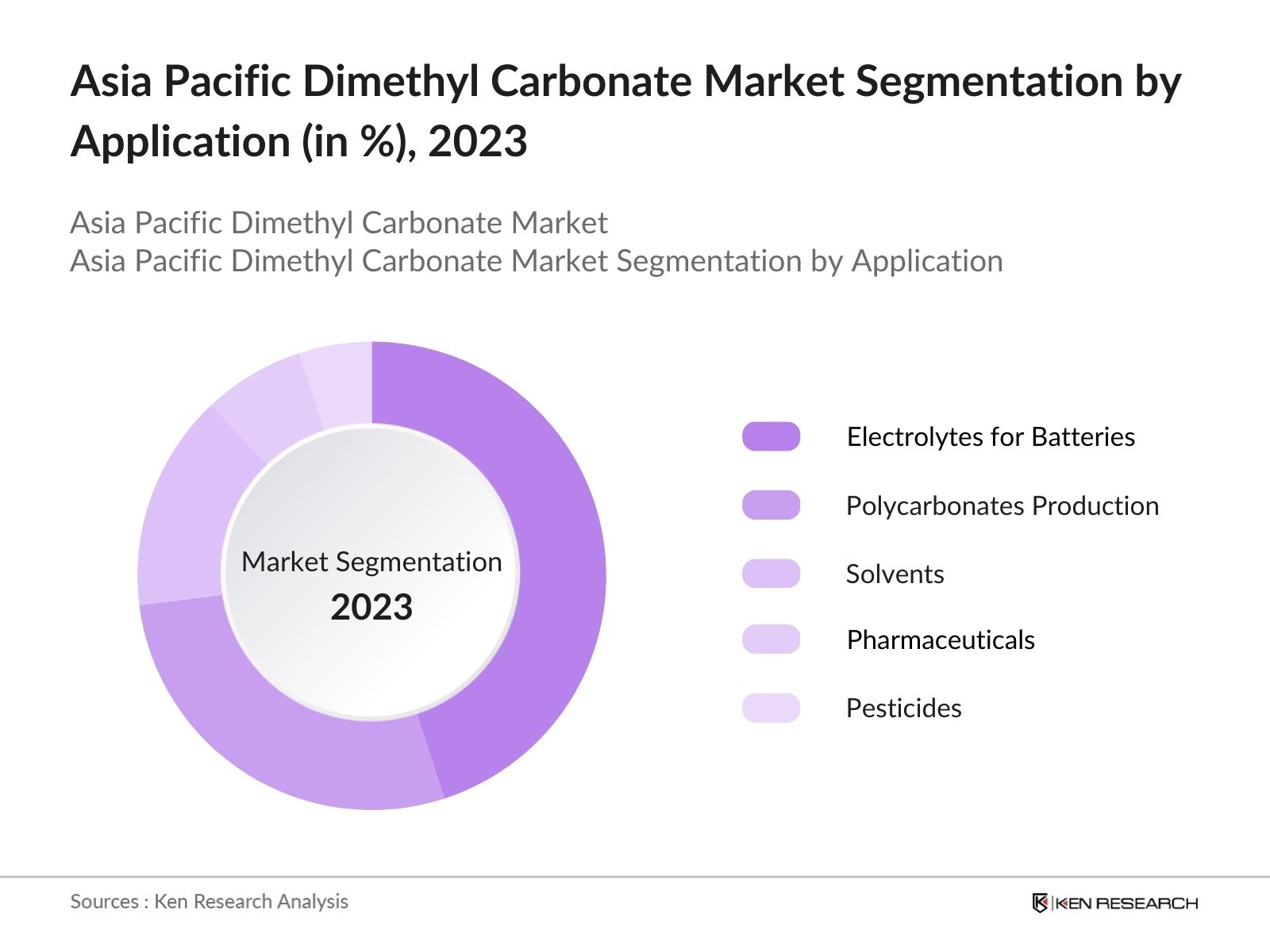

By Application: The market is also segmented by application into solvents, electrolytes for batteries, polycarbonates production, pharmaceuticals, and pesticides. The electrolyte for batteries sub-segment holds the largest market share within this segmentation. This dominance is largely attributed to the increased production of lithium-ion batteries in the Asia Pacific region, which are crucial for both the automotive and electronics sectors. As electric vehicles gain momentum, the demand for high-performance battery electrolytes, including DMC, continues to grow rapidly.

Asia Pacific Dimethyl Carbonate (DMC) Market Competitive Landscape

The Asia Pacific Dimethyl Carbonate market is characterized by several leading global and regional players. These companies engage in various strategies, including product innovation, capacity expansions, and collaborations with battery manufacturers to maintain their competitive edge. The market's concentration is evident from the dominance of a few key players who control significant portions of the production and supply chain. New entrants face challenges due to high production costs and the technical complexities involved in DMC manufacturing.

|

Company |

Establishment Year |

Headquarters |

Revenue |

No. of Employees |

R&D Investment |

Global Presence |

Sustainability Initiatives |

Manufacturing Capacity |

|

Sonoco Products Company |

1899 |

Hartsville, SC |

||||||

|

Placon Corporation |

1966 |

Madison, WI |

||||||

|

Anchor Packaging |

1963 |

St. Louis, MO |

||||||

|

Fabri-Kal Corporation |

1950 |

Kalamazoo, MI |

||||||

|

Berry Global Inc. |

1967 |

Evansville, IN |

Asia Pacific Dimethyl Carbonate (DMC) Industry Analysis

Growth Drivers

Shift Towards Sustainable Solvents: The Asia Pacific Dimethyl Carbonate (DMC) market is witnessing significant growth due to its role as a sustainable solvent, replacing traditional hazardous substances like toluene and xylene. The global shift towards greener chemical processes has seen an increase in demand for environmentally benign solvents like DMC, which is biodegradable and non-toxic. For example, Chinas chemical sector, which contributes over 30% of the worlds chemical output, has embraced DMC as part of its green chemistry initiatives. DMC is now widely used in industries such as paints, coatings, and adhesives as a safer alternative.

Increasing Use in Lithium-Ion Batteries: Dimethyl Carbonate plays a crucial role in the production of lithium-ion batteries, particularly as a component in the electrolyte. With the surge in electric vehicle (EV) production in Asia Pacific, particularly in China and India, the demand for lithium-ion batteries is rising sharply. China alone produced 6.9 million EVs in 2023, making it the largest EV producer in the world. DMC, being a key ingredient in battery electrolytes, is witnessing heightened demand as the EV market expands. The lithium-ion battery market in Asia Pacific, valued at USD 40 billion in 2023, is a major driver for DMC production in the region.

Expanding Automotive and Coatings Industries: The automotive and coatings industries are significant drivers of DMC demand, as it is used in the synthesis of polycarbonates. The automotive sector in Asia Pacific, particularly in countries like Japan, South Korea, and India, is experiencing robust growth. In 2023, Asia Pacific produced approximately 50 million motor vehicles, contributing to the growing need for polycarbonates in vehicle components and coatings. Additionally, the coatings industry, which reached USD 200 billion in value in 2023, is increasingly adopting DMC due to its low toxicity and reduced environmental impact.

Market Challenges

3.2.1 High Production Costs: One of the key challenges in the DMC market is the high cost of production, particularly due to carbon capture and storage (CCS) technologies required for sustainable production. CCS is essential for capturing CO2, which is used as a feedstock in DMC production, but the costs associated with CCS implementation can be prohibitive. In Asia Pacific, the adoption of CCS technologies is still in its nascent stages, with countries like China and India investing a combined USD 5 billion in CCS projects as of 2023, but these costs pose a challenge for DMC producers.

Competition from Alternatives: Dimethyl Carbonate faces competition from alternatives such as ethylene carbonate and propylene carbonate, which are also used in applications like battery electrolytes and solvents. Ethylene carbonate, for instance, is preferred in some battery applications due to its higher dielectric constant. The global production of ethylene carbonate reached 1 million metric tons in 2023, with a significant share coming from Asia Pacific. This competitive pressure limits the market share of DMC in certain sectors.

Asia Pacific Dimethyl Carbonate (DMC) Market Future Outlook

Over the next five years, the Asia Pacific Dimethyl Carbonate market is expected to experience substantial growth, driven by the increasing adoption of electric vehicles, expanding industrial applications, and stricter environmental regulations favoring eco-friendly solvents. The market is likely to benefit from increased investments in lithium-ion battery production, especially in China, as well as rising demand for polycarbonates in the automotive and construction sectors.

Future Market Opportunities

Increasing Applications in Pharmaceuticals: Dimethyl Carbonate is gaining traction in the pharmaceutical industry, where it is used as a reagent and intermediate in the synthesis of pharmaceutical compounds. Asia Pacific is a major hub for pharmaceutical manufacturing, with India being one of the largest producers of generic drugs. The pharmaceutical industry in Asia Pacific was valued at USD 475 billion in 2023, with a growing demand for green chemicals like DMC due to their lower toxicity and environmental impact.

Advancements in Production Technologies: Technological advancements in catalytic synthesis are opening new avenues for DMC production, reducing reliance on traditional processes that involve hazardous chemicals. Asia Pacific countries like Japan and China are at the forefront of developing catalytic technologies for DMC production. In 2023, China invested USD 1 billion in research and development for green chemical production, including catalytic synthesis technologies, which are expected to enhance the efficiency and cost-effectiveness of DMC production.

Scope of the Report

|

By Grade |

Industrial Grade Pharmaceutical Grade Battery Grade |

|

By Application |

Solvent Electrolytes for Batteries Polycarbonates Production Pharmaceuticals Pesticides |

|

By End-User Industry |

Automotive Chemicals Electronics Pharmaceuticals |

|

By Production Process |

Phosgene Process Non-Phosgene Process (CO2 Synthesis) |

|

By Region |

China India Japan Southeast Asia Australia |

Products

Key Target Audience

Dimethyl Carbonate Manufacturers

Lithium-ion Battery Manufacturers

Automotive Companies

Polycarbonate Manufacturers

Banks and Financial Institutes

Government and Regulatory Bodies (China National Chemical Corporation, Japan Chemical Industry Association)

Investments and Venture Capitalist Firms

Electronics and Semiconductor Companies

Energy Storage Solution Providers

Companies

Major Players

UBE Industries

Mitsubishi Chemical

Shandong Shida Shenghua Chemical Group

Haike Chemical Group

Asahi Kasei Corporation

Dongying Hi-tech Spring Chemical

Merck KGaA

Alfa Aesar

Guangzhou Tinci Materials Technology Co. Ltd.

Lotte Chemical Corporation

Kishida Chemical Co. Ltd.

Avantor Inc.

SABIC

Huntsman Corporation

Shandong Haike Chemical Group

Table of Contents

1. Asia Pacific Dimethyl Carbonate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Dimethyl Carbonate Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Dimethyl Carbonate Market Analysis

3.1. Growth Drivers

3.1.1. Shift Towards Sustainable Solvents

3.1.2. Increasing Use in Lithium-Ion Batteries (Battery Electrolytes)

3.1.3. Expanding Automotive and Coatings Industries (Demand for Polycarbonates)

3.1.4. Government Policies on Green Chemicals (Substitution of Hazardous Solvents)

3.2. Market Challenges

3.2.1. High Production Costs (Carbon Capture and Storage)

3.2.2. Regulatory Compliance (Environmental Regulations)

3.2.3. Competition from Alternatives (Ethylene Carbonate, Propylene Carbonate)

3.3. Opportunities

3.3.1. Growing Demand in Emerging Economies (China, India)

3.3.2. Increasing Applications in Pharmaceuticals (Pharmaceutical Intermediates)

3.3.3. Advancements in Production Technologies (Catalytic Synthesis)

3.4. Trends

3.4.1. Circular Economy Practices (Use of CO2 as Raw Material)

3.4.2. Increasing Collaborations with Battery Manufacturers

3.4.3. Expansion of Capacity in Asia Pacific (New Production Plants)

3.5. Government Regulation

3.5.1. Asia Pacific Green Chemistry Policies

3.5.2. Environmental Emission Standards

3.5.3. Trade Policies and Tariffs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Dimethyl Carbonate Market Segmentation

4.1. By Grade (In Value %)

4.1.1. Industrial Grade

4.1.2. Pharmaceutical Grade

4.1.3. Battery Grade

4.2. By Application (In Value %)

4.2.1. Solvent

4.2.2. Electrolytes for Batteries

4.2.3. Polycarbonates Production

4.2.4. Pharmaceuticals

4.2.5. Pesticides

4.3. By End-User Industry (In Value %)

4.3.1. Automotive

4.3.2. Chemicals

4.3.3. Electronics

4.3.4. Pharmaceuticals

4.4. By Production Process (In Value %)

4.4.1. Phosgene Process

4.4.2. Non-Phosgene Process (Catalytic Synthesis from CO2)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Southeast Asia

4.5.5. Australia

5. Asia Pacific Dimethyl Carbonate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. UBE Industries

5.1.2. Mitsubishi Chemical

5.1.3. Asahi Kasei Corporation

5.1.4. Shandong Shida Shenghua Chemical Group

5.1.5. Dongying Hi-tech Spring Chemical

5.1.6. Merck KGaA

5.1.7. Alfa Aesar

5.1.8. Haike Chemical Group

5.1.9. Shandong Haike Chemical Group

5.1.10. Kishida Chemical Co. Ltd.

5.1.11. Guangzhou Tinci Materials Technology Co. Ltd.

5.1.12. Huntsman Corporation

5.1.13. Lotte Chemical Corporation

5.1.14. Avantor Inc.

5.1.15. SABIC

5.2. Cross Comparison Parameters (Production Capacity, Revenue, R&D Investment, Sustainability Initiatives, Market Share, Product Innovation, Global Presence, Market Penetration Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Dimethyl Carbonate Market Regulatory Framework

6.1. Environmental Standards

6.2. Safety Standards for Chemical Handling

6.3. Compliance Requirements for Industrial Grade DMC

6.4. Certification Processes for Green DMC

7. Asia Pacific Dimethyl Carbonate Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Dimethyl Carbonate Future Market Segmentation

8.1. By Grade (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Production Process (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Dimethyl Carbonate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves mapping the ecosystem of stakeholders within the Asia Pacific Dimethyl Carbonate Market. This step relies on comprehensive desk research using a combination of secondary sources and proprietary databases to gather vital industry information. The focus is on identifying the key variables affecting the market, such as production capacity, demand drivers, and technological advancements.

Step 2: Market Analysis and Construction

The second phase involves compiling and analyzing historical data for the Dimethyl Carbonate Market in the Asia Pacific region. This includes an evaluation of production volumes, usage rates in key applications, and revenue generation across different countries. Key factors like regulatory shifts and technology innovations are also assessed to ensure accurate market projections.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews and surveys to validate the hypotheses formed during the data analysis phase. These consultations provide first-hand insights into production processes, market demand, and supply chain challenges, ensuring the accuracy and reliability of the data used in the final report.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all research findings to provide a comprehensive and validated analysis of the Asia Pacific Dimethyl Carbonate Market. This stage incorporates feedback from key industry players to refine the final output, ensuring that the report presents an accurate picture of market dynamics, growth drivers, and future trends.

Frequently Asked Questions

01 How big is the Asia Pacific Dimethyl Carbonate Market?

The Asia Pacific Dimethyl Carbonate market is valued at USD 627 million, driven by its application in lithium-ion batteries and polycarbonate production. The demand for eco-friendly solvents and growing electric vehicle production are key drivers.

02 What are the challenges in the Asia Pacific Dimethyl Carbonate Market?

Challenges in the Asia Pacific Dimethyl Carbonate market include high production costs, competition from alternative carbonates, and stringent regulatory compliance requirements for chemical manufacturing. These factors pose barriers to market entry for new players.

03 Who are the major players in the Asia Pacific Dimethyl Carbonate Market?

Key players in the Asia Pacific Dimethyl Carbonate market include UBE Industries, Mitsubishi Chemical, Shandong Shida Shenghua Chemical, Haike Chemical Group, and Asahi Kasei Corporation. These companies dominate due to their extensive production capabilities and strong partnerships.

04 What are the growth drivers of the Asia Pacific Dimethyl Carbonate Market?

The Asia Pacific Dimethyl Carbonate market is driven by factors such as the growing demand for lithium-ion batteries, the increasing adoption of electric vehicles, and government regulations promoting the use of green chemicals and sustainable practices.

05 Which segment leads the Asia Pacific Dimethyl Carbonate Market?

Battery-grade DMC leads the Asia Pacific Dimethyl Carbonate market, primarily driven by its use in the rapidly growing electric vehicle industry and the expansion of lithium-ion battery manufacturing in China and Japan.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.