Asia-Pacific Dimethyl Ether (DME) Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4298

November 2024

93

About the Report

Asia-Pacific Dimethyl Ether (DME) Market Overview

- The Asia-Pacific Dimethyl Ether (DME) market is valued at USD 1.1 billion based on a five-year historical analysis. The market is primarily driven by increasing demand for clean fuel alternatives due to government policies aimed at reducing carbon emissions. DME is widely used as a substitute for liquefied petroleum gas (LPG) and diesel, especially in countries like China, Japan, and South Korea, where industrial activities and environmental regulations are key driving factors. The shift towards cleaner energy alternatives is accelerating the adoption of DME in various sectors.

- China dominates the Asia-Pacific DME market due to its focus on reducing pollution and its large-scale industrial usage of clean fuels. The countrys policy initiatives, such as the promotion of alternative fuels in transportation and industry, make it a key player. South Korea and Japan are also major contributors, driven by their advancements in DME technology and the adoption of renewable energy sources. These countries have well-established infrastructure and government support for clean energy solutions, further cementing their dominance in the DME market.

- Governments across Asia-Pacific are providing subsidies and incentives for renewable DME production to support the transition to clean energy. In 2023, the Indian government offered USD 250 million in subsidies for bio-DME production plants, further boosting the renewable DME market. These financial incentives are helping reduce the cost of production and encouraging more companies to enter the renewable DME space. This, in turn, is expected to drive the wider adoption of DME as a clean fuel.

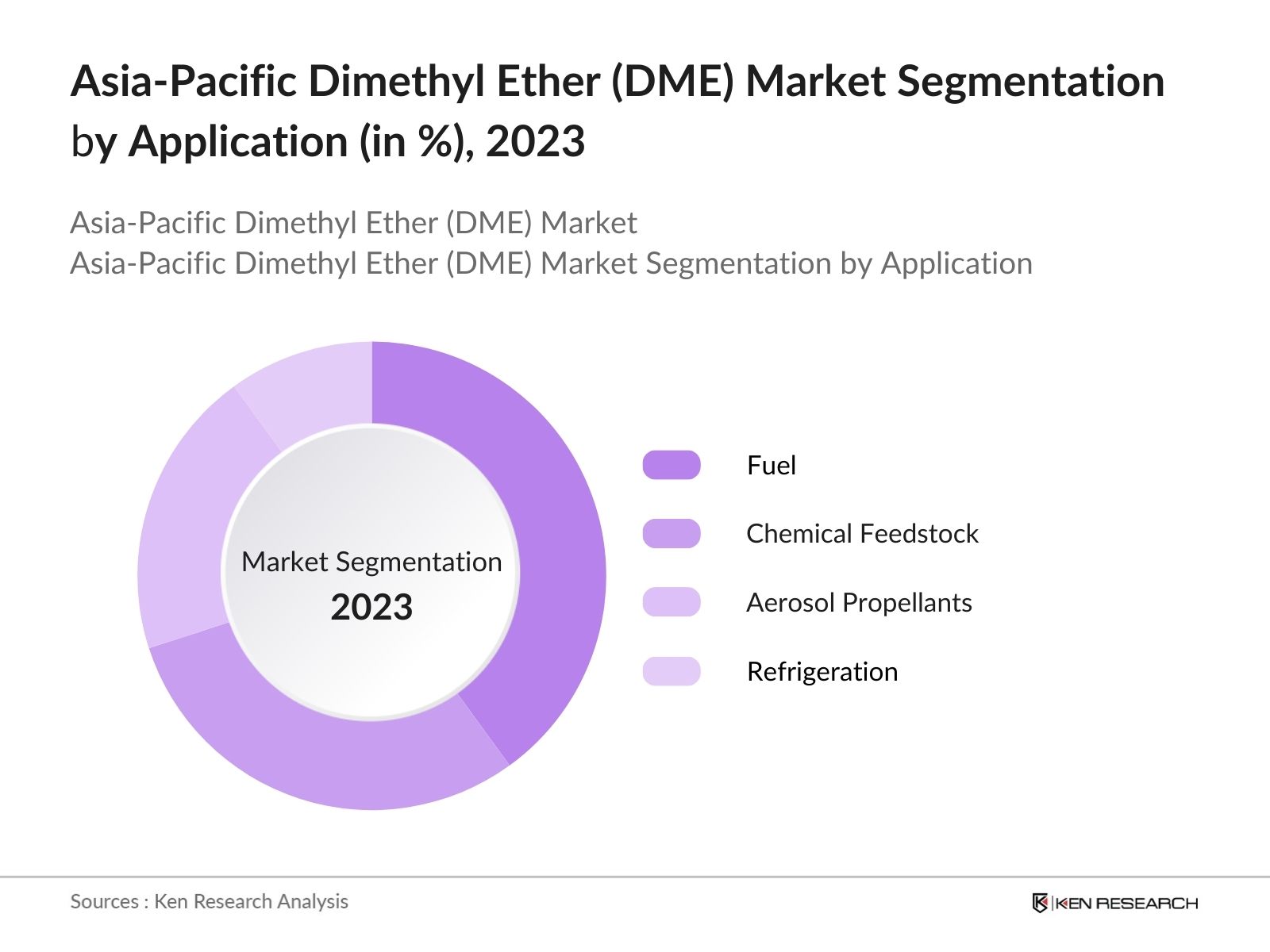

Asia-Pacific Dimethyl Ether (DME) Market Segmentation

By Application: The market is segmented by application into fuel, chemical feedstock, aerosol propellants, and refrigeration. Among these, the fuel segment holds a dominant market share due to the increasing use of DME as an alternative to LPG and diesel, especially in the transportation and domestic cooking sectors. The rising environmental concerns and government regulations promoting low-emission fuels have boosted the demand for DME in the fuel industry. In addition, its use in the transportation sector for clean fuel vehicles is expected to further drive this segments dominance.

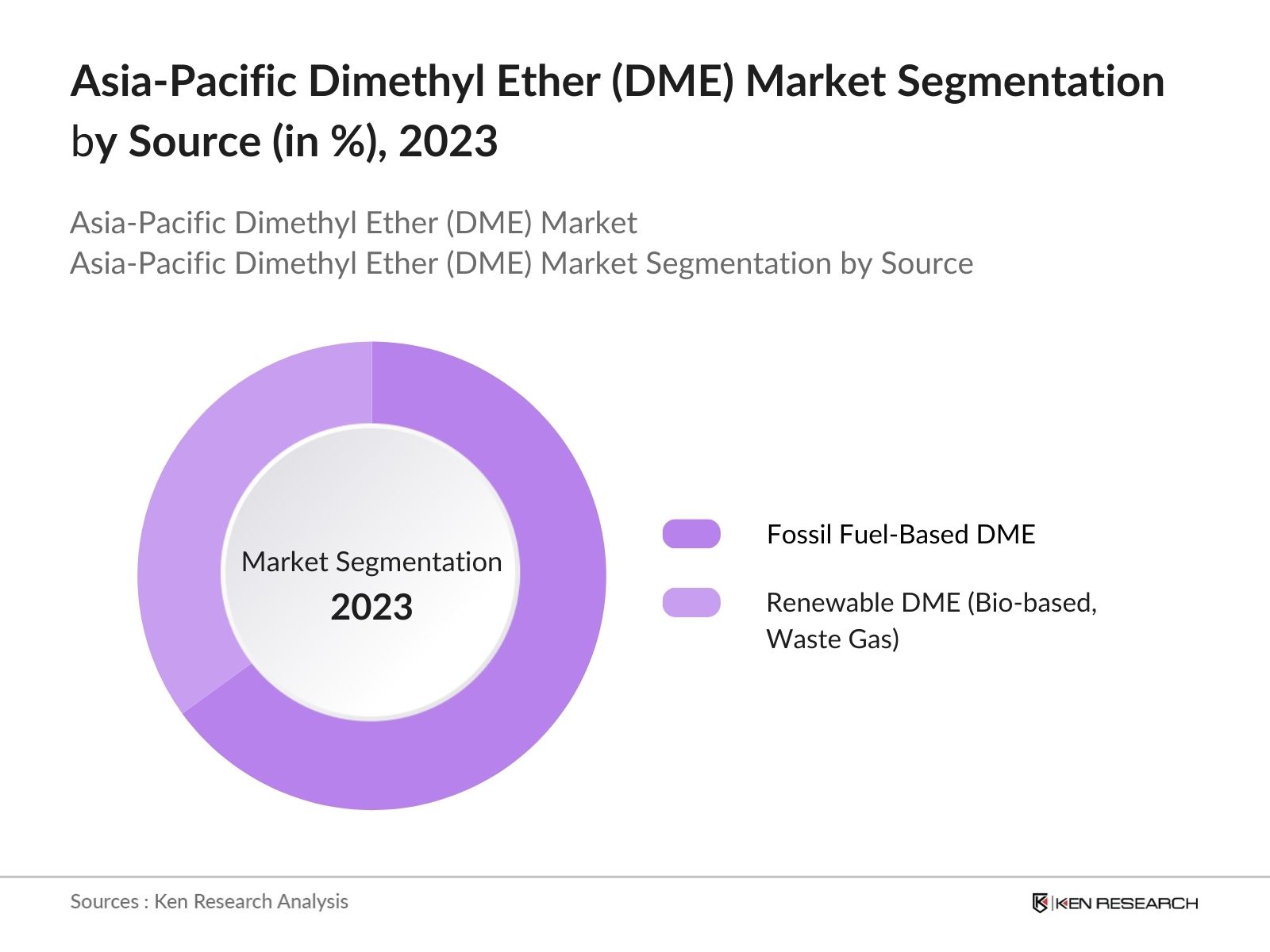

By Source: The market is further segmented by source into fossil fuel-based DME and renewable DME (bio-based and waste gas). Fossil fuel-based DME holds a substantial share due to its established production infrastructure and higher cost-effectiveness compared to renewable sources. However, renewable DME is rapidly gaining traction, driven by global trends towards sustainability and the adoption of waste-to-energy initiatives. The environmental benefits associated with renewable DME, such as reduced carbon emissions, are making it a more viable option for future growth.

By Source: The market is further segmented by source into fossil fuel-based DME and renewable DME (bio-based and waste gas). Fossil fuel-based DME holds a substantial share due to its established production infrastructure and higher cost-effectiveness compared to renewable sources. However, renewable DME is rapidly gaining traction, driven by global trends towards sustainability and the adoption of waste-to-energy initiatives. The environmental benefits associated with renewable DME, such as reduced carbon emissions, are making it a more viable option for future growth.

Asia-Pacific Dimethyl Ether (DME) Market Competitive Landscape

The Asia-Pacific DME market is dominated by a mix of regional and global players, who are leveraging technological advancements, strategic partnerships, and government collaborations to maintain their competitive edge. Key players are focusing on expanding their production capacities, particularly in renewable DME, in response to growing environmental concerns. Global corporations like Royal Dutch Shell and Linde Group also have a strong foothold due to their well-established distribution networks and investments in clean energy technologies. Local players such as Zagros Petrochemical Company are also notable contributors, focusing on the production of cost-effective fossil fuel-based DME.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (2023) |

Production Capacity (Tons/Year) |

Market Penetration |

Sustainability Initiatives |

Strategic Partnerships |

|

Mitsubishi Corporation |

1950 |

Tokyo, Japan |

||||||

|

Royal Dutch Shell |

1907 |

The Hague, Netherlands |

||||||

|

China Energy |

1995 |

Beijing, China |

||||||

|

Linde Group |

1879 |

Munich, Germany |

||||||

|

Zagros Petrochemical Company |

2000 |

Tehran, Iran |

Asia-Pacific Dimethyl Ether (DME) Industry Analysis

Growth Drivers

- Growing Demand for Clean Fuels: Dimethyl ether (DME) is gaining traction as a clean alternative to diesel and LPG due to its low carbon emissions and lack of particulates. With Asia-Pacific governments targeting emission reductions, the industrial use of DME is being promoted through policy measures. For instance, Japan aims to reduce greenhouse gas emissions to 1.1 billion metric tons by 2030, encouraging the adoption of low-emission fuels like DME. DME is increasingly used in power generation and transport, contributing to industrial demand. In South Korea, industrial DME consumption increased by 18,000 metric tons between 2022 and 2023.

- Expanding Applications in Petrochemical and Automotive Sectors: DMEs applications have expanded within the petrochemical and automotive industries due to its chemical properties and cleaner combustion profile. In 2023, China alone accounted for 60,000 metric tons of DME used as a propellant in aerosol applications and an additive in LPG. Furthermore, in the automotive industry, DME is being trialed in trucks and buses in Japan, where 2,500 commercial vehicles were adapted for DME usage between 2022 and 2024. This uptake is expected to reduce reliance on traditional fuels and lower transportation emissions.

- Industrial Shift to Alternative Fuel Sources: There is a clear shift in the Asia-Pacific region towards alternative fuel sources as industries focus on reducing their carbon footprints. The production of DME as an alternative to LPG and diesel has surged in countries like China, where DME production increased by 20,000 metric tons between 2022 and 2023. With further investments in cleaner fuel production, industries in sectors such as chemicals and logistics are gradually adopting DME as a viable alternative, contributing to the overall shift towards green energy solutions in the region.

Market Challenges

- Availability of Alternatives: The availability of cheaper and more established fuel alternatives such as natural gas and LPG presents a challenge for DMEs market growth. In 2023, the Asia-Pacific region consumed 2.8 trillion cubic meters of natural gas, a widely available alternative to DME. Moreover, LPG, which saw a production increase of 1.5 million tons across Southeast Asia, continues to be a more familiar fuel option for industrial and residential use, limiting DMEs market penetration.

- Logistics and Storage Issues for Large Scale Operations: The logistics and storage of DME remain challenging for large-scale operations, as DME requires specialized infrastructure. In 2023, countries like Japan faced a shortfall of 15,000 metric tons in DME storage capacity due to the limited number of dedicated storage facilities. Additionally, DMEs lower energy density compared to LPG complicates its transportation and storage, increasing operational costs and limiting its widespread adoption across the Asia-Pacific region.

Asia-Pacific Dimethyl Ether (DME) Market Future Outlook

Over the next five years, the Asia-Pacific Dimethyl Ether (DME) market is expected to experience steady growth driven by increasing government support for cleaner fuels and innovations in DME production technologies. The market will continue to be shaped by the growing demand for alternative energy sources in both the transportation and industrial sectors. Furthermore, advancements in renewable DME production and collaborations between private and public sectors will play a role in ensuring the markets sustainability and expansion. This, coupled with rising environmental awareness and stringent emission regulations, will ensure a stable upward trend for the DME market in the region.

Future Market Opportunities

- Expanding Renewable DME Production: The push towards renewable DME production, including the use of biomass and waste-to-energy processes, is expanding the market. In 2023, South Korea produced 50,000 metric tons of renewable DME using biomass, contributing to the countrys low-carbon fuel targets. Similarly, Japan initiated waste-to-energy projects that resulted in the production of 12,000 metric tons of DME by converting waste gas from industrial operations. These initiatives highlight the potential of renewable DME in the clean energy landscape.

- Partnerships for Green Fuel Innovations: Collaborative partnerships between public and private entities are driving innovation in the DME market. For instance, in 2024, Japan and South Korea announced a joint venture to develop DME as a transportation fuel, with a goal to produce 100,000 metric tons by 2025. This venture aims to reduce the dependency on fossil fuels and contribute to the regions energy diversification efforts, creating new opportunities for market players in the clean fuel sector.

Scope of the Report

|

Application |

Fuel Chemical Feedstock Aerosol Propellants Refrigeration |

|

Source |

Fossil Fuel-Based DME Renewable DME (Bio-based, Waste Gas) |

|

End-User Industry |

Transportation Sector Energy Sector Chemical Industry |

|

Production Technology |

Direct Synthesis from Syngas Indirect Methanol Dehydration Biomass Gasification |

|

Region |

China Japan South Korea India Australia |

Products

Key Target Audience

Dimethyl Ether (DME) Producers

Government and Regulatory Bodies (e.g., Ministry of Energy, National Energy Administration)

Automotive Manufacturers

Petrochemical Companies

Renewable Energy Companies

Investor and Venture Capitalist Firms

Banks and Financial institutes

Industrial Fuel Consumers

Environmental Agencies

Companies

Major Players

Mitsubishi Corporation

Royal Dutch Shell

China Energy

AkzoNobel

Linde Group

Oberon Fuels

BASF SE

Total S.A.

Korea Gas Corporation

Ferrostaal GmbH

Grillo-Werke AG

Toyo Engineering Corporation

Zagros Petrochemical Company

ExxonMobil

China National Petroleum Corporation (CNPC)

Table of Contents

1. Asia-Pacific Dimethyl Ether (DME) Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia-Pacific Dimethyl Ether (DME) Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia-Pacific Dimethyl Ether (DME) Market Analysis

3.1 Growth Drivers

3.1.1 Growing Demand for Clean Fuels (Emission Reduction, Industrial Adoption)

3.1.2 Government Regulations for Low Carbon Alternatives (Fuel Policies, Subsidies)

3.1.3 Expanding Applications in Petrochemical and Automotive Sectors

3.1.4 Industrial Shift to Alternative Fuel Sources

3.2 Market Challenges

3.2.1 High Initial Production Costs (Technology, Infrastructure Investment)

3.2.2 Limited Awareness Amongst End-Users

3.2.3 Availability of Alternatives (Natural Gas, LPG)

3.2.4 Logistics and Storage Issues for Large Scale Operations

3.3 Opportunities

3.3.1 Technological Advancements in DME Production

3.3.2 Expanding Renewable DME Production (Biomass, Waste-to-Energy)

3.3.3 Partnerships for Green Fuel Innovations

3.3.4 Increasing Investment in Sustainable Energy Projects

3.4 Trends

3.4.1 Shift Towards Renewable Energy Sources (Waste Gas Conversion)

3.4.2 Adoption of DME in Commercial Transport

3.4.3 Development of Hybrid DME Combustion Systems

3.4.4 Export Opportunities in Emerging Economies

3.5 Government Regulations

3.5.1 Carbon Emission Targets (Regulations on Emission Standards, Clean Energy Policies)

3.5.2 Subsidies and Incentives for Renewable DME Production

3.5.3 Public-Private Partnerships for R&D in Clean Fuels

3.5.4 DME Blending Mandates in Transportation

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Producers, Distributors, End-Users)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia-Pacific Dimethyl Ether (DME) Market Segmentation

4.1 By Application (In Value %)

4.1.1 Fuel (Transportation, Domestic Cooking)

4.1.2 Chemical Feedstock (Petrochemicals, Fertilizers)

4.1.3 Aerosol Propellants

4.1.4 Refrigeration

4.2 By Source (In Value %)

4.2.1 Fossil Fuel-Based DME

4.2.2 Renewable DME (Bio-based, Waste Gas)

4.3 By End-User Industry (In Value %)

4.3.1 Transportation Sector

4.3.2 Energy Sector

4.3.3 Chemical Industry

4.4 By Production Technology (In Value %)

4.4.1 Direct Synthesis from Syngas

4.4.2 Indirect Methanol Dehydration

4.4.3 Biomass Gasification

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 South Korea

4.5.4 India

4.5.5 Australia

5. Asia-Pacific Dimethyl Ether (DME) Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mitsubishi Corporation

5.1.2 Royal Dutch Shell

5.1.3 Oberon Fuels

5.1.4 China Energy

5.1.5 AkzoNobel

5.1.6 Linde Group

5.1.7 Grillo-Werke AG

5.1.8 Toyo Engineering Corporation

5.1.9 Ferrostaal GmbH

5.1.10 Zagros Petrochemical Company

5.1.11 Total S.A.

5.1.12 China National Petroleum Corporation (CNPC)

5.1.13 ExxonMobil

5.1.14 BASF SE

5.1.15 Korea Gas Corporation

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Production Capacity, Market Penetration, Product Portfolio, Sustainability Initiatives, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. Asia-Pacific Dimethyl Ether (DME) Market Regulatory Framework

6.1 Emission Standards for Transportation and Industrial Applications

6.2 Compliance Requirements for Renewable Fuel Production

6.3 Certification Processes for DME Production Facilities

7. Asia-Pacific Dimethyl Ether (DME) Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia-Pacific Dimethyl Ether (DME) Future Market Segmentation

8.1 By Application (In Value %)

8.2 By Source (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Production Technology (In Value %)

8.5 By Region (In Value %)

9. Asia-Pacific Dimethyl Ether (DME) Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped the key stakeholders in the Asia-Pacific DME market. This was done through extensive secondary research, reviewing government publications, and leveraging proprietary databases to identify major players and influential market variables, including production capacities, fuel substitution trends, and regulatory frameworks.

Step 2: Market Analysis and Construction

This phase involved analyzing historical market data, including production volumes, distribution networks, and end-user applications. By assessing the performance of the market in various sectors, such as transportation and petrochemicals, we were able to construct a robust model for the DME market in the Asia-Pacific region.

Step 3: Hypothesis Validation and Expert Consultation

We validated our market assumptions through expert consultations with stakeholders such as DME producers, environmental regulatory bodies, and industry analysts. These consultations provided valuable insights into market dynamics, which were cross verified with industry data for accuracy.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from both primary and secondary sources to develop a comprehensive report. By combining qualitative insights with quantitative data, we ensured that our analysis of the Asia-Pacific DME market is both detailed and accurate.

Frequently Asked Questions

01 How big is the Asia-Pacific Dimethyl Ether (DME) market?

The Asia-Pacific DME market is valued at USD 1.1 billion, driven by increasing demand for cleaner energy sources and government initiatives to reduce carbon emissions.

02 What are the challenges in the Asia-Pacific DME market?

Key challenges in the Asia-Pacific DME market include high initial production costs, limited awareness among end-users, and the availability of cheaper alternatives like natural gas and LPG.

03 Who are the major players in the Asia-Pacific Dimethyl Ether (DME) market?

Major players in the Asia-Pacific DME market include Mitsubishi Corporation, Royal Dutch Shell, China Energy, Linde Group, and Oberon Fuels. These companies dominate the market due to their large production capacities and strong government partnerships.

04 What are the growth drivers for the Asia-Pacific Dimethyl Ether (DME) market?

Growth drivers in the Asia-Pacific DME market include the rising adoption of DME as a clean fuel alternative, technological advancements in production, and increased investments in renewable DME sources.

05 What sectors are driving demand for Dimethyl Ether (DME)?

The transportation and petrochemical sectors are the primary drivers of demand, with DME being used as an alternative to diesel and LPG, especially in regions with strict emission control regulations in the Asia-Pacific DME market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.