Asia-Pacific Dry Mix Mortar Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD8677

December 2024

80

About the Report

Asia-Pacific Dry Mix Mortar Market Overview

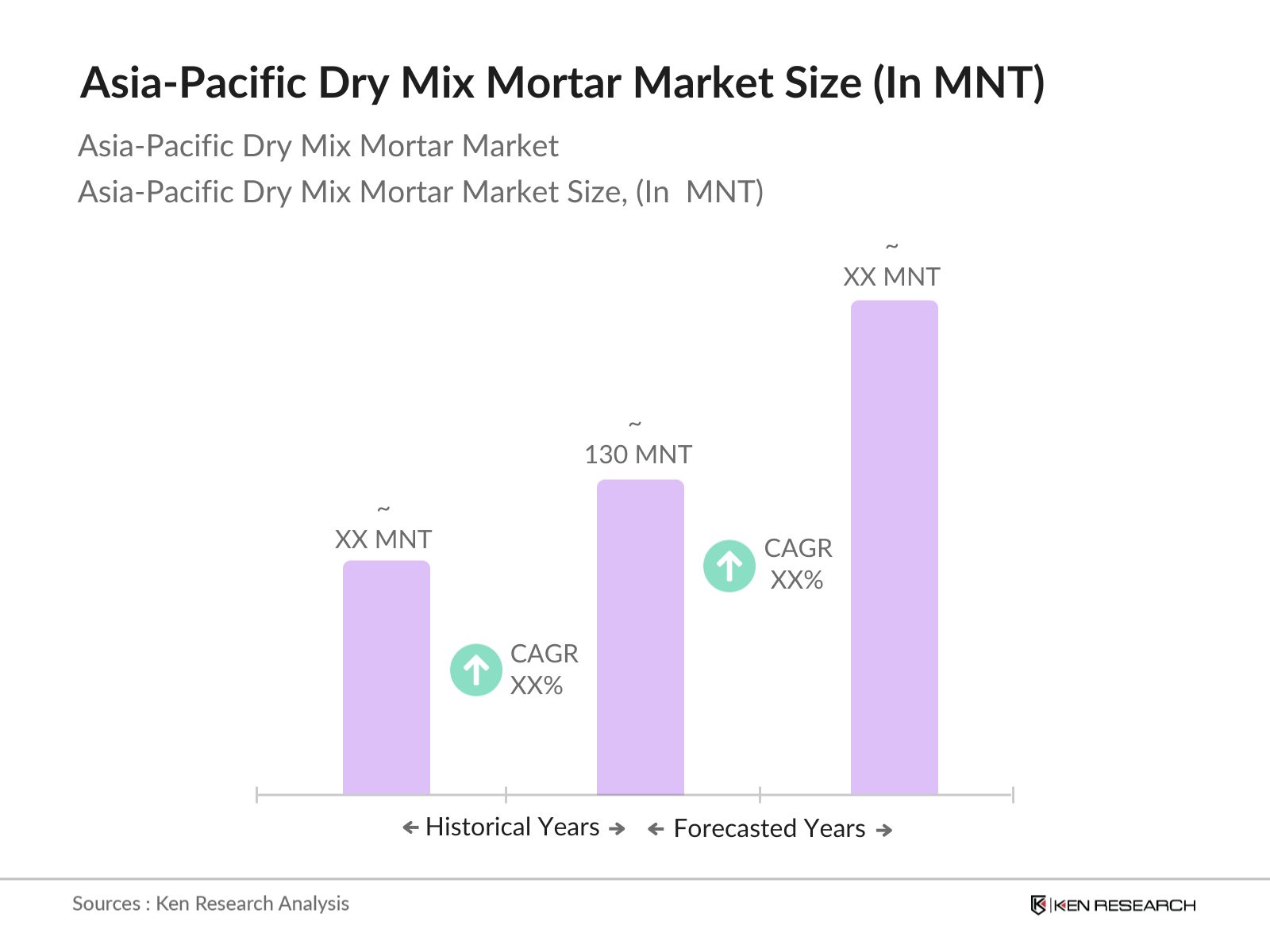

- The Asia-Pacific Dry Mix Mortar Market reached an estimated valuation of 130 million tons, supported by sustained demand from the construction industry. Rising urbanization and a shift toward time-efficient construction solutions across major economies heavily drive this market's growth. Cement-based mortars, alongside innovations in polymer-modified formulations, cater to applications that meet specific environmental and structural requirements, further propelling demand.

- Countries such as China, India, and Japan lead this market due to rapid urbanization, large-scale infrastructure investments, and government initiatives to support eco-friendly construction materials. China, with its high urban population and large-scale infrastructure projects, and India, driven by urbanization policies, have emerged as dominant contributors. Additionally, Japans advanced technology in construction materials gives it a significant edge in specialized mortar products.

- Green building certifications, such as Singapore's Green Mark, require construction projects to meet eco-friendly standards. Dry mix mortars that conform to these standards are increasingly mandated in both public and private sector projects. This regulatory push towards environmentally compliant materials drives demand for certified dry mix mortar products across the region.

Asia-Pacific Dry Mix Mortar Market Segmentation

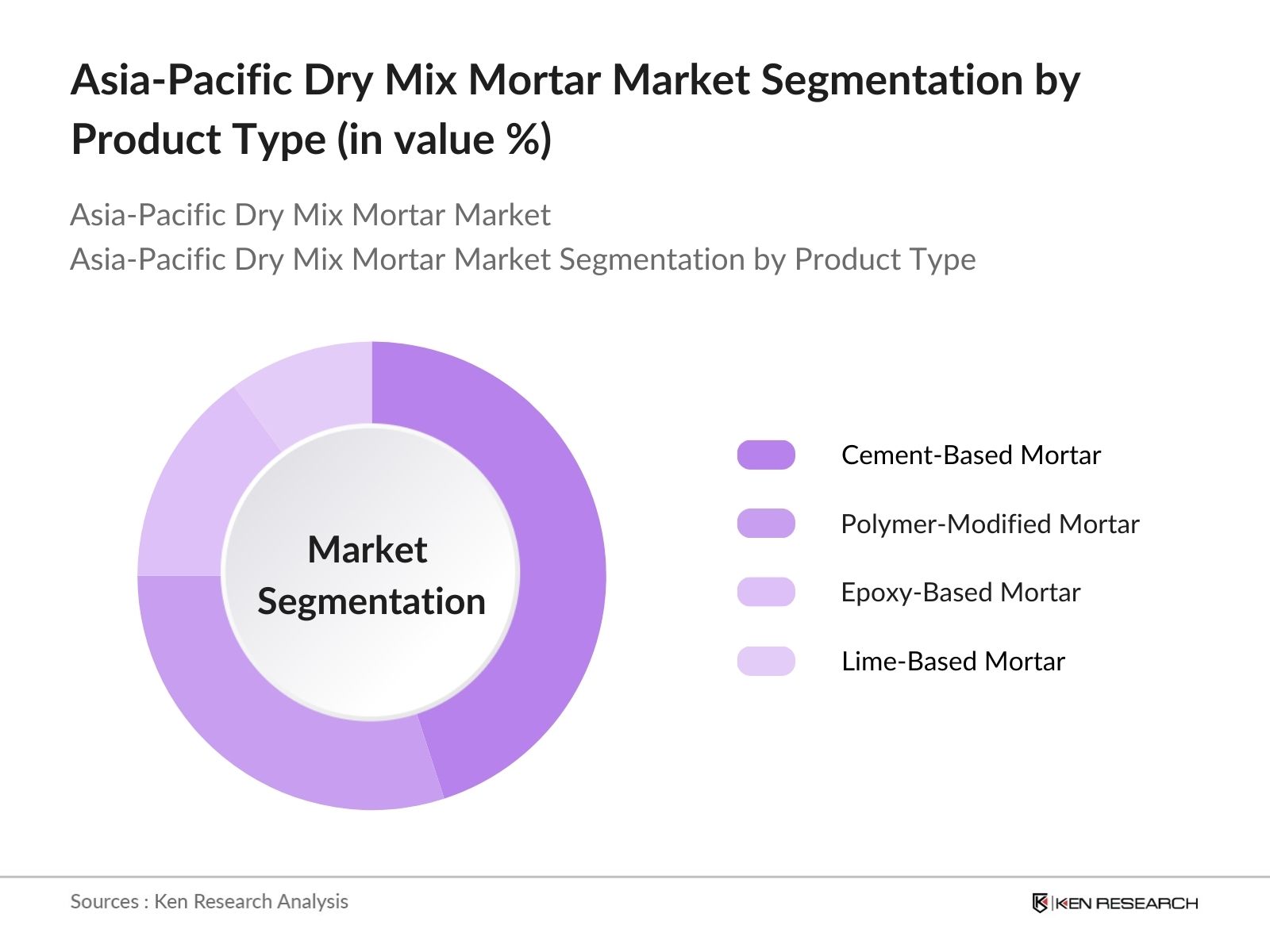

- By Product Type: The Asia-Pacific Dry Mix Mortar Market is segmented by product type into cement-based, polymer-modified, epoxy-based, and lime-based mortars. Cement-based mortars have a dominant market share within this segment, attributed to their wide-ranging application, high compatibility with construction materials, and suitability for mass infrastructure projects. Cement-based mortars are favoured due to cost efficiency and reliability in various environmental conditions, making them a cornerstone of the construction industry in this region.

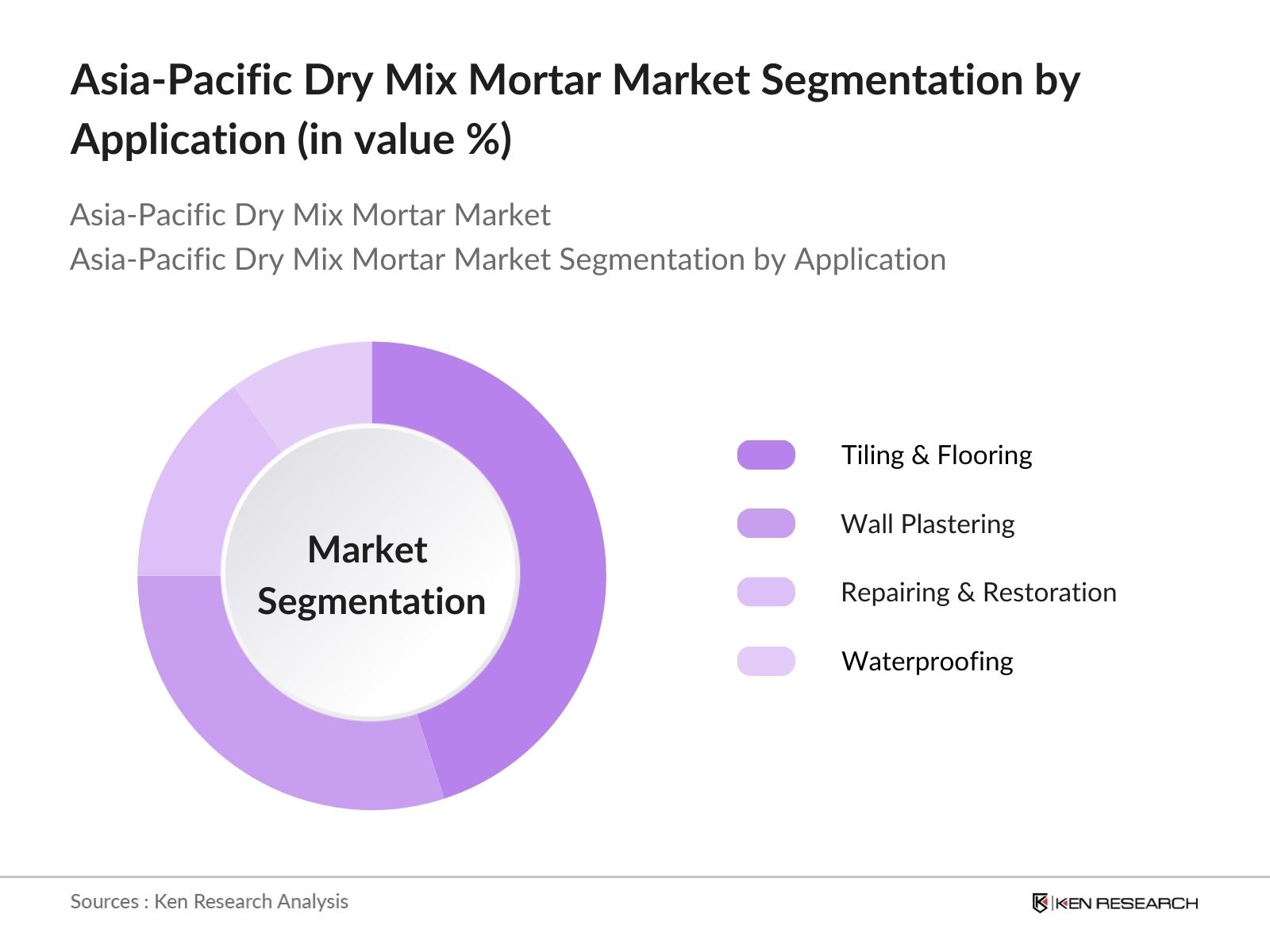

- By Application: The market is further segmented by application, with categories including tiling and flooring, wall plastering, repairing and restoration, and waterproofing. Within this segment, tiling and flooring lead the market share, driven by high demand from residential, commercial, and infrastructural construction. Tiling and flooring mortars are preferred due to their ease of application, durability, and aesthetic versatility, supporting both new builds and renovation projects.

Asia-Pacific Dry Mix Mortar Market Competitive Landscape

The Asia-Pacific Dry Mix Mortar Market is characterized by a blend of multinational corporations and regional manufacturers. Dominated by established names like Sika AG, Saint-Gobain Weber, and BASF SE, the market witnesses strategic positioning focused on product innovation, sustainability, and regional expansion to capture demand. These firms' stronghold in the market stems from their extensive distribution networks, continuous R&D investments, and diversified product portfolios.

Asia-Pacific Dry Mix Mortar Market Analysis

Market Growth Drivers

- Urbanization and Real Estate Growth: Rapid urbanization across Asia-Pacific countries, particularly in China and India, continues to drive demand for dry mix mortar. In 2024, China's urban population reached over 900 million people, reflecting ongoing infrastructure investments and the need for time-efficient, quality construction solutions. Similarly, Indias housing demand remains robust, supported by real estate regulations like RERA, which encourage more standardized construction practices to accommodate an increasing population. Dry mix mortar, a material that reduces site mixing time, supports these demands, aligning with urbanization and real estate growth requirements.

- Demand for Time-Efficient Construction: The Asia-Pacific construction market is under pressure to adopt methods that accelerate project timelines. China and Southeast Asia are investing in prefabricated and modular construction techniques, reducing project duration by up to 40%, according to government construction reports. The dry mix mortar market benefits as these materials are pre-mixed and ready to use, streamlining construction schedules. This aligns with broader national objectives to reduce infrastructure completion times across the region.

- Regulatory Push for Sustainable Building Materials: Several Asia-Pacific countries now prioritize eco-friendly building materials. For example, Japan's Ministry of Land, Infrastructure, Transport, and Tourism has implemented green building mandates that require low-emission materials. Dry mix mortars, known for minimal onsite waste, contribute to these sustainability goals, encouraging adoption across urban projects. With environmental building standards gaining traction, the demand for low-emission materials like dry mix mortar continues to rise, driven by government regulations and consumer awareness.

Market Challenges

- Fluctuations in Raw Material Costs: Raw material costs in the Asia-Pacific region, especially for essential components like sand and cement, are volatile. Indonesia, for example, saw a sharp increase in cement prices by 5-10% due to supply chain disruptions, impacting the dry mix mortar sector (Indonesia Statistics Bureau). These fluctuations raise costs for manufacturers and create instability, which can delay projects and reduce contractor profitability.

- Transportation and Storage Constraints: Asia-Pacific countries with vast geography, like India and Indonesia, face logistical challenges in transporting dry mix mortar, particularly to remote construction sites. The average transportation distance for construction materials exceeds 300 km in some regions, leading to potential delays and storage issues (Ministry of Transport, India). As dry mix mortar is sensitive to moisture, inadequate storage can degrade product quality, posing challenges in regions with limited infrastructure.

Asia-Pacific Dry Mix Mortar Market Future Outlook

In the coming years, the Asia-Pacific Dry Mix Mortar Market is anticipated to show steady growth, driven by increasing urbanization, demand for time-efficient building solutions, and a strong emphasis on sustainability. The market will benefit from advancements in formulation technology, allowing for enhanced product performance and environmental compliance. The integration of lightweight and multi-functional mortars will cater to evolving construction practices, supporting a robust demand from residential and infrastructure segments.

Market Opportunities

- Advancements in Lightweight Mortar Mixes: Lightweight mortar mixes are becoming a preferred choice for high-rise construction due to their ease of handling and reduced structural load. South Korea reports a 15% increase in lightweight mortar usage in its metropolitan construction projects, aiding in faster project timelines and improved structural integrity. This innovation presents significant growth potential, especially in regions with high urban density.

- Expansion into High-Growth Regions: Countries like Vietnam and the Philippines are experiencing rapid growth in residential and commercial construction. In 2024, the Philippines saw a 7% increase in construction activity, creating a strong demand for quick-setting materials like dry mix mortar. This growth represents an opportunity for dry mix mortar providers to expand into emerging markets where construction activity is high and evolving.

Scope of the Report

|

Product Type |

Cement-Based Polymer Modified Epoxy-Based Lime-Based |

|

Application |

Tiling & Flooring Wall Plastering Repairing and Restoration Waterproofing |

|

End-User |

Residential Commercial Infrastructure |

|

Distribution Channel |

Direct Sales Retail Channels Online Distribution |

|

Region |

China India Japan South Korea Southeast Asia |

Products

Key Target Audience

Real Estate Developers

Construction Contractors

Industrial Infrastructure Firms

Residential Project Owners

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Housing and Urban-Rural Development, Bureau of Construction Standards)

Building Material Manufacturers

Architectural and Engineering Firms

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Sika AG

Saint-Gobain Weber

LafargeHolcim Ltd.

BASF SE

Ardex GmbH

Mapei S.p.A

CEMEX S.A.B. de C.V.

Dow Inc.

Fosroc International Ltd.

Parex Group

Table of Contents

1. Asia-Pacific Dry Mix Mortar Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Asia-Pacific Dry Mix Mortar Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Dry Mix Mortar Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Real Estate Growth

3.1.2. Demand for Time-Efficient Construction

3.1.3. Regulatory Push for Sustainable Building Materials

3.1.4. Innovation in Product Formulations

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Costs

3.2.2. Transportation and Storage Constraints

3.2.3. Skilled Labor Shortages in Mortar Application

3.3. Opportunities

3.3.1. Advancements in Lightweight Mortar Mixes

3.3.2. Expansion into High-Growth Regions

3.3.3. Increasing Demand for Waterproofing Solutions

3.4. Trends

3.4.1. Rise of Sustainable and Eco-Friendly Mixes

3.4.2. Adoption of Modular Construction Practices

3.4.3. Integration of Smart and Insulated Mortar Solutions

3.5. Regulatory Framework

3.5.1. Building Codes and Green Certifications

3.5.2. Restrictions on VOC Emissions

3.5.3. Standards for Product Quality and Consistency

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia-Pacific Dry Mix Mortar Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cement-Based Mortar

4.1.2. Polymer Modified Mortar

4.1.3. Epoxy-Based Mortar

4.1.4. Lime-Based Mortar

4.2. By Application (In Value %)

4.2.1. Tiling & Flooring

4.2.2. Wall Plastering

4.2.3. Repairing and Restoration

4.2.4. Waterproofing

4.3. By End-User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Infrastructure

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Retail Channels

4.4.3. Online Distribution

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Southeast Asia

5. Asia-Pacific Dry Mix Mortar Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sika AG

5.1.2. Saint-Gobain Weber

5.1.3. LafargeHolcim Ltd.

5.1.4. BASF SE

5.1.5. Mapei S.p.A

5.1.6. Ardex GmbH

5.1.7. CEMEX S.A.B. de C.V.

5.1.8. Dow Inc.

5.1.9. Fosroc International Ltd.

5.1.10. Parex Group

5.1.11. H.B. Fuller

5.1.12. Wacker Chemie AG

5.1.13. Knauf Group

5.1.14. Akzo Nobel N.V.

5.1.15. Adhesive Specialities

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographical Presence, Market Share, Recent Product Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific Dry Mix Mortar Market Regulatory Framework

6.1. Environmental Standards and Codes

6.2. Compliance Requirements for VOC Content

6.3. Certification Processes for Sustainable Products

7. Asia-Pacific Dry Mix Mortar Market Future Market Size (In USD Bn)

7.1. Market Size Projections

7.2. Key Drivers for Future Market Growth

8. Asia-Pacific Dry Mix Mortar Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Dry Mix Mortar Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the Asia-Pacific Dry Mix Mortar Market, identifying all significant stakeholders. Extensive desk research, supported by secondary databases, aids in defining the primary variables influencing market growth, such as material availability, environmental policies, and demand drivers.

Step 2: Market Analysis and Construction

A compilation of historical data assesses market penetration rates, market channels, and revenue flow within the dry mix mortar sector. Quality metrics are analyzed to ensure precise revenue estimates, giving insights into distribution networks, production capacities, and consumption patterns.

Step 3: Hypothesis Validation and Expert Consultation

Using structured interviews with industry experts, this phase involves validating market hypotheses. Insights are gathered from professionals across companies in the mortar production, distribution, and application fields to enhance data accuracy and reflect real-time market conditions.

Step 4: Research Synthesis and Final Output

In the concluding stage, direct engagement with dry mix mortar manufacturers and distributors refines the analysis, covering product segmentation, demand cycles, and material sourcing. This interaction guarantees a comprehensive and validated representation of the Asia-Pacific Dry Mix Mortar Market.

Frequently Asked Questions

01. How big is the Asia-Pacific Dry Mix Mortar Market?

The Asia-Pacific Dry Mix Mortar Market, valued at 130 million tons, is primarily driven by the need for rapid and sustainable construction solutions in urbanizing economies.

02. What challenges exist in the Asia-Pacific Dry Mix Mortar Market?

Challenges include volatile raw material prices, high logistics costs, and the need for skilled labor in mortar applications, which impact the profitability of manufacturers.

03. Who are the major players in the Asia-Pacific Dry Mix Mortar Market?

Major players include Sika AG, Saint-Gobain Weber, BASF SE, Ardex GmbH, and Mapei S.p.A., who dominate due to established distribution networks and innovative product lines.

04. What are the growth drivers in the Asia-Pacific Dry Mix Mortar Market?

Key drivers include urbanization, demand for eco-friendly materials, and advances in mortar technology, fostering robust growth across residential and infrastructure sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.