Asia Pacific E-Liquid Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6878

December 2024

90

About the Report

Asia Pacific E-Liquid Market Overview

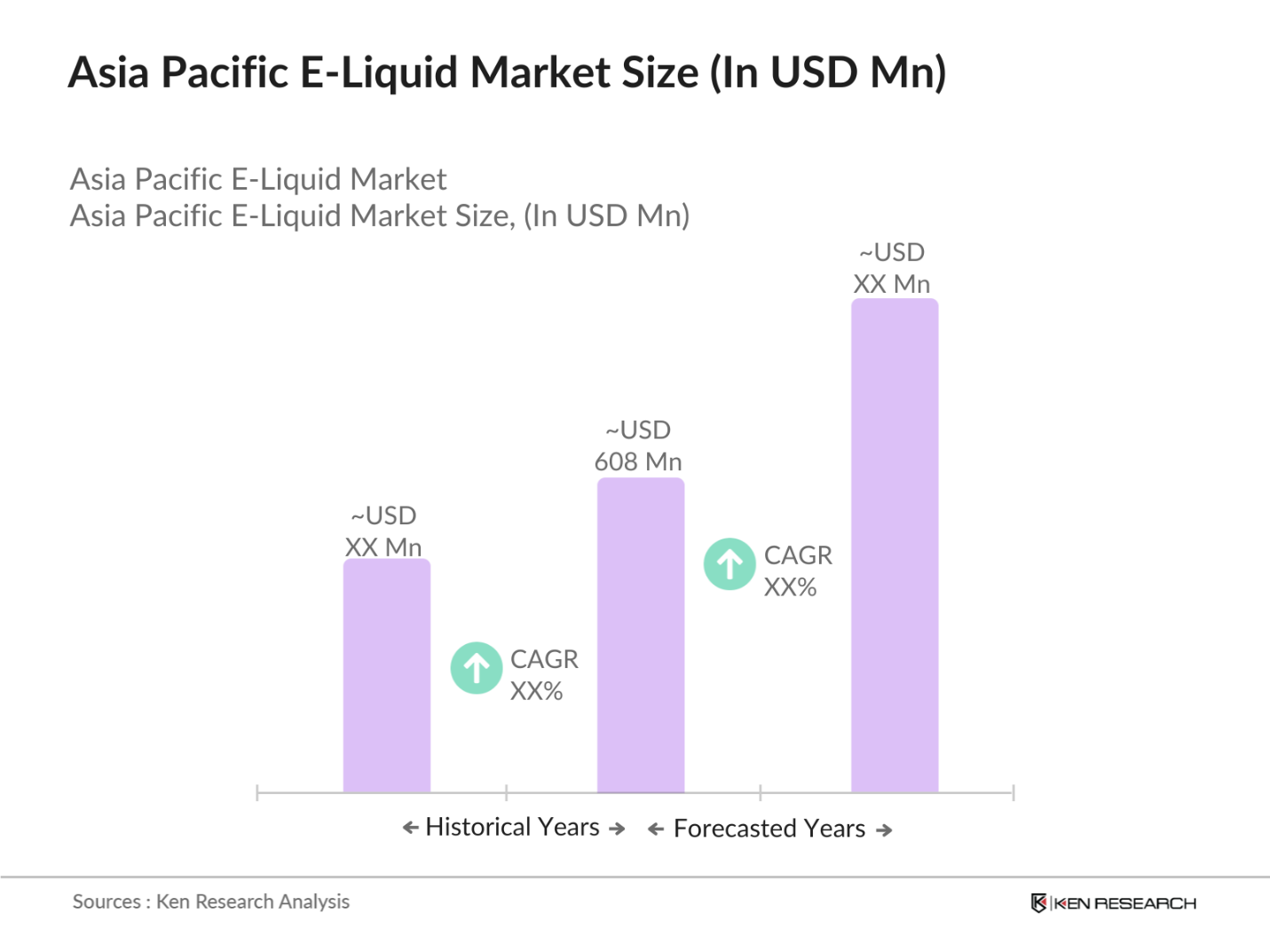

- The Asia Pacific e-liquid market is valued at USD 608 million, based on a five-year historical analysis. This market's growth is driven by the increasing shift from traditional tobacco smoking to vaping, as consumers become more health-conscious and seek alternatives perceived as less harmful. The rising adoption of e-cigarettes in countries like Japan, China, and South Korea is contributing significantly to this growth, especially with the availability of varied flavors and nicotine strengths. Additionally, government regulations around nicotine content have shaped product offerings, impacting market dynamics.

- Countries such as China, Japan, and South Korea dominate the Asia Pacific e-liquid market due to their well-established vaping industries and large consumer base. China is home to several key manufacturers, making it a significant production hub, while Japan's strict regulatory environment has led to a shift towards heat-not-burn (HNB) products that still utilize e-liquids. South Koreas rapid adoption of vaping, spurred by consumer demand for alternatives to combustible tobacco, also cements its position as a key player in this market.

- The demand for organic and natural e-liquids is growing in the Asia Pacific market, as consumers become more health-conscious and seek safer alternatives. In 2023, Thailands Ministry of Commerce reported a 25% increase in the import of organic ingredients used in e-liquid production, reflecting the rising demand for cleaner, additive-free products. Organic e-liquids are especially popular among younger consumers in urban areas, driving innovation in product formulation and setting new standards for the industry.

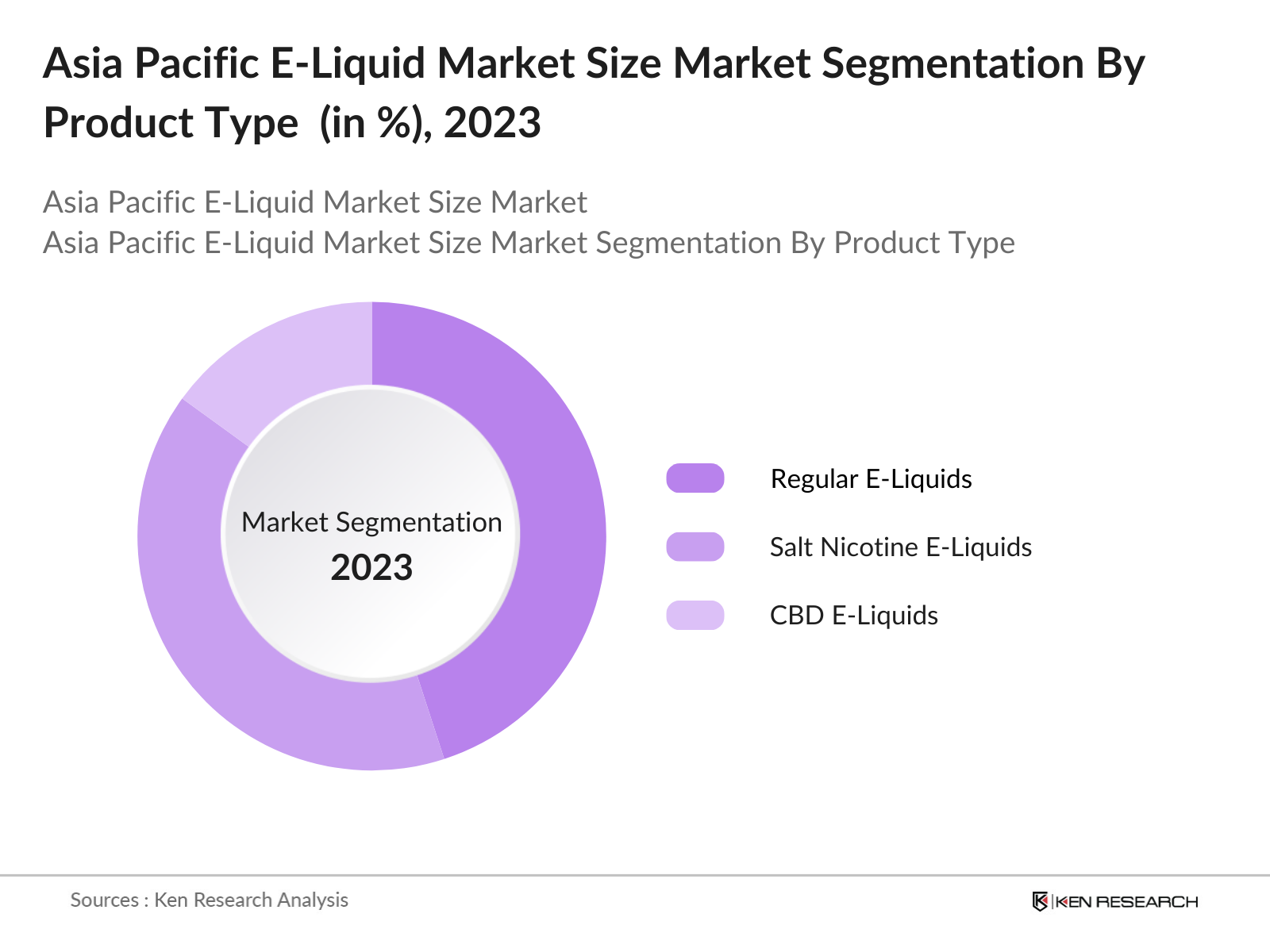

Asia Pacific E-Liquid Market Segmentation

By Product Type: The Asia Pacific e-liquid market is segmented by product type into Regular E-Liquids, Salt Nicotine E-Liquids, and CBD E-Liquids. Recently, Salt Nicotine E-Liquids have a dominant market share under this segmentation, primarily due to their smoother throat hit and higher nicotine concentration. These e-liquids cater to the rising demand for strong nicotine satisfaction, especially among former smokers who transition to vaping. Salt Nicotine E-Liquids are widely preferred in markets like South Korea and Japan, where consumers seek a more intense yet smoother nicotine experience, leading to higher sales in these regions.

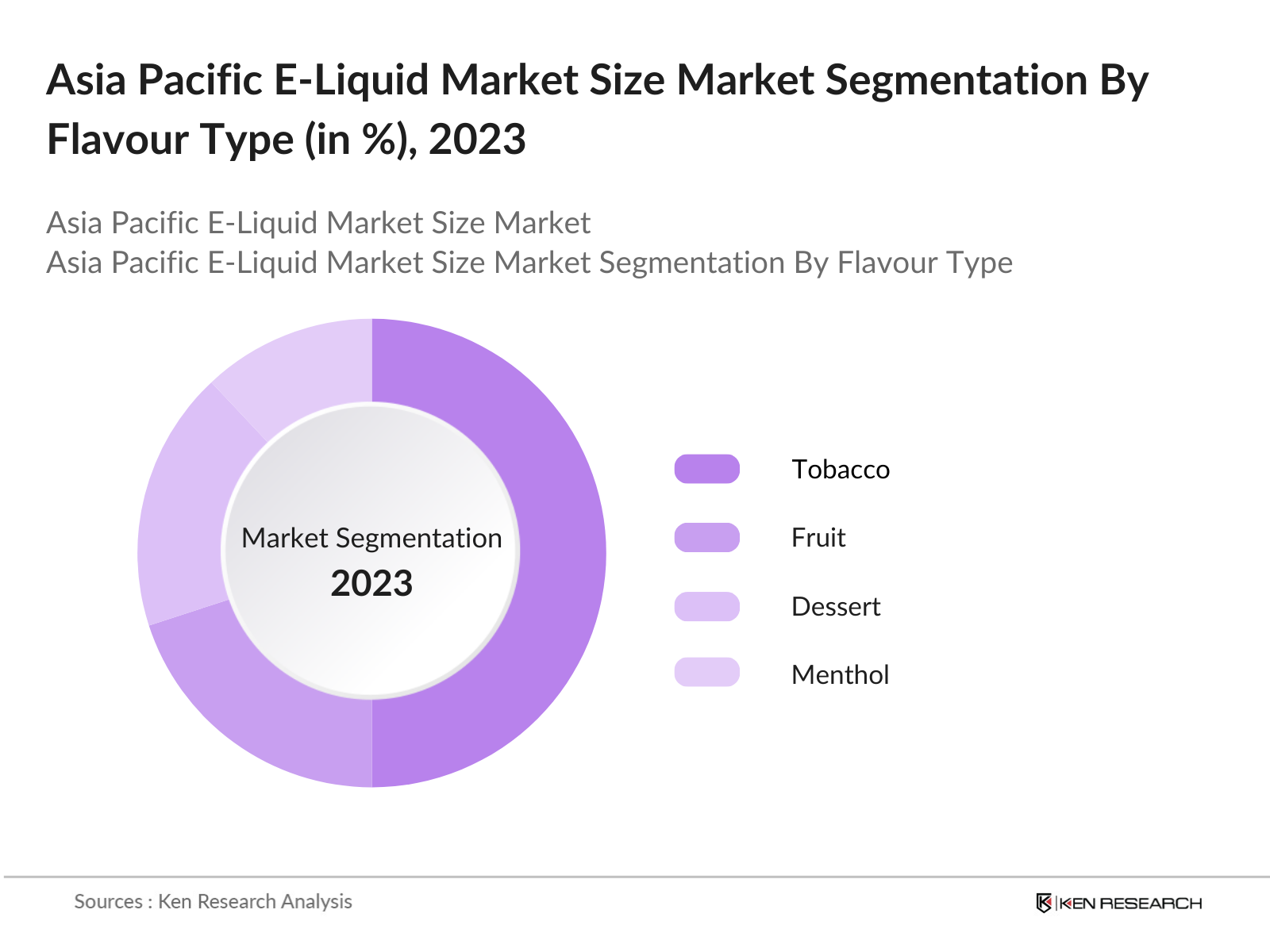

By Flavors: The Asia Pacific e-liquid market is further segmented by flavors into Tobacco, Fruit, Dessert, Menthol, and Beverage flavors. Tobacco flavors hold the largest share of the market due to their deep association with traditional smoking. Consumers transitioning from cigarettes prefer tobacco-flavored e-liquids, especially in countries like China and South Korea, where the smoking culture is ingrained. Additionally, tobacco-flavored e-liquids are seen as a safer bridge for smokers looking to quit, making them a consistent favorite among adult users.

Asia Pacific E-Liquid Market Competitive Landscape

The Asia Pacific e-liquid market is dominated by several major players, both domestic and international. These companies have established strong footholds through a combination of technological advancements, flavor innovations, and distribution channels. The competition is characterized by continuous product development to cater to local consumer preferences and regulatory changes.

The competitive landscape features companies that focus on the entire supply chainfrom manufacturing to distributionenabling them to maintain product quality while keeping costs competitive. Additionally, collaborations between e-liquid manufacturers and vaping device producers have strengthened brand loyalty and consumer retention.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Flavors Offered |

Nicotine Levels |

R&D Investments |

Geographical Reach |

Distribution Channels |

|

JUUL Labs |

2017 |

USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Vuse (BAT) |

2013 |

UK |

_ |

_ |

_ |

_ |

_ |

_ |

|

Nasty Juice |

2015 |

Malaysia |

_ |

_ |

_ |

_ |

_ |

_ |

|

Vaporesso |

2010 |

China |

_ |

_ |

_ |

_ |

_ |

_ |

|

Halo (Nicopure Labs) |

2009 |

USA |

_ |

_ |

_ |

_ |

_ |

_ |

Asia Pacific E-Liquid Industry Analysis

Growth Drivers

- Rising Popularity of E-Cigarettes: The rising adoption of e-cigarettes in the Asia Pacific region is fueled by the increasing shift from traditional tobacco smoking. As of 2024, Indonesia, Thailand, and Malaysia reported a significant increase in e-cigarette users, with Indonesia alone experiencing a rise from 6.1 million e-cigarette users in 2022 to 8.5 million by 2024, according to the Ministry of Health in Indonesia. This shift can be attributed to changing consumer preferences and growing public awareness regarding the health risks of smoking combustible cigarettes. Additionally, increasing investments in e-cigarette infrastructure are supporting this trend.

- Increasing Awareness About Tobacco Harm Reduction: Growing awareness regarding the benefits of tobacco harm reduction strategies is another driver in the e-liquid market. Countries like Japan and South Korea have intensified public health campaigns highlighting the benefits of switching to lower-risk alternatives like e-cigarettes. In South Korea, the Ministry of Health reported a 15% decline in cigarette smoking rates from 2022 to 2024, largely attributed to growing public campaigns about e-cigarettes and other harm-reducing alternatives. The decline in traditional tobacco use and a simultaneous uptick in e-cigarette usage are key drivers for the e-liquid market.

- Favorable Government Policies: The regulatory environment in the Asia Pacific region has become more conducive to the growth of the e-liquid market. Countries such as Japan and the Philippines have introduced favorable tax policies on e-cigarettes, significantly lower than those on combustible cigarettes. For instance, Japan has imposed a 30% lower tax rate on e-cigarette products compared to traditional tobacco, which incentivizes users to switch. Furthermore, advertising regulations have been relaxed, particularly in online spaces, allowing manufacturers to promote their products more effectively. These policy changes provide a significant boost to the e-liquid market in the region.

Market Challenges

- Stringent Government Regulations: Despite favorable growth drivers, stringent regulations remain a significant challenge in the Asia Pacific e-liquid market. For instance, in 2023, the Philippines passed a law banning flavored e-liquids, which impacted 70% of the available e-liquid products in the country, according to the Philippines Food and Drug Administration. This restriction on flavors is accompanied by strict health warning requirements, similar to those enforced in Singapore, where e-liquids are heavily regulated, leading to reduced product availability and a stifling of market expansion. These regulations hinder the growth potential of the e-liquid market.

- Misconceptions Regarding E-Liquids: One major obstacle in the Asia Pacific market is the persistence of misconceptions surrounding the safety and use of e-liquids. In a 2024 survey by the South Korean Ministry of Health, 37% of respondents incorrectly believed that e-liquids are as harmful as traditional tobacco products. This misconception is largely due to misinformation and a lack of clear, authoritative communication from public health agencies. These public perceptions have led to a slower adoption rate in some countries, despite the growing body of scientific evidence supporting the relative safety of e-cigarettes compared to traditional tobacco products.

Asia Pacific E-Liquid Market Future Outlook

Over the next five years, the Asia Pacific e-liquid market is expected to witness significant growth, driven by increasing consumer demand for safer alternatives to smoking, regulatory changes, and technological advancements in the vaping industry. As health awareness rises, e-liquids with lower nicotine concentrations and organic ingredients are predicted to gain traction. Countries like China and South Korea, which are currently experiencing rapid market expansion, will continue to be key players due to their large consumer bases and manufacturing capacities. The introduction of more innovative products, such as CBD-infused e-liquids and e-liquids tailored for new-age devices like heat-not-burn systems, will further fuel the market. Furthermore, government support in the form of relaxed regulations for nicotine products is likely to create new opportunities for international players to enter untapped markets.

Opportunities

Technological Innovations in E-Liquid Production: The Asia Pacific e-liquid market is witnessing technological advancements, especially in the development of synthetic nicotine and flavor-enhancing technologies. In 2024, Japans National Institute of Advanced Industrial Science and Technology (AIST) introduced a synthetic nicotine variant that mimics the sensation of traditional nicotine but is derived from non-tobacco sources. This innovation is expected to cater to health-conscious consumers and those concerned about tobacco-related risks. Such technological advancements open new avenues for product development, reducing reliance on tobacco-based nicotine and fostering market growth. Source: Japans AIST, 2024.

Expanding Market in Untapped Regions: There is substantial growth potential in untapped markets, particularly in rural areas and Tier 2 cities across the Asia Pacific region. In China, for example, e-liquid consumption has grown by 30% in Tier 2 cities like Wuhan and Xi'an from 2022 to 2024, according to the National Bureau of Statistics of China. This trend is largely driven by the increasing availability of e-cigarettes through online channels and the expansion of retail networks. The untapped potential in these regions presents a significant opportunity for manufacturers to expand their market reach.

Scope of the Report

|

Product Type |

Regular E-Liquids Salt Nicotine E-Liquids CBD E-Liquids PG/VG Ratio E-Liquids |

|

Flavors |

Tobacco Flavors Fruit Flavors Dessert Flavors Menthol/Mint Flavors Beverage Flavors |

|

Nicotine Strength |

0mg Nicotine 3mg-6mg Nicotine 6mg-12mg Nicotine Above 12mg Nicotine |

|

End-User |

Adults Aged 18-25 Adults Aged 26-35 Adults Aged 36-50 |

|

Distribution Channel |

Online Sales Specialty Vape Shops Convenience Stores Supermarkets/Hypermarkets Direct Sales |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Food and Drug Administration, National Health Regulatory Agencies)

E-Cigarette Companies

E-Liquid Industries

Specialty Vape Companies

Online Companies

Flavors and Nicotine Additive Industries

Companies

Players Mentioned in the Report:

JUUL Labs

Vuse (BAT)

Nasty Juice

Vaporesso

Halo (Nicopure Labs)

Dinner Lady

Myblu

Vapemate

Breazy

Philip Morris International (IQOS)

Table of Contents

1. Asia Pacific E-Liquid Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, Market Penetration, Regulatory Environment)

1.4 Market Segmentation Overview (Product Type, Flavors, Nicotine Strength, End-User, Distribution Channels)

2. Asia Pacific E-Liquid Market Size (In USD Bn)

2.1 Historical Market Size (Market Share, Consumer Preferences, Sales Data)

2.2 Year-On-Year Growth Analysis (Regulatory Impact, Health Trends, Industry Consolidation)

2.3 Key Market Developments and Milestones (Government Regulations, Product Innovations, Consumer Shifts)

3. Asia Pacific E-Liquid Market Analysis

3.1 Growth Drivers

3.1.1 Rising Popularity of E-Cigarettes

3.1.2 Increasing Awareness About Tobacco Harm Reduction

3.1.3 Favorable Government Policies (e.g., Taxation, Advertising Regulations)

3.1.4 Product Customization Trends (Nicotine Levels, Flavor Preferences)

3.2 Market Challenges

3.2.1 Stringent Government Regulations (Ban on Flavors, Health Warnings)

3.2.2 Misconceptions Regarding E-Liquids

3.2.3 Supply Chain Issues (Logistics, Import/Export Restrictions)

3.3 Opportunities

3.3.1 Technological Innovations in E-Liquid Production (Synthetic Nicotine, Flavor Enhancement)

3.3.2 Expanding Market in Untapped Regions (Rural and Tier 2 Cities)

3.3.3 Strategic Alliances with Tobacco Giants

3.4 Trends

3.4.1 Shift Towards Organic E-Liquids

3.4.2 Customization and DIY E-Liquid Kits

3.4.3 Introduction of Salt Nicotine E-Liquids

3.4.4 Growth in Online Sales Channels

3.5 Government Regulation

3.5.1 Nicotine Content Restrictions

3.5.2 Advertising and Marketing Limitations

3.5.3 Health Warnings and Labeling Laws

3.5.4 Bans on Specific Flavor Profiles

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Suppliers, Distributors, Retailers)

3.8 Porters Five Forces Analysis (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitutes, Threat of New Entrants)

3.9 Competition Ecosystem (Top Market Players, Strategic Partnerships)

4. Asia Pacific E-Liquid Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Regular E-Liquids

4.1.2 Salt Nicotine E-Liquids

4.1.3 CBD E-Liquids

4.1.4 PG/VG Ratio E-Liquids

4.2 By Flavors (In Value %)

4.2.1 Tobacco Flavors

4.2.2 Fruit Flavors

4.2.3 Dessert Flavors

4.2.4 Menthol/Mint Flavors

4.2.5 Beverage Flavors

4.3 By Nicotine Strength (In Value %)

4.3.1 0mg Nicotine (Nicotine-Free)

4.3.2 3mg-6mg Nicotine

4.3.3 6mg-12mg Nicotine

4.3.4 Above 12mg Nicotine

4.4 By End-User (In Value %)

4.4.1 Adults Aged 18-25

4.4.2 Adults Aged 26-35

4.4.3 Adults Aged 36-50

4.5 By Distribution Channel (In Value %)

4.5.1 Online Sales

4.5.2 Specialty Vape Shops

4.5.3 Convenience Stores

4.5.4 Supermarkets/Hypermarkets

4.5.5 Direct Sales

5. Asia Pacific E-Liquid Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Vuse (BAT)

5.1.2 JUUL Labs

5.1.3 Nasty Juice

5.1.4 Dinner Lady

5.1.5 Vaporesso

5.1.6 Halo

5.1.7 Cosmic Fog

5.1.8 Philip Morris International (IQOS)

5.1.9 Nicopure Labs (Halo)

5.1.10 Vape Wild

5.1.11 PAX Labs

5.1.12 Breazy

5.1.13 IVG

5.1.14 Vapemate

5.1.15 Myblu

5.2 Cross Comparison Parameters (Market Penetration, Manufacturing Capacity, Flavor Portfolio, Nicotine Content Innovation, Geographic Presence, Brand Value, Marketing Spend, Sales Channels)

5.3 Market Share Analysis (Top Competitors Market Share by Revenue)

5.4 Strategic Initiatives (Product Launches, Strategic Partnerships, Expansion Plans)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific E-Liquid Market Regulatory Framework

6.1 Nicotine and Tobacco Control Standards

6.2 Compliance Requirements for E-Liquid Production

6.3 Certification Processes for E-Liquids and Vapor Devices

6.4 Import/Export Restrictions and Tariff Barriers

7. Asia Pacific E-Liquid Future Market Size (In USD Bn)

7.1 Future Market Size Projections (Consumer Trends, Regulatory Relaxation, Technological Innovations)

7.2 Key Factors Driving Future Market Growth (New Demographics, Reduced Nicotine Products, Flavor Bans)

8. Asia Pacific E-Liquid Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Flavor Profile (In Value %)

8.3 By Nicotine Strength (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific E-Liquid Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Geography, Age, Preferences)

9.3 Marketing Initiatives (Social Media, Influencer Marketing, Digital Marketing)

9.4 White Space Opportunity Analysis (New Product Innovation, Untapped Markets)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves the creation of an ecosystem map that includes all major stakeholders within the Asia Pacific e-liquid market. This phase utilizes extensive desk research with the aim of identifying the primary variables affecting market trends. Key factors such as consumer preferences, government regulations, and industry competition are analyzed.

Step 2: Market Analysis and Construction

At this stage, historical data for the e-liquid market is compiled, focusing on market penetration and revenue generation. Additionally, an analysis of consumer behavior, including preferences for flavors and nicotine levels, is conducted to construct a complete market outlook.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through expert interviews with industry professionals, including manufacturers, distributors, and regulatory authorities. These interviews provide critical insights that help refine and validate market projections.

Step 4: Research Synthesis and Final Output

The final phase of research involves synthesizing data from multiple sources to ensure a comprehensive and accurate market report. Direct interaction with e-liquid manufacturers and suppliers ensures that the report reflects the most current industry trends.

Frequently Asked Questions

01 How big is the Asia Pacific E-Liquid Market?

The Asia Pacific e-liquid market is valued at USD 608 million, driven by a rising shift from traditional smoking to vaping, particularly in countries like China and South Korea.

02 What are the challenges in the Asia Pacific E-Liquid Market?

Challenges in the Asia Pacific e-liquid market include stringent government regulations, misconceptions about vaping, and supply chain issues, particularly related to flavor bans and nicotine content limits.

03 Who are the major players in the Asia Pacific E-Liquid Market?

Key players include JUUL Labs, Vuse (BAT), Nasty Juice, Vaporesso, and Halo, with these companies dominating the market due to strong brand presence and extensive product ranges.

04 What are the growth drivers of the Asia Pacific E-Liquid Market?

The market is driven by the rising popularity of vaping as a safer alternative to smoking, product innovations like salt nicotine e-liquids, and government regulations that favor harm reduction over traditional smoking.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.