Asia Pacific Earphones & Headphones Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD9494

November 2024

86

About the Report

Asia Pacific Earphones & Headphones Market Overview

- The Asia Pacific Earphones & Headphones market is valued at USD 23.2 billion, with growth driven primarily by technological advancements and a surge in mobile device usage. Increasing consumer demand for high-quality audio experiences, coupled with the widespread adoption of wireless and True Wireless Stereo (TWS) technologies, has significantly contributed to the market's expansion. E-commerce platforms play a crucial role in amplifying sales, allowing manufacturers to tap into new customer segments. The regions growing middle class with rising disposable incomes further fuels the demand for premium audio products.

- The market is largely dominated by countries such as China, India, and Japan. China leads due to its vast manufacturing capacity and robust export activities, making it the world's largest producer of earphones and headphones. Indias dominance is driven by its rapidly growing urban population and increasing smartphone penetration, whereas Japan excels in innovation, with companies like Sony introducing cutting-edge audio technologies. These countries have strong consumer bases and extensive distribution networks, enhancing their leadership in the region.

- Governments in the Asia-Pacific region have implemented strict import regulations on consumer electronics to protect domestic manufacturers. India, for instance, requires detailed compliance documentation under its Bureau of Indian Standards (BIS) regulations for imported electronics, including earphones and headphones. These regulations, according to the Ministry of Commerce, are intended to ensure product quality and safety. While this creates barriers for international companies, it also opens opportunities for local manufacturers to dominate the market.

Asia Pacific Earphones & Headphones Market Segmentation

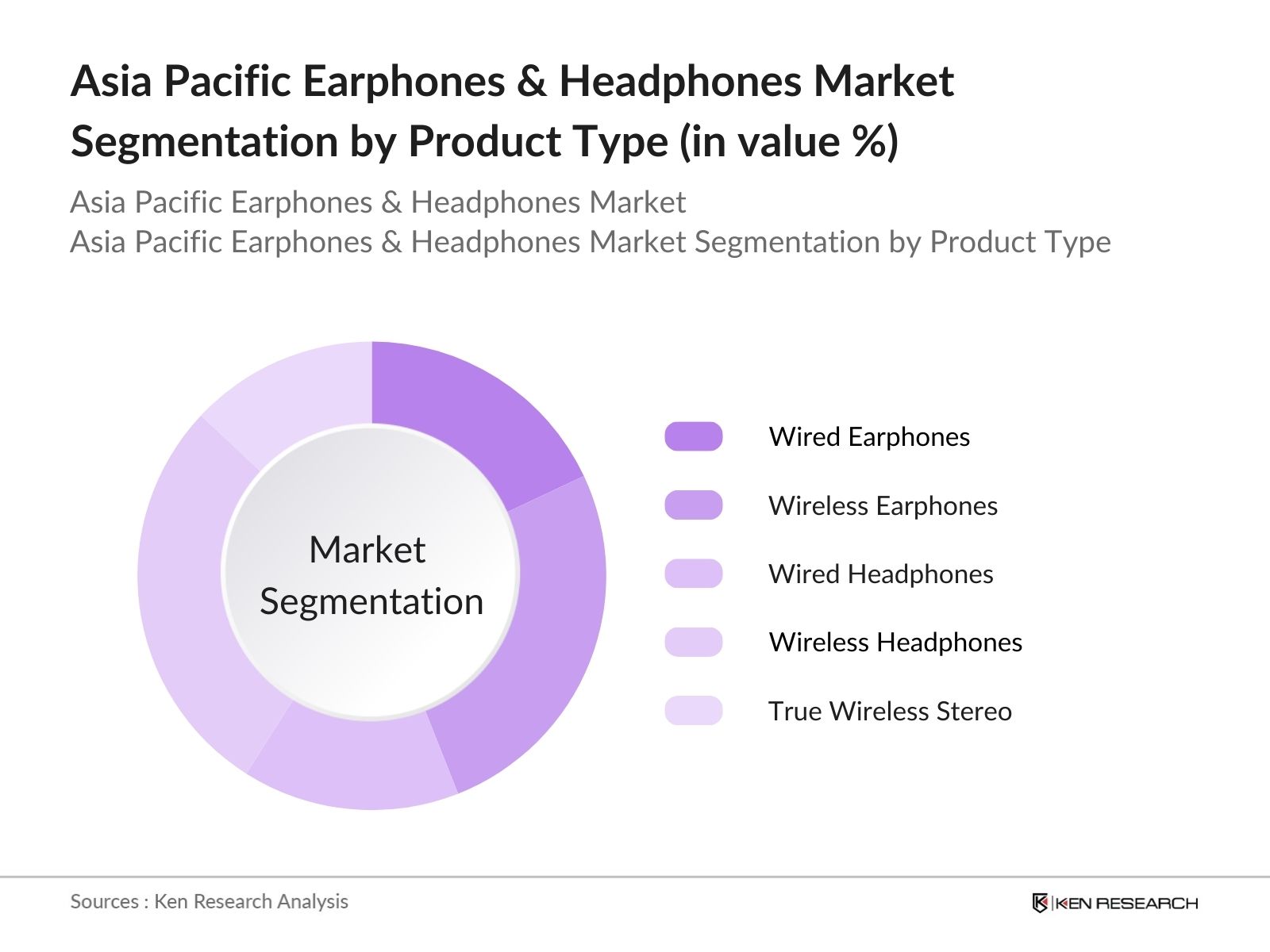

- By Product Type: The market is segmented by product type into wired earphones, wireless earphones, wired headphones, wireless headphones, and True Wireless Stereo (TWS) devices. Wireless headphones dominate this segment, driven by consumer preferences for convenience, portability, and the elimination of tangled wires. With the advent of noise-canceling technology and longer battery life, wireless headphones have become an essential accessory for travelers, gamers, and professionals alike. True Wireless Stereo (TWS) is also gaining momentum, particularly in markets such as India and China, due to its compact design and seamless integration with smartphones.

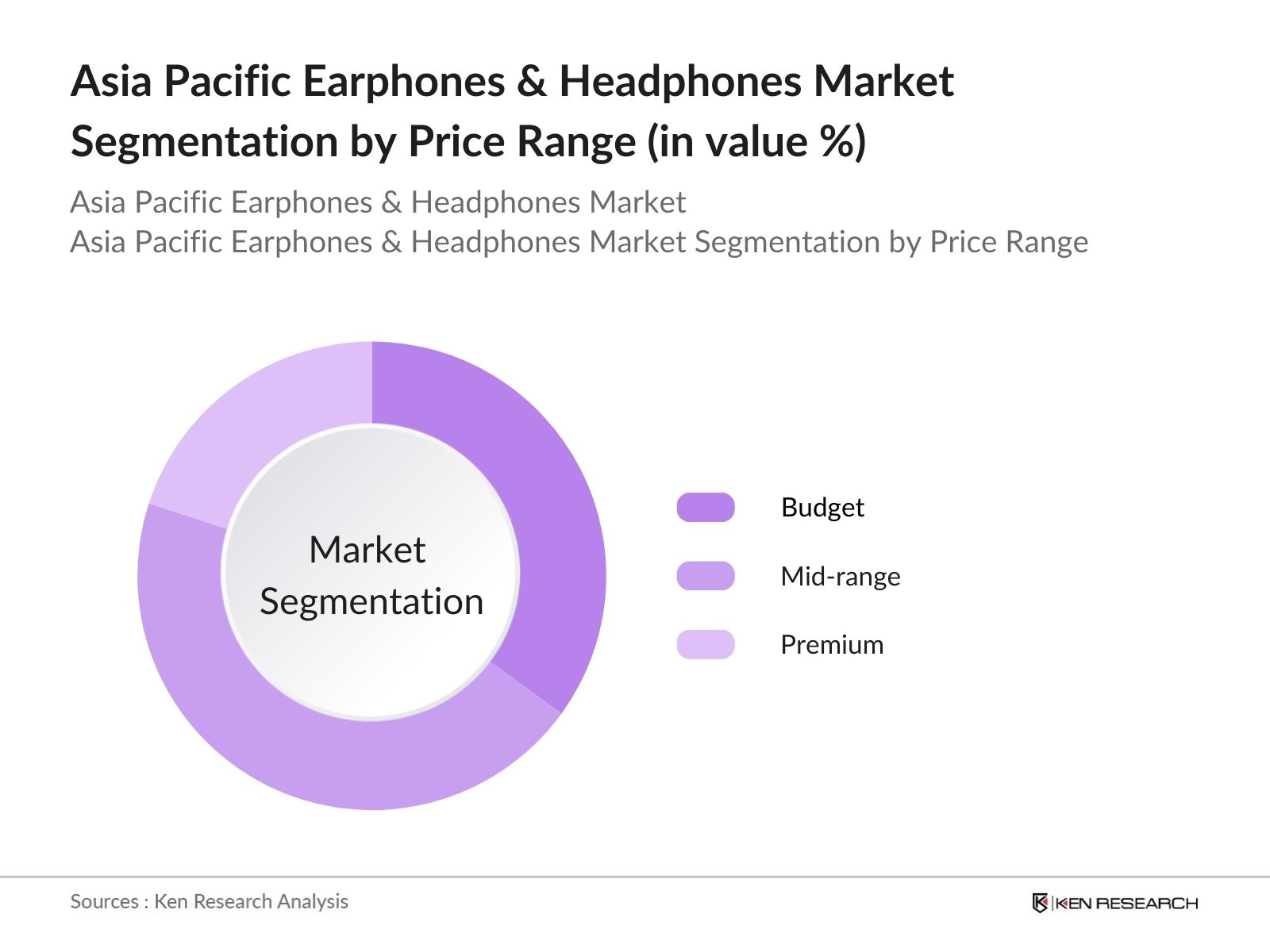

- By Price Range: The market is segmented into budget, mid-range, and premium categories. The mid-range segment holds the largest market share due to the balance of affordability and advanced features that appeal to a wide array of consumers. Brands such as JBL, Sony, and Xiaomi offer products in this range that include essential features like wireless connectivity and noise cancellation, which resonate with the needs of everyday users. The premium segment, led by brands like Bose and Sennheiser, caters to audiophiles and professionals, contributing significantly to the segments revenue due to higher price points.

Asia Pacific Earphones & Headphones Market Competitive Landscape

The Asia Pacific Earphones & Headphones market is characterized by intense competition, with major global and regional players vying for market share. Companies like Sony and Samsung lead due to their technological innovations, while emerging players from China like Xiaomi and Realme are making significant strides in the mid-range and budget segments. The presence of global brands coupled with strong regional competitors highlights the competitive intensity in the market.

|

Company |

Established |

Headquarters |

Revenue |

Market Share |

Product Innovation |

Distribution Network |

Customer Loyalty |

Brand Presence |

Regional Focus |

|

Sony Corporation |

1946 |

Tokyo, Japan |

|||||||

|

Samsung Electronics |

1938 |

Suwon, South Korea |

|||||||

|

Xiaomi Corporation |

2010 |

Beijing, China |

|||||||

|

Bose Corporation |

1964 |

Framingham, USA |

|||||||

|

Realme |

2018 |

Shenzhen, China |

Asia Pacific Earphones & Headphones Industry Analysis

Growth Drivers

- Increase in Music Streaming Platforms: The rise in music streaming platforms like Spotify and Apple Music has significantly influenced earphone and headphone adoption in the Asia-Pacific region. According to the World Bank, internet penetration in the region has reached 54% in 2024, driving demand for these platforms, which in turn increases the need for quality audio devices. Streaming platforms report that there are over 200 million active users in key markets such as India, Japan, and Indonesia, further accelerating the demand for personal audio devices. The growing number of subscribers underlines the increasing reliance on earphones and headphones.

- Surge in Mobile Device Penetration: Asia-Pacific is home to some of the largest smartphone markets globally, with over 3 billion mobile phone users in 2024, according to the International Telecommunication Union (ITU). The growing penetration of smartphones drives the adoption of headphones and earphones, as more consumers use these devices for entertainment, communication, and work. China and India alone account for over 1.6 billion mobile subscriptions, highlighting the massive potential for audio accessories in the region. As smartphone prices continue to drop, consumers are increasingly investing in complementary audio products.

- Rising Disposable Income: In 2024, the rise in disposable income across Asia-Pacific has supported the demand for higher-end earphones and headphones. According to the Asian Development Bank, real GDP per capita has grown in key markets such as South Korea ($35,000) and China ($13,500). With this increase in disposable income, consumers are more willing to invest in premium audio devices. This trend is particularly visible in urban areas, where individuals prioritize quality and brand reputation when purchasing personal electronics.

Market Challenges

- Price Competition from Local Players: Local manufacturers in markets like China and India pose significant competition for global brands, offering lower-priced alternatives. According to the Chinese Ministry of Industry and Information Technology (MIIT), the country's electronic goods industry produced over 3 billion units of earphones and headphones in 2023, many of which are exported at lower prices. This price competition often pressures international brands to cut prices or offer discounts, impacting profitability. The sheer scale of local manufacturing presents an ongoing challenge for premium international brands operating in the region.

- High Import Tariffs on Electronic Goods: Asia-Pacific countries impose high tariffs on imported electronic goods, which affects the pricing of premium earphones and headphones. India levies an import duty of 20% on electronic goods, including headphones, according to the Central Board of Indirect Taxes and Customs (CBIC). These tariffs raise the end price for consumers, discouraging the purchase of high-end products and pushing them towards locally manufactured alternatives. The uneven tariff structures across the region create additional challenges for international brands.

Asia Pacific Earphones & Headphones Market Future Outlook

Over the next few years, the Asia Pacific Earphones & Headphones market is expected to experience substantial growth, fueled by the continuous development of wireless and TWS technologies, the proliferation of music streaming services, and a growing consumer appetite for high-quality audio experiences. Increasing disposable incomes across emerging economies in the region, particularly in India and Southeast Asia, will drive further market penetration. Additionally, technological advancements such as AI integration and enhanced noise-canceling features will enhance the appeal of premium audio products.

Future Market Opportunities

- Adoption of Wireless and True Wireless Stereo (TWS) Technology: The shift towards wireless and True Wireless Stereo (TWS) technology is a key opportunity for growth in the Asia-Pacific market. In 2024, ITU reported over 800 million wireless audio device users in the region, with demand rising in both urban and rural areas. TWS technology offers convenience and flexibility, making it popular among younger consumers. Brands like Apple and Samsung have capitalized on this trend by launching high-quality wireless products, leading to a surge in adoption. This presents ongoing growth potential, especially as more consumers transition to wireless devices.

- Expansion into Untapped Rural Markets: Rural markets in countries such as India, Indonesia, and Vietnam present substantial growth opportunities, driven by increasing mobile device penetration. In 2024, the World Bank estimated that over 60% of rural households in these countries now own mobile phones, up from 40% in 2020. As infrastructure improves and internet access expands, rural consumers are becoming a key market for affordable earphones and headphones. This expansion represents an untapped potential, especially for entry-level and mid-tier brands targeting these regions.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Wired Earphones Wireless Earphones Wired Headphones Wireless Headphones True Wireless Stereo (TWS) |

|

By Distribution Channel |

Online (E-commerce) Offline (Retail Chains, Brand Stores) |

|

By Price Range |

Budget Segment Mid-Range Segment Premium Segment |

|

By End-User |

Consumer Enterprise & Professional |

|

By Country |

China India Japan South Korea Australia Others (Southeast Asia, New Zealand) |

Products

Key Target Audience

Consumer Electronics Manufacturers

Audio Equipment Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., China Electronic Standards Institute, India Bureau of Industrial Standards)

Mobile Phone Manufacturers

Music Streaming Services Providers

Retail Chains and E-commerce Platforms

Banks and Financial Institutes

Professional Audio Equipment Distributors

Companies

Major Players

Sony Corporation

Samsung Electronics

Xiaomi Corporation

Bose Corporation

JBL (Harman International)

Sennheiser Electronic GmbH

OnePlus Technology

Realme

Skullcandy Inc.

Plantronics, Inc.

Audio-Technica Corporation

Anker Innovations

Jabra (GN Group)

Edifier International

Apple Inc. (Beats)

Table of Contents

1. Asia Pacific Earphones & Headphones Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Earphones & Headphones Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Earphones & Headphones Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Music Streaming Platforms

3.1.2. Surge in Mobile Device Penetration

3.1.3. Rising Disposable Income

3.1.4. Growth of E-commerce

3.2. Market Challenges

3.2.1. Price Competition from Local Players

3.2.2. High Import Tariffs on Electronic Goods

3.2.3. Counterfeit Products in the Market

3.3. Opportunities

3.3.1. Adoption of Wireless and True Wireless Stereo (TWS) Technology

3.3.2. Expansion into Untapped Rural Markets

3.3.3. Collaborations with Music and Gaming Brands

3.4. Trends

3.4.1. Integration of Noise-Cancelling Technology

3.4.2. Rise of AI-based Voice Assistants in Earphones

3.4.3. Preference for Eco-friendly and Sustainable Materials

3.5. Government Regulations

3.5.1. Import Regulations on Consumer Electronics

3.5.2. Electronic Waste Management Policies

3.5.3. Safety Standards for Consumer Electronics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Retailers, E-commerce Platforms, Service Providers)

3.8. Porters Five Forces

Threat of New Entrants

Bargaining Power of Buyers

Bargaining Power of Suppliers

Threat of Substitutes

Industry Rivalry

3.9. Competition Ecosystem (Technology, Market Reach, Brand Loyalty)

4. Asia Pacific Earphones & Headphones Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Wired Earphones

4.1.2. Wireless Earphones

4.1.3. Wired Headphones

4.1.4. Wireless Headphones

4.1.5. True Wireless Stereo (TWS)

4.2. By Distribution Channel (In Value %)

4.2.1. Online (E-commerce)

4.2.2. Offline (Retail Chains, Brand Stores)

4.3. By Price Range (In Value %)

4.3.1. Budget Segment

4.3.2. Mid-Range Segment

4.3.3. Premium Segment

4.4. By End-User (In Value %)

4.4.1. Consumer

4.4.2. Enterprise & Professional

4.5. By Country (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

4.5.6. Others (Southeast Asia, New Zealand)

5. Asia Pacific Earphones & Headphones Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc. (Beats)

5.1.2. Sony Corporation

5.1.3. Samsung Electronics (AKG)

5.1.4. Bose Corporation

5.1.5. Sennheiser Electronic GmbH

5.1.6. JBL (Harman International)

5.1.7. Xiaomi Corporation

5.1.8. OnePlus Technology

5.1.9. Realme

5.1.10. Jabra (GN Group)

5.1.11. Anker Innovations

5.1.12. Skullcandy Inc.

5.1.13. Plantronics, Inc.

5.1.14. Edifier International

5.1.15. Audio-Technica Corporation

5.2. Cross Comparison Parameters

Revenue

Market Share

Technological Innovation

Product Portfolio

Distribution Network

Customer Base

Brand Equity

Geographical Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives

Product Launches

Partnerships and Collaborations

Market Expansion

Technological Developments

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Earphones & Headphones Market Regulatory Framework

6.1. Industry Standards (ISO, BIS)

6.2. Safety and Quality Certifications

6.3. Compliance with Environmental Regulations

7. Asia Pacific Earphones & Headphones Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Earphones & Headphones Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Price Range (In Value %)

8.4. By End-User (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Earphones & Headphones Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase includes mapping key stakeholders in the Asia Pacific Earphones & Headphones Market. Desk research and secondary databases, such as government data, were employed to understand industry variables and key market drivers.

Step 2: Market Analysis and Construction

This phase involved gathering and analyzing historical data from the Asia Pacific market. Key focus areas included revenue generation and competitive analysis based on product categories and geographical penetration.

Step 3: Hypothesis Validation and Expert Consultation

The data hypotheses were validated by conducting telephone interviews with industry experts from leading earphone and headphone manufacturers. The consultation provided additional insights and fine-tuned the analysis.

Step 4: Research Synthesis and Final Output

The final step included synthesizing market data into actionable insights, verified by engaging directly with manufacturers and key distributors. This step ensured the accuracy and reliability of the data collected.

Frequently Asked Questions

01. How big is the Asia Pacific Earphones & Headphones Market?

The Asia Pacific Earphones & Headphones market is valued at USD 23.2 billion, driven by rising mobile device adoption and advancements in wireless technology.

02. What are the challenges in the Asia Pacific Earphones & Headphones Market?

Challenges in the Asia Pacific Earphones & Headphones market include intense price competition from local manufacturers, high import tariffs on electronics, and a growing counterfeit market, which affects both revenue and consumer trust.

03. Who are the major players in the Asia Pacific Earphones & Headphones Market?

Key players in the Asia Pacific Earphones & Headphones market include Sony Corporation, Samsung Electronics, Xiaomi Corporation, Bose Corporation, and JBL, dominating due to their innovative products and strong distribution networks.

04. What are the growth drivers of the Asia Pacific Earphones & Headphones Market?

The Asia Pacific Earphones & Headphones market is driven by a surge in smartphone usage, increased consumer demand for high-quality audio experiences, and the proliferation of wireless and True Wireless Stereo (TWS) technologies.

05. Which countries dominate the Asia Pacific Earphones & Headphones Market?

China, India, and Japan lead the market, driven by their strong manufacturing bases, high consumer demand, and technological innovation in the Asia Pacific Earphones & Headphones market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.