Asia Pacific Electric Motor Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9202

December 2024

84

About the Report

Asia Pacific Electric Motor Market Overview

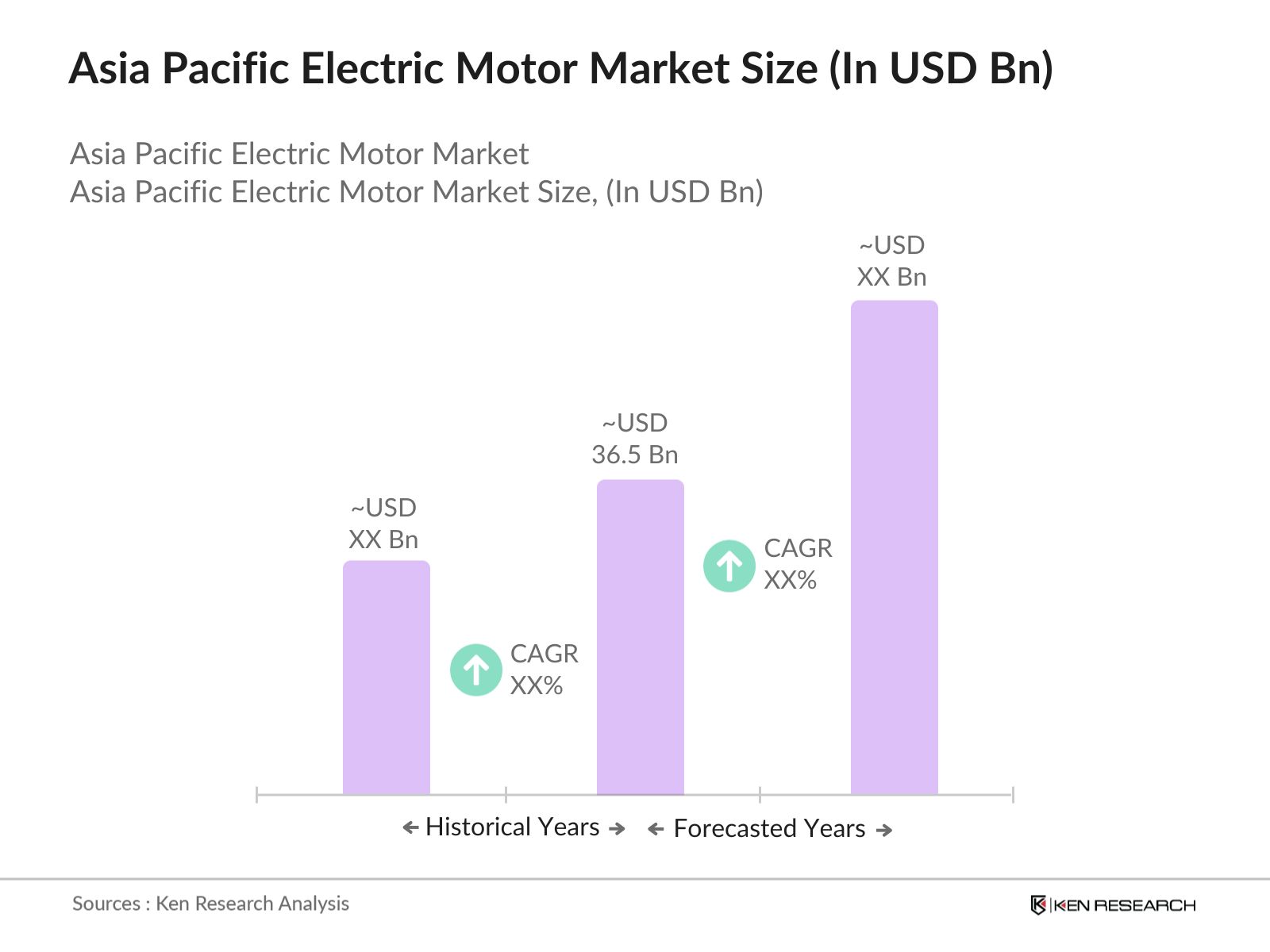

- The Asia Pacific Electric Motor Market is valued at USD 36.5 billion, driven primarily by the growing adoption of electric vehicles (EVs), automation in industries, and increasing demand for energy-efficient solutions. Over five years, the market has shown robust growth, influenced by government initiatives promoting green energy and technology upgrades in manufacturing and residential applications. The sustained expansion of industrial and infrastructure projects in the region also contributes significantly to the markets trajectory.

- China, India, and Japan are the dominant players in the Asia Pacific Electric Motor Market. China leads due to its vast manufacturing base, heavy investments in renewable energy projects, and government support for EV adoption. India is rapidly expanding due to industrialization and infrastructure development, while Japan holds a strong position owing to its advanced technology and expertise in motor manufacturing for robotics and automation.

- In 2023, Mitsubishi Electric Corporation launched a new series of high-efficiency motors designed for industrial applications, aiming to capture a larger market share in the Asia Pacific region.

Asia Pacific Electric Motor Market Segmentation

- By Motor Type: The Asia Pacific Electric Motor Market is segmented by motor type into AC motors, DC motors, and hermetic motors. AC motors dominate this segment due to their widespread application in industrial machinery, HVAC systems, and home appliances. Their efficiency, reliability, and ability to handle varying loads make them the preferred choice for manufacturers and consumers.

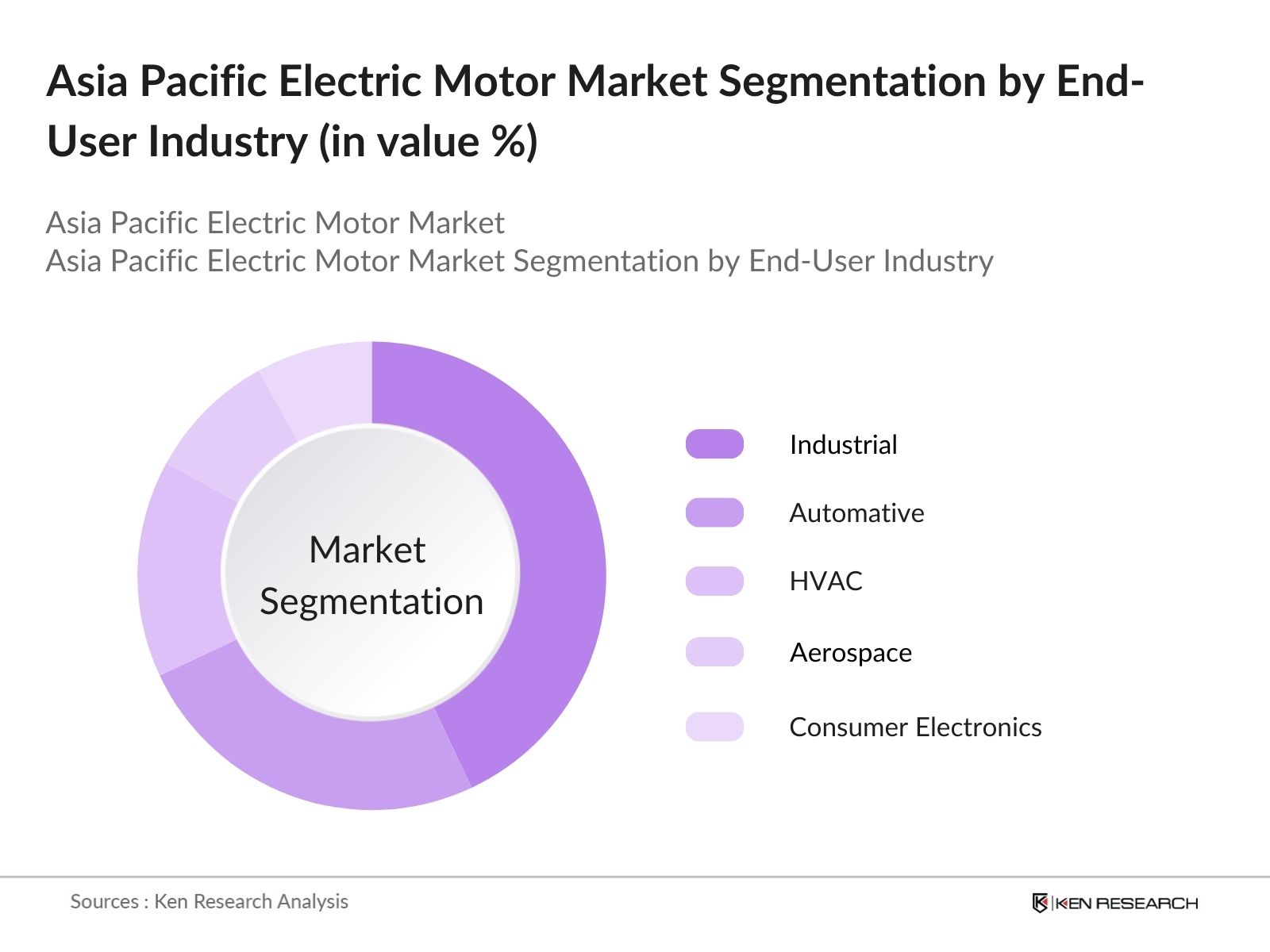

- By End-User Industry: The market is segmented by end-user industries into industrial, automotive, HVAC, aerospace, and consumer electronics. The industrial sector dominates this segment, driven by ongoing industrialization and the growing need for automation across various sectors like manufacturing, mining, and construction. Industrial motors ability to enhance productivity and energy efficiency further accelerates their demand.

Asia Pacific Electric Motor Market Competitive Landscape

The Asia Pacific Electric Motor Market is dominated by key regional and global players, reflecting strong consolidation and technological expertise in the industry. The market is shaped by major players, such as ABB Ltd., Siemens AG, and Nidec Corporation, who bring extensive portfolios and advanced motor technologies. Local manufacturers in China and India are also competing through cost-effective products and regional expansion.

Asia Pacific Electric Motor Market Analysis

Growth Drivers

- Industrial Automation: The Asia Pacific region is experiencing a significant surge in industrial automation, leading to increased demand for electric motors. For instance, China's industrial robot installations reached approximately 168,000 units in 2023, highlighting the growing automation trend. Electric motors are integral to these automated systems, driving the need for efficient and reliable motor solutions.

- Electric Vehicle Adoption: The rapid adoption of electric vehicles (EVs) in the Asia Pacific region is a major driver for the electric motor market. In 2023, China registered over 3 million new EVs, accounting for more than 50% of global EV sales. Each EV requires multiple electric motors for propulsion and auxiliary functions, significantly boosting the demand for high-performance motors.

- Infrastructure Development: Massive infrastructure projects across Asia Pacific are propelling the need for electric motors. India's National Infrastructure Pipeline, with an investment of INR 111 lakh crore (approximately USD 1.5 trillion) by 2025, includes extensive development in sectors like power and transportation, all of which rely heavily on electric motors for operations.

Market Challenges

- High Initial Investment: The upfront cost of advanced electric motors remains a barrier for many industries. For example, high-efficiency motors can cost up to 20% more than standard models, making it challenging for small and medium-sized enterprises to adopt them despite long-term energy savings.

- Technical Challenges: Integrating electric motors into complex systems requires specialized knowledge. A survey by the Asian Development Bank found that 40% of manufacturing firms in Southeast Asia cited a lack of technical expertise as a significant hurdle in adopting advanced motor technologies.

Asia Pacific Electric Motor Market Future Outlook

Over the next five years, the Asia Pacific Electric Motor Market is expected to see sustained growth, driven by advancements in electric motor technology, increasing adoption of EVs, and strong government support for renewable energy. The growing demand for energy-efficient appliances and the rise of smart home technologies are also poised to shape the future of the market significantly.

Market Opportunities

- Technological Advancements: Innovations such as the development of smart motors with IoT capabilities are creating new market opportunities. The global market for smart motors is projected to reach USD 2.5 billion by 2025, with Asia Pacific contributing a significant share, indicating a shift towards intelligent motor systems.

- Expansion into Emerging Markets: Countries like Vietnam and Indonesia are witnessing industrial growth. Vietnam's manufacturing sector grew by 7.5% in 2023, increasing the demand for electric motors in various applications, from manufacturing to infrastructure projects.

Scope of the Report

|

By Motor Type |

- AC Motors |

|

By Voltage |

- Low Voltage |

|

By End-User Industry |

- Industrial |

|

By Application |

- Pumps |

|

By Country |

- China |

Products

Key Target Audience

Automotive manufacturers

Industrial machinery manufacturers

Electric vehicle producers

HVAC system integrators

Aerospace component manufacturers

Consumer electronics companies

Investors and venture capitalist firms

Government and regulatory bodies (e.g., Ministry of Industry, National Energy Agency)

Companies

Players Mentioned in the Report:

ABB Ltd.

Siemens AG

Nidec Corporation

Toshiba Corporation

Mitsubishi Electric Corporation

WEG Industries

Regal Rexnord Corporation

Hitachi Ltd.

Johnson Electric Holdings Limited

TECO Electric & Machinery Co., Ltd.

Table of Contents

1. Asia Pacific Electric Motor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Electric Motor Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Electric Motor Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation

3.1.2. Electric Vehicle Adoption

3.1.3. Infrastructure Development

3.1.4. Energy Efficiency Regulations

3.2. Market Challenges

3.2.1. High Initial Investment

3.2.2. Technical Challenges

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion into Emerging Markets

3.3.3. Government Incentives

3.4. Trends

3.4.1. Integration with IoT

3.4.2. Development of Smart Motors

3.4.3. Increased Use in Renewable Energy Systems

3.5. Government Regulations

3.5.1. Energy Efficiency Standards

3.5.2. Emission Reduction Targets

3.5.3. Incentives for Electric Motor Adoption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia Pacific Electric Motor Market Segmentation

4.1. By Motor Type (Value %)

4.1.1. AC Motors

4.1.2. DC Motors

4.1.3. Hermetic Motors

4.2. By Voltage (Value %)

4.2.1. Low Voltage

4.2.2. Medium Voltage

4.2.3. High Voltage

4.3. By End-User Industry (Value %)

4.3.1. Industrial

4.3.2. Automotive

4.3.3. HVAC

4.3.4. Aerospace

4.3.5. Consumer Electronics

4.4. By Application (Value %)

4.4.1. Pumps

4.4.2. Fans

4.4.3. Compressors

4.4.4. Others

4.5. By Country (Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Rest of Asia Pacific

5. Asia Pacific Electric Motor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. Nidec Corporation

5.1.4. Toshiba Corporation

5.1.5. Hitachi Ltd.

5.1.6. Mitsubishi Electric Corporation

5.1.7. WEG Industries

5.1.8. Regal Rexnord Corporation

5.1.9. Johnson Electric Holdings Limited

5.1.10. TECO Electric & Machinery Co., Ltd.

5.1.11. Hyundai Electric & Energy Systems Co., Ltd.

5.1.12. Kirloskar Electric Company

5.1.13. Bharat Heavy Electricals Limited (BHEL)

5.1.14. Fuji Electric Co., Ltd.

5.1.15. Yaskawa Electric Corporation

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters Location

5.2.3. Year of Inception

5.2.4. Revenue

5.2.5. Product Portfolio

5.2.6. Market Share

5.2.7. Recent Developments

5.2.8. Strategic Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia Pacific Electric Motor Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Electric Motor Future Market Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Electric Motor Future Market Segmentation

8.1. By Motor Type (Value %)

8.2. By Voltage (Value %)

8.3. By End-User Industry (Value %)

8.4. By Application (Value %)

8.5. By Country (Value %)

9. Asia Pacific Electric Motor Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem of the Asia Pacific Electric Motor Market, including stakeholders such as manufacturers, distributors, and end-users. This stage relies on secondary research from credible sources and databases to define the market's key variables.

Step 2: Market Analysis and Construction

Historical data is collected to evaluate the penetration and performance of electric motors across industries. Metrics like energy efficiency standards and market adoption rates are analyzed to construct an accurate market overview.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations through interviews and surveys validate initial hypotheses. These interactions involve stakeholders from motor manufacturing, EV production, and industrial automation industries to ensure data accuracy and reliability.

Step 4: Research Synthesis and Final Output

Insights from stakeholders and secondary data are synthesized to develop comprehensive findings. Final validations are conducted to align statistics and trends with market realities, ensuring a reliable and actionable report.

Frequently Asked Questions

01. How big is the Asia Pacific Electric Motor Market?

The Asia Pacific Electric Motor Market is valued at USD 36.5 billion, driven by the expansion of industrial sectors, increasing adoption of EVs, and demand for energy-efficient appliances.

02. What are the challenges in the Asia Pacific Electric Motor Market?

Challenges in the Asia Pacific Electric Motor Market include high production costs, technical complexities in advanced motor designs, and supply chain disruptions due to geopolitical tensions.

03. Who are the major players in the Asia Pacific Electric Motor Market?

Key players in the Asia Pacific Electric Motor Market include ABB Ltd., Siemens AG, Nidec Corporation, Toshiba Corporation, and Mitsubishi Electric Corporation, known for their technological advancements and wide product portfolios.

04. What are the growth drivers of the Asia Pacific Electric Motor Market?

Growth drivers in the Asia Pacific Electric Motor Market include the adoption of electric vehicles, industrial automation, and increased investments in renewable energy projects, boosting demand for energy-efficient motors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.