Asia Pacific Electric Motors Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD11236

December 2024

87

About the Report

Asia Pacific Electric Motor Market Overview

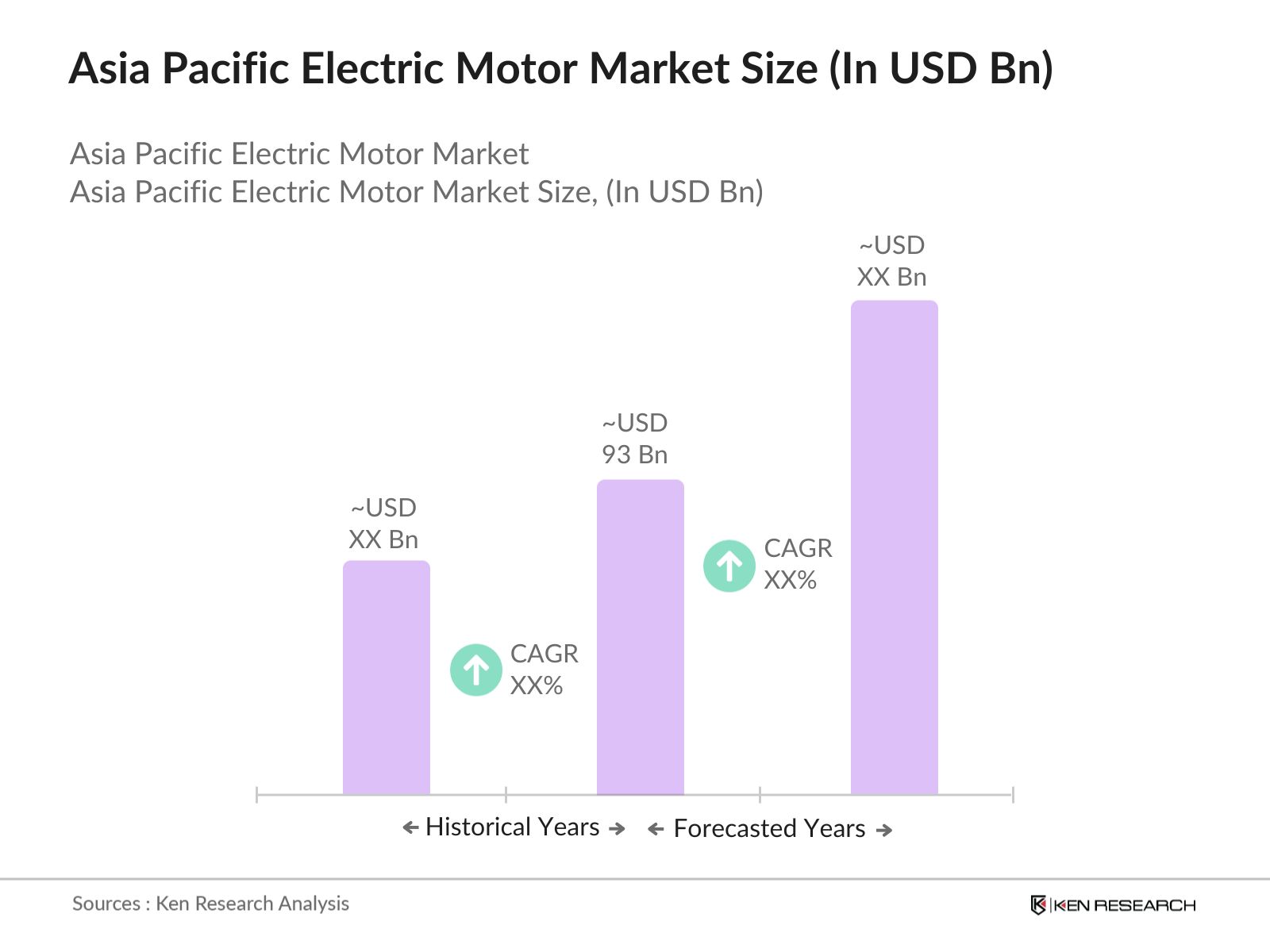

- The Asia Pacific electric motor market holds a significant valuation of USD 93 billion, driven by the surge in industrial automation, increased adoption of electric vehicles, and the region's robust manufacturing infrastructure. Rising consumer demand for energy-efficient solutions, along with government mandates for reduced emissions, further bolsters market growth.

- Leading the market are China, Japan, and India due to their strong industrial bases, continuous government initiatives supporting electrification, and high demand for electric vehicles. Chinas extensive manufacturing facilities and Japans advanced automotive sector play key roles in their dominance, while Indias infrastructure expansion and urbanization trends are crucial factors driving its market share.

- Subsidies for renewable energy in Asia Pacific encourage the development of energy-efficient electric motors. In 2023, India introduced subsidies amounting to 600 million USD to support renewable energy projects, creating a favorable environment for motors utilized in wind and solar applications. These subsidies drive demand for motors that meet high-efficiency standards required in renewable projects.

Asia Pacific Electric Motor Market Segmentation

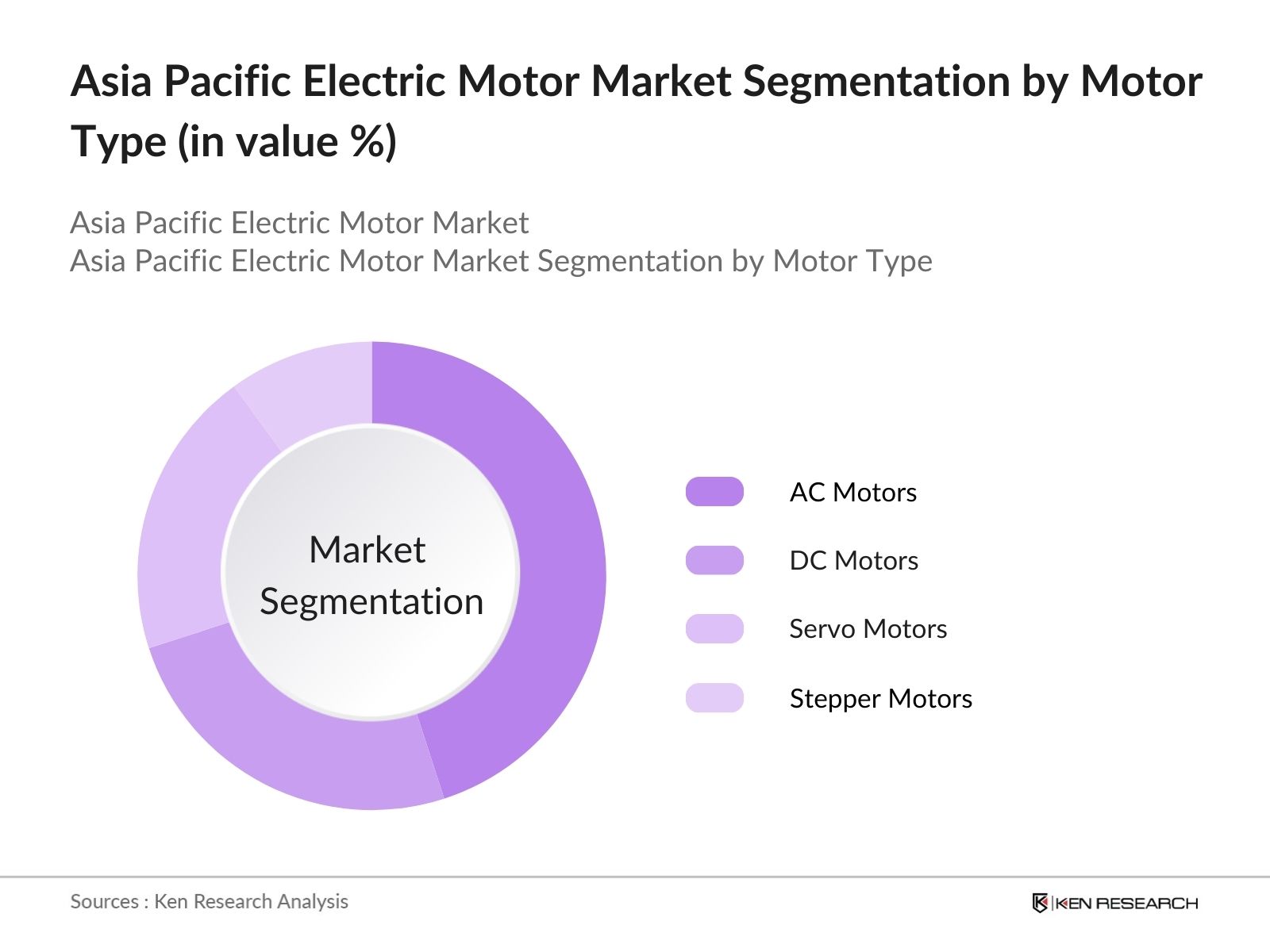

By Motor Type: The Asia Pacific electric motor market is segmented by motor type into Alternating Current (AC) Motors, Direct Current (DC) Motors, Servo Motors, and Stepper Motors. Currently, AC Motors dominate this segment due to their extensive applications in manufacturing industries and energy efficiency. These motors are widely adopted for their robustness and cost-effectiveness, making them a preferred choice in heavy-duty applications across industrial, commercial, and household sectors, particularly in Chinas manufacturing base.

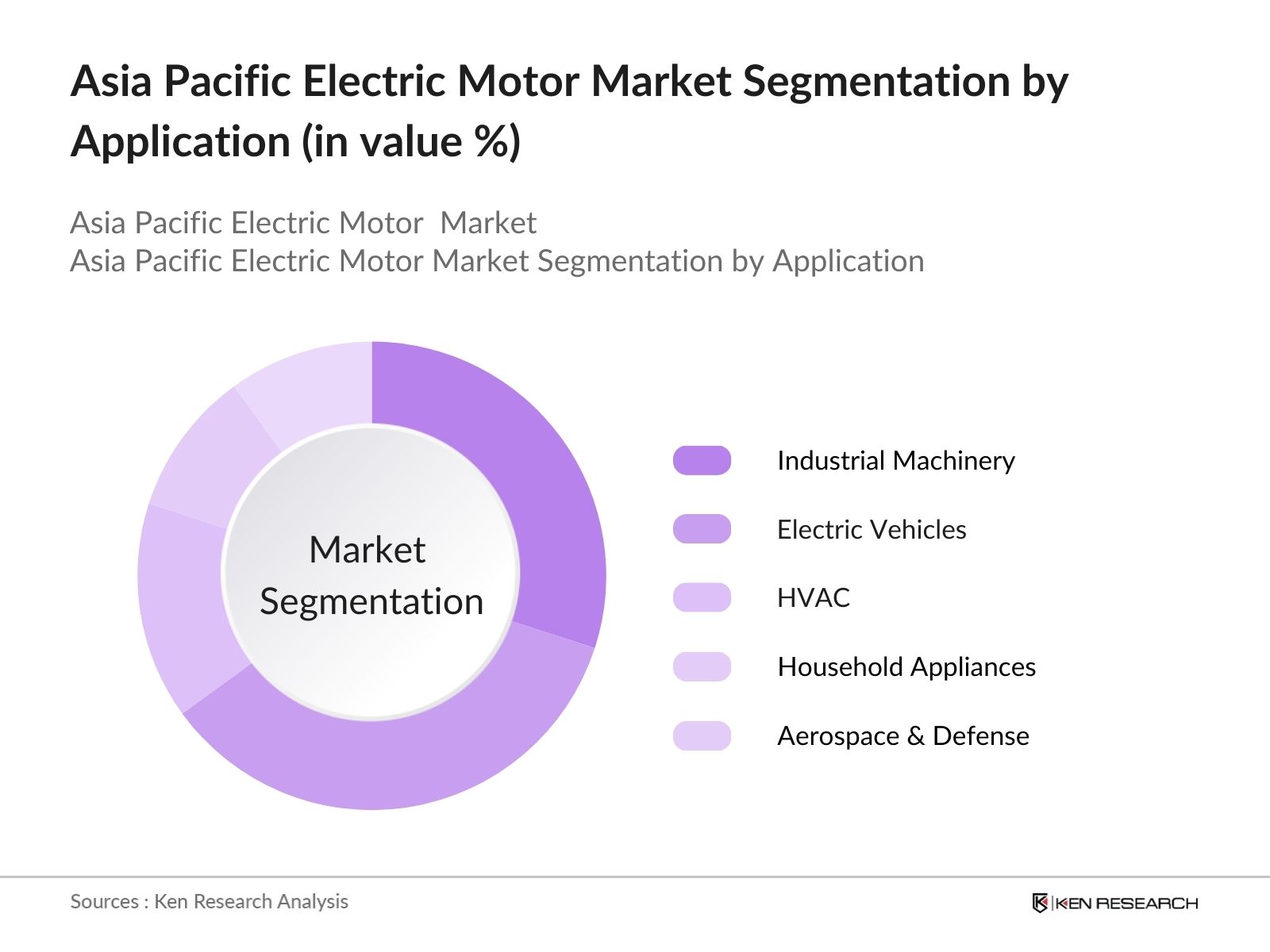

By Application: The market is segmented by application into Industrial Machinery, Electric Vehicles, HVAC (Heating, Ventilation, and Air Conditioning), Household Appliances, and Aerospace & Defense. Electric Vehicles hold a dominant market share within this segment, propelled by the increasing adoption of EVs, particularly in China and Japan, where supportive policies, extensive charging infrastructure, and consumer demand for green technology contribute to their widespread use.

Asia Pacific Electric Motor Market Competitive Landscape

The Asia Pacific electric motor market is primarily dominated by established players who influence the market through technological advancements and strategic expansions. Companies like Nidec Corporation and Mitsubishi Electric dominate with high market presence due to their large product portfolios, while new entrants focus on innovative, energy-efficient solutions to capture a share of this lucrative market.

Asia Pacific Electric Motor Market Analysis

Growth Drivers

- Industrial Automation Expansion: The expansion of industrial automation in Asia Pacific has spurred a growing demand for high-efficiency electric motors. Countries like China and India, which together comprise over 2.7 billion people, are implementing extensive automation in manufacturing, driving demand for motors capable of optimizing energy usage. Automation equipment imports into China alone reached approximately 65 billion USD in 2023. This regional trend is backed by government initiatives like China's "Made in China 2025," aimed at modernizing its industrial sector through automation, emphasizing energy-efficient technologies.

- Surge in Electric Vehicle (EV) Production: Asia Pacific's electric vehicle production continues to rise, increasing the demand for high-efficiency electric motors essential in EV manufacturing. Japan, South Korea, and China collectively accounted for over 60% of global EV production by 2023. China alone produced around 4.3 million EVs, heavily contributing to the electric motor market. This surge aligns with national targets across Asia to reduce carbon emissions by promoting electric mobility. Government subsidies and incentives across these regions further boost production and technological advancements in electric motors.

- Renewable Energy Applications: The Asia Pacific regions renewable energy sector, particularly in China and India, is experiencing substantial growth, leading to a higher demand for electric motors optimized for solar and wind power systems. In 2023, Chinas installed wind energy capacity exceeded 380 gigawatts, while Indias solar power capacity reached nearly 70 gigawatts. Electric motors play a crucial role in efficient energy transmission and storage in these systems, enhancing the push for energy sustainability.

Challenges

- High Initial Investment Cost: The electric motor industry faces high initial investment costs due to advanced technologies and materials needed for energy efficiency and durability. Prices of essential raw materials like copper and rare earth metals have increased significantly; copper prices in 2023 averaged around 8,400 USD per ton. These cost pressures affect the affordability of motor production, posing a challenge for smaller firms to adopt premium electric motor technologies.

- Technical Skill Shortages: Asia Pacific faces a skills gap in the electric motor industry, particularly in specialized motor technologies. Countries like Vietnam and Thailand have noted shortages in skilled technicians, limiting the industry's ability to innovate and scale production of advanced, high-efficiency motors. In 2023, Thailand reported a shortage of over 45,000 skilled technicians in the manufacturing sector, impacting the labor-intensive electric motor production segment.

Asia Pacific Electric Motor Market Future Outlook

Asia Pacific electric motor market is anticipated to experience substantial growth driven by the region's ongoing industrial expansion, widespread adoption of electric vehicles, and integration of energy-efficient technologies. With increasing investments in renewable energy and favorable regulatory frameworks, the market is poised for rapid technological advancements, positioning electric motors as a crucial component in achieving energy sustainability.

Market Opportunities

- Advancements in IoT and Digitalization: The adoption of IoT in electric motors is transforming the Asia Pacific electric motor market, enabling predictive maintenance and energy efficiency. In 2023, Japan reported over 80% of new industrial electric motors as IoT-compatible, contributing to streamlined industrial processes. These advancements not only reduce downtime but also optimize performance in energy-intensive sectors like manufacturing, driving adoption of IoT-integrated electric motors across the region.

- Growth in Asia Pacific Manufacturing Sector: Asia Pacific, led by China and India, has shown a significant uptick in manufacturing output, pushing demand for energy-efficient electric motors. Chinas manufacturing sector alone generated a revenue of approximately 9.3 trillion USD in 2023, contributing to demand for robust, efficient motors. Countries in the region are increasingly investing in automated and smart manufacturing setups that require durable electric motors capable of high performance.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Motor Type |

Alternating Current (AC) Motors Direct Current (DC) Motors Servo Motors Stepper Motors |

|

By Power Output |

Fractional Horsepower Motors Integral Horsepower Motors |

|

By Voltage Range |

Low Voltage Motors Medium Voltage Motors High Voltage Motors |

|

By Application |

Industrial Machinery Electric Vehicles Heating, Ventilation, and Air Conditioning (HVAC) Household Appliances Aerospace and Defense |

|

By Region |

China Japan India South Korea Rest of Asia Pacific |

Products

Key Target Audience

Electric Vehicle Manufacturers

Industrial Equipment Manufacturers

Renewable Energy Solution Providers

HVAC Systems Providers

Aerospace and Defense Contractors

Electric Motor Distributors and Resellers

Investors and Venture Capital Firms

Government and Regulatory Bodies (e.g., China National Energy Administration, Japan Ministry of Economy, Trade, and Industry)

Companies

Players Mentioned in the Report

Nidec Corporation

ABB Ltd.

Siemens AG

Mitsubishi Electric Corporation

Toshiba Corporation

Johnson Electric Holdings

Hitachi Ltd.

TECO Electric & Machinery Co., Ltd.

WEG S.A.

Regal Beloit Corporation

Table of Contents

1. Asia Pacific Electric Motor Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Electric Motor Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Electric Motor Market Analysis

3.1 Growth Drivers (Increasing Demand for Energy-Efficient Solutions)

3.1.1 Industrial Automation Expansion

3.1.2 Surge in Electric Vehicle (EV) Production

3.1.3 Renewable Energy Applications

3.1.4 Rising Urbanization and Infrastructure Development

3.2 Market Challenges (Raw Material Price Volatility)

3.2.1 High Initial Investment Cost

3.2.2 Technical Skill Shortages

3.2.3 Trade and Tariff Restrictions

3.3 Opportunities (Expansion of Smart Grid Infrastructure)

3.3.1 Advancements in IoT and Digitalization

3.3.2 Growth in Asia Pacific Manufacturing Sector

3.3.3 Investment in Green Technology

3.4 Trends (Increased Miniaturization and Efficiency)

3.4.1 Compact and Lightweight Motors

3.4.2 Integration of IoT in Electric Motors

3.4.3 Adoption of Permanent Magnet Synchronous Motors (PMSM)

3.5 Government Regulations (Emission Standards and Energy Efficiency Guidelines)

3.5.1 Energy Efficiency Standards (Minimum Energy Performance Standards)

3.5.2 Regional Subsidies for Renewable Energy Adoption

3.5.3 Emission Control Policies for Industrial Motors

3.5.4 Safety and Compliance Certifications

3.6 Competitive Ecosystem (Market Structure and Competition Level)

3.6.1 Market Fragmentation Level

3.6.2 Strategies for Market Entry

3.6.3 Key Patents and Intellectual Property

3.6.4 Regional Distribution Strategies

3.7 Porters Five Forces Analysis

3.8 Stake Ecosystem

3.9 SWOT Analysis

4. Asia Pacific Electric Motor Market Segmentation

4.1 By Motor Type (In Value %)

4.1.1 Alternating Current (AC) Motors

4.1.2 Direct Current (DC) Motors

4.1.3 Servo Motors

4.1.4 Stepper Motors

4.2 By Power Output (In Value %)

4.2.1 Fractional Horsepower Motors

4.2.2 Integral Horsepower Motors

4.3 By Voltage Range (In Value %)

4.3.1 Low Voltage Motors

4.3.2 Medium Voltage Motors

4.3.3 High Voltage Motors

4.4 By Application (In Value %)

4.4.1 Industrial Machinery

4.4.2 Electric Vehicles

4.4.3 Heating, Ventilation, and Air Conditioning (HVAC)

4.4.4 Household Appliances

4.4.5 Aerospace and Defense

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 South Korea

4.5.5 Rest of Asia Pacific

5. Asia Pacific Electric Motor Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nidec Corporation

5.1.2 ABB Ltd.

5.1.3 Siemens AG

5.1.4 Mitsubishi Electric Corporation

5.1.5 Toshiba Corporation

5.1.6 Regal Beloit Corporation

5.1.7 Johnson Electric Holdings Limited

5.1.8 Hitachi Ltd.

5.1.9 TECO Electric & Machinery Co., Ltd.

5.1.10 WEG S.A.

5.2 Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Inception Year, Market Reach, Market Share, Product Portfolio Depth, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers, Acquisitions, Joint Ventures)

5.5 Product Launches and Innovations

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Private Equity Investments

6. Asia Pacific Electric Motor Market Regulatory Framework

6.1 Energy Efficiency and Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes (ISO Standards, CE Marking, Regional Certifications)

7. Asia Pacific Electric Motor Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Electric Motor Future Market Segmentation

8.1 By Motor Type (In Value %)

8.2 By Power Output (In Value %)

8.3 By Voltage Range (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Electric Motor Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Target Customer Cohorts

9.3 Market Positioning Strategies

9.4 White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The research begins with an extensive analysis of the electric motor ecosystem within the Asia Pacific, identifying primary variables that drive market dynamics. This step involves compiling insights from secondary databases and proprietary sources, establishing the market's baseline factors.

Step 2: Market Analysis and Construction

In this phase, historical market data is examined to evaluate penetration across different segments, analyzing demand patterns, industry growth rates, and revenue generation trends within the electric motor sector. This analysis helps in identifying key growth areas and potential revenue streams.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts via computer-assisted telephone interviews (CATIs), the hypotheses developed from initial research are validated. Expert insights provide operational and financial perspectives that enhance the accuracy of market estimates and segment forecasts.

Step 4: Research Synthesis and Final Output

Final data synthesis is conducted to verify insights from a bottom-up approach, ensuring the data's integrity and comprehensiveness. Market insights and segment trends are finalized, resulting in an in-depth and reliable analysis of the Asia Pacific electric motor market.

Frequently Asked Questions

01. How big is the Asia Pacific Electric Motor Market?

The Asia Pacific electric motor market is valued at USD 93 billion, driven by rising industrial automation and electric vehicle demand, alongside robust government support for energy-efficient technologies.

02. What are the challenges in the Asia Pacific Electric Motor Market?

Key challenges in Asia Pacific electric motor market include high initial investment costs, fluctuating raw material prices, and the need for skilled technical labor, which may affect the market's scalability.

03. Who are the major players in the Asia Pacific Electric Motor Market?

Major players in Asia Pacific electric motor market include Nidec Corporation, ABB Ltd., Siemens AG, Mitsubishi Electric Corporation, and Toshiba Corporation, with extensive market reach and advanced technology integration.

04. What are the growth drivers of the Asia Pacific Electric Motor Market?

Growth in Asia Pacific electric motor market is fueled by increasing adoption of electric vehicles, industrialization, energy efficiency standards, and supportive government regulations in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.