Region:Asia

Author(s):Shubham

Product Code:KRAA1778

Pages:81

Published On:August 2025

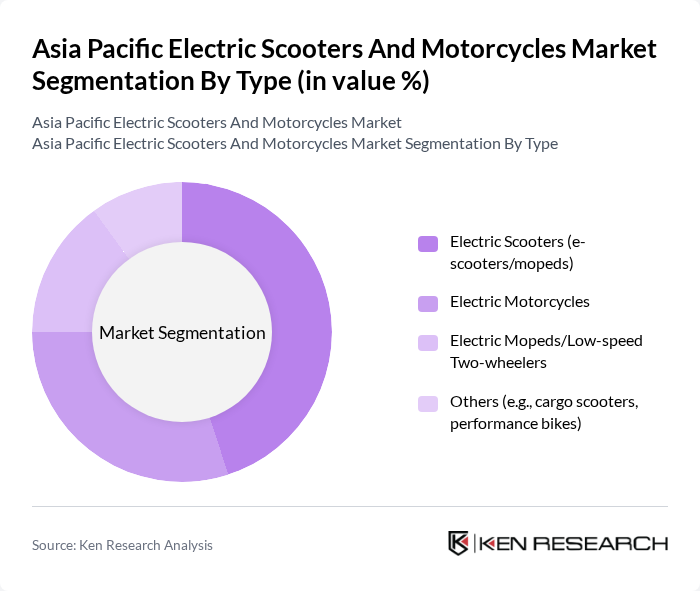

By Type:The market is segmented into various types, including Electric Scooters (e-scooters/mopeds), Electric Motorcycles, Electric Mopeds/Low-speed Two-wheelers, and Others (e.g., cargo scooters, performance bikes). Among these, Electric Scooters are the most popular due to their affordability, ease of use, and suitability for urban commuting. The growing trend of shared mobility and last-mile delivery services has also contributed to the increasing demand for electric scooters.

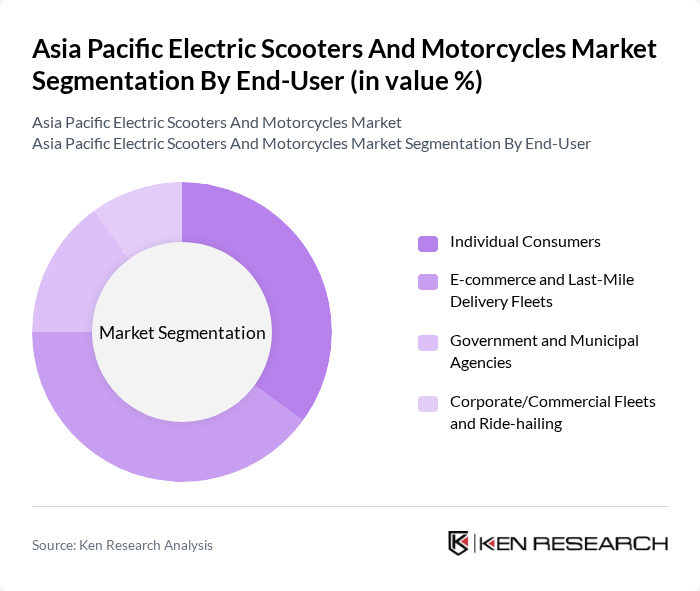

By End-User:The market is segmented by end-users, including Individual Consumers, E-commerce and Last-Mile Delivery Fleets, Government and Municipal Agencies, and Corporate/Commercial Fleets and Ride-hailing. The E-commerce and Last-Mile Delivery Fleets segment is currently leading the market due to the rapid growth of online shopping and the need for efficient delivery solutions. Companies are increasingly adopting electric scooters for their delivery operations to reduce costs and meet sustainability goals.

The Asia Pacific Electric Scooters And Motorcycles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yadea Technology Group Co., Ltd., NIU Technologies, Gogoro Inc., Ather Energy Pvt. Ltd., Ola Electric Mobility Pvt. Ltd., Hero MotoCorp Ltd. (Vida), Hero Electric (Hero Electric Vehicles Pvt. Ltd.), TVS Motor Company Ltd., Bajaj Auto Ltd., Greaves Electric Mobility Pvt. Ltd. (Ampere), Okinawa Autotech Pvt. Ltd., Revolt Intellicorp Pvt. Ltd., TAILG Group, Sunra (Jiangsu Xinri E-Vehicle Co., Ltd.), Super Soco (VMoto Soco Group), Vmoto Limited, Horwin Global, Surron (Chongqing Surron Electric Vehicle Co., Ltd.), Pure EV (PurEnergy Pvt. Ltd.), Kwang Yang Motor Co., Ltd. (KYMCO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric scooters and motorcycles market in the Asia Pacific region appears promising, driven by increasing urbanization and supportive government policies. As cities expand and environmental concerns grow, the demand for sustainable transportation solutions will likely rise. Additionally, advancements in battery technology and charging infrastructure development are expected to enhance the appeal of electric two-wheelers, making them a viable alternative to traditional vehicles. The market is poised for significant growth as consumer preferences shift towards eco-friendly mobility options.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Scooters (e-scooters/mopeds) Electric Motorcycles Electric Mopeds/Low-speed Two-wheelers Others (e.g., cargo scooters, performance bikes) |

| By End-User | Individual Consumers E-commerce and Last-Mile Delivery Fleets Government and Municipal Agencies Corporate/Commercial Fleets and Ride-hailing |

| By Region | China India Japan South Korea Southeast Asia (e.g., Indonesia, Vietnam, Thailand) Rest of Asia-Pacific |

| By Battery Type | Lithium-Ion (LFP, NMC) Lead-Acid Others (e.g., NiMH) |

| By Sales Channel | Online/Digital Authorized Dealerships Direct-to-Consumer/OEM Stores |

| By Price Range | Budget (Entry-level/Commuter) Mid-Range Premium/Performance |

| By Usage Type | Personal Mobility Commercial/Logistics Shared Mobility (rental/subscription) |

| By Voltage/Power Output | V V V V and above |

| By Charging/?? Model | Fixed Charging (AC/DC plug-in) Battery Swapping Fast Charging Capable |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuter Preferences | 150 | Daily commuters, Electric scooter users |

| Retail Market Insights | 100 | Retail Managers, Sales Executives |

| Manufacturer Feedback | 80 | Product Development Managers, Operations Directors |

| Government Policy Impact | 60 | Policy Makers, Regulatory Officials |

| Consumer Adoption Trends | 120 | Potential buyers, Current electric vehicle owners |

The Asia Pacific Electric Scooters and Motorcycles Market is valued at approximately USD 30 billion, driven by urbanization, rising fuel prices, and a focus on sustainable transportation solutions. This valuation is based on a five-year historical analysis of market trends.