Asia Pacific Electronic Manufacturing System (EMS) Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD2751

November 2024

85

About the Report

Asia Pacific Electronic Manufacturing System (EMS) Market Overview

The Asia Pacific EMS market was valued at USD 180 billion. This growth has been driven by the regions expanding consumer electronics sector, automotive industry, and increased demand for telecommunications infrastructure. The EMS industry benefits from lower production costs and access to a skilled workforce in countries like China, India, and Vietnam.

Leading EMS providers in the Asia Pacific region include Hon Hai Precision Industry (Foxconn), Flex Ltd., Pegatron Corporation, Wistron Corporation, and Jabil Inc. These companies dominate the industry with their large-scale production capabilities and established relationships with global technology firms. Their operations span various industries, including telecommunications, automotive, consumer electronics, and medical devices, making them integral to the supply chain.

In 2024, Foxconn announced a USD 200 million investment to build a new manufacturing facility in Tamil Nadu, India. The new plant is expected to produce electronic components for smartphones and EVs, contributing significantly to Indias EMS market. The expansion is aligned with the Indian government's push for increased local production under its PLI scheme, further bolstering the countrys position as a key EMS hub.

China remains the dominant player in the Asia Pacific EMS sector, accounted the highest market share in 2023. This dominance is attributed to the countrys robust manufacturing infrastructure and significant investments in R&D. Cities such as Shenzhen, which is home to numerous technology and manufacturing firms, play a central role in the electronics manufacturing supply chain. Additionally, Indias Bengaluru is emerging as a key EMS hub, driven by government incentives and foreign investment.

Asia Pacific Electronic Manufacturing System (EMS) Market Segmentation

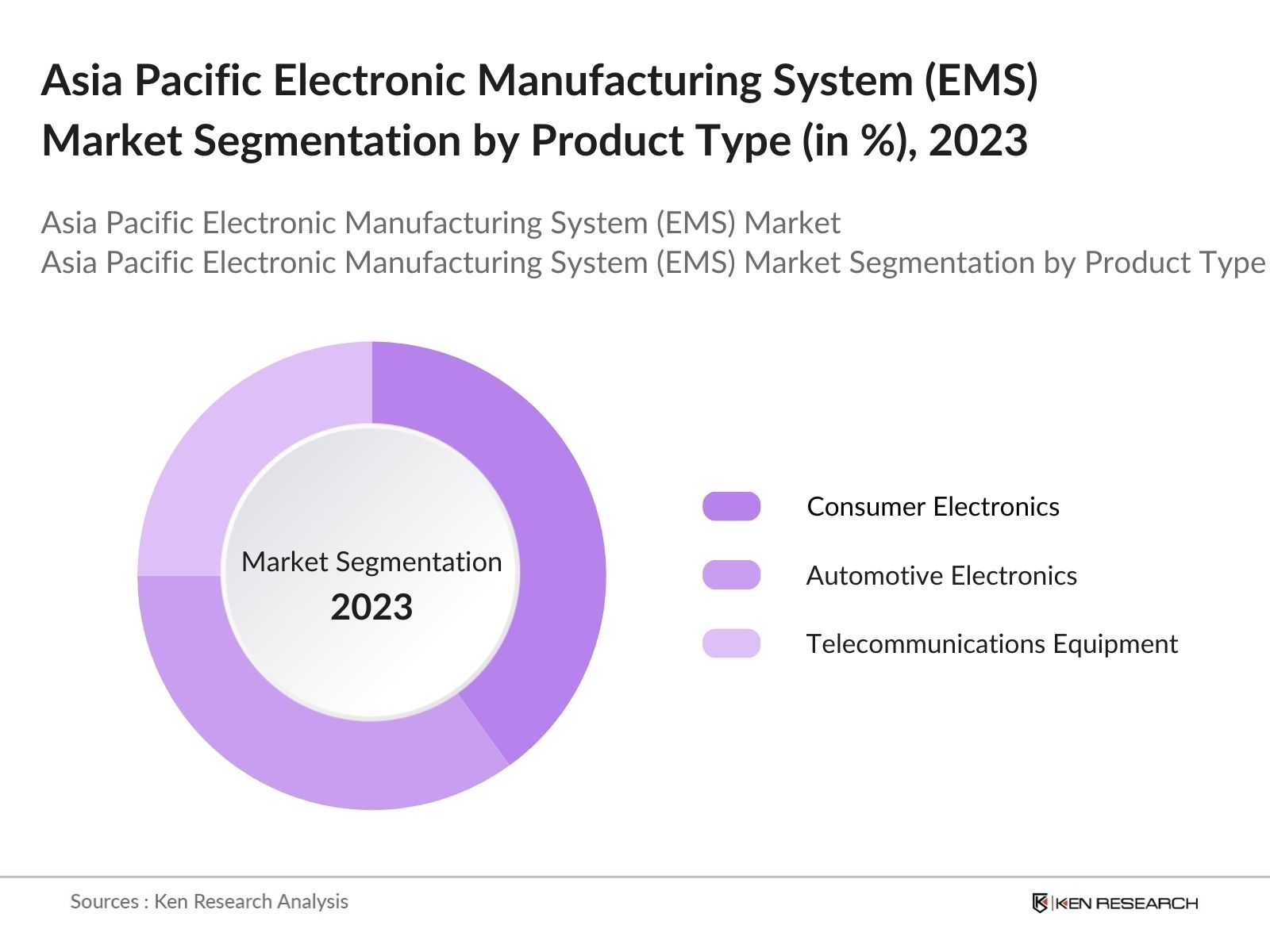

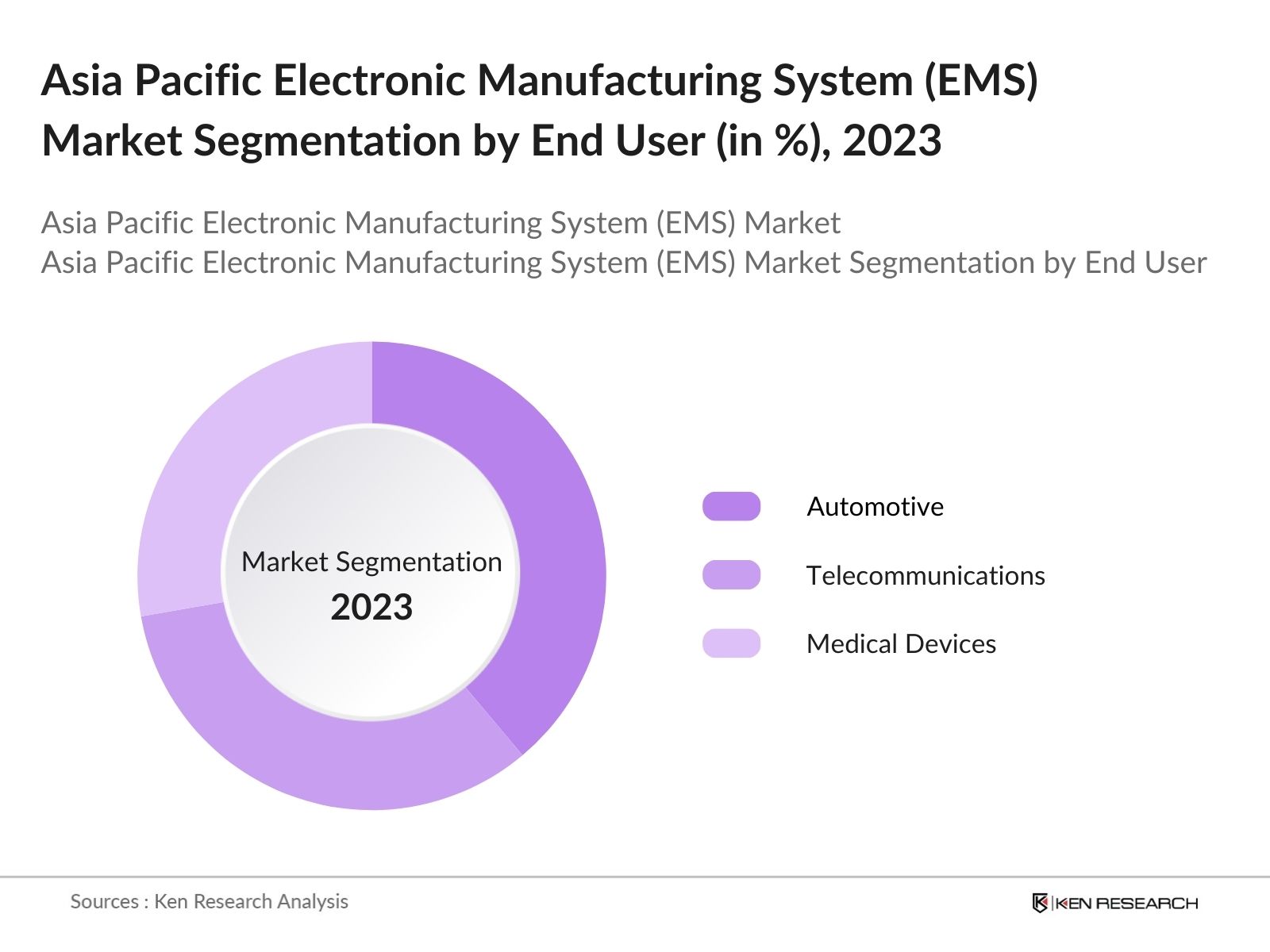

The Asia Pacific Electronic Manufacturing System (EMS) market is segmented into various factors such as product type, End-user industry and region etc.

By Product Type: The market is segmented by product type into consumer electronics, automotive electronics, and telecommunications equipment. In 2023, consumer electronics accounted for more than one-third of the market share, driven by the continuous demand for smartphones, laptops, and smart home devices. The segments dominance is supported by the rapid adoption of 5G, AI-driven devices, and the increased penetration of IoT technologies in daily life.

By End-Use Industry: The market is further segmented by end-use industry into automotive, telecommunications, and medical devices. The automotive segments dominance can be attributed to the growing demand for electronic components in EVs and connected cars. Countries such as China and Japan have invested heavily in developing their EV infrastructure, which is propelling the demand for EMS solutions in the automotive sector.

By Region: Geographically, the market is segmented into China, South Korea, Japan, India, Australia and rest of APAC. China holds the dominant position in the market due to its well-established manufacturing infrastructure, extensive supply chain, and strong government support through initiatives like "Made in China 2025." Cities like Shenzhen are central to global electronics production.

Asia Pacific Electronic Manufacturing System (EMS) Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Hon Hai Precision |

1974 |

Taiwan |

|

Flex Ltd. |

1969 |

Singapore |

|

Pegatron Corporation |

2008 |

Taiwan |

|

Wistron Corporation |

2001 |

Taiwan |

|

Jabil Inc. |

1966 |

United States |

- Pegatron's New Facility in Vietnam

In 2024, Pegatron completed the construction of a new EMS facility in Vietnam, with an investment of USD 1 billion. The facility will manufacture components for consumer electronics and automotive electronics, capitalizing on Vietnams growing reputation as a cost-effective alternative to China for electronics manufacturing. This expansion is expected to add USD 3 billion to Pegatron's annual revenue by 2026. - Jabils AI-Powered Manufacturing Expansion

Jabil Inc. implemented AI-powered automation systems in its manufacturing facilities in China and South Korea in 2024. This new technology is expected to increase production efficiency by 30%, reducing operational costs by USD 500 million annually. The integration of AI into EMS processes positions Jabil as a leader in innovative and cost-effective manufacturing solutions in the Asia Pacific region.

Asia Pacific Electronic Manufacturing System (EMS) Industry Analysis

Growth Drivers

- Rise in Consumer Electronics Demand: The production of smartphones, laptops, and tablets reached over 1.8 billion units across China and India, driven by increased digital adoption. This high production volume requires extensive contract manufacturing services, pushing the EMS market forward. Countries like China have emerged as leading production hubs, with the city of Shenzhen alone contributing over USD 200 billion to the EMS sector annually.

- Expansion of 5G Infrastructure: The rollout of 5G networks across the Asia Pacific region has boosted the need for advanced telecommunications equipment. China, South Korea, and Japan collectively invested heavily in 5G infrastructure, accelerating the deployment of EMS services for manufacturing network components such as routers, modems, and base stations. This demand for telecommunications equipment manufacturing is creating new opportunities for EMS providers.

- Growth of Medical Device Manufacturing: The Asia Pacific region has witnessed a surge in the demand for medical devices, especially after the COVID-19 pandemic. In 2024, the production of ventilators, diagnostic equipment, and wearable health devices in countries like Japan and South Korea contributed to an estimated USD 60 billion in EMS contracts. The medical device sector requires high-quality and precise manufacturing, which EMS providers in the region are equipped to deliver, making this a key growth driver.

Challenges

- Supply Chain Disruptions: The Asia Pacific EMS Industry is facing challenges from supply chain disruptions, particularly due to geopolitical tensions. In 2024, delays in the shipment of critical components such as semiconductors resulted in a production shortfall of smartphones in China. This disruption has forced manufacturers to seek alternative supply routes, but this comes at a cost, impacting the profitability of EMS providers in the region.

- Increased Competition from Emerging Markets: Countries like Vietnam and Indonesia are rapidly emerging as alternative manufacturing hubs, offering lower production costs compared to traditional leaders like China. In 2024, Vietnams EMS market grew, driven by its lower labor costs and favorable government policies. This shift is creating competition for established players in the region, forcing them to reevaluate their production strategies to maintain their market share.

Government Initiatives

- Indias Production Linked Incentive (PLI) Scheme: The PLI scheme, launched in April 2020, is designed to incentivize large-scale electronics manufacturing in India. As of mid-2024, the scheme has generated substantial investment and production output. By June 2024, incremental investments under the PLI scheme reached approximately 8,390 crores (around USD 1.1 billion), contributing to a total production value of 5.14 lakh crores (about USD 62 billion) in electronics manufacturing.

- South Koreas Green New Deal

South Koreas 2024 budget included USD 8 billion earmarked for the development of green and sustainable manufacturing processes, focusing on the EMS industry. This initiative incentivizes EMS companies to adopt energy-efficient practices and reduce carbon emissions. South Korean EMS providers are now integrating renewable energy solutions into their production processes, aiming to produce 5 million green-certified electronics devices annually by 2026.

Asia Pacific EMS Market Future Outlook

The Asia Pacific EMS market is projected to grow exponentially, driven by rapid advancements in 5G infrastructure, electric vehicles, and the Internet of Things (IoT). The region's focus on innovation, coupled with government incentives for domestic manufacturing, will continue to bolster market growth.

Future Trends

- Expansion of Advanced Manufacturing Technologies: EMS providers in the Asia Pacific region will increasingly adopt advanced manufacturing technologies such as AI, machine learning, and robotics. The integration of AI-powered automation systems will reduce production costs across the region, improving operational efficiency and driving market growth. This trend will be particularly prominent in countries like China and Japan, where investments in Industry 4.0 technologies are accelerating.

- Increased Localization of Manufacturing: In response to supply chain disruptions and geopolitical tensions, companies will shift towards localizing their production facilities in the Asia Pacific region. Major EMS providers will have established more localized manufacturing hubs in countries like Vietnam, India, and Indonesia, reducing dependency on China. This shift will add more investment to the EMS market along with government incentives.

Scope of the Report

|

By Product Type |

Consumer Electronics Automotive Electronics Telecommunications Equipment |

|

By End User Industry |

Consumer Electronics Automotive Electronics Telecommunications Equipment |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Electronics manufacturers

Automotive OEMs

Telecommunications providers

Semiconductor companies

IoT device manufacturers

Ministry of Industry and Information Technology (China)

Department of Electronics and Information Technology (India)

Investors and VC Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Hon Hai Precision Industry (Foxconn)

Flex Ltd.

Pegatron Corporation

Wistron Corporation

Jabil Inc.

Sanmina Corporation

Celestica Inc.

Benchmark Electronics

New Kinpo Group

BYD Electronics

Venture Corporation Limited

UMC Electronics Co., Ltd.

Shenzhen Kaifa Technology Co., Ltd.

SIIX Corporation

Universal Scientific Industrial (USI)

Table of Contents

1 Asia Pacific Electronic Manufacturing System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Electronic Manufacturing System Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Electronic Manufacturing System Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Consumer Electronics Demand

3.1.2. Increase in Automotive Electronics Production

3.1.3. Expansion of 5G Infrastructure

3.1.4. Growth of Medical Device Manufacturing

3.2. Restraints

3.2.1. Supply Chain Disruptions

3.2.2. Labor Shortages and Rising Wages

3.2.3. Intellectual Property (IP) Concerns

3.2.4. Increased Competition from Emerging Markets

3.3. Opportunities

3.3.1. AI and Automation Integration

3.3.2. EV Sector Growth

3.3.3. Sustainable Manufacturing Practices

3.3.4. Regional Expansion and Localization of Production

3.4. Trends

3.4.1. Adoption of Advanced Manufacturing Technologies

3.4.2. Localization of Production

3.4.3. Role of EMS in Electric Vehicles

3.4.4. Sustainability in Manufacturing

3.5. Government Regulations

3.5.1. Indias Production Linked Incentive (PLI) Scheme

3.5.2. Chinas "Made in China 2025" Policy

3.5.3. South Koreas Green New Deal

3.5.4. Vietnams Foreign Investment Laws

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia Pacific Electronic Manufacturing System Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Consumer Electronics

4.1.2. Automotive Electronics

4.1.3. Telecommunications Equipment

4.2. By End-Use Industry (in Value %)

4.2.1. Automotive

4.2.2. Telecommunications

4.2.3. Medical Devices

4.3. By Region (in Value %)

4.3.1. China

4.3.2. South Korea

4.3.3. Japan

4.3.4. India

4.3.5. Australia

4.3.6. Rest of APAC

5. Asia Pacific Electronic Manufacturing System Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Hon Hai Precision Industry (Foxconn)

5.1.2. Flex Ltd.

5.1.3. Pegatron Corporation

5.1.4. Wistron Corporation

5.1.5. Jabil Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia Pacific Electronic Manufacturing System Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Foreign Direct Investments

6.4.2. Government Grants and Incentives

6.4.3. Private Sector Investments

7. Asia Pacific Electronic Manufacturing System Market Regulatory Framework

7.1. Industry Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Asia Pacific Electronic Manufacturing System Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia Pacific Electronic Manufacturing System Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-Use Industry (in Value %)

9.3. By Region (in Value %)

10. Asia Pacific Electronic Manufacturing System Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Strategic Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on Asia-Pacific Electronic manufacturing system Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for electronic manufacturing system Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple electronic manufacturing system companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Asia-Pacific Electronic manufacturing system industry.

Frequently Asked Questions

01 How big is Asia Pacific Electronic Manufacturing System (EMS) Market?

The Asia Pacific Electronic Manufacturing System (EMS) market was valued at USD 240 billion in 2023, driven by the demand for consumer electronics, automotive electronics, and the expansion of 5G infrastructure across key countries like China, India, and South Korea.

02 What are the challenges in the Asia Pacific Electronic Manufacturing System (EMS) Market?

Challenges in the Asia Pacific EMS market include supply chain disruptions caused by geopolitical tensions, rising labor costs in key manufacturing hubs like China, and competition from emerging markets such as Vietnam. Intellectual property concerns and the rising cost of raw materials also present significant hurdles for the market.

03 Who are the major players in the Asia Pacific Electronic Manufacturing System (EMS) Market?

Key players in the Asia Pacific EMS market include Hon Hai Precision Industry (Foxconn), Flex Ltd., Pegatron Corporation, Wistron Corporation, and Jabil Inc. These companies lead due to their large-scale production capabilities, technological innovations, and established relationships with global electronics brands.

04 What are the growth drivers of the Asia Pacific Electronic Manufacturing System (EMS) Market?

The growth of the Asia Pacific EMS market is fueled by the increasing production of consumer electronics, the rise of electric vehicles (EVs), the expansion of 5G infrastructure, and the demand for medical devices. Governments across the region are also providing incentives for local manufacturing, which further drives market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.