Asia Pacific Embedded Non-volatile Memory Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD7371

November 2024

88

About the Report

Asia Pacific Embedded Non-volatile Memory Market Overview

- The Asia Pacific embedded non-volatile memory (eNVM) market is valued at USD 1.8 billion based on a detailed five-year historical analysis. The market is largely driven by the rapid growth of connected devices in the region, particularly in sectors such as automotive, industrial automation, and consumer electronics. The proliferation of IoT devices, coupled with increasing demand for high-speed data processing in mobile and wearable devices, has accelerated the adoption of eNVM.

- China, Japan, and South Korea dominate the Asia Pacific eNVM market. These countries have established advanced semiconductor industries supported by significant R&D investments and government policies aimed at self-reliance in chip manufacturing. Chinas rise as a major player stems from its large consumer electronics market and ongoing efforts to reduce dependency on foreign semiconductor imports.

- Governments in the Asia Pacific region are offering significant subsidies to boost domestic semiconductor manufacturing. China, for instance, committed over $100 billion in subsidies by 2023 to increase self-reliance in semiconductor production. These subsidies are supporting the development of eNVM technologies, providing manufacturers with the necessary resources to innovate and scale production.

Asia Pacific Embedded Non-volatile Memory Market Segmentation

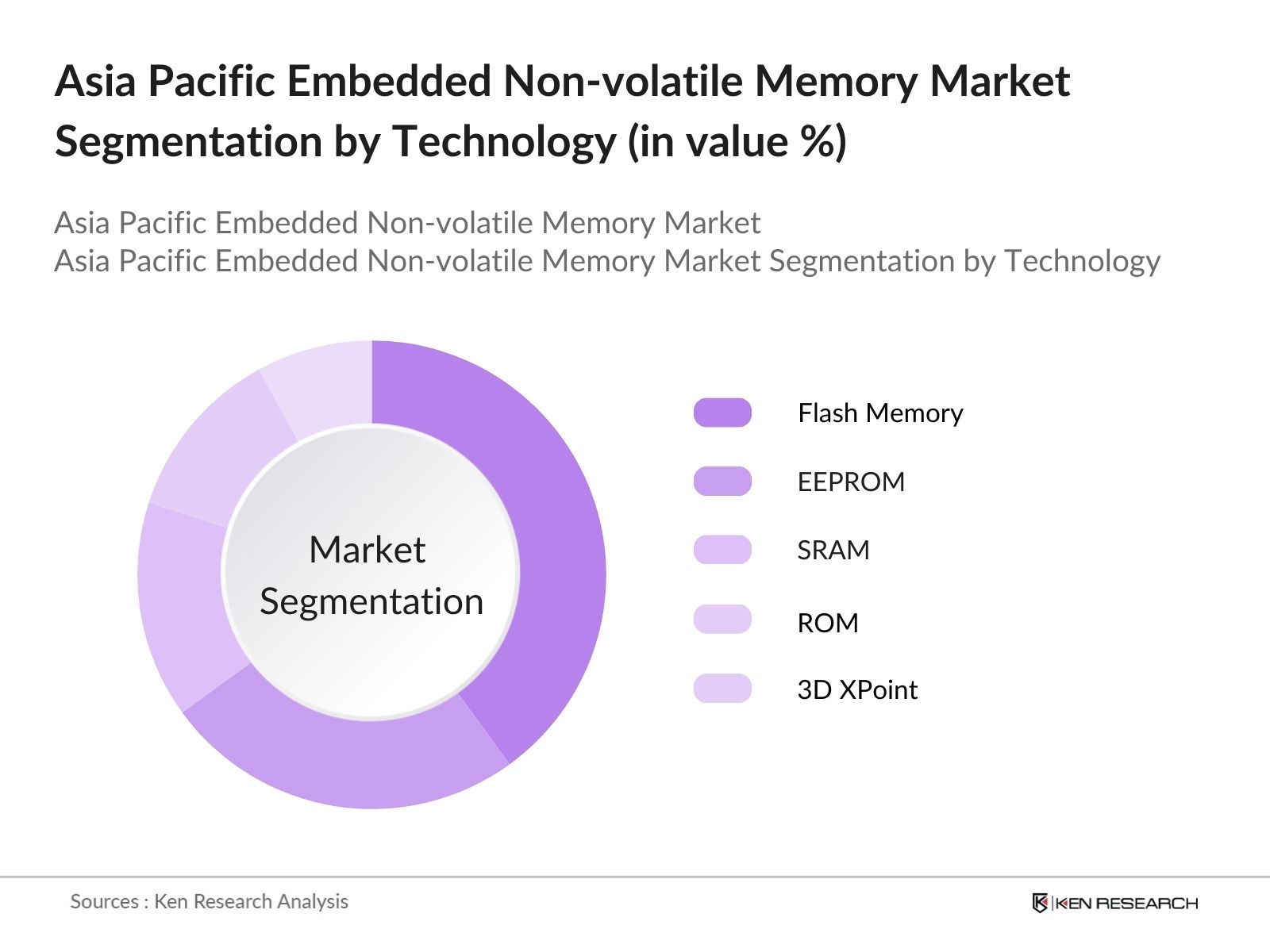

By Technology: The market is segmented by technology into EEPROM, Flash Memory, SRAM, ROM, and 3D XPoint. Among these, Flash Memory dominates the market due to its high-speed performance and ability to be scaled down to smaller geometries, which is crucial for the development of advanced microchips used in mobile and automotive applications. The wide application of flash memory in smartphones, tablets, and smart wearables continues to strengthen its position in the market.

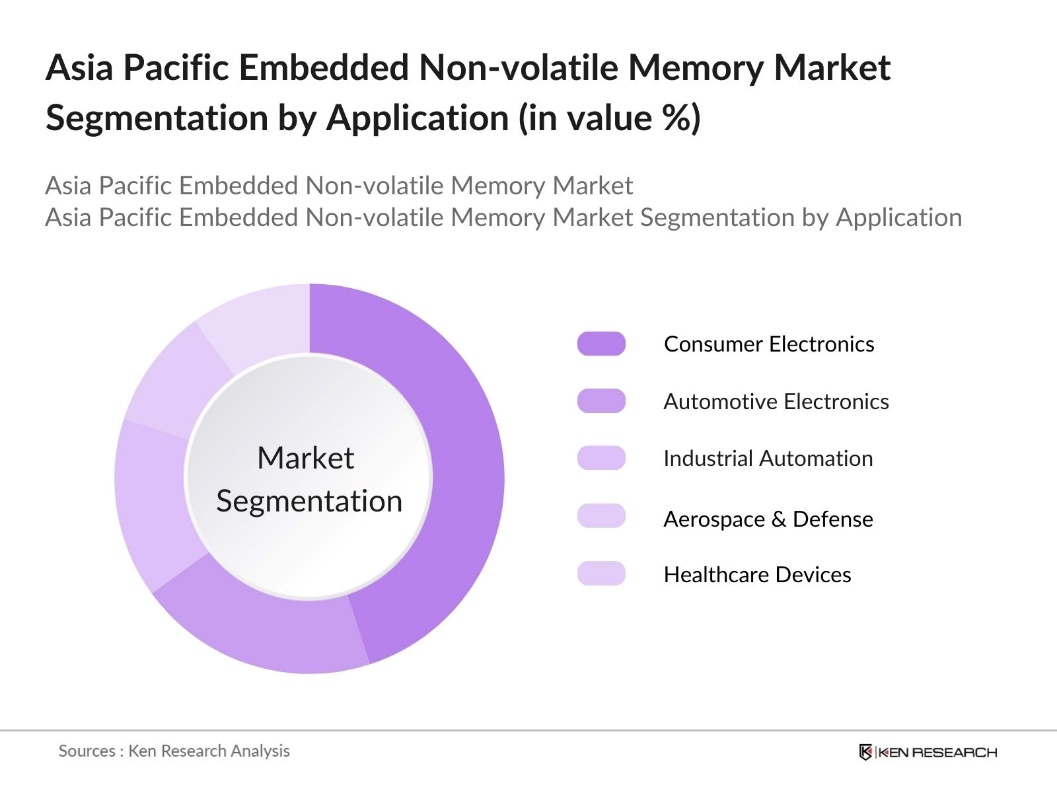

By Application The market is segmented by application into consumer electronics, automotive electronics, industrial automation, aerospace & defense, and healthcare devices. Consumer electronics hold the largest share due to the widespread use of embedded non-volatile memory in smartphones, tablets, and wearable devices. The rapid shift towards 5G technology and increasing demand for devices with higher memory capacity and faster processing speeds are the key factors driving the dominance of this segment.

Asia Pacific Embedded Non-volatile Memory Market Competitive Landscape

The Asia Pacific eNVM market is dominated by a mix of global semiconductor giants and local manufacturers. Key players are leveraging their advanced technology and manufacturing capabilities to maintain a competitive edge. GlobalFoundries and TSMC have strengthened their foothold in the region by expanding their chip production capacities, while Samsung and SK Hynix continue to lead in memory technology development.

Asia Pacific Embedded Non-volatile Memory Industry Analysis

Growth Drivers

- Demand for Smart and Connected Devices (Mobile, Wearables, Automotive Electronics): The Asia Pacific region continues to witness a rise in smart devices, with over 3.5 billion mobile subscribers, making it a hub for smartphone production and usage. Devices like wearables and automotive electronics, such as infotainment systems, increasingly require eNVM solutions to enhance processing efficiency and data storage. Countries like South Korea and Japan are leaders in wearable tech, and Chinas dominance in global smartphone manufacturing makes the region a key player for eNVM integration.

- Integration of Artificial Intelligence and Machine Learning (Edge Computing, eNVM): AI and ML applications, particularly edge computing, are driving the demand for eNVM. AI-powered devices need efficient memory to process vast amounts of data at the edge, reducing latency. Countries like Japan and South Korea are at the forefront of AI research. South Korea has rapidly positioned itself as a leader in AI, with government funding exceeding $2 billion annually dedicated to AI research and development. These developments make eNVM a critical component in AI processors and neural network applications.

- Advancements in Semiconductor Manufacturing Processes: Advancements in semiconductor manufacturing, particularly with 7nm and 5nm nodes, are boosting demand for high-performance embedded non-volatile memory (eNVM) solutions. Taiwan leads in producing these advanced chips, which are essential for devices requiring enhanced processing power, such as high-performance computing and mobile devices. The Asia Pacific semiconductor industry continues to leverage these technologies, driving growth in eNVM integration across various applications.

Market Challenges

- High Manufacturing Costs of Advanced eNVM Solutions: The production of advanced embedded non-volatile memory (eNVM) solutions remains costly due to the need for complex fabrication processes and specialized materials. The expense associated with newer semiconductor nodes presents challenges for widespread adoption, particularly in cost-sensitive industries. Manufacturers face increased financial burdens, making it difficult for eNVM solutions to be implemented broadly across various sectors requiring advanced memory technology.

- Limited Compatibility with Older Systems (Legacy Equipment and Systems): Integrating advanced eNVM technology into legacy systems is a significant challenge, especially in regions with outdated infrastructure. Countries with extensive older manufacturing equipment struggle with the high costs of upgrading to support newer memory technologies. This lack of compatibility hampers the adoption of eNVM, as transitioning from legacy systems to modern solutions often requires expensive and time-consuming overhauls.

Asia Pacific Embedded Non-volatile Memory Market Future Outlook

Over the next five years, the Asia Pacific eNVM market is poised for substantial growth. Key drivers include advancements in AI-powered devices, the continuous rollout of 5G networks, and the increasing adoption of electric vehicles that rely on advanced embedded memory for enhanced safety features. Additionally, governments across the region are heavily investing in local semiconductor manufacturing, aiming to reduce reliance on imports and boost domestic production capabilities.

Market Opportunities

- Growing Automotive Applications (ADAS, EVs, Infotainment Systems): Automotive applications like advanced driver assistance systems (ADAS), electric vehicles (EVs), and infotainment systems increasingly rely on embedded non-volatile memory (eNVM) for efficient data processing. As the automotive industry shifts towards smarter and more connected vehicles, the demand for eNVM is growing. This presents significant opportunities for the integration of advanced memory solutions in various automotive applications, enabling improved performance and functionality.

- 5G Rollout and the Need for Higher Data Storage Capacity: The rollout of 5G technology across Asia Pacific has led to an increased need for higher data storage capacity in telecommunications, industrial automation, and consumer electronics. 5G networks demand fast and reliable data storage, making eNVM solutions crucial for these high-speed applications. As more industries adopt 5G technologies, the demand for embedded memory solutions continues to grow, supporting advancements in data processing and connectivity.

Scope of the Report

|

By Type |

Embedded Flash Memory (eFlash) Embedded PCM, Embedded MRAM Embedded RRAM, Embedded FRAM |

|

By Application |

Consumer Electronics Automotive Electronics Industrial Automation Aerospace and Defense Healthcare Devices |

|

By Technology |

EEPROM Flash Memory SRAM ROM 3D XPoint |

|

By Node Size |

28nm 16nm 10nm 7nm 5nm and Below |

|

By Region |

China Japan South Korea Taiwan Southeast Asia |

Products

Key Target Audience

Automotive Manufacturers

Consumer Electronics Companies

Semiconductor Manufacturers

Healthcare Device Manufacturers

Government and Regulatory Bodies (Ministry of Industry, China; Ministry of Trade, Japan)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

TSMC

Samsung Electronics

Intel Corporation

SK Hynix

GlobalFoundries

Micron Technology

UMC

Fujitsu Semiconductor

NXP Semiconductors

Infineon Technologies

Table of Contents

1. Asia Pacific Embedded Non-volatile Memory Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Embedded Non-volatile Memory Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Embedded Non-volatile Memory Market Analysis

3.1. Growth Drivers

3.1.1. Proliferation of IoT Devices (eNVM for IoT Applications)

3.1.2. Demand for Smart and Connected Devices (Mobile, Wearables, Automotive Electronics)

3.1.3. Advancements in Semiconductor Manufacturing Processes (7nm, 5nm Nodes)

3.1.4. Integration of Artificial Intelligence and Machine Learning (Edge Computing, eNVM)

3.2. Market Challenges

3.2.1. High Manufacturing Costs of Advanced eNVM Solutions

3.2.2. Limited Compatibility with Older Systems (Legacy Equipment and Systems)

3.2.3. Volatile Demand in Automotive and Consumer Electronics (Demand Fluctuation Due to Market Conditions)

3.3. Opportunities

3.3.1. Growing Automotive Applications (ADAS, EVs, Infotainment Systems)

3.3.2. 5G Rollout and the Need for Higher Data Storage Capacity

3.3.3. Customization for Industry-Specific Solutions (Healthcare, Aerospace, Defense)

3.4. Trends

3.4.1. Shift Towards Advanced Packaging Technologies (Fan-Out Wafer Level Packaging, Chiplets)

3.4.2. Integration of eNVM in AI-Driven Applications (AI Processors, Neural Networks)

3.4.3. Adoption of Non-Volatile Memory Express (NVMe) for High-Performance Applications

3.5. Government Regulation

3.5.1. Semiconductor Manufacturing Subsidies (Government Initiatives to Boost Domestic Manufacturing)

3.5.2. Trade Policies Affecting Semiconductor Supply Chains (Impact of Tariffs and Export Restrictions)

3.5.3. R&D Grants and Innovation Policies (Public-Private Partnerships, Funding for Chip R&D)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Asia Pacific Embedded Non-volatile Memory Market Segmentation

4.1. By Type (In Value %)

4.1.1. Embedded Flash Memory (eFlash)

4.1.2. Embedded Phase Change Memory (ePCM)

4.1.3. Embedded Magnetic RAM (eMRAM)

4.1.4. Embedded Resistive RAM (eRRAM)

4.1.5. Embedded Ferroelectric RAM (eFRAM)

4.2. By Application (In Value %)

4.2.1. Consumer Electronics (Smartphones, Tablets, Wearables)

4.2.2. Automotive Electronics (ADAS, EVs, Infotainment Systems)

4.2.3. Industrial Automation (Smart Manufacturing, Robotics)

4.2.4. Aerospace and Defense (Rugged Computing, Secure Communications)

4.2.5. Healthcare Devices (Wearable Health Monitors, Implantable Devices)

4.3. By Technology (In Value %)

4.3.1. EEPROM

4.3.2. Flash Memory

4.3.3. SRAM

4.3.4. ROM

4.3.5. 3D XPoint

4.4. By Node Size (In Value %)

4.4.1. 28nm

4.4.2. 16nm

4.4.3. 10nm

4.4.4. 7nm

4.4.5. 5nm and Below

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Taiwan

4.5.5. Southeast Asia

5. Asia Pacific Embedded Non-volatile Memory Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. TSMC

5.1.2. Samsung Electronics

5.1.3. Intel Corporation

5.1.4. GlobalFoundries

5.1.5. Micron Technology

5.1.6. UMC

5.1.7. SMIC

5.1.8. SK Hynix

5.1.9. Fujitsu Semiconductor

5.1.10. Winbond Electronics

5.1.11. Infineon Technologies

5.1.12. Renesas Electronics

5.1.13. NXP Semiconductors

5.1.14. Western Digital Corporation

5.1.15. Cypress Semiconductor

5.2. Cross Comparison Parameters (Headquarters, Revenue, Market Share, Technology Focus, R&D Spend, Manufacturing Capacity, Key Customers, Key Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Embedded Non-volatile Memory Market Regulatory Framework

6.1. Semiconductor Industry Standards

6.2. Intellectual Property (IP) Rights Protection

6.3. Compliance Requirements for Export Controls

6.4. Environmental Regulations

7. Asia Pacific Embedded Non-volatile Memory Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Embedded Non-volatile Memory Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Node Size (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Embedded Non-volatile Memory Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase of research focuses on identifying the key variables driving the eNVM market. This includes a detailed assessment of technological advancements, supply chain dynamics, and industry regulations. Data is sourced from proprietary databases and reputable secondary sources such as government reports and industry journals.

Step 2: Market Analysis and Construction

A thorough analysis of historical data related to the embedded memory market is carried out. Key indicators like technology adoption rates, the penetration of eNVM in various applications, and financial performance of major companies are evaluated to construct an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including senior executives from leading semiconductor manufacturers. This step ensures that the research findings are aligned with real-world market conditions.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all data into a comprehensive report. Inputs from industry experts and secondary data are cross-validated, ensuring that the report delivers accurate and actionable insights.

Frequently Asked Questions

01. How big is the Asia Pacific Embedded Non-volatile Memory Market?

The Asia Pacific embedded non-volatile memory market is valued at USD 1.8 billion, driven by the rise of IoT devices, increased demand for advanced consumer electronics, and growing automotive applications.

02. What are the challenges in the Asia Pacific Embedded Non-volatile Memory Market?

Challenges in the Asia Pacific embedded non-volatile memory market include high manufacturing costs, particularly in the production of cutting-edge memory solutions, and fluctuating demand due to the volatile nature of the automotive and consumer electronics sectors.

03. Who are the major players in the Asia Pacific Embedded Non-volatile Memory Market?

The Asia Pacific embedded non-volatile memory market is dominated by major players such as TSMC, Samsung Electronics, Intel Corporation, SK Hynix, and GlobalFoundries, all of whom are investing heavily in R&D and expanding their manufacturing capabilities.

04. What are the growth drivers of the Asia Pacific Embedded Non-volatile Memory Market?

Growth in the Asia Pacific embedded non-volatile memory market is primarily driven by the increasing adoption of IoT devices, advancements in semiconductor technology, and the proliferation of electric vehicles requiring embedded memory for safety features.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.