Asia Pacific Endoscopy Devices Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD8497

November 2024

93

About the Report

Asia Pacific Endoscopy Devices Market Overview

- The Asia Pacific endoscopy devices market is valued at USD 14 billion, based on a five-year historical analysis, driven by increasing healthcare expenditures and advances in diagnostic imaging technology. This growth is significantly supported by government healthcare programs across multiple countries, aimed at improving access to diagnostic procedures and early disease detection. Furthermore, the demand for minimally invasive procedures has surged, given their advantages in reducing recovery time and costs for patients, thus propelling the market.

- China and Japan lead in this market, attributed to their highly developed healthcare infrastructure and substantial investments in medical technology advancements. Chinas ongoing initiatives to expand healthcare access and Japans advanced medical facilities and strong R&D focus create a favorable environment for endoscopy device usage. Additionally, emerging markets like India are gaining traction due to rising awareness and increasing healthcare spending.

- Compliance standards in Asia Pacific require stringent protocols for endoscopy equipment to ensure patient safety. Japan, for instance, mandates adherence to the PMDA standards, which entail rigorous device testing before market entry. Chinas National Medical Products Administration (NMPA) enforces standards that require diagnostic devices, including endoscopy tools, to undergo extensive quality checks. These regulations aim to uphold the quality and safety of medical devices in the region.

Asia Pacific Endoscopy Devices Market Segmentation

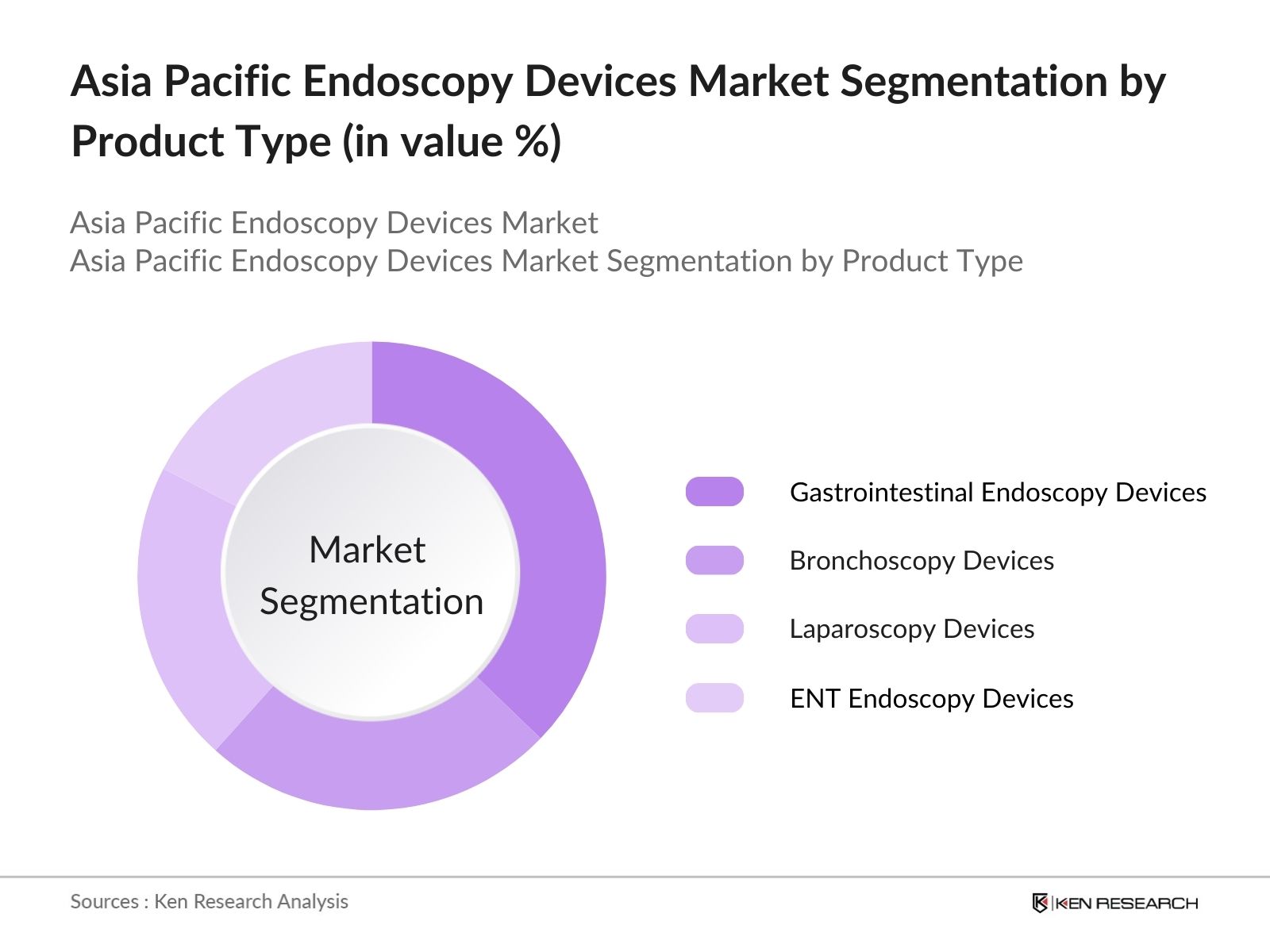

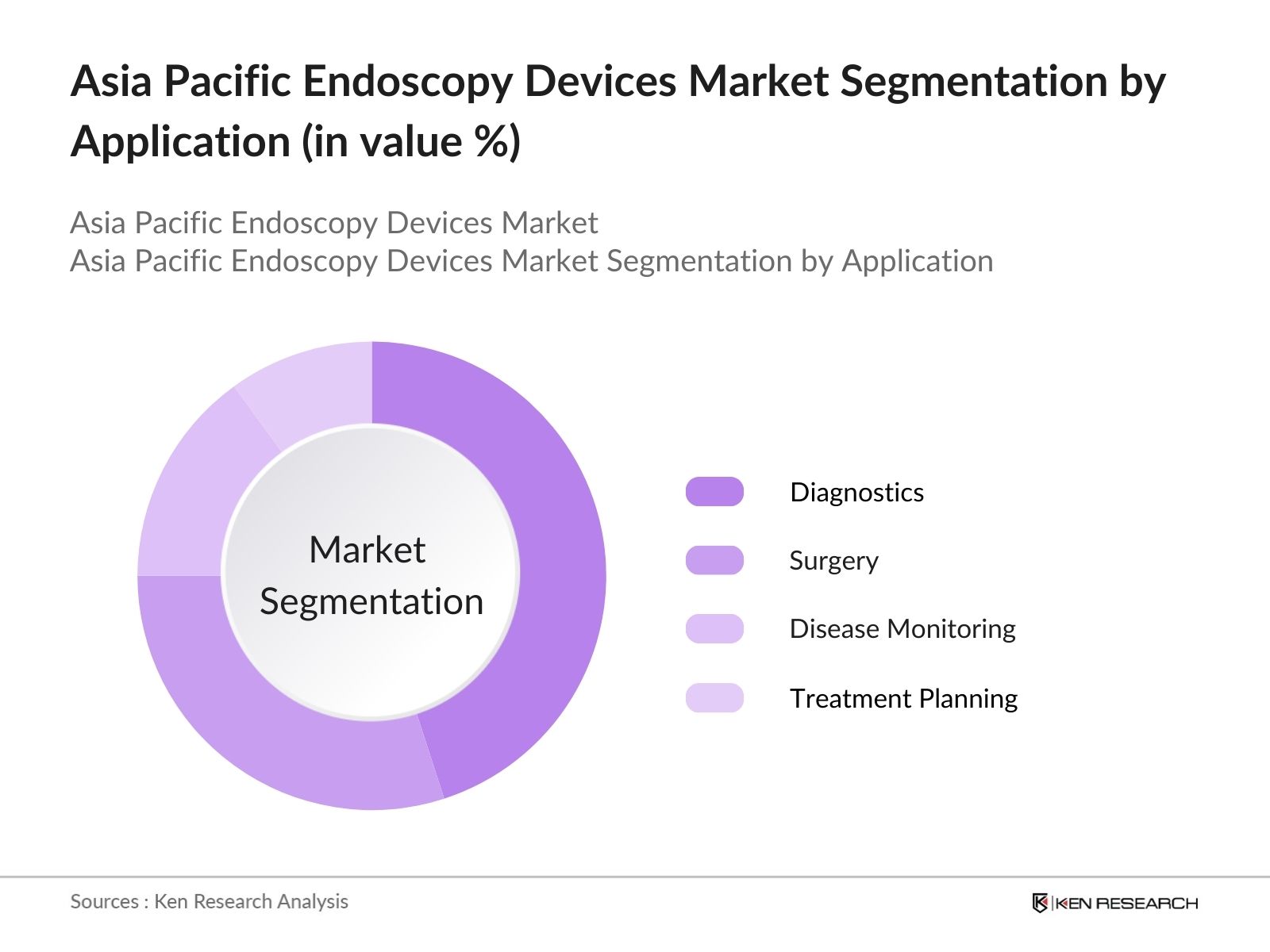

The Asia Pacific endoscopy devices market is segmented by product type and by application.

- By Product Type: The Asia Pacific endoscopy devices market is segmented by product type into gastrointestinal endoscopy devices, bronchoscopy devices, laparoscopy devices, ENT endoscopy devices, and others. Recently, gastrointestinal endoscopy devices have dominated under the segmentation by product type due to their essential role in detecting and diagnosing gastrointestinal disorders. This segment benefits from established usage in hospitals and specialty clinics, bolstered by the rising incidence of gastrointestinal conditions and the advancement of device capabilities, making early diagnosis and preventive care more accessible.

- By Application: The market is also segmented by application into diagnostics, surgery, disease monitoring, and treatment planning. Diagnostics holds a dominant share due to the increasing demand for minimally invasive diagnostic procedures. With advancements in imaging technology and integration of artificial intelligence, diagnostic endoscopy procedures are becoming more accurate, driving the demand for devices that support improved disease detection and management. Diagnostic procedures are now widely utilized in specialty centers, hospitals, and clinics across the region, particularly in urban areas.

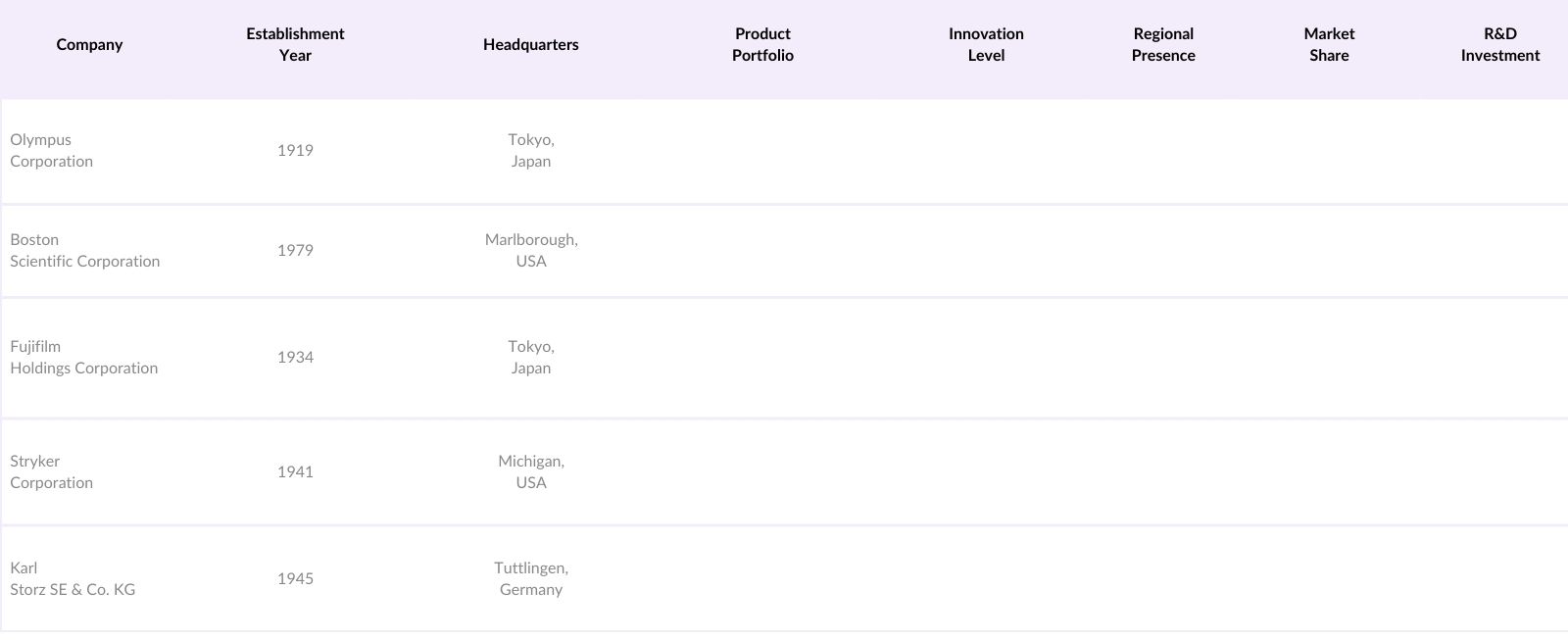

Asia Pacific Endoscopy Devices Market Competitive Landscape

The Asia Pacific endoscopy devices market is dominated by leading global and regional manufacturers who invest in research and development, product innovations, and strategic collaborations. Companies like Olympus Corporation and Fujifilm Holdings maintain a strong market presence due to extensive product portfolios and strategic R&D investments.

Asia Pacific Endoscopy Devices Market Analysis

Growth Drivers

- Rising Healthcare Expenditure: The Asia Pacific region has seen substantial growth in healthcare expenditure, driven by increasing investment in healthcare infrastructure. For example, in 2023, China allocated USD 290 billion to healthcare, a figure that includes significant funding for advanced medical equipment like endoscopy devices. South Korea similarly boosted its healthcare budget to USD 175 billion in 2024, with dedicated funding for digital and diagnostic healthcare innovations. Japan's healthcare spending reached over USD 480 billion in 2023, focused on integrating advanced imaging and diagnostic tools to improve preventive healthcare.

- Advancements in Medical Imaging: Medical imaging technology has advanced in Asia Pacific, with countries like Japan and South Korea leading the development of high-resolution imaging techniques. Japans Ministry of Health announced that, in 2023, over USD 100 million was directed towards R&D in medical imaging to support non-invasive procedures, including endoscopy. In Singapore, investment in medical R&D rose to USD 2.5 billion in 2024, emphasizing minimally invasive technologies for diagnosis and early disease detection. This trend supports growth in endoscopy equipment by enhancing accuracy and efficiency in diagnostics.

- Increasing Geriatric Population: With Asia Pacifics aging population, particularly in Japan, where nearly 29% of the population is above 65, there is increased demand for endoscopy devices for diagnosing age-related diseases. South Korea reported a 20% rise in endoscopy procedures among those aged 60 and above in 2023, while Chinas aging population also spurred healthcare providers to expand endoscopic services. The rising elderly demographic necessitates sophisticated diagnostic tools, including endoscopy, to cater to age-related ailments like gastrointestinal disorders.

Market Challenges

- High Equipment Costs: Endoscopy equipment involves substantial investment, posing challenges for widespread adoption in lower-income areas. In 2023, the average cost of setting up endoscopy facilities in rural parts of India ranged from USD 25,000 to USD 50,000, limiting accessibility. Similarly, in Indonesia, over 40% of clinics lack advanced diagnostic equipment due to cost constraints, impacting the reach of endoscopic services. The high initial investment required for endoscopic setups remains a significant barrier in expanding diagnostic capabilities across the region.

- Limited Access to Skilled Professionals: The lack of skilled endoscopy professionals poses challenges in the Asia Pacific region, particularly in developing countries. In India, for instance, there is an estimated shortage of 25,000 gastroenterologists trained in endoscopic techniques. Thailand faces similar shortages, with only around 1,500 endoscopy-trained physicians for a population exceeding 70 million. This scarcity hinders the efficient use of available endoscopy technology, limiting the growth potential of the market.

Asia Pacific Endoscopy Devices Market Future Outlook

Over the next five years, the Asia Pacific endoscopy devices market is expected to grow due to increasing healthcare investments, especially in emerging economies. Factors such as the integration of artificial intelligence for more precise diagnostics, and the rising prevalence of chronic diseases requiring regular monitoring, are anticipated to continue to drive market expansion. Additionally, technological innovations in endoscopy devices to enhance image clarity and procedural efficiency are likely to further strengthen the market.

Market Opportunities

Emerging Markets Expansion: Emerging markets in Asia, including Vietnam and the Philippines, offer growth opportunities for the endoscopy devices market due to improving healthcare infrastructure. In 2023, the Philippines allocated USD 3 billion to healthcare improvements, prioritizing diagnostic equipment. Vietnam followed suit with a healthcare budget increase to approximately USD 10 billion, with plans to upgrade diagnostic services in public hospitals. These emerging markets provide a fertile ground for expanding endoscopic services.

- Integration with AI for Diagnostics: AI integration in diagnostics is gaining momentum across Asia Pacific, enhancing the accuracy of endoscopic procedures. In 2024, South Korea invested around USD 1 billion in AI-assisted diagnostic technology, with applications for endoscopy to identify early-stage cancers. Singapores healthcare system has similarly introduced AI-based diagnostic support, allocating USD 500 million to AI research in healthcare, thus supporting the deployment of AI-powered endoscopy.

Scope of the Report

|

Gastrointestinal Endoscopy Devices Bronchoscopy Devices Laparoscopy Devices ENT Endoscopy Devices |

|

|

By Application |

Diagnostics Surgery Disease Monitoring Treatment Planning |

|

By End-User |

Hospitals Specialty Clinics Ambulatory Surgical Centers Diagnostic Centers |

|

By Technology |

Fiber Optic Endoscopy Video Endoscopy Capsule Endoscopy Robotic-Assisted Endoscopy |

|

By Region |

China Japan India South Korea Australia |

Products

Key Target Audience

Hospitals and Specialty Clinics

Diagnostic Centers

Ambulatory Surgical Centers

Research and Development Centers

Healthcare Equipment Distributors

Government and Regulatory Bodies (e.g., Ministry of Health, Health Canada)

Investors and Venture Capitalist Firms

Medical Technology and Device Manufacturers

Companies

Players Mention in the Report:

Olympus Corporation

Boston Scientific Corporation

Fujifilm Holdings Corporation

Stryker Corporation

Karl Storz SE & Co. KG

Smith & Nephew PLC

Richard Wolf GmbH

Medtronic PLC

Conmed Corporation

Cook Medical

Ambu A/S

Hoya Corporation

Intuitive Surgical Inc.

Pentax Medical

B. Braun Melsungen AG

Table of Contents

1. Asia Pacific Endoscopy Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Endoscopy Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Endoscopy Devices Market Analysis

3.1. Growth Drivers

Rising Healthcare Expenditure

Advancements in Medical Imaging

Increasing Geriatric Population

Government Health Initiatives

3.2. Market Challenges

High Equipment Costs

Limited Access to Skilled Professionals

Regulatory Barriers

3.3. Opportunities

Emerging Markets Expansion

Integration with AI for Diagnostics

Development of Minimally Invasive Techniques

3.4. Trends

Adoption of Robotic-Assisted Endoscopy

Telemedicine Integration

Biopsy-Integrated Imaging

3.5. Government Regulation

Compliance Standards

Licensing Requirements

Subsidy Programs for Healthcare Innovation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Endoscopy Devices Market Segmentation

4.1. By Product Type (In Value %)

Gastrointestinal Endoscopy Devices

Bronchoscopy Devices

Laparoscopy Devices

ENT Endoscopy Devices

Others

4.2. By Application (In Value %)

Diagnostics

Surgery

Disease Monitoring

Treatment Planning

4.3. By End-User (In Value %)

Hospitals

Specialty Clinics

Ambulatory Surgical Centers

Diagnostic Centers

4.4. By Technology (In Value %)

Fiber Optic Endoscopy

Video Endoscopy

Capsule Endoscopy

Robotic-Assisted Endoscopy

4.5. By Country (In Value %)

China

Japan

India

South Korea

Australia

5. Asia Pacific Endoscopy Devices Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

Olympus Corporation

Boston Scientific Corporation

Fujifilm Holdings Corporation

Stryker Corporation

Karl Storz SE & Co. KG

Smith & Nephew PLC

Richard Wolf GmbH

Medtronic PLC

Conmed Corporation

Cook Medical

Ambu A/S

Hoya Corporation

Intuitive Surgical Inc.

Pentax Medical

B. Braun Melsungen AG

5.2 Cross Comparison Parameters (Product Portfolio, Innovation Level, Regional Presence, Market Share, R&D Investment, Sales Growth Rate, Patents, and Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Endoscopy Devices Market Regulatory Framework

6.1. Quality Standards

6.2. Compliance and Certification Requirements

6.3. Import and Export Regulations

7. Asia Pacific Endoscopy Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Endoscopy Devices Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Endoscopy Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Endoscopy Devices Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia Pacific Endoscopy Devices Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple endoscopy device manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Endoscopy Devices market.

Frequently Asked Questions

01. How big is the Asia Pacific Endoscopy Devices Market?

The Asia Pacific Endoscopy Devices Market, valued at USD 14 billion, is driven by increasing healthcare expenditures and demand for minimally invasive procedures.

02. What are the challenges in the Asia Pacific Endoscopy Devices Market?

Challenges in Asia Pacific Endoscopy Devices Market include high costs of endoscopy equipment, limited access to skilled healthcare professionals, and regulatory barriers across different countries in the region.

03. Who are the major players in the Asia Pacific Endoscopy Devices Market?

Key players in Asia Pacific Endoscopy Devices Market include Olympus Corporation, Boston Scientific, Fujifilm Holdings, Stryker Corporation, and Karl Storz SE, each contributing through extensive R&D and strategic partnerships.

04. What are the growth drivers of the Asia Pacific Endoscopy Devices Market?

Growth drivers in Asia Pacific Endoscopy Devices Market include the rising prevalence of gastrointestinal diseases, technological advancements in imaging, and supportive healthcare policies by governments in the region.

05. How is the endoscopy devices market segmented?

The Asia Pacific Endoscopy Devices Market is segmented by product type, such as gastrointestinal endoscopy and bronchoscopy devices, and by application, including diagnostics and surgery.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.