Asia Pacific Enterprise Data Management Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD1997

November 2024

97

About the Report

Asia Pacific Enterprise Data Management Market Overview

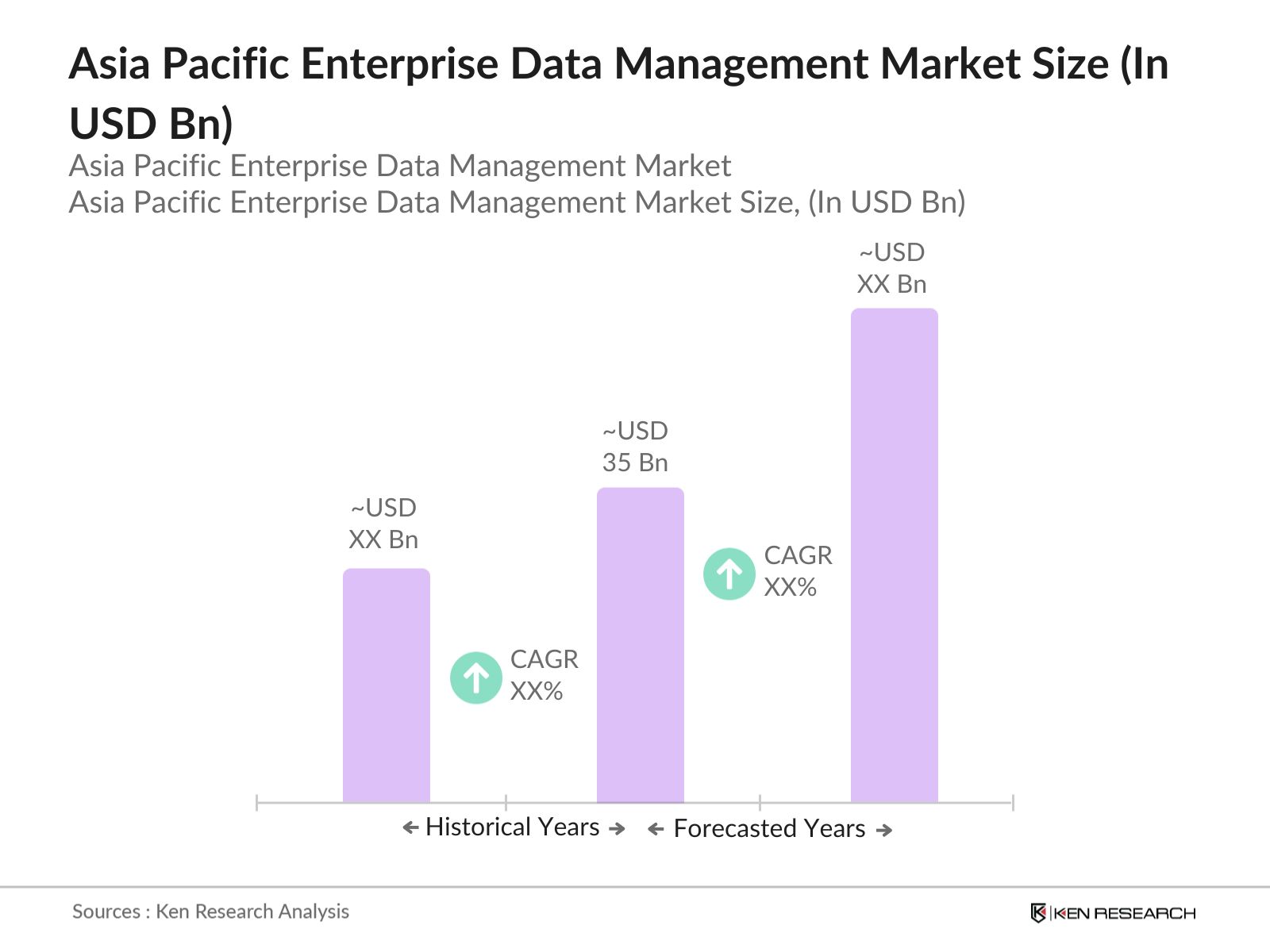

The Asia Pacific Enterprise Data Management (EDM) market is valued at USD 35 billion. The growth of the market is driven primarily by the increasing need for organizations to manage large volumes of data more efficiently and securely. Key drivers include the adoption of cloud computing, advancements in artificial intelligence, and the growing importance of regulatory compliance regarding data privacy. Companies in the region are investing heavily in data management solutions to streamline processes and leverage data for business intelligence.

The Asia Pacific EDM market is dominated by countries like China, Japan, and India. Chinas dominance stems from the countrys rapid digitization, industrial growth, and large-scale adoption of big data analytics and cloud infrastructure. Japan and India are also key players due to their robust IT sectors, growing number of SMEs, and government initiatives aimed at promoting digital transformation across industries.

Stringent data protection regulations like the General Data Protection Regulation (GDPR) in the EU and the Act on the Protection of Personal Information (APPI) in Japan are driving enterprises in the Asia Pacific to adopt stricter data governance frameworks. In 2024, Japan and South Korea have seen an increase in compliance audits, with non-compliant businesses facing fines exceeding USD 2 million. These regulations aim to protect consumer data and ensure transparency in data handling, forcing enterprises to enhance their data management systems to avoid legal consequences.

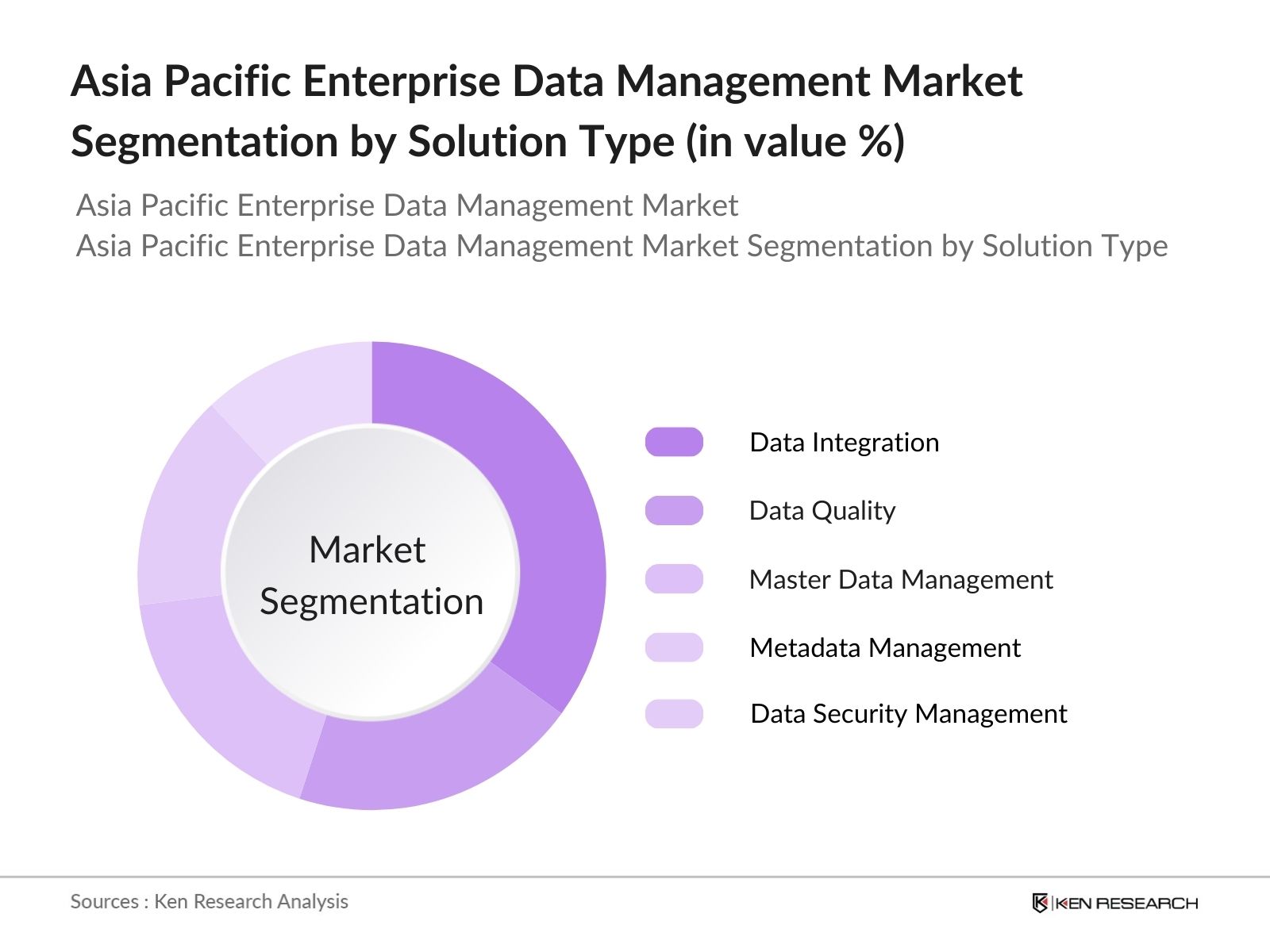

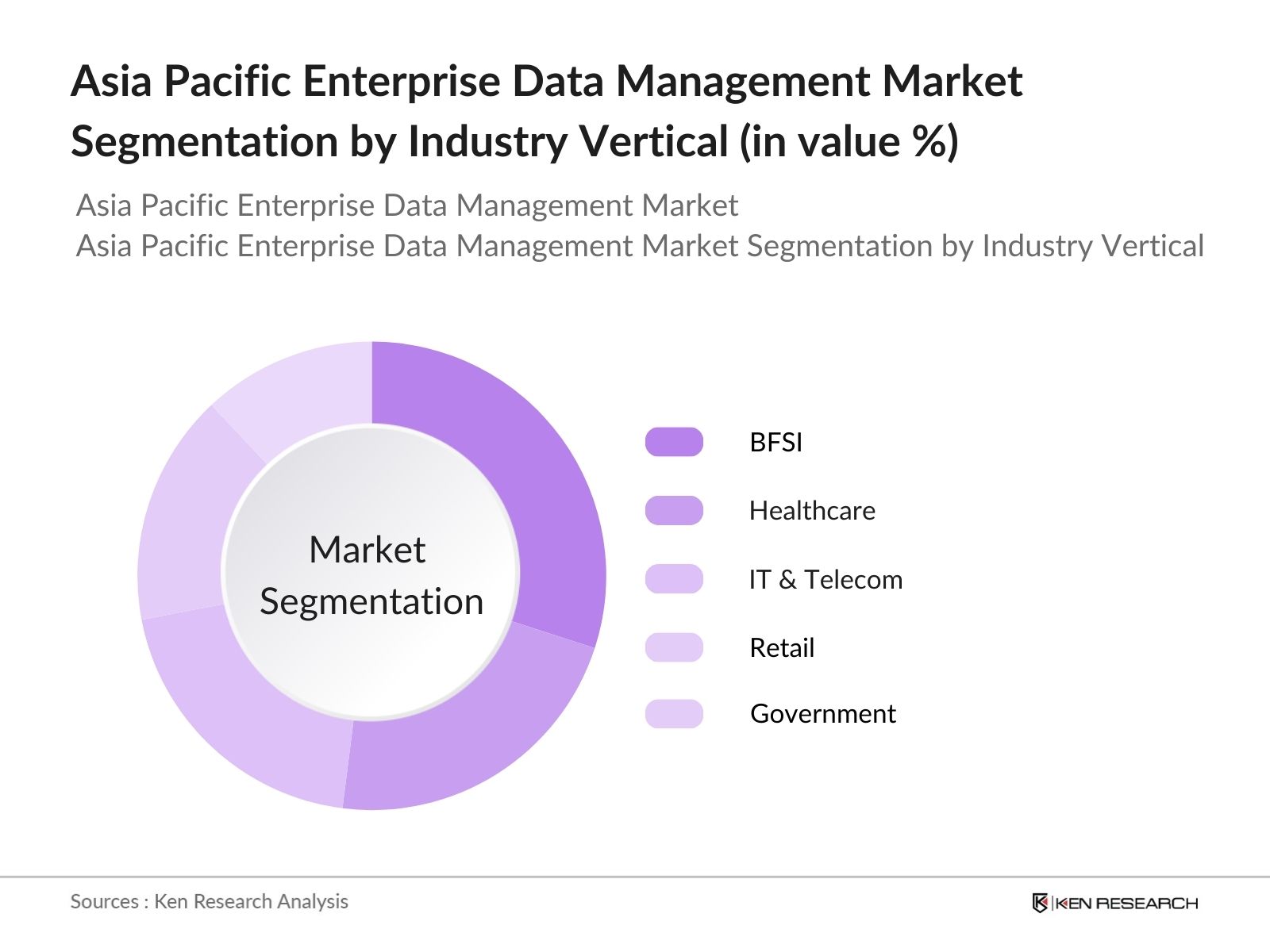

Asia Pacific Enterprise Data Management Market Segmentation

By Solution Type: The market is segmented by solution type into data integration, data quality, master data management (MDM), metadata management, and data security management. Recently, data integration has held a dominant market share in the Asia Pacific EDM market under the segmentation by solution type. This is primarily due to the increasing complexity of IT infrastructures and the need for seamless data flow across different platforms. Organizations are adopting advanced data integration tools to maintain data accuracy and consistency across various business applications.

By Industry Vertical: The market is also segmented by industry vertical into BFSI, healthcare, IT & telecom, retail, and government. The BFSI segment has been the most dominant in the Asia Pacific EDM market. This can be attributed to the stringent regulatory requirements within the financial services sector, which demand secure and efficient data management solutions. Additionally, the increasing volume of transactional and financial data is driving banks and financial institutions to adopt advanced EDM solutions to enhance decision-making and customer service.

Asia Pacific Enterprise Data Management Market Competitive Landscape

The Asia Pacific EDM market is competitive, with key players leveraging partnerships and technological advancements to maintain their market positions. SAP, Oracle, and IBM are the top leaders, and they dominate the market due to their comprehensive product offerings and strong client bases in financial services, IT, and telecom sectors. Additionally, new players are entering the market, pushing for innovation, especially in AI-driven data management solutions.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Market Position |

Solution Portfolio |

Key Clients |

Partnerships |

Innovation Focus |

Geographic Reach |

|---|---|---|---|---|---|---|---|---|---|

|

SAP SE |

1972 |

Walldorf, Germany |

|||||||

|

Oracle Corporation |

1977 |

Austin, USA |

|||||||

|

IBM Corporation |

1911 |

Armonk, USA |

|||||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

|||||||

|

Informatica |

1993 |

Redwood City, USA |

Asia Pacific Enterprise Data Management Industry Analysis

Growth Drivers

- Increasing Data Volume and Complexity: The Asia Pacific region is experiencing an exponential rise in data generation, driven by a rapid increase in internet users, which stood at 2.7 billion in 2023. This volume of data is growing at unprecedented rates, fueled by the widespread use of smartphones and IoT devices, which are projected to reach 8.5 billion connections by 2025. The need to manage and analyze this massive data, which now includes unstructured formats like social media interactions and sensor data, is driving demand for enterprise data management solutions. Regulatory demands for secure data handling and storage are further intensifying the need for robust data management systems.

- Rising Adoption of Cloud-Based Solutions: Cloud adoption in the Asia Pacific region has surged, with around 53% of enterprises in countries like India, Japan, and Australia migrating to cloud infrastructures by mid-2024. The shift toward hybrid and multi-cloud solutions is driven by the need for scalable, cost-efficient platforms that can manage complex and growing datasets. Countries such as India, with a projected 5 million businesses expected to operate via cloud platforms by 2025, underscore the regions pivotal role in cloud innovation, fostering the rise of enterprise data management systems that can seamlessly integrate cloud environments with legacy systems.

- Digital Transformation Across Enterprises: The Asia Pacific region is undergoing significant digital transformation, with over 60% of businesses in sectors such as manufacturing, retail, and financial services adopting digital-first strategies by 2024. Governments in countries like Singapore and South Korea are heavily investing in digital infrastructure, contributing billions in annual budget allocations to enhance digital capabilities across enterprises. This large-scale shift to digital operations necessitates advanced enterprise data management to ensure that businesses can handle the deluge of data produced by digital platforms efficiently and securely.

Market Challenges

- Integration Complexity: A major challenge for enterprises in the Asia Pacific region is the integration of advanced data management systems with legacy IT infrastructures, which are still in use by over 40% of medium-sized businesses. Complex integration processes can disrupt operational efficiency, and data silos often emerge due to incompatibility between older systems and modern data management platforms. Despite the need for modernization, many organizations in markets like India and Malaysia are hesitant to overhaul their systems due to the high risk of operational disruptions during the transition process.

- Data Security Concerns: Data breaches have become increasingly common across the Asia Pacific. Countries like Australia and Singapore are prime targets for cyberattacks due to their advanced digital infrastructures. Enterprises face the ongoing challenge of ensuring robust cybersecurity measures within their data management systems, as a single breach can result in financial losses exceeding USD 500 million in severe cases. Thus, businesses are cautious about implementing complex data management solutions that could introduce new vulnerabilities.

Asia Pacific Enterprise Data Management Market Future Outlook

Over the next five years, the Asia Pacific Enterprise Data Management market is expected to experience a massive growth driven by rapid digitization, increasing cloud adoption, and rising regulatory demands. Organizations will continue to invest in data governance and data security solutions to comply with international data protection regulations. The shift towards AI and machine learning technologies is also expected to fuel demand for data management tools that can handle unstructured and semi-structured data.

Future Market Opportunities

- AI and Machine Learning Integration: The integration of artificial intelligence (AI) and machine learning (ML) technologies into enterprise data management systems is transforming the way businesses in the Asia Pacific handle and interpret large datasets. In 2024, over 25% of leading enterprises in the region have integrated AI-driven analytics into their data management systems, enabling them to derive actionable insights from vast data pools in real time. These technologies allow for predictive analytics, driving efficiencies in sectors like finance, manufacturing, and retail.

- Growing Demand for Real-Time Data Analytics: The demand for real-time data analytics in sectors like e-commerce and financial services is rapidly increasing across the Asia Pacific region. In 2024, it is estimated that 35% of companies in the region use real-time data analytics tools to monitor customer behavior, optimize supply chains, and make time-sensitive decisions. Countries like Singapore and Australia lead the charge in deploying these tools, reflecting a growing need for enterprise data management platforms that support real-time processing and analysis of large datasets.

Scope of the Report

|

Solution Type |

Data Integration Data Quality Master Data Management Metadata Management Data Security Management |

|

Deployment Mode |

On-Premise Cloud-Based |

|

Industry Vertical |

BFSI Healthcare IT & Telecom Retail Government |

|

Organization Size |

Small & Medium Enterprises Large Enterprises |

|

Region |

China India Japan Australia Rest of Asia Pacific |

Products

Key Target Audience

BFSI Enterprises

Healthcare Providers

IT & Telecom Companies

Retail Enterprises

Government and Regulatory Bodies (e.g., Ministry of Electronics and Information Technology, Asia Data Protection Authorities)

Large Enterprises

Banks and Financial Institutes

Small and Medium-Sized Enterprises (SMEs)

Investment and Venture Capitalist Firms

Companies

Major Players in the Market

SAP SE

Oracle Corporation

IBM Corporation

Microsoft Corporation

Informatica

TIBCO Software

Cloudera

Talend

Amazon Web Services (AWS)

SAS Institute

Hitachi Vantara

Alation

Snowflake

Teradata Corporation

Syncsort

Table of Contents

1. Asia Pacific Enterprise Data Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Enterprise Data Management Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Enterprise Data Management Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Data Volume and Complexity (Big Data)

3.1.2. Rising Adoption of Cloud-Based Solutions (Cloud Computing)

3.1.3. Digital Transformation Across Enterprises (Digitalization)

3.1.4. Regulatory Compliance Demands (Data Governance and Compliance)

3.2. Market Challenges

3.2.1. Integration Complexity (Legacy System Integration)

3.2.2. High Initial Investment Costs

3.2.3. Data Security Concerns (Cybersecurity)

3.3. Opportunities

3.3.1. AI and Machine Learning Integration

3.3.2. Expansion of Data-Driven Decision Making (Business Intelligence)

3.3.3. Growing Demand for Real-Time Data Analytics

3.4. Trends

3.4.1. Adoption of Data-as-a-Service (DaaS) Models

3.4.2. Increased Use of Self-Service Data Tools

3.4.3. Growth in Data Lakes and Data Warehousing Solutions

3.5. Government Regulations

3.5.1. Data Protection Regulations (GDPR, APPI)

3.5.2. Cybersecurity Frameworks

3.5.3. Cross-Border Data Flow Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Enterprise Data Management Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Data Integration Tools

4.1.2. Data Quality Solutions

4.1.3. Master Data Management (MDM) Solutions

4.1.4. Metadata Management

4.1.5. Data Security Management

4.2. By Deployment Mode (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By Industry Vertical (In Value %)

4.3.1. BFSI

4.3.2. Healthcare

4.3.3. IT & Telecom

4.3.4. Retail

4.3.5. Government

4.4. By Organization Size (In Value %)

4.4.1. Small & Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Rest of Asia Pacific

5. Asia Pacific Enterprise Data Management Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP SE

5.1.2. Oracle Corporation

5.1.3. IBM Corporation

5.1.4. Informatica

5.1.5. Talend

5.1.6. Cloudera

5.1.7. Microsoft Corporation

5.1.8. SAS Institute

5.1.9. TIBCO Software

5.1.10. AWS (Amazon Web Services)

5.1.11. Alation

5.1.12. Syncsort

5.1.13. Hitachi Vantara

5.1.14. Snowflake

5.1.15. Teradata Corporation

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employee Count, Product Portfolio, Strategic Initiatives, Industry Footprint, Growth Rate, Key Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Asia Pacific Enterprise Data Management Market Regulatory Framework

6.1. Data Security Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Enterprise Data Management Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Enterprise Data Management Future Market Segmentation

8.1. By Solution Type (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Enterprise Data Management Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. Marketing Strategy Insights

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating an ecosystem map of key stakeholders in the Asia Pacific EDM market. This is done through extensive desk research and by leveraging proprietary databases. The goal is to identify the critical factors influencing market dynamics, including industry trends, regulatory influences, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, solution adoption, and revenue generation is compiled. We also assess service quality statistics to ensure reliable revenue projections. This includes examining the growth of enterprise data needs and their impacts on infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated using computer-assisted telephone interviews (CATIs) with experts from the data management and cloud service industries. Their insights refine our market projections and provide real-world perspectives on the trends driving the market.

Step 4: Research Synthesis and Final Output

The final step includes direct engagement with data management solution providers. This ensures the validation of product segmentation, customer preferences, and technology adoption statistics. These insights complement our bottom-up analysis to provide an accurate and validated picture of the Asia Pacific EDM market.

Frequently Asked Questions

01. How big is the Asia Pacific Enterprise Data Management Market?

The Asia Pacific EDM market was valued at USD 35 billion, driven by the increasing need for effective data integration, security, and governance solutions across industries.

02. What are the challenges in the Asia Pacific Enterprise Data Management Market?

Key challenges in the Asia Pacific EDM market include integration complexities due to legacy systems, high initial setup costs for large-scale enterprises, and ongoing data security concerns in light of emerging cyber threats.

03. Who are the major players in the Asia Pacific Enterprise Data Management Market?

Leading players in the Asia Pacific EDM market include SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, and Informatica, who dominate through their extensive product portfolios and global client bases.

04. What are the growth drivers of the Asia Pacific Enterprise Data Management Market?

The Asia Pacific EDM market is driven by rapid digitization, increasing data volumes, and regulatory demands related to data privacy and security. The adoption of cloud-based solutions and advancements in AI are also critical drivers.

05. How is the competitive landscape shaping up in the Asia Pacific Enterprise Data Management Market?

The competitive landscape is dominated by a few global players in the Asia Pacific EDM market, but new entrants are pushing for innovations in AI and machine learning, which is driving competition in the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.