Asia Pacific Epoxy Resin Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD3794

November 2024

91

About the Report

Asia Pacific Epoxy Resin Market Overview

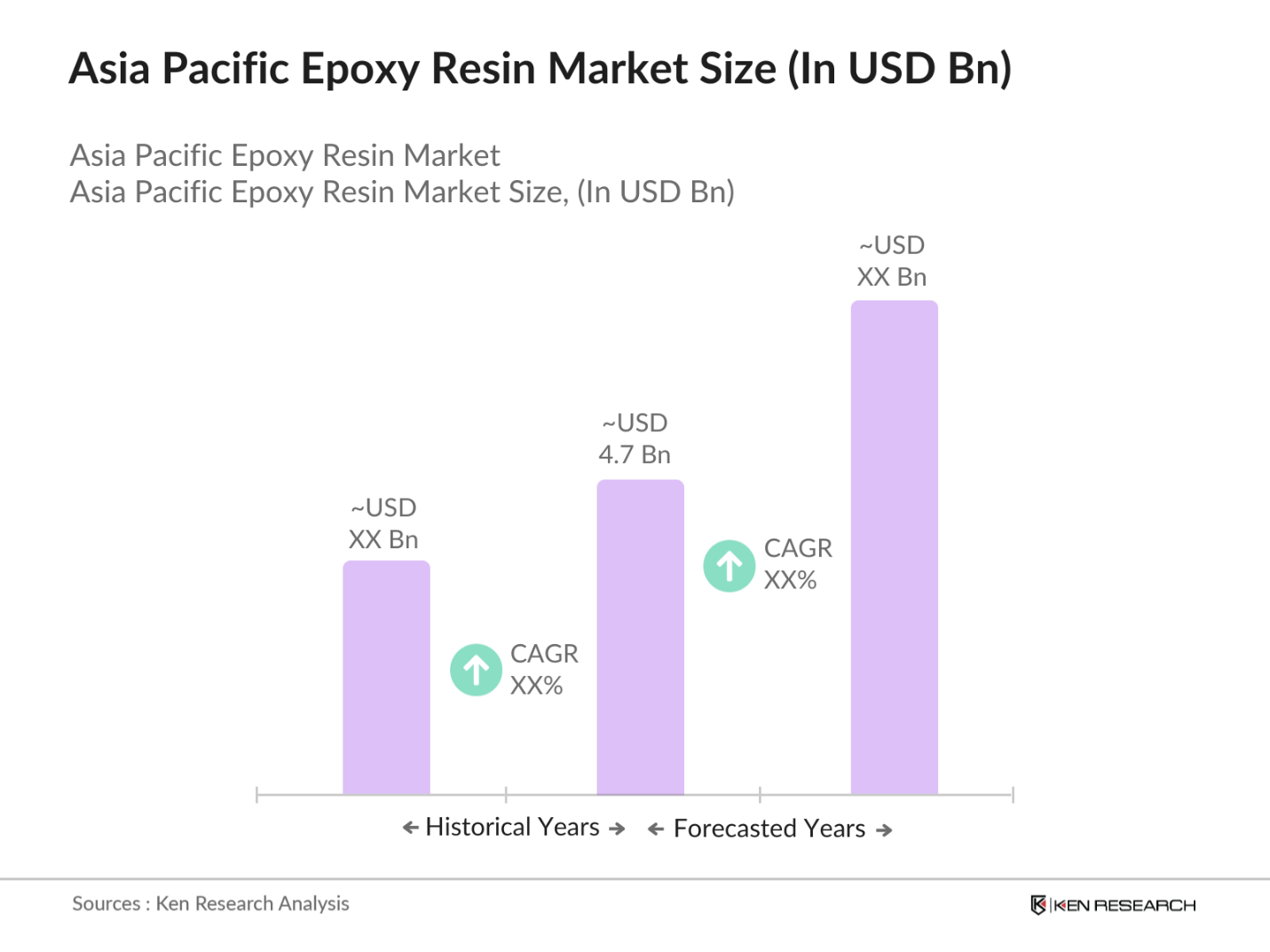

- The Asia Pacific Epoxy Resin Market is valued at USD 4.7 billion, supported by rising demand across several industries, including automotive, construction, and electronics. This market is driven by the growing need for lightweight materials in manufacturing, especially in automotive and aerospace industries. The surge in infrastructure projects and rapid urbanization in emerging economies further fuel market demand. Additionally, advancements in epoxy resin technology, such as bio-based resins, are contributing to the market's expansion, particularly in environmentally conscious markets.

- Countries such as China, India, and Japan dominate the epoxy resin market in the region. China leads due to its expansive industrial base and construction activities, while India is rapidly catching up with its booming infrastructure and automotive sectors. Japan remains dominant in electronics manufacturing, particularly in high-performance applications where epoxy resins play a critical role. The dominance of these countries stems from their strong industrial ecosystems, government support for infrastructure projects, and growing exports of manufactured goods.

- Handling hazardous materials, including epoxy resins, is regulated by stringent laws in the Asia Pacific. South Koreas Occupational Safety and Health Act requires industries to follow rigorous safety protocols for chemical handling. In 2024, the government intensified inspections, resulting in over 2,500 compliance checks in the chemical sector. These regulations are driving epoxy resin manufacturers to adopt safer production processes and invest in cleaner technologies.

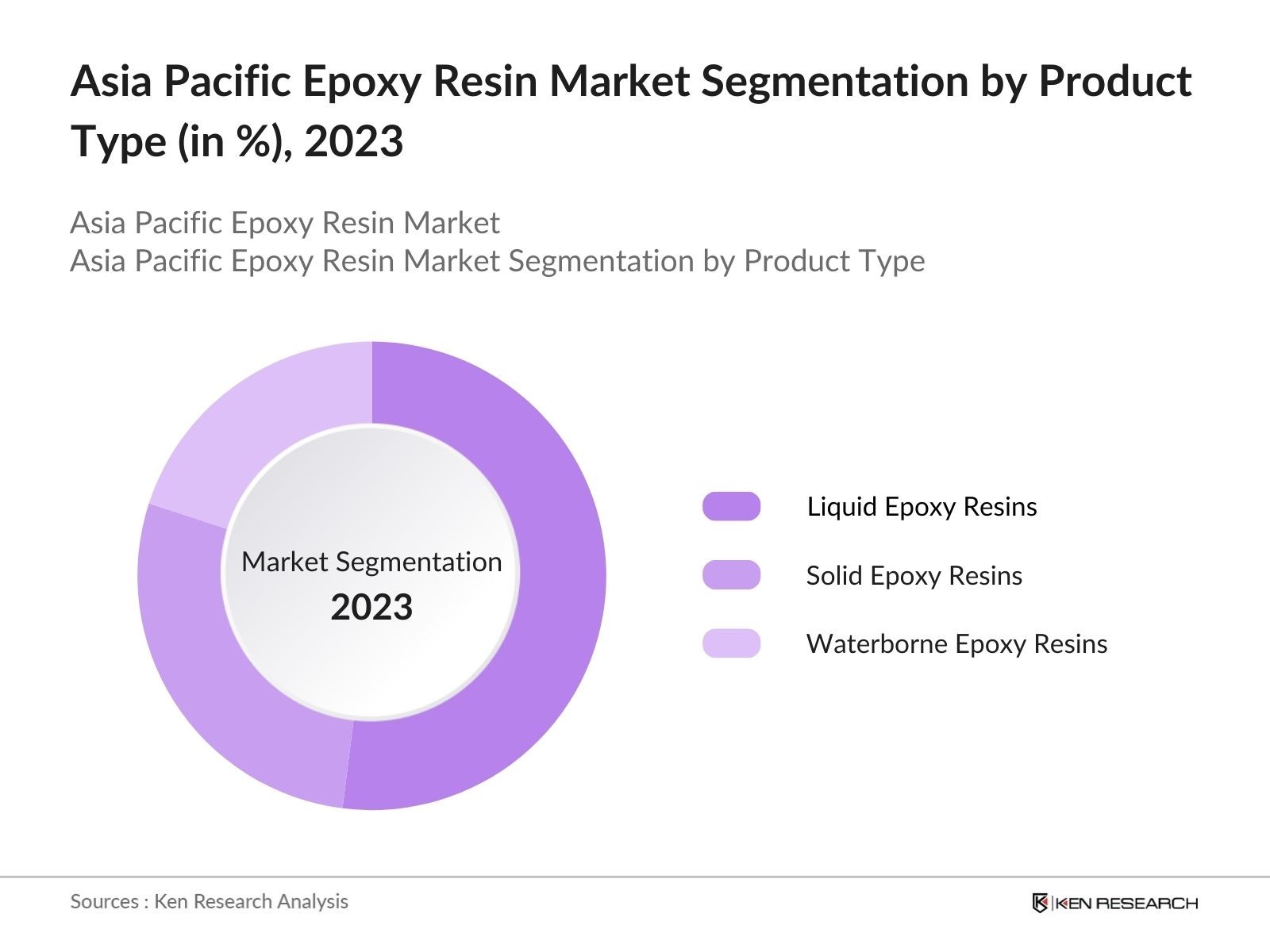

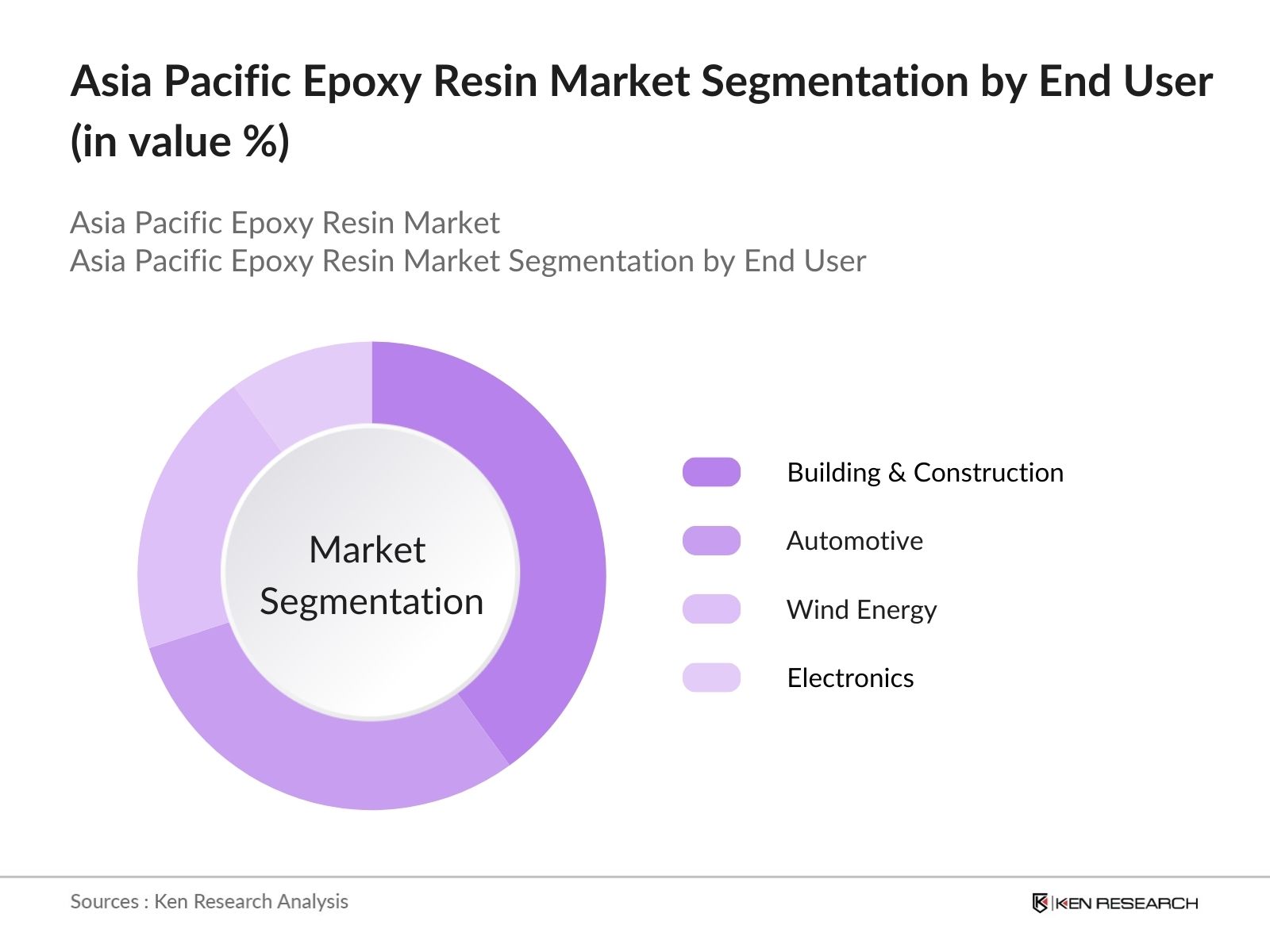

Asia Pacific Epoxy Resin Market Segmentation

By Product Type: The market is segmented by product type into liquid epoxy resins, solid epoxy resins, and waterborne epoxy resins. Among these, liquid epoxy resins dominate the market, primarily due to their versatility and extensive use across various applications, such as coatings and adhesives. Liquid resins offer ease of application and superior bonding properties, which makes them ideal for large-scale construction and automotive projects. Additionally, their use in electronics, for encapsulation and protection, further solidifies their dominance in the market.

By End-User Industry: The market is further segmented by end-user industry into building & construction, automotive, wind energy, and electronics. The building & construction segment has the highest market share, driven by the need for high-strength adhesives and coatings for infrastructure projects. The rapid growth of urban centers and the increasing number of public infrastructure developments across countries like China and India has led to a surge in demand for epoxy resins in this segment.

Asia Pacific Epoxy Resin Market Competitive Landscape

The Asia Pacific Epoxy Resin Market is dominated by several key players, including major regional and international companies. This consolidation in the market is due to strong product portfolios and consistent investments in research and development (R&D) to create advanced resin solutions. Companies like Olin Corporation and Huntsman Corporation hold a market presence due to their innovation capabilities and extensive distribution networks.

|

Company |

Establishment Year |

Headquarters |

Market Presence |

Revenue |

Product Innovation |

R&D Investment |

Global Expansion |

Sustainability Initiatives |

|---|---|---|---|---|---|---|---|---|

|

Olin Corporation |

1892 |

USA |

||||||

|

Huntsman Corporation |

1970 |

USA |

||||||

|

Hexion Inc. |

1910 |

USA |

||||||

|

Nan Ya Plastics Corporation |

1958 |

Taiwan |

||||||

|

Kukdo Chemical Co., Ltd. |

1970 |

South Korea |

Asia Pacific Epoxy Resin Industry Analysis

Growth Drivers

- Rising Demand from the Construction Industry: The construction sector in the Asia Pacific region is witnessing a surge, driven by rapid urbanization and infrastructural development. In 2024, the construction market in countries like China, India, and Indonesia accounted for nearly $5 trillion in spending, with increased focus on durable materials like epoxy resins. Epoxy's superior adhesive properties and resistance to environmental factors make it integral in building sustainable and long-lasting structures. The market demand is further fueled by government-led infrastructure projects such as the Belt and Road Initiative in China.

- Increasing Use in Automotive and Aerospace Applications: The Asia Pacific automotive sector produced over 50 million vehicles in 2023, driving demand for lightweight materials like epoxy resin for structural parts and coatings. The aerospace industry also benefits from epoxy resins ability to enhance fuel efficiency through its lightweight properties. With over $300 billion in aerospace manufacturing in 2024, driven by countries like Japan and China, epoxy resin is becoming a preferred material due to its high strength-to-weight ratio and corrosion resistance.

- Expanding Wind Energy Sector: Epoxy resin is a key material in manufacturing wind turbine blades, which are critical to the renewable energy push in the Asia Pacific region. As of 2024, China, India, and Japan collectively added more than 70 GW of wind energy capacity, representing a portion of the global installations. The wind energy industrys reliance on epoxy resins for its durability and efficiency is creating ample growth opportunities in the market, especially in wind-heavy regions like Inner Mongolia and Tamil Nadu.

Market Challenges

- Volatile Raw Material Prices: The epoxy resin market is heavily influenced by fluctuations in the price of crude oil, which is a major component in resin production. In 2023, crude oil prices averaged around $80 per barrel, creating uncertainty in the cost structure for resin manufacturers. This volatility is particularly challenging for countries like China and India, where manufacturing margins are thinner due to high energy demands. The resin industry must navigate these price fluctuations while maintaining profitability.

- Environmental Concerns and Regulations: The production and disposal of epoxy resins pose environmental challenges due to their non-biodegradable nature and emission of volatile organic compounds (VOCs). Governments in the Asia Pacific region are imposing stricter regulations on VOC emissions. For instance, Chinas Ministry of Ecology and Environment introduced new environmental regulations in 2023 aimed at reducing industrial emissions by 15%. Compliance with these standards adds costs and complexities to the manufacturing process.

Asia Pacific Epoxy Resin Market Future Outlook

Over the next five years, the Asia Pacific Epoxy Resin Market is poised for growth, driven by increasing demand from the automotive and construction industries, as well as rapid urbanization across emerging economies. The adoption of bio-based and waterborne epoxy resins, owing to stringent environmental regulations, will further fuel market expansion. Moreover, innovations in high-performance epoxy composites, particularly in wind energy applications, are expected to contribute to market growth.

Future Market Opportunities

- Growing Electronics Industry: The electronics manufacturing industry in the Asia Pacific is experiencing robust growth, valued at over $3 trillion in 2023. Epoxy resins are widely used in the production of printed circuit boards, adhesives, and encapsulants, essential for various electronic devices. With countries like South Korea, Japan, and Taiwan leading the global electronics manufacturing, the demand for epoxy resins in this sector is expected to remain strong. The growing consumption of consumer electronics further drives the need for durable and efficient materials like epoxy resin.

- Increasing Focus on Lightweight Materials: The trend towards lightweight materials is prominent in both automotive and aerospace industries as manufacturers aim to reduce emissions and improve fuel efficiency. In 2024, over 65% of Asia Pacific's automotive production incorporated lightweight materials, including epoxy resins, in structural applications. The shift towards electric vehicles (EVs) in China and Japan is further amplifying the demand for these materials, as EVs require more lightweight components to enhance battery performance and range.

Scope of the Report

|

Product Type |

Liquid Epoxy Resins Solid Epoxy Resins Waterborne Epoxy Resins |

|

Application |

Coatings Adhesives Composites Electrical & Electronics |

|

End-User Industry |

Building & Construction Automotive Wind Energy Electronics |

|

Technology |

Reactive Dilution Catalytic Technology |

|

Region |

China India Japan South Korea Southeast Asia |

Products

Key Target Audience

Epoxy Resin Manufacturers

Automotive OEMs

Building & Construction Companies

Government and Regulatory Bodies (such as the National Development and Reform Commission in China)

Electronics Manufacturers

Investors and Venture Capital Firms

Wind Energy Firms

Banks and Financial Institutes

Packaging and Adhesive Companies

Companies

Major Players

Olin Corporation

Huntsman Corporation

Hexion Inc.

Nan Ya Plastics Corporation

Kukdo Chemical Co., Ltd.

Sinopec

Mitsubishi Chemical Holdings Corporation

Aditya Birla Chemicals

BASF SE

Jiangsu Sanmu Group Co., Ltd.

3M

Atul Ltd

The Dow Chemical Company

Evonik Industries AG

Solvay

Table of Contents

1. Asia Pacific Epoxy Resin Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Epoxy Resin Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Epoxy Resin Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand from Construction Industry

3.1.2. Increasing Use in Automotive and Aerospace Applications

3.1.3. Expanding Wind Energy Sector

3.1.4. Technological Advancements in Epoxy Resins

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. Environmental Concerns and Regulations

3.2.3. Competition from Substitutes

3.3. Opportunities

3.3.1. Growing Electronics Industry

3.3.2. Increasing Focus on Lightweight Materials

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Adoption of Bio-based Epoxy Resins

3.4.2. Development of Epoxy Nanocomposites

3.4.3. Increased Usage in 3D Printing

3.5. Government Regulation (Market-specific regulations)

3.5.1. Environmental Standards for Chemical Use

3.5.2. VOC Emission Restrictions

3.5.3. Hazardous Material Handling Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Epoxy Resin Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Liquid Epoxy Resins

4.1.2. Solid Epoxy Resins

4.1.3. Waterborne Epoxy Resins

4.2. By Application (In Value %)

4.2.1. Coatings

4.2.2. Adhesives

4.2.3. Composites

4.2.4. Electrical & Electronics

4.3. By End-User Industry (In Value %)

4.3.1. Building & Construction

4.3.2. Automotive

4.3.3. Wind Energy

4.3.4. Electronics

4.4. By Technology (In Value %)

4.4.1. Reactive Dilution

4.4.2. Catalytic Technology

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Southeast Asia

5. Asia Pacific Epoxy Resin Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Olin Corporation

5.1.2. Huntsman Corporation

5.1.3. Hexion Inc.

5.1.4. Nan Ya Plastics Corporation

5.1.5. Kukdo Chemical Co., Ltd.

5.1.6. Chang Chun Group

5.1.7. Sinopec

5.1.8. BASF SE

5.1.9. Mitsubishi Chemical Holdings Corporation

5.1.10. Aditya Birla Chemicals

5.1.11. Jiangsu Sanmu Group Co., Ltd.

5.1.12. Nanya Epoxy

5.1.13. 3M

5.1.14. Atul Ltd

5.1.15. The Dow Chemical Company

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Presence, Product Innovation, Strategic Alliances, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Epoxy Resin Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Epoxy Resin Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Epoxy Resin Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Epoxy Resin Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the major factors driving the Asia Pacific Epoxy Resin Market. This is achieved through extensive desk research utilizing secondary sources like market reports and proprietary databases. The key variables identified include industrial demand, technological advancements, and government policies.

Step 2: Market Analysis and Construction

This phase includes the collection of historical data on market growth, key industry drivers, and technological innovations. Quantitative data, such as market size and market share, are gathered and analyzed to understand the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

To ensure data accuracy, the research includes validation of hypotheses through consultations with industry experts, particularly from leading epoxy resin manufacturing companies. These consultations offer critical insights into market trends and challenges.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing research findings, market data, and expert inputs into a comprehensive report. This phase also includes peer review to verify the accuracy and reliability of the research outcomes.

Frequently Asked Questions

01. How big is the Asia Pacific Epoxy Resin Market?

The Asia Pacific Epoxy Resin Market is valued at USD 4.7 billion, driven by increasing demand across automotive, construction, and electronics industries.

02. What are the challenges in the Asia Pacific Epoxy Resin Market?

The Asia Pacific Epoxy Resin Market faces challenges such as volatile raw material prices, stringent environmental regulations, and competition from substitute products.

03. Who are the major players in the Asia Pacific Epoxy Resin Market?

Key players in the Asia Pacific Epoxy Resin Market include Olin Corporation, Huntsman Corporation, Nan Ya Plastics Corporation, Hexion Inc., and Kukdo Chemical Co., Ltd.

04. What are the growth drivers of the Asia Pacific Epoxy Resin Market?

The Asia Pacific Epoxy Resin Market is propelled by the growing demand for lightweight materials in the automotive and aerospace sectors, as well as the rapid expansion of construction activities in emerging economies.

05. What are the market trends in the Asia Pacific Epoxy Resin Market?

The trends in Asia Pacific Epoxy Resin Market include the adoption of bio-based epoxy resins and the increasing use of epoxy nanocomposites in advanced applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.