Asia Pacific Excipients Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD6905

December 2024

96

About the Report

Asia Pacific Excipients Market Overview

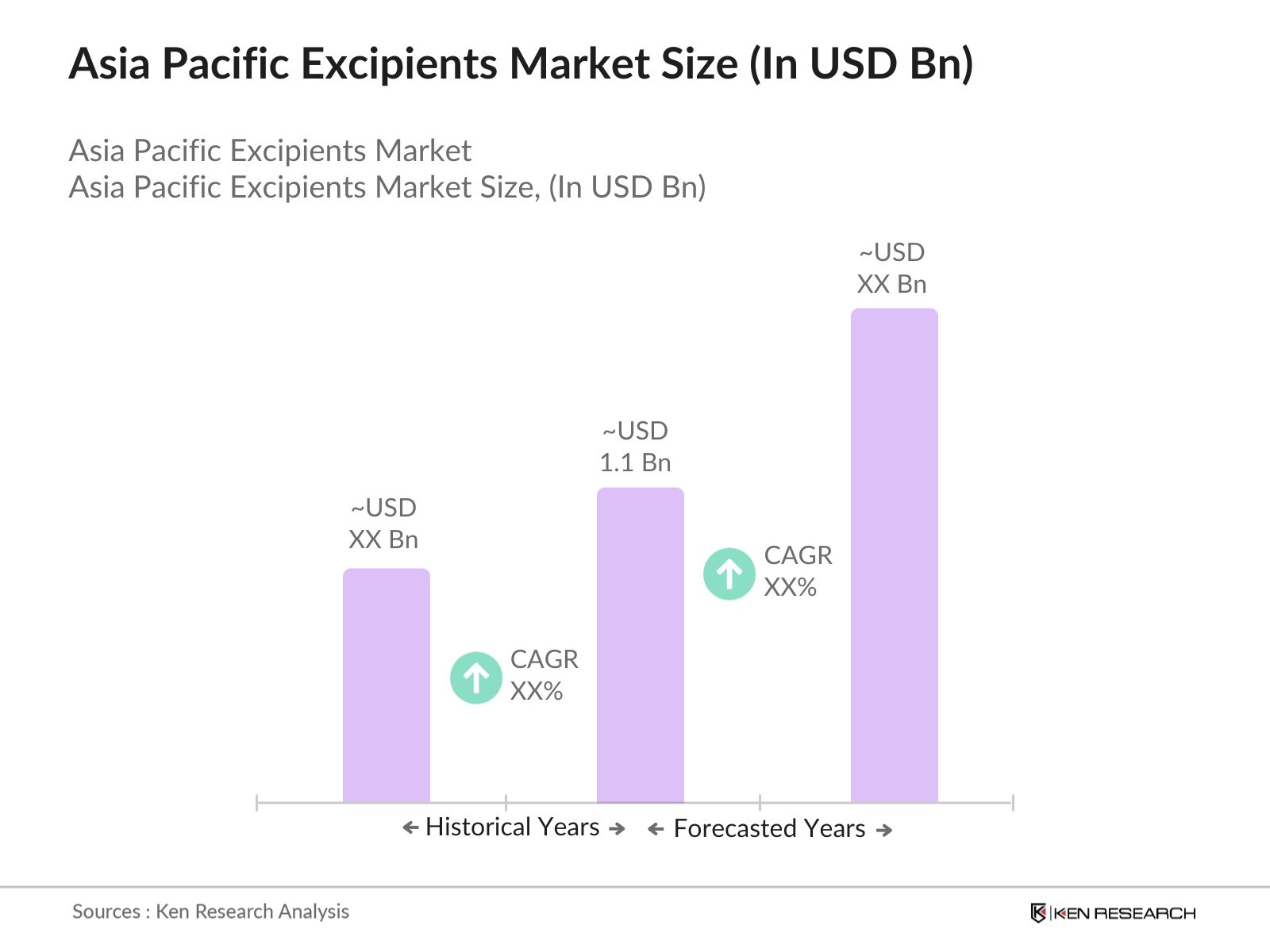

- The Asia Pacific excipients market is valued at USD 1.1 billion. Driven by the expanding pharmaceutical and nutraceutical industries, the market sees substantial demand for functional and bio-based excipients, which aid in enhancing drug delivery systems and product efficacy. The region's pharmaceutical sector has also witnessed significant investments in R&D, supporting the need for novel excipients to meet evolving industry standards and patient demands.

- India and China dominate the Asia Pacific excipients market due to their robust pharmaceutical manufacturing capabilities, large consumer base, and increasing R&D investments. China benefits from cost-effective production and government support for pharmaceutical innovation, while India's well-established generics market and export-oriented manufacturing further consolidate its leadership. Both countries also exhibit significant demand for excipients due to their rapidly growing healthcare infrastructure.

- The regulatory environment for excipients in Asia Pacific is characterized by adherence to GMP, ICH guidelines, and ASEAN harmonization. In 2023, China enforced stringent GMP practices across excipient production facilities, while ASEAN continued to promote excipient quality standardization. Japan and South Korea comply with ICH guidelines, requiring documentation and testing for excipient compatibility with APIs. This framework has streamlined compliance for cross-border distribution but also requires manufacturers to adhere to multiple regulatory standards.

Asia Pacific Excipients Market Segmentation

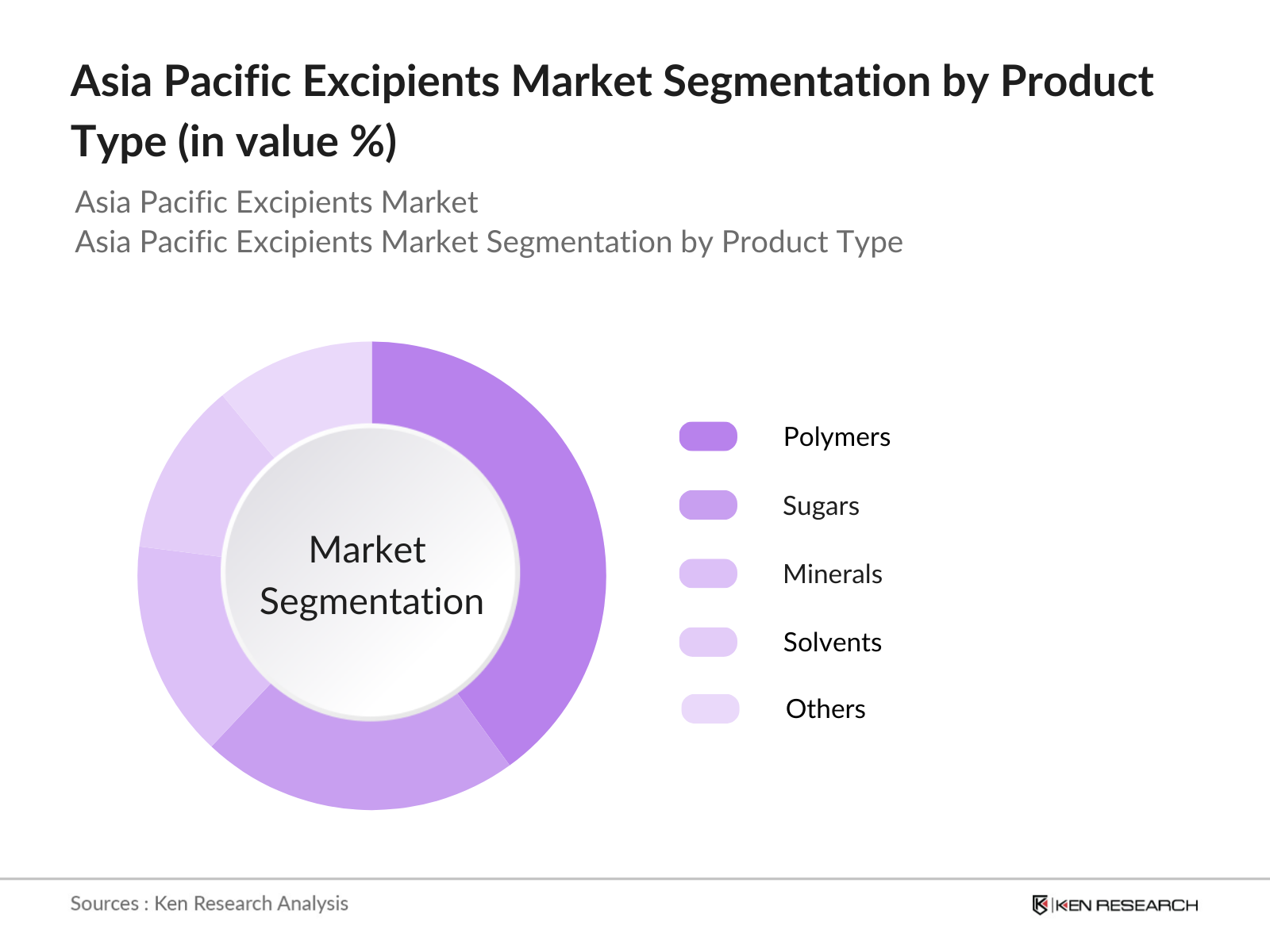

By Product Type: The market is segmented by product type into polymers, sugars, minerals, solvents, and others. Polymers hold a dominant market share under the product type segmentation, primarily due to their versatile applications in drug formulations, such as tablet binding and controlled drug release. Polymers are preferred in solid oral dosages due to their ability to improve stability and bioavailability. Companies like Ashland and BASF have strong polymer portfolios, catering to various drug delivery needs.

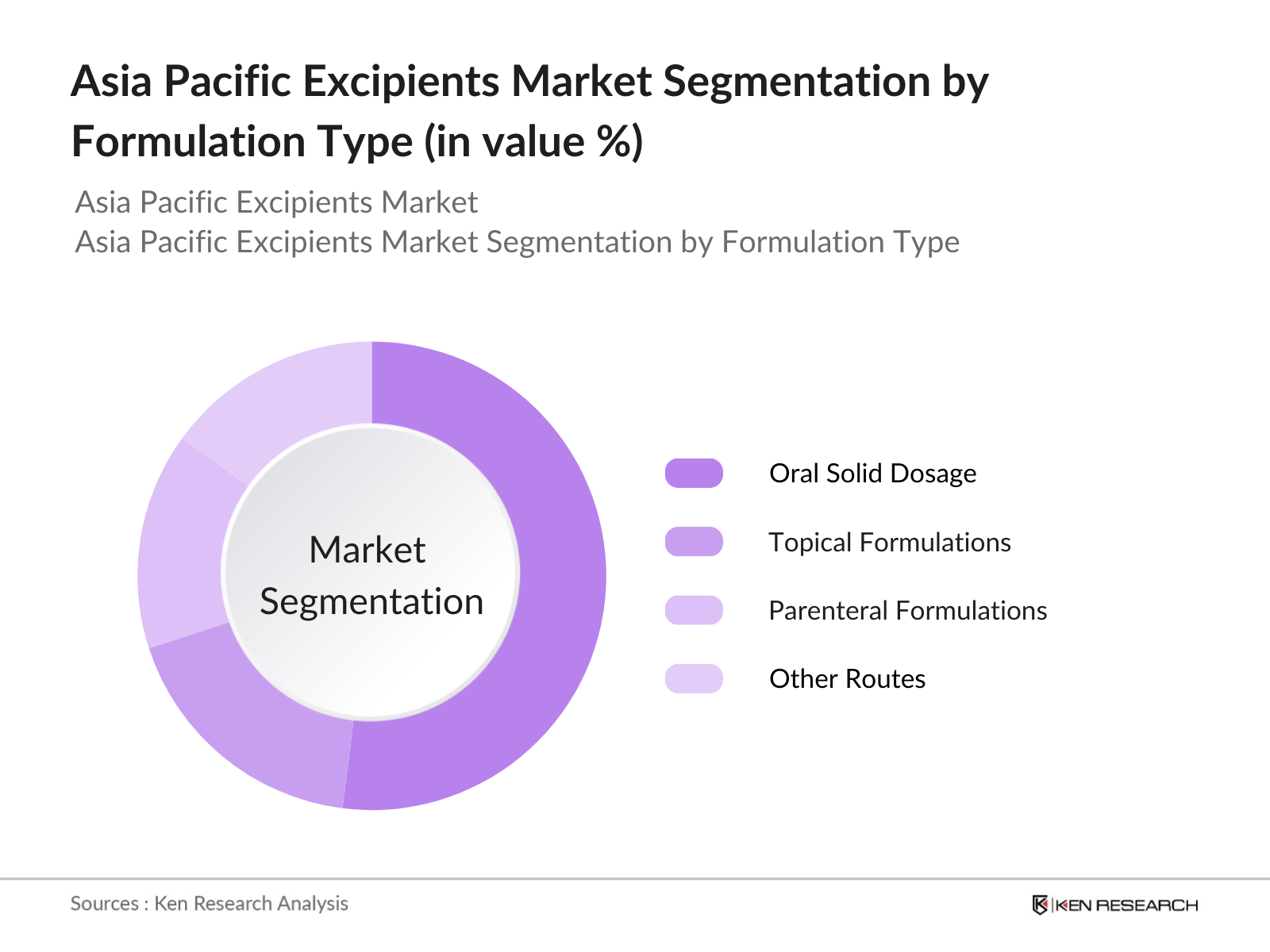

By Formulation Type: The market is segmented by formulation type into oral solid dosage forms, topical formulations, parenteral formulations, and other routes. Oral solid dosage forms dominate the formulation type segment due to their widespread use in tablets and capsules. This segments popularity is driven by ease of administration, patient compliance, and efficient drug delivery. Excipients in this category contribute to formulation stability, efficacy, and controlled drug release, making them essential in the pharmaceutical industrys product offerings.

Asia Pacific Excipients Market Competitive Landscape

The Asia Pacific excipients market is dominated by a few major players, including Ashland Global Holdings, BASF SE, and Roquette Frres, among others. These companies leverage their extensive product portfolios and strong distribution networks to maintain market leadership.

Asia Pacific Excipients Industry Analysis

Growth Drivers

- Pharmaceutical Industry Expansion: The pharmaceutical industry in Asia Pacific has witnessed significant growth due to the rising burden of chronic diseases and population growth. In 2024, Chinas pharmaceutical sector recorded over 100,000 pharmaceutical manufacturers, driven by expanding healthcare access. Indias pharmaceutical exports rose to 22 billion units in 2023, with government initiatives supporting production and innovation, according to Indias Ministry of Commerce.

- Increased Demand for Oral Solid Dosages: With oral solid dosages preferred for their convenience and stability, the demand for excipients like fillers, binders, and disintegrants has increased. In 2023, around 60% of pharmaceutical formulations in Asia were oral solid dosages, per the Indian Pharmaceutical Association. Countries like Japan and South Korea have seen a notable rise in oral solid drug prescriptions, increasing excipient demand to meet standards of tablet stability and drug delivery.

- Innovations in Drug Delivery Systems: Advances in drug delivery, such as targeted and controlled release mechanisms, are driving the need for specialized excipients. In 2024, approximately 30% of the new drugs approved by the Japan Pharmaceuticals and Medical Devices Agency included modified release formulations. Countries like India and South Korea are investing in nanotechnology-based drug delivery systems, creating higher demand for excipients that support controlled release. Source: Japan Pharmaceuticals and Medical Devices Agency.

Market Challenges

- Regulatory Constraints and Compliance: In 2023, various Asia Pacific nations increased regulatory requirements for excipients, including API compatibility and raw material sourcing standards. India and Chinas excipient manufacturers must adhere to stringent API compatibility norms, increasing compliance costs. ASEAN countries enforce specific guidelines, further complicating cross-border supply chains.

- High R&D and Production Costs: Developing innovative excipients requires significant investment, with excipient production costs in Japan estimated to be 15% higher in 2024 due to advanced technology requirements. The growing focus on functional and bio-based excipients adds to production complexity, with significant financial implications for manufacturers in South Korea and India. Source: Japan Ministry of Health, Labour and Welfare.

Asia Pacific Excipients Market Future Outlook

The Asia Pacific excipients market is expected to exhibit strong growth in the coming years, driven by continuous advancements in drug formulation technology, rising demand for functional excipients, and a growing focus on bioavailability enhancement. The shift towards biologics, biosimilars, and personalized medicines will further stimulate demand for innovative excipient solutions. Additionally, the region's evolving healthcare policies and expanding nutraceuticals sector will contribute to increased excipient consumption.

Future Market Opportunities

- Growth in Nutraceuticals and Biopharmaceuticals: In 2024, the Asia Pacific nutraceutical market saw a surge, with China reporting 40 million daily users of dietary supplements, per the Ministry of Health. Biopharmaceutical development is also increasing, with South Korea investing over $2 billion in biopharmaceutical R&D. These sectors demand high-quality excipients for stability and bioavailability, providing growth opportunities for excipient producers. Source: Ministry of Health, China, Korea Health Industry Development Institute.

- Emerging Markets in Southeast Asia: The growth in healthcare infrastructure across Southeast Asia, supported by government initiatives, has expanded excipient demand. Indonesias pharmaceutical industry grew 15% in production capacity by 2023, while Vietnam recorded an increase in healthcare spending, creating a ripe market for excipients in these emerging economies.

Scope of the Report

|

By ProductType |

Polymers |

|

By Function |

Fillers & Diluents |

|

By Formulation Type |

Oral SolidDosage Forms |

|

By End-Use Industry |

Pharmaceuticals |

|

By Region |

East Asia |

Products

Key Target Audience

Pharmaceutical Manufacturers

Nutraceutical Manufacturers

Veterinary Pharmaceutical Producers

Biopharmaceutical Companies

Excipients Manufacturers and Distributors

Formulation Scientists

Government and Regulatory Bodies (e.g., SFDA, TGA)

Investments and Venture Capitalist Firms

Companies

Major Players in the Asia Pacific Excipients Market

Ashland Global Holdings

BASF SE

Roquette Frres

DFE Pharma

Colorcon, Inc.

DuPont

Kerry Group

JRS Pharma

Gattefoss

SPI Pharma, Inc.

Avantor, Inc.

IMCD Group

Cargill, Incorporated

MEGGLE Group Wasserburg BG Excipients

Evonik Industries AG

Table of Contents

1. Asia Pacific Excipients Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Excipients Demand, Regulatory Standards)

1.4 Market Segmentation Overview

1.5 Key Market Insights

2. Asia Pacific Excipients Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Milestones and Developments

2.4 Impact Analysis of Key Events (Pharmaceutical Advancements, Regional Approvals)

3. Asia Pacific Excipients Market Analysis

3.1 Growth Drivers

3.1.1 Pharmaceutical Industry Expansion

3.1.2 Increased Demand for Oral Solid Dosages

3.1.3 Innovations in Drug Delivery Systems

3.1.4 Rising Focus on Quality and Safety Standards

3.2 Market Challenges

3.2.1 Regulatory Constraints and Compliance (API Compatibility, Raw Material Regulations)

3.2.2 High R&D and Production Costs

3.2.3 Supply Chain Vulnerabilities

3.3 Opportunities

3.3.1 Growth in Nutraceuticals and Biopharmaceuticals

3.3.2 Emerging Markets in Southeast Asia

3.3.3 Technological Advancements in Excipients (e.g., Co-processed Excipients)

3.4 Trends

3.4.1 Shift to Functional Excipients

3.4.2 Growing Use of Bio-based Excipients

3.4.3 Increased Adoption of Controlled Release Formulations

3.5 Regulatory Environment (GMP, ICH Guidelines, ASEAN Harmonization)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Pharmaceutical Companies, Manufacturers, Distributors)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

4. Asia Pacific Excipients Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Polymers

4.1.2 Sugars

4.1.3 Minerals

4.1.4 Solvents

4.1.5 Others (Gums, Gelatins)

4.2 By Function (In Value %)

4.2.1 Fillers & Diluents

4.2.2 Binders

4.2.3 Coating Agents

4.2.4 Lubricants

4.2.5 Preservatives

4.3 By Formulation Type (In Value %)

4.3.1 Oral Solid Dosage Forms

4.3.2 Topical Formulations

4.3.3 Parenteral Formulations

4.3.4 Other Routes of Administration

4.4 By End-Use Industry (In Value %)

4.4.1 Pharmaceuticals

4.4.2 Nutraceuticals

4.4.3 Cosmeceuticals

4.4.4 Veterinary Pharmaceuticals

4.5 By Region (In Value %)

4.5.1 East Asia

4.5.2 South Asia

4.5.3 Southeast Asia

4.5.4 Oceania

5. Asia Pacific Excipients Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Ashland Global Holdings Inc.

5.1.2 BASF SE

5.1.3 DFE Pharma

5.1.4 DuPont

5.1.5 Kerry Group

5.1.6 Roquette Frres

5.1.7 JRS Pharma

5.1.8 Colorcon, Inc.

5.1.9 Evonik Industries AG

5.1.10 MEGGLE Group Wasserburg BG Excipients

5.1.11 SPI Pharma, Inc.

5.1.12 Cargill, Incorporated

5.1.13 Avantor, Inc.

5.1.14 Gattefoss

5.1.15 IMCD Group

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Product Portfolio, R&D Investment, Regional Presence, GMP Compliance, Customer Base, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis (Private Equity, Venture Capital)

5.7 Government Support and Grants

5.8 Key Partnerships and Alliances

6. Asia Pacific Excipients Market Regulatory Framework

6.1 Regional Standards and Policies (GMP, GSP, Pharmacopoeial Requirements)

6.2 Compliance and Certification Procedures (ISO, IPEC Certification)

6.3 Key Regulatory Authorities and Influencing Bodies

6.4 Import and Export Regulations

6.5 Impact of Trade Policies

7. Asia Pacific Excipients Future Market Size (In USD Billion)

7.1 Projected Market Growth

7.2 Key Growth Drivers

7.3 Industry Forecast and Scenarios

7.4 Potential Market Barriers

8. Asia Pacific Excipients Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Function (In Value %)

8.3 By Formulation Type (In Value %)

8.4 By End-Use Industry (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Excipients Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Segment-Specific Strategic Insights

9.3 Go-to-Market Strategies for Key Regions

9.4 White Space Analysis and Emerging Opportunities

9.5 Sustainability and Innovation Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We begin by identifying essential variables and stakeholders influencing the Asia Pacific excipients market, such as pharmaceutical manufacturers, excipient producers, and regulatory bodies. This involves using proprietary databases and secondary research to gather foundational data.

Step 2: Market Analysis and Construction

Historical data for the Asia Pacific excipients market is compiled, focusing on formulation usage patterns, market segmentation by excipient type, and market drivers. The revenue generation analysis allows us to validate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Our research team conducts expert interviews with excipients manufacturers and pharmaceutical companies to verify key assumptions. These interviews provide firsthand insights on market demand, R&D priorities, and competitive landscape.

Step 4: Research Synthesis and Final Output

Data is synthesized to ensure a holistic market understanding. Cross-verifying insights from primary and secondary sources, we deliver an in-depth and validated report for strategic decision-making.

Frequently Asked Questions

01. How big is the Asia Pacific Excipients Market?

The Asia Pacific excipients market is valued at USD 1.1 billion, driven by growth in the pharmaceutical sector and an increasing focus on excipient functionality and bioavailability.

02. What are the main drivers of the Asia Pacific Excipients Market?

Key drivers in the Asia Pacific excipients market include the regions expanding pharmaceutical manufacturing, increasing demand for functional and bio-based excipients, and growth in the nutraceutical and cosmeceutical industries.

03. Who are the major players in the Asia Pacific Excipients Market?

Prominent players in the Asia Pacific excipients market include Ashland Global Holdings, BASF SE, Roquette Frres, and DFE Pharma, known for their comprehensive product offerings and strong distribution networks.

04. What challenges are faced in the Asia Pacific Excipients Market?

Challenges in the Asia Pacific excipients market include stringent regulatory compliance requirements, high R&D costs, and the need for compatibility with active pharmaceutical ingredients (APIs), which can limit excipient usage.

05. Which formulation type dominates in the Asia Pacific Excipients Market?

Oral solid dosage forms dominate the Asia Pacific excipients market due to high demand in tablet and capsule production, supported by excipients that enhance stability and controlled release.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.