Asia Pacific False Eyelashes Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD6003

November 2024

81

About the Report

Asia Pacific False Eyelashes Market Overview

- The Asia Pacific False Eyelashes market is valued at USD 435 million, supported by a surge in demand across beauty-conscious consumers and professional makeup artists. This market growth is fueled by the expanding influence of social media beauty influencers and the rising trend of using false eyelashes for everyday looks as well as special occasions.

- Countries like China and South Korea dominate the market, primarily due to their strong presence in the beauty and cosmetic industry. These regions are home to numerous leading manufacturers, supported by a well-established beauty culture. In South Korea, K-beauty trends have significantly boosted the popularity of false eyelashes, while China leads with a robust supply chain and a large domestic consumer base, driving the demand for innovative and fashionable beauty products.

- In 2023, the Chinese government introduced stricter regulations under its new "Cosmetics Supervision and Administration Regulation." This regulation mandates rigorous testing of cosmetic products, including false eyelashes, to ensure safety and quality. This initiative has forced manufacturers to comply with higher standards, reducing the prevalence of low-quality and counterfeit products.

Asia Pacific False Eyelashes Market Segmentation

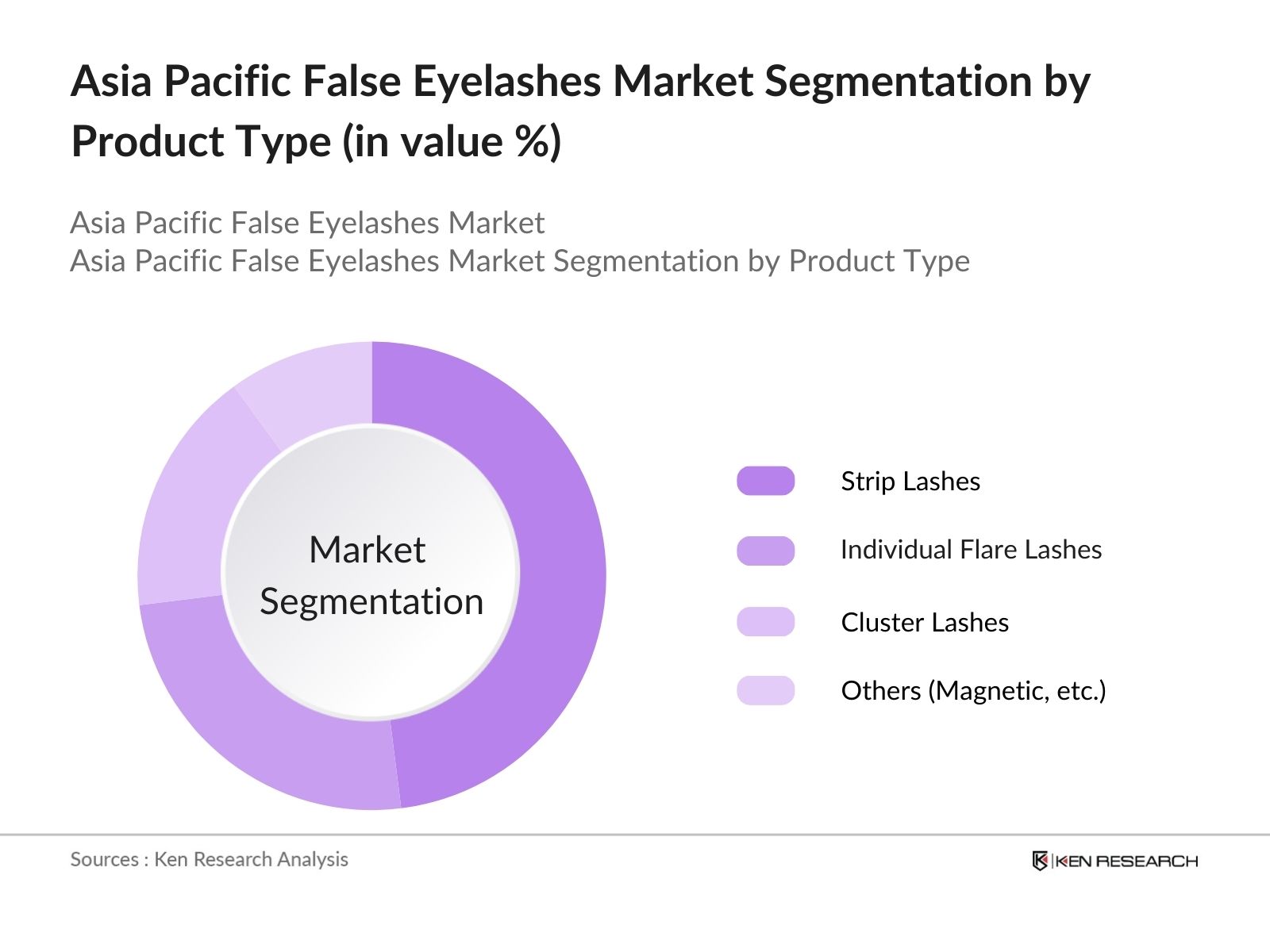

By Product Type: The market is segmented by product type into strip lashes, individual flare lashes, cluster lashes, and others (e.g., magnetic lashes). Strip lashes currently dominate the product type segment due to their ease of application, wide availability, and cost-effectiveness. Their popularity is driven by beauty enthusiasts who value convenience and versatility. Established brands like Ardell and KISS offer a wide range of strip lashes that cater to different styles and preferences, contributing to the strong market share of this segment.

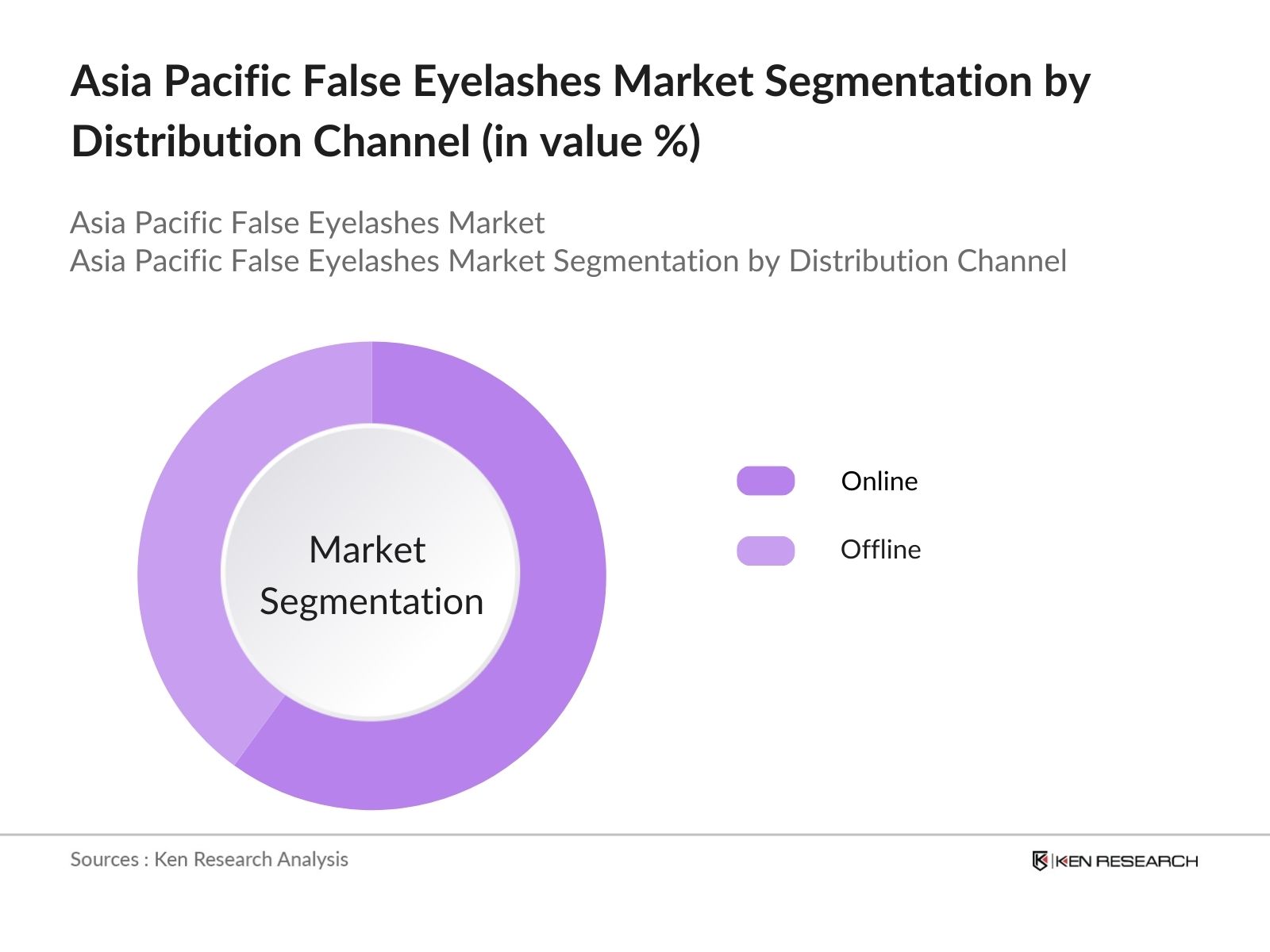

By Distribution Channel: The market is segmented into online and offline sales channels. The online segment has gained a dominant market share due to the increasing influence of digital platforms, beauty bloggers, and influencers who promote products via social media. E-commerce giants like Alibaba and Sephora have made it easier for consumers to access a wide range of lash products at competitive prices, further strengthening the online channels market position.

Asia Pacific False Eyelashes Market Competitive Landscape

The market is highly competitive, with both international and local players striving to capture market share. Established brands such as Huda Beauty and Velour Beauty continue to dominate the premium segment, while local manufacturers from China cater to the growing demand for affordable products.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Distribution Network |

Sustainability Initiatives |

Revenue (USD Mn) |

Online Presence |

Brand Recognition |

|

Ardell Lashes |

1971 |

USA |

||||||

|

Huda Beauty |

2013 |

UAE |

||||||

|

KISS Products |

1989 |

USA |

||||||

|

House of Lashes |

2012 |

USA |

||||||

|

Qingdao LashBeauty Cosmetics |

2003 |

China |

Asia Pacific False Eyelashes Market Analysis

Market Growth Drivers

- Increasing Consumer Awareness Towards Eye Aesthetics: As of 2024, over 210 million consumers in Asia Pacific have shown growing interest in eye-enhancing products, particularly false eyelashes. With more beauty-conscious consumers across urban and semi-urban areas, the demand for high-quality, reusable false eyelashes is on the rise. This trend is significantly supported by the expansion of beauty retail stores and e-commerce platforms, where sales of false eyelashes increased by 24 million units in 2023, providing a steady driver for market growth.

- Expansion of Beauty Industry in Key Markets: Japan and South Korea, two leading markets in the Asia Pacific region, have seen tremendous growth in their beauty sectors, contributing to increased demand for false eyelashes. In 2024, these markets reported retail sales exceeding 120 billion yen and 13 trillion won, respectively. The integration of advanced manufacturing processes to develop lightweight, natural-looking lashes in these markets is further propelling demand, alongside a growing number of beauty salons offering false eyelash services.

- Rising Popularity of K-Beauty and J-Beauty Trends: The global influence of K-beauty (Korean beauty) and J-beauty (Japanese beauty) has substantially boosted the demand for false eyelashes. In 2023, over 45 million consumers in the region were influenced by beauty trends from these countries, with cosmetic exports from South Korea to Southeast Asia reaching $9.5 billion. This popularity drives market penetration for products such as magnetic false eyelashes and hybrid lash extensions.

Market Challenges

- High Prevalence of Counterfeit Products: The Asia Pacific market has been flooded with counterfeit false eyelashes, especially in countries like China and India, where the fake product market was valued at over $3 billion in 2023. These products pose quality and safety concerns, leading to health issues such as eye infections, which damage consumer trust in the overall market.

- Volatile Raw Material Prices: The price of synthetic fibers and natural mink, essential raw materials for false eyelash manufacturing, has experienced significant fluctuations. In 2024, the price of mink fur used in premium eyelashes increased by $2 per gram, adding pressure on manufacturers and leading to higher retail prices.

Asia Pacific False Eyelashes Market Future Outlook

Over the next five years, the Asia Pacific False Eyelashes industry is expected to witness strong growth driven by rising consumer interest in personalized beauty products, increasing e-commerce penetration, and technological advancements in false lash manufacturing.

Future Market Opportunities

- Growth in Customizable and Personalized Eyelashes: Over the next five years, the Asia Pacific false eyelashes market is projected to experience increasing demand for customizable and personalized lash products. By 2029, it is estimated that over 30 million consumers will be purchasing false eyelashes tailored to their specific eye shapes, preferences, and aesthetics, supported by advanced 3D printing and AI-driven customization technologies.

- Expansion of Vegan and Cruelty-Free Products: The demand for vegan and cruelty-free false eyelashes is expected to grow, with major brands already investing in plant-based materials. By 2029, it is estimated that eco-friendly false eyelashes will account for 22 million units of sales annually in the Asia Pacific market, driven by rising consumer awareness of environmental and ethical concerns.

Scope of the Report

|

Product Type |

Strip Lashes Individual Flare Lashes Cluster Lashes Others |

|

Material |

Synthetic Lashes Mink Lashes Silk Lashes Human Hair Lashes |

|

Distribution Channel |

Online Offline |

|

End User |

Professional Individual |

|

Region |

China Japan South Korea Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Private Equity Firms

Investments and venture capital firms

Government and regulatory bodies (APAC Cosmetic Product Safety Agencies)

Beauty influencers and social media marketers

Packaging and raw material suppliers

Cosmetic product development companies

Companies

Players Mentioned in the Report:

Ardell Lashes

Huda Beauty

KISS Products

Velour Beauty

House of Lashes

Qingdao LashBeauty Cosmetics

ESQIDO

Lashify

MAC Cosmetics

Tarte Cosmetics

Shu Uemura

Sephora Collection

Revlon

Thrive Causemetics

Lilly Lashes

Table of Contents

1. Asia Pacific False Eyelashes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (in Revenue USD)

1.4. Market Segmentation Overview

2. Asia Pacific False Eyelashes Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific False Eyelashes Market Analysis

3.1. Growth Drivers

3.1.1. Rising demand for beauty and cosmetic products

3.1.2. Growth of social media beauty influencers

3.1.3. Expanding e-commerce distribution channels

3.1.4. Increasing popularity of premium products

3.2. Market Challenges

3.2.1. Growing competition from local manufacturers

3.2.2. Regulatory challenges on synthetic materials

3.2.3. Price fluctuations in raw materials (e.g., mink and silk)

3.2.4. Counterfeit products in the market

3.3. Opportunities

3.3.1. Expansion in untapped rural markets

3.3.2. Development of vegan and cruelty-free lashes

3.3.3. Strategic partnerships with beauty salons and makeup artists

3.3.4. Technological innovation in adhesive and lash fibers

3.4. Trends

3.4.1. Increasing demand for eco-friendly materials

3.4.2. Customized false lashes with 3D printing

3.4.3. Rise of reusable and magnetic false lashes

3.5. Government Regulation

3.5.1. Regulatory framework for cosmetic products in Asia Pacific

3.5.2. Import-export tariffs on eyelash products

3.5.3. Consumer safety regulations for adhesives and fibers

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific False Eyelashes Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Strip Lashes

4.1.2. Individual Flare Lashes

4.1.3. Cluster Lashes

4.1.4. Others (e.g., Magnetic, Semi-permanent)

4.2. By Material (In Value %)

4.2.1. Synthetic Lashes

4.2.2. Mink Lashes

4.2.3. Silk Lashes

4.2.4. Human Hair Lashes

4.3. By Distribution Channel (In Value %)

4.3.1. Online (E-commerce, Social Media Platforms)

4.3.2. Offline (Beauty Stores, Supermarkets, Salons)

4.4. By End User (In Value %)

4.4.1. Professional (Salons, Beauty Institutes)

4.4.2. Individual

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. Rest of APAC

5. Asia Pacific False Eyelashes Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ardell Lashes

5.1.2. Huda Beauty

5.1.3. Lilly Lashes

5.1.4. Velour Beauty

5.1.5. House of Lashes

5.1.6. KISS Products

5.1.7. Qingdao LashBeauty Cosmetic Co.

5.1.8. ESQIDO

5.1.9. Lashify

5.1.10. MAC Cosmetics

5.1.11. Tarte Cosmetics

5.1.12. Sephora Collection

5.1.13. Revlon

5.1.14. Thrive Causemetics

5.1.15. Shu Uemura

5.2. Cross Comparison Parameters (Revenue, Distribution Network, Brand Recognition, Product Portfolio, Sustainability Initiatives, Online Presence, Innovation in Product Offering, Customer Retention Rate)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific False Eyelashes Market Regulatory Framework

6.1. Cosmetic Product Safety Standards

6.2. Compliance with Manufacturing Standards (GMP)

6.3. Import-Export Certification

7. Asia Pacific False Eyelashes Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific False Eyelashes Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific False Eyelashes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

We begin by analyzing the key variables that define the Asia Pacific False Eyelashes market, including the major product types, distribution channels, and consumer demographics. This is done through comprehensive desk research, leveraging industry reports, company databases, and government statistics.

Step 2: Market Analysis and Construction

A detailed market analysis is conducted to assess historical market size and penetration. This phase involves evaluating revenue generation across different product types and determining their market shares. We also assess supply chain dynamics to construct an accurate picture of market trends.

Step 3: Hypothesis Validation and Expert Consultation

To ensure data accuracy, our hypotheses are validated by conducting interviews with industry experts, including manufacturers, distributors, and retailers. This process provides insights into product performance, pricing strategies, and consumer preferences.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the research findings from both primary and secondary sources. We cross-reference the data from the interviews with proprietary databases to ensure a robust and accurate market report.

Frequently Asked Questions

01. How big is the Asia Pacific False Eyelashes Market?

The Asia Pacific False Eyelashes market is valued at USD 435 million, driven by the growing demand for beauty products and the influence of social media trends.

02. What are the challenges in the Asia Pacific False Eyelashes Market?

Challenges in the Asia Pacific False Eyelashes market include the proliferation of counterfeit products, price fluctuations in raw materials, and the high competition from local manufacturers.

03. Who are the major players in the Asia Pacific False Eyelashes Market?

Key players in the Asia Pacific False Eyelashes market include Ardell Lashes, Huda Beauty, KISS Products, Velour Beauty, and Qingdao LashBeauty Cosmetics. These brands dominate due to their wide product portfolios and strong brand loyalty.

04. What are the growth drivers of the Asia Pacific False Eyelashes Market?

The Asia Pacific False Eyelashes market is driven by the rising influence of social media influencers, increasing consumer preference for premium beauty products, and the convenience of online shopping platforms.

05. Which regions dominate the Asia Pacific False Eyelashes Market?

China and South Korea lead the Asia Pacific False Eyelashes market due to their well-established beauty industries, robust manufacturing capabilities, and large consumer base.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.