Asia Pacific Fintech Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5192

December 2024

99

About the Report

Asia Pacific Fintech Market Overview

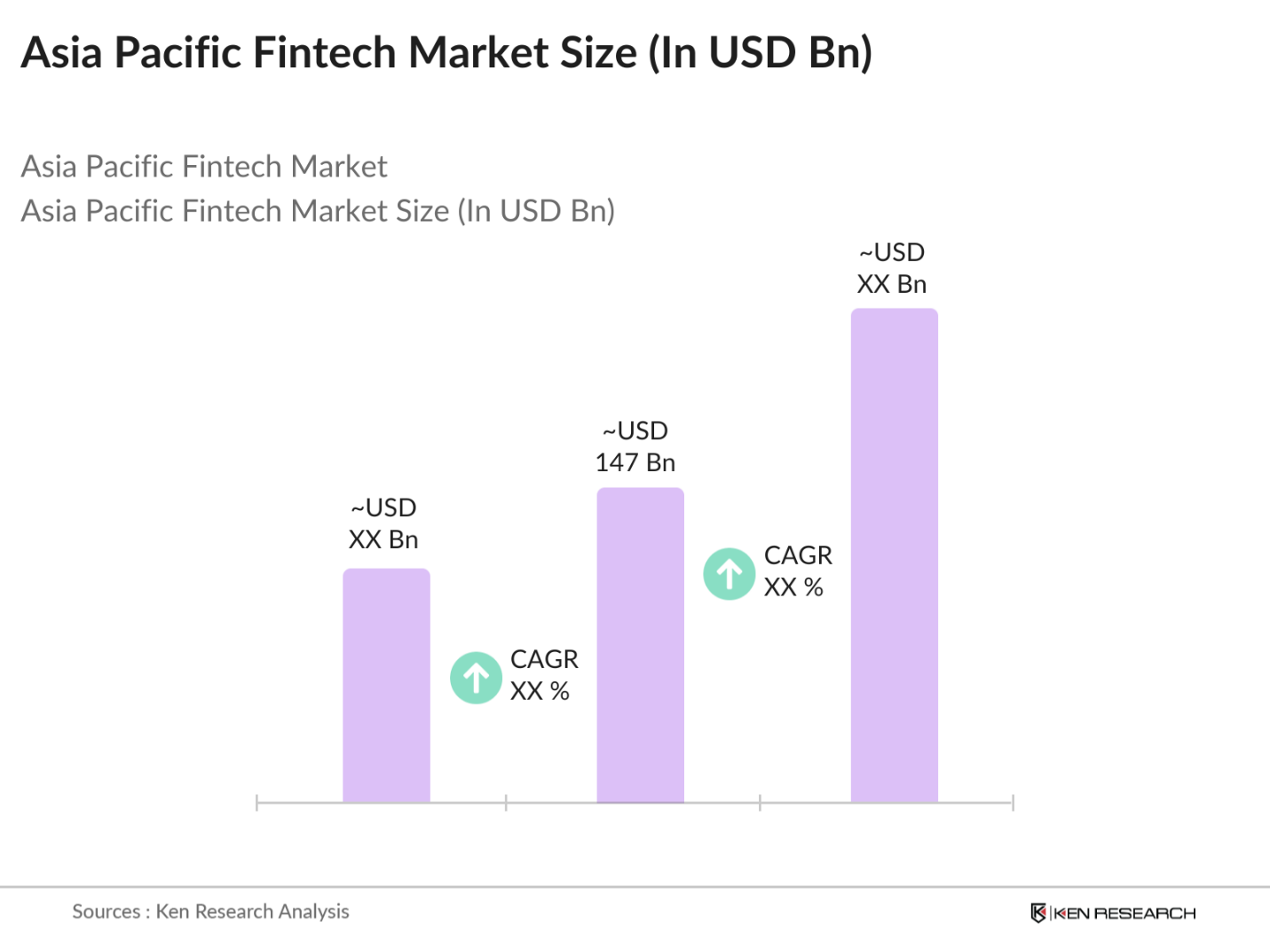

- The Asia Pacific fintech market is valued at USD 147 billion, driven by the region's growing demand for digital financial solutions and the increased adoption of mobile banking. With a large percentage of the population moving towards digital payments and financial inclusion, the growth is further supported by advancements in technology such as blockchain and artificial intelligence. The proliferation of smartphones, particularly in developing markets like India and Southeast Asia, has also accelerated the adoption of fintech services across the region.

- Countries like China and India dominate the Asia Pacific fintech market due to their large populations, rapid digitalization, and supportive government policies. China leads with the presence of major players like Ant Financial and Tencent, while India is propelled by its governments initiatives for financial inclusion and digital payments infrastructure. Southeast Asian nations such as Indonesia and Singapore also play pivotal roles due to their strategic financial hubs and progressive regulations.

- Governments across Asia Pacific have introduced policies aimed at fostering fintech innovation. In Singapore, the Monetary Authority of Singapore (MAS) introduced a regulatory sandbox framework in 2016, allowing fintech firms to experiment with products under relaxed regulations. As of 2024, over 50 fintech firms have utilized this sandbox, driving advancements in financial technology.

Asia Pacific Fintech Market Segmentation

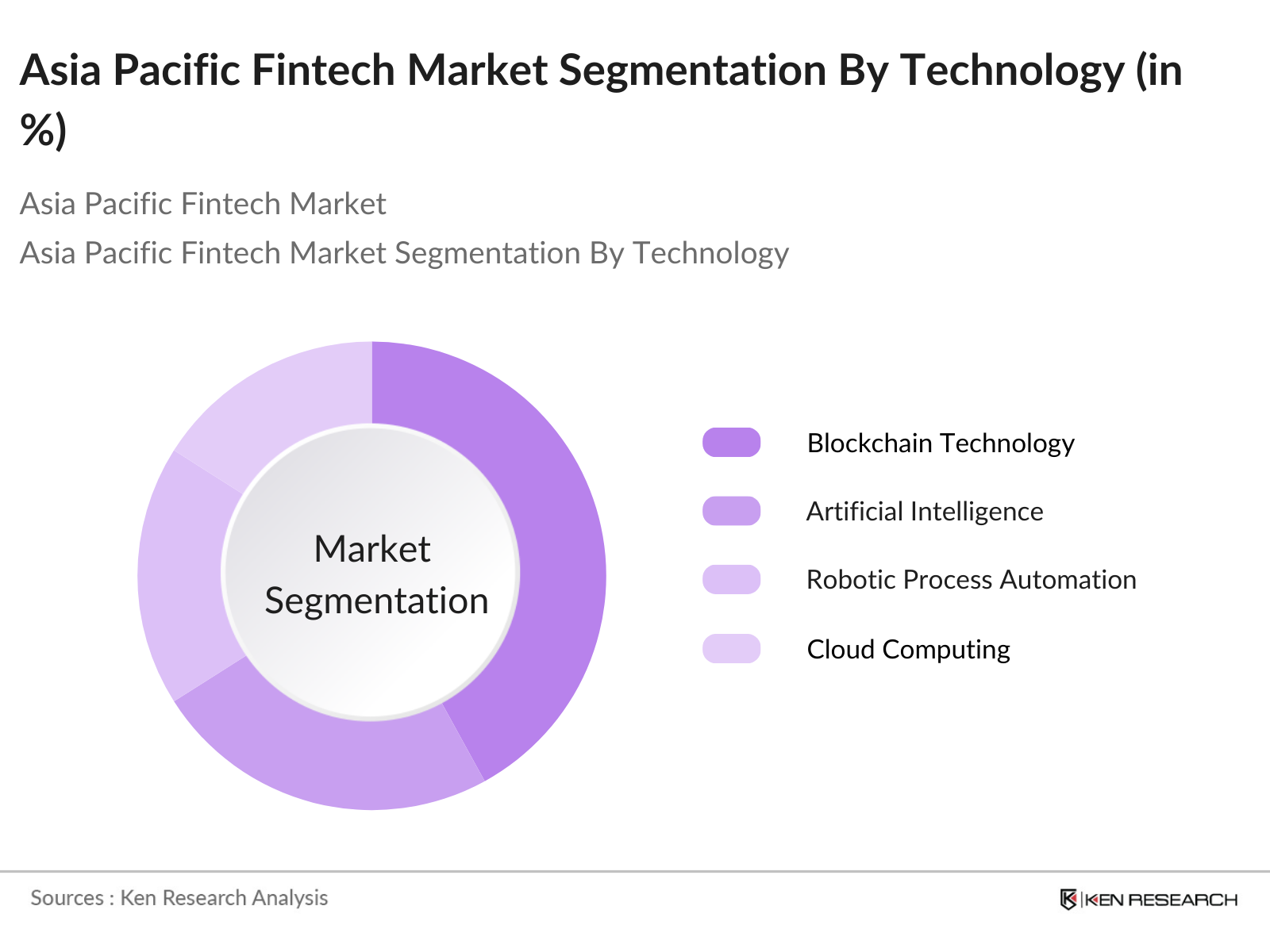

By Technology: The market is segmented by technology into blockchain technology, artificial intelligence (AI), robotic process automation (RPA), cloud computing, and data analytics. In recent years, blockchain technology has captured a significant share of the market. This dominance is largely due to its decentralized nature, allowing for secure and transparent transactions across financial services. Key applications of blockchain in the fintech space include cross-border payments, digital identity verification, and smart contracts.

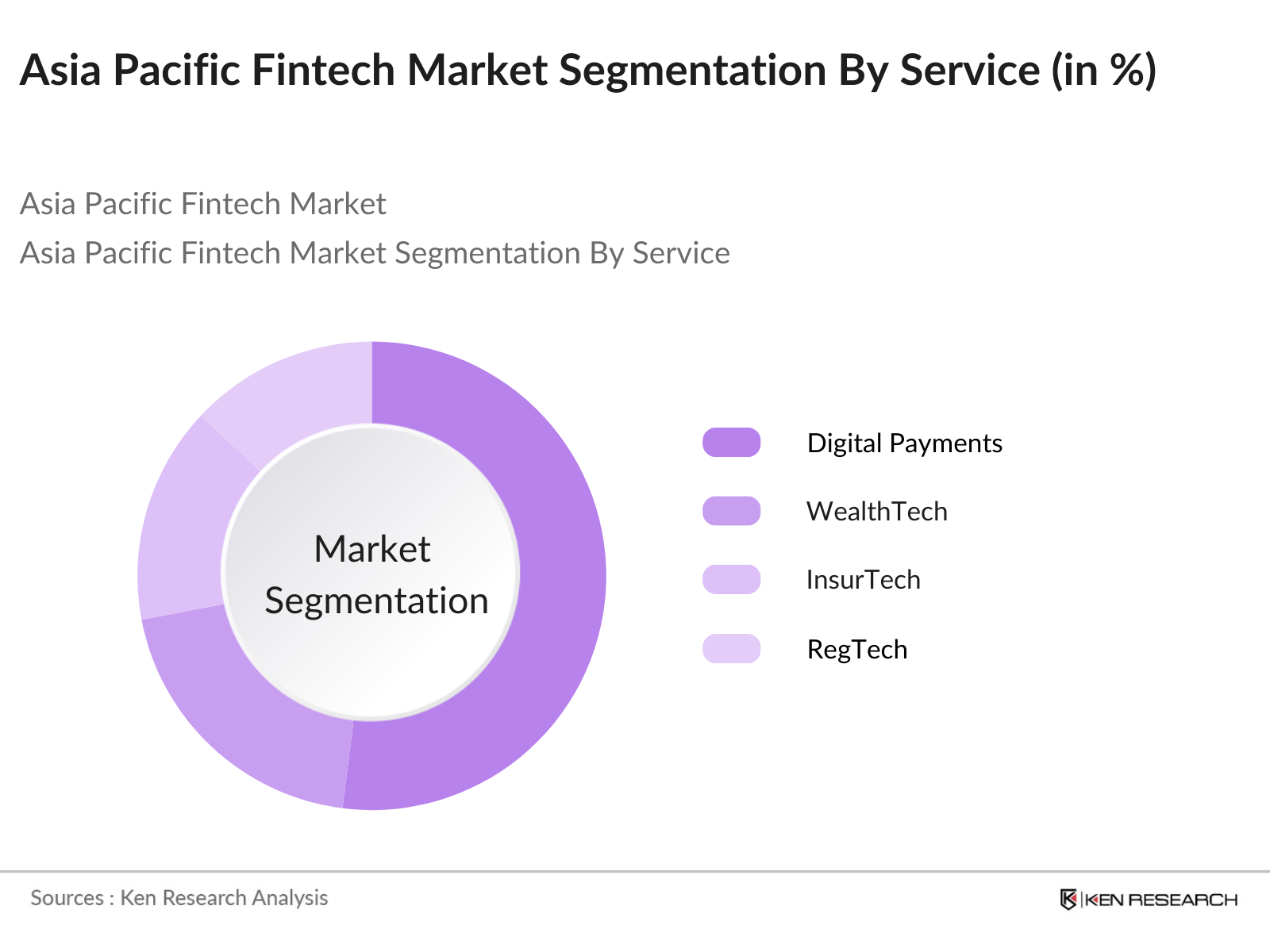

By Service: The fintech market in Asia Pacific is also segmented by service into digital payments, WealthTech, InsurTech, RegTech, and lending. Digital payments have become the leading service segment due to the regions increasing reliance on mobile wallets, payment gateways, and QR code payments. Companies like Paytm in India and Alipay in China have revolutionized how payments are processed, providing accessible and user-friendly platforms for both urban and rural populations.

Asia Pacific Fintech Market Competitive Landscape

The Asia Pacific fintech market is characterized by the dominance of both global and regional players. The competition is intense, especially in digital payments and blockchain services, where companies are investing heavily in technological advancements to maintain their market positions. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their services across borders.

Asia Pacific Fintech Industry Analysis

Growth Drivers

- Increasing Digital Payments Adoption (Digital Payment Transactions): In the Asia Pacific region, digital payments have seen a surge in adoption, largely driven by the rapid penetration of smartphones and mobile internet. As of 2024, the number of digital payment transactions in the region exceeded 500 billion annually. Countries like India and China are leading the digital payment space, with their government-backed initiatives such as India's Unified Payments Interface (UPI) and China's Alipay and WeChat Pay.

- Rising Smartphone Penetration (Mobile Banking, App Usage): The growing availability of affordable smartphones has transformed the Asia Pacific region into a hotspot for fintech development. As of 2024, smartphone penetration in countries like Indonesia reached 73%, up from 66% in 2022. This increase in mobile usage has directly influenced the growth of mobile banking and digital wallets, as seen in countries like South Korea, where mobile payment transactions exceeded $5 trillion in the first half of 2024, according to the Bank of Korea.

- Growth in Financial Inclusion (Unbanked Population Access): In 2024, financial inclusion efforts are gaining traction across the Asia Pacific region, where nearly 200 million people remain unbanked. Countries such as the Philippines have introduced initiatives like the "National Strategy for Financial Inclusion," aiming to expand banking access through digital means. By mid-2024, over 10 million unbanked adults had gained access to formal financial services, facilitated by fintech platforms and digital wallets.

Market Challenges

- Regulatory Complexity (Compliance Costs, Cross-Border Restrictions): Fintech companies in the Asia Pacific region face significant challenges due to regulatory fragmentation across jurisdictions. For example, firms operating in both Singapore and Indonesia must navigate vastly different financial regulations, contributing to increased compliance costs. As of 2024, compliance expenditures for cross-border fintech services in the region have surged, with larger firms reporting spending over $200 million annually on regulatory adherence.

- Data Privacy and Security Issues (Cybersecurity Breaches, Regulatory Compliance): Data privacy and security concerns continue to present significant challenges in the fintech landscape. In 2023, Japan experienced one of the largest cybersecurity breaches, with over 50 million customer records exposed from a major fintech provider. This breach underscored the need for stronger cybersecurity protocols across the region. Governments are tightening regulations, with Singapore enforcing the Personal Data Protection Act (PDPA), imposing fines of up to SGD 1 million for non-compliance.

Asia Pacific Fintech Market Future Outlook

The Asia Pacific fintech market is poised for substantial growth in the coming years, driven by the increasing penetration of digital technologies and the regions push towards financial inclusion. Governments across the region are introducing favorable policies, such as regulatory sandboxes, which are encouraging the entry of new fintech startups. Additionally, advancements in artificial intelligence and blockchain technology are expected to further drive innovation, offering new solutions in payments, lending, and insurance.

Market Opportunities

- Expanding Cryptocurrency Usage (Crypto Wallets, Blockchain Integration): Cryptocurrency adoption in the Asia Pacific region has accelerated in 2024, with countries like Japan, South Korea, and Australia at the forefront of crypto wallet adoption. According to the Financial Services Agency of Japan, there were over 3 million registered cryptocurrency wallets in the country by mid-2024. Blockchain integration is also gaining ground, with South Korea implementing blockchain technology in its digital identity verification systems.

- AI and Machine Learning in Fintech (Robo-Advisors, Fraud Detection): The deployment of AI and machine learning in fintech is transforming the industry in Asia Pacific. As of 2024, over 100 fintech firms in Singapore and Hong Kong are utilizing AI-driven solutions for robo-advisory services and fraud detection. The Monetary Authority of Singapore reported that AI-powered robo-advisors managed over SGD 10 billion in assets by early 2024, a fivefold increase from 2022.

Scope of the Report

|

By Technology |

Blockchain Technology Artificial Intelligence (AI) Robotic Process Automation (RPA) Cloud Computing Data Analytics |

|

By Service |

Digital Payments WealthTech InsurTech RegTech Lending |

|

By Application |

Retail Banking Investment Management Insurance Payment Processing Cross-Border Transactions |

|

By Deployment Mode |

Cloud On-Premise |

|

By Region |

China India Japan Southeast Asia (Indonesia, Malaysia, Singapore) Australia and New Zealand |

Products

Key Target Audience

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Monetary Authority of Singapore, Reserve Bank of India)

Financial Institutions (e.g., Banks, Credit Unions)

Digital Payment Solution Providers

Blockchain Technology Companies

Insurance Companies

Private Equity Firms

Fintech Startups and SMEs

Companies

Players Mentioned in the Report

Ant Financial

Tencent Holdings

Paytm

Afterpay

Gojek

Grab Financial Group

Razorpay

Tokopedia

Adyen

Nium

Table of Contents

1. Asia Pacific Fintech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Fintech Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Fintech Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Digital Payments Adoption (Digital Payment Transactions)

3.1.2. Government Policies Supporting Fintech (Regulatory Sandbox Initiatives, Open Banking)

3.1.3. Rising Smartphone Penetration (Mobile Banking, App Usage)

3.1.4. Growth in Financial Inclusion (Unbanked Population Access)

3.2. Market Challenges

3.2.1. Regulatory Complexity (Compliance Costs, Cross-Border Restrictions)

3.2.2. Data Privacy and Security Issues (Cybersecurity Breaches, Regulatory Compliance)

3.2.3. Competition from Traditional Financial Institutions (Bank-Led Innovations)

3.3. Opportunities

3.3.1. Expanding Cryptocurrency Usage (Crypto Wallets, Blockchain Integration)

3.3.2. AI and Machine Learning in Fintech (Robo-Advisors, Fraud Detection)

3.3.3. Growth in BNPL (Buy Now Pay Later Services Adoption)

3.4. Trends

3.4.1. Integration of AI and Blockchain in Financial Services (Smart Contracts, AI-Powered Solutions)

3.4.2. Rise of Digital Banks (Neobanks, Challenger Banks)

3.4.3. Expansion of Cross-Border Payment Solutions (Blockchain-Based Remittance Solutions)

3.5. Government Regulations

3.5.1. Open Banking Regulations (Open API Frameworks)

3.5.2. Digital Payment Standards (E-Wallet Regulations, Security Protocols)

3.5.3. AML (Anti-Money Laundering) and KYC (Know Your Customer) Regulations

3.5.4. Fintech Licensing Requirements (Regional Licensing Models)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Fintech Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Blockchain Technology

4.1.2. Artificial Intelligence (AI)

4.1.3. Robotic Process Automation (RPA)

4.1.4. Cloud Computing

4.1.5. Data Analytics

4.2. By Service (In Value %)

4.2.1. Digital Payments

4.2.2. WealthTech (Robo-Advisors, Investment Platforms)

4.2.3. InsurTech (Digital Insurance Platforms)

4.2.4. RegTech (Compliance Automation, AML Solutions)

4.2.5. Lending (P2P Lending, Crowdfunding)

4.3. By Application (In Value %)

4.3.1. Retail Banking

4.3.2. Investment Management

4.3.3. Insurance

4.3.4. Payment Processing

4.3.5. Cross-Border Transactions

4.4. By Deployment Mode (In Value %)

4.4.1. Cloud

4.4.2. On-Premise

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Southeast Asia (Indonesia, Malaysia, Singapore)

4.5.5. Australia and New Zealand

5. Asia Pacific Fintech Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ant Financial

5.1.2. Tencent Holdings

5.1.3. Paytm

5.1.4. Afterpay

5.1.5. Gojek

5.1.6. Grab Financial Group

5.1.7. Razorpay

5.1.8. Tokopedia

5.1.9. Adyen

5.1.10. Nium

5.1.11. Airwallex

5.1.12. Revolut

5.1.13. OVO

5.1.14. PhonePe

5.1.15. BharatPe

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Market Share, Services Offered, Technology Stack, Regional Presence, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Fintech Market Regulatory Framework

6.1. Financial Regulations for Fintech Companies

6.2. AML/KYC Compliance

6.3. Data Protection Regulations (GDPR, Local Data Protection Laws)

6.4. Licensing and Compliance Requirements

7. Asia Pacific Fintech Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Fintech Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Service (In Value %)

8.3. By Application (In Value %)

8.4. By Deployment Mode (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Fintech Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out the ecosystem of the Asia Pacific fintech market. Extensive desk research is conducted using a combination of secondary sources and proprietary databases to gather comprehensive data. Key variables, such as technology adoption rates, financial inclusion metrics, and regulatory trends, are identified for a clearer understanding of the markets structure.

Step 2: Market Analysis and Construction

We compile historical data from various fintech services and assess the markets penetration, transaction volumes, and technology adoption across key markets. Revenue data and quality metrics are analyzed to build an accurate picture of the market dynamics, ensuring a reliable forecast for future performance.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market assumptions, we engage with industry experts via computer-assisted telephone interviews (CATIs). These consultations offer real-world insights from professionals working across leading fintech companies and regulators, further refining our market data and projections.

Step 4: Research Synthesis and Final Output

This phase involves direct engagement with fintech service providers to gain insights into consumer preferences, technological advancements, and market penetration. This information complements bottom-up data collection methods, ensuring a robust, comprehensive analysis of the Asia Pacific fintech market.

Frequently Asked Questions

1. How big is the Asia Pacific Fintech Market?

The Asia Pacific fintech market is valued at USD 147 billion, driven by the region's growing demand for digital financial solutions and the increased adoption of mobile banking.

2. What are the challenges in the Asia Pacific Fintech Market?

Key challenges include regulatory complexities, data security concerns, and competition from traditional financial institutions. Governments are grappling with how to regulate rapidly evolving technologies like blockchain and AI.

3. Who are the major players in the Asia Pacific Fintech Market?

Major players include Ant Financial, Tencent Holdings, Paytm, Gojek, and Grab Financial Group. These companies dominate due to their strong technology platforms and extensive customer base.

4. What are the growth drivers of the Asia Pacific Fintech Market?

The market is driven by increasing smartphone penetration, government policies encouraging digital payments, and the adoption of blockchain technology for secure and efficient transactions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.