Asia Pacific Fish Processing Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6931

December 2024

99

About the Report

Asia Pacific Fish Processing Market Overview

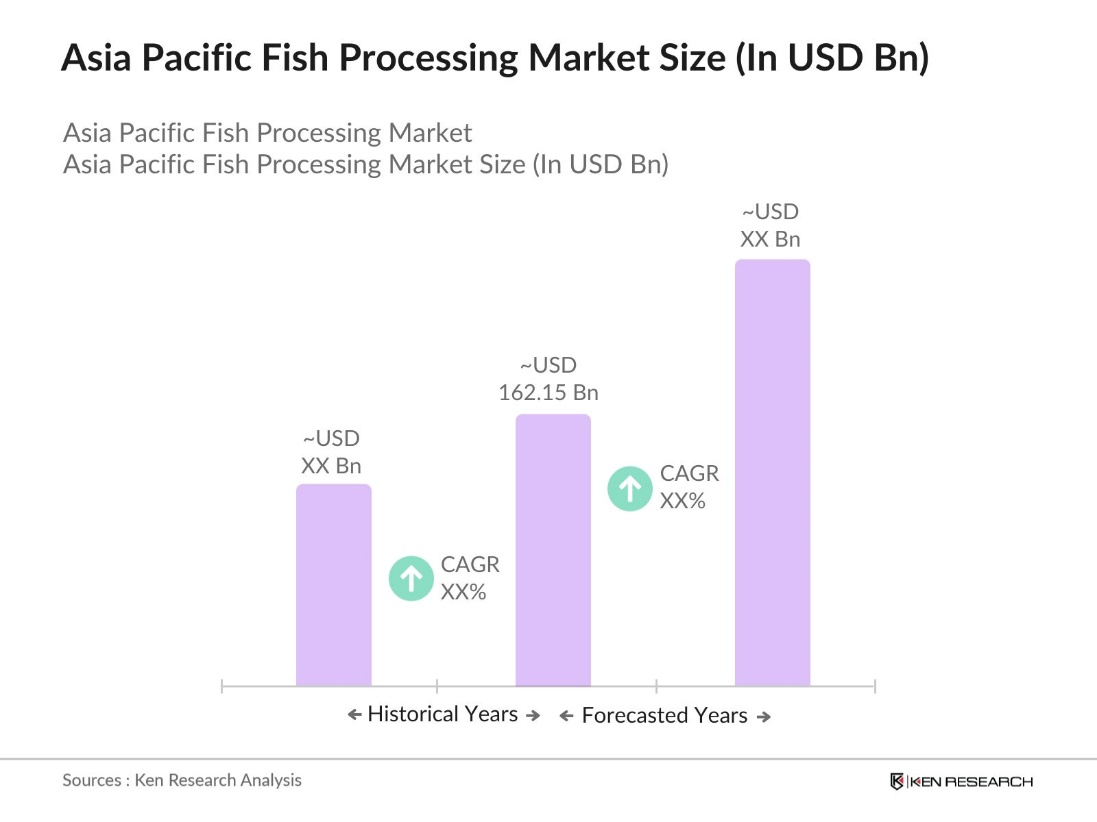

- The Asia Pacific fish processing market is valued at USD 162.15 billion, based on a comprehensive analysis of historical data. This sector's growth is driven by rising demand for processed seafood products due to the regions large urban populations, evolving consumer preferences, and increased export opportunities. Government support through subsidies and infrastructure investments in aquaculture has further fueled market expansion, making processed fish products an essential component of the regional food industry.

- China, Japan, and India stand out as dominant players in the Asia Pacific fish processing market. Chinas dominance is attributed to its expansive coastline, substantial seafood processing capabilities, and well-established export networks. Japan maintains a strong market position due to its high consumer demand for quality seafood, while India has emerged as a growing contributor due to the governments support for the aquaculture sector and its expanding seafood export operations.

- Food safety regulations are crucial in Asia Pacific, with countries such as Japan enforcing strict standards to ensure high-quality processed seafood. The Food Sanitation Act was revised earlier, with significant changes taking effect on June 1, 2020, rather than being newly implemented in 2023. The revisions included the introduction of a positive list system for food contact materials and the requirement for facilities to adhere to Hazard Analysis and Critical Control Points (HACCP) protocols.

Asia Pacific Fish Processing Market Segmentation

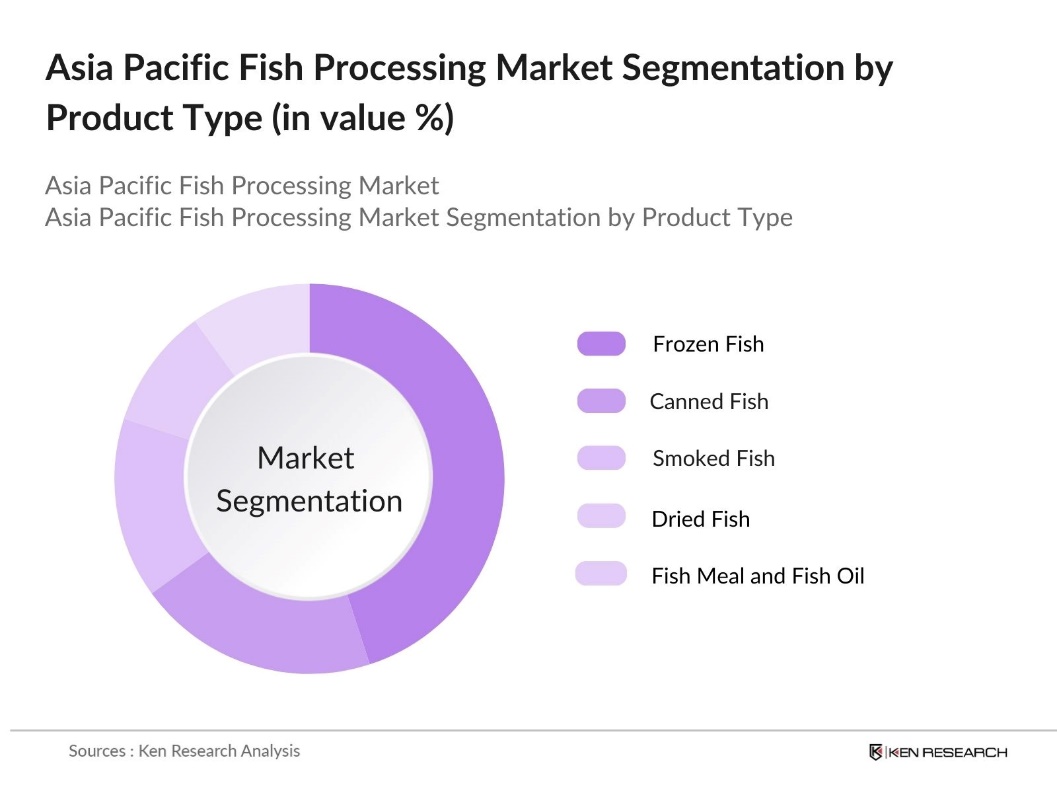

By Product Type: The market is segmented by product type into frozen fish, canned fish, smoked fish, dried fish, and fish meal and fish oil. Recently, frozen fish holds a dominant market share under the product type segment. Its popularity stems from the growing demand for high-quality seafood products that retain nutritional value. Frozen fish is favored for its longer shelf life, making it ideal for both domestic consumption and export.

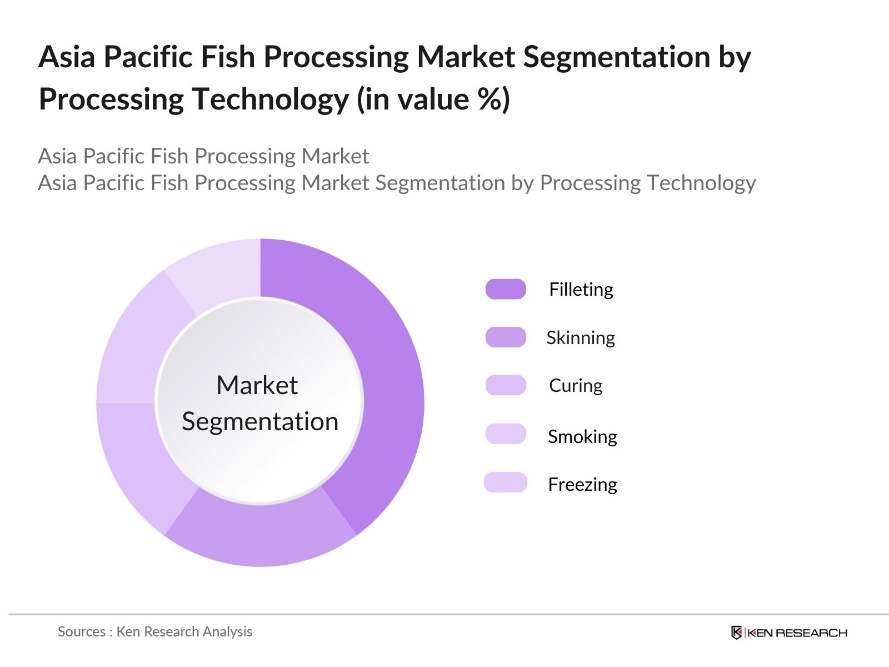

By Processing Technology: The market is further segmented by processing technology, including filleting, skinning, curing, smoking, and freezing. Filleting dominates this segment due to its importance in preserving product quality for high-end consumer markets. This sub-segments dominance is supported by a robust demand for ready-to-cook and value-added products. Key players in the market have also invested in advanced filleting technology to cater to consumer demand and to ensure minimal waste.

Asia Pacific Fish Processing Market Competitive Landscape

The Asia Pacific fish processing market is dominated by several major players, including global leaders and strong regional entities, whose influence shapes the competitive landscape. Companies like Thai Union Group and Maruha Nichiro Corporation exemplify the consolidation within the market, bringing expertise in production and distribution that strengthens their market positions.

Asia Pacific Fish Processing Industry Analysis

Growth Drivers

- Rising Demand for Processed Seafood: Demand for processed seafood in the Asia Pacific region has surged due to increased urbanization and busy consumer lifestyles. For instance, in 2024, urbanization rates in Asia hit 56.9%. This urban growth has driven a shift towards convenient, ready-to-eat seafood products, with seafood consumption now representing the protein intake in countries like Japan and South Korea. This shift supports the demand for processed fish products, contributing significantly to the market's growth.

- Increased Export Opportunities: Asia Pacific nations have intensified fish and seafood exports due to rising global demand. According to the 2024 FAO Fisheries and Aquaculture report, the region exported over 36 million metric tons (USD 159 billion) of fish. Countries like Vietnam, Thailand, and India have strategically increased export volumes, accounting for around 60% of global seafood exports. Government support for exporters, including subsidies and streamlined customs processes, has made Asia a leader in seafood trade.

- Technological Advancements in Processing: Technological innovations, like automation and advanced freezing methods, are enhancing fish processing efficiency in Asia Pacific. Automated filleting reduces waste, while improved freezing techniques extend seafood shelf life. These advancements lower costs, boost product quality, and support export standards. Government investments in technology upgrades further strengthen the regions competitive edge, advancing processing capabilities to meet growing global demand.

Market Challenges

- High Operational Costs: The Asia Pacific fish processing industry faces substantial operational costs, driven by high energy demands for freezing and cold storage and increased transportation expenses. Rising fuel prices also impact distribution costs, putting pressure on profit margins and limiting growth, especially for smaller processors. These challenges make cost management essential to ensure sustainable operations and maintain competitiveness in the global market.

- Environmental Concerns and Regulatory Constraints: Stringent environmental regulations significantly influence fish processing methods in Asia Pacific. Governments are implementing policies to reduce waste, control emissions, and promote sustainable practices, increasing operational costs. These regulations ensure environmental compliance but require processors to carefully balance growth objectives with adherence to regulatory standards, underscoring the sector's commitment to sustainability while maintaining industry expansion.

Asia Pacific Fish Processing Market Future Outlook

Over the coming years, the Asia Pacific fish processing market is projected to exhibit steady growth, driven by factors such as an expanding middle class, rising health consciousness, and the adoption of sustainable seafood sourcing practices. Key regional players are also expected to focus on technology improvements to reduce environmental impact and enhance efficiency. Regulatory support for sustainable fishing practices is anticipated to play a significant role in fostering long-term growth for the market.

Market Opportunities

- Expanding Demand for Value-Added Product: The Asia Pacific market is experiencing growing interest in value-added fish products, such as pre-marinated and filleted options, fueled by a rising preference for premium seafood. This shift opens opportunities for fish processors to diversify their product offerings, meeting evolving consumer tastes and enhancing profitability in both domestic and international markets. The demand for high-quality, ready-to-use seafood products drives expansion within the industry.

- Growth in Aquaculture Sector: The expansion of aquaculture across Asia Pacific is providing a steady, reliable supply of fish for processing, essential to meet increasing seafood demand. Investments in aquaculture infrastructure, particularly by countries with robust fisheries industries, are strengthening supply chains and supporting the processing sector. This growth aligns with the rising demand for seafood, offering substantial potential for the fish processing industry.

Scope of the Report

|

Product Type |

Frozen Fish Canned Fish Smoked Fish Dried Fish Fish Meal and Fish Oil |

|

Processing Technology |

Filleting Skinning Curing Smoking Freezing |

|

Distribution Channel |

Retail Food Service Institutional |

|

End-Use Industry |

Food & Beverage Pharmaceuticals Animal Feed Nutraceuticals |

|

Country |

China Japan India Thailand Vietnam |

Products

Key Target Audience

Seafood Processing Companies

Cold Chain Logistics Industry

Exporters and Importers

Retail and Food Service Chains

Environmental Organizations

Technology Providers for Fish Processing

Government and Regulatory Bodies (e.g., Ministry of Fisheries, Department of Marine Resources)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Thai Union Group

Nippon Suisan Kaisha, Ltd.

Maruha Nichiro Corporation

Charoen Pokphand Foods

Trident Seafoods Corporation

High Liner Foods Inc.

Tassal Group Limited

Austevoll Seafood ASA

Sanford Limited

Pescanova S.A.

Table of Contents

1. Asia Pacific Fish Processing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Fish Processing Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Fish Processing Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Processed Seafood

3.1.2 Increased Export Opportunities

3.1.3 Government Initiatives and Subsidies

3.1.4 Technological Advancements in Processing

3.2 Market Challenges

3.2.1 High Operational Costs

3.2.2 Environmental Concerns and Regulatory Constraints

3.2.3 Fluctuations in Fish Stock Availability

3.3 Opportunities

3.3.1 Expanding Demand for Value-Added Products

3.3.2 Growth in Aquaculture Sector

3.3.3 Increasing Adoption of Sustainable Processing Techniques

3.4 Trends

3.4.1 Rise in Cold Chain Logistics

3.4.2 Integration of Automation in Processing

3.4.3 Development of Ready-to-Cook and Ready-to-Eat Fish Products

3.5 Government Regulation

3.5.1 Food Safety Standards

3.5.2 Export Compliance and Certifications

3.5.3 Sustainable Fishing Quotas

3.5.4 Traceability and Labelling Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Asia Pacific Fish Processing Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Frozen Fish

4.1.2 Canned Fish

4.1.3 Smoked Fish

4.1.4 Dried Fish

4.1.5 Fish Meal and Fish Oil

4.2 By Processing Technology (In Value %)

4.2.1 Filleting

4.2.2 Skinning

4.2.3 Curing

4.2.4 Smoking

4.2.5 Freezing

4.3 By Distribution Channel (In Value %)

4.3.1 Retail

4.3.2 Food Service

4.3.3 Institutional

4.4 By End-Use Industry (In Value %)

4.4.1 Food & Beverage

4.4.2 Pharmaceuticals

4.4.3 Animal Feed

4.4.4 Nutraceuticals

4.5 By Country (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Thailand

4.5.5 Vietnam

5. Asia Pacific Fish Processing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Thai Union Group

5.1.2 Nippon Suisan Kaisha, Ltd.

5.1.3 Maruha Nichiro Corporation

5.1.4 Charoen Pokphand Foods

5.1.5 Dongwon Industries

5.1.6 Trident Seafoods Corporation

5.1.7 High Liner Foods Inc.

5.1.8 Tassal Group Limited

5.1.9 Austevoll Seafood ASA

5.1.10 Sanford Limited

5.1.11 Pescanova S.A.

5.1.12 Pacific Seafood Group

5.1.13 Sajo Industries Co., Ltd.

5.1.14 Marine Harvest ASA

5.1.15 Iceland Seafood International

5.2 Cross Comparison Parameters (Revenue, No. of Employees, Processing Capacity, Export Volume, Key Products, Sustainability Programs, Market Reach, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Fish Processing Market Regulatory Framework

6.1 Marine Resource Management Regulations

6.2 Export Compliance and Trade Policies

6.3 Food Safety and Hygiene Standards

6.4 Environmental Regulations and Sustainability Requirements

6.5 Certification Processes for Export

7. Asia Pacific Fish Processing Market Future Segmentation

7.1 By Product Type (In Value %)

7.2 By Processing Technology (In Value %)

7.3 By Distribution Channel (In Value %)

7.4 By End-Use Industry (In Value %)

7.5 By Country (In Value %)

8. Asia Pacific Fish Processing Market Analyst Recommendations

8.1 Market Entry Strategies

8.2 Product Positioning

8.3 Supply Chain Optimization

8.4 Emerging Market Opportunities

8.5 Consumer Preference Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase begins by mapping all primary stakeholders within the Asia Pacific Fish Processing Market. Extensive desk research is conducted using secondary and proprietary databases to identify crucial factors influencing the market.

Step 2: Market Analysis and Construction

Historical data from the fish processing market is compiled, focusing on aspects like market penetration, the balance between supply chain players, and resulting revenue. Further, quality assessments are conducted to validate data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formed and validated through interviews with industry experts. This step provides insights into operational trends and financial performance metrics directly from market practitioners.

Step 4: Research Synthesis and Final Output

Engagement with multiple seafood processing companies occurs to refine data and validate product-specific insights. This interaction ensures a comprehensive, accurate analysis that reflects the dynamics of the Asia Pacific Fish Processing Market.

Frequently Asked Questions

01. How big is the Asia Pacific Fish Processing Market?

The Asia Pacific Fish Processing Market was valued at USD 162.15 billion, driven by urbanization, rising seafood demand, and export growth, positioning it as a key contributor to the global seafood industry.

02. What are the major challenges in the Asia Pacific Fish Processing Market?

Challenges in Asia Pacific Fish Processing Market include high operational costs, regulatory constraints on fishing practices, and the environmental impact of processing activities, which require companies to invest in sustainable practices.

03. Who are the major players in the Asia Pacific Fish Processing Market?

Key players in Asia Pacific Fish Processing Market include Thai Union Group, Nippon Suisan Kaisha, Maruha Nichiro Corporation, and Charoen Pokphand Foods, each leveraging robust infrastructure and export networks to maintain dominance.

04. What drives growth in the Asia Pacific Fish Processing Market?

The Asia Pacific Fish Processing Market growth is propelled by factors like high domestic seafood demand, advancements in cold chain logistics, and government subsidies that support processing capabilities and export initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.