Asia Pacific Food and Beverage Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD1798

October 2024

97

About the Report

Asia Pacific Food and Beverage Market Overview

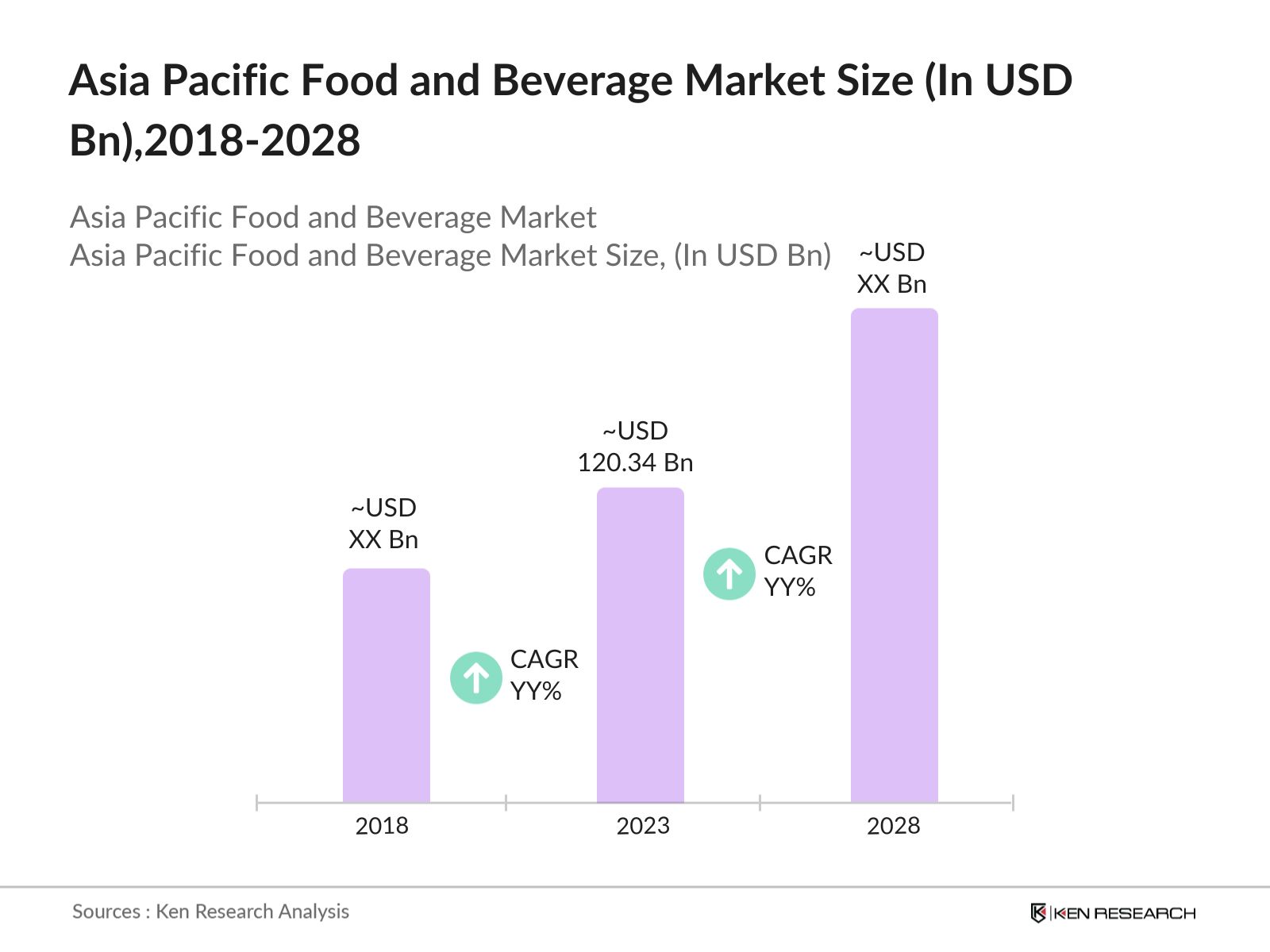

- The Asia Pacific Food and Beverage Market was valued at USD 120.34 billion in 2023. The market is expected to continue its upward, driven by evolving consumer preferences towards healthier food options, increased demand for convenience foods, and the growth of e-commerce platforms.

- The market is dominated by several key players are Nestl SA, PepsiCo Inc., Unilever PLC, Danone SA, and China Mengniu Dairy Company Limited. These companies have established strong brand recognition and extensive distribution networks across the region. Their strategic focus on product innovation, market expansion, and mergers and acquisitions has allowed them to maintain a competitive edge in the rapidly growing market.

- In 2023, the market witnessed a significant development with the acquisition of Yashili International Holdings Ltd by China Mengniu Dairy Company Limited. This acquisition, strengthening Mengniu's position in the infant formula segment, particularly in China. This move reflects the growing demand for premium dairy products in the region, driven by increasing consumer awareness of nutritional benefits and the rising purchasing power of middle-class families.

- China is the dominant market due to the country's large population, rising middle class, and increasing urbanization have driven the demand for a wide range of food and beverage products. Furthermore, the Chinese government's focus on food security and the modernization of agriculture has bolstered the domestic food industry.

Asia Pacific Food and Beverage Market Segmentation

The market is segmented into various factors like product, distribution channel, and region.

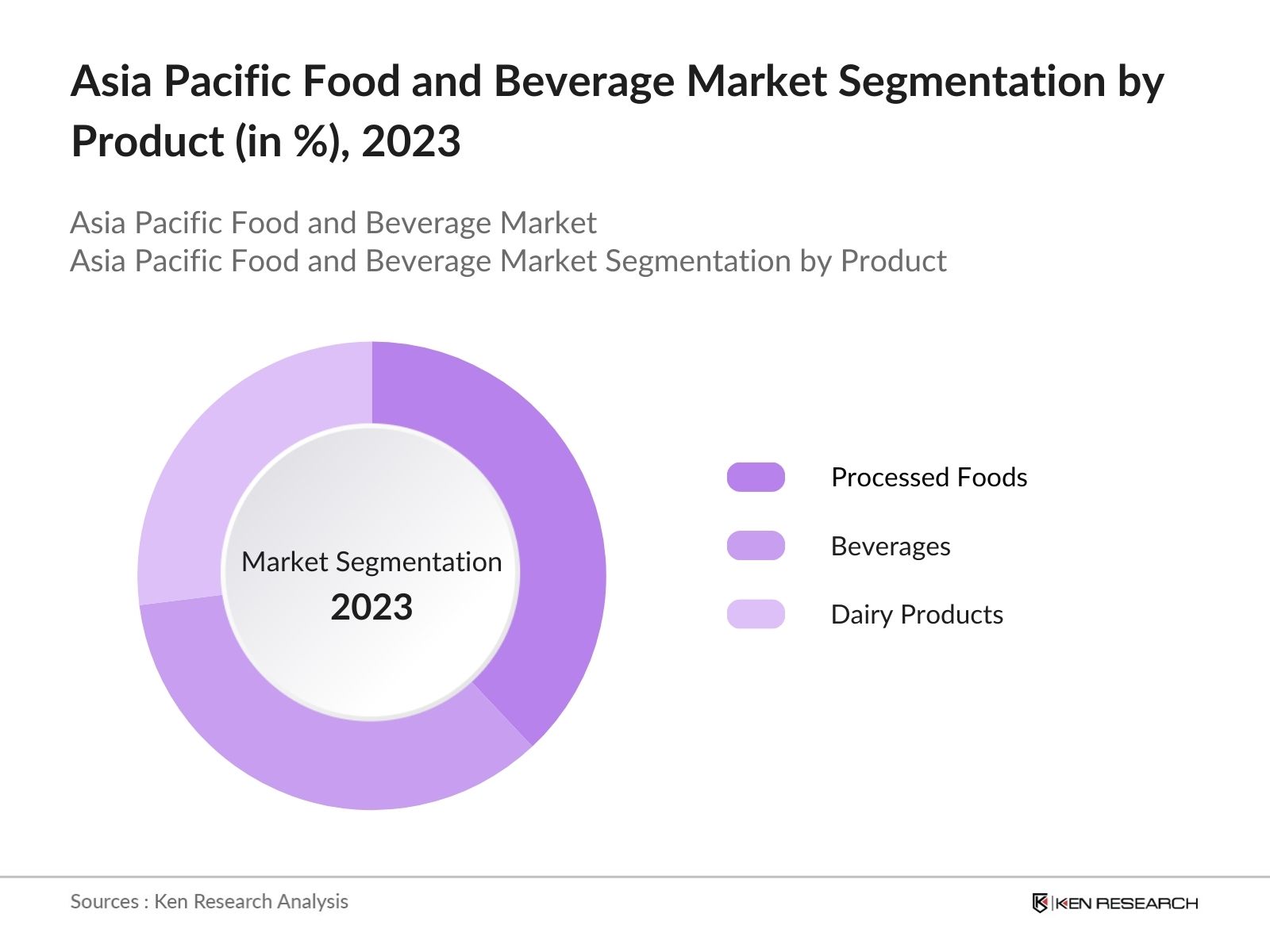

By Product: The market is segmented by product into processed foods, beverages, and dairy products. In 2023, processed foods held the largest market share, due to the growing demand for convenience foods, driven by busy lifestyles and the increasing number of working professionals in the region. Ready-to-eat meals, frozen foods, and snacks are particularly popular, with companies like Nestl and Unilever leading the segment.

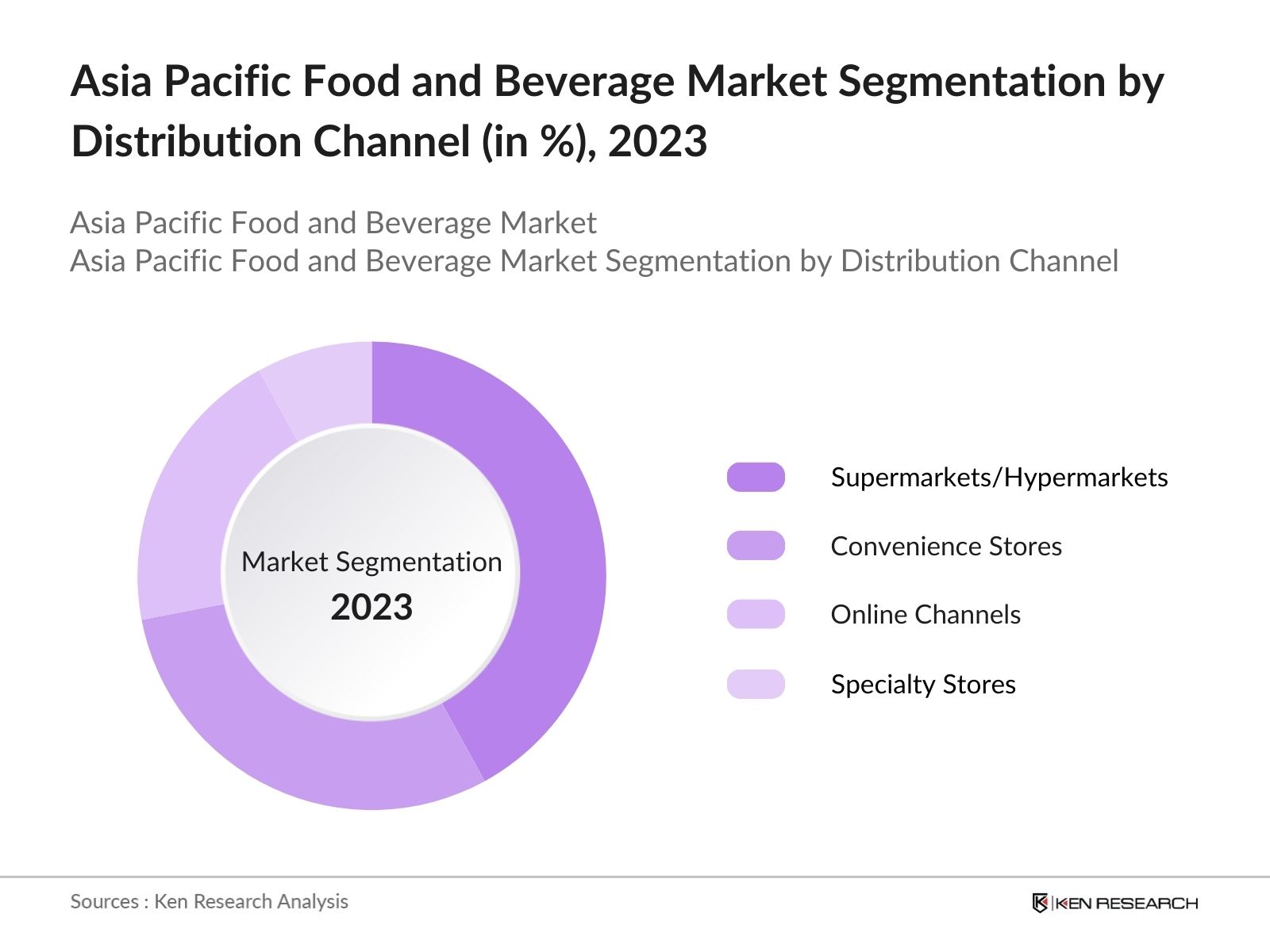

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online channels, and specialty stores. In 2023, supermarkets/hypermarkets dominated the distribution channel segment, with the widespread presence of these stores across urban and semi-urban areas, along with their ability to offer a wide variety of products under one roof, has made them the preferred shopping destination for consumers.

By Region: The market is segmented by region into China, South Korea, Japan, India, Australia, and the Rest of APAC. In 2023, China held the largest market share, due to increased consumer spending on food and beverage products, particularly in the premium and imported segments.

Asia Pacific Food and Beverage Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Nestl SA |

1867 |

Vevey, Switzerland |

|

PepsiCo Inc. |

1965 |

Purchase, USA |

|

Unilever PLC |

1930 |

London, UK |

|

Danone SA |

1919 |

Paris, France |

|

China Mengniu Dairy Company Ltd. |

1999 |

Hohhot, China |

- PepsiCo Inc.: In 2024, PepsiCo advanced its sustainable packaging initiative by developing biodegradable flexible packaging using polyhydroxyalkanoates (PHA). The new material aims to replace traditional polypropylene films and is designed to biodegrade in various environments, including landfills and oceans. While still undergoing certification, PepsiCo expects this innovation to significantly reduce plastic waste.

- Mondelez International: In June 2024, Arla Foods secured a brand partnership with Mondelz International to supply dairy ingredients for popular products like Philadelphia cream cheese. This collaboration is expected to generate annual sales of over 100 million units, significantly boosting Arla's position in the global dairy market and expanding Mondelzs product offerings.

Asia Pacific Food and Beverage Market Analysis

Market Growth Drivers

- Increasing Demand for Functional Beverages: The Asia Pacific region is witnessing a significant rise in the demand for functional beverages, driven by the growing consumer focus on health and wellness. In 2023, the sales of functional beverages, including energy drinks, sports drinks, and fortified juices, reached 2 billion units, reflecting a steady growth from previous years. The regions aging population and increasing prevalence of lifestyle-related diseases are primary factors driving this demand.

- Expansion of Organized Retail: The expansion of organized retail in India has been a major growth driver for the F&B sector. In 2024, organized retail channels, including supermarkets and hypermarkets, generated high sales. The growing footprint of these retail channels has improved product accessibility and availability, particularly in urban and semi-urban areas, leading to increased consumer spending on food and beverages.

- Investment in Cold Chain Infrastructure: The cold chain infrastructure is crucial for reducing post-harvest losses, enhancing food security, and increasing farmers' incomes. The Government of India has taken several measures to improve cold chain infrastructure, including thePradhan Mantri Kisan SAMPADA Yojana, which aims to leverage investment of INR 11,095.93 Cr and generate 5,44,432 direct/indirect employment by 2025-26.

Market Challenges

- Supply Chain Disruptions and Raw Material Shortages: The Asia Pacific food and beverage industry faces challenges due to ongoing supply chain disruptions and raw material shortages. This disruption has been exacerbated by geopolitical tensions and natural disasters, which have affected the production and transportation of key raw materials. As a result, food and beverage companies are facing increased production costs and delays in product delivery, impacting their ability to meet consumer demand.

- Environmental Concerns and Sustainability Issues: The Asia Pacific food and beverage sector is grappling with growing environmental concerns, particularly related to water scarcity, deforestation, and greenhouse gas emissions. In 2023, the region's agriculture sector, a major contributor to the food and beverage industry, consumed over 2.8 trillion cubic meters of water, leading to severe water stress in countries like India and China.

Government Initiatives

- Indias Production-Linked Incentive (PLI) Scheme for Food Processing: In December 2023, Indias food processing industry invested 7,126 crore under the Production-Linked Incentive (PLI) scheme, aimed at boosting domestic manufacturing and exports. The initiative supported over 70 projects, enhancing capacity by 1.5 million tons annually, and creating thousands of jobs, strengthening Indias position in the global food market.

- Chinas New Food Safety Regulations: In 2024, the Chinese government introduced stringent food safety regulations requiring all food and beverage companies to implement advanced traceability systems. These regulations are part of a broader effort to improve food safety standards in the country, following several high-profile food safety incidents in previous years. The implementation of these regulations is expected to increase the compliance costs for companies.

Asia Pacific Food and Beverage Market Future Outlook

The future trends in the Asia Pacific food and beverage industry include the rise of personalized nutrition products, expansion of alternative protein sources, integration of AI and IoT in food production, and an increased focus on sustainable and ethical sourcing practices.

Future Market Trends

- Rising Demand for Personalized Nutrition Products: Over the next five years, this market will see a significant increase in demand for personalized nutrition products, driven by advances in biotechnology and data analytics. By 2028, it is estimated that over 800 million consumers in the region will opt for customized dietary solutions that cater to their specific health needs, lifestyle preferences, and genetic profiles.

- Integration of AI and IoT in Food Production: The integration of artificial intelligence (AI) and the Internet of Things (IoT) in food production will revolutionize the industry over the next five years. By 2028, it is expected that over 10,000 food processing facilities in the region will adopt AI and IoT technologies to enhance production efficiency, reduce waste, and improve product quality.

Scope of the Report

|

By Product |

Processed Foods Beverages Dairy Products |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Channels Specialty Stores |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Packaging Companies

Logistics and Supply Chain Companies

Government Regulatory Bodies (e.g., FSSAI)

Financial Institutions and Investors

Health and Wellness Product Companies

Beverage Companies

Venture Capitalist

Companies

Players Mentioned in the Report:

Nestl SA

PepsiCo Inc.

Unilever PLC

Danone SA

China Mengniu Dairy Company Limited

Mondelez International

Coca-Cola Company

Fonterra Co-operative Group Limited

Yili Group

Kraft Heinz Company

Marico Limited

Wilmar International Limited

Suntory Beverage & Food Limited

Meiji Holdings Co., Ltd.

Kellogg's Asia Pacific

Table of Contents

1. Asia Pacific Food and Beverage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Food and Beverage Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Food and Beverage Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Functional Beverages

3.1.2. Expansion of E-commerce in the Food and Beverage Sector

3.1.3. Growing Popularity of Plant-Based Foods

3.1.4. Investment in Food Technology and Innovation

3.2. Restraints

3.2.1. Supply Chain Disruptions and Raw Material Shortages

3.2.2. Stringent Food Safety Regulations

3.2.3. Environmental Concerns and Sustainability Issues

3.2.4. Rising Production Costs Due to Inflation

3.3. Opportunities

3.3.1. Expansion into Rural Markets

3.3.2. Technological Advancements in Food Processing

3.3.3. Increased Focus on Organic and Natural Products

3.3.4. Growth in the Ready-to-Eat Meals Segment

3.4. Trends

3.4.1. Adoption of Sustainable Packaging Solutions

3.4.2. Integration of AI and IoT in Food Production

3.4.3. Increased Consumer Demand for Health and Wellness Products

3.4.4. Rise of Direct-to-Consumer (D2C) Channels

3.5. Government Regulations

3.5.1. Indias Production-Linked Incentive (PLI) Scheme

3.5.2. Chinas Food Safety Regulations

3.5.3. Australias Agricultural Innovation Program

3.5.4. Japans Food Export Expansion Strategy

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia Pacific Food and Beverage Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Processed Foods

4.1.2. Beverages

4.1.3. Dairy Products

4.2. By Distribution Channel (in Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Channels

4.2.4. Specialty Stores

4.3. By Region (in Value %)

4.3.1. China

4.3.2. South Korea

4.3.3. Japan

4.3.4. India

4.3.5. Australia

4.3.6. Rest of APAC

5. Asia Pacific Food and Beverage Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl SA

5.1.2. PepsiCo Inc.

5.1.3. Unilever PLC

5.1.4. Danone SA

5.1.5. China Mengniu Dairy Company Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia Pacific Food and Beverage Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Asia Pacific Food and Beverage Market Regulatory Framework

7.1. Food Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Asia Pacific Food and Beverage Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia Pacific Food and Beverage Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Distribution Channel (in Value %)

9.3. By Region (in Value %)

10. Asia Pacific Food and Beverage Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia Pacific Food and Beverage industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple food and beverage companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such food and beverage companies.

Frequently Asked Questions

01 How big is the Asia Pacific Food and Beverage market?

The Asia Pacific Food and Beverage Market was valued at USD 120.34 billion in 2023. The market is expected to continue its upward trajectory, driven by evolving consumer preferences towards healthier food options, increased demand for convenience foods, and the growth of e-commerce platforms.

02 What are the challenges in the Asia Pacific Food and Beverage market?

Challenges in the Asia Pacific Food and Beverage market include supply chain disruptions, stringent food safety regulations, environmental concerns related to sustainability, and rising production costs due to inflation and raw material shortages.

03 Who are the major players in the Asia Pacific Food and Beverage market?

Key players in the Asia Pacific Food and Beverage market include Nestl SA, PepsiCo Inc., Unilever PLC, Danone SA, and China Mengniu Dairy Company Limited, each of which has a significant influence on the market through product innovation and strategic partnerships.

04 What are the main growth drivers of the Asia Pacific Food and Beverage market?

The growth of the Asia Pacific Food and Beverage market include the rising demand for functional beverages, expansion of e-commerce platforms, growing popularity of plant-based foods, and significant investments in food technology and innovation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.