Asia Pacific Food Hydrocolloids Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD2141

December 2024

83

About the Report

Asia Pacific Food Hydrocolloids Market Overview

- The Asia Pacific Food Hydrocolloids Market was valued at USD 1.3 billion, primarily driven by the rising consumption of processed and convenience foods. As consumers become more health-conscious, the demand for low-fat and low-sugar alternatives that require hydrocolloids to maintain desirable textures has surged. Furthermore, food hydrocolloids are increasingly used in plant-based and vegan food products, which are gaining traction across the region.

- Leading players in this market include Cargill Inc., DuPont Nutrition & Biosciences, Kerry Group, Ingredion Incorporated, and CP Kelco. These companies have established their presence in the region through strategic investments in manufacturing facilities and R&D centers to cater to the growing demand for food hydrocolloids in multiple sectors.

- In November 2023, Cargill unveiled its first Cocoa Development Center in Gresik, Indonesia, to drive innovation and sustainability in the cocoa sector across Asia-Pacific. The center aims to support local farmers and develop products aligned with Asian consumer preferences. This initiative is part of Cargill's broader effort to enhance cocoa production using local resources, modern technology, and sensory innovation, benefiting both consumers and farmers in the region.

- In 2023, Shanghai, emerged as the dominant city in this market, attributed to its well-established food processing industry, advanced research and development capabilities, and proximity to raw material suppliers. Furthermore, the city's strategic location as a global trade hub allows for easy distribution to other regions, reinforcing its position as a market leader.

Asia Pacific Food Hydrocolloids Market Segmentation

The Asia Pacific Food Hydrocolloids Market is segmented into different factors like by product type, by application and region.

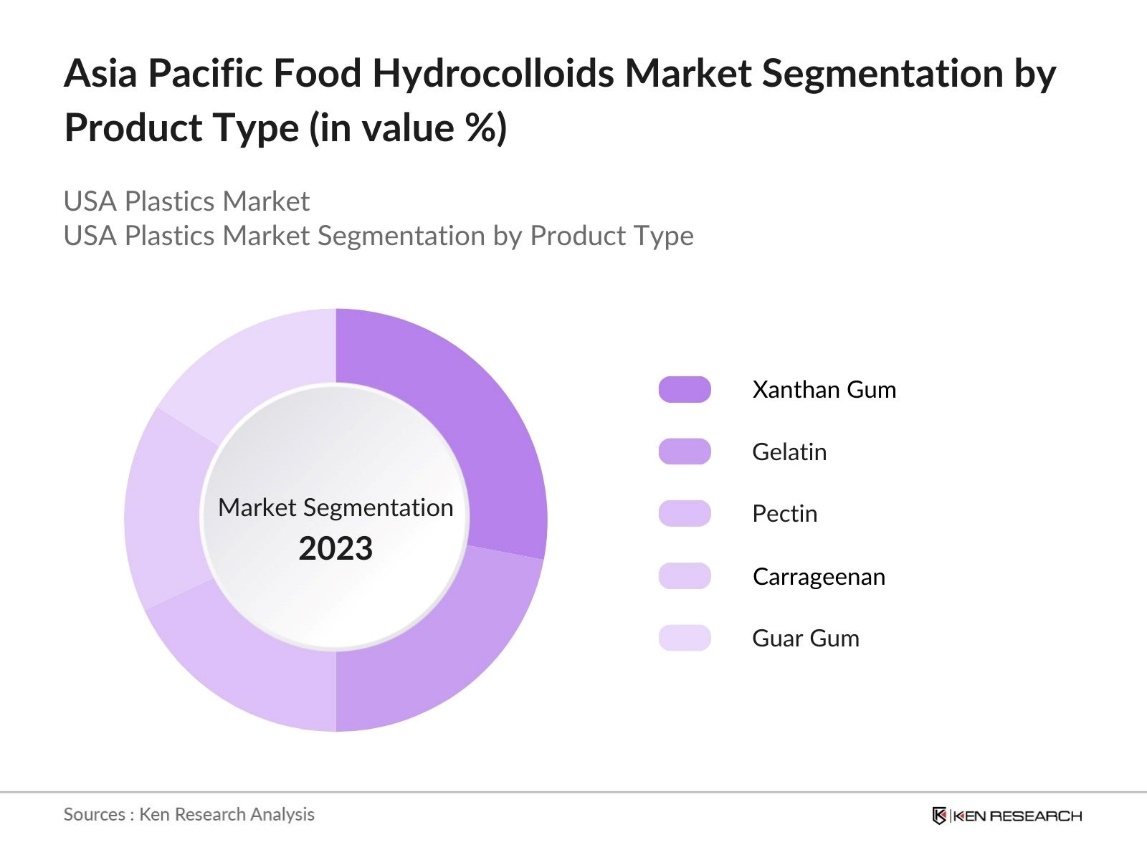

By Product Type The market is segmented by product type into gelatin, pectin, xanthan gum, carrageenan, and guar gum. In 2023, xanthan gum held a dominant market share due to its extensive use in bakery and dairy products for thickening and stabilizing. The growing trend towards gluten-free and vegan alternatives is further driving the demand for xanthan gum. Additionally, its ability to withstand a wide range of temperatures and pH levels makes it a versatile choice across various food applications.

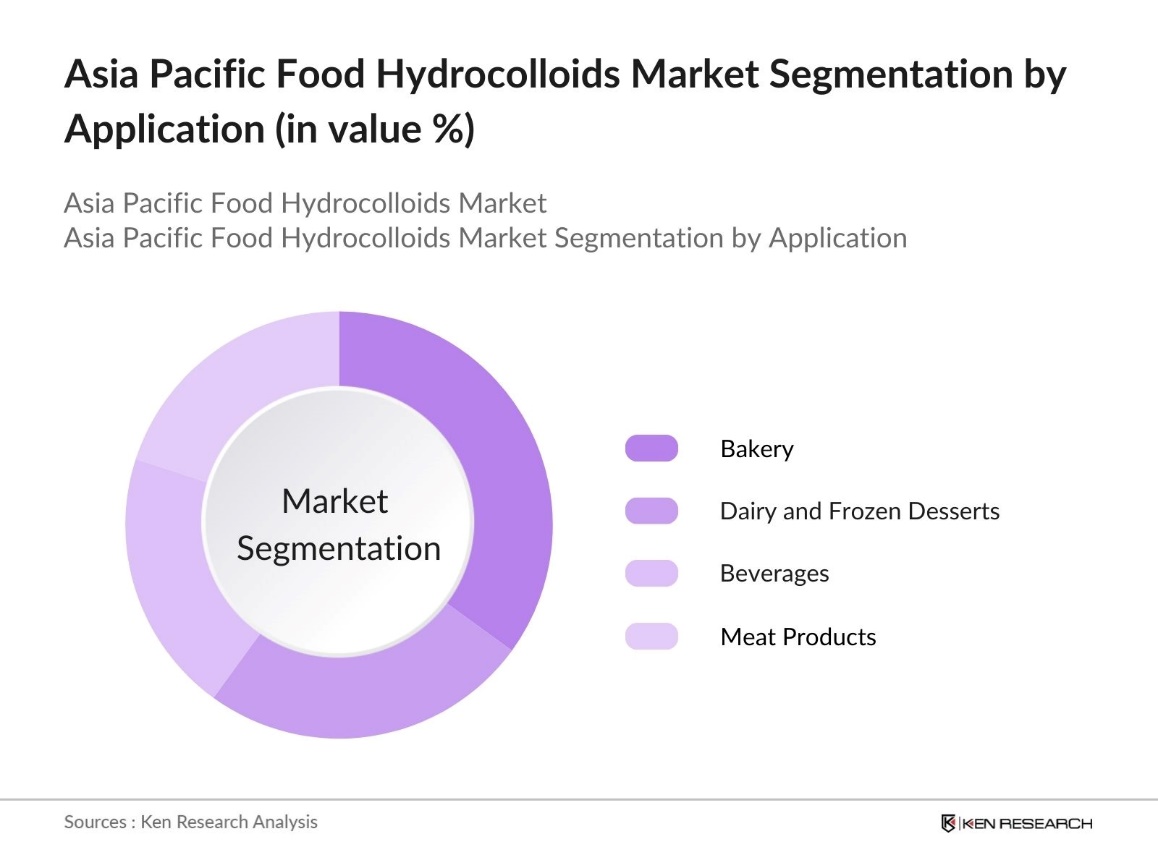

By Application The market is segmented by application into bakery, dairy and frozen desserts, beverages, and meat products. In 2023, the bakery segment dominated the market, driven by the increasing consumption of processed and packaged baked goods. The versatility of hydrocolloids in maintaining moisture and extending the shelf life of products has made them an essential ingredient in this segment. Innovations in gluten-free and low-fat baked goods are further bolstering their demand.

By Region The market is segmented by region into China, South Korea, Japan, India, Australia, and Rest of APAC. In 2023, China held a dominant market share, largely due to its large food processing sector, which accounts for a significant portion of its industrial output. The demand for hydrocolloids in processed foods, such as sauces, dressings, and dairy products, continues to rise as consumer preferences shift toward convenience foods.

Asia Pacific Food Hydrocolloids Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Cargill Inc. |

1865 |

Minnesota, USA |

|

DuPont de Nemours Inc. |

1802 |

Delaware, USA |

|

Kerry Group |

1972 |

Tralee, Ireland |

|

CP Kelco |

1934 |

Atlanta, USA |

|

Ashland Global Holdings |

1924 |

Kentucky, USA |

- CP Kelco: In April 2024, CP Kelco completed a $60 million expansion of its citrus fiber production capacity at its Mato, Brazil facility. This expansion increased the total production capacity to approximately 5,000 metric tons, driven by growing demand for sustainable and clean-label products. The citrus fiber products, including NUTRAVA and KELCOSENS, cater to a variety of applications in food, beverages, and personal care, supporting global demand for natural, label-friendly ingredients.

- Ashland Global Holdings: In 2021, Ashland Global Holdings introduced AquaFlow ECO-300, a high-shear, biocide-free, nonionic synthetic thickener designed for high-performance waterborne paints and coatings. This innovative thickener is highly efficient at building rheology and improving the consistency of paints and coatings by interacting effectively with other ingredients.

Asia Pacific Food Hydrocolloids Market Analysis

Growth Drivers

- Rising Consumer Demand for Clean-Label Ingredients: Consumers across the Asia Pacific region are increasingly prioritizing clean-label food products, with 74% considering 100% natural groceries important. This shift toward natural ingredients, such as pectin and xanthan gum, is driving manufacturers to reformulate their offerings. The trend is particularly strong in the bakery and dairy sectors, where hydrocolloids play a vital role in maintaining product quality while meeting consumer demand for natural, additive-free foods.

- Expansion of Plant-Based Food Products: The plant-based food industry in the Asia Pacific region is growing rapidly, fueled by increasing health and sustainability awareness. Innovations in food technology have enabled the creation of plant-based products that closely mimic the taste and texture of traditional animal-based foods. Food hydrocolloids, such as guar gum and carrageenan, are essential in achieving these textures, driving demand as consumption of vegan alternatives continues to rise.

- Increased Demand for Processed Foods: The demand for processed and packaged foods in the Asia Pacific region has surged, particularly in urban areas where convenience foods are preferred. Globally, ultra-processed foods now make up 25% to 60% of dietary intake in many middle- and high-income countries. Food hydrocolloids, essential for enhancing texture and stability in these products, are experiencing increased demand, and the market is expected to grow as processed food consumption continues to rise.

Challenges

- Limited Awareness Among Small-Scale Producers: Limited awareness among small and medium-sized food producers in the Asia Pacific region hinders the adoption of food hydrocolloids. Many producers, especially in rural areas, lack knowledge about their benefits and applications, slowing market penetration. Without targeted education and technical support, this gap is likely to persist, limiting the full potential of hydrocolloids in local food production.

- Environmental Concerns Around Synthetic Hydrocolloids: The use of synthetic hydrocolloids is raising environmental concerns, particularly regarding waste management and the carbon footprint linked to their production processes. With increasing pressure from regulatory bodies and consumers for more sustainable practices, there is a push for manufacturers to transition toward natural, eco-friendly alternatives. However, these greener solutions often come with higher production costs, posing challenges for businesses aiming to remain competitive while adopting sustainable methods.

Government Initiatives

- Uttar Pradesh Food Processing Industry Policy: The Uttar Pradesh Food Processing Industry Policy 2023 offers various incentives to boost food processing in the state. Key initiatives include a 35% subsidy on expenditure for plant and machinery (up to INR 5 crore) and 25% on modernization (up to INR 1 crore). The policy also grants 100% stamp duty exemptions for land purchases and provides 50% subsidies on solar power utilities in rural areas, along with support for cold chain infrastructure and agro-processing clusters.

- Chinas National Health Commission: In 2024, Chinas National Health Commission is developing or updating several food safety standards, including a new standard for food contact adhesives (GB 4806.15-2024), set to take effect in February 2025. The governments initiative also focuses on chemical migration from food contact materials and evaluating the use of recycled plastics in food contact applications. These updates align with Chinas efforts to strengthen food safety and environmental sustainability in the food packaging sector.

Asia Pacific Food Hydrocolloids Market Future Outlook

The Asia Pacific Food Hydrocolloids Market is projected to grow exponentially driven by continued innovation in food formulations and increasing health-conscious consumer behavior. The market is expected to see a rise in the use of hydrocolloids in plant-based alternatives, with China, India, and Japan being the key growth regions.

Future Market Trends

- Technological Innovations in Hydrocolloid Production: Technological advancements in hydrocolloid production processes are expected to reduce production costs. Innovations such as bio-based extraction methods and sustainable raw material sourcing will drive the development of new, eco-friendly hydrocolloid products. These advancements will help meet the rising demand for sustainable and clean-label food ingredients in the Asia Pacific region.

- Expansion of Functional Food Applications: The use of hydrocolloids in functional foods is set to grow exponentially as these ingredients will play a vital role in dietary supplements, fortified beverages, and probiotics, particularly in Japan and South Korea. The growth is driven by increasing consumer demand for health-enhancing food products, with additional support from government initiatives aimed at promoting functional food consumption. This trend highlights the expanding role of hydrocolloids in boosting the quality and functionality of health-focused food products.

Scope of the Report

|

By Product Type |

Xanthan Gum Gelatin Pectin Carrageenan Guar Gum |

|

By Application |

Bakery Dairy and Frozen Desserts Beverages Meat Products |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food Manufacturers

Processed Food Companies

Beverage Producing Companies

Dairy Product Manufacturers

Bakery and Confectionery Producers

Vegan Food Brands

Food Technologists

Packaging Companies

Government and Regulatory Bodies

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Cargill Inc.

DuPont de Nemours Inc.

Kerry Group

CP Kelco

Ashland Global Holdings

Tate & Lyle PLC

FMC Corporation

Ingredion Incorporated

Archer Daniels Midland Company

Corbion N.V.

Gelita AG

Fufeng Group

Darling Ingredients Inc.

Hawkins Watts Ltd.

Nexira

Table of Contents

1. Asia Pacific Food Hydrocolloids Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (Product Type, Application, Region)

1.3 Market Growth Rate (Financial Projections, Trends)

1.4 Market Segmentation Overview

2. Asia Pacific Food Hydrocolloids Market Size (Value in USD)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis (Volume, Revenue)

2.3 Key Market Developments and Milestones

3. Asia Pacific Food Hydrocolloids Market Analysis

3.1 Growth Drivers

3.1.1 Demand for Clean-Label Ingredients

3.1.2 Growth in Processed Food Consumption

3.1.3 Rising Plant-Based and Vegan Food Demand

3.1.4 Technological Advancements in Hydrocolloid Extraction

3.2 Restraints

3.2.1 Fluctuating Raw Material Prices (Supply Chain, Production Costs)

3.2.2 Regulatory Hurdles and Approval Delays (Compliance, Legislation)

3.2.3 Limited Market Penetration in Rural Areas (Access, Infrastructure)

3.2.4 Environmental Concerns with Synthetic Hydrocolloids

3.3 Opportunities

3.3.1 Expansion in Functional Foods and Beverages

3.3.2 Growing Demand for Natural Hydrocolloids (Sustainability)

3.3.3 Adoption of Hydrocolloids in Emerging Economies

3.3.4 Collaboration with Local Producers

3.4 Trends

3.4.1 Clean-Label Movement

3.4.2 Growth in Plant-Based and Dairy Alternatives

3.4.3 Use of Hydrocolloids in Low-Fat and Sugar-Reduced Foods

3.4.4 Expansion of E-commerce for Ingredient Procurement

3.5 Government Regulations

3.5.1 Food Safety Standards in China and India (Biodegradable Packaging)

3.5.2 Subsidies for Processed Food Companies (Uttar Pradesh Policy 2023)

3.5.3 Clean-Label Certification Programs (Asia Pacific)

3.5.4 Initiatives Promoting Local Manufacturing of Hydrocolloids

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. Asia Pacific Food Hydrocolloids Market Segmentation

4.1 By Product Type (Value in USD)

4.1.1 Xanthan Gum

4.1.2 Pectin

4.1.3 Gelatin

4.1.4 Carrageenan

4.1.5 Guar Gum

4.2 By Application (Value in USD)

4.2.1 Bakery

4.2.2 Dairy & Frozen Desserts

4.2.3 Beverages

4.2.4 Meat Products

4.3 By Source (Value in USD)

4.3.1 Plant-Based (Pectin, Guar Gum)

4.3.2 Animal-Based (Gelatin)

4.3.3 Microbial-Based (Xanthan Gum)

4.3.4 Seaweed-Based (Carrageenan)

4.4 By Functionality (Value in USD)

4.4.1 Thickening Agents

4.4.2 Gelling Agents

4.4.3 Stabilizers

4.4.4 Emulsifiers

4.5 By Region (Value in USD)

4.5.1 China

4.5.2 Japan

4.5.3 South Korea

4.5.4 India

4.5.5 Australia

4.5.6 Rest of APAC

5. Asia Pacific Food Hydrocolloids Market Competitive Landscape

5.1 Market Share Analysis (Top Players, Regional Players)

5.2 Strategic Initiatives (Joint Ventures, Collaborations)

5.3 Mergers and Acquisitions

5.4 Investment Analysis

5.4.1 Private Equity and Venture Capital Investments

5.4.2 Government Grants and Subsidies

5.5 Company Profiles

5.5.1 Cargill Inc.

5.5.2 DuPont de Nemours Inc.

5.5.3 Kerry Group

5.5.4 CP Kelco

5.5.5 Ashland Global Holdings

5.5.6 Ingredion Incorporated

5.5.7 Tate & Lyle PLC

5.5.8 Archer Daniels Midland Company

5.5.9 Fufeng Group

5.5.10 Gelita AG

5.5.11 Nexira

5.5.12 Corbion N.V.

5.5.13 Darling Ingredients

5.5.14 Hawkins Watts Ltd.

5.5.15 FMC Corporation

5.6 Cross-Comparison of Competitors (Inception Year, Revenue, Geographic Reach)

6. Asia Pacific Food Hydrocolloids Market Regulatory Framework

6.1 Food Safety Regulations (Compliance, Standards)

6.2 Labeling Requirements (Clean Label, Health Claims)

6.3 Import and Export Laws (Tariffs, Quotas)

7. Asia Pacific Food Hydrocolloids Future Market Size (Value in USD)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Food Hydrocolloids Future Market Segmentation

8.1 By Product Type (Value in USD)

8.2 By Application (Value in USD)

8.3 By Source (Value in USD)

8.4 By Functionality (Value in USD)

8.5 By Region (Value in USD)

9. Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Product Development and R&D Opportunities

9.3 Strategic Market Entry Recommendations

9.4 Customer Acquisition Strategies

Contact US

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Asia Pacific Food Hydrocolloids Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia Pacific Food Hydrocolloids Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from chemical companies.

Frequently Asked Questions

01 How big is the Asia Pacific Food Hydrocolloids Market?

The Asia Pacific Food Hydrocolloids Market was valued at USD 1.3 billion, driven by increased demand for processed foods, clean-label ingredients, and plant-based alternatives.

02 What are the challenges in the Asia Pacific Food Hydrocolloids Market?

Challenges in Asia Pacific Food Hydrocolloids Market include fluctuating raw material prices, regulatory hurdles, environmental concerns about synthetic hydrocolloids, and limited awareness among small-scale producers regarding the benefits of hydrocolloids.

03 Who are the major players in the Asia Pacific Food Hydrocolloids Market?

Key players in Asia Pacific Food Hydrocolloids Market include Cargill Inc., DuPont de Nemours Inc., Kerry Group, CP Kelco, and Ashland Global Holdings, who dominate the market through strong R&D, innovation, and extensive distribution networks.

04 What are the growth drivers of the Asia Pacific Food Hydrocolloids Market?

Key drivers in Asia Pacific Food Hydrocolloids Market include the rise in demand for clean-label ingredients, the expansion of processed foods, growing plant-based food consumption, and increasing applications of hydrocolloids in functional foods and beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.