Asia Pacific Food Packaging Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5300

December 2024

83

About the Report

Asia Pacific Food Packaging Market Overview

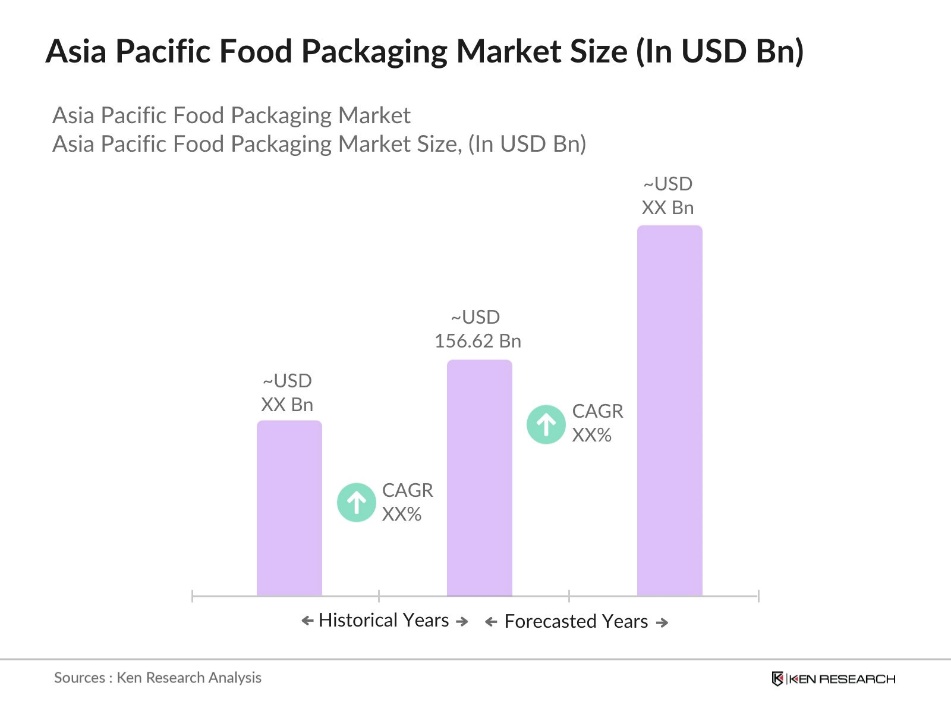

- The Asia-Pacific Food Packaging Market, based on a five-year historical analysis, is valued at USD 156.62 billion. The market has been driven by the growing demand for packaged and processed food, urbanization, and the increasing adoption of sustainable packaging solutions. The demand for convenience food is rising, coupled with the heightened need for long shelf life and food safety, contributing to the packaging industry's expansion. Regulatory pressure to reduce plastic waste is pushing companies to adopt recyclable and biodegradable packaging solutions.

- Countries such as China, India, and Japan dominate the food packaging market in the Asia-Pacific region. China leads due to its massive food manufacturing sector and high consumption of packaged goods, particularly driven by its expanding urban population and increased disposable income. Indias growing e-commerce sector and consumer inclination towards convenience foods have propelled its role in the market, while Japans advanced technology in packaging and focus on eco-friendly solutions enhance its dominance.

- Australia's 2025 National Packaging Targets aim for 100% recyclable, reusable, or compostable packaging and the phase-out of single-use plastics by the end of 2025. While significant progress has been made, recent data shows that the targets are unlikely to be fully met. However, the Australian Packaging Covenant Organization (APCO) continues to encourage collaboration between industry, government, and consumers to push toward achieving these goals, fostering a transition to a circular economy for packaging.

Asia Pacific Food Packaging Market Segmentation

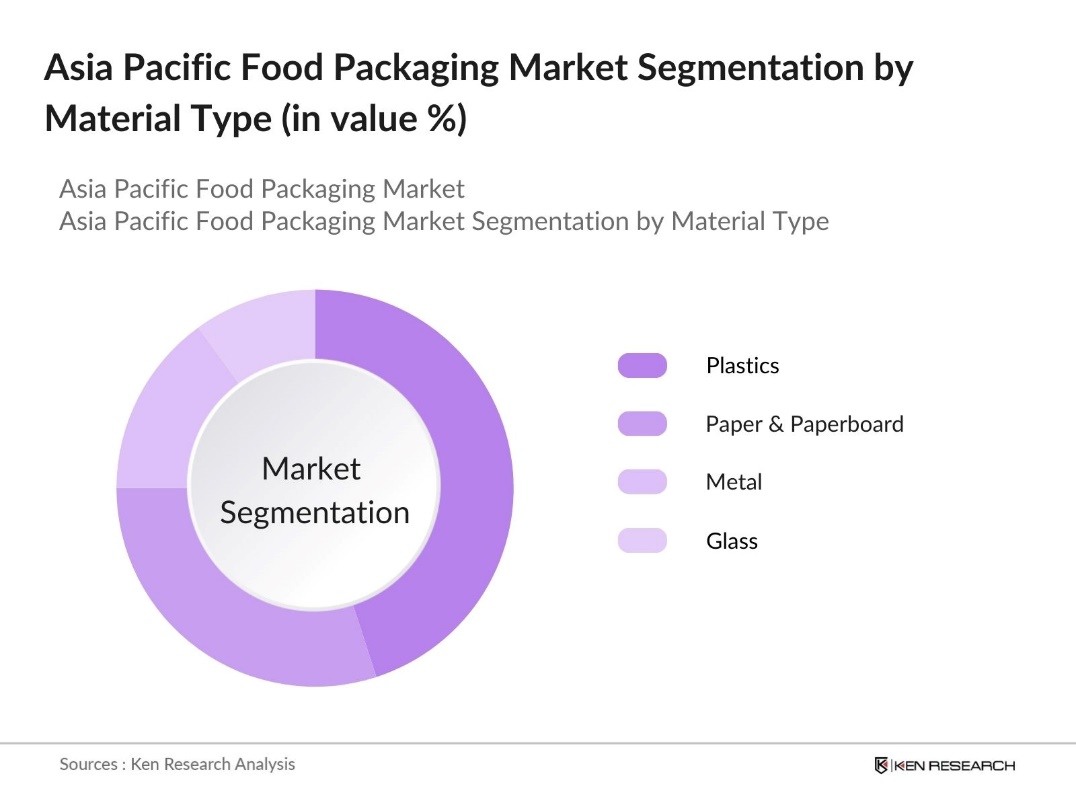

By Material Type: The Asia-Pacific Food Packaging market is segmented by material type into plastics, paper & paperboard, metal, and glass. Recently, plastics hold a dominant market share under this segmentation due to their affordability and versatility in food packaging. However, the increasing regulations on single-use plastics have led to a gradual shift towards recyclable plastics, which continues to see high usage in processed food, frozen food, and takeaway packaging.

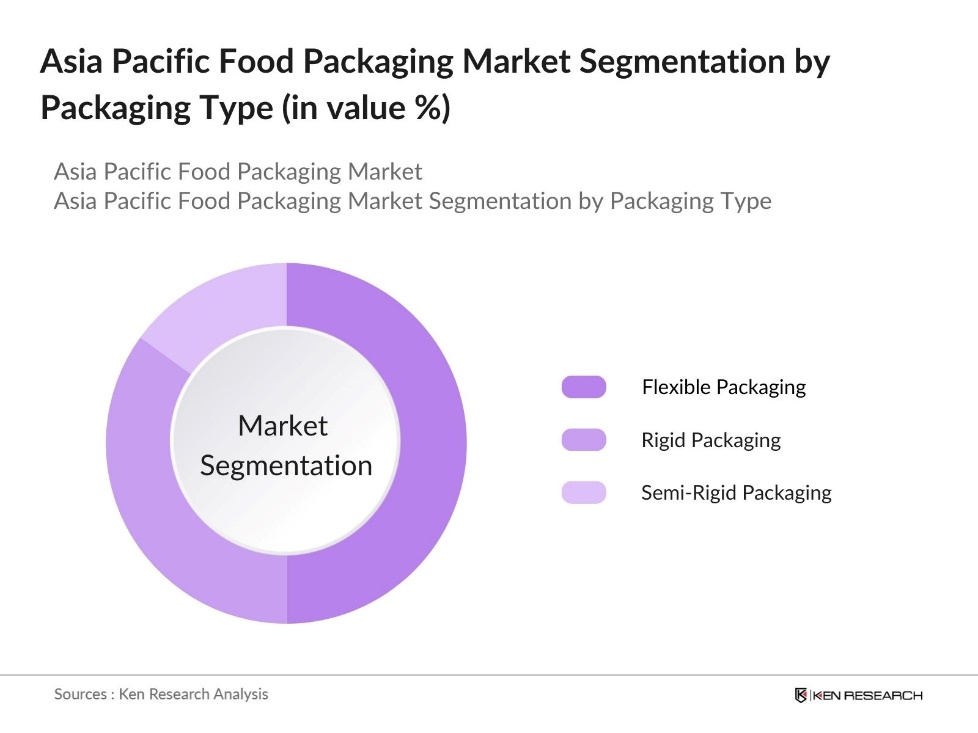

By Packaging Type: The Asia-Pacific Food Packaging market is segmented by packaging type into rigid packaging, flexible packaging, and semi-rigid packaging. Flexible packaging holds a significant share of the market as it offers enhanced durability, lightweight properties, and cost-effectiveness, making it a preferred choice for manufacturers. It is extensively used for snacks, frozen foods, and beverages, due to its superior barrier properties that protect products from contamination and extend shelf life.

Asia Pacific Food Packaging Market Competitive Landscape

The market is dominated by a mix of global and regional players, with significant market consolidation. The competition is marked by innovation in sustainable packaging solutions, mergers, and acquisitions. The use of eco-friendly materials and smart packaging solutions is a trend being adopted by major companies to gain a competitive edge. Major players focus on expanding their production capacities and entering into strategic partnerships to maintain their market position.

|

Company |

Establishment Year |

Headquarters |

Key Parameter 1 |

Key Parameter 2 |

Key Parameter 3 |

Key Parameter 4 |

Key Parameter 5 |

Key Parameter 6 |

|

Amcor Plc |

1860 |

Melbourne, Australia |

||||||

|

Mondi Group |

1967 |

Johannesburg, South Africa |

||||||

|

Tetra Pak International SA |

1951 |

Lausanne, Switzerland |

||||||

|

Huhtamaki Oyj |

1920 |

Espoo, Finland |

||||||

|

Sealed Air Corporation |

1960 |

Charlotte, USA |

Asia Pacific Food Packaging Industry Analysis

Growth Drivers

- Increased Consumer Awareness on Sustainable Packaging: Consumers in Asia-Pacific are becoming increasingly aware of the environmental impact of plastic waste, leading to higher demand for sustainable packaging. In 2023, countries like Australia and Japan introduced stricter regulations on single-use plastics, pushing companies to adopt biodegradable alternatives. The environmental regulations and consumer behavior shifts increase in the production of sustainable packaging materials in the region.

- Rapid Urbanization: Urbanization in the Asia-Pacific region is fueling the demand for packaged food. In 2024, Indias urban population rise up to 35-37%, this also increasing the consumption of packaged products. This rise in urban dwellers leads to a greater need for efficient packaging to meet food safety standards and facilitate transportation. The urbanization also increases in the regions packaged food consumption, particularly in metropolitan areas.

- Rising Demand for Convenient Food Products: The demand for convenient food products in the Asia-Pacific region is rising due to changes in lifestyle and growing urbanization. Countries such as China, India, and Japan are witnessing a shift in consumer preferences towards ready-to-eat meals and packaged foods. As more people migrate to cities, the need for durable and convenient packaging solutions grows, driving the food packaging market. This trend is supported by the region's increasing focus on time-saving products that cater to busy lifestyles, which in turn fuels the demand for efficient and sustainable packaging options.

Market Challenges

- High Production Costs of Eco-friendly Packaging: The production of eco-friendly packaging materials poses a significant challenge in the Asia-Pacific market. The manufacturing costs for biodegradable and sustainable packaging are generally higher than for traditional plastic alternatives. This cost difference makes it difficult for small and medium-sized enterprises (SMEs) to adopt these greener options, as the switch could affect their profit margins. Despite growing demand for sustainable packaging, the higher costs remain a barrier to widespread adoption, slowing the transition to environmentally friendly solutions in the region.

- Complex Regulatory Environment: The Asia-Pacific region faces a complex regulatory environment for food packaging. Different countries have varying standards and regulations, which makes it challenging for companies operating in multiple markets to stay compliant. Stricter regulations in some countries, such as Japan and South Korea, contrast with more lenient rules in others, like Indonesia, creating difficulties for manufacturers in streamlining their production and distribution processes. Navigating these regulatory discrepancies often leads to delays and additional costs, particularly for companies with cross-border operations.

Asia Pacific Food Packaging Market Future Outlook

Over the next five years, the Asia-Pacific Food Packaging Market is expected to exhibit robust growth, driven by the increasing consumption of packaged food, growing e-commerce penetration, and government initiatives towards sustainable packaging. The rising awareness of environmental impacts has led to a significant shift towards recyclable, biodegradable, and eco-friendly materials in the food packaging industry. The flexible packaging segment, in particular, is anticipated to witness substantial growth, owing to its cost efficiency and superior protection qualities.

Market Opportunities

- Adoption of Innovative and Biodegradable Packaging: The Asia-Pacific region presents significant opportunities for the growth of innovative and biodegradable packaging. As companies increasingly shift from conventional plastic to eco-friendly alternatives, there has been a marked rise in interest toward research and development (R&D) in advanced packaging solutions. Government incentives in various countries, such as Australia and Japan, have further encouraged manufacturers to adopt sustainable packaging methods.

- Expansion of E-commerce and Online Food Delivery: The rapid expansion of e-commerce and online food delivery services in the Asia-Pacific region has driven demand for durable, secure food packaging. As more consumers turn to digital platforms for purchasing food products, the packaging industry faces increasing pressure to provide solutions that ensure safety and convenience. E-commerce growth, particularly in large urban centers, has contributed to the demand for packaging that meets the logistical and protective needs of online food delivery.

Scope of the Report

|

Material Type |

Plastics Paper & Paperboard Metal Glass |

|

Packaging Type |

Rigid Packaging Flexible Packaging Semi-Rigid Packaging |

|

Application |

Dairy Products Bakery & Confectionery Meat Poultry and Seafood Beverages Processed Food |

|

End-User |

Retail & E-commerce Foodservice Institutional Sales |

|

Region |

China Japan India Southeast Asia Australia & New Zealand |

Products

Key Target Audience

Food and Beverage Manufacturers

Retailers and E-commerce Companies

Packaging Manufacturers

Recycling and Waste Management Companies

Government and Regulatory Bodies (Ministry of Environment, Ministry of Food Processing Industries)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Amcor Plc

Mondi Group

Tetra Pak International SA

Huhtamaki Oyj

Sealed Air Corporation

DS Smith Plc

Ball Corporation

Crown Holdings Inc.

WestRock Company

Toyo Seikan Group

Oji Holdings Corporation

Berry Global Inc.

Stora Enso Oyj

Sonoco Products Company

UFlex Ltd.

Table of Contents

1. Asia-Pacific Food Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia-Pacific Food Packaging Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia-Pacific Food Packaging Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Convenient Food Products

3.1.2 Increased Consumer Awareness on Sustainable Packaging

3.1.3 Rapid Urbanization

3.1.4 Government Regulations on Plastic Waste

3.2 Market Challenges

3.2.1 High Production Costs of Eco-friendly Packaging

3.2.2 Complex Regulatory Environment

3.2.3 Volatile Raw Material Prices

3.2.4 Lack of Infrastructure for Recycling

3.3 Opportunities

3.3.1 Adoption of Innovative and Biodegradable Packaging

3.3.2 Expansion of E-commerce and Online Food Delivery

3.3.3 Technological Advancements in Packaging Materials

3.3.4 Rising Investments in Sustainable Packaging Solutions

3.4 Trends

3.4.1 Shift Towards Minimalistic Packaging

3.4.2 Growth of Smart Packaging with QR Codes and Sensors

3.4.3 Increasing Use of Recyclable Materials

3.4.4 Customization of Packaging for Premium Products

3.5 Government Regulation

3.5.1 Bans on Single-Use Plastics

3.5.2 Incentives for Adoption of Sustainable Packaging

3.5.3 Regulations for Labeling and Traceability

3.5.4 National Initiatives for Waste Management

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.7.1 Suppliers of Raw Materials

3.7.2 Packaging Manufacturers

3.7.3 Retailers and Food Producers

3.8 Porters Five Forces

3.8.1 Bargaining Power of Suppliers

3.8.2 Bargaining Power of Buyers

3.8.3 Threat of New Entrants

3.8.4 Threat of Substitutes

3.8.5 Industry Rivalry

3.9 Competition Ecosystem

3.9.1 Competitive Positioning of Key Players

3.9.2 Market Share Analysis

4. Asia-Pacific Food Packaging Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Plastics

4.1.2 Paper & Paperboard

4.1.3 Metal

4.1.4 Glass

4.2 By Packaging Type (In Value %)

4.2.1 Rigid Packaging

4.2.2 Flexible Packaging

4.2.3 Semi-Rigid Packaging

4.3 By Application (In Value %)

4.3.1 Dairy Products

4.3.2 Bakery & Confectionery

4.3.3 Meat, Poultry, and Seafood

4.3.4 Beverages

4.3.5 Processed Food

4.4 By End-User (In Value %)

4.4.1 Retail & E-commerce

4.4.2 Foodservice

4.4.3 Institutional Sales

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Southeast Asia

4.5.5 Australia & New Zealand

5. Asia-Pacific Food Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amcor Plc

5.1.2 Mondi Group

5.1.3 Tetra Pak International SA

5.1.4 Sealed Air Corporation

5.1.5 Huhtamaki Oyj

5.1.6 DS Smith Plc

5.1.7 Ball Corporation

5.1.8 Crown Holdings Inc.

5.1.9 WestRock Company

5.1.10 Toyo Seikan Group

5.1.11 Oji Holdings Corporation

5.1.12 Berry Global Inc.

5.1.13 Stora Enso Oyj

5.1.14 Sonoco Products Company

5.1.15 UFlex Ltd.

5.2 Cross Comparison Parameters (Headquarters, No. of Employees, Market Share, Revenue)

5.3 Strategic Initiatives

5.4 Mergers and Acquisitions

5.5 Investment Analysis

5.6 Venture Capital Funding

5.7 Government Grants

5.8 Private Equity Investments

6. Asia-Pacific Food Packaging Market Regulatory Framework

6.1 Packaging Material Compliance

6.2 Environmental and Waste Disposal Regulations

6.3 Food Safety and Labeling Requirements

6.4 Recycling Standards

7. Asia-Pacific Food Packaging Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia-Pacific Food Packaging Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Packaging Type (In Value %)

8.3 By Application (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Asia-Pacific Food Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia-Pacific Food Packaging Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed. This includes assessing market penetration, packaging material types, and revenue generation. Evaluating the consumption of various packaging materials is crucial to ensuring the accuracy of our projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through consultations with industry experts representing companies across the packaging industry. These consultations provide operational insights and financial data to corroborate the market analysis.

Step 4: Research Synthesis and Final Output

The final phase engages multiple packaging manufacturers to acquire detailed insights into product segments, sales performance, and innovations. This interaction serves to validate the statistics derived from our approach, ensuring an accurate and comprehensive analysis of the Asia-Pacific Food Packaging Market.

Frequently Asked Questions

01. How big is the Asia-Pacific Food Packaging Market?

The Asia-Pacific Food Packaging Market is valued at USD 156.62 billion, driven by growing demand for convenience food, urbanization, and eco-friendly packaging solutions.

02. What are the challenges in the Asia-Pacific Food Packaging Market?

Challenges in Asia-Pacific Food Packaging Market include fluctuating raw material prices, stringent environmental regulations, and the high cost of developing sustainable packaging solutions. Lack of recycling infrastructure is also a growing concern in many countries.

03. Who are the major players in the Asia-Pacific Food Packaging Market?

Major players in Asia-Pacific Food Packaging Market include Amcor Plc, Mondi Group, Tetra Pak International SA, Huhtamaki Oyj, and Sealed Air Corporation, each holding strong positions through innovation, sustainability, and extensive global reach.

04. What are the growth drivers of the Asia-Pacific Food Packaging Market?

The Asia-Pacific Food Packaging Market is driven by the rise in demand for packaged food, government regulations encouraging sustainable packaging, technological advancements in packaging materials, and growing e-commerce.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.