Asia Pacific Food Service Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD6042

November 2024

80

About the Report

Asia Pacific Food Service Market Overview

- The Asia Pacific food service market is currently valued at USD 406 billion, driven by a combination of urbanization, rising disposable incomes, and changing consumer preferences. With an increasing number of consumers opting for dining out and ordering food online, the market has seen consistent growth over the past five years. This growth is also supported by the expansion of quick service restaurants (QSRs), cafs, and full-service dining chains, which cater to the region's evolving taste preferences and convenience-driven demand.

- Dominant countries in this market include China, Japan, and India, driven by their massive population bases, high levels of urbanization, and a growing middle class with disposable income. China leads due to its rapid economic development and the proliferation of both international and local food chains, especially in urban centers like Beijing and Shanghai. Japan's dominance is attributed to its well-established food service sector and innovations in food delivery services.

- Labor laws and minimum wage regulations across the Asia Pacific region continue to impact the food service industry. For example, As of July 1, 2023, the National Minimum Wage in Australia was indeed increased to AUD 23.23 per hour. This wage increase, coupled with stricter labor laws, has resulted in higher labor costs for food service operators. These labor regulations have prompted businesses to adapt their operating models to absorb the increased costs.

Asia Pacific Food Service Market Segmentation

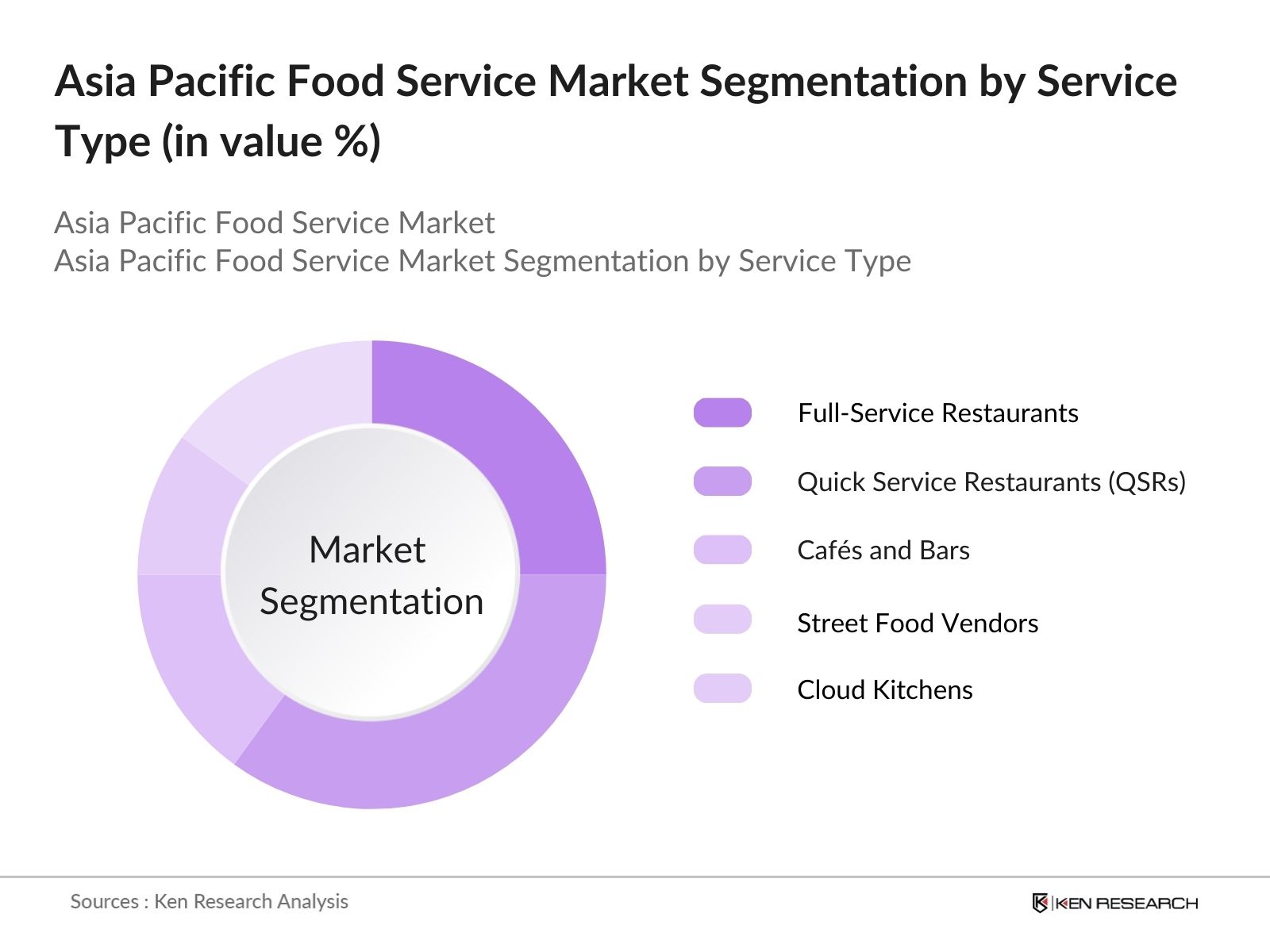

By Service Type: The market is segmented by service type into full-service restaurants, quick service restaurants (QSRs), cafs and bars, street food vendors, and cloud kitchens. Quick service restaurants (QSRs) hold a dominant market share due to the increasing demand for convenience and affordability among consumers. The ability of QSRs to offer standardized, fast meals at a low cost appeals to busy urban populations. Major QSR chains like McDonalds, KFC, and local brands dominate this segment, driven by aggressive expansion strategies and strong brand loyalty.

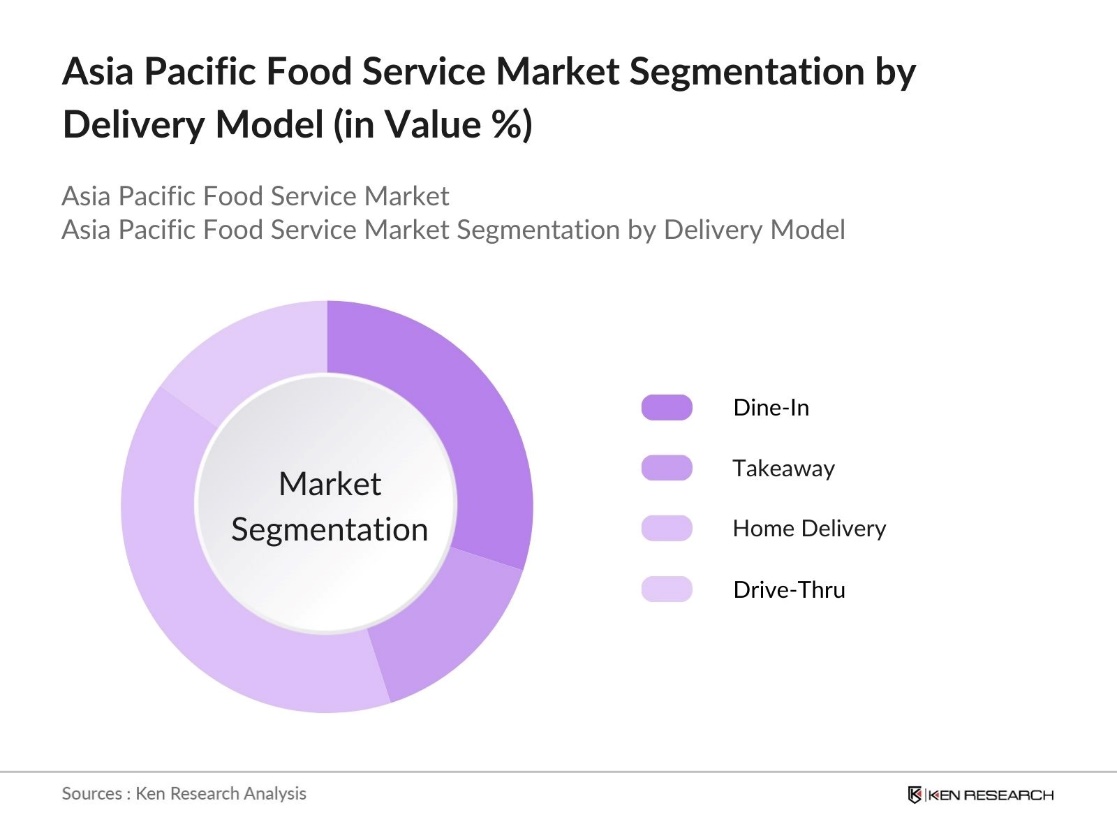

By Delivery Model: The market is segmented by delivery model segmentation includes dine-in, takeaway, home delivery, and drive-thru options. Home delivery leads the market in this segment due to the rise of online food delivery platforms such as Zomato, Swiggy, and Uber Eats, which provide convenient, on-demand food services to consumers. The COVID-19 pandemic has further solidified home delivery as the preferred model for many consumers, especially in urban regions where the service is quick and efficient.

Asia Pacific Food Service Market Competitive Landscape

The Asia Pacific food service market is dominated by both global giants and local companies that cater to diverse regional tastes. The markets competitive landscape is highly consolidated, with a few key players leading due to their extensive operational networks, brand recognition, and innovation in menu offerings. Local companies like Jollibee in the Philippines or Haidilao in China cater to regional preferences, while international brands such as McDonalds and Starbucks continue to grow their footprint due to strong brand loyalty and strategic franchising models.

Asia Pacific Food Service Industry Analysis

Growth Drivers

- Urbanization and Changing Lifestyles: Urbanization has significantly impacted the Asia Pacific food service market. As of 2023, over 1.6 billion people in the Asia Pacific region live in urban areas, accounting for approximately 59% of the population, according to the United Nations. This urban migration has accelerated the demand for food services, as urban dwellers often rely more on quick, accessible dining options. Governments in countries like India and China have invested heavily in urban infrastructure, pushing more people into cities, creating increased demand for food services. Urbanized regions also see higher footfall in food courts, cafes, and QSRs.

- Increasing Disposable Income: The rise in disposable income across Asia Pacific has driven growth in the food service industry. China's per capita disposable income was reported to be approximately 5,565 USD in 2023. This growth allows consumers to frequent restaurants more often, enhancing revenue streams for food service providers, especially in cities where eating out is considered part of the lifestyle.

- Growth in Organized Food Service Chains: The expansion of organized food service chains is a key driver in the Asia Pacific market. Countries like India and the Philippines have seen rapid growth of international franchises like McDonald's and KFC, supported by relaxed FDI policies. This has led to a more structured and standardized dining experience, which is crucial for the growth and modernization of the region's food service industry.

Market Challenges

- Regulatory Compliance (Food Safety and Standards Authority of India (FSSAI), Australian Food Standards): Adhering to stringent food safety regulations is a significant challenge for food service operators in the Asia Pacific region. Agencies like the FSSAI in India and FSANZ in Australia have implemented strict guidelines for hygienic food handling, storage, and preparation. Non-compliance can result in severe penalties, including fines or closures. These regulations, while essential for ensuring public safety, can be costly for small and medium-sized operators, adding financial strain through required certifications and regular inspections.

- Labor Shortages and Skilled Workforce Availability: Labor shortages remain a persistent challenge for the food service sector across the Asia Pacific region, exacerbated by the effects of the COVID-19 pandemic. Many restaurants struggle to find and retain skilled staff, leading to increased operational pressures. The shortages drive up wages, especially for smaller businesses, which find it hard to compete with larger chains that can offer higher salaries. This issue, compounded by evolving family dynamics in certain countries, impacts the industry's ability to maintain efficient operations.

Asia Pacific Food Service Market Future Outlook

Over the next five years, the Asia Pacific food service market is expected to see steady growth driven by the increased penetration of online food delivery platforms, rising disposable incomes, and the ongoing shift towards convenience-driven dining options. The growth of cloud kitchens, supported by the strong demand for delivery-only restaurants, will also play a key role in reshaping the competitive landscape. Furthermore, sustainability initiatives and healthier menu offerings will continue to gain importance, as consumers become more conscious of their environmental impact and nutritional choices.

Market Opportunities

- Cloud Kitchens and Online Food Delivery Boom: Cloud kitchens and online food delivery services have rapidly grown in the Asia Pacific region. The cloud kitchen model allows food service operators to minimize overhead costs by eliminating the need for high-cost retail spaces, making it an attractive option for small and medium businesses. The rise of food delivery apps has further supported this growth, providing a convenient and efficient way to cater to the growing demand from tech-savvy, urban consumers.

- Expansion of International Food Brands in Tier 2 and 3 Cities: International food brands are increasingly expanding into Tier 2 and 3 cities across the Asia Pacific region. These cities offer untapped opportunities for growth due to rising disposable incomes and growing demand for western-style fast food. As major urban markets become saturated, brands are shifting focus to smaller cities, increasing their visibility and access to new consumer segments in these emerging areas.

Scope of the Report

|

By Service Type |

Full-Service Restaurants Quick Service Restaurants (QSRs) Cafs and Bars Street Food Vendors Cloud Kitchens |

|

By Delivery Model |

Dine-In, Takeaway Home Delivery Drive-Thru |

|

By End-User |

Corporate Households Students Tourists |

|

By Menu Type |

Fast Food Casual Dining Fine Dining Street Food Caf Menu |

|

By Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Full-Service Dining Operators

Online Food Delivery Platforms

Food Packaging Manufacturers

Food and Beverage Equipment Manufacturers

Government and Regulatory Bodies (FSSAI, China FDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

McDonalds Corporation

Yum! Brands

Starbucks Corporation

Restaurant Brands International (Burger King, Tim Hortons)

Domino's Pizza Inc.

Jollibee Foods Corporation

Minor International (The Coffee Club, Benihana)

Haidilao International Holding Ltd.

Zensho Holdings (Sukiya)

Ajisen (China) Holdings

Table of Contents

1. Asia Pacific Food Service Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Service Type, Delivery Model, End-User, Regional Demand, Menu Type)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Food Service Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Food Service Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Changing Lifestyles

3.1.2. Increasing Disposable Income

3.1.3. Growth in Organized Food Service Chains

3.1.4. Rising Demand for Quick Service Restaurants (QSRs)

3.2. Market Challenges

3.2.1. Regulatory Compliance (Food Safety and Standards Authority of India (FSSAI), Australian Food Standards)

3.2.2. Labor Shortages and Skilled Workforce Availability

3.2.3. Supply Chain Disruptions

3.2.4. High Operating Costs (Energy, Rent, Raw Materials)

3.3. Opportunities

3.3.1. Cloud Kitchens and Online Food Delivery Boom

3.3.2. Expansion of International Food Brands in Tier 2 and 3 Cities

3.3.3. Customization and Localization of Menus (Fusion Cuisine, Regional Preferences)

3.4. Trends

3.4.1. Growth in Vegan and Plant-Based Offerings

3.4.2. Focus on Sustainable Packaging and Zero-Waste Initiatives

3.4.3. Digital Transformation (AI for Customer Engagement, POS Systems)

3.4.4. Health-Conscious Menus (Low-Calorie, Gluten-Free, Organic)

3.5. Government Regulations

3.5.1. Food Safety Standards and Compliance (FSSAI, Chinese FDA)

3.5.2. Labor Laws and Minimum Wage Regulations

3.5.3. Taxation and Incentives for Food Service Operators

3.5.4. Import Tariffs on Food Ingredients

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Franchise Owners, Suppliers, Distributors, Online Food Aggregators)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Food Service Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Full-Service Restaurants

4.1.2. Quick Service Restaurants (QSRs)

4.1.3. Cafs and Bars

4.1.4. Street Food Vendors

4.1.5. Cloud Kitchens

4.2. By Delivery Model (In Value %)

4.2.1. Dine-In

4.2.2. Takeaway

4.2.3. Home Delivery

4.2.4. Drive-Thru

4.3. By End-User (In Value %)

4.3.1. Corporate

4.3.2. Households

4.3.3. Students

4.3.4. Tourists

4.4. By Menu Type (In Value %)

4.4.1. Fast Food

4.4.2. Casual Dining

4.4.3. Fine Dining

4.4.4. Street Food

4.4.5. Caf Menu

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific Food Service Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Yum! Brands

5.1.2. McDonald's Corporation

5.1.3. Restaurant Brands International (Burger King, Tim Hortons)

5.1.4. Domino's Pizza Inc.

5.1.5. Starbucks Corporation

5.1.6. Minor International (The Coffee Club, Benihana)

5.1.7. Jollibee Foods Corporation

5.1.8. Darden Restaurants (Olive Garden)

5.1.9. Alsea Group (P.F. Chang's, Cheesecake Factory)

5.1.10. Foodco Group (Muffin Break, Jamaica Blue)

5.1.11. Haidilao International Holding Ltd.

5.1.12. Zensho Holdings (Sukiya)

5.1.13. Barbeque Nation Hospitality

5.1.14. Ajisen (China) Holdings

5.1.15. Pizza Hut

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Menu Innovation, Expansion Strategy, Partnerships, Sustainability Initiatives, Local Menu Adaptation, Online Presence)

5.3. Market Share Analysis

5.4. Strategic Initiative

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Food Service Market Regulatory Framework

6.1. Food Safety and Hygiene Standards

6.2. Compliance with Environmental Regulations (Packaging Waste, Carbon Footprint)

6.3. Labor Law Compliance and Worker Rights

6.4. Taxation Policies Affecting Food Service Chains

6.5. Licenses and Permits (Alcohol Licensing, Health Inspection)

7. Asia Pacific Food Service Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Food Service Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Delivery Model (In Value %)

8.3. By End-User (In Value %)

8.4. By Menu Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Food Service Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves constructing a comprehensive map of the food service ecosystem in the Asia Pacific region, identifying key players, service types, and consumer demographics. Extensive desk research was conducted using secondary sources, including industry databases, government reports, and company filings, to gather relevant data on the market's operational environment.

Step 2: Market Analysis and Construction

The market analysis phase focused on collecting historical market data, analyzing growth drivers such as urbanization and consumer spending, and compiling detailed service-level metrics. By analyzing service penetration, restaurant count, and customer satisfaction indices, we established a clear picture of the markets current state.

Step 3: Hypothesis Validation and Expert Consultation

To validate the assumptions and hypotheses formed during the analysis phase, we conducted interviews with industry experts, including senior managers at major food service companies. These consultations provided firsthand insights into operational challenges, strategic initiatives, and emerging trends.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesized the data from all sources and expert consultations to produce a comprehensive report. We engaged with food service operators directly to cross-validate sales performance, growth rates, and consumer behavior patterns, ensuring that the final analysis is both accurate and relevant.

Frequently Asked Questions

01. How big is the Asia Pacific Food Service Market?

The Asia Pacific food service market is valued at USD 406 billion, driven by factors such as urbanization, rising disposable incomes, and the growing popularity of online food delivery services.

02. What are the key challenges in the Asia Pacific Food Service Market?

Key challenges in Asia Pacific food service market include regulatory hurdles, high operational costs, and labor shortages. Additionally, managing supply chain disruptions and maintaining food safety standards pose significant challenges for market players.

03. Who are the major players in the Asia Pacific Food Service Market?

Major players in Asia Pacific food service market include global chains such as McDonalds, Yum! Brands, and Starbucks, as well as regional leaders like Jollibee Foods Corporation and Haidilao International. These companies dominate due to their brand strength, innovative business models, and expansive restaurant networks.

04. What are the growth drivers of the Asia Pacific Food Service Market?

Key growth drivers in Asia Pacific food service market include the expansion of quick service restaurants (QSRs), the rise of cloud kitchens, and increasing consumer preference for convenient and affordable dining options. The growing popularity of online food delivery services also plays a major role in market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.