Asia Pacific Freelance Platforms Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD10181

November 2024

84

About the Report

Asia Pacific Freelance Platforms Market Overview

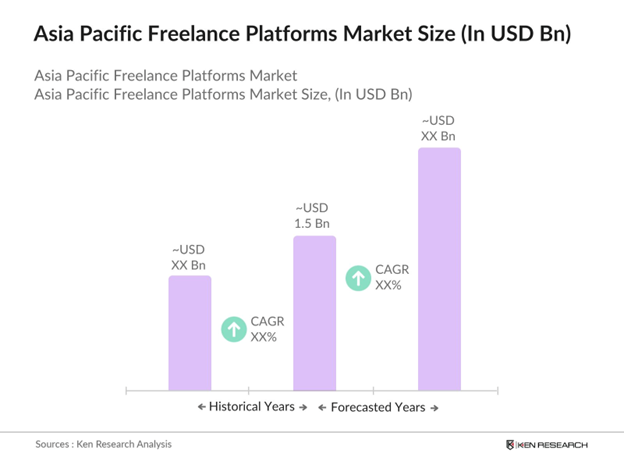

- The Asia Pacific Freelance Platforms market is valued at USD 1.5 billion, driven by increasing digitalization, internet penetration, and the shift towards flexible, remote work models. Freelance platforms are enabling companies and individuals to access diverse skills and expertise without geographical limitations. Large enterprises and startups are adopting these platforms to reduce operational costs, while skilled professionals find it a lucrative alternative to traditional employment.

- Countries like India, China, and the Philippines lead the Asia Pacific freelance platforms market. India's dominance is due to a vast pool of English-speaking, digitally skilled talent catering to global clients. China, with its robust digital infrastructure, is leveraging the freelance economy for specialized sectors, while the Philippines is a hub for outsourcing in services such as content creation and customer support. These countries provide a combination of quality talent, competitive rates, and reliable digital infrastructure, driving market growth.

- Governments in countries like Japan and South Korea have enacted labor rights for freelancers, granting them partial benefits like health coverage. In 2023, over 21% of freelancers in Asia-Pacific had access to these benefits, according to data from the World Bank. This access marks progress in formalizing freelancing as a sustainable employment form.

Asia Pacific Freelance Platforms Market Segmentation

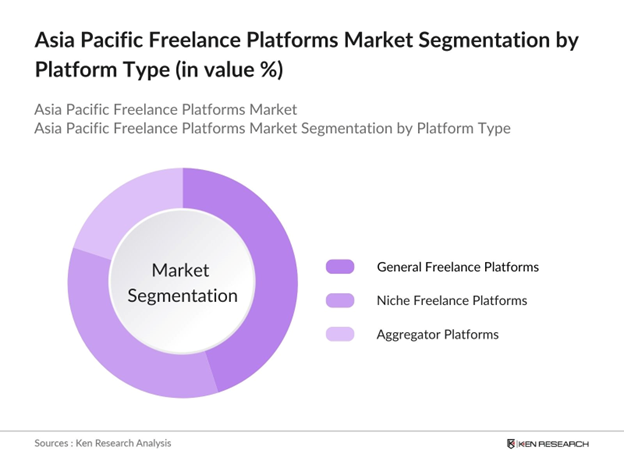

By Platform Type: Asia Pacific freelance platforms are segmented by platform type into general freelance platforms, niche freelance platforms, and aggregator platforms. Recently, general freelance platforms have gained a dominant market share, as they cater to a wide variety of services, making them versatile for both freelancers and employers. These platforms are particularly favored for their user-friendly interfaces, extensive reach, and comprehensive support for diverse job categories, allowing them to attract a large user base across different industries.

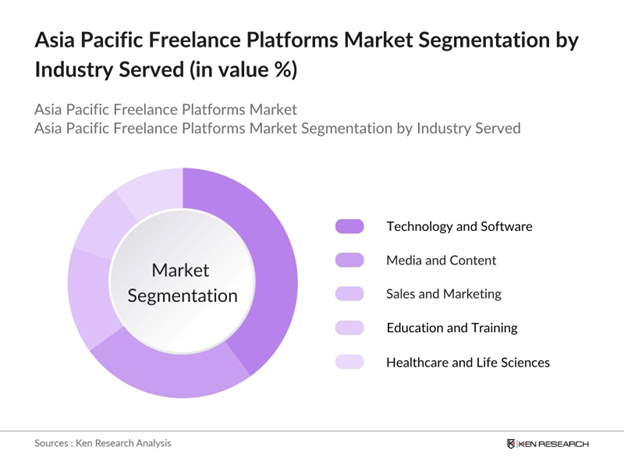

By Industry Served: The Asia Pacific freelance market is segmented by industries served, including technology and software, media and content, sales and marketing, education and training, and healthcare and life sciences. The technology and software segment leads, fueled by the demand for freelance software developers, data analysts, and IT specialists. This demand is driven by the rapid adoption of digital transformation across various sectors, making tech professionals essential. The high-paying opportunities and project-based work also attract freelancers with specialized skills in this field.

Asia Pacific Freelance Platforms Market Competitive Landscape

The Asia Pacific freelance platforms market is dominated by a few major players, including Upwork, Fiverr, Freelancer.com, Toptal, and PeoplePerHour. These companies lead due to their strong market presence, advanced technology integration, and extensive regional focus, enabling them to attract clients across different sectors.

Asia Pacific Freelance Platforms Market Analysis

Growth Drivers

- Rising Demand for Remote Work: The freelance market in Asia-Pacific is experiencing significant growth, primarily driven by the surge in demand for remote work solutions. In 2024, over 260 million individuals in this region were involved in remote work, supported by increased broadband access in countries like India and the Philippines. According to the International Telecommunication Union, internet usage in Asia-Pacific grew to 59.5% in 2023, allowing more freelancers to connect with international clients.

- Increasing Internet Penetration: Internet penetration in Asia-Pacific continues to expand, reaching over 2.1 billion users in 2024, according to the World Bank. India and Indonesia have seen notable improvements, with broadband infrastructure reaching rural areas, helping freelancers access more opportunities. This widespread connectivity fosters higher engagement on freelance platforms, allowing users to work with clients across borders and time zones. In countries like Vietnam, internet speeds rose to an average of 80 Mbps in 2023, boosting the potential for seamless, online-based work.

- Technological Advancements in Platform Infrastructure: The adoption of cloud-based solutions and AI-powered matching systems has improved the operational efficiency of freelance platforms. In 2023, approximately 73% of Asia-Pacific platforms integrated AI for matching talent with projects, enhancing user experience and engagement. The World Bank estimates that 12.7% of IT budgets in the region are now dedicated to freelance platform infrastructure upgrades, reflecting a commitment to robust digital ecosystems.

Challenges

- Payment Security and Regulatory Issues: Payment security is a persistent challenge, with a 17% rise in fraud cases involving freelance payments reported in Asia-Pacific in 2023, according to the Asian Development Bank. Additionally, regulatory inconsistencies across different countries complicate transactions. The IMF notes that only 38% of countries in the region have implemented standard freelance payment protections, limiting trust and creating barriers for cross-border freelancing.

- Difficulty in Platform Differentiation: The abundance of freelance platforms creates differentiation challenges, with around 4,000 platforms operating in Asia-Pacific as of 2023. According to the World Bank, over 65% of these platforms offer similar services, which limits their unique value propositions. This market saturation places a strain on platforms to attract and retain freelancers and clients, impacting overall platform growth and engagement.

Asia Pacific Freelance Platforms Market Future Outlook

Over the next few years, the Asia Pacific Freelance Platforms market is expected to expand significantly, driven by technological advancements in platform functionalities, rising digital literacy, and a shift towards project-based work models. Additionally, the growing preference for flexible work and talent outsourcing will fuel demand for freelance platforms across sectors, making this market a prominent force in the digital economy.

Market Opportunities

- Potential in Emerging Skill Sets: Freelance demand for emerging skill sets, such as data science and blockchain development, has seen a notable increase. According to the World Bank, 14% of freelancers in Asia-Pacific specialize in high-demand tech skills as of 2023, up from 9% in 2022. This shift indicates strong growth potential in niche markets, especially for platforms offering specialized skill matching.

- Integration of Artificial Intelligence for Matching Talent: AI integration for skill-based talent matching is growing, with 72% of top freelance platforms in Asia-Pacific having adopted AI solutions by 2024. These systems help streamline the hiring process, improving matching accuracy by over 45%, per IMF data. This advancement has significantly reduced job turnaround times and improved freelancer-client relationships.

Scope of the Report

|

Segment |

Sub-Segments |

|

Type of Platform |

General Freelance Platforms |

|

Employment Type |

Full-Time Freelancers |

|

Industry Served |

Technology and Software |

|

Business Size of Clients |

Large Enterprises |

|

Payment Model |

Subscription-based |

Products

Key Target Audience

Large enterprises and multinational corporations

Small and medium enterprises (SMEs)

Freelance professionals

Technology and software development companies

Media and content creation agencies

Sales and marketing firms

Government and regulatory bodies (Ministry of Labor, Department of Trade and Industry)

Investors and venture capitalist firms

Companies

Players Mentioned in the Report

Upwork Inc.

Fiverr International Ltd.

Freelancer.com

Toptal, LLC

PeoplePerHour

Guru.com

99Designs

FlexJobs

Catalant

LinkedIn ProFinder

Table of Contents

1. Asia Pacific Freelance Platforms Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Freelance Platforms Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Freelance Platforms Market Analysis

3.1 Growth Drivers (Freelance Demand, Technology Adoption, Payment Methods, etc.)

3.1.1 Rising Demand for Remote Work

3.1.2 Increasing Internet Penetration

3.1.3 Technological Advancements in Platform Infrastructure

3.1.4 Rising Awareness and Acceptance of Freelance Economy

3.2 Market Challenges (Payment Security, Workforce Stability, Platform Regulations, etc.)

3.2.1 Payment Security and Regulatory Issues

3.2.2 Talent Retention and Stability in Freelance Workforce

3.2.3 Difficulty in Platform Differentiation

3.2.4 Lack of Standardized Freelance Employment Laws

3.3 Opportunities (Expansion to Niche Skills, AI Integration, Platform Mergers, etc.)

3.3.1 Potential in Emerging Skill Sets

3.3.2 Integration of Artificial Intelligence for Matching Talent

3.3.3 Growth Through Platform Mergers and Acquisitions

3.3.4 Increased Interest from SMEs and Startups

3.4 Trends (On-demand Talent, Decentralized Platforms, Real-time Communication, etc.)

3.4.1 Rising Use of On-Demand Talent Pooling

3.4.2 Shift Towards Decentralized Freelance Platforms

3.4.3 Real-time Communication Tools Integration

3.4.4 Increased Transparency and Rating Mechanisms

3.5 Government Regulation (Tax Policies, Freelance Rights, Employment Protections, etc.)

3.5.1 Taxation Policies for Freelancers

3.5.2 Labor Rights and Employment Benefits

3.5.3 Local Compliance for Freelance Operations

3.5.4 Government Initiatives Supporting Freelance Economy

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Freelancers, Clients, Platform Owners, etc.)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape (Market Share, Investment Flow, Expansion Strategies, etc.)

4. Asia Pacific Freelance Platforms Market Segmentation

4.1 By Type of Platform (In Value %)

4.1.1 General Freelance Platforms

4.1.2 Niche Freelance Platforms

4.1.3 Aggregator Platforms

4.2 By Employment Type (In Value %)

4.2.1 Full-Time Freelancers

4.2.2 Part-Time Freelancers

4.2.3 Project-Based Freelancers

4.3 By Industry Served (In Value %)

4.3.1 Technology and Software

4.3.2 Media and Content

4.3.3 Sales and Marketing

4.3.4 Education and Training

4.3.5 Healthcare and Life Sciences

4.4 By Business Size of Clients (In Value %)

4.4.1 Large Enterprises

4.4.2 Small and Medium Enterprises (SMEs)

4.4.3 Startups

4.5 By Payment Model (In Value %)

4.5.1 Subscription-based

4.5.2 Commission-based

4.5.3 Task-based

5. Asia Pacific Freelance Platforms Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Upwork Inc.

5.1.2 Fiverr International Ltd.

5.1.3 Freelancer.com

5.1.4 Toptal, LLC

5.1.5 PeoplePerHour

5.1.6 Guru.com

5.1.7 FlexJobs

5.1.8 99Designs

5.1.9 Catalant

5.1.10 LinkedIn ProFinder

5.2 Cross Comparison Parameters (Active Users, Revenue, HQ Location, Market Share, Services Offered, Platform Ratings, Client Base, Employee Count)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Platform Expansion, Strategic Partnerships, Market Positioning, etc.)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Funding Sources, Private Equity, etc.)

5.7 Government Grants

5.8 Private Equity Investments

6. Asia Pacific Freelance Platforms Market Regulatory Framework

6.1 Employment Regulations

6.2 Freelance Taxation Policies

6.3 Compliance Requirements for Platforms

6.4 Certification and Legal Framework for Freelancers

7. Asia Pacific Freelance Platforms Future Market Size (In USD Million)

7.1 Future Market Size

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Freelance Platforms Future Market Segmentation

8.1 By Type of Platform (In Value %)

8.2 By Employment Type (In Value %)

8.3 By Industry Served (In Value %)

8.4 By Business Size of Clients (In Value %)

8.5 By Payment Model (In Value %)

9. Asia Pacific Freelance Platforms Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem and major stakeholders within the Asia Pacific Freelance Platforms Market. Through comprehensive desk research, key market dynamics were identified to assess potential growth drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this phase, we examined historical data on market size, penetration, and growth trends. This included analyzing the ratio of freelancers to employers on platforms and the average revenue generated by different platform types. This data provided a foundation for constructing an accurate market size and share analysis.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through interviews and surveys to validate market hypotheses, providing practical insights from both platform providers and users. This step allowed for a refined understanding of market nuances and player strategies.

Step 4: Research Synthesis and Final Output

Engagement with multiple freelance platform providers was conducted to validate the accuracy of collected data. This process also involved evaluating user preferences, service quality, and emerging trends, which were incorporated to produce a comprehensive and validated market analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Freelance Platforms Market?

The Asia Pacific Freelance Platforms Market was valued at USD 1.5 billion, driven by a rise in digital adoption and the shift towards remote work models.

02. What are the challenges in the Asia Pacific Freelance Platforms Market?

Key challenges in Asia Pacific Freelance Platforms Market include regulatory issues, payment security concerns, and competition among platforms, which may limit market growth in certain regions.

03. Who are the major players in the Asia Pacific Freelance Platforms Market?

Major players in Asia Pacific Freelance Platforms Market include Upwork, Fiverr, Freelancer.com, Toptal, and PeoplePerHour, known for their extensive reach, platform quality, and innovative services.

04. What are the growth drivers of the Asia Pacific Freelance Platforms Market?

Growth drivers in Asia Pacific Freelance Platforms Market include the increase in internet penetration, high demand for flexible work models, and the expansion of digital infrastructure across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.