Asia Pacific Freight and Logistics Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD5352

November 2024

85

About the Report

Asia Pacific Freight and Logistics Market Overview

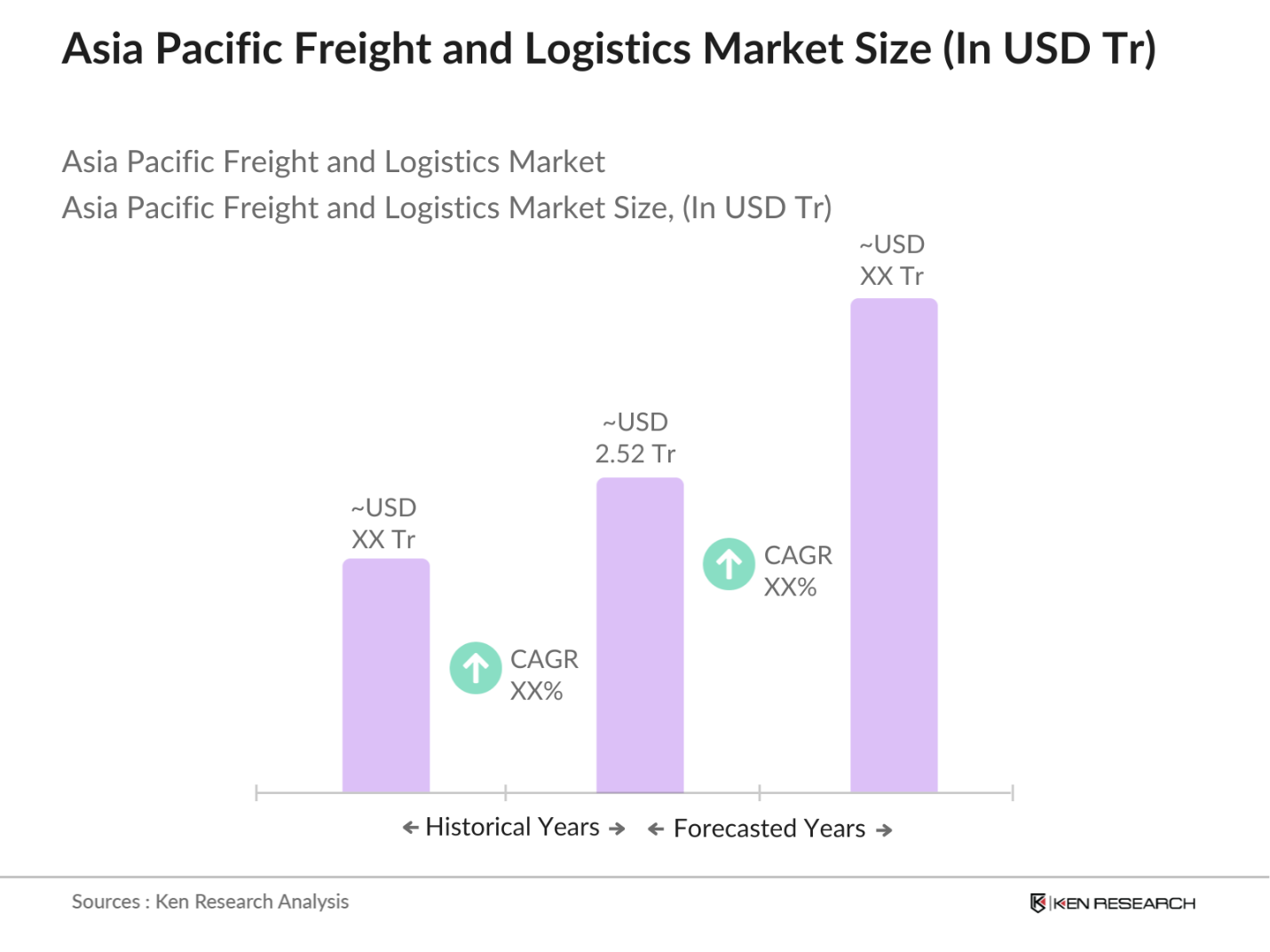

- The Asia Pacific freight and logistics market is valued at USD 2.52 trillion, reflecting robust growth driven by increased e-commerce penetration, expanding manufacturing activities, and infrastructure development across key countries. The continuous rise of cross-border trade, the regional expansion of supply chains, and the growing demand for integrated logistics solutions further fuel market expansion. Investment in technology, particularly in the digitalization of logistics, and growing consumer demand for fast deliveries also support the market's substantial growth. The ongoing globalization and regional trade agreements have made the market a focal point for business development.

- The leading players in this market come from countries like China, India, and Japan, which dominate due to their strong manufacturing bases, extensive transport networks, and well-established logistics infrastructure. Chinas dominance is primarily due to its large-scale manufacturing industries and its strategic position as the worlds factory, while Indias fast-growing e-commerce sector and government initiatives to develop multimodal transportation systems bolster its growth. Japan, known for its advanced logistics technologies, also plays a significant role, contributing to the rapid development of smart logistics solutions in the region.

- Digital freight platforms are revolutionizing logistics in the Asia-Pacific region, with over 1,000 such platforms operating across China alone in 2023. These platforms streamline freight booking, tracking, and delivery processes, reducing transportation costs and improving efficiency. The integration of digital tools has reduced booking times by 20% across the region, particularly in Japan and South Korea. This trend is expected to further drive market growth as logistics companies adopt more digital solutions.

Asia Pacific Freight and Logistics Market Segmentation

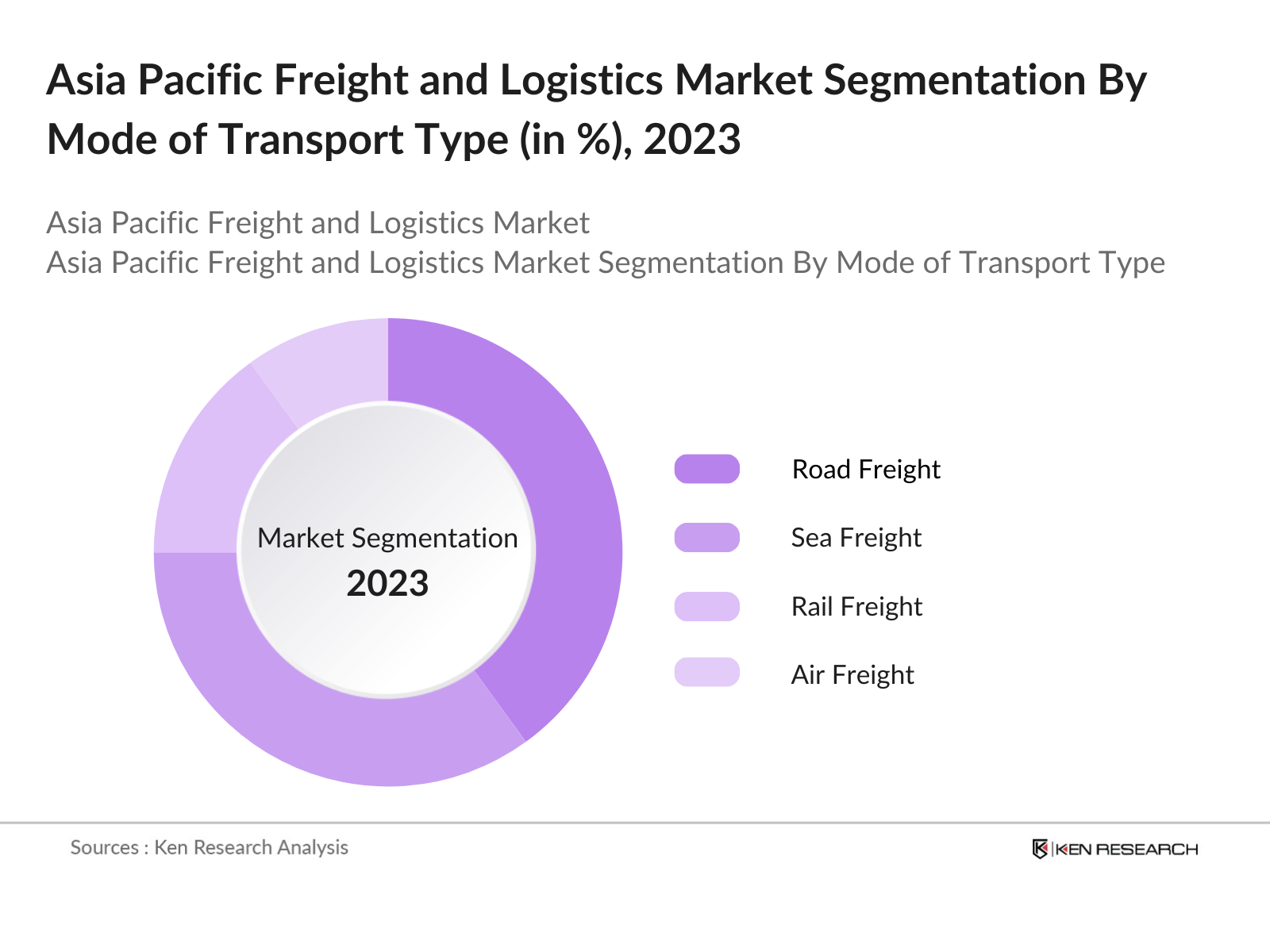

By Mode of Transport: The Asia Pacific freight and logistics market is segmented by mode of transport into road freight, rail freight, air freight, sea freight, and multimodal transport. Recently, road freight has been a dominant segment due to the extensive road networks and the growing use of trucks for short and medium distances. China, India, and Japan have invested heavily in expanding their road infrastructure to support domestic transport needs, which has strengthened the presence of road freight. With increasing urbanization and intercity deliveries driven by e-commerce, road freight remains a preferred method for last-mile delivery in densely populated areas.

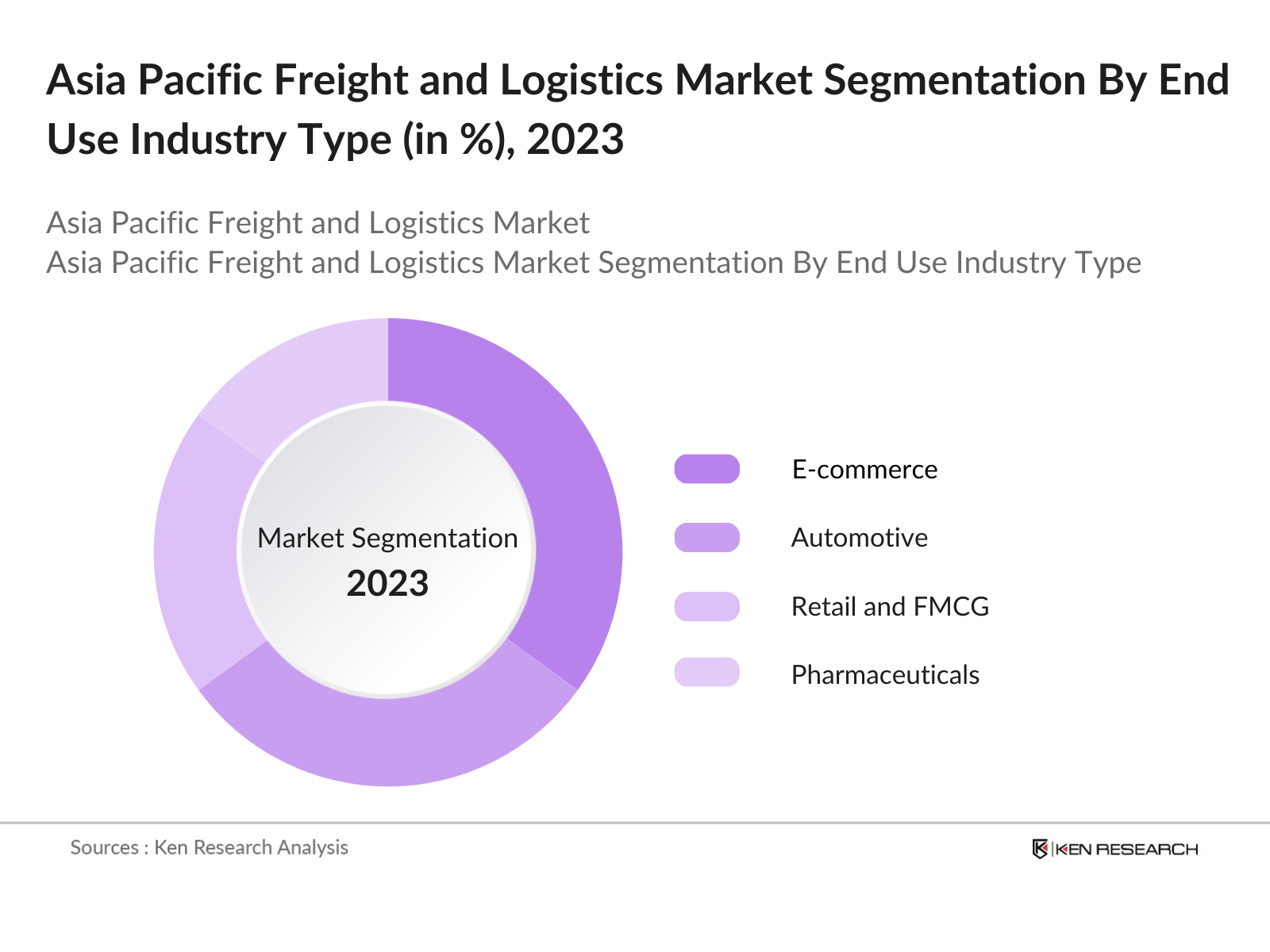

By End-Use Industry: The freight and logistics market in the Asia Pacific is segmented by end-use industry into e-commerce, automotive, retail and FMCG, pharmaceuticals, and industrial manufacturing. E-commerce has emerged as the leading segment, mainly driven by rapid online shopping trends, especially in China, India, and Southeast Asian countries. The sector's growth is powered by increasing consumer expectations for fast delivery, supported by logistical innovations such as digital freight platforms and fulfillment centers that speed up the supply chain process. Furthermore, large e-commerce players are investing in their logistics arms, leading to further dominance in the market.

Asia Pacific Freight and Logistics Market Competitive Landscape

The Asia Pacific freight and logistics market is dominated by both regional and global players. Companies have been leveraging advanced technologies, such as artificial intelligence, the Internet of Things (IoT), and blockchain, to streamline logistics processes. The region is seeing increased competition due to the rise of home-grown logistics startups, alongside the expansion of global giants into new markets. Strategic partnerships and mergers & acquisitions are shaping the market, as companies aim to strengthen their geographical reach and service offerings.

|

Company |

Establishment Year |

Headquarters |

Fleet Size |

No. of Warehouses |

Revenue (USD Bn) |

Geographic Reach |

Technology Adoption |

Strategic Partnerships |

Sustainability Initiatives |

|

DHL Supply Chain |

1969 |

Bonn, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Kuehne + Nagel |

1890 |

Schindellegi, Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

DB Schenker |

1872 |

Essen, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Nippon Express |

1937 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Yusen Logistics |

1955 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Asia Pacific Freight and Logistics Industry Analysis

Growth Drivers

- Increased E-commerce Penetration: The Asia-Pacific region has seen a tremendous surge in e-commerce activities due to increased internet penetration, particularly in countries like India and China. In 2023, over 4.9 billion parcels were shipped domestically within China, a reflection of rising consumer demand. Indonesias e-commerce sales grew significantly, reaching $80 billion in 2022. The freight and logistics sector must support this growing demand for timely and efficient deliveries. The increase in mobile payments and digital banking across the region also supports the shift towards e-commerce.

- Expansion of Manufacturing Hubs: Manufacturing in the Asia-Pacific region continues to grow, driven by China, Vietnam, and India. Vietnams manufacturing output reached $160 billion in 2023, contributing to a significant increase in freight movement. Indias production-linked incentive (PLI) schemes are expected to drive an additional $50 billion in domestic manufacturing by 2024. This has caused a spike in demand for both domestic and international logistics services as goods produced in the region require efficient transportation to global markets.

- Free Trade Agreements (FTAs) and Trade Bloc Dynamics: The Regional Comprehensive Economic Partnership (RCEP), involving 15 Asia-Pacific nations, went into effect in 2022, eliminating tariffs on nearly 90% of goods traded within the bloc. This has boosted intra-regional trade, generating a new wave of demand for cross-border freight and logistics services. Australia, as part of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), increased its exports to Vietnam by $10 billion in 2023 alone.

Market Challenges

- Infrastructure Bottlenecks: Despite rapid developments, infrastructure in some parts of Asia-Pacific remains underdeveloped, particularly in Southeast Asia and parts of South Asia. Poor road quality in India and Indonesia results in inefficiencies, increasing transportation times by 20-30%. In 2023, only 60% of roads in rural India were considered in good condition, delaying freight transport. These bottlenecks limit the efficiency of logistics operations in the region.

- Supply Chain Disruptions: Asia-Pacific faces frequent natural disasters, with over 80 typhoons annually in East Asia and the Pacific. The 2023 floods in Thailand led to delays in supply chains, affecting industries reliant on just-in-time delivery models. Global events like the COVID-19 pandemic also exposed vulnerabilities in supply chain resilience across the region, leading to freight bottlenecks and delays.

Asia Pacific Freight and Logistics Market Future Outlook

Over the next five years, the Asia Pacific freight and logistics market is expected to show significant growth driven by continuous government support for infrastructure development, technological advancements, and the expansion of cross-border trade. The growing e-commerce industry, along with increasing consumer demand for faster and more efficient logistics solutions, will further enhance the markets growth trajectory. Additionally, investment in green logistics and the adoption of sustainable practices will become crucial, as the region moves toward environmental goals. The integration of technologies such as AI, IoT, and blockchain into logistics processes will enable more efficient supply chains, reducing costs and improving delivery times. The rise of multimodal transport and cold chain logistics will open new avenues for market expansion, especially in sectors like pharmaceuticals and perishables.

Opportunities

- Technological Advancements: The adoption of automation and Internet of Things (IoT) technologies is transforming the logistics sector in Asia-Pacific. IoT-enabled tracking devices improved shipment visibility for 30% of logistics firms in the region by 2023. Automation of warehouses, particularly in China and Japan, reduced operational costs by over $5 billion in 2022. AI is also being deployed to optimize route planning and supply chain management, driving further efficiency gains in the industry.

- Rise of Multimodal Logistics: Multimodal logistics, integrating air, sea, and land transport, has gained traction in the Asia-Pacific region. In 2022, 60% of international cargo in the region was moved using at least two modes of transportation. This flexibility is critical for regions like Southeast Asia, where terrain and infrastructure limitations necessitate multimodal approaches. Investments in port and rail infrastructure in countries like Malaysia ($5 billion in 2023) further support this trend.

Scope of the Report

|

Mode of Transport |

Road Freight Rail Freight Air Freight Sea Freight Multimodal Transport |

|

End-Use Industry |

E-commerce Automotive Retail and FMCG Pharmaceuticals Industrial Manufacturing |

|

Service Type |

Freight Forwarding Warehousing Customs Brokerage Value-Added Services (VAS) |

|

Geography |

East Asia South Asia Southeast Asia Oceania Others (Cross-regional Trade Flows) |

|

Customer Type |

B2B B2C C2C |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., ASEAN Secretariat, Ministry of Transport)

E-commerce Platform Companies

Logistics and Supply Chain Companies

Automotive Manufacturing Industries

FMCG and Retail Chain Industries

Pharmaceutical Companies

Port and Transport Infrastructure Authorities

Companies

Players Mentioned in the Report

DHL Supply Chain

Kuehne + Nagel

DB Schenker

Nippon Express

Yusen Logistics

CJ Logistics

CEVA Logistics

Agility Logistics

Sinotrans

Kerry Logistics

Table of Contents

1. Asia Pacific Freight and Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Freight and Logistics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Freight and Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Increased E-commerce Penetration

3.1.2. Expansion of Manufacturing Hubs

3.1.3. Free Trade Agreements (FTAs) and Trade Bloc Dynamics

3.1.4. Government Initiatives for Infrastructure Development

3.2. Market Challenges

3.2.1. Infrastructure Bottlenecks

3.2.2. Supply Chain Disruptions

3.2.3. Labor Shortage

3.2.4. Compliance with Customs and Trade Regulations

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Rise of Multimodal Logistics

3.3.3. Cross-border E-commerce Expansion

3.3.4. Strategic Partnerships and Joint Ventures

3.4. Trends

3.4.1. Digitalization of Freight and Logistics

3.4.2. Shift Towards Sustainable and Green Logistics

3.4.3. Growth of Cold Chain Logistics

3.4.4. Autonomous Vehicles and Drone Delivery Systems

3.5. Government Regulations

3.5.1. Trade Policies and Tariffs

3.5.2. Customs Regulations and Compliance

3.5.3. Investment in Logistics Corridors

3.5.4. Public-Private Partnerships (PPPs) in Infrastructure Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Freight and Logistics Market Segmentation

4.1. By Mode of Transport (In Value %)

4.1.1. Road Freight

4.1.2. Rail Freight

4.1.3. Air Freight

4.1.4. Sea Freight

4.1.5. Multimodal Transport

4.2. By End-Use Industry (In Value %)

4.2.1. E-commerce

4.2.2. Automotive

4.2.3. Retail and FMCG

4.2.4. Pharmaceuticals

4.2.5. Industrial Manufacturing

4.3. By Service Type (In Value %)

4.3.1. Freight Forwarding

4.3.2. Warehousing

4.3.3. Customs Brokerage

4.3.4. Value-Added Services (VAS)

4.4. By Geography (In Value %)

4.4.1. East Asia

4.4.2. South Asia

4.4.3. Southeast Asia

4.4.4. Oceania

4.4.5. Others (Cross-regional Trade Flows)

4.5. By Customer Type (In Value %)

4.5.1. B2B

4.5.2. B2C

4.5.3. C2C

5. Asia Pacific Freight and Logistics Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. DHL Supply Chain

5.1.2. Kuehne + Nagel

5.1.3. DB Schenker

5.1.4. Nippon Express

5.1.5. Yusen Logistics

5.1.6. CJ Logistics

5.1.7. CEVA Logistics

5.1.8. Agility Logistics

5.1.9. Sinotrans

5.1.10. Kerry Logistics

5.1.11. DSV Panalpina

5.1.12. Bollor Logistics

5.1.13. Gati Ltd.

5.1.14. Tiong Nam Logistics

5.1.15. XPO Logistics

5.2 Cross Comparison Parameters (Fleet Size, Number of Warehouses, Revenue, Market Presence, Operational Efficiency, Technology Adoption, Sustainability Initiatives, Strategic Alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Expansions, Collaborations, Digitalization Strategies)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Capex Trends, M&A Funding)

5.7 Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

6. Asia Pacific Freight and Logistics Market Regulatory Framework

6.1. Regional Trade Agreements and FTAs

6.2. Compliance with Regional and International Trade Laws

6.3. Environmental Standards (Sustainability Goals, Emissions Regulations)

6.4. Import-Export Documentation and Compliance Requirements

7. Asia Pacific Freight and Logistics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Freight and Logistics Future Market Segmentation

8.1. By Mode of Transport (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Service Type (In Value %)

8.4. By Geography (In Value %)

8.5. By Customer Type (In Value %)

9. Asia Pacific Freight and Logistics Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Segmented by Industry, Size, Geography)

9.3. Marketing Initiatives (Targeting Strategy, Branding)

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific freight and logistics market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific freight and logistics market. This includes assessing market penetration, the ratio of service providers to the end-users, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple logistics providers to acquire detailed insights into transport modes, supply chain performance, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific freight and logistics market.

Frequently Asked Questions

How big is the Asia Pacific Freight and Logistics Market?

The Asia Pacific freight and logistics market is valued at USD 2.52 trillion, driven by rapid e-commerce growth, increasing trade, and investments in infrastructure.

What are the challenges in the Asia Pacific Freight and Logistics Market?

Challenges include infrastructure bottlenecks, regulatory hurdles, and increasing competition. The need for better technology integration and sustainability is also pressing.

Who are the major players in the Asia Pacific Freight and Logistics Market?

Key players include DHL Supply Chain, Kuehne + Nagel, DB Schenker, Nippon Express, and Yusen Logistics, dominating due to their vast networks and advanced technology adoption.

What are the growth drivers of the Asia Pacific Freight and Logistics Market?

The market is driven by the booming e-commerce industry, growing cross-border trade, and government investments in multimodal transportation infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.