Asia Pacific Gaming Equipment Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD10209

November 2024

97

About the Report

Asia Pacific Gaming Equipment Market Overview

- The Asia Pacific Gaming Equipment market is valued at USD 1.5 billion, supported by rapid advancements in gaming technology, a booming e-sports culture, and increased internet penetration. Key drivers include the rising availability of high-speed internet, improvements in gaming hardware, and a surge in demand for immersive gaming experiences.

- China and Japan are dominant in the Asia Pacific Gaming Equipment market, primarily due to their strong manufacturing bases, robust technological infrastructure, and large consumer bases with a high propensity for digital entertainment. Chinas thriving e-sports scene and Japans longstanding history in game development position these countries as leaders in innovation and consumer adoption, attracting both local and global players to invest in these markets.

- Asia-Pacific countries are increasingly implementing data protection laws to safeguard user data in online gaming. In 2023, Chinas Cybersecurity Law enforced strict regulations on gaming data, impacting over 200 million users, according to Chinas Cybersecurity Bureau. This regulatory shift ensures data privacy and builds user trust in the online gaming ecosystem.

Asia Pacific Gaming Equipment Market Segmentation

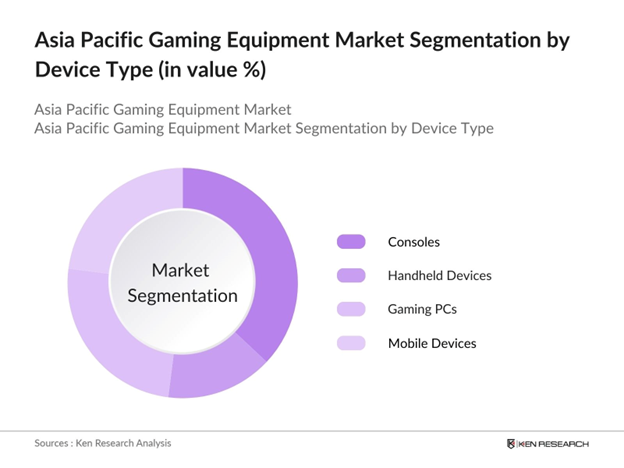

By Device Type: The Asia Pacific Gaming Equipment market is segmented by device type into consoles, handheld devices, gaming PCs, and mobile devices. Consoles hold a dominant market share under this segmentation, driven by their entrenched popularity and consistent innovations in immersive gameplay. Companies like Sony and Microsoft maintain strong brand loyalty, ensuring consoles remain a preferred choice, particularly among dedicated gamers who seek high-quality, console-specific titles.

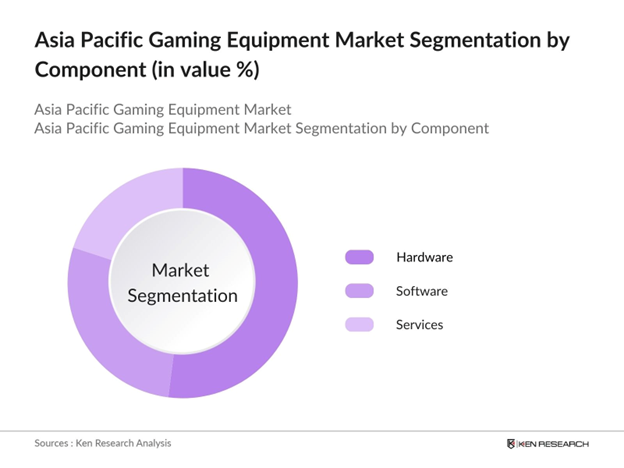

By Component: The market is further segmented by component into hardware, software, and services. Hardware dominates the market share, propelled by increasing consumer demand for advanced gaming systems with enhanced graphics capabilities, VR headsets, and other peripherals. This segment thrives on continuous improvements in gaming technology and high consumer expectations for immersive experiences, which drive consistent upgrades and innovations.

Asia Pacific Gaming Equipment Market Competitive Landscape

The Asia Pacific Gaming Equipment market is characterized by a few dominant players with extensive reach and advanced technological integration. Major companies in this space focus on sustained innovation, large-scale investments in e-sports, and the cultivation of gaming communities to strengthen their market positions. The markets competitive landscape showcases the consolidation of local manufacturers alongside established international brands.

Asia Pacific Gaming Equipment Market Analysis

Growth Drivers

- Increase in E-sports Viewership: The Asia-Pacific region has seen a remarkable rise in e-sports viewership, driven by increasing internet penetration and the popularity of online streaming platforms. In 2023, Asia-Pacific accounted for over 50% of the global e-sports audience, with over 300 million viewers, according to data from the Asia-Pacific Broadcasting Union (APBU). This increase is supported by the World Banks report on digital growth in the region, where internet access expanded by 25 million new users in 2023 alone, driving viewership numbers in countries like China and South Korea.

- Technological Advancements (VR, AR, AI): Advancements in technologies like Virtual Reality (VR), Augmented Reality (AR), and Artificial Intelligence (AI) have significantly impacted gaming experiences across Asia-Pacific. The region invested over $10 billion in gaming-related technology R&D in 2022, with a growth trend in areas such as VR headset usage, expected to reach 40 million active users in 2024, according to the Ministry of Science and ICT, South Korea. The expansion of such technologies is closely related to enhanced user engagement in gaming.

- Expansion in Gaming Platforms: The gaming platform landscape in Asia-Pacific is expanding rapidly, with a marked increase in both console and mobile gaming users. In 2024, mobile gaming users in the region numbered 674 million, as per data from the Telecommunications Ministry of China, attributed to greater smartphone penetration and 5G rollout. Console gaming also grew by 15 million new units sold, aided by government-backed technology funding in markets like Japan and South Korea. These shifts are contributing significantly to the growth of gaming as an entertainment form.

Challenges

- High Development Costs: The gaming industry in Asia-Pacific faces high development costs, with an estimated $15 billion allocated for game development in 2023, according to the Ministry of Industry and Information Technology, China. Development expenses have been exacerbated by rising labor costs in countries like Japan and South Korea, where developer salaries rose by 12% in 2023, putting pressure on profitability for local gaming companies.

- Competitive Price Sensitivity: Asia-Pacific's gaming market is highly price-sensitive, particularly in emerging markets such as India and Indonesia. In 2023, approximately 60% of gamers in these markets opted for low-cost or free gaming platforms, according to the Asia Digital Gaming Alliance, challenging companies to maintain profitability while remaining competitive. This price sensitivity is further fueled by local economic constraints.

Asia Pacific Gaming Equipment Market Future Outlook

Over the next five years, the Asia Pacific Gaming Equipment market is poised for substantial growth, fueled by advancements in cloud gaming, the integration of artificial intelligence in gaming experiences, and a growing consumer shift toward online and mobile gaming. The increasing penetration of 5G networks is expected to further amplify gaming accessibility and enhance gameplay quality. This continued growth will be supported by evolving technologies and increased investments in gaming infrastructure, promising a vibrant and dynamic market landscape.

Market Opportunities

- Cloud Gaming Expansion: Cloud gaming presents a significant opportunity in Asia-Pacific, particularly in urban centers with high-speed internet infrastructure. In 2024, cloud gaming users surpassed 45 million across China and Japan, as per the Asian Internet Coalition. The adoption of cloud platforms is driven by the region's extensive fiber-optic network, facilitating seamless gaming experiences without the need for high-end hardware.

- Collaboration with Content Creators: Collaborations between gaming companies and content creators are expanding, allowing for enhanced user engagement and brand reach. In 2023, over 70% of major game developers in the region partnered with influencers on platforms like Douyin, according to a report by China's Ministry of Culture and Tourism. This strategy has been successful, with influencer-driven games seeing engagement rates increase by up to 30% compared to non-promoted games.

Scope of the Report

|

Segment |

Sub-segments |

|

Device Type |

Consoles Handheld Devices Gaming PCs Mobile Devices |

|

Component |

Hardware Software Services |

|

Gaming Type |

Online Multiplayer Offline Single Player Cloud Gaming Mobile Games |

|

Technology |

VR AR AI Motion Tracking |

|

Region |

China Japan South Korea Southeast Asia India |

Products

Key Target Audience

Gaming Device Manufacturers

E-sports Organizations and Teams

Gaming Content Developers

Gaming Software Providers

Cloud Gaming Service Providers

Virtual Reality (VR) and Augmented Reality (AR) Equipment Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Information and Communication Technology)

Companies

Players Mentioned in the Report

Sony Corporation

Microsoft Corporation

Tencent Holdings Ltd.

Nintendo Co., Ltd.

Razer Inc.

Acer Inc.

Corsair Gaming Inc.

Sega Sammy Holdings Inc.

Bandai Namco Entertainment Inc.

Activision Blizzard Inc.

Table of Contents

1. Asia Pacific Gaming Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Asia Pacific Gaming Equipment Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.Asia Pacific Gaming Equipment Market Analysis

3.1. Growth Drivers (e.g., rising disposable income, gaming technology adoption)

3.1.1. Increase in E-sports Viewership

3.1.2. Technological Advancements (VR, AR, AI)

3.1.3. Expansion in Gaming Platforms (Console, Mobile)

3.1.4. Demand for Multiplayer Online Gaming

3.2. Market Challenges (e.g., high cost, regulatory limitations)

3.2.1. High Development Costs

3.2.2. Competitive Price Sensitivity

3.2.3. Market Saturation in Developed Regions

3.3. Opportunities (e.g., untapped emerging markets, digital penetration)

3.3.1. Cloud Gaming Expansion

3.3.2. Collaboration with Content Creators

3.3.3. Growth in Subscription-Based Services

3.4. Trends (e.g., mobile gaming, streaming)

3.4.1. Rise of Cross-Platform Gaming

3.4.2. Integration with Social Media Platforms

3.4.3. Streaming and Game Broadcasting

3.5. Government Regulation (e.g., data security, privacy laws)

3.5.1. Data Protection Acts

3.5.2. Online Gaming Regulations

3.5.3. National Standards for E-sports

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape Overview

4. Asia Pacific Gaming Equipment Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Consoles

4.1.2. Handheld Devices

4.1.3. Gaming PCs

4.1.4. Mobile Devices

4.2. By Component (In Value %)

4.2.1. Hardware

4.2.2. Software

4.2.3. Services

4.3. By Gaming Type (In Value %)

4.3.1. Online Multiplayer

4.3.2. Offline Single Player

4.3.3. Cloud Gaming

4.3.4. Mobile Games

4.4. By Technology (In Value %)

4.4.1. Virtual Reality (VR)

4.4.2. Augmented Reality (AR)

4.4.3. Artificial Intelligence (AI)

4.4.4. Motion Tracking

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Southeast Asia

4.5.5. India

5. Asia Pacific Gaming Equipment Market Competitive Analysis

5.1. Profiles of Key Companies

5.1.1. Sony Corporation

5.1.2. Microsoft Corporation

5.1.3. Nintendo Co., Ltd.

5.1.4. Tencent Holdings Ltd.

5.1.5. Razer Inc.

5.1.6. Acer Inc.

5.1.7. Corsair Gaming Inc.

5.1.8. Sega Sammy Holdings Inc.

5.1.9. Bandai Namco Entertainment Inc.

5.1.10. Activision Blizzard Inc.

5.2. Cross Comparison Parameters (Revenue, Market Share, Regional Presence, Gaming Portfolio, Innovation Index, Key Partnerships, Consumer Engagement, Research & Development)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Gaming Equipment Market Regulatory Framework

6.1. Data Security Regulations

6.2. Compliance with Regional Gaming Standards

6.3. Certification Requirements

7. Asia Pacific Gaming Equipment Future Market Size (In USD Mn)

7.1. Future Market Projections

7.2. Key Factors Influencing Future Growth

8. Asia Pacific Gaming Equipment Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Component (In Value %)

8.3. By Gaming Type (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Gaming Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of the Asia Pacific Gaming Equipment Market, covering all relevant stakeholders. This phase relied on desk research, utilizing both secondary and proprietary databases to gather a comprehensive range of data on industry-level trends and dynamics. Key variables influencing the market, including technological advances and consumer behaviors, were identified.

Step 2: Market Analysis and Construction

In this step, we compiled and analyzed historical data, focusing on the market's penetration, device adoption rates, and revenue sources. This step ensured accurate, reliable analysis of revenue estimates, which were evaluated based on service quality statistics across major gaming segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations with industry experts were conducted through phone interviews. Experts from various gaming companies provided insights into the operational and financial aspects of the market, refining and corroborating our data and enabling a holistic analysis.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with gaming equipment manufacturers and distributors, capturing detailed insights on market dynamics, device preferences, and key consumer segments. This comprehensive, validated data enabled a reliable synthesis, ensuring accurate projections and insights into the Asia Pacific Gaming Equipment market.

Frequently Asked Questions

01. How big is the Asia Pacific Gaming Equipment Market?

The Asia Pacific Gaming Equipment market is valued at USD 1.5 billion, driven by high internet penetration, e-sports growth, and advancements in gaming technology.

02. What are the challenges in the Asia Pacific Gaming Equipment Market?

Challenges in Asia Pacific Gaming Equipment market include high manufacturing costs, intense competition among gaming companies, and market saturation in developed regions. The rising cost of hardware components also impacts market profitability.

03. Who are the major players in the Asia Pacific Gaming Equipment Market?

Major players in Asia Pacific Gaming Equipment market include Sony Corporation, Microsoft Corporation, Tencent Holdings Ltd., Nintendo Co., Ltd., and Razer Inc., who lead due to technological innovation, strong brand presence, and extensive distribution networks.

04. What are the growth drivers of the Asia Pacific Gaming Equipment Market?

Key growth drivers in Asia Pacific Gaming Equipment market include the proliferation of e-sports, advancements in VR and AR technology, and rising consumer demand for immersive gaming experiences, particularly in mobile and cloud gaming.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.