Asia-Pacific GPS Anti-Jamming Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9187

November 2024

94

About the Report

Asia-Pacific GPS Anti-Jamming Market Overview

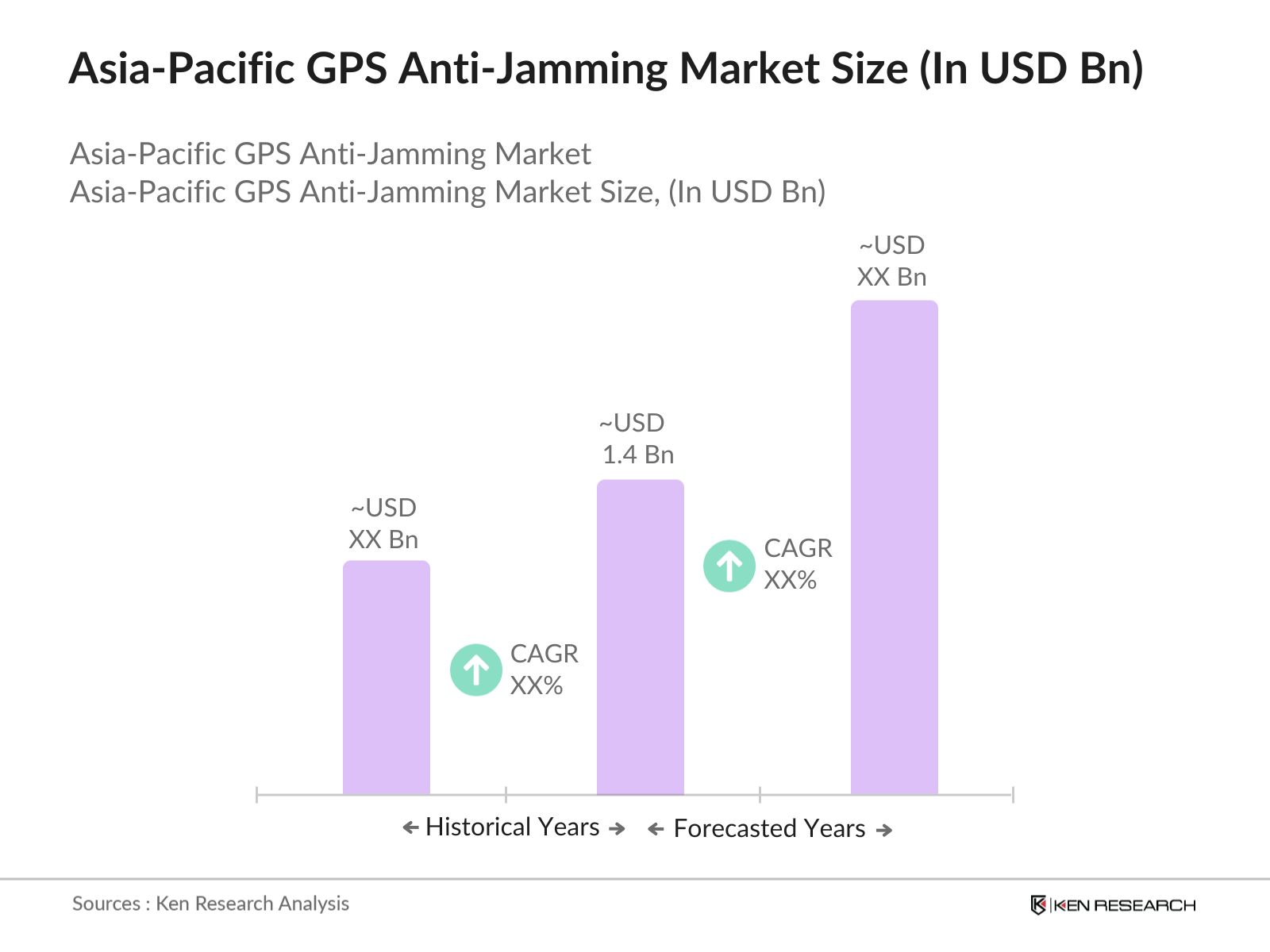

- The Asia-Pacific GPS Anti-Jamming market is valued at USD 1.4 billion, driven by the regions increasing reliance on satellite-based communications for both military and civilian applications. The demand for secure and uninterrupted GPS signals has escalated due to the growing incidences of jamming and spoofing activities. The proliferation of UAVs (Unmanned Aerial Vehicles) in defense and commercial sectors is also fueling the need for robust anti-jamming technologies. The development of advanced GPS systems by government agencies in China, Japan, and South Korea has further expanded the market.

- Countries like China and Japan dominate the Asia-Pacific GPS Anti-Jamming market due to their significant investment in satellite communications and defense technologies. China has been particularly aggressive in enhancing its GPS capabilities, driven by its Belt and Road Initiative, which requires resilient navigation systems. Japan, with its highly advanced technological landscape and increasing emphasis on homeland security, also leads the market. South Koreas government-backed projects in space technology contribute to the regions dominance.

- The strict enforcement of ITAR limits the transfer of defense technologies, including GPS anti-jamming systems, to Asia-Pacific countries like Malaysia and Indonesia. ITAR compliance remains a significant hurdle, as seen in the 2023 delays in the transfer of critical GPS technologies to Southeast Asia due to regulatory concerns. These regulations complicate defense procurement for smaller nations, delaying the adoption of anti-jamming solutions.

Asia-Pacific GPS Anti-Jamming Market Segmentation

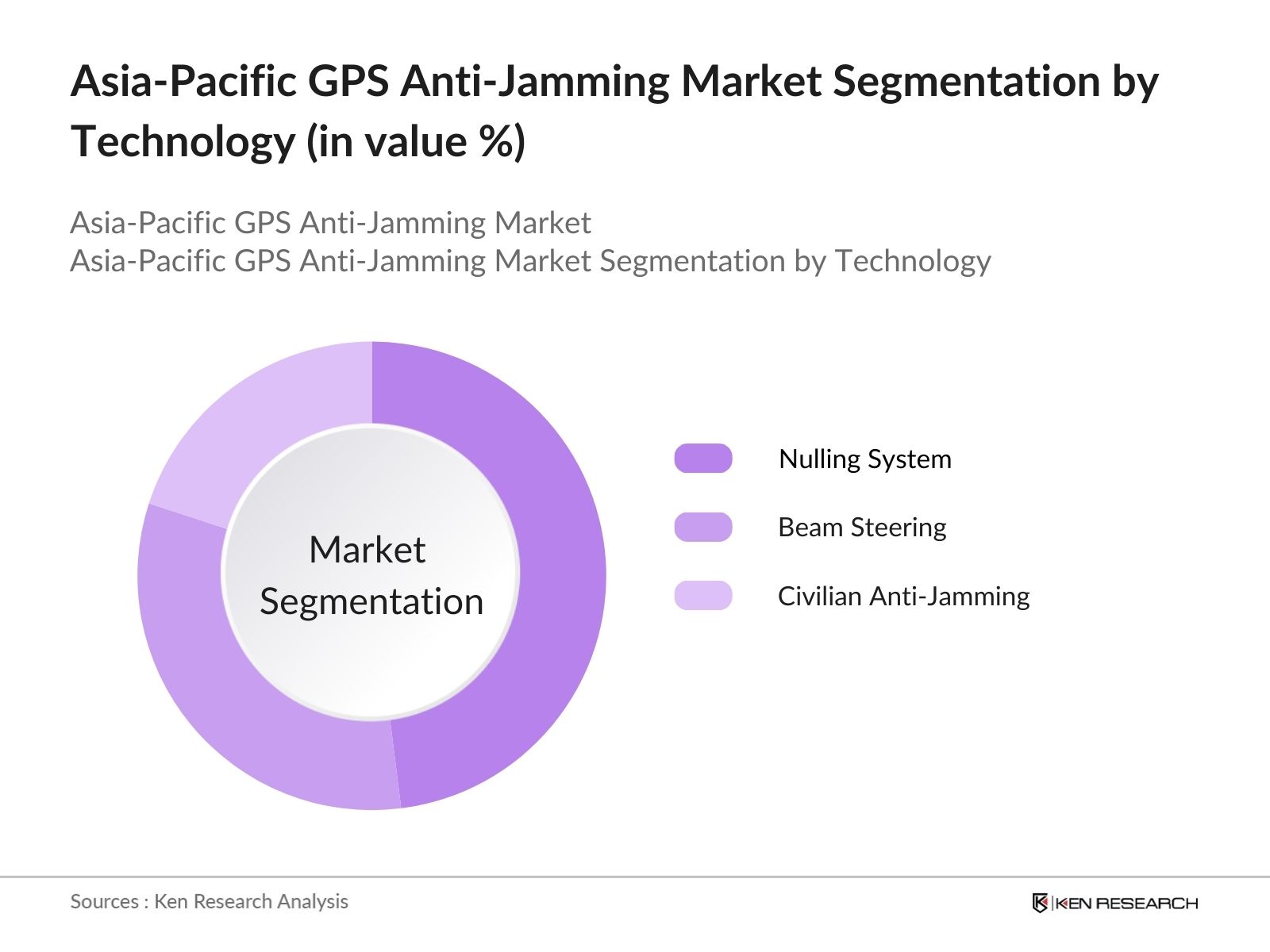

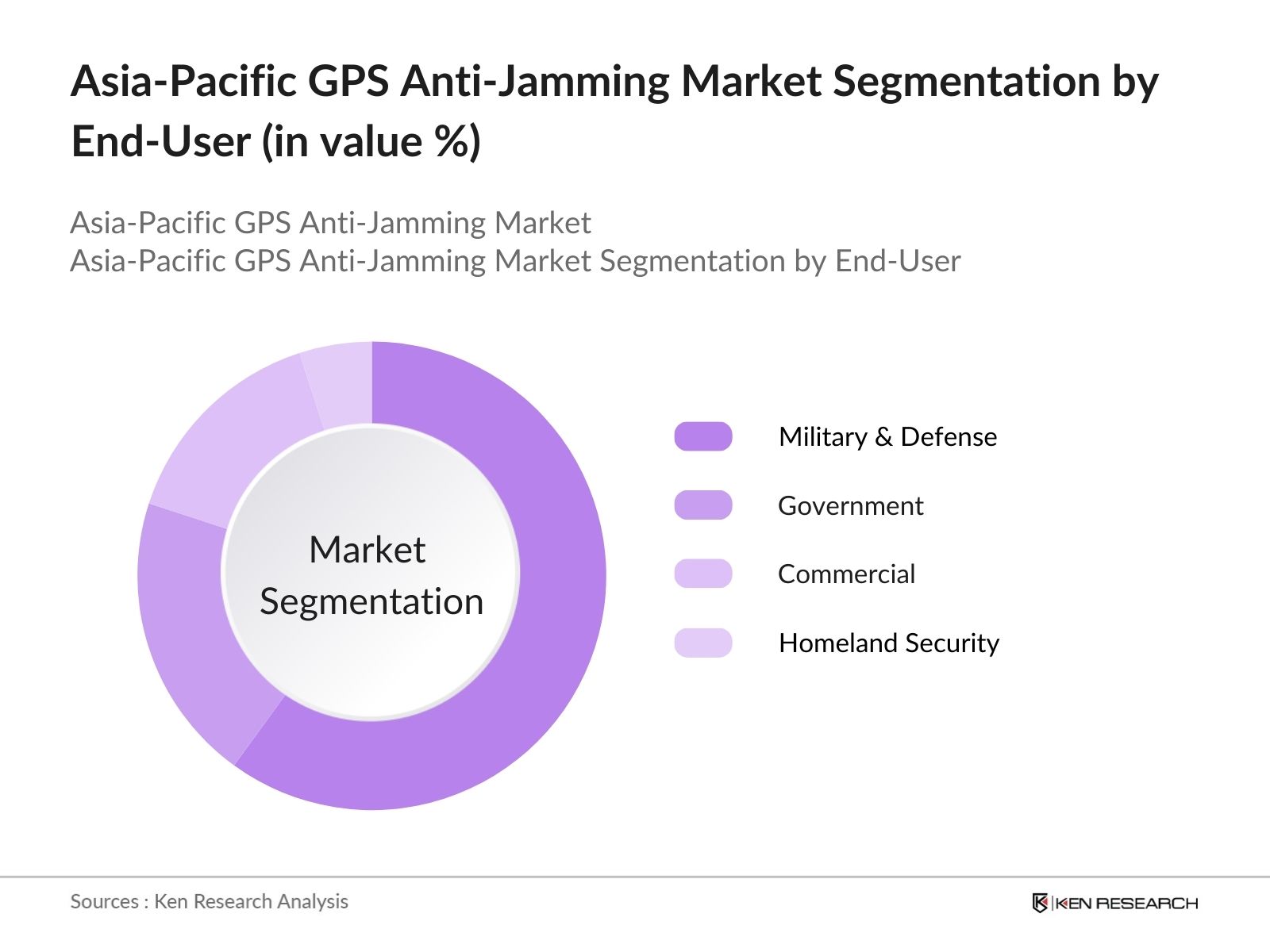

The Asia-Pacific GPS Anti-Jamming market is segmented by technology and by end-user.

- By Technology: The Asia-Pacific GPS Anti-Jamming market is segmented by technology into Nulling System, Beam Steering, and Civilian Anti-Jamming Solutions. Nulling systems have dominated the market due to their capability to effectively block interference from multiple jamming sources. These systems are widely adopted in military applications where reliability and precision are critical. The growth of UAVs in the defense sector, especially in China and Japan, has significantly driven the demand for nulling systems. Their proven efficacy in defense scenarios, where high accuracy and jamming immunity are paramount, has made them a top choice in the region.

- By End-User: The market is further segmented by end-user into Military & Defense, Government, Commercial, and Homeland Security. The Military & Defense segment holds the highest market share due to ongoing defense modernization programs across Asia-Pacific. Countries like China, India, and South Korea are heavily investing in anti-jamming technologies to enhance their military GPS systems, ensuring protection against spoofing and jamming attacks. The reliance on GPS-based navigation for missile guidance and troop movement has made anti-jamming solutions a key component of defense strategies in the region.

Asia-Pacific GPS Anti-Jamming Market Competitive Landscape

The Asia-Pacific GPS Anti-Jamming market is dominated by a few key players that specialize in defense technology and satellite communications. Major defense contractors have a strong presence, leveraging their global networks to supply cutting-edge GPS solutions. The Asia-Pacific GPS Anti-Jamming market is primarily controlled by major global players such as Raytheon Technologies, BAE Systems, and Harris Corporation, alongside regional competitors. These companies have established themselves through extensive defense contracts and collaborations with government agencies, ensuring a strong market hold. Their continuous investment in R&D and satellite-based technologies further reinforces their dominant position.

|

Company |

Establishment Year |

Headquarters |

Annual Revenue |

R&D Spending |

Product Offerings |

|

Raytheon Technologies |

1922 |

USA |

|||

|

BAE Systems |

1999 |

UK |

|||

|

Harris Corporation |

1895 |

USA |

|||

|

Thales Group |

2000 |

France |

|||

|

Novatel Inc. |

1978 |

Canada |

Asia-Pacific GPS Anti-Jamming Industry Analysis

Growth Drivers

- Defense Modernization: Asia-Pacific countries, particularly China and India, are heavily investing in defense modernization to strengthen their military capabilities. China's military expenditure reached $293 billion in 2022, driven by the increasing need for advanced technologies like GPS anti-jamming to protect communication systems. India's defense spending was $81 billion in 2022, reflecting the demand for enhanced GPS systems in military applications. The defense modernization push is expected to drive the adoption of GPS anti-jamming technology across Asia-Pacific, securing military assets and satellite communications.

- Expansion of UAVs (Unmanned Aerial Vehicles): The demand for UAVs in Asia-Pacific is rising rapidly, with countries like Japan and South Korea deploying UAVs for surveillance and reconnaissance missions. In 2022, Japan increased its defense UAV fleet to support maritime and aerial defense operations. South Korea's UAV exports also surged, with 100+ UAVs deployed for military operations. The reliance on GPS for UAV operations necessitates robust anti-jamming systems, especially for defense operations where GPS jamming is a growing threat.

- Rising Incidents of GPS Spoofing and Jamming: There has been a significant increase in incidents of GPS jamming and spoofing in Asia-Pacific. China and Russia have been reported to conduct military exercises involving GPS jamming across disputed areas. In 2023, over 200 GPS jamming incidents were reported near the South China Sea. These disruptions have forced governments to invest in GPS anti-jamming technology to safeguard satellite-based communications and navigation systems across maritime and airspace operations.

Market Challenges

- High Cost of Anti-Jamming Equipment: The high cost of anti-jamming technology presents a challenge for the Asia-Pacific market. Advanced military-grade GPS anti-jamming systems, often exceeding $150,000 per unit, limit widespread adoption by smaller nations in the region. Countries like Vietnam and Malaysia have struggled to afford these technologies due to budget constraints. This challenge hinders the market's growth, especially for non-military applications, where cost-efficiency is critical.

- Limited Availability of Skilled Technicians: Countries in the Asia-Pacific region face a shortage of skilled technicians capable of managing and maintaining GPS anti-jamming systems. For instance, only 5% of the defense workforce in Indonesia is trained in handling advanced satellite systems, creating an operational bottleneck. This lack of skilled personnel has slowed the adoption of anti-jamming systems, making training and workforce development a priority for governments and defense contractors.

Asia-Pacific GPS Anti-Jamming Market Future Outlook

Over the next five years, the Asia-Pacific GPS Anti-Jamming market is expected to show robust growth driven by defense modernization efforts, technological advancements, and an increasing focus on securing GPS-dependent infrastructure. The rise in cyberattacks and GPS jamming incidents will push governments and organizations to adopt advanced anti-jamming systems. Moreover, collaborations between local governments and global defense contractors are set to enhance the technological capabilities of the region, further driving the market growth.

Market Opportunities

- Integration of Anti-Jamming Solutions with 5G Networks: The development of 5G networks in Asia-Pacific presents an opportunity for the integration of GPS anti-jamming systems. South Korea, which is a leader in 5G adoption, has launched multiple initiatives to integrate satellite-based anti-jamming solutions with 5G communication networks to ensure uninterrupted service. In 2023, South Korea's government allocated $250 million to enhance 5G and satellite integration, presenting growth opportunities for GPS anti-jamming technology.

- Advancements in GNSS (Global Navigation Satellite System) Technologies: Countries in the Asia-Pacific region are focusing on GNSS advancements to improve navigation accuracy and resilience. In 2023, Japan launched its Michibiki satellite, specifically designed to support anti-jamming capabilities for both civilian and defense applications. Such advancements in GNSS are driving demand for enhanced GPS anti-jamming systems, especially in defense sectors looking to improve satellite security.

Scope of the Report

Products

Key Target Audience

Military and Defense Agencies (Ministry of Defense, PLA Strategic Support Force)

Government and Regulatory Bodies (Telecommunications Regulatory Authority, Japan Space Agency)

UAV Manufacturers

Satellite Communication Providers

GPS Equipment Manufacturers

Maritime and Aviation Authorities

Homeland Security Agencies

Investment and Venture Capitalist Firms

Companies

Players Mention in the Report:

Raytheon Technologies

BAE Systems

Harris Corporation

Thales Group

Novatel Inc.

Cobham PLC

Hexagon AB

Boeing Defense

Furuno Electric Co., Ltd

InfiniDome Ltd.

Hwa Create Technology Co.

SAAB AB

ST Electronics

Litef GmbH

Lockheed Martin

Table of Contents

1. Asia-Pacific GPS Anti-Jamming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Impact of Regional Military Investment, Satellite-Based Communications Penetration)

1.4. Market Segmentation Overview (Anti-Jamming Techniques, End-User Sectors, Regional Landscape)

2. Asia-Pacific GPS Anti-Jamming Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Deployment in Defense Systems, Government Spending in GPS Systems)

3. Asia-Pacific GPS Anti-Jamming Market Analysis

3.1. Growth Drivers

3.1.1. Defense Modernization

3.1.2. Expansion of UAVs (Unmanned Aerial Vehicles)

3.1.3. Rising Incidents of GPS Spoofing and Jamming

3.1.4. Government Investments in Satellite Communications

3.2. Market Challenges

3.2.1. High Cost of Anti-Jamming Equipment

3.2.2. Limited Availability of Skilled Technicians

3.2.3. Technological Complexity in Integrating Anti-Jamming Systems

3.2.4. Regulatory Barriers in Defense Technology Transfer

3.3. Opportunities

3.3.1. Integration of Anti-Jamming Solutions with 5G Networks

3.3.2. Advancements in GNSS (Global Navigation Satellite System) Technologies

3.3.3. Emerging Markets for Commercial Applications (Maritime, Aviation)

3.3.4. Government Incentives for Satellite-Based Infrastructure

3.4. Trends

3.4.1. Increased Adoption of CRPA (Controlled Reception Pattern Antenna) Technology

3.4.2. Use of AI and Machine Learning in GPS Anti-Jamming Systems

3.4.3. Growing Investment in Cybersecurity for GPS Technologies

3.4.4. Integration with Autonomous Vehicles

3.5. Government Regulation

3.5.1. ITAR (International Traffic in Arms Regulations)

3.5.2. Frequency Spectrum Allocation Policies

3.5.3. National Defense Procurement Plans

3.5.4. Bilateral Defense Agreements in the Asia-Pacific Region

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Key Government Agencies, Defense Contractors, Commercial Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia-Pacific GPS Anti-Jamming Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Nulling System

4.1.2. Beam Steering

4.1.3. Civilian Anti-Jamming Solutions

4.2. By End-User (In Value %)

4.2.1. Military & Defense

4.2.2. Government (Civilian Use, Public Safety)

4.2.3. Commercial (Aviation, Maritime, Telecom)

4.2.4. Homeland Security

4.3. By Component (In Value %)

4.3.1. Hardware (Antennas, Receivers, Amplifiers)

4.3.2. Software Solutions (AI Algorithms, Signal Processing)

4.4. By Anti-Jamming Technique (In Value %)

4.4.1. Power Minimization

4.4.2. Adaptive Filtering

4.4.3. Anti-Jamming Antennas (CRPA, Nulling Antennas)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia-Pacific GPS Anti-Jamming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Raytheon Technologies

5.1.2. Lockheed Martin

5.1.3. BAE Systems

5.1.4. Harris Corporation

5.1.5. Cobham PLC

5.1.6. Thales Group

5.1.7. Novatel Inc.

5.1.8. Hwa Create Technology Co.

5.1.9. Boeing Defense

5.1.10. InfiniDome Ltd.

5.1.11. Hexagon AB

5.1.12. SAAB AB

5.1.13. ST Electronics

5.1.14. Furuno Electric Co., Ltd

5.1.15. Litef GmbH

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Spending, Strategic Partnerships, Global Presence, Technological Innovations, Defense Contracts)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific GPS Anti-Jamming Market Regulatory Framework

6.1. Defense Acquisition Regulations

6.2. GPS Satellite Bandwidth Allocation

6.3. Export Control Regulations

6.4. Compliance Standards

7. Asia-Pacific GPS Anti-Jamming Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific GPS Anti-Jamming Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By End-User (In Value %)

8.3. By Component (In Value %)

8.4. By Anti-Jamming Technique (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific GPS Anti-Jamming Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the major stakeholders in the Asia-Pacific GPS Anti-Jamming Market, including defense agencies, commercial end-users, and technology providers. Extensive desk research was conducted using secondary and proprietary databases to identify key variables affecting market trends, such as government regulations and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical data from government publications and market databases were analyzed to identify growth patterns in the Asia-Pacific GPS Anti-Jamming market. Data on defense budgets, GPS-related cyberattacks, and satellite infrastructure were assessed to construct the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts, including defense contractors and satellite communication specialists. These interviews provided insights into operational challenges, technological innovations, and the demand-supply scenario in the anti-jamming sector.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing data from primary and secondary sources, providing a comprehensive analysis of the Asia-Pacific GPS Anti-Jamming market. A bottom-up approach was applied to calculate market size and validate the competitive landscape, ensuring accurate and reliable conclusions.

Frequently Asked Questions

01. How big is the Asia-Pacific GPS Anti-Jamming Market?

The Asia-Pacific GPS Anti-Jamming market is valued at USD 1.4 billion, driven by increasing reliance on satellite communications and defense modernization initiatives across the region.

02. What are the challenges in the Asia-Pacific GPS Anti-Jamming Market?

Key challenges in Asia-Pacific GPS Anti-Jamming market include the high cost of anti-jamming equipment, technological complexity in integration, and regulatory barriers in defense technology transfer between countries.

03. Who are the major players in the Asia-Pacific GPS Anti-Jamming Market?

Leading players in the Asia-Pacific GPS Anti-Jamming market include Raytheon Technologies, BAE Systems, Harris Corporation, Thales Group, and Novatel Inc., with a strong presence in both military and commercial sectors.

04. What are the growth drivers of the Asia-Pacific GPS Anti-Jamming Market?

Growth drivers in Asia-Pacific GPS Anti-Jamming market include rising incidents of GPS spoofing and jamming, increasing investment in defense technology, and growing demand for secure satellite communications in both military and civilian applications.

05. Which countries dominate the Asia-Pacific GPS Anti-Jamming Market?

China and Japan dominate the Asia-Pacific GPS Anti-Jamming market due to significant government investment in satellite communications and defense infrastructure. Their focus on cybersecurity and technological advancements further drives their market leadership.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.