Asia Pacific Graphics Processing Unit (GPU) Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3450

November 2024

90

About the Report

Asia Pacific Graphics Processing Unit (GPU) Market Overview

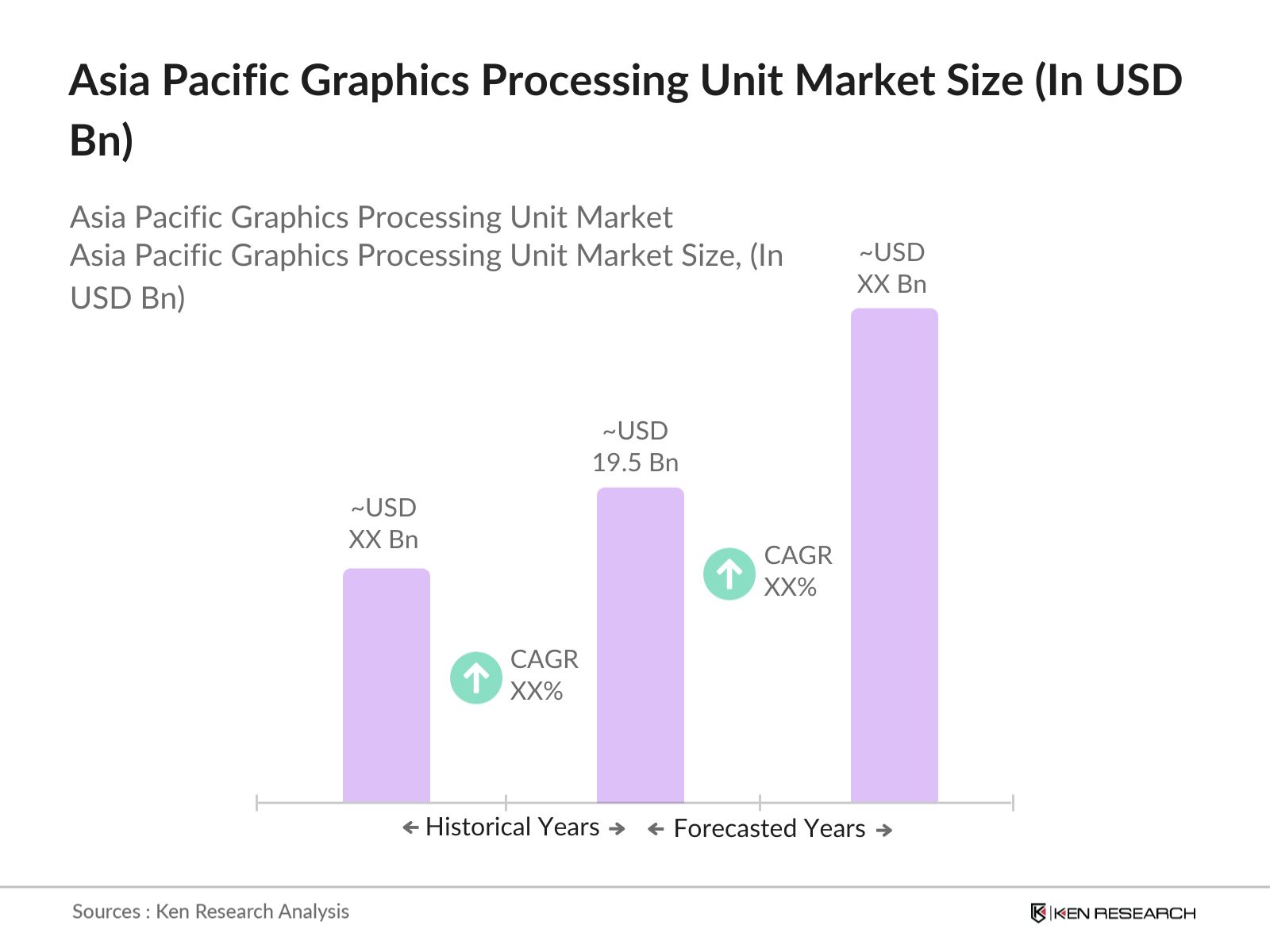

- The Asia Pacific Graphics Processing Unit (GPU) market is valued at USD 19.5 billion, based on a five-year historical analysis. This market has seen rapid growth driven by increasing demand for high-performance computing in applications such as gaming, artificial intelligence (AI), and data centers. The growth of the gaming industry, the adoption of AI across industries, and the expansion of data centers in countries such as China, Japan, and South Korea have significantly influenced market demand. Moreover, GPUs are playing a critical role in emerging technologies such as autonomous vehicles and AI-powered edge devices, further driving market expansion.

- China, Japan, and South Korea dominate the GPU market in the Asia Pacific region. China leads due to its large-scale manufacturing capabilities, expanding gaming industry, and government focus on developing AI and data centers. Japan and South Korea are at the forefront of technology innovation, with major players investing heavily in research and development in sectors like robotics, AI, and automotive technologies. These countries benefit from advanced semiconductor infrastructure and strong government support for technology advancements, contributing to their dominance in the GPU market.

- Several countries in the Asia Pacific region have implemented export controls on high-performance GPUs due to concerns over national security and technology transfer. In 2023, China tightened export restrictions on advanced semiconductors, including GPUs, to ensure domestic availability. These regulations could impact the supply chain for high-performance GPUs and affect the ability of manufacturers in the region to meet global demand.

Asia Pacific Graphics Processing Unit (GPU) Market Segmentation

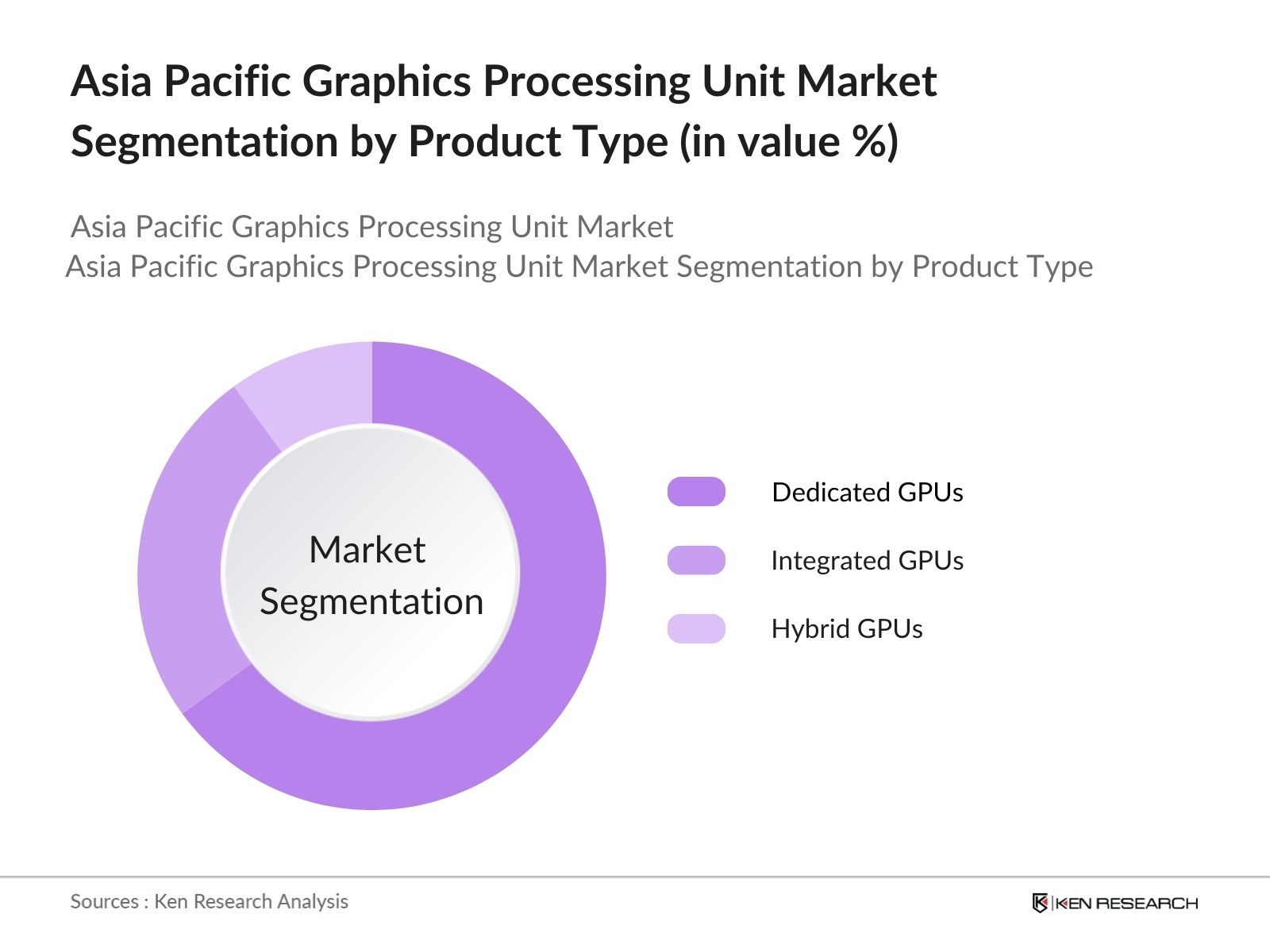

- By Product Type: The Asia Pacific GPU market is segmented by product type into Dedicated GPUs, Integrated GPUs, and Hybrid GPUs. Recently, Dedicated GPUs have a dominant market share under this segmentation, driven by their high performance and widespread adoption in gaming, professional workstations, and AI applications. Dedicated GPUs provide superior processing power, allowing them to handle intensive tasks like real-time rendering and AI-driven workloads. As a result, brands such as NVIDIA and AMD have established strong market positions, making dedicated GPUs the preferred choice for high-performance computing.

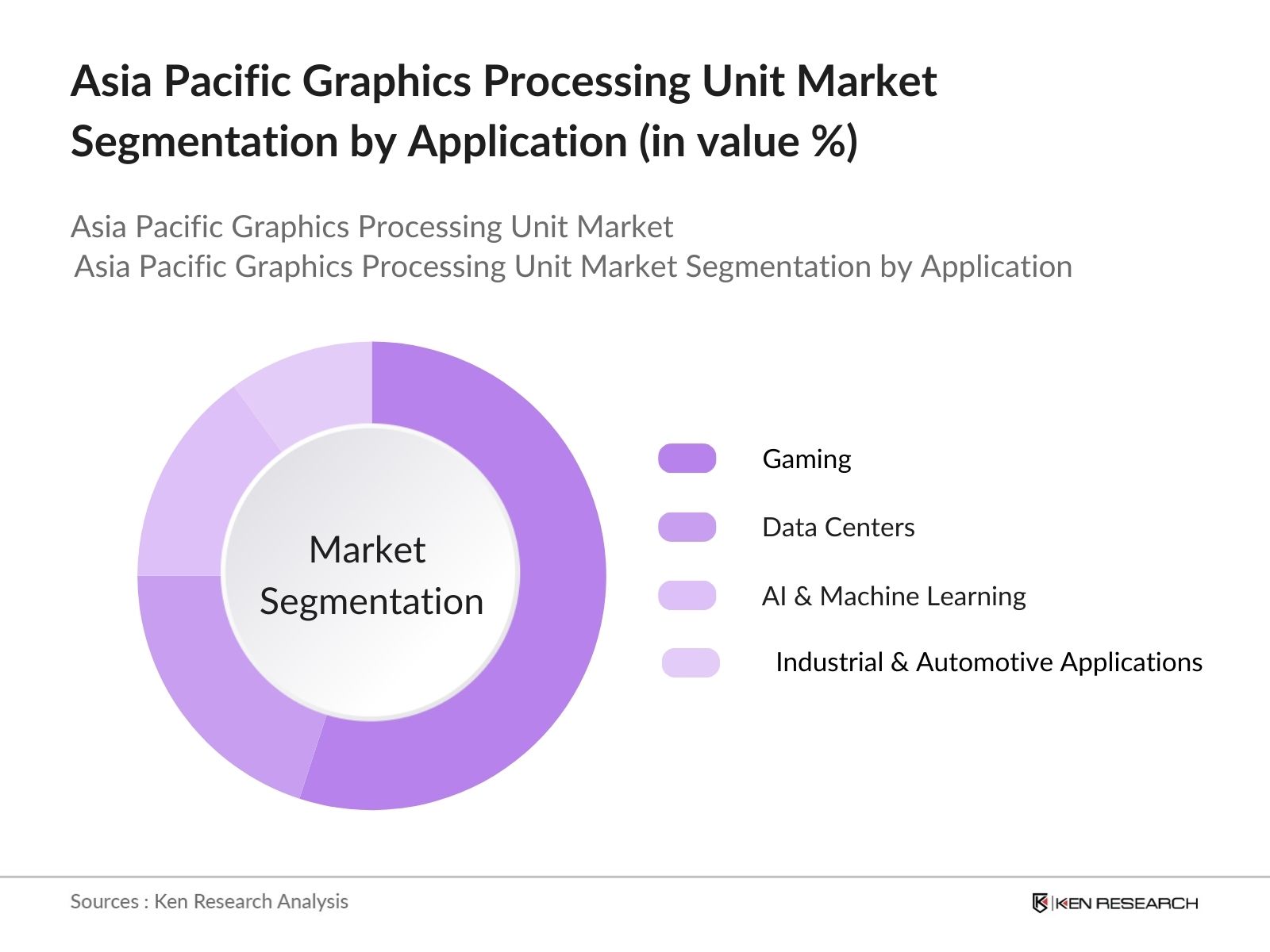

- By Application: The Asia Pacific GPU market is segmented by application into Gaming, Data Centers, AI & Machine Learning, and Industrial & Automotive Applications. The Gaming segment has a dominant market share due to the growing popularity of online gaming and esports. The increasing availability of high-performance gaming PCs, the rise of cloud gaming platforms, and the expansion of internet infrastructure in the region have fueled the demand for powerful GPUs. Leading gaming companies continuously seek GPUs that can support immersive gaming experiences, driving the dominance of this segment.

Asia Pacific Graphics Processing Unit (GPU) Market Competitive Landscape

The Asia Pacific GPU market is dominated by key global and regional players who are shaping the market through innovation, strategic partnerships, and expansions. These companies hold significant market influence due to their vast product portfolios, strong R&D capabilities, and leading-edge technology adoption. The Asia Pacific GPU market is highly competitive, with global giants such as NVIDIA and AMD leading the space. These companies are closely followed by Intel, which has entered the GPU market with strong technological advancements. Regional players such as Huawei and Samsung also have a notable presence, with a focus on AI-enabled chips and advanced semiconductor technologies. The competitive environment is further enhanced by partnerships and mergers as companies strive to maintain leadership in emerging GPU applications like AI, AR/VR, and cloud gaming.

|

Company Name |

Established Year |

Headquarters |

GPU Technology |

Product Portfolio |

AI Integration |

|

NVIDIA Corporation |

1993 |

Santa Clara, USA |

|||

|

Advanced Micro Devices (AMD) |

1969 |

Santa Clara, USA |

|||

|

Intel Corporation |

1968 |

Santa Clara, USA |

|||

|

Samsung Electronics Co., Ltd |

1969 |

Suwon, South Korea |

|||

|

Huawei Technologies Co., Ltd |

1987 |

Shenzhen, China |

Asia Pacific Graphics Processing Unit (GPU) Industry Analysis

Market Growth Drivers

- Adoption of AI and Machine Learning: The integration of AI and machine learning in various industries such as healthcare, finance, and manufacturing has significantly increased the demand for GPUs. In 2023, global spending on AI reached $154 billion, a large portion of which is allocated for high-performance computing infrastructure, particularly GPUs, which are essential for deep learning applications. The Asia Pacific region, driven by China's AI development strategy, saw significant investments, with AI-related spending growing by 17% in 2022 alone. The need for advanced GPUs for training AI models and processing complex datasets is a key growth driver in the region.

- Gaming Industry Growth: The gaming industry in Asia Pacific continues to boom, driving the demand for GPUs, especially high-performance ones. According to the International Monetary Fund (IMF), the gaming industry in the region was valued at over $95 billion in 2023, driven by countries like China, Japan, and South Korea. With more than 1.5 billion active gamers in the region, the demand for GPUs capable of handling graphically intensive games has surged. This gaming boom is leading to higher GPU sales as consumers seek more powerful gaming experiences.

- Cloud Computing: Cloud computing infrastructure providers in the Asia Pacific region are expanding rapidly, driving the demand for GPUs to support computational workloads in AI, gaming, and video rendering. Data from the World Bank indicates that cloud computing adoption in the region increased by 23% from 2022 to 2023, with companies like Alibaba and Tencent leading investments in GPU-accelerated cloud platforms. As more businesses shift their operations to cloud-based solutions, the need for robust GPUs for data processing and storage grows.

Market Challenges

- High Manufacturing Costs: The cost of manufacturing GPUs has risen significantly due to increasing raw material costs, labor shortages, and energy prices. According to the Asian Development Bank (ADB), the cost of raw materials for semiconductor production, including silicon and rare earth metals, increased by 18% in 2023. Furthermore, rising labor costs in key production hubs such as South Korea and Taiwan have added to the overall expenses, making it more challenging for GPU manufacturers to maintain competitive pricing while managing higher production costs.

- Geopolitical Risks: The Asia Pacific GPU market is facing significant geopolitical risks, particularly concerning the strained relations between China and Taiwan, a major producer of semiconductor chips. According to the IMF, the potential for escalating tensions in the Taiwan Strait poses a substantial risk to the supply chain for GPUs. Taiwans semiconductor manufacturing industry plays a critical role in global GPU production, and any disruptions due to geopolitical conflicts could have far-reaching impacts on the market.

Asia Pacific Graphics Processing Unit (GPU) Market Future Outlook

Over the next five years, the Asia Pacific GPU market is expected to experience significant growth driven by rising demand for AI and machine learning applications, advancements in gaming technology, and the increasing use of GPUs in cloud data centers. As the region continues to invest in 5G networks, autonomous driving technology, and smart city initiatives, the demand for high-performance GPUs is anticipated to surge. The ongoing development of AI and machine learning in sectors like healthcare, finance, and education will further propel GPU adoption in the region.

Market Opportunities

- Expansion into AR/VR: The growing adoption of Augmented Reality (AR) and Virtual Reality (VR) in sectors such as gaming, healthcare, and education presents a significant opportunity for the GPU market in Asia Pacific. By 2023, the AR/VR market in the region was valued at approximately $32 billion, with countries like China and Japan leading the charge in integrating AR/VR into both consumer and enterprise applications. GPUs are essential for rendering immersive AR/VR experiences, and the increasing adoption of these technologies creates a favorable environment for GPU manufacturers.

- AI-Powered Edge Devices: With the rise of IoT and AI-powered edge devices in industries like manufacturing and logistics, the demand for GPUs that can support real-time data processing is increasing. According to the Asian Development Bank (ADB), the IoT market in the Asia Pacific region is expected to generate over $200 billion in economic output by 2025. GPUs play a critical role in enabling AI-powered edge computing, which allows for faster decision-making and processing at the device level, creating new opportunities for GPU manufacturers to tap into this growing market.

Scope of the Report

|

Dedicated GPUs Integrated GPUs Hybrid GPUs |

|

|

By Distribution Channel |

Gaming, Data Centers AI & Machine Learning Industrial & Automotive Applications |

|

By Application |

Ray Tracing Multi-GPU Technology AI Accelerated Computing |

|

By Consumer Group |

Consumer Electronics Enterprise Automotive Healthcare |

|

By Region |

North East West South |

Products

Key Target Audience

GPU Manufacturers

Data Center Operators

Cloud Service Providers

Gaming Companies

AI & Machine Learning Enterprises

Automotive and Autonomous Vehicle Manufacturers

Venture Capital and Investment Firms

Government and Regulatory Bodies (China Ministry of Industry and Information Technology, Japans Ministry of Economy, Trade and Industry)

Companies

Players Mention in the Report:

NVIDIA Corporation

Advanced Micro Devices (AMD)

Intel Corporation

Qualcomm Technologies, Inc.

Imagination Technologies

ARM Limited

Samsung Electronics Co., Ltd.

Huawei Technologies Co., Ltd.

MediaTek Inc.

Apple Inc.

ASUStek Computer Inc.

EVGA Corporation

Gigabyte Technology Co., Ltd.

MSI (Micro-Star International)

Zotac Technology Limited

Table of Contents

1. Asia Pacific GPU Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific GPU Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific GPU Market Analysis

3.1. Growth Drivers (e.g., Adoption of AI and Machine Learning, Gaming Industry Growth, Cloud Computing)

3.2. Market Challenges (e.g., Supply Chain Disruptions, High Manufacturing Costs, Geopolitical Risks)

3.3. Opportunities (e.g., Expansion into AR/VR, AI-Powered Edge Devices, Autonomous Vehicles)

3.4. Trends (e.g., Increasing Demand for High-Performance GPUs, Cloud Gaming, GPU Virtualization)

3.5. Government Regulations (e.g., Export Controls on High-Performance GPUs, Data Privacy Laws, Local Content Regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Asia Pacific GPU Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dedicated GPUs

4.1.2. Integrated GPUs

4.1.3. Hybrid GPUs

4.2. By Application (In Value %)

4.2.1. Gaming

4.2.2. Data Centers

4.2.3. AI & Machine Learning

4.2.4. Industrial & Automotive Applications

4.3. By Technology (In Value %)

4.3.1. Ray Tracing

4.3.2. Multi-GPU Technology

4.3.3. AI Accelerated Computing

4.4. By End User (In Value %)

4.4.1. Consumer Electronics

4.4.2. Enterprise

4.4.3. Automotive

4.4.4. Healthcare

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific GPU Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. NVIDIA Corporation

5.1.2. Advanced Micro Devices (AMD)

5.1.3. Intel Corporation

5.1.4. Qualcomm Technologies, Inc.

5.1.5. Imagination Technologies

5.1.6. ARM Limited

5.1.7. Samsung Electronics Co., Ltd.

5.1.8. Huawei Technologies Co., Ltd.

5.1.9. MediaTek Inc.

5.1.10. Apple Inc.

5.1.11. ASUStek Computer Inc.

5.1.12. EVGA Corporation

5.1.13. Gigabyte Technology Co., Ltd.

5.1.14. MSI (Micro-Star International)

5.1.15. Zotac Technology Limited

5.2. Cross Comparison Parameters (Headquarters, Number of Patents, Product Portfolio, GPU Technology, Market Presence, Strategic Partnerships, R&D Investments, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific GPU Market Regulatory Framework

6.1. Environmental Standards for Manufacturing

6.2. Export and Import Regulations

6.3. Compliance with Intellectual Property Laws

6.4. Certification Requirements for GPU Products

7. Asia Pacific GPU Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific GPU Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific GPU Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping the entire Asia Pacific GPU ecosystem. This includes identifying all major stakeholders such as GPU manufacturers, data centers, gaming companies, and AI developers. Through a combination of desk research and secondary databases, the most critical factors driving the GPU market, such as product innovation and industry partnerships, are identified and analyzed.

Step 2: Market Analysis and Construction

In this phase, we gather and analyze historical data on the Asia Pacific GPU market. This includes assessing market penetration rates, product adoption in various sectors, and financial performance across leading companies. The data helps us estimate revenue contributions and growth potential for different segments, ensuring accuracy in market size and segmentation analysis.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are developed and validated through expert interviews and consultations. Industry experts from leading GPU manufacturers and AI companies are consulted to gain insight into market trends, technological advancements, and consumer preferences. This feedback is critical in refining the market forecasts and segment analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all data collected from both primary and secondary sources. The insights gathered from company reports, industry experts, and proprietary databases are used to produce the final report. A bottom-up approach is employed to ensure that the analysis is comprehensive and accurate, leading to a well-validated representation of the Asia Pacific GPU market.

Frequently Asked Questions

01. How big is the Asia Pacific GPU Market?

The Asia Pacific GPU market is valued at USD 19.5 billion, driven by demand for high-performance computing in sectors like gaming, AI, and cloud data centers.

02. What are the challenges in the Asia Pacific GPU Market?

Challenges in Asia Pacific GPU market include supply chain disruptions, the high cost of GPU manufacturing, and geopolitical tensions that can affect semiconductor production and distribution across key markets.

03. Who are the major players in the Asia Pacific GPU Market?

Key players in the Asia Pacific GPU market include NVIDIA Corporation, AMD, Intel Corporation, Samsung Electronics, and Huawei Technologies, which dominate the market through strong innovation and extensive product portfolios.

04. What are the growth drivers of the Asia Pacific GPU Market?

The Asia Pacific GPU market is propelled by advancements in AI, growing demand for gaming GPUs, and the expansion of cloud data centers across countries like China, Japan, and South Korea.

05. What are the key trends in the Asia Pacific GPU Market?

Key trends in Asia Pacific GPU market include the integration of GPUs in AI applications, increased use of GPUs in cloud computing, and the development of next-generation GPUs for autonomous driving and smart city applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.