Asia Pacific Gum Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9776

November 2024

98

About the Report

Asia Pacific Gum Market Overview

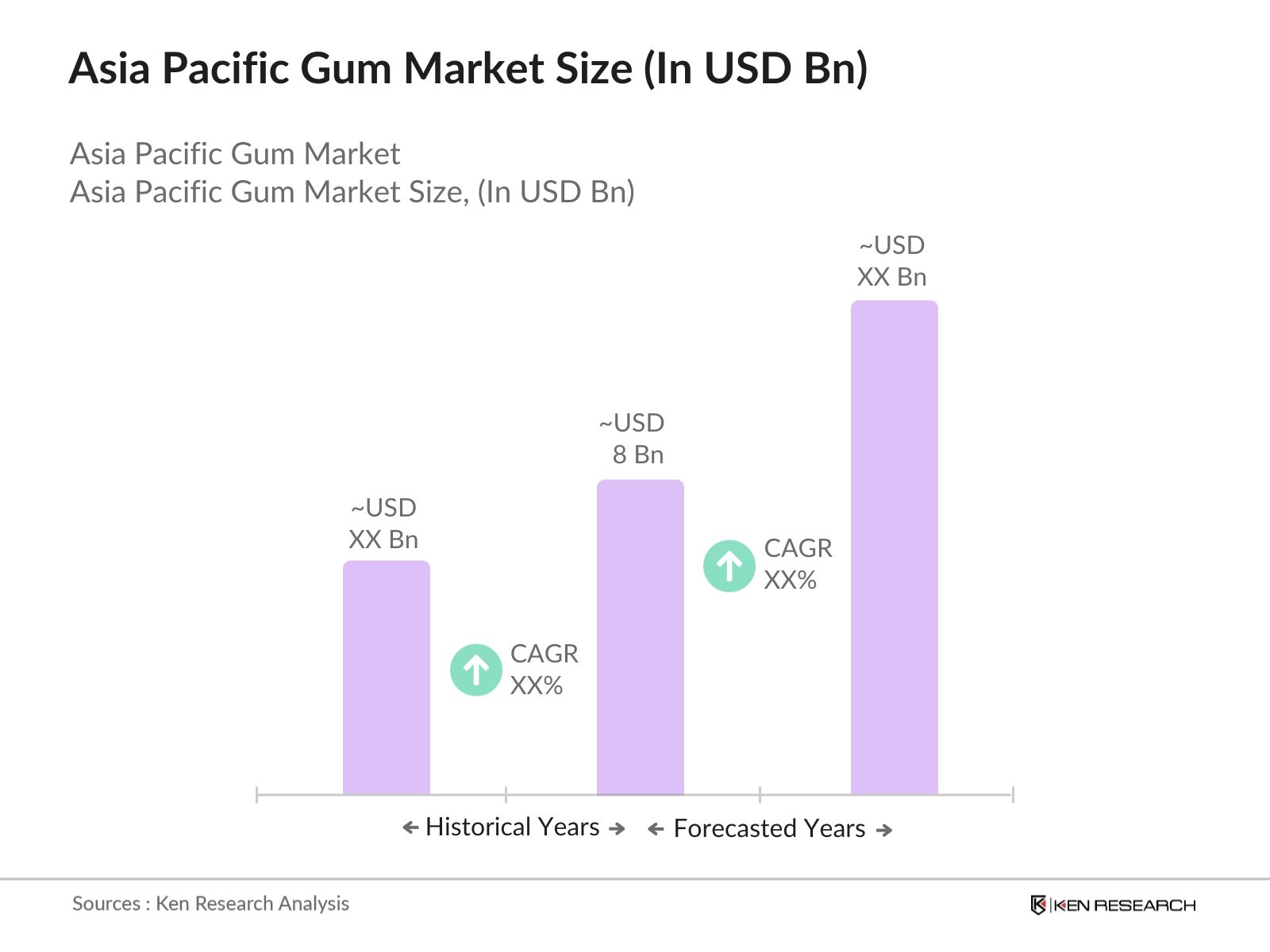

- The Asia Pacific gum market is valued at USD 8 billion, driven by increasing health-consciousness and consumer demand for sugar-free and functional gum varieties. Urbanization and rising disposable income across key regions such as East Asia and Southeast Asia have spurred market expansion. This growth is further amplified by strong retail networks that ensure wide accessibility of these products to consumers. Health and wellness trends have also played a significant role in propelling the demand for nutraceutical gum products, positioning the market for robust growth.

- Dominant regions within the Asia Pacific gum market include China, Japan, and India. These countries lead the market due to their large consumer base, strong urbanization rates, and rising middle-class populations, which boost consumer spending. In particular, China benefits from a growing demand for health-oriented products, while Japans penchant for premium and functional gum products drives its dominance. India, with its expanding retail network and rising disposable incomes, remains a key player due to increasing demand for affordable gum varieties.

- Several governments in the Asia Pacific region have introduced environmental policies aimed at addressing the issue of gum waste, particularly due to the non-biodegradable nature of synthetic gum. For example, in 2023, the Singaporean government implemented new waste management regulations, penalizing businesses that fail to comply with proper disposal and recycling measures for plastic-based gum products. China has also introduced stricter waste disposal laws under its revised Environmental Protection Law, aimed at reducing non-recyclable waste, which includes traditional gum. These regulations push manufacturers to develop biodegradable gum options or face fines and restrictions on sales.

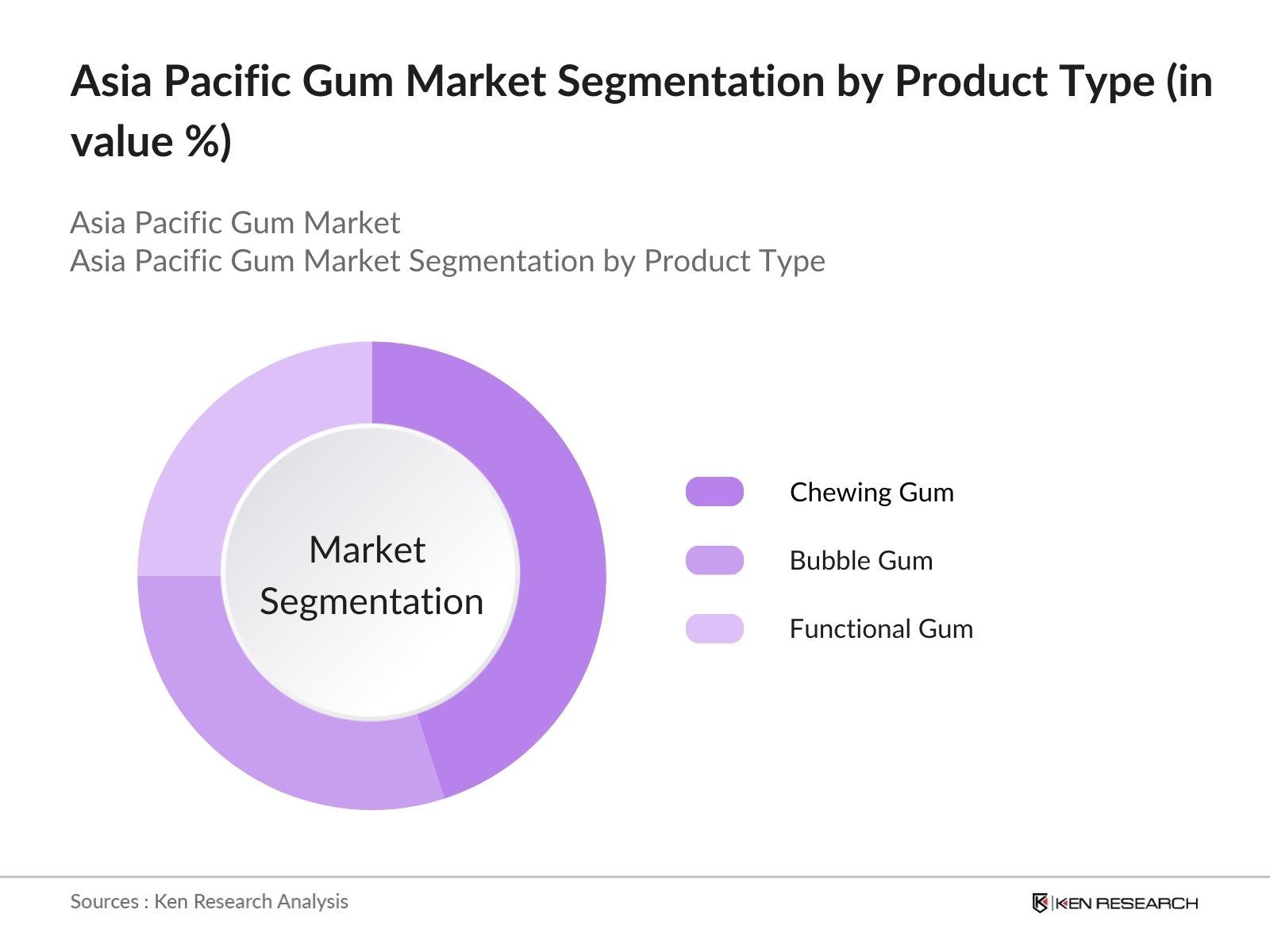

Asia Pacific Gum Market Segmentation

- By Product Type: The market is segmented by product type into chewing gum, bubble gum, and functional gum. Recently, functional gum has gained a dominant market share within the product type segmentation. This is due to its rising popularity among health-conscious consumers, as these gums are often infused with vitamins, caffeine, and other functional ingredients aimed at enhancing consumer wellness. The increasing consumer demand for sugar-free options and functional benefits like dental care, energy, and stress relief has boosted this segments market share significantly.

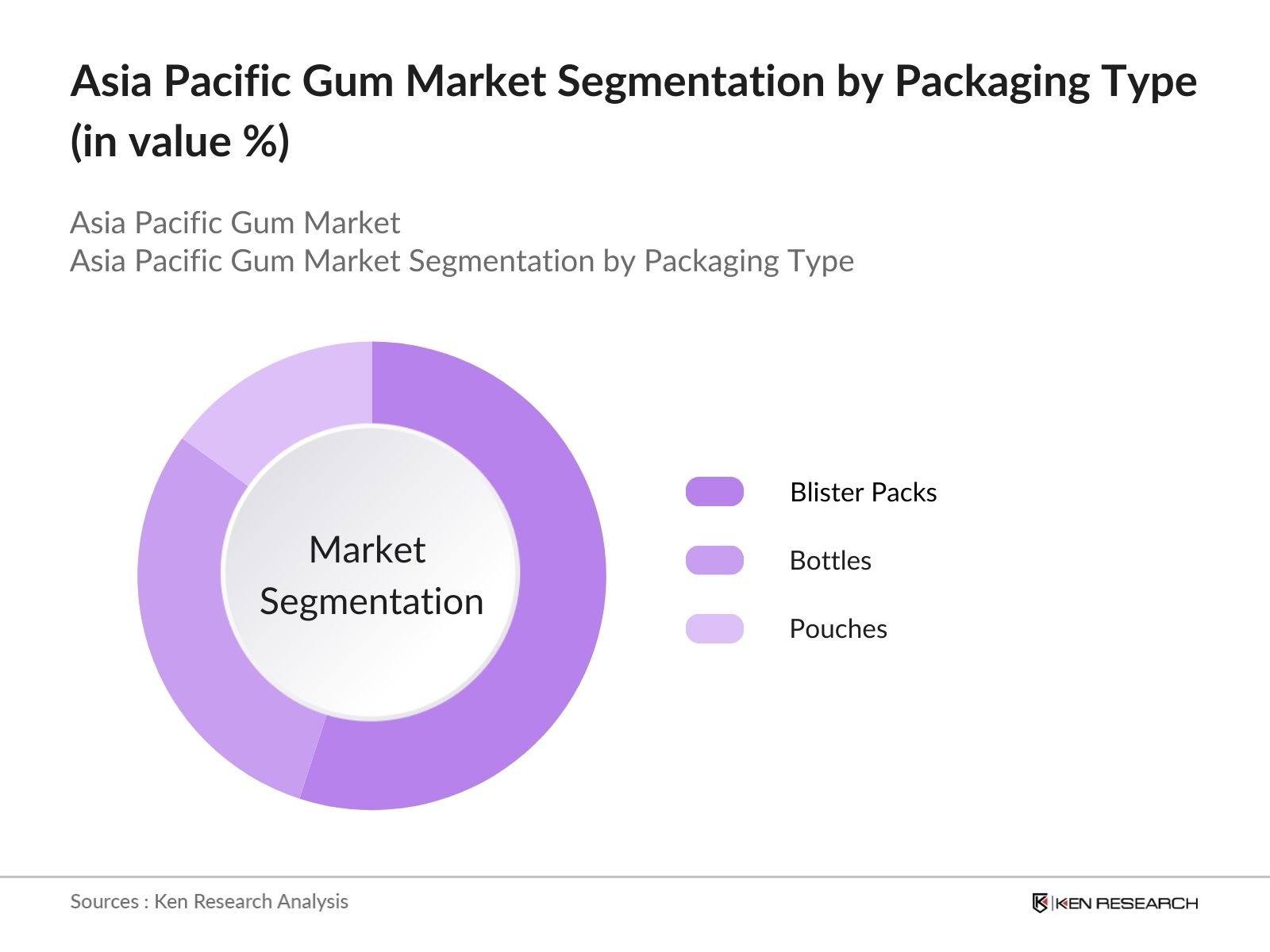

- By Packaging Type: The market is also segmented by packaging type into blister packs, bottles, and pouches. Blister packs hold a leading market share due to their convenience and long-standing popularity. These packs are compact, portable, and preserve product freshness effectively, making them a preferred choice for consumers on the go. Furthermore, blister packs offer clear visibility of the product, making them appealing to retailers. Bottles and pouches are also popular for their bulk sizes, catering to family use or frequent consumers.

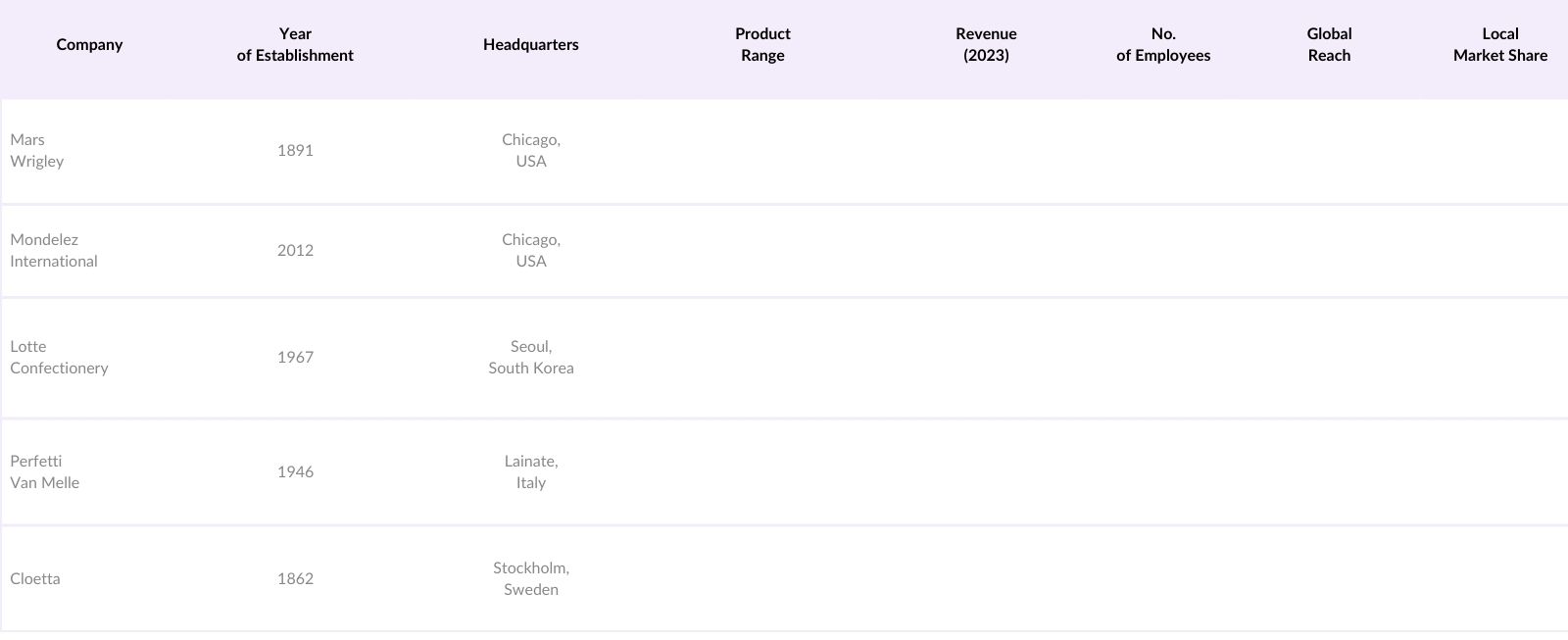

Asia Pacific Gum Market Competitive Landscape

The Asia Pacific gum market is dominated by a few major players that have established strong brand loyalty and distribution networks across the region. Global leaders such as Mars Wrigley and Mondelez International, along with regional giants like Lotte Confectionery and Perfetti Van Melle, continue to consolidate their market positions through product innovation and marketing strategies. These companies have made significant investments in developing sugar-free and functional gum products to cater to evolving consumer preferences.

Asia Pacific Gum Industry Analysis

Growth Drivers

- Health-conscious consumption trends (demand for sugar-free and functional gum): In Asia Pacific, growing health awareness is shaping consumer preferences, especially in urban areas. The demand for sugar-free gum products has seen a significant rise, reflecting the increasing incidence of diabetes. In India alone, over 77 million people were diagnosed with diabetes in 2022, pushing consumers toward sugar alternatives, including sugar-free gum. Similarly, functional gum containing ingredients like vitamins or caffeine is gaining traction as consumers seek added benefits in daily consumables. Japan, known for its aging population, sees a higher demand for such functional products as consumers seek oral health benefits as well.

- Urbanization and increasing disposable incomes: Urbanization in Asia Pacific is directly correlated with the rise in disposable incomes. As per the IMF, approximately 55% of Asia's population lives in urban areas, contributing to a rise in consumer spending, including non-essential items like gum. China, the regions largest economy, saw an average disposable income of 43,834 yuan per capita in 2023. As urban populations grow, the demand for convenience products, including chewing gum, is also rising, spurred by fast-paced urban lifestyles and on-the-go consumption trends.

- Marketing and product innovations (flavors and packaging): Innovations in flavors and packaging are key drivers in the Asia Pacific gum market. Major brands have introduced bold and exotic flavors to attract consumers, particularly younger demographics in countries like South Korea and China. In 2023, South Korea's younger population (aged 15-24) constituted 13.2 million people, forming a substantial consumer base for such products. In addition, sustainable and convenient packaging innovations such as resealable pouches are gaining popularity, reflecting changing consumer priorities. These innovations are crucial for enhancing product appeal and shelf-life, particularly in highly competitive markets like Japan.

Market Challenges

- Fluctuations in raw material prices (chicle, synthetic polymers): The Asia Pacific gum market is vulnerable to fluctuations in raw material prices, particularly chicle, a natural gum base, and synthetic polymers like polyvinyl acetate. In 2023, the global synthetic polymer market experienced a 10% price increase due to supply chain disruptions and rising oil prices. Countries like Thailand, which rely on chicle production, are also impacted by agricultural shifts and environmental changes, affecting the supply chain. Such volatility in raw material pricing affects profit margins and pricing strategies across the gum industry.

- Environmental concerns about plastic-based gum: Asia Pacific is facing growing environmental scrutiny due to the non-biodegradable nature of plastic-based gum. An estimated 100,000 tonnes of chewing gum waste are generated globally each year, with a significant proportion attributed to plastic-based products. Many countries, including Singapore, are considering stricter regulations on plastic waste. Additionally, in China, new environmental laws have led to higher penalties for waste disposal non-compliance, prompting manufacturers to seek biodegradable alternatives. The environmental concerns pose a direct challenge to traditional gum products.

Asia Pacific Gum Market Future Outlook

Over the next five years, the Asia Pacific gum market is expected to experience substantial growth, driven by advancements in product formulations, such as the development of sugar-free and functional gum. As consumer awareness about oral health and wellness continues to rise, demand for gums that offer added health benefits is likely to fuel market expansion. Additionally, the growth of e-commerce and online retail platforms will provide new distribution channels, further driving sales in untapped regions across Asia.

Market Opportunities

- Innovation in biodegradable gum products: There is a growing demand for biodegradable gum products in response to environmental concerns, providing a significant opportunity for manufacturers in the Asia Pacific region. In 2023, biodegradable alternatives made from natural polymers saw increased interest, particularly in eco-conscious markets like Japan and Australia. Japan, with an estimated 12% annual increase in demand for eco-friendly products, is encouraging innovation in biodegradable packaging and ingredients. This shift aligns with broader government policies aimed at reducing plastic waste, presenting an opportunity for new entrants and innovators.

- Increasing health awareness and gum with functional benefits (vitamin-enriched, energy-boosting): Health-conscious consumers are driving demand for gum with added functional benefits, such as vitamin-enriched or energy-boosting variants. In 2023, Thailand saw a 15% increase in sales of functional food products, including chewing gum fortified with vitamins like B12 or C. This trend aligns with the regions focus on preventive health and well-being, creating opportunities for brands that can offer additional health benefits through everyday products. The increasing preference for multifunctional consumables positions this segment for growth, particularly in fast-paced urban centers across Asia.

Scope of the Report

Products

Key Target Audience

Chewing Gum Manufacturers

Functional Food Producers

Retail Chains and Supermarkets

E-commerce Platforms

Health and Wellness Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, China Food and Drug Administration)

Packaging and Raw Material Suppliers

Companies

Major Players in the Asia Pacific Gum Market

Mars Wrigley Confectionery

Perfetti Van Melle

Lotte Confectionery

Mondelez International

Meiji Holdings Co., Ltd.

The Hershey Company

Cloetta AB

Orion Confectionery

Haribo GmbH & Co. KG

Gumlink Confectionery Company

LOT-100 Food Co. Ltd.

Tokyo Candy Co.

Xlear, Inc.

Mayora Indah

Big Sky Brands Inc.

Table of Contents

1. Asia Pacific Gum Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Gum Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Gum Market Analysis

3.1 Growth Drivers

- Health & Wellness Trends

- Increased Demand for Sugar-Free Options

- Rising Consumption in Emerging Markets

- Expanding Applications in Functional Foods

3.2 Market Challenges

- Regulatory Hurdles (FDA, Food Safety Standards)

- Volatile Raw Material Prices (Natural Gum, Synthetic Gum)

- Growing Competition from Alternatives (Chewing Gums, Breath Fresheners)

3.3 Opportunities

- Innovation in Flavors and Packaging

- Expansion into Untapped Markets

- Rise of Functional and Medicinal Gum Categories

3.4 Trends

- Focus on Sustainable Sourcing of Ingredients

- Technological Innovations in Gum Processing

- Increasing Demand for Vegan and Organic Gum

3.5 Government Regulations

- Food Labeling and Health Claims (APAC Regulatory Agencies)

- Import and Export Regulations (Tariffs, Trade Policies)

- Regulations on Additives and Sweeteners (Government Health Agencies)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Manufacturers, Retailers)

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Asia Pacific Gum Market Segmentation

4.1 By Product Type (In Value %)

- 4.1.1 Chewing Gum

- 4.1.2 Bubble Gum

- 4.1.3 Functional Gum

4.2 By Flavor (In Value %)

- 4.2.1 Mint

- 4.2.2 Fruit

- 4.2.3 Herbal

4.3 By Packaging Type (In Value %)

- 4.3.1 Blister Packs

- 4.3.2 Bottles

- 4.3.3 Pouches

4.4 By Distribution Channel (In Value %)

- 4.4.1 Supermarkets/Hypermarkets

- 4.4.2 Convenience Stores

- 4.4.3 Online Retail

4.5 By Region (In Value %)

- 4.5.1 North

- 4.5.2 East

- 4.5.3 West

- 4.5.4 South

5. Asia Pacific Gum Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

- Wrigley

- Mondelz International

- Perfetti Van Melle

- Lotte Corporation

- Haribo GmbH & Co. KG

- LOT100

- ZOFT Gum Company

- Hershey Co.

- The Simply Gum Company

- Xlear Inc.

- Verve Inc. (PUR Gum)

- Meiji Holdings Co. Ltd.

- Ferrero Group

- Cloetta AB

- Trident

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Product Portfolio, Manufacturing Capacity, Geographical Presence, Innovation Initiatives, Market Share, Revenue Growth Rate)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Collaborations, Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Gum Market Regulatory Framework

6.1 Food Safety Standards (FDA, FSSAI, APAC Agencies)

6.2 Compliance Requirements (Labeling, Ingredient Certifications)

6.3 Certification Processes (Organic, Halal, Vegan Certifications)

7. Asia Pacific Gum Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Gum Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Flavor (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Gum Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Gum Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including consumer preferences, pricing, and product innovation.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Gum Market. This includes assessing market penetration, the ratio of gum varieties to retailers, and revenue generation. Furthermore, an evaluation of sales data and consumer purchase behavior will be conducted to ensure the reliability and accuracy of the revenue estimates and to understand consumer trends across the region.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts from both regional and global companies. These consultations provide valuable insights into operational strategies, financial performance, and product trends, ensuring a comprehensive understanding of market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with major gum manufacturers to gather detailed insights into product segments, sales performance, and market dynamics. This interaction helps verify and complement data from the bottom-up approach, ensuring a well-rounded, data-driven analysis of the Asia Pacific Gum Market.

Frequently Asked Questions

01. How big is the Asia Pacific Gum Market?

The Asia Pacific gum market is valued at USD 8 billion, driven by the growing consumer preference for sugar-free and functional gum, alongside rising disposable incomes across key markets like China, Japan, and India.

02. What are the challenges in the Asia Pacific Gum Market?

Challenges in the Asia Pacific gum market include fluctuating raw material costs, particularly for natural gum base ingredients, increasing environmental concerns about non-biodegradable gum, and competition from other breath-freshening products like mints.

03. Who are the major players in the Asia Pacific Gum Market?

Key players in the Asia Pacific gum market include Mars Wrigley Confectionery, Mondelez International, Lotte Confectionery, Perfetti Van Melle, and Meiji Holdings Co., Ltd. These companies have a significant influence due to their extensive product portfolios, innovation capabilities, and strong distribution channels.

04. What are the growth drivers of the Asia Pacific Gum Market?

The Asia Pacific gum market is driven by increasing consumer demand for sugar-free and health-oriented gum products, product innovations, and the expanding e-commerce sector. The rising disposable income in emerging markets like China and India further boosts the growth of the gum market.

05. What are the trends in the Asia Pacific Gum Market?

Key trends in Asia Pacific gum market include the development of functional gum with added vitamins and herbal ingredients, a focus on biodegradable gum products, and a surge in online sales due to the convenience of e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.