Asia Pacific Health & Wellness Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD5690

November 2024

86

About the Report

Asia Pacific Health & Wellness Market Overview

- The Asia Pacific Health & Wellness Market is valued at USD 2 billion, driven by increasing consumer awareness towards preventive healthcare and wellness products. The market is further fueled by the rise in chronic diseases, leading consumers to adopt healthier lifestyles, and the proliferation of digital health technologies. Countries in the region have seen rapid economic growth, resulting in higher disposable incomes and a willingness to invest in health-related products and services, particularly in markets like fitness, nutrition, and mental wellness.

- In terms of dominant countries, China, Japan, and Australia lead the Asia Pacific Health & Wellness Market. Chinas large population, coupled with increasing demand for health supplements and fitness products, drives its leadership position. Japan, with its aging population, has a high demand for wellness products and preventive healthcare solutions, while Australias high standard of living and proactive health awareness contribute to its significant market share. These countries dominate due to their established health infrastructure, widespread consumer education, and rising governmental support for health-focused initiatives.

- The certification process for wellness products across the Asia Pacific is highly regulated, particularly for organic and natural products. In 2024, over 5,000 products in Australia underwent certification by the Australian Certified Organic (ACO) organization, ensuring adherence to strict safety and environmental standards. Similarly, Japans Ministry of Agriculture, Forestry and Fisheries requires all wellness products claiming organic status to meet national standards, and in 2023, 800 new products were certified under these guidelines. These processes ensure transparency and quality control but can delay market entry.

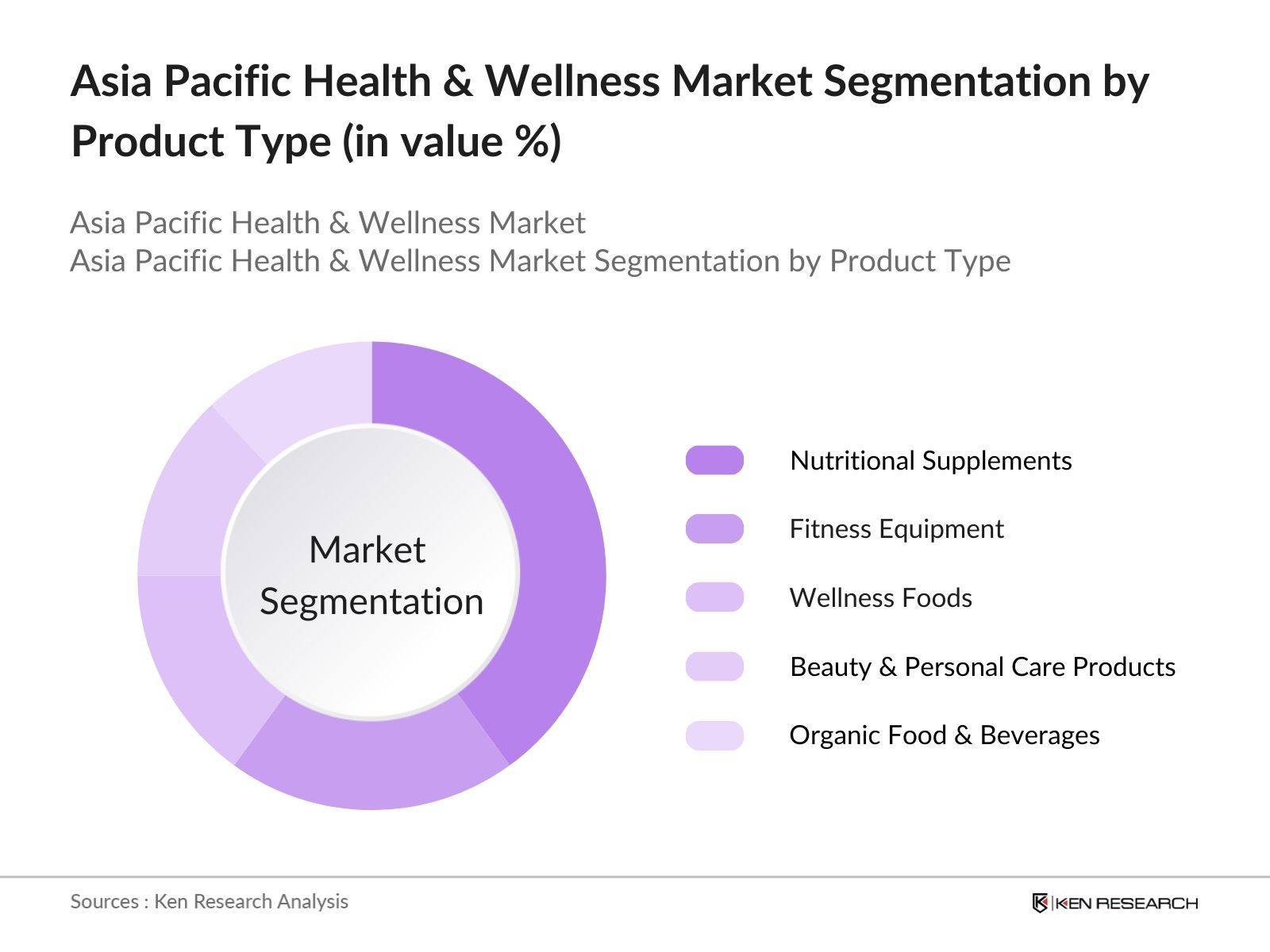

Asia Pacific Health & Wellness Market Segmentation

By Product Type: The Asia Pacific Health & Wellness Market is segmented by product type into nutritional supplements, fitness equipment, wellness foods, beauty and personal care products, and organic food & beverages. Nutritional supplements dominate this segment, primarily due to increasing awareness of the importance of dietary supplements in improving overall health and wellness. Vitamins, minerals, and protein supplements are widely consumed by health-conscious individuals, particularly in urban areas. The rise in chronic diseases and an aging population further contribute to the dominance of this sub-segment, as consumers seek preventive solutions for long-term health benefits.

By Distribution Channel: The market is also segmented by distribution channels into online retail, specialty stores, supermarkets/hypermarkets, and pharmacies. Online retail is the dominant distribution channel, primarily driven by the convenience it offers to consumers. The growth of e-commerce platforms, particularly in China and India, has accelerated the availability of health and wellness products, enabling consumers to access a wide range of options from the comfort of their homes.

By Distribution Channel: The market is also segmented by distribution channels into online retail, specialty stores, supermarkets/hypermarkets, and pharmacies. Online retail is the dominant distribution channel, primarily driven by the convenience it offers to consumers. The growth of e-commerce platforms, particularly in China and India, has accelerated the availability of health and wellness products, enabling consumers to access a wide range of options from the comfort of their homes.

Asia Pacific Health & Wellness Market Competitive Landscape

The Asia Pacific Health & Wellness Market is dominated by a few key players, with companies like Nestl Health Science and Amway Corporation holding a significant share due to their extensive product portfolios and established distribution networks. The market also sees strong competition from local brands, particularly in emerging markets like India and Southeast Asia, where demand for affordable health and wellness solutions is rising.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Portfolio |

Geographical Reach |

R&D Investments |

Market Penetration |

Digital Platforms |

Sustainability Initiatives |

|

Nestl Health Science |

2011 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

Amway Corporation |

1959 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Herbalife Nutrition |

1980 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Unilever |

1929 |

UK |

- |

- |

- |

- |

- |

- |

- |

|

GNC Holdings |

1935 |

USA |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Health & Wellness Market Analysis

Growth Drivers

- Growing Focus on Preventive Healthcare: Preventive healthcare is becoming a central focus across the Asia Pacific, as governments increase healthcare funding. Countries like Singapore are also enhancing their focus on preventive health, investing USD 1.5 billion in preventive healthcare technologies. This shift aims to reduce long-term healthcare costs and improve population health outcomes, particularly in aging populations where chronic conditions such as diabetes and cardiovascular diseases are prevalent.

- Increasing Demand for Organic and Natural Products: The demand for organic and natural health products has surged across the region. By 2024, Australias organic product market was valued at USD 2.6 billion, driven by consumer preference for chemical-free and sustainable products. Similarly, the Indian government recorded an 18% rise in domestic production of organic health supplements in 2023, with over 1,000 new organic certification applications filed that year. The rise in lifestyle-related health concerns has led to a heightened demand for natural remedies and supplements, especially in urban centers.

- Rising Adoption of Digital Health Solutions: Digital health solutions are revolutionizing healthcare delivery across the Asia Pacific, with Japan and South Korea leading the adoption. In 2024, over 30 million telehealth consultations were conducted in South Korea, facilitated by a government-supported digital health infrastructure worth USD 12 billion. In India, the Ministry of Health reported a 120% increase in telemedicine use since 2022, reflecting the growing reliance on technology for healthcare access. This trend is significantly reducing the healthcare gap in rural regions, where physical healthcare facilities are sparse.

Challenges

- Regulatory Compliance and Standards: Ensuring compliance with stringent regulatory frameworks remains a significant challenge for health and wellness businesses in Asia Pacific. InIndia, the government is reviewing whether nutraceuticals should be regulated under the Central Drugs Standard Control Organisation (CDSCO). The fragmented regulatory landscape, with different countries enforcing varying levels of oversight, poses additional complexities for manufacturers looking to operate across borders.

- Market Fragmentation: The Asia Pacific health and wellness market is highly fragmented, with over 10,000 small and medium-sized enterprises (SMEs) competing alongside multinational corporations. In 2023, the Indian Ministry of Commerce reported that SMEs constituted 60% of the wellness product market, leading to a crowded marketplace with varying product quality and market reach. This fragmentation hampers the ability of smaller players to achieve scale and compete effectively against established brands.

Asia Pacific Health & Wellness Market Future Outlook

Asia Pacific Health & Wellness Market is expected to show significant growth, driven by increasing consumer demand for preventive healthcare solutions, advancements in health technology, and the rising popularity of personalized wellness products. Governments in the region are also supporting health and wellness initiatives, which will contribute to the sectors continued expansion. Furthermore, the growing influence of digital platforms and e-commerce is expected to further enhance the accessibility of wellness products, particularly in rural areas and underserved markets.

Market Opportunities

- Expansion into Untapped Markets in Southeast Asia: Southeast Asia presents a significant growth opportunity for health and wellness brands. In 2024, the ASEAN Economic Community forecasted that the health and wellness industry in the region could expand by USD 15 billion over the next five years, driven by rising healthcare investments and increasing consumer awareness. Markets like Vietnam, Laos, and Cambodia, where wellness products are underrepresented, offer substantial potential for companies seeking new growth avenues.

- Growth in Digital Health Platforms: The digital health market in Asia Pacific is forecasted to grow exponentially as telemedicine, mobile health apps, and wellness platforms become more mainstream. In 2024, China recorded 80 million active users on digital health platforms, contributing to the wider adoption of wellness solutions. This provides health and wellness brands with a growing digital channel to engage consumers and offer personalized wellness services remotely.

Scope of the Report

|

Segment |

Sub-Segment |

|

Product Type |

Nutritional Supplements Functional Foods & Beverages Wellness Equipment (Fitness Devices, Wearables) Personal Care & Beauty Products Organic Food & Beverages |

|

Distribution Channel |

Online Retail Supermarkets & Hypermarkets Specialty Stores Pharmacies & Drugstores |

|

Demographics |

Urban Population Rural Population Age Group (Millennials, Gen X, Baby Boomers) |

|

Application |

Preventive Healthcare Fitness and Weight Management Mental Health and Wellness Beauty and Personal Care |

|

Region |

East Asia Southeast Asia Oceania South Asia |

Products

Key Target Audience

Health and Wellness Brands

Fitness Equipment Manufacturers

Nutritional Supplement Manufacturers

Organic Food Producers

Wellness App and Platform Developers

Pharmacies & Drugstores

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Ministry of Commerce)

Companies

Players Mentioned in the Report

Nestl Health Science

Amway Corporation

Herbalife Nutrition

Unilever

GNC Holdings

Natures Bounty

Suntory Wellness

Bayer AG

Abbott Laboratories

Glanbia Performance Nutrition

Table of Contents

1. Asia Pacific Health & Wellness Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Health & Wellness Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Health & Wellness Market Analysis

3.1. Growth Drivers

3.1.1. Growing Focus on Preventive Healthcare

3.1.2. Increasing Demand for Organic and Natural Products

3.1.3. Rising Adoption of Digital Health Solutions

3.1.4. Government Initiatives Promoting Health & Wellness

3.2. Market Challenges

3.2.1. Regulatory Compliance and Standards

3.2.2. High Cost of Premium Products

3.2.3. Market Fragmentation

3.2.4. Limited Consumer Awareness in Developing Countries

3.3. Opportunities

3.3.1. Expansion into Untapped Markets in Southeast Asia

3.3.2. Collaboration with Healthcare Providers

3.3.3. Growth in Digital Health Platforms

3.3.4. Innovations in Personalization and Customization

3.4. Trends

3.4.1. Growing Popularity of Telehealth and Virtual Consultations

3.4.2. Increased Use of Wearable Health Devices

3.4.3. Personalized Nutrition Solutions Gaining Traction

3.4.4. Consumer Shift Towards Plant-Based Supplements

3.5. Government Regulation

3.5.1. National Health Campaigns

3.5.2. Regulatory Standards for Health Supplements

3.5.3. Certification Processes for Wellness Products

3.5.4. Health Data Privacy Regulations

4. Asia Pacific Health & Wellness Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Nutritional Supplements

4.1.2. Functional Foods & Beverages

4.1.3. Wellness Equipment (Fitness Devices, Wearables)

4.1.4. Personal Care & Beauty Products

4.1.5. Organic Food & Beverages

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets & Hypermarkets

4.2.3. Specialty Stores

4.2.4. Pharmacies & Drugstores

4.3. By Demographics (In Value %)

4.3.1. Urban Population

4.3.2. Rural Population

4.3.3. Age Group (Millennials, Gen X, Baby Boomers)

4.4. By Application (In Value %)

4.4.1. Preventive Healthcare

4.4.2. Fitness and Weight Management

4.4.3. Mental Health and Wellness

4.4.4. Beauty and Personal Care

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. Southeast Asia

4.5.3. Oceania

4.5.4. South Asia

5. Asia Pacific Health & Wellness Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl Health Science

5.1.2. Amway Corporation

5.1.3. Herbalife Nutrition

5.1.4. Unilever

5.1.5. GNC Holdings

5.1.6. Abbott Laboratories

5.1.7. Bayer AG

5.1.8. Natures Bounty

5.1.9. Suntory Wellness

5.1.10. Glanbia Performance Nutrition

5.2. Cross Comparison Parameters (Revenue, Distribution Networks, Product Portfolio, Consumer Base, R&D Investment, Sustainability Initiatives, Market Share, Growth Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Funding & Grants

5.8. Venture Capital and Private Equity Investments

6. Asia Pacific Health & Wellness Market Regulatory Framework

6.1. Regulations for Nutritional Supplements

6.2. Health & Wellness Certifications

6.3. Government Health Campaigns and Support

6.4. Food Safety and Standards Regulations

7. Asia Pacific Health & Wellness Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Health & Wellness Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Demographics (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Health & Wellness Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of the Asia Pacific Health & Wellness Market. Extensive desk research is conducted using proprietary databases to gather information on the major stakeholders, including consumers, manufacturers, distributors, and regulatory bodies. The objective is to identify critical variables that influence market dynamics, such as consumer preferences, purchasing power, and government regulations.

Step 2: Market Analysis and Construction

This phase includes the collection and analysis of historical data on market segments such as product types and distribution channels. Data on market penetration, sales performance, and consumer preferences is compiled, helping to build an accurate picture of current market conditions. This step ensures that our estimates are based on reliable data sources.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through interviews with industry experts from leading health and wellness companies. This consultation process validates the insights derived from desk research and enhances the overall reliability of the report. The information obtained provides key operational and financial insights that form the basis of our market projections.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from various sources, including manufacturers and distributors, to provide a comprehensive overview of the market. This step involves triangulating data to ensure accuracy, followed by a detailed analysis of market trends and growth opportunities. The final output offers a thorough, data-driven report on the Asia Pacific Health & Wellness Market.

Frequently Asked Questions

1. How big is the Asia Pacific Health & Wellness Market?

The Asia Pacific Health & Wellness Market is valued at USD 2 billion, driven by increased consumer awareness and demand for preventive healthcare products, along with the expansion of e-commerce platforms.

2. What are the challenges in the Asia Pacific Health & Wellness Market?

Challenges in Asia Pacific Health & Wellness Market include regulatory hurdles, market fragmentation, and the high cost of premium products. Additionally, limited consumer awareness in rural areas hampers market growth.

3. Who are the major players in the Asia Pacific Health & Wellness Market?

Key players in Asia Pacific Health & Wellness Market include Nestl Health Science, Amway Corporation, Herbalife Nutrition, Unilever, and GNC Holdings. These companies dominate due to their extensive product portfolios, global presence, and strong brand loyalty.

4. What are the growth drivers of the Asia Pacific Health & Wellness Market?

Asia Pacific Health & Wellness Market is driven by factors such as growing awareness of preventive healthcare, government initiatives promoting health and wellness, and the increasing adoption of digital health technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.