Asia Pacific Herbal Supplements Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD8293

December 2024

81

About the Report

Asia Pacific Herbal Supplements Market Overview

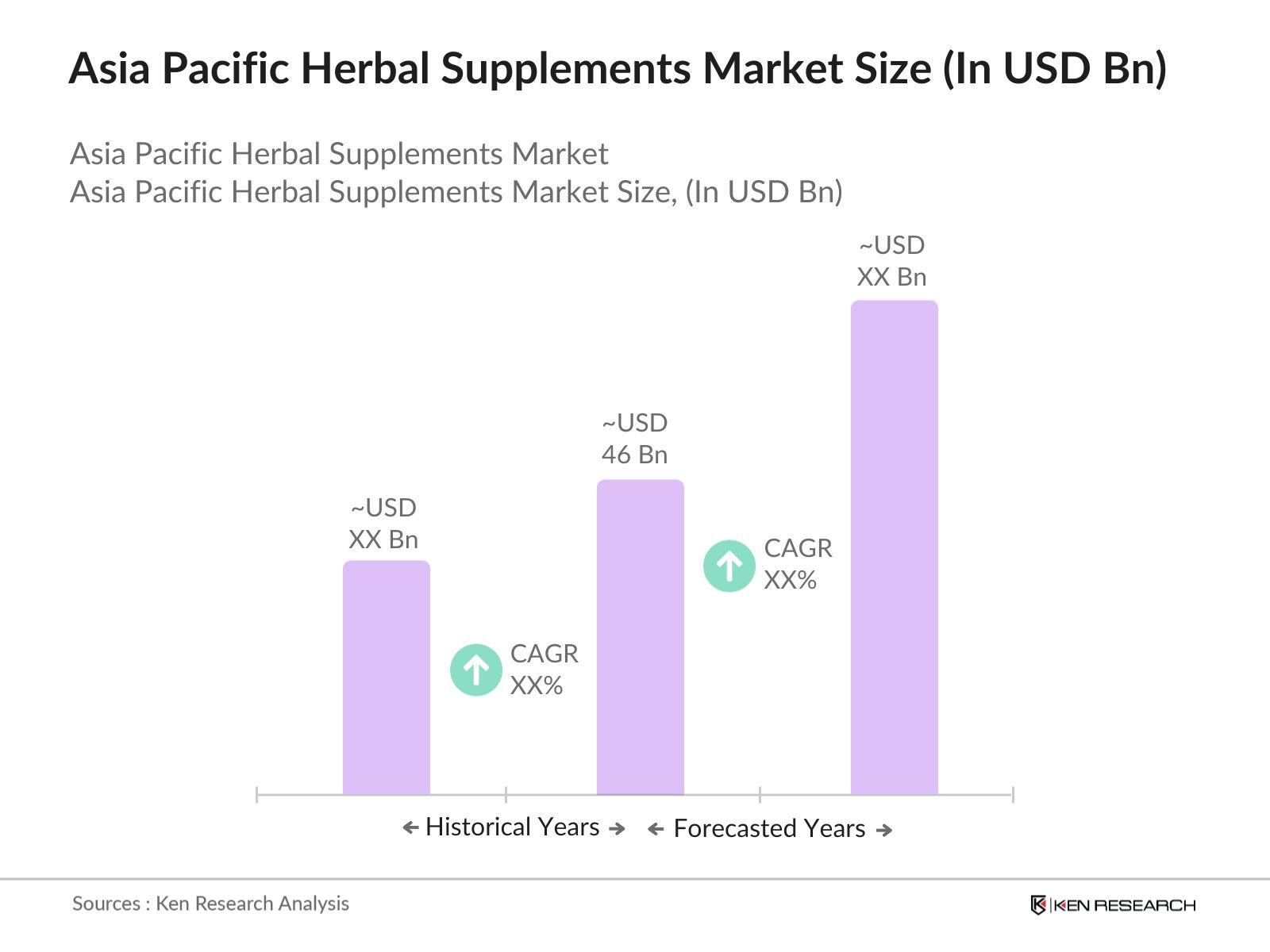

- Asia Pacific Herbal Supplements market is valued at USD 46 billion, based on a five-year historical analysis. This market is primarily driven by the rising consumer interest in natural and plant-based supplements, fueled by increasing health awareness and the inclination towards preventive healthcare. Additionally, the growing geriatric population in countries like Japan and China has further accelerated the demand for herbal supplements, which are perceived as a safer alternative to pharmaceutical drugs.

- Countries like China, India, and Japan dominate the Asia Pacific Herbal Supplements market due to their long-standing tradition of herbal medicine use. China and India, in particular, have extensive histories in herbal remedies, supported by government initiatives that promote the integration of traditional medicine in mainstream healthcare. The established infrastructure for herbal supplement production and research in these nations also contributes to their dominance in the market.

- Several governments in the Asia-Pacific region have launched initiatives to promote the use of herbal medicine, especially in countries like China, India, and Malaysia. In 2023, China allocated over $500 million for the development of Traditional Chinese Medicine (TCM) under its national health policy. Similarly, India's Ministry of AYUSH has been actively promoting Ayurveda and herbal supplements through government-funded research and international collaboration initiatives

Asia Pacific Herbal Supplements Market Segmentation

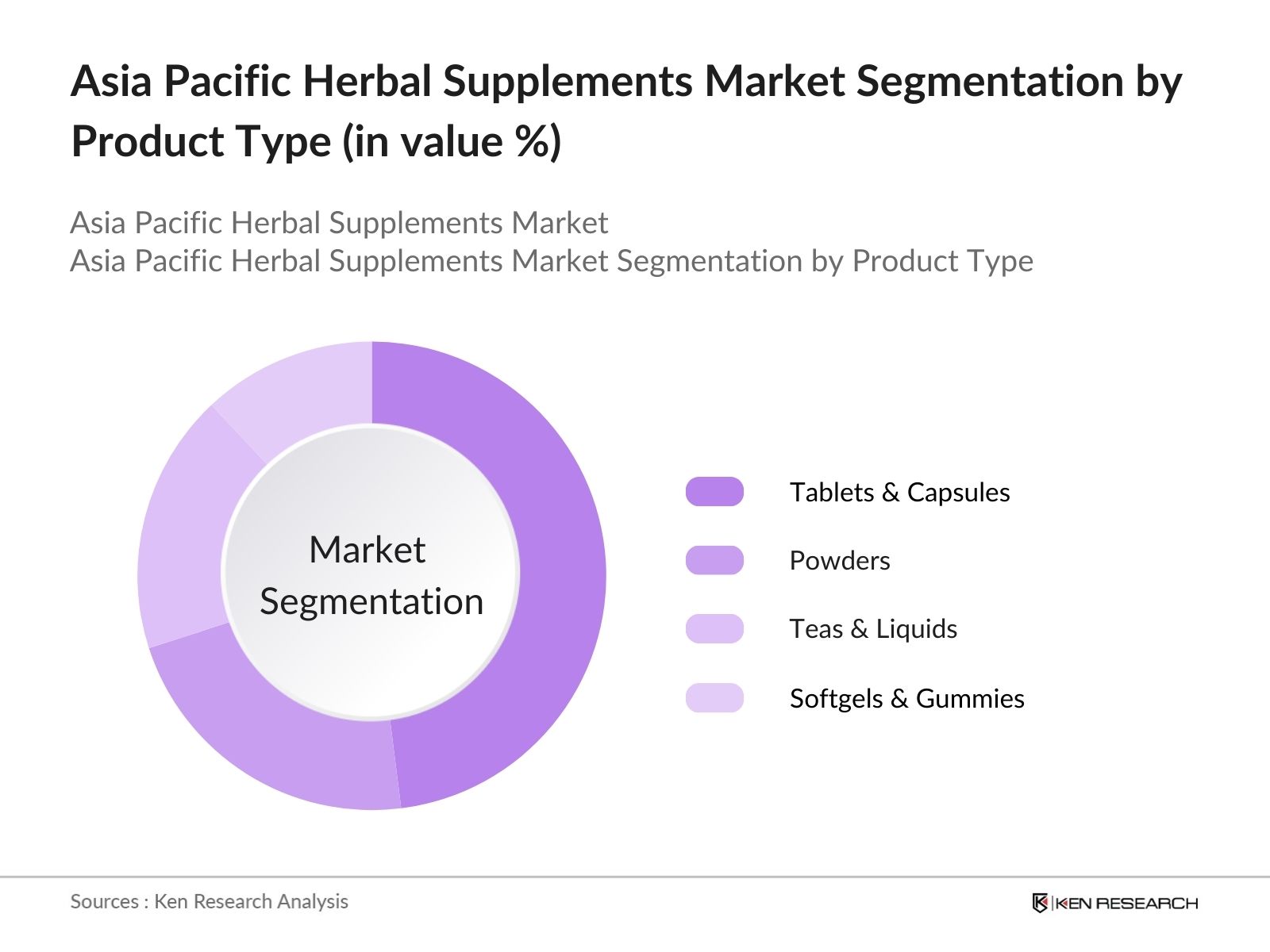

By Product Type: The Asia Pacific Herbal Supplements market is segmented by product type into tablets and capsules, powders, teas and liquids, and softgels and gummies. Recently, tablets and capsules hold a dominant market share under this segmentation due to their ease of consumption and extended shelf life. Consumers favor this format for its convenience, especially in markets where herbal supplements are part of daily healthcare routines. Additionally, pharmaceutical companies have invested heavily in this segment, ensuring quality control and efficient distribution networks.

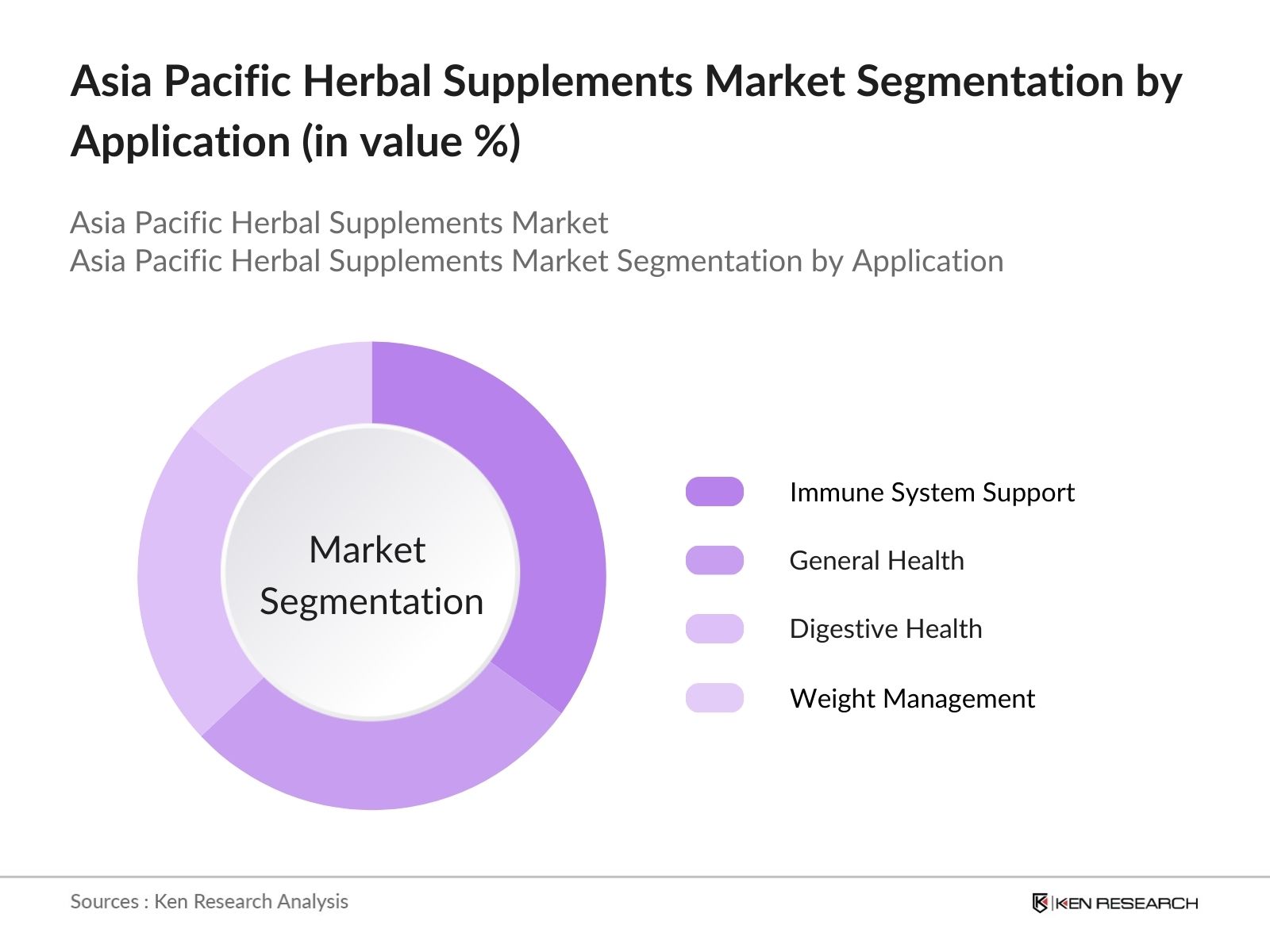

By Application: The Asia Pacific Herbal Supplements market is also segmented by application into general health, digestive health, immune system support, and weight management. The immune system support segment dominates the market due to the increasing awareness about the benefits of herbal supplements in strengthening immunity, especially post-pandemic. Consumers are increasingly turning towards natural supplements to maintain a robust immune system, as they are perceived to have fewer side effects than synthetic alternatives.

Asia Pacific Herbal Supplements Market Competitive Landscape

The Asia Pacific Herbal Supplements market is dominated by several key players, both regional and international. This consolidation highlights the significant influence of established herbal supplement manufacturers with robust distribution channels and R&D capabilities. The competition is characterized by innovation in product offerings, expansion into new markets, and collaborations with pharmaceutical companies.

|

Company Name |

Establishment Year |

Headquarters |

Market Share |

Product Portfolio |

Herbal Source |

Certifications |

Sustainability Initiatives |

Global Footprint |

|

Amway Corporation |

1959 |

Michigan, USA |

- |

- |

- |

- |

- |

- |

|

Herbalife Nutrition Ltd. |

1980 |

California, USA |

- |

- |

- |

- |

- |

- |

|

Natures Bounty Co. |

1971 |

New York, USA |

- |

- |

- |

- |

- |

- |

|

Himalaya Drug Company |

1930 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

|

Dabur India Ltd. |

1884 |

Ghaziabad, India |

- |

- |

- |

- |

- |

- |

Asia Pacific Herbal Supplements Market Analysis

Growth Drivers

- Increased Health Consciousness: According to the World Bank, non-communicable diseases accounted for over 80% of all deaths in the region in 2022, prompting a shift toward healthier lifestyles and products like herbal supplements. Herbal supplements are considered a natural alternative to pharmaceuticals, fueling demand for these products across various consumer segments, particularly in urban areas. This rise in demand is expected to strengthen the sector, with governments promoting preventive healthcare measures.

- Growing Geriatric Population: The Asia-Pacific region is home to one of the fastest-growing aging populations in the world. In 2024, over 240 million people aged 65 and above reside in the region, according to the United Nations Population Division. This demographic shift creates a high demand for herbal supplements, as elderly consumers often turn to natural remedies to manage age-related ailments such as arthritis, cognitive decline, and bone health issues.

- Rising Awareness of Natural Products: The shift towards natural and organic products is another key growth driver in the Asia-Pacific herbal supplements market. Consumers are increasingly aware of the harmful effects of synthetic ingredients and are opting for natural alternatives. For instance, a 2022 report by the World Health Organization indicated that nearly 65% of consumers in Southeast Asia preferred herbal and natural supplements over conventional pharmaceuticals for minor health issues, boosting the growth of the herbal supplements market.

Market Challenges

- Inconsistent Quality Standards: While countries like Japan and South Korea have stringent regulations for herbal product safety, other markets lack uniformity in production, leading to substandard products entering the market. According to the Asian Development Bank, over 40% of herbal products imported into the region in 2022 were flagged for failing to meet international quality standards. This has raised concerns about product efficacy and safety, potentially slowing market growth if not addressed.

- Stringent Regulatory Requirements: In countries like Japan and Singapore, products must undergo extensive testing before approval, making market entry challenging for new players. The World Trade Organization (WTO) reports that compliance costs for herbal supplement manufacturers have increased by nearly 20% between 2022 and 2023 due to tightened regulations on safety and efficacy. These stringent regulations can delay product launches and increase operational costs, affecting market dynamics.

Asia Pacific Herbal Supplements Market Future Outlook

Asia Pacific Herbal Supplements market is expected to grow significantly due to the rising demand for natural and organic supplements across countries in the region. Factors like government initiatives promoting traditional medicine, the growing focus on preventive healthcare, and the increasing demand for supplements tailored to specific health conditions will further drive market growth. Additionally, advancements in herbal supplement formulation and increasing online sales channels are projected to propel market expansion.

Market Opportunities

- Increasing Online Sales Channels: The rise of e-commerce platforms across Asia-Pacific presents a significant opportunity for the herbal supplements market. The Asia-Pacific region, led by China and India, saw a 25% growth in e-commerce sales for healthcare products in 2023. The shift to online sales allows herbal supplement companies to reach a broader customer base, including those in remote areas where physical stores may not be accessible. This trend is expected to drive greater demand for herbal products, particularly among younger, tech-savvy consumers.

- Product Diversification in Organic and Vegan Supplements: The growing preference for organic and vegan products in Asia-Pacific presents opportunities for herbal supplement manufacturers to diversify their product offerings. In 2024, vegan and organic supplements accounted for over 15% of the overall herbal supplement market in the region. The shift toward plant-based and sustainably sourced products is driven by increased consumer awareness of environmental issues and the health benefits of a vegan diet, providing room for innovation in product formulations.

Scope of the Report

|

Product Type |

Tablets and Capsules Powders Teas and Liquids Softgels and Gummies |

|

Application |

General Health Digestive Health Immune System Support Weight Management |

|

Distribution Channel |

Online Retail Pharmacies and Drug Stores Supermarkets and Hypermarkets Specialty Stores |

|

Source |

Herbal Extracts Organic Herbal Supplements Non-organic Herbal Supplements |

|

Region |

China India Japan Australia South Korea |

Products

Key Target Audience

Pharmaceutical Companies

Retail Pharmacies

Health and Wellness Centers

Herbal Supplement Manufacturers

E-commerce Platforms

Exporters of Herbal Supplements

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of AYUSH, Chinas State Administration of Traditional Chinese Medicine)

Companies

Players Mentioned in the Report

Amway Corporation

Herbalife Nutrition Ltd.

Natures Bounty Co.

Himalaya Drug Company

Dabur India Ltd.

Glanbia PLC

Bio-Botanica Inc.

Gaia Herbs

Solgar Inc.

Blackmores Ltd.

Table of Contents

1. Asia Pacific Herbal Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Key Market Developments

2. Asia Pacific Herbal Supplements Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Milestones and Developments

3. Asia Pacific Herbal Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Increased Health Consciousness

3.1.2. Growing Geriatric Population

3.1.3. Rising Awareness of Natural Products

3.1.4. Government Support for Herbal Medicine

3.2. Market Challenges

3.2.1. Inconsistent Quality Standards

3.2.2. Stringent Regulatory Requirements

3.2.3. Lack of Scientific Backing for Traditional Remedies

3.2.4. Distribution Channel Constraints

3.3. Opportunities

3.3.1. Increasing Online Sales Channels

3.3.2. Product Diversification in Organic and Vegan Supplements

3.3.3. Global Export Opportunities

3.3.4. Strategic Partnerships with Pharmaceutical Companies

3.4. Trends

3.4.1. Growth of Herbal Blends and Multi-Ingredient Products

3.4.2. Focus on Sustainable and Organic Ingredients

3.4.3. Rising Demand for Personalized Herbal Nutrition

3.4.4. Technology Integration in Herbal Supplement Formulation

3.5. Government Regulation

3.5.1. Government Herbal Medicine Promotion Initiatives

3.5.2. Stringent Product Approval Procedures

3.5.3. Licensing and Compliance for Manufacturers

3.5.4. Quality Control Measures and Certifications

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Herbal Supplements Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tablets and Capsules

4.1.2. Powders

4.1.3. Teas and Liquids

4.1.4. Softgels and Gummies

4.2. By Application (In Value %)

4.2.1. General Health

4.2.2. Digestive Health

4.2.3. Immune System Support

4.2.4. Weight Management

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Pharmacies and Drug Stores

4.3.3. Supermarkets and Hypermarkets

4.3.4. Specialty Stores

4.4. By Source (In Value %)

4.4.1. Herbal Extracts

4.4.2. Organic Herbal Supplements

4.4.3. Non-organic Herbal Supplements

4.5. By Country (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

5. Asia Pacific Herbal Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amway Corporation

5.1.2. Herbalife Nutrition Ltd.

5.1.3. Natures Bounty Co.

5.1.4. Himalaya Drug Company

5.1.5. Dabur India Ltd.

5.1.6. Glanbia PLC

5.1.7. Bio-Botanica Inc.

5.1.8. Gaia Herbs

5.1.9. Solgar Inc.

5.1.10. Blackmores Ltd.

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, R&D Investment, Product Launches, Herbal Source, Certifications, Sustainability Efforts, Global Footprint)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Incentives

5.8. Venture Capital Funding

5.9. Private Equity Investments

6. Asia Pacific Herbal Supplements Market Regulatory Framework

6.1. Licensing and Compliance Requirements

6.2. Herbal Supplement Labeling Laws

6.3. Product Certification and Quality Assurance

6.4. Import/Export Regulations

7. Asia Pacific Herbal Supplements Future Market Size (In USD Bn)

7.1. Market Projections

7.2. Key Factors Driving Future Growth

8. Asia Pacific Herbal Supplements Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Source (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Herbal Supplements Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Entry Strategies

9.4. Product Portfolio Expansion Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all major stakeholders in the Asia Pacific Herbal Supplements Market. Desk research and proprietary databases are utilized to identify and define the critical variables influencing market dynamics, including supply chain analysis and regulatory requirements.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on market penetration, product consumption patterns, and sales channels for herbal supplements. An evaluation of the ratio between regional manufacturers and suppliers is also performed to estimate revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts and herbal supplement manufacturers. These consultations provide insights into production trends, consumer preferences, and future growth prospects, ensuring the accuracy of data.

Step 4: Research Synthesis and Final Output

Direct engagement with industry stakeholders and manufacturers allows for a comprehensive understanding of market trends. This step involves validating data derived from the bottom-up approach and refining the final market analysis to ensure accuracy.

Frequently Asked Questions

01. How big is the Asia Pacific Herbal Supplements Market?

The Asia Pacific Herbal Supplements market is valued at USD 46 billion, driven by the rising demand for natural and organic supplements across various countries in the region.

02. What are the challenges in the Asia Pacific Herbal Supplements Market?

Challenges in Asia Pacific Herbal Supplements market include inconsistent quality standards, regulatory hurdles, and a lack of scientific evidence supporting some traditional herbal remedies. Additionally, fragmented supply chains pose a significant challenge.

03. Who are the major players in the Asia Pacific Herbal Supplements Market?

Key players in Asia Pacific Herbal Supplements market include Amway Corporation, Herbalife Nutrition Ltd., Natures Bounty Co., Himalaya Drug Company, and Dabur India Ltd., all of which have established strong distribution networks and product portfolios.

04. What are the growth drivers of the Asia Pacific Herbal Supplements Market?

Asia Pacific Herbal Supplements market is driven by increasing health consciousness among consumers, growing demand for immune-boosting supplements, and government support for herbal medicine. The rise in preventive healthcare practices is also fueling market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.