Asia Pacific Hotel Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1380

June 2025

90

About the Report

Asia Pacific Hotel Market Overview

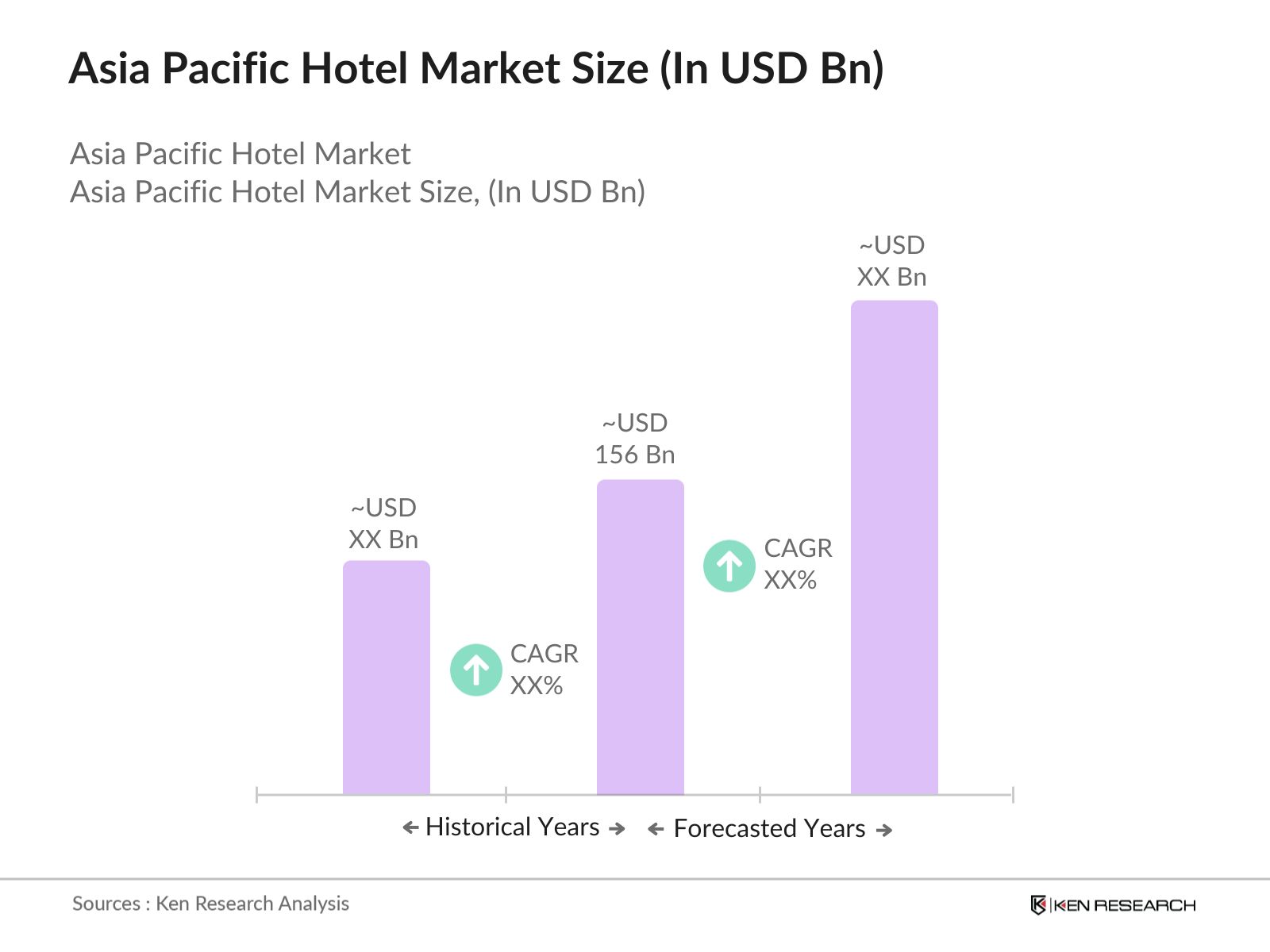

- The Asia Pacific Hotel Market is valued at USD 156 billion, based on a five-year historical analysis. This growth is primarily driven by increasing tourism, rising disposable incomes, and a growing middle class in the region. The demand for both luxury and budget accommodations has surged, reflecting changing consumer preferences and the expansion of travel networks across Asia Pacific countries.

- Key players in this market include major cities such as Tokyo, Bangkok, and Sydney, which dominate due to their status as international travel hubs. These cities benefit from robust infrastructure, a wide range of attractions, and significant investments in hospitality, making them preferred destinations for both leisure and business travelers.

- In 2024, the government of Australia implemented new regulations aimed at enhancing the safety and quality standards of hotels. This includes mandatory compliance with updated fire safety codes and health regulations, ensuring that accommodations meet international standards and improve overall guest experiences.

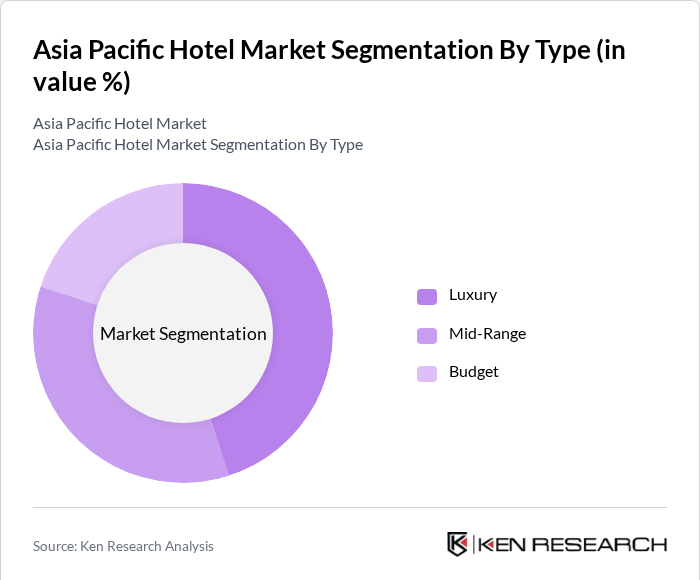

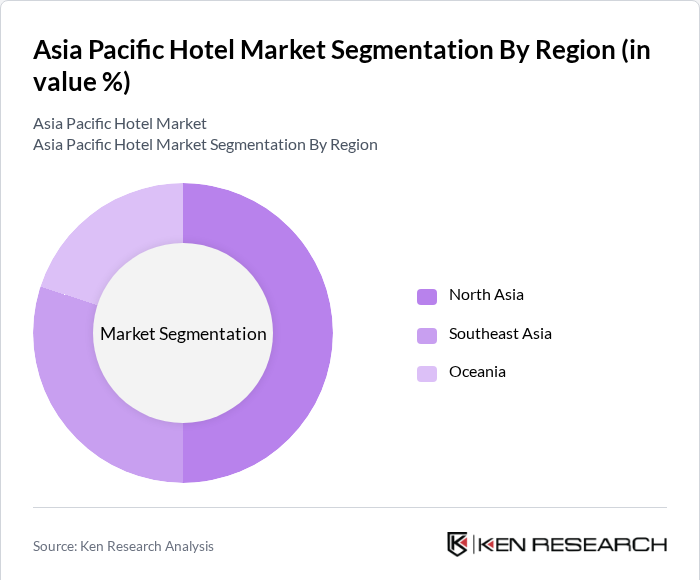

Asia Pacific Hotel Market Segmentation

By Type: The hotel market is segmented into luxury, mid-range, and budget hotels. Among these, the luxury segment is dominating the market due to the increasing number of affluent travelers seeking high-end experiences. This segment has seen a rise in demand for personalized services, unique experiences, and premium amenities, which are becoming essential for attracting discerning customers. The mid-range segment also shows significant growth, catering to both business and leisure travelers looking for comfort without the luxury price tag.

By Region: The market is further segmented into North Asia, Southeast Asia, and Oceania. North Asia is currently the leading region, driven by countries like China and Japan, which have a high volume of domestic and international travelers. The rapid urbanization and economic growth in these countries have led to increased investments in hospitality infrastructure, making them attractive for hotel operators. Southeast Asia is also witnessing robust growth, fueled by rising tourism and government initiatives to promote travel.

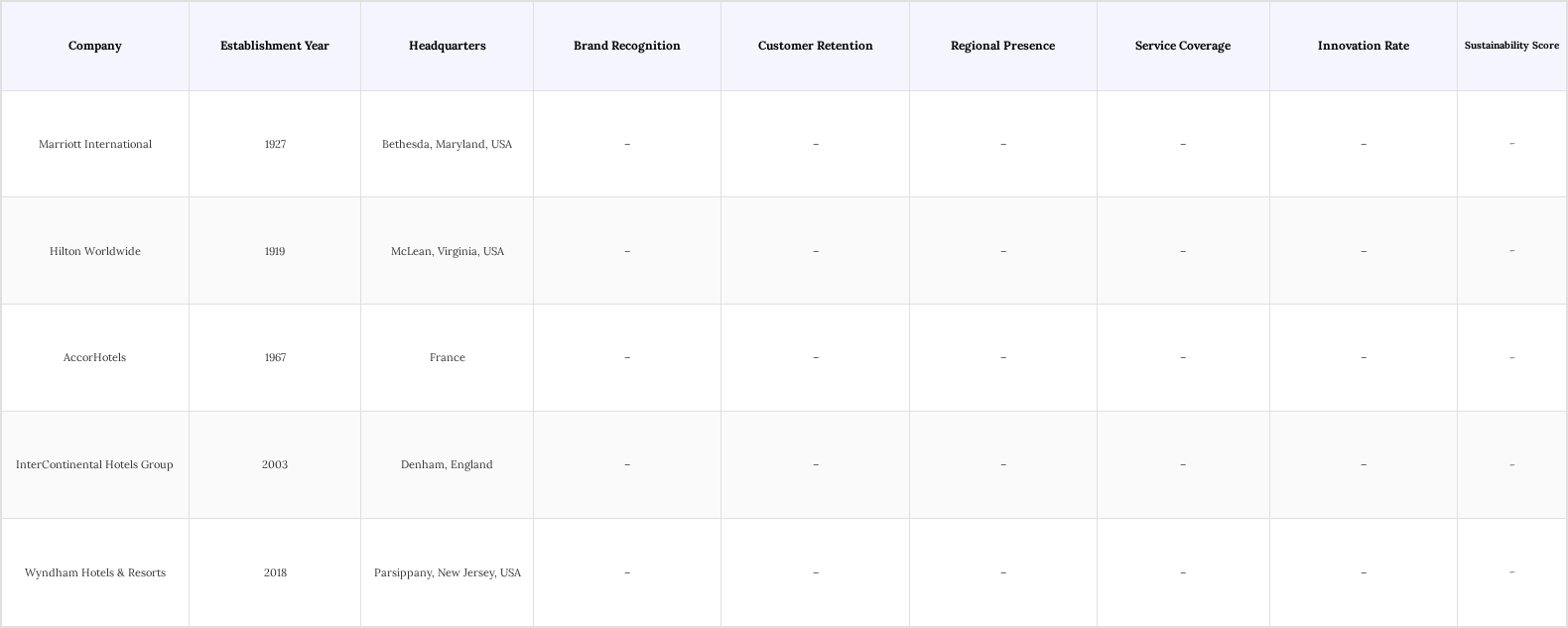

Asia Pacific Hotel Market Competitive Landscape

The Asia Pacific Hotel Market is characterized by intense competition among both local and international players. Major companies such as Marriott International, Hilton Worldwide, and AccorHotels are prominent in this market, leveraging their extensive brand recognition and diverse portfolios to capture a significant share. The competitive dynamics are further influenced by the growing trend of boutique hotels and alternative accommodations, which cater to niche markets and changing consumer preferences.

Asia Pacific Hotel Market Industry Analysis

Growth Drivers

- Increasing Tourism and Travel Activities: The Asia Pacific region is witnessing a surge in tourism, with international tourist arrivals reaching 522 million in 2023, a 10% increase from 2022. This growth is driven by the easing of travel restrictions and the promotion of regional attractions. Countries like Thailand and Japan are leading in tourist numbers, contributing significantly to hotel occupancy rates, which averaged 70% in major cities. This trend is expected to continue, bolstering hotel revenues and investments.

- Rising Disposable Incomes and Consumer Spending: The Asia Pacific region's GDP is projected to grow by 4.5% in 2024, leading to increased disposable incomes. In countries like China and India, the middle class is expanding rapidly, with disposable income per capita expected to rise by 8% annually. This economic growth translates into higher consumer spending on travel and accommodation, driving demand for hotels across various segments, particularly mid-range and luxury options.

- Expansion of Online Booking Platforms: The expansion of online booking platforms in Asia Pacific is driven by rising internet penetration and mobile device usage, making it easier for consumers to book accommodations digitally. In 2024, the region accounted for over 31.8% of the global online travel market, with accommodation bookings as the fastest-growing segment. The 32-43 years age group represents about 35.1% of online travel users, reflecting a tech-savvy demographic with strong travel demand.

Market Challenges

- Intense Competition Among Hotel Chains: The Asia Pacific hotel market is characterized by fierce competition, with over 1,500 hotel brands vying for market share. Major chains like Marriott and Hilton dominate, but numerous local players are emerging, leading to price wars and reduced profit margins. In 2023, average daily rates (ADR) fell substantially in key markets, pressuring hotels to innovate and differentiate their offerings to maintain profitability.

- Economic Fluctuations Impacting Travel Budgets: Economic instability in the region poses a significant challenge, with GDP growth rates fluctuating due to global economic conditions. The IMF projects a slowdown in growth in 2024, which may lead to reduced travel budgets for both leisure and business travelers. This uncertainty can result in lower hotel occupancy rates and decreased revenues, forcing hotels to adapt their pricing strategies and service offerings.

Asia Pacific Hotel Market Future Outlook

The Asia Pacific hotel market is poised for robust growth, driven by increasing travel demand and evolving consumer preferences. The rise of sustainable tourism and eco-friendly accommodations is expected to shape the market, with hotels adopting green practices to attract environmentally conscious travelers. Additionally, advancements in technology, such as AI and IoT, will enhance guest experiences and operational efficiency. As emerging markets continue to develop, opportunities for expansion and innovation will abound, positioning the region as a leader in the global hospitality industry.

Market Opportunities

- Growth in Sustainable and Eco-friendly Hotels: The demand for sustainable accommodations is rising, with majority of travelers willing to pay more for eco-friendly options. This trend presents a significant opportunity for hotels to invest in green technologies and practices, potentially increasing their market share and attracting a loyal customer base focused on sustainability.

- Technological Advancements in Hospitality Services: The integration of smart technology in hotel operations is revolutionizing guest experiences and operational efficiency. Around 60% of hotels worldwide have adopted at least one form of smart technology, such as mobile check-ins, keyless room entry, and AI-powered concierge services. Personalized services enabled by data analytics and IoT devices allow hotels to tailor guest preferences, improving satisfaction and loyalty

Scope of the Report

| By Type |

Luxury Mid-range Budget |

| By Region |

North Asia South-east Asia Oceania |

| By Customer Segment |

Business Travelers Leisure Travelers Group Travelers |

| By Booking Channel |

Online Travel Agencies Direct Booking Travel Agents |

| By Hotel Size |

Small Hotels Medium Hotels Large Hotels |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Tourism, National Development Agency)

Hotel Management Companies

Real Estate Investment Trusts (REITs)

Tourism Boards and Promotion Agencies

Hospitality Technology Providers

Construction and Development Firms

Travel and Tourism Associations

Companies

Players Mentioned in the Report:

Marriott International

Hilton Worldwide

AccorHotels

InterContinental Hotels Group

Wyndham Hotels & Resorts

Shangri-La Hotels and Resorts

OYO Rooms

Minor Hotels

RedDoorz

Dusit International

Table of Contents

1. Asia Pacific Hotel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Hotel Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Hotel Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Tourism and Travel Activities

3.1.2. Rising Disposable Incomes and Consumer Spending

3.1.3. Expansion of Online Booking Platforms

3.2. Market Challenges

3.2.1. Intense Competition Among Hotel Chains

3.2.2. Economic Fluctuations Impacting Travel Budgets

3.2.3. Regulatory Compliance and Environmental Concerns

3.3. Opportunities

3.3.1. Growth in Sustainable and Eco-friendly Hotels

3.3.2. Technological Advancements in Hospitality Services

3.3.3. Emerging Markets and Untapped Regions

3.4. Trends

3.4.1. Increasing Popularity of Boutique Hotels

3.4.2. Integration of Smart Technology in Hotel Operations

3.4.3. Focus on Health and Wellness Tourism

3.5. Government Regulation

3.5.1. Licensing and Operational Standards

3.5.2. Health and Safety Regulations

3.5.3. Environmental Protection Laws

3.5.4. Labor Laws and Employment Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Hotel Market Segmentation

4.1. By Type

4.1.1. Luxury

4.1.2. Mid-range

4.1.3. Budget

4.2. By Region

4.2.1. North Asia

4.2.2. South-east Asia

4.2.3. Oceania

4.3. By Customer Segment

4.3.1. Business Travelers

4.3.2. Leisure Travelers

4.3.3. Group Travelers

4.4. By Booking Channel

4.4.1. Online Travel Agencies

4.4.2. Direct Booking

4.4.3. Travel Agents

4.5. By Hotel Size

4.5.1. Small Hotels

4.5.2. Medium Hotels

4.5.3. Large Hotels

5. Asia Pacific Hotel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Marriott International

5.1.2. Hilton Worldwide

5.1.3. AccorHotels

5.1.4. InterContinental Hotels Group

5.1.5. Wyndham Hotels & Resorts

5.1.6. Shangri-La Hotels and Resorts

5.1.7. OYO Rooms

5.1.8. Minor Hotels

5.1.9. RedDoorz

5.1.10. Dusit International

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Ratings

5.2.4. Average Daily Rate (ADR)

5.2.5. Occupancy Rate

5.2.6. Number of Properties

5.2.7. Geographic Presence

5.2.8. Brand Recognition

6. Asia Pacific Hotel Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Hotel Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Hotel Market Future Market Segmentation

8.1. By Type

8.1.1. Luxury

8.1.2. Mid-range

8.1.3. Budget

8.2. By Region

8.2.1. North Asia

8.2.2. South-east Asia

8.2.3. Oceania

8.3. By Customer Segment

8.3.1. Business Travelers

8.3.2. Leisure Travelers

8.3.3. Group Travelers

8.4. By Booking Channel

8.4.1. Online Travel Agencies

8.4.2. Direct Booking

8.4.3. Travel Agents

8.5. By Hotel Size

8.5.1. Small Hotels

8.5.2. Medium Hotels

8.5.3. Large Hotels

9. Asia Pacific Hotel Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Hotel Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia Pacific Hotel Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple stakeholders to acquire detailed insights into market trends, consumer preferences, and competitive dynamics. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Hotel Market.

Frequently Asked Questions

01. How big is the Asia Pacific Hotel Market?

The Asia Pacific Hotel Market is valued at USD 156 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Asia Pacific Hotel Market?

Key challenges in the Asia Pacific Hotel Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Asia Pacific Hotel Market?

Major players in the Asia Pacific Hotel Market include Marriott International, Hilton Worldwide, AccorHotels, InterContinental Hotels Group, Wyndham Hotels & Resorts, among others.

04. What are the growth drivers for the Asia Pacific Hotel Market?

The primary growth drivers for the Asia Pacific Hotel Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.