Asia Pacific Hydraulics Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD7777

November 2024

94

About the Report

Asia Pacific Hydraulics Market Overview

- The Asia Pacific hydraulics market, was valued at USD 17.2 billion, driven by the growing demand from the construction, mining, and agricultural sectors. This market is propelled by the need for efficient hydraulic machinery, particularly in infrastructure development projects and industrial manufacturing processes. The rise in automation across industries is another key driver, as hydraulic systems are increasingly being integrated into automated production lines.

- Countries such as China, Japan, and India dominate the hydraulics market in the region due to their extensive industrial bases, heavy infrastructure investments, and significant manufacturing activities. China's dominance can be attributed to its leadership in the manufacturing and construction sectors, driven by government initiatives such as the Belt and Road Initiative, which significantly boosts demand for hydraulic machinery.

- Import and export restrictions on hydraulic components are influencing the market across Asia Pacific. In 2023, Japan implemented new tariffs on imported hydraulic parts from non-FTA countries. This has led manufacturers to source locally, driving innovation and investment in domestic hydraulic production.

Asia Pacific Hydraulics Market Segmentation

By Product Type: The market is segmented by product type into hydraulic pumps, hydraulic cylinders, valves, accumulators, and filters. Among these, hydraulic pumps have a dominant market share due to their critical role in hydraulic systems, where they convert mechanical power into hydraulic energy. Their widespread application in industries like construction, mining, and agriculture contributes to this dominance. The demand for more efficient, energy-saving pumps is also increasing as industries strive for sustainability and cost-efficiency.

By End-Use Industry: The market is segmented by end-use industries into construction, agriculture, mining, oil & gas, and automotive & transportation. The construction industry holds the largest share due to the increasing number of infrastructure projects in countries like China, India, and Southeast Asian nations. This dominance is driven by the significant use of hydraulic machinery in earthmoving, material handling, and excavation. Additionally, hydraulic systems are vital for construction activities, contributing to the industry's strong market presence.

Asia Pacific Hydraulics Market Competitive Landscape

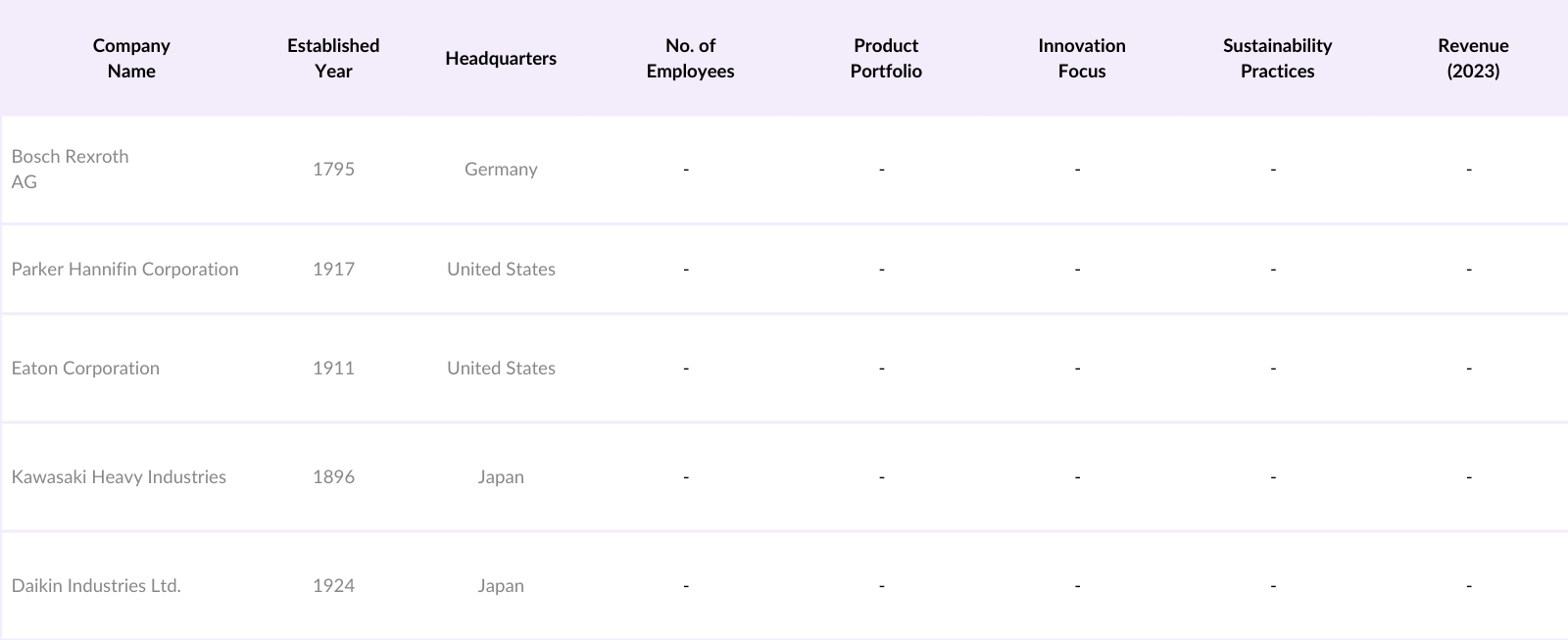

The Asia Pacific hydraulics market is characterized by the presence of both global and regional players, leading to a competitive market environment. The major companies in this space focus on technological advancements, energy-efficient products, and strategic collaborations to gain a competitive edge. Additionally, local players are emerging in the market due to lower manufacturing costs and an increasing demand for hydraulic systems in the construction and agricultural sectors.

Asia Pacific Hydraulics Industry Analysis

Growth Drivers

- Expansion of Construction and Mining Industries: Urbanization across Asia Pacific is accelerating infrastructure development, driving the demand for hydraulic systems in the construction and mining sectors. In 2023, the Asian Infrastructure Investment Bank (AIIB) reported a $4.8 billion allocation for infrastructure projects in the region, including hydraulic-dependent machinery for mining and construction. Countries like India and China are leading with massive infrastructure expansion, contributing to the rise of hydraulic machinery.

- Rise in Agricultural Mechanization: The adoption of advanced farming equipment is rising in the Asia Pacific, driven by increased mechanization. The Sub-Mission on Agricultural Mechanization (SMAM) promotes the use of modern farming equipment by offering financial support to farmers for machinery purchases. Its goal is to boost mechanization levels, which are currently around 47% for major crops, much lower than in countries like China and Brazil.

- Industrial Automation and Robotics: Industrial automation is expanding across Asia Pacific, particularly in manufacturing hubs like Japan, South Korea, and China. Hydraulic systems are integral to automated production lines, providing essential power and precision. These systems are widely used in robotics and automated machinery, enhancing efficiency and performance in advanced manufacturing sectors. Their ability to deliver high power and smooth control makes them critical for automation growth in the region.

Market Challenges

- High Installation and Maintenance Costs: Hydraulic systems, though highly efficient, come with significant installation and maintenance costs. These expenses can be a deterrent for smaller businesses, as setting up and maintaining such systems requires specialized components and skilled labor. The complexity of hydraulic systems, including costly spare parts like pumps and valves, further adds to the financial burden, making them a more challenging investment for companies looking to manage operational costs effectively.

- Technological Integration Difficulties: Integrating Internet of Things (IoT) technologies into hydraulic systems remains a challenge, particularly in developing economies across Asia Pacific. The high costs of adopting IoT-enabled hydraulic systems, coupled with limited technical expertise, pose barriers to wider implementation. This slow integration hinders the potential benefits of predictive maintenance and operational efficiency, which are essential for advancing hydraulic systems' performance in various industries

Asia Pacific Hydraulics Market Future Outlook

Over the next few years, the Asia Pacific hydraulics market is expected to experience continued growth, driven by sustained infrastructure development, particularly in emerging economies such as India, Indonesia, and Vietnam. The expansion of industrial automation and advancements in smart hydraulic systems will also fuel market demand. Furthermore, the rising focus on energy-efficient and eco-friendly hydraulic solutions will push companies to invest more in research and development, providing opportunities for technological advancements in hydraulic components.

Market Opportunities

- Expansion of Manufacturing in Emerging Economies: Emerging economies in Southeast Asia, including Vietnam and Thailand, are experiencing rapid industrial growth, which is creating substantial opportunities for the hydraulic market. As these countries expand their manufacturing sectors in industries like textiles and electronics, the demand for hydraulic systems that support heavy machinery is increasing. Government initiatives to enhance industrial capabilities are also driving the need for more advanced hydraulic technologies, making this a key growth area for the market.

- Advancements in Energy-Efficient Hydraulic Systems: There is growing demand for energy-efficient hydraulic systems as industries focus on reducing their environmental impact. Manufacturers are increasingly developing eco-friendly hydraulic solutions that consume less energy and lower carbon footprints. These advancements present significant opportunities for hydraulic system providers to cater to industries seeking sustainable options, especially as regulatory pressures and corporate sustainability goals push for greener technologies across various sectors in the region.

Scope of the Report

|

Product Type |

Hydraulic Pumps Hydraulic Cylinders Valves, Accumulators Filters, Others (Hoses, Fittings) |

|

End-Use Industry |

Construction Agriculture Mining Oil & Gas Automotive and Transportation |

|

Technology |

Mobile Hydraulics Industrial Hydraulics |

|

Application |

Material Handling Earthmoving Equipment Excavators and Loaders Hydraulic Presses |

|

Region |

China Japan India Southeast Asia Australia |

Products

Key Target Audience

Hydraulic Equipment Manufacturers

Construction and Mining Companies

Agricultural Machinery Manufacturers

Automotive and Transport Industry Players

Oil & Gas Companies

Government and Regulatory Bodies (Chinas Ministry of Industry and Information Technology, Japans Ministry of Economy, Trade, and Industry)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Bosch Rexroth AG

Parker Hannifin Corporation

Eaton Corporation

Kawasaki Heavy Industries Ltd.

Daikin Industries Ltd.

Moog Inc.

HYDAC Technology GmbH

Wipro Infrastructure Engineering

Linde Hydraulics

Bucher Hydraulics

Table of Contents

1. Asia Pacific Hydraulics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Hydraulic Systems, Components, End-Use Industries, Regional Segments)

1.3. Market Growth Rate (Influence of Industrial Growth, Infrastructure Expansion, and Automotive Sector)

1.4. Market Segmentation Overview (Industrial Applications, Component Types, Geographical Spread)

2. Asia Pacific Hydraulics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (OEM Demand, Maintenance and Repair, and Replacement Demand Trends)

2.3. Key Market Developments and Milestones (Innovations in Hydraulic Systems, Impact of Automation, Regional Infrastructure Projects)

3. Asia Pacific Hydraulics Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Construction and Mining Industries (Urbanization, Infrastructure Development)

3.1.2. Rise in Agricultural Mechanization (Growth in Farming Equipment Adoption)

3.1.3. Industrial Automation and Robotics (Automation in Manufacturing and Production Lines)

3.1.4. Government Policies and Infrastructure Investment (Public-Private Partnerships in Infrastructure Projects)

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs (Expensive Hydraulic Components)

3.2.2. Technological Integration Difficulties (Challenges in IoT Adoption in Hydraulic Systems)

3.2.3. Competition from Electrical Systems (Emergence of Electro-Hydraulic Solutions)

3.3. Opportunities

3.3.1. Expansion of Manufacturing in Emerging Economies (Industrial Growth in Southeast Asia)

3.3.2. Advancements in Energy-Efficient Hydraulic Systems (Demand for Green Hydraulics Solutions)

3.3.3. Rising Demand for Hydraulic Equipment in Marine and Offshore Applications

3.4. Trends

3.4.1. Adoption of Smart Hydraulics (IoT Integration and Predictive Maintenance in Hydraulic Systems)

3.4.2. Increasing Use of Hydraulics in Renewable Energy Sectors (Wind Turbines, Solar Panel Installation)

3.4.3. Development of Compact and Lightweight Hydraulic Systems

3.5. Government Regulation

3.5.1. Compliance with Environmental Emission Standards (Sustainability in Hydraulic Fluids)

3.5.2. Industry-Specific Safety Regulations (Mining and Construction Sector Standards)

3.5.3. Import-Export Restrictions (Tariffs and Trade Agreements Impacting Hydraulic Components)

3.5.4. Support for Technological Innovations (Subsidies for Energy Efficient Systems)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (OEMs, Component Suppliers, Aftermarket Providers, Maintenance Services)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Threat of Substitutes)

3.9. Competition Ecosystem (Emergence of Global and Local Players in the Hydraulic Market)

4. Asia Pacific Hydraulics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hydraulic Pumps

4.1.2. Hydraulic Cylinders

4.1.3. Valves

4.1.4. Accumulators and Filters

4.1.5. Others (Hydraulic Hoses, Fittings)

4.2. By End-Use Industry (In Value %)

4.2.1. Construction

4.2.2. Agriculture

4.2.3. Mining

4.2.4. Oil & Gas

4.2.5. Automotive and Transportation

4.3. By Technology (In Value %)

4.3.1. Mobile Hydraulics

4.3.2. Industrial Hydraulics

4.4. By Application (In Value %)

4.4.1. Material Handling

4.4.2. Earthmoving Equipment

4.4.3. Excavators and Loaders

4.4.4. Hydraulic Presses

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Southeast Asia

4.5.5. Australia

5. Asia Pacific Hydraulics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch Rexroth AG

5.1.2. Parker Hannifin Corporation

5.1.3. Eaton Corporation

5.1.4. Kawasaki Heavy Industries Ltd.

5.1.5. Danfoss Power Solutions

5.1.6. HYDAC Technology GmbH

5.1.7. Moog Inc.

5.1.8. Wipro Infrastructure Engineering

5.1.9. Daikin Industries Ltd.

5.1.10. Enerpac Tool Group

5.1.11. Bucher Hydraulics

5.1.12. Linde Hydraulics

5.1.13. SMC Corporation

5.1.14. Yuken Kogyo Co. Ltd.

5.1.15. China National Heavy Duty Truck Group Co. Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Lines, Revenue, Product Innovation, End-use Sectors, Regional Penetration, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, Joint Ventures, Licensing Agreements)

5.5. Mergers and Acquisitions (Recent Consolidation in Hydraulics Industry)

5.6. Investment Analysis (Hydraulics-related Capital Expenditure)

5.7. Venture Capital Funding (Funding in Hydraulics Start-ups)

5.8. Government Grants (Grants for Technological Development in Hydraulic Systems)

5.9. Private Equity Investments (Major Private Equity Firms in the Market)

6. Asia Pacific Hydraulics Market Regulatory Framework

6.1. Safety and Performance Standards (Industry-Specific Standards)

6.2. Environmental and Emission Regulations (Hydraulic Fluid Regulations)

6.3. Certification Requirements (ISO Standards for Hydraulic Components)

7. Asia Pacific Hydraulics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological Advancements, Regional Expansion)

8. Asia Pacific Hydraulics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Hydraulics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Hydraulic System Market Penetration)

9.2. Customer Cohort Analysis (End-User Profiles)

9.3. Marketing Initiatives (Marketing Strategies for Hydraulic System Providers)

9.4. White Space Opportunity Analysis (Unexplored Applications in Emerging Sectors)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping out the entire ecosystem of the Asia Pacific hydraulics market, identifying key stakeholders across sectors such as construction, agriculture, mining, and automotive. Detailed secondary research is conducted using proprietary databases and industry reports to isolate crucial variables like demand patterns, pricing structures, and supply chain analysis.

Step 2: Market Analysis and Construction

In this phase, historical market data is gathered, analyzed, and synthesized to evaluate the markets performance over the past five years. We also assess key economic indicators such as industrial production and construction activity across the Asia Pacific region, which significantly influence demand for hydraulic systems.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, consultations are conducted with industry experts and key opinion leaders from major hydraulic equipment manufacturers. Their insights into emerging technologies, customer demands, and regulatory challenges help refine the research model.

Step 4: Research Synthesis and Final Output

The final stage consolidates data obtained from primary and secondary research, resulting in a comprehensive analysis of the Asia Pacific hydraulics market. This synthesis ensures that the report presents accurate and actionable insights, tailored for industry professionals and decision-makers.

Frequently Asked Questions

01. How big is the Asia Pacific Hydraulics Market?

The Asia Pacific hydraulics market is valued at USD 17.2 billion, with key growth drivers being the rising demand in construction, mining, and agricultural sectors, as well as increasing industrial automation across the region.

02. What are the major challenges in the Asia Pacific Hydraulics Market?

Key challenges in Asia Pacific hydraulics market include high installation and maintenance costs, integration issues with newer technologies such as IoT, and increasing competition from alternative power systems such as electrical and pneumatic systems.

03. Who are the major players in the Asia Pacific Hydraulics Market?

Major players in the Asia Pacific hydraulics market include Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation, Kawasaki Heavy Industries, and Daikin Industries Ltd. These companies dominate due to their strong product portfolios, global presence, and technological innovations.

04. What are the growth drivers of the Asia Pacific Hydraulics Market?

The Asia Pacific hydraulics market is driven by the increasing demand for hydraulic systems in construction and infrastructure development, automation in manufacturing processes, and advancements in energy-efficient hydraulic components.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.