Asia Pacific Ice Cream Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD4765

December 2024

98

About the Report

Asia Pacific Ice Cream Market Overview

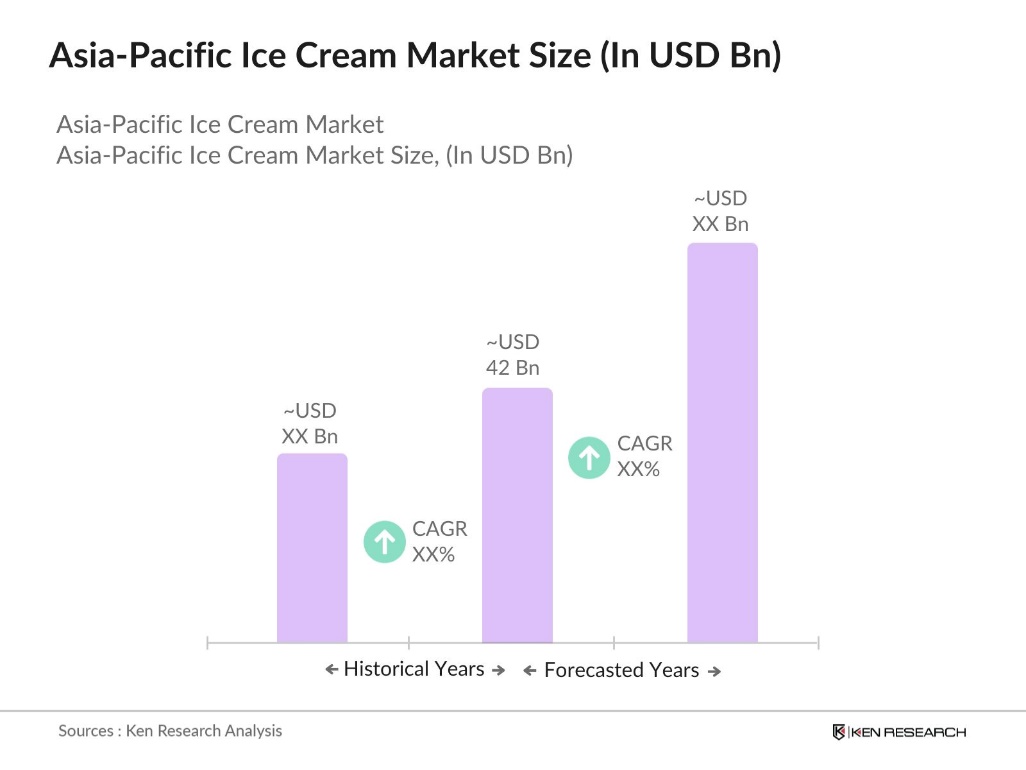

- The Asia-Pacific Ice Cream Market is valued at USD 42 billion in 2023, driven by rising disposable incomes and the increasing demand for premium and artisanal ice creams across key markets in the region. The significant influence of urbanization and shifting consumer preferences towards indulgent and healthier options, such as low-fat and vegan ice creams, are major factors contributing to the market's growth. Growing retail penetration and the expansion of e-commerce channels have also played an essential role in the market's expansion, with consumers increasingly opting for doorstep deliveries of ice cream products. This is especially evident in densely populated and economically growing countries in the region.

- Cities like Shanghai, Tokyo, and Sydney, alongside countries such as China, Japan, and Australia, dominate the Asia-Pacific ice cream market. These locations lead due to high consumer demand for premium products, greater disposable incomes, and established cold chain logistics that allow efficient ice cream distribution. Additionally, the increasing presence of international ice cream brands and growing local competition have made these markets critical for overall revenue generation and product innovation within the Asia-Pacific region.

- The Goods and Services Tax (GST) on ice cream in India indicate that packaged ice cream is subject to a 5% GST rate, while ice cream sticks and soft-serve varieties are taxed at 18%. This differentiation impacts pricing strategies and profit margins for manufacturers. Additionally, businesses face increased compliance costs, including the need for proper record-keeping and filing of GST returns. Input tax credits (ITC) can help offset some of these costs by allowing businesses to claim credits on taxes paid for inputs like raw materials and packaging.

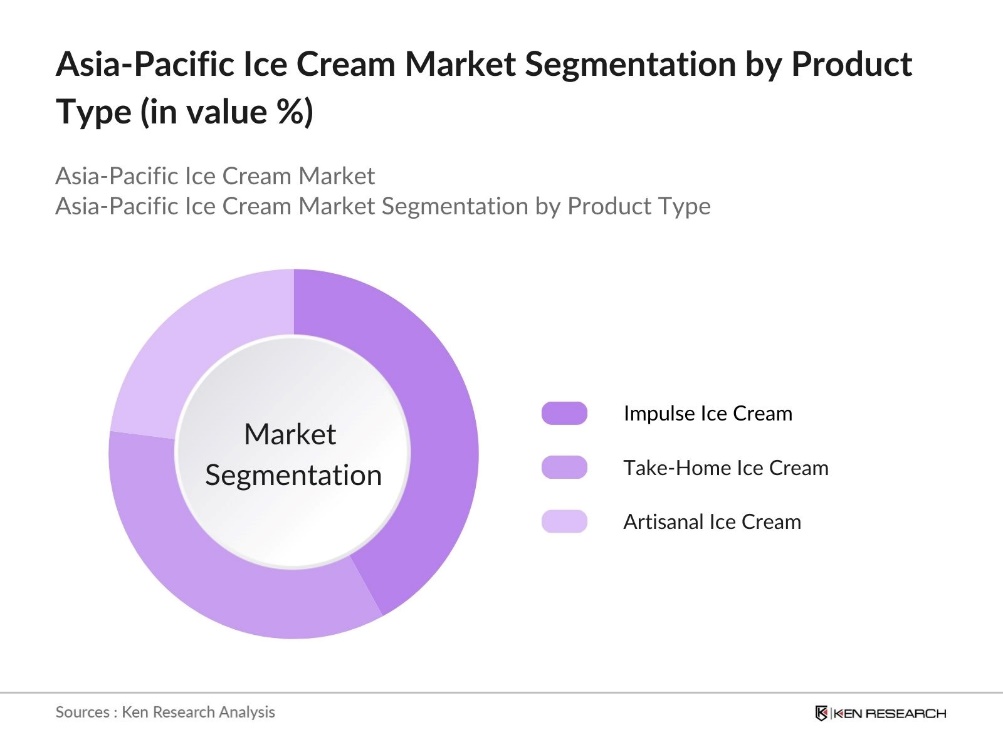

Asia Pacific Ice Cream Market Segmentation

By Product Type: The Asia-Pacific Ice Cream market is segmented by product type into impulse ice cream, take-home ice cream, and artisanal ice cream. Recently, impulse ice cream has maintained a dominant market share in this category, attributed to its convenience and immediate consumption format. Impulse ice creams, available in cones, bars, and cups, are particularly popular among the younger population due to their accessibility in various retail formats such as convenience stores and vending machines. The strong brand loyalty of global players like Unilevers Magnum and Cornetto continues to drive this segments dominance.

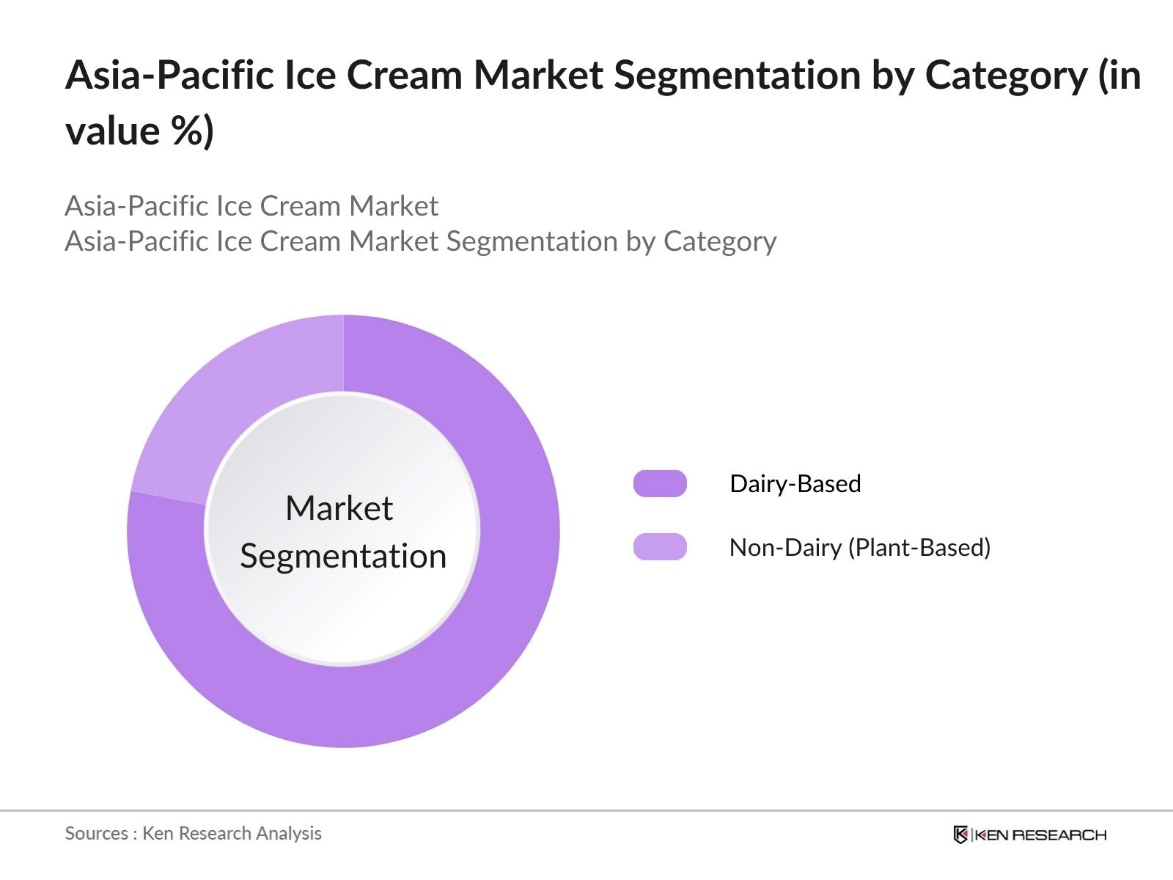

By Category: The Asia-Pacific Ice Cream market is also segmented by category into dairy-based and non-dairy (plant-based) ice creams. Dairy-based ice cream holds the largest market share, driven by its deep-rooted presence and consumer preference for traditional creamy textures and flavors. Brands offering dairy-based products, such as Hagen-Dazs and Baskin Robbins, benefit from consumer perceptions of premium quality, particularly in China and Japan. However, the non-dairy ice cream segment is witnessing rapid growth, fueled by the rising demand for plant-based alternatives due to increasing lactose intolerance and veganism across the region.

Asia Pacific Ice Cream Market Competitive Landscape

The market is dominated by multinational companies like Unilever, Nestl, and local giants like Lotte Confectionery in South Korea. These brands benefit from robust distribution networks, superior product innovations, and strategic partnerships with retail giants. As the competition intensifies, leading companies are focusing on sustainability initiatives and healthier product lines to capture the evolving consumer preferences across the region.

|

Company Name |

Year Established |

Headquarters |

No. of Employees |

Product Range |

Revenue (USD Bn) |

Geographical Presence |

Sustainability Initiatives |

R&D Investments |

Market Share (2023) |

|

Unilever |

1930 |

London, UK |

|||||||

|

Nestl |

1867 |

Vevey, Switzerland |

|||||||

|

Lotte Confectionery |

1967 |

Seoul, South Korea |

|||||||

|

General Mills |

1928 |

Minneapolis, USA |

|||||||

|

Meiji Holdings Co. |

1916 |

Tokyo, Japan |

Asia Pacific Ice Cream Industry Analysis

Growth Drivers

- Rising Disposable Income: Rising disposable income in emerging Asia-Pacific economies like India and Vietnam has fueled spending on non-essential goods, including premium ice cream. For FY 2022-23, India's per capita net national income was estimated at 172,000 ($2,080). This financial growth is driving consumer interest in indulgent and luxury ice cream products, shifting preferences toward premium and artisanal brands, and contributing to the overall market expansion.

- Expansion of Supermarket Chains: According to Savills Research, the prime shopping center new supply in Asia Pacific is projected to reach around 6 million square meters between 2024 and 2025, creating greater access to frozen desserts like ice cream. This expanded retail infrastructure, coupled with advanced cold chain logistics, enables broader distribution of ice cream products, improving availability for consumers.

- Increased Demand for Health-Conscious and Organic Products: Health-conscious consumers in the Asia-Pacific region are increasingly turning towards organic and "clean label" ice cream options. Countries like Japan and South Korea are seeing growing interest in low-sugar, lactose-free, and organic varieties as people become more aware of dietary preferences and health impacts. Consumers are seeking products that align with their health goals, including options free from artificial additives or made from sustainably sourced ingredients. This shift in consumer preference is prompting manufacturers to innovate and offer a wider range of healthier ice cream options to meet the evolving market demands.

Market Challenges

- High Operational Costs in Cold Storage: Cold storage operational costs pose a significant challenge for the ice cream market, particularly in developing nations. Maintaining the necessary temperature for frozen goods requires considerable energy, and this becomes more costly in areas with less efficient infrastructure. For smaller manufacturers, these high operational expenses can impact profitability. Additionally, rural regions with inadequate cold chain systems face even higher costs for distributing products, adding to the challenges of operating in these markets.

- Seasonal Nature of the Business: The ice cream industry in certain countries experiences a highly seasonal demand, with sales peaking during warmer months and dropping significantly in colder seasons. This fluctuation in demand makes it difficult for manufacturers to sustain consistent revenue throughout the year. To address this, companies often explore strategies like off-season promotions or diversify their product offerings to appeal to consumers year-round. Managing this seasonality is crucial for maintaining profitability in the ice cream business.

Asia Pacific Ice Cream Market Future Outlook

Over the next five years, the Asia-Pacific Ice Cream market is expected to experience significant growth driven by evolving consumer preferences toward premium and healthier ice cream options. Rising disposable incomes, urbanization, and an increasing preference for convenience will further fuel the demand for impulse ice creams and take-home products. Moreover, the non-dairy segment is poised to expand rapidly due to the growing number of consumers adopting vegan diets and dairy alternatives, especially in developed markets like Australia, Japan, and South Korea.

Market Opportunities

- Rising Popularity of Vegan and Lactose-Free Ice Cream: The Asia-Pacific market has seen a growing preference for vegan and lactose-free ice cream, driven by increasing consumer interest in health-conscious and ethical products. Many consumers are opting for plant-based alternatives, whether due to dietary restrictions like lactose intolerance or lifestyle choices such as veganism. This shift is encouraging manufacturers to explore plant-based milk options, such as almond, soy, and oat milk, allowing them to meet the demands of a growing segment that seeks dairy-free frozen desserts.

- Technological Advancements in Ice Cream Manufacturing: Technological advancements in ice cream manufacturing have led to significant improvements in both production efficiency and product innovation. Automated production systems allow manufacturers to scale up operations while minimizing labor costs and improving consistency in product quality. These innovations also make it possible to experiment with more complex flavors and textures, catering to the increasing demand for premium and artisanal ice cream varieties in the market. Such advancements help manufacturers meet evolving consumer preferences while maintaining operational efficiency.

Scope of the Report

|

Product Type |

Impulse Ice Cream Take-Home Ice Cream Artisanal Ice Cream |

|

Flavor Type |

Vanilla Chocolate Fruit-Based Exotic Flavors |

|

Category |

Dairy-Based Non-Dairy (Plant-Based) |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Region |

China Japan India Australia South Korea |

Products

Key Target Audience

Ice Cream Manufacturers

Technology Providers

Food Processing Equipment Manufacturers

E-commerce Platforms

Banks and Financial Institutions

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Food Safety and Standards Authority of India, Food Standards Australia New Zealand)

Companies

Players Mentioned in the Report

Unilever

Nestl

Lotte Confectionery

General Mills

Meiji Holdings Co.

Hagen-Dazs

Baskin Robbins

Dairy Farmers of America

Blue Bell Creameries

Yili Group

Mengniu Dairy

Aurora Organic Dairy

Ezaki Glico Co., Ltd.

Dean Foods

Bulla Dairy Foods

Table of Contents

1. Asia-Pacific Ice Cream Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Ice Cream Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Ice Cream Market Analysis

3.1. Growth Drivers (Per Capita Dairy Consumption, Demand for Premium Products, Emerging Economies)

3.1.1. Rising Disposable Income

3.1.2. Expansion of Supermarket Chains

3.1.3. Increased Demand for Health-Conscious and Organic Products

3.1.4. Impact of Climate Conditions on Ice Cream Sales

3.2. Market Challenges (Raw Material Price Volatility, Supply Chain Disruptions, Sustainability)

3.2.1. High Operational Costs in Cold Storage

3.2.2. Seasonal Nature of the Business

3.2.3. Regulatory Standards for Food Quality and Safety

3.3. Opportunities (Growth in Online Retail, Innovative Flavors, Sustainable Packaging)

3.3.1. Rising Popularity of Vegan and Lactose-Free Ice Cream

3.3.2. Technological Advancements in Ice Cream Manufacturing

3.3.3. Growth of Niche Products in Developing Markets

3.4. Trends (Plant-Based Ice Cream, Alcohol-Infused Varieties, Personalization)

3.4.1. Surge in Demand for Low-Calorie and High-Protein Ice Cream

3.4.2. Innovations in Packaging Solutions

3.4.3. Integration of AI and Automation in Manufacturing

3.5. Government Regulations (Import/Export Tariffs, Dairy Product Regulations, Labeling Standards)

3.5.1. Food Safety and Quality Certification Requirements

3.5.2. Taxation Policies on Frozen Desserts

3.5.3. Country-Specific Regulatory Bodies for Dairy Industry

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia-Pacific Ice Cream Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Impulse Ice Cream (Cones, Bars, Cups)

4.1.2. Take-Home Ice Cream (Tubs, Multipacks)

4.1.3. Artisanal Ice Cream

4.2. By Flavor Type (In Value %)

4.2.1. Vanilla

4.2.2. Chocolate

4.2.3. Fruit-Based Flavors

4.2.4. Exotic and New Flavors

4.3. By Category (In Value %)

4.3.1. Dairy-Based

4.3.2. Non-Dairy (Plant-Based)

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Retail

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. South Korea

5. Asia-Pacific Ice Cream Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Unilever Group

5.1.2. Nestl S.A.

5.1.3. Lotte Confectionery

5.1.4. General Mills, Inc.

5.1.5. Meiji Holdings Co., Ltd.

5.1.6. Amul (Gujarat Cooperative Milk Marketing Federation)

5.1.7. Bulla Dairy Foods

5.1.8. Yili Group

5.1.9. Mengniu Dairy Company Limited

5.1.10. Dean Foods

5.1.11. Aurora Organic Dairy

5.1.12. Blue Bell Creameries

5.1.13. Dairy Farmers of America

5.1.14. China Mengniu Dairy Company Limited

5.1.15. Ezaki Glico Co., Ltd.

5.2 Cross Comparison Parameters (Revenue, No. of Employees, Market Share, Product Portfolio, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Technological Innovations in Manufacturing

5.9. Sustainability Initiatives

6. Asia-Pacific Ice Cream Market Regulatory Framework

6.1. Food Safety and Labeling Regulations

6.2. Dairy Production Standards

6.3. Compliance Requirements for Export/Import

6.4. Certification Processes for Dairy Products

7. Asia-Pacific Ice Cream Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Ice Cream Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor Type (In Value %)

8.3. By Category (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Ice Cream Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Product Differentiation Strategies

9.4. Consumer Cohort Analysis

9.5. Marketing and Advertising Strategies

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying and mapping key variables influencing the Asia-Pacific Ice Cream market, including consumer behavior, economic factors, and technological advancements. Extensive secondary research is conducted using proprietary databases and government resources to gather relevant data.

Step 2: Market Analysis and Construction

In this phase, historical data and market penetration rates are analyzed to understand the current dynamics of the ice cream market. Cold chain logistics, product innovation, and regulatory factors are also evaluated to assess market performance.

Step 3: Hypothesis Validation and Expert Consultation

Insights and market hypotheses are validated through in-depth interviews with industry experts and professionals in ice cream production, supply chain, and retail. These consultations provide direct operational and financial data to ensure market accuracy.

Step 4: Research Synthesis and Final Output

The final research report is developed by combining data from primary and secondary sources, ensuring a comprehensive and validated analysis. Feedback from manufacturers, distributors, and retailers are incorporated to further refine the analysis.

Frequently Asked Questions

01 How big is the Asia-Pacific Ice Cream Market?

The Asia-Pacific Ice Cream Market is valued at USD 42 billion, driven by rising consumer demand for premium and healthier ice cream options, along with the expansion of retail and e-commerce channels.

02 What are the key challenges in the Asia-Pacific Ice Cream Market?

Key challenges in Asia-Pacific Ice Cream Market include supply chain disruptions, high operational costs related to cold storage and transportation, and regulatory standards for dairy products, particularly regarding food safety and labeling.

03 Who are the major players in the Asia-Pacific Ice Cream Market?

Major players in Asia-Pacific Ice Cream Market include Unilever, Nestlé, Lotte Confectionery, General Mills, and Meiji Holdings Co., each dominating through their expansive product portfolios, strong distribution networks, and focus on sustainability.

04 What are the growth drivers of the Asia-Pacific Ice Cream Market?

The Asia-Pacific Ice Cream Market is primarily driven by increasing disposable incomes, rising consumer preferences for premium and artisanal products, and the growing demand for healthier alternatives, including non-dairy and vegan ice creams.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.