Asia Pacific In Vitro Diagnostics (IVD) Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD3459

December 2024

88

About the Report

Asia Pacific In Vitro Diagnostics (IVD) Market Overview

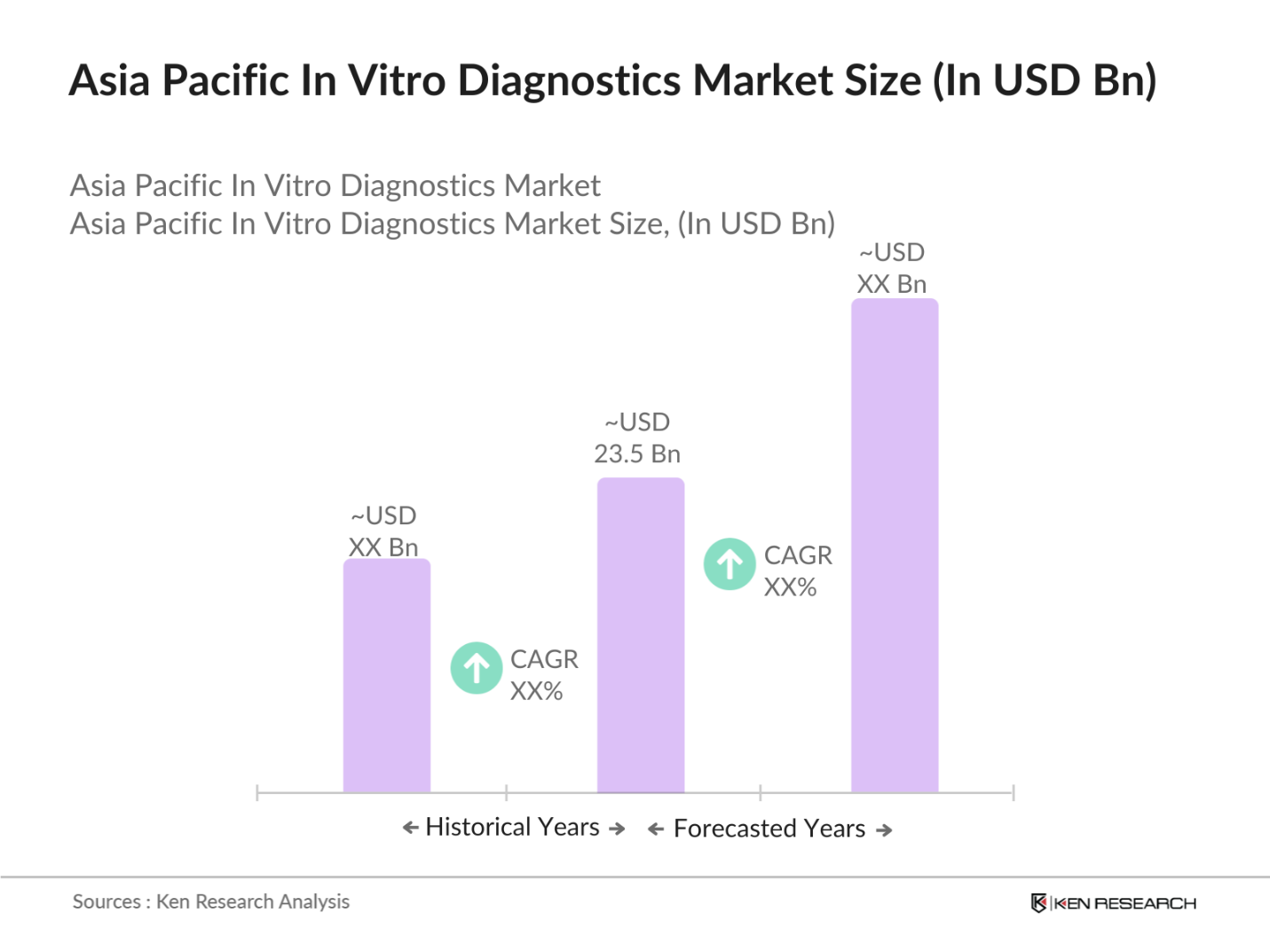

- The Asia Pacific In Vitro Diagnostics (IVD) market is valued at USD 23.5 billion, driven by factors such as the increasing prevalence of chronic diseases, advancements in molecular diagnostics, and the rise in demand for point-of-care diagnostics. Additionally, governments in key countries are investing heavily in healthcare infrastructure, fueling market growth. The demand for rapid diagnostics, particularly in response to the COVID-19 pandemic, has further accelerated the adoption of IVD solutions, leading to robust growth in 2023.

- The Asia Pacific IVD market is dominated by China, Japan, and India due to their large populations, advanced healthcare systems, and government support for diagnostic innovations. Chinas dominance stems from significant government investment in healthcare and technological innovation, while Japan leads in terms of advanced diagnostics due to its strong medical device industry. Indias rapid healthcare expansion and increasing accessibility to diagnostic services also contribute to its growing influence in the market.

- The need for rapid and accurate detection of infectious diseases has led to a rise in the use of molecular diagnostics across Asia-Pacific. PCR tests for COVID-19 remain a common application, with over 1 billion tests conducted across the region by 2023. Molecular diagnostics are also being increasingly used for detecting influenza, hepatitis, and other infectious diseases, with China conducting around 200 million PCR tests annually for these diseases. This trend indicates a growing reliance on molecular technologies for infectious disease control.

Asia Pacific In Vitro Diagnostics (IVD) Market Segmentation

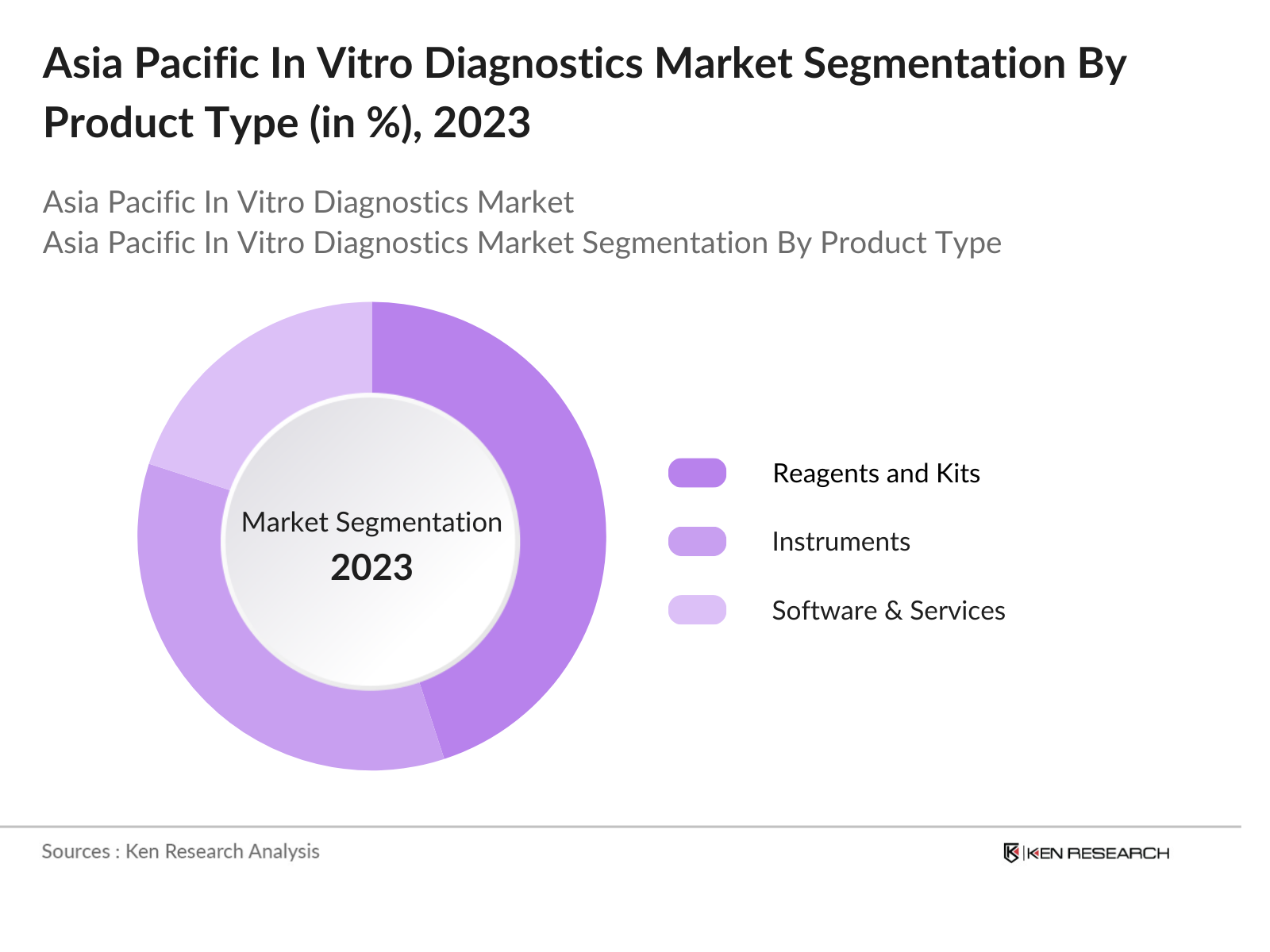

By Product Type: The Asia Pacific IVD market is segmented by product type into reagents and kits, instruments, and software and services. Recently, reagents and kits have a dominant market share under the segmentation product type, owing to the widespread need for diagnostic testing across various applications, particularly in infectious disease testing and oncology. The increasing frequency of routine diagnostic tests, combined with the COVID-19 pandemic, has driven the demand for reagents and kits, as they are essential for conducting diagnostic procedures across laboratories and point-of-care settings.

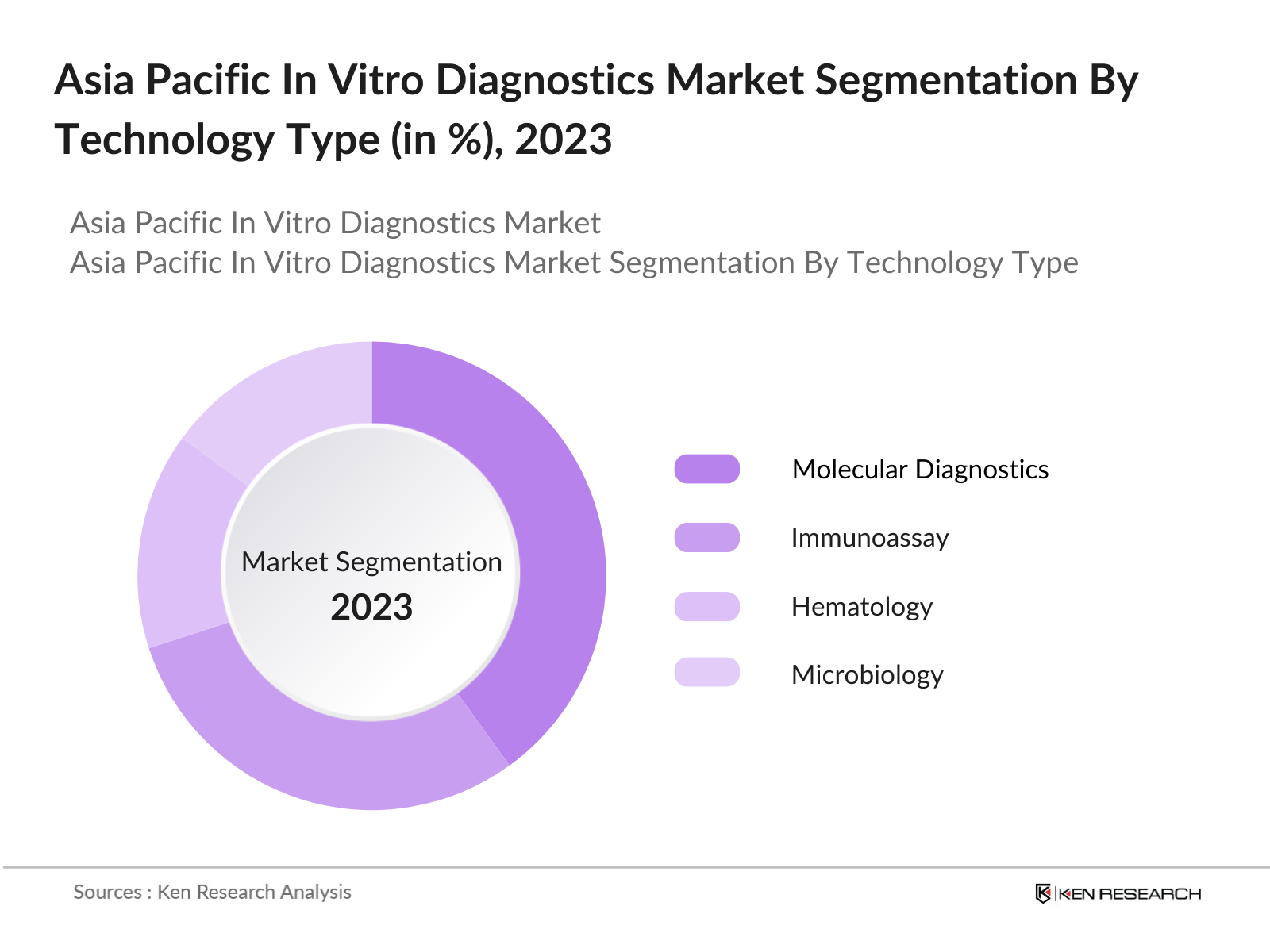

By Technology: The Asia Pacific IVD market is also segmented by technology into molecular diagnostics, immunoassay, hematology, and microbiology. Molecular diagnostics leads in market share due to its role in diagnosing complex diseases, including cancer and genetic disorders. Its high specificity and sensitivity have made it the preferred method for detecting infectious diseases like COVID-19, tuberculosis, and influenza, contributing to its dominance. Furthermore, advancements in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies are bolstering this segments growth.

Asia Pacific In Vitro Diagnostics (IVD) Market Competitive Landscape

The Asia Pacific IVD market is highly competitive, dominated by both local players and international giants. The market features a mix of established multinational companies and emerging regional manufacturers. The major players are engaged in product innovation, strategic partnerships, and acquisitions to maintain their competitive edge. Companies like Roche Diagnostics and Abbott Laboratories dominate due to their expansive product portfolios and strong distribution networks, while regional players in China and India focus on cost-effective solutions to cater to the rising demand for diagnostics in their respective countries.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

R&D Expenditure |

Revenue (USD Bn) |

Key Products |

Market Strategy |

Recent Initiatives |

|

Roche Diagnostics |

1896 |

Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

|

Abbott Laboratories |

1888 |

USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Thermo Fisher Scientific |

1956 |

USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Siemens Healthineers |

1847 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sysmex Corporation |

1968 |

Japan |

_ |

_ |

_ |

_ |

_ |

_ |

Asia Pacific In Vitro Diagnostics (IVD) Industry Analysis

Growth Drivers

- Increasing prevalence of chronic diseases: Chronic diseases such as diabetes, cancer, and cardiovascular conditions are rising sharply across the Asia-Pacific region. As per the World Health Organization (WHO), Asia is home to over 300 million individuals living with diabetes, and cardiovascular diseases account for a significant portion of the mortality rate in countries like India and China. For instance, in 2022, China reported around 10 million new cancer cases, emphasizing the critical need for diagnostics. The growing burden of chronic illnesses is prompting a surge in demand for early diagnosis, driving the market for in vitro diagnostics (IVD) across the region.

- Rising demand for point-of-care diagnostics: The demand for point-of-care diagnostics has grown substantially in the Asia-Pacific region, particularly due to the COVID-19 pandemic and the ongoing need for quick, accessible testing solutions. In 2023, the Asia-Pacific region accounted for over 30 million rapid test kits distributed for COVID-19 testing. Furthermore, point-of-care tests are now increasingly used for chronic diseases such as diabetes, with over 70 million individuals in India alone utilizing POC diagnostics for routine glucose monitoring. This trend is pushing IVD manufacturers to innovate more portable, faster diagnostic solutions, fueling market growth.

- Advancements in molecular diagnostics: Molecular diagnostics technologies such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) are experiencing rapid growth in Asia-Pacific. These technologies are crucial for diagnosing cancer, genetic diseases, and infectious diseases. In 2023, Japan alone saw the utilization of over 8 million PCR tests for various applications, while China led the way with around 12 million NGS-based diagnostic procedures. As healthcare systems in the region adopt personalized medicine strategies, molecular diagnostics have become a cornerstone in early and precise diagnosis, further driving market expansion.

Market Challenges

- Regulatory complexities: Navigating the regulatory landscape in Asia-Pacific is a significant challenge for IVD manufacturers. Each country has its own regulatory framework for medical devices and diagnostics. For example, Chinas National Medical Products Administration (NMPA) requires rigorous testing and compliance measures, with 10,000+ medical device applications processed annually. Japans Pharmaceuticals and Medical Devices Agency (PMDA) also maintains stringent regulations, making it difficult for foreign manufacturers to enter the market quickly. These regulatory complexities can delay product approvals and increase costs, hindering market growth.

- High costs of advanced diagnostic tools: The high costs associated with advanced diagnostic technologies such as PCR and genetic testing remain a challenge, particularly for low- and middle-income countries in the region. A single PCR test can cost upwards of $100 in some parts of Southeast Asia, limiting its accessibility. Similarly, NGS-based genetic tests are priced even higher, which makes them out of reach for a significant portion of the population. This cost barrier restricts widespread adoption of these advanced tools in resource-constrained settings, slowing market penetration.

Asia Pacific In Vitro Diagnostics (IVD) Market Future Outlook

Over the next five years, the Asia Pacific In Vitro Diagnostics (IVD) market is expected to witness robust growth driven by continuous advancements in molecular diagnostics, increased demand for personalized medicine, and growing government investments in healthcare infrastructure. The rise of telemedicine and home diagnostics is also anticipated to contribute to the markets future expansion. Additionally, as the region continues to combat the increasing prevalence of chronic and infectious diseases, the demand for advanced diagnostic solutions will surge, positioning the market for sustained growth.

Opportunities

- Expansion of diagnostics in emerging economies: Emerging economies like India and Southeast Asia present a significant opportunity for IVD manufacturers. India, with a population of over 1.4 billion, is rapidly expanding its healthcare infrastructure, supported by the government's investment in diagnostics through initiatives like Ayushman Bharat. Similarly, Southeast Asian nations such as Vietnam and Indonesia are seeing increased healthcare investment, with Indonesia allocating over $20 billion towards healthcare in 2023. This expansion in healthcare services creates a fertile ground for the growth of diagnostics, particularly in underserved regions.

- Growth of personalized medicine: The personalized medicine sector is expanding rapidly in the Asia-Pacific region, driven by the adoption of precision medicine techniques that require advanced diagnostic tools. Japan and South Korea are leading the charge, with government-backed initiatives focused on integrating genomics into routine healthcare. In 2023, South Korea allocated $500 million to its precision medicine initiative, which heavily relies on molecular diagnostics such as NGS. This growth is creating new opportunities for IVD companies to offer specialized, targeted diagnostic solutions that align with the personalized medicine movement.

Scope of the Report

|

By Product Type |

Reagents and Kits Instruments Software and Services |

|

By Technology |

Molecular Diagnostics Immunoassay Hematology Microbiology |

|

By Application |

Infectious Disease Testing Oncology Diagnostics Cardiology Diagnostics Diabetes Management |

|

By End User |

Hospitals and Clinics Diagnostic Laboratories Research Institutes Homecare Settings |

|

By Region |

China Japan India Australia Southeast Asia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Hospitals and Diagnostic Companies

Biotechnology Companies

Medical Device Companies

Government and Regulatory Bodies (e.g., Chinas NMPA, Indias CDSCO, Japans PMDA)

Healthcare Investors and Venture Capitalists

Pharmaceutical Companies

Diagnostic Products Idustries

Companies

Players Mentioned in the Report:

Abbott Laboratories

Roche Diagnostics

Thermo Fisher Scientific

Siemens Healthineers

Sysmex Corporation

Becton Dickinson & Company

Qiagen N.V.

Bio-Rad Laboratories

Agilent Technologies

PerkinElmer Inc.

Biomerieux SA

Illumina Inc.

Hologic Inc.

Ortho Clinical Diagnostics

Danaher Corporation

Table of Contents

1. Asia Pacific In Vitro Diagnostics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific In Vitro Diagnostics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific In Vitro Diagnostics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing prevalence of chronic diseases

3.1.2. Rising demand for point-of-care diagnostics

3.1.3. Advancements in molecular diagnostics

3.1.4. Increasing healthcare expenditure

3.2. Market Challenges

3.2.1. Regulatory complexities

3.2.2. High costs of advanced diagnostic tools

3.2.3. Limited accessibility in rural areas

3.3. Opportunities

3.3.1. Expansion of diagnostics in emerging economies

3.3.2. Growth of personalized medicine

3.3.3. Integration of AI and machine learning in diagnostics

3.4. Trends

3.4.1. Shift towards home diagnostics

3.4.2. Increased use of molecular diagnostics for infectious diseases

3.4.3. Growth in non-invasive prenatal testing

3.5. Government Regulations

3.5.1. IVD regulations in key Asia-Pacific countries

3.5.2. Reimbursement policies

3.5.3. Harmonization of regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific In Vitro Diagnostics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Reagents and Kits

4.1.2. Instruments

4.1.3. Software and Services

4.2. By Technology (In Value %)

4.2.1. Molecular Diagnostics

4.2.2. Immunoassay

4.2.3. Hematology

4.2.4. Microbiology

4.3. By Application (In Value %)

4.3.1. Infectious Disease Testing

4.3.2. Oncology Diagnostics

4.3.3. Cardiology Diagnostics

4.3.4. Diabetes Management

4.4. By End User (In Value %)

4.4.1. Hospitals and Clinics

4.4.2. Diagnostic Laboratories

4.4.3. Research Institutes

4.4.4. Homecare Settings

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific In Vitro Diagnostics Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Abbott Laboratories

5.1.2. Roche Diagnostics

5.1.3. Thermo Fisher Scientific

5.1.4. Siemens Healthineers

5.1.5. Bio-Rad Laboratories

5.1.6. Sysmex Corporation

5.1.7. Danaher Corporation

5.1.8. Becton Dickinson & Company

5.1.9. Qiagen N.V.

5.1.10. Agilent Technologies

5.1.11. PerkinElmer Inc.

5.1.12. Biomerieux SA

5.1.13. Illumina Inc.

5.1.14. Hologic Inc.

5.1.15. Ortho Clinical Diagnostics

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, R&D Spend, Global Presence, Market Share, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific In Vitro Diagnostics Market Regulatory Framework

6.1. IVD Regulations and Guidelines

6.2. Approval Processes in Major Markets (China, Japan, India, Australia)

6.3. Country-Specific Compliance Requirements

6.4. Certification and Licensing Processes

7. Asia Pacific In Vitro Diagnostics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific In Vitro Diagnostics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific In Vitro Diagnostics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out all major stakeholders in the Asia Pacific IVD market. This includes comprehensive desk research using both secondary and proprietary databases to gather a holistic view of the market. We aim to pinpoint the key variables influencing market dynamics, such as government regulations, healthcare expenditures, and diagnostic trends.

Step 2: Market Analysis and Construction

We collect and analyze historical data from various sources to assess the penetration of diagnostic tools, revenue generation, and service quality across the Asia Pacific market. This data is compiled and processed to ensure it reflects the latest market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Our research team formulates market hypotheses that are validated through interviews with industry experts, including healthcare professionals, diagnostic companies, and market regulators. These consultations provide direct insights into market trends, operational challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

In the final stage, we synthesize the data collected from both primary and secondary sources. The findings are cross-validated with major players in the market, ensuring an accurate, detailed, and comprehensive analysis of the Asia Pacific IVD market. This ensures that our report provides actionable insights for business decision-makers.

Frequently Asked Questions

1. How big is the Asia Pacific In Vitro Diagnostics market?

The Asia Pacific IVD market is valued at USD 23.5 billion, driven by rising demand for point-of-care diagnostics and advancements in molecular diagnostics.

2. What are the challenges in the Asia Pacific In Vitro Diagnostics market?

Key challenges include regulatory complexities, the high cost of advanced diagnostic tools, and limited accessibility in rural regions.

3. Who are the major players in the Asia Pacific In Vitro Diagnostics market?

Major players include Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Siemens Healthineers, and Sysmex Corporation.

4. What are the growth drivers of the Asia Pacific In Vitro Diagnostics market?

Growth drivers include an increasing prevalence of chronic diseases, rising demand for personalized medicine, and technological advancements in diagnostics.

5. What are the dominant countries in the Asia Pacific In Vitro Diagnostics market?

China, Japan, and India dominate due to large populations, strong healthcare systems, and significant government support for diagnostic innovations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.