Asia Pacific Industrial Coatings Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2519

November 2024

85

About the Report

Asia-Pacific Industrial Coatings Market Overview

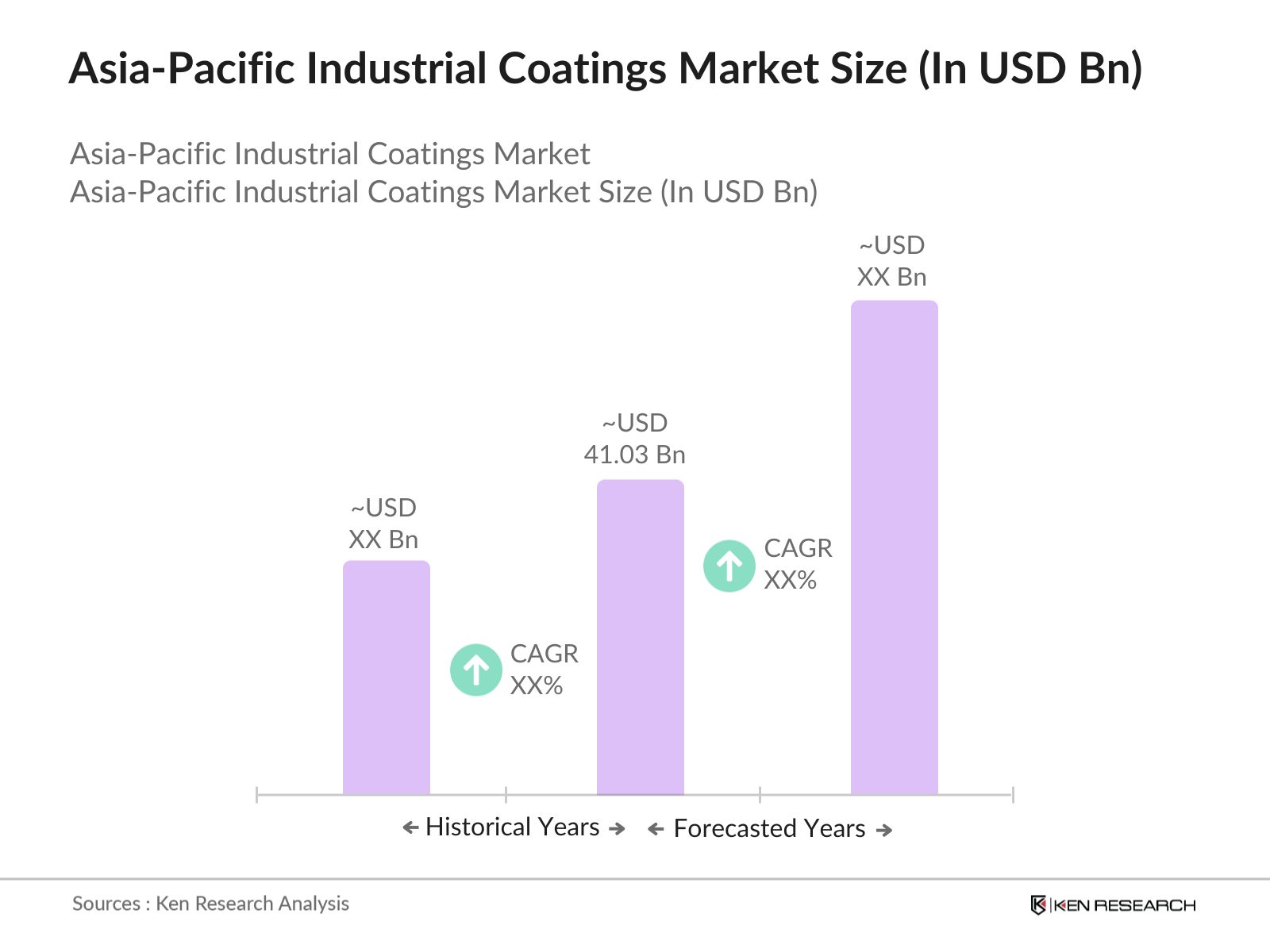

- The Asia-Pacific Industrial Coatings Market was valued at USD 41.03 billion. The market's growth is driven by rapid industrialization, increasing infrastructure development, and the rising demand for protective coatings across sectors such as automotive, construction, and aerospace.

- The key players in the Asia-Pacific Industrial Coatings Market include AkzoNobel N.V., PPG Industries, Nippon Paint Holdings, Axalta Coating Systems, and Sherwin-Williams. These companies focus on product innovation, sustainable coatings development, and expanding their regional footprint to cater to diverse industrial needs.

- AkzoNobel launches Accelshield 300, a bisphenol-free internal coating for aluminium cans, offering superior corrosion protection, flexibility, and sensory performance while meeting evolving industry regulations and sustainability demands.

- In 2023, China led the Asia-Pacific Industrial Coatings Market, driven by its robust automotive and construction sectors. Japan and India followed closely, with their increasing focus on green building and infrastructure development.

Asia-Pacific Industrial Coatings Market Segmentation

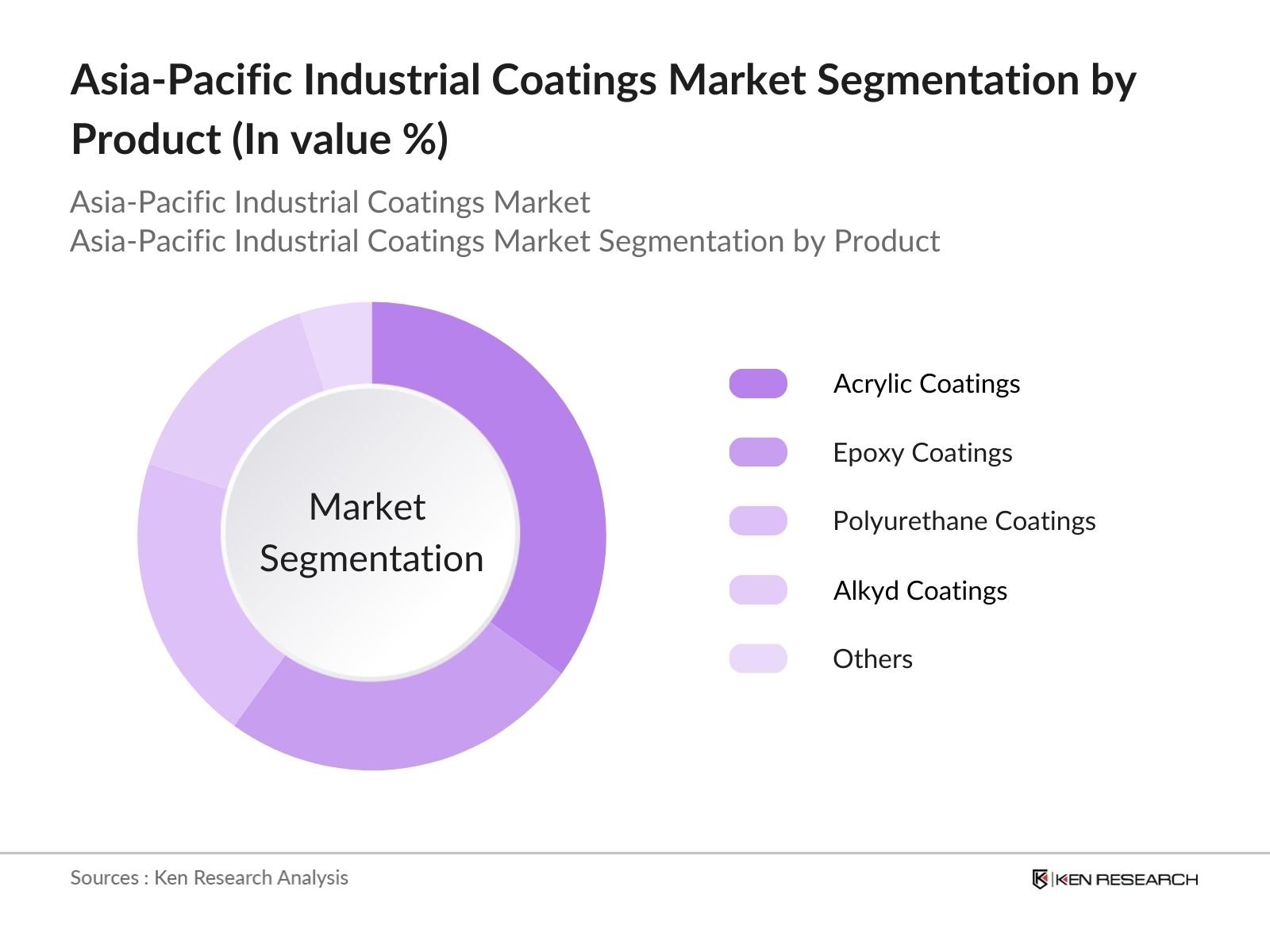

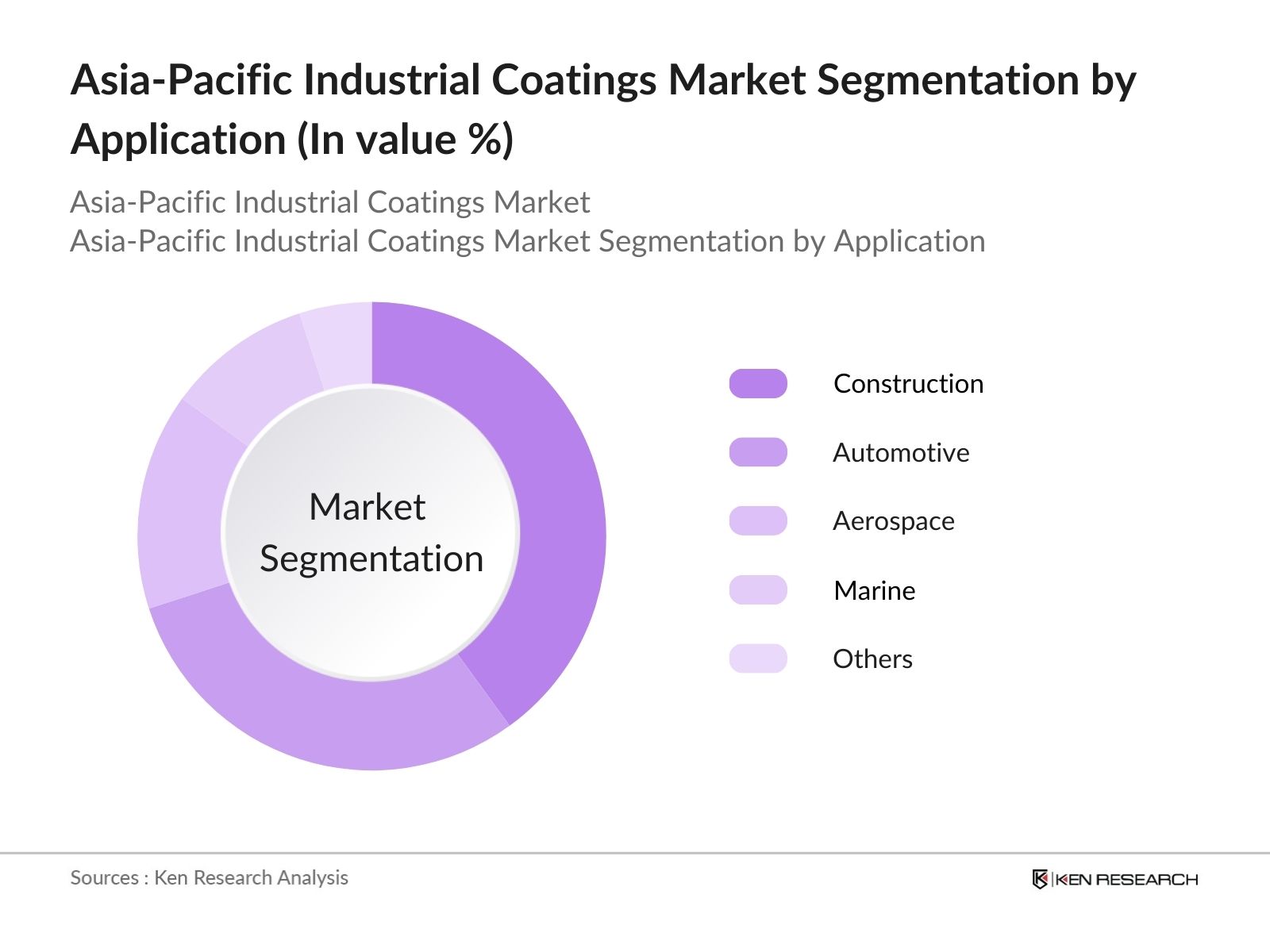

The Asia-Pacific Industrial Coatings Market is segmented by Product, application, and region.

- By Product: The market is segmented into acrylic, epoxy, polyurethane, alkyl, and others. In 2023, acrylic coatings dominated the market due to their versatile application in various industries.

- By Application: The market is segmented into automotive, construction, aerospace, marine, and others. The construction segment held the largest market share in 2023, attributed to ongoing infrastructure developments across Asia-Pacific.

- By Region: The market is segmented into China, Japan, South Korea, India, Australia, and Rest of APAC. China accounted for the highest market share in 2023, followed by Japan, owing to rapid industrialization and the expansion of LNG infrastructure.

Asia-Pacific Industrial Coatings Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Akzo Nobel N.V. |

1792 |

Amsterdam, Netherlands |

|

PPG Industries |

1883 |

Pennsylvania, USA |

|

Nippon Paint Holdings |

1881 |

Osaka, Japan |

|

Jotun |

1926 |

Sandefjord, Norway |

|

Sherwin-Williams |

1866 |

Ohio, USA |

- Nippon Paint: Nippon Paint India has announced the 100% acquisition of VIBGYOR Paints and Chemicals, a key supplier in South India. This strategic move aims to enhance Nippon's industrial coatings portfolio, particularly for Indian Railways, while integrating VIBGYOR's expertise and resources into its operations.

- PPG Industries: PPG has completed upgrades to its industrial coatings plant in Bc Ninh, Vietnam, enhancing capacity with a new production line for AQUACRON waterborne coatings. The facility now features six production lines, aiming to meet the growing demand for sustainable coatings in Southeast Asia's consumer electronics sector

Asia-Pacific Industrial Coatings Market Analysis

Asia-Pacific Industrial Coatings Market Growth Drivers:

- Rising Construction Activities: The ongoing infrastructure boom in emerging economies like China and India has substantially increased the demand for industrial coatings. In 2022, China invested around $1.4 trillion in infrastructure, while India plans to increase its infrastructure investment from 5.3% of GDP in 2024 to 6.5% by 2029, reflecting a robust commitment to development.

- Automotive Sector Growth: As the region continues to dominate global vehicle production, coatings for protection and aesthetics remain in high demand. In 2022, China produced over 30.16 million vehicles, marking an 11.6% increase from the previous year. India's automotive production is projected to reach 28 million units in 2023-24, highlighting strong growth.

- Infrastructure Expansion: The construction sector in China and India is experiencing rapid growth, with increasing use of industrial coatings for protective and decorative purposes. In 2023, India recorded 179 million two-wheeler sales, while China's infrastructure investments are projected at $1.4 trillion, boosting the demand for industrial coatings in both markets.

Asia-Pacific Industrial Coatings Market Challenges:

- Fluctuating Raw Material Prices: In 2023, prices for key raw materials like resins, solvents, and pigments rose by 12%, increasing production costs for coating manufacturers. This fluctuation poses challenges in maintaining profitability and may lead to adjustments in pricing strategies.

- Environmental Compliance: Stringent environmental regulations in Japan and South Korea have heightened compliance costs for manufacturers. These regulations are driving a shift towards sustainable coatings, particularly those with reduced volatile organic compound (VOC) content, reflecting a growing emphasis on eco-friendly practices in the coatings industry.

Asia-Pacific Industrial Coatings Market Government Initiatives:

- China's Infrastructure Development Plan: China's 14th Five-Year Plan (2021-2025) focuses on "new infrastructure" projects, with an expected investment of RMB 10-17.5 trillion (USD 1.43-2.51 trillion) over five years. This substantial commitment is boosting demand for coatings in construction.

- India's Manufacturing Growth: India's "Make in India" initiative encourages international manufacturers to set up production facilities, boosting demand for industrial coatings. In 2021-22, India attracted a record USD 83.6 billion in foreign direct investment, enhancing domestic manufacturing and stimulating the coatings market, particularly in the architectural segment.

Asia-Pacific Industrial Coatings Market Future Market Outlook

The Asia-Pacific Industrial Coatings Market is expected to continue its growth trajectory over the next five years, driven by advancements in coating technologies and rising demand from the automotive and construction sectors.

Asia-Pacific Industrial Coatings Market Future Market Trends:

- Increased Demand for Eco-friendly Coatings: In the coming years, the market will witness a surge in demand for water-based and low-VOC coatings as sustainability becomes a priority, with companies adopting eco-friendly materials to align with regulations and consumer preferences.

- Technological Innovations: In the coming years, new coatings providing enhanced corrosion resistance and durability will see greater adoption in industries such as marine and aerospace, with advancements like nanocoatings and self-healing coatings extending material lifespan and reducing maintenance costs.

Scope of the Report

|

By Product |

Acrylic Epoxy Polyurethane Alkyd Others |

|

By Application |

Automotive Construction Aerospace Marine Others |

|

By Region |

China Japan South Korea India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Automotive Manufacturers

Construction Companies

Aerospace Companies

Industrial Coating Manufacturers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Air Liquide S.A.

Linde plc

Chart Industries, Inc.

Cryofab Inc.

Taylor-Wharton International

Praxair, Inc.

INOXCVA

Cryogenic Industries

Wessington Cryogenics

Iwatani Corporation

Cryoquip, LLC

Technifab Products, Inc.

VRV Group

FIBA Technologies, Inc.

Cryogas Equipment Pvt. Ltd.

Table of Contents

1. Asia-Pacific Industrial Coatings Market Overview

1.1 Definition and Scope of the Asia-Pacific Industrial Coatings Market

1.2 Market Taxonomy (Product, Application, Region)

1.3 Market Growth Rate and Trends

1.4 Market Drivers (Industrialization, Construction Growth, Automotive Demand)

1.5 Market Restraints (Environmental Compliance, Raw Material Price Fluctuations)

2. Asia-Pacific Industrial Coatings Market Size (in USD Billion)

2.1 Historical Market Size Analysis (2018-2023)

2.2 Year-on-Year Growth Analysis

2.3 Forecast Market Size and Growth Projections (2023-2028)

2.4 Key Market Milestones and Developments

3. Asia-Pacific Industrial Coatings Market Analysis

3.1 Growth Drivers

3.1.1 Rising Infrastructure Developments

3.1.2 Automotive Sector Expansion

3.1.3 Increased Demand for Eco-Friendly Coatings

3.2 Market Challenges

3.2.1 Raw Material Price Volatility

3.2.2 Stringent Environmental Regulations

3.2.3 High Cost of Compliance

3.3 Opportunities

3.3.1 Adoption of Advanced Coating Technologies

3.3.2 Growing Demand in Aerospace and Marine Sectors

3.3.3 Expansion in Emerging Economies

3.4 Market Trends

3.4.1 Shift Toward Low-VOC and Water-Based Coatings

3.4.2 Innovations in Nanocoatings and Self-Healing Coatings

4. Asia-Pacific Industrial Coatings Market Segmentation

4.1 By Product (in Value %)

4.1.1 Acrylic

4.1.2 Epoxy

4.1.3 Polyurethane

4.1.4 Alkyd

4.1.5 Others

4.2 By Application (in Value %)

4.2.1 Automotive

4.2.2 Construction

4.2.3 Aerospace

4.2.4 Marine

4.2.5 Others

4.3 By Region (in Value %)

4.3.1 China

4.3.2 Japan

4.3.3 South Korea

4.3.4 India

4.3.5 Australia

4.3.6 Rest of APAC

5. Asia-Pacific Industrial Coatings Competitive Landscape

5.1 Competitive Market Share Analysis

5.2 Company Profiles

5.2.1 AkzoNobel N.V. (Established 1792, Headquarters: Amsterdam, Netherlands)

5.2.2 PPG Industries (Established 1883, Headquarters: Pennsylvania, USA)

5.2.3 Nippon Paint Holdings (Established 1881, Headquarters: Osaka, Japan)

5.2.4 Jotun (Established 1926, Headquarters: Sandefjord, Norway)

5.2.5 Sherwin-Williams (Established 1866, Headquarters: Ohio, USA)

5.2.6 Axalta Coating Systems (Established 1866, Headquarters: Pennsylvania, USA)

5.2.7 BASF SE (Established 1865, Headquarters: Ludwigshafen, Germany)

5.2.8 RPM International Inc. (Established 1947, Headquarters: Ohio, USA)

5.2.9 Asian Paints (Established 1942, Headquarters: Mumbai, India)

5.2.10 Kansai Paint Co., Ltd. (Established 1918, Headquarters: Osaka, Japan)

5.2.11 Berger Paints India Ltd. (Established 1923, Headquarters: Kolkata, India)

5.2.12 Hempel Group (Established 1915, Headquarters: Copenhagen, Denmark)

5.2.13 Tikkurila (Established 1862, Headquarters: Vantaa, Finland)

5.2.14 Masco Corporation (Established 1929, Headquarters: Michigan, USA)

5.2.15 Teknos Group (Established 1948, Headquarters: Helsinki, Finland)

5.3 Strategic Initiatives and Investments

5.4 Recent Mergers and Acquisitions

5.5 Technological Innovations and R&D Investments

6. Asia-Pacific Industrial Coatings Market Government Regulations and Initiatives

6.1 Chinas Infrastructure Expansion Policies

6.2 Indias Make in India Initiative and Its Impact on Coatings Demand

6.3 Environmental Regulations on Low-VOC Coatings in Japan and South Korea

7. Asia-Pacific Industrial Coatings Market Future Market Size and Segmentation

7.1 Market Segmentation by Product (2023-2028)

7.2 Market Segmentation by Application (2023-2028)

7.3 Market Segmentation by Region (2023-2028)

7.4 Future Market Trends (Eco-Friendly Coatings, Advanced Technologies)

8. Asia-Pacific Industrial Coatings Technological Advancements

8.1 Innovations in Water-Based and Low-VOC Coatings

8.2 Nanocoatings and Their Applications

8.3 AI and IoT-Driven Smart Coating Solutions

8.4 Impact of Technological Advancements on Sustainability

9. Asia-Pacific Industrial Coatings Market Investment and Funding Landscape

9.1 Key Investments in Industrial Coatings Technologies

9.2 Mergers and Acquisitions in the Asia-Pacific Market

9.3 Government Grants and Incentives for Sustainable Coatings

9.4 Private Equity and Venture Capital Funding in Coating Companies

10. Asia-Pacific Industrial Coatings Market SWOT Analysis

10.1 Strengths (Innovative Technologies, Strong Market Players)

10.2 Weaknesses (High Production Costs, Regulatory Barriers)

10.3 Opportunities (Expansion into Emerging Markets, Eco-Friendly Solutions)

10.4 Threats (Raw Material Volatility, Increasing Competition)

11. Analysts Recommendations

11.1 Strategic Market Entry and Expansion Opportunities

11.2 Collaboration with Construction and Automotive Firms

11.3 Innovative Product Development (Green and Smart Coatings)

11.4 Market Positioning Strategies for Key Players

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Asia-Pacific Industrial Coatings market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple coating manufacturers and stakeholders in the automotive and construction industries a to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these coating manufacturers and stakeholders in the automotive and construction industries.

Frequently Asked Questions

01. How big is the Asia-Pacific Industrial Coatings Market?

The Asia-Pacific Industrial Coatings Market was valued at USD 41.03 billion, driven by demand from automotive, construction, and aerospace sectors.

02. Who are the major players in the Asia-Pacific Industrial Coatings market?

Major players in the Asia-Pacific Industrial Coatings Market include AkzoNobel N.V., PPG Industries, Nippon Paint Holdings, Axalta Coating Systems, and Jotun. These companies lead through innovations in eco-friendly coatings and expansions in high-demand sectors.

03. What are the growth drivers of the Asia-Pacific Industrial Coatings market?

Growth drivers for the Asia-Pacific Industrial Coatings Market include rapid industrialization, infrastructure development, and increasing demand for protective coatings in automotive and construction. Rising environmental regulations are also pushing demand for eco-friendly, low-VOC coatings.

04. What are the Asia-Pacific Industrial Coatings market challenges?

The Asia-Pacific Industrial Coatings Market faces challenges such as fluctuations in raw material prices, especially for resins and solvents, and stringent environmental regulations in key markets like Japan and South Korea, which raise production and compliance costs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.