Asia-Pacific Industrial Transmission Substation Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD7689

November 2024

89

About the Report

Asia-Pacific Industrial Transmission Substation Market Overview

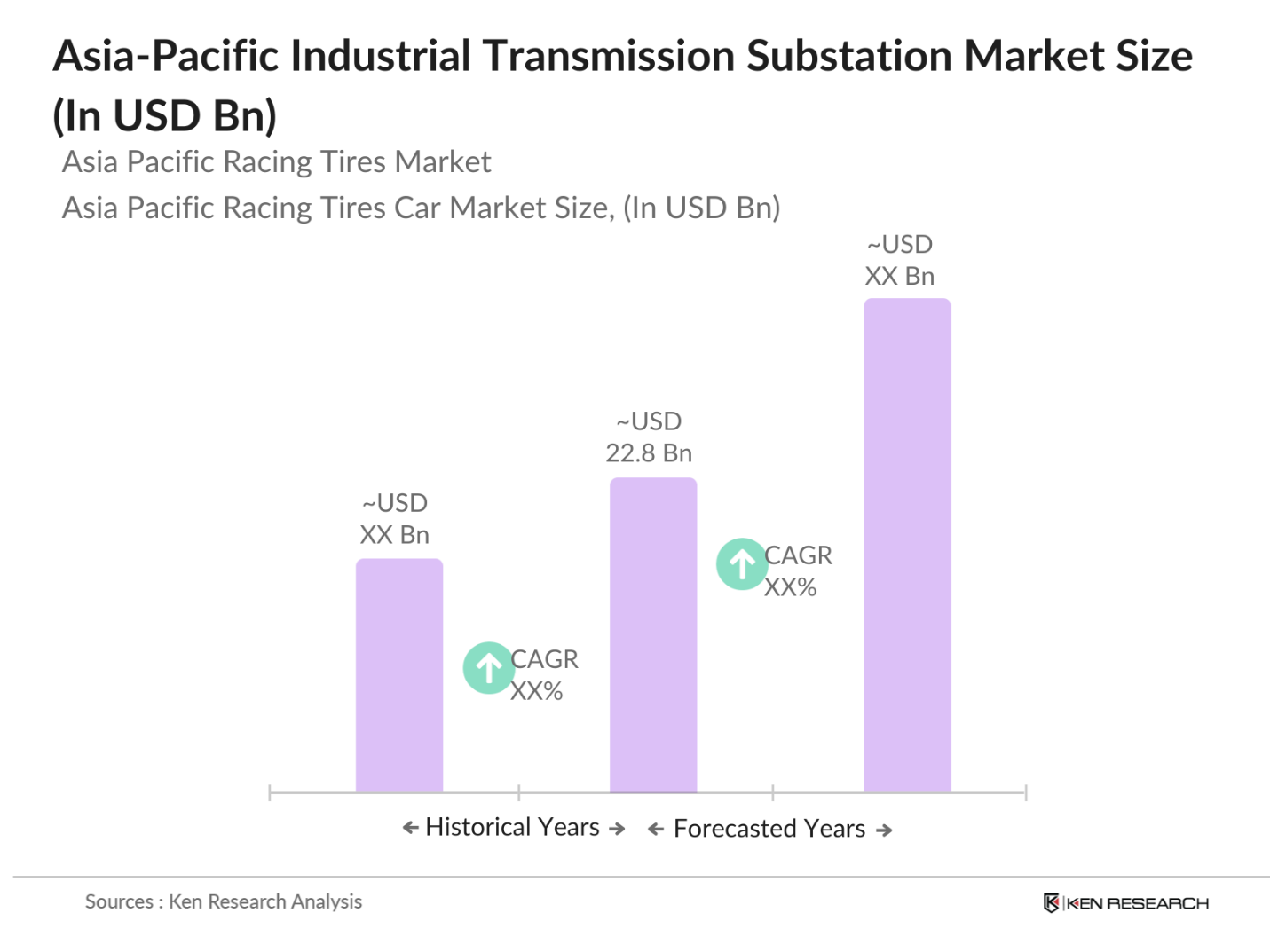

- The Asia-Pacific industrial transmission substation market is valued at USD 22.8 billion, driven by the rapid industrialization and expanding energy infrastructure across the region. The region's continued shift towards renewable energy sources and the increasing investments in grid modernization are key drivers of market growth. A historical analysis of the past five years reveals that significant investments have been made in countries like China, India, and Japan to upgrade aging substations and incorporate smart technologies to enhance operational efficiency.

- Dominant countries such as China, India, and Japan lead the market due to their massive energy demands, driven by urbanization and industrial growth. China, in particular, has made substantial investments in high-voltage direct current (HVDC) technology, while India has focused on modernizing its power grid to reduce transmission losses. Japan's robust energy policies and emphasis on automation and digital substations have contributed to its dominance in the region.

- The integration of IoT in substation monitoring is becoming increasingly prevalent across the Asia-Pacific region. By 2024, countries like Japan, South Korea, and China have implemented IoT technologies in over 50% of their new substations, allowing real-time monitoring of performance, predictive maintenance, and enhanced safety protocols. IoT-based monitoring systems are expected to reduce maintenance costs by 15% and improve system reliability, which is crucial for managing the integration of renewable energy sources into the grid.

Asia-Pacific Industrial Transmission Substation Market Segmentation

By Substation Type: The Asia-Pacific industrial transmission substation market is segmented by substation type into Gas Insulated Substations (GIS), Air Insulated Substations (AIS), Hybrid Substations, and Underground Substations. Recently, Gas Insulated Substations (GIS) have gained a dominant market share in the region. This is attributed to their compact design, lower maintenance requirements, and suitability for urban and densely populated areas. Many cities in China and Japan prefer GIS due to the limited space available for infrastructure expansion. In addition, GIS technology is more resistant to environmental conditions and is increasingly being integrated with renewable energy sources, making it a preferred choice for modern grid infrastructure.

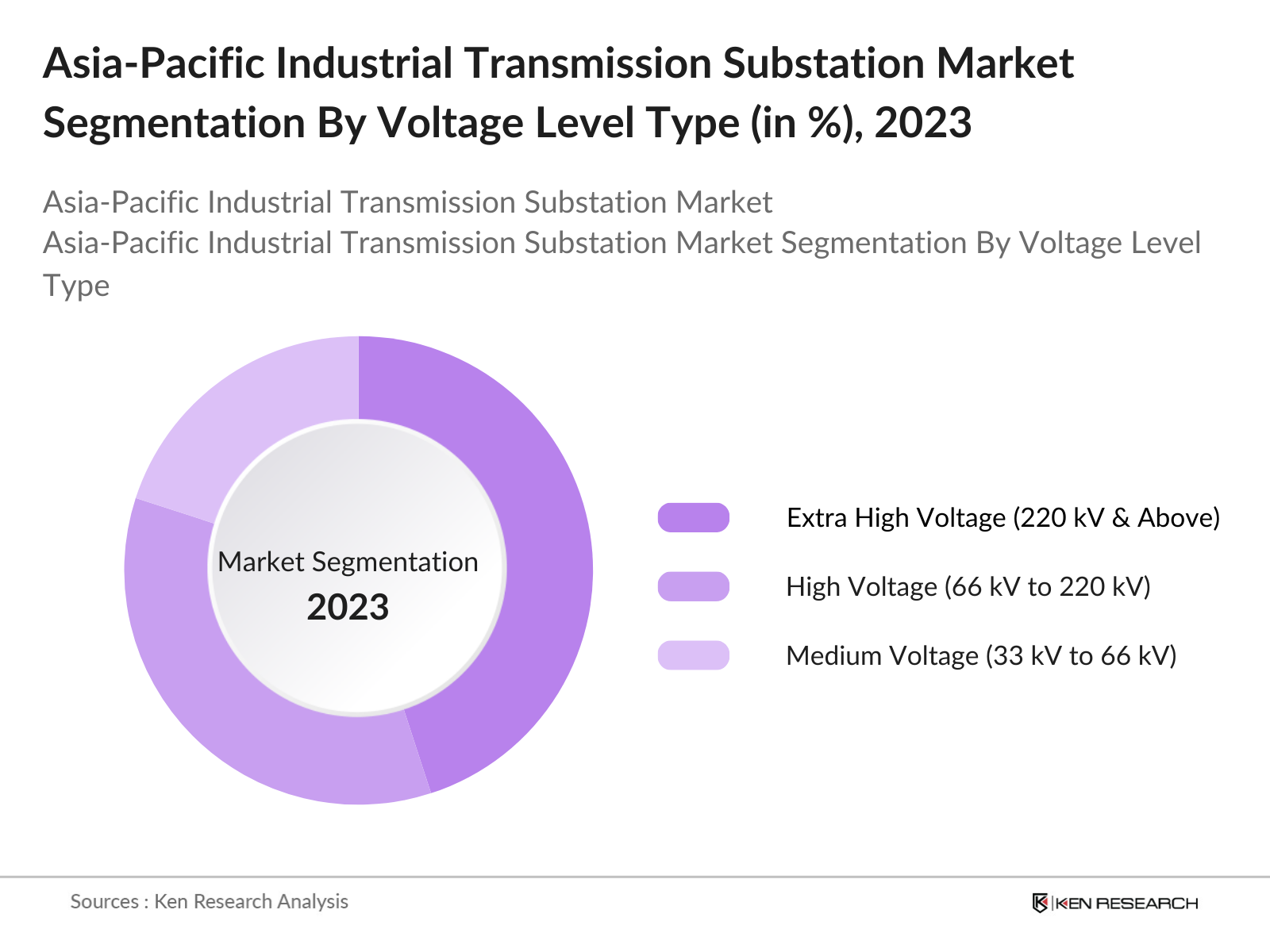

By Voltage Level: The market is also segmented by voltage level into Extra High Voltage (220 kV & Above), High Voltage (66 kV to 220 kV), and Medium Voltage (33 kV to 66 kV). Extra High Voltage (220 kV & Above) substations have captured a significant share of the market. The demand for extra high voltage substations is being driven by the need to transfer electricity over long distances, especially in countries like India and China where renewable energy sources such as wind and solar are located far from population centers. These substations are crucial for improving transmission efficiency and reducing energy losses during long-distance electricity transmission.

Asia-Pacific Industrial Transmission Substation Market Competitive Landscape

The Asia-Pacific industrial transmission substation market is dominated by a few major players who offer a broad range of substation solutions, from conventional to digital and automated substations. The competitive landscape includes key players with well-established presences in both regional and global markets. These companies are heavily investing in research and development to integrate advanced technologies such as Internet of Things (IoT) and artificial intelligence into their substation offerings. Partnerships and strategic collaborations with governments and utility companies further strengthen their market positions.

|

Company Name |

Establishment Year |

Headquarters |

Technology Focus |

No. of Employees |

Revenue (USD) |

Product Portfolio |

Global Presence |

Major Projects |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

|

Siemens AG |

1847 |

Munich, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

Schneider Electric SE |

1836 |

Rueil-Malmaison, France |

_ |

_ |

_ |

_ |

_ |

_ |

|

General Electric |

1892 |

Boston, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mitsubishi Electric Corporation |

1921 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

Asia-Pacific Industrial Transmission Substation Industry Analysis

Growth Drivers

- Expansion of Industrialization in Emerging Markets: Emerging economies in the Asia-Pacific region, like India, Vietnam, and Indonesia, are experiencing rapid industrial growth. According to the World Bank, India's industrial sector expanded by over 9% in 2023. Vietnam saw similar growth with a 7.5% increase, driven by increased demand for energy and infrastructure improvements. The rapid industrialization in these countries has necessitated the upgrade of transmission infrastructure to support the burgeoning energy demand, which has surged from 1,500 TWh in 2022 to over 1,600 TWh in 2024. This infrastructure expansion includes industrial substations to ensure reliable power distribution to growing industries.

- Rising Investments in Renewable Energy Sources: Governments across the Asia-Pacific region are heavily investing in renewable energy projects to reduce reliance on fossil fuels. According to the International Energy Agency (IEA), renewable energy capacity in the region increased by over 350 GW between 2022 and 2024, with solar and wind energy accounting for 85% of this expansion. Countries like China, Australia, and India are focusing on integrating these renewable sources into the grid, which requires substantial investments in transmission substations to handle fluctuations in energy output and manage load distribution. This investment is a major driver for upgrading substation technology to handle renewables.

- Aging Infrastructure in Developed Economies: Developed economies like Japan, South Korea, and Australia face challenges with aging electrical infrastructure. The World Bank reported that by 2024, over 40% of Japan's transmission infrastructure was over 30 years old, requiring significant upgrades to ensure reliability. This has led to increased government spending on substation modernization projects. In Australia, the government allocated $6.6 billion in 2023 towards upgrading aging transmission and distribution systems, including substations. These modernization efforts are crucial to maintaining a stable and efficient energy supply in these countries.

Market Challenges

- High Initial Costs of Transmission Substations: The cost of establishing new transmission substations in the Asia-Pacific region is a significant barrier. According to the International Energy Agency, the average cost of building a high-voltage transmission substation in 2023 ranged from $20 million to $30 million, depending on the country and the level of technology integration. These high upfront costs often slow down projects, particularly in emerging markets where funding may be limited. In India, transmission infrastructure investments have struggled due to a financing gap of $15 billion as of 2024, impacting substation deployment timelines.

- Complex Technical Integration and Maintenance: The integration of renewable energy sources, smart grids, and high-voltage direct current (HVDC) systems into traditional transmission substations poses significant technical challenges. Countries like Japan and South Korea have reported difficulties in retrofitting existing infrastructure to accommodate new technologies. By 2023, over 30% of substations in Japan required complex upgrades to support renewable energy integration. Maintenance costs have also surged, with Australia spending over $1 billion annually on maintaining and upgrading its substations to handle advanced technical systems. Japan Ministry of Energy Report on Transmission Upgrades 2023.

Asia-Pacific Industrial Transmission Substation Market Future Outlook

Over the next five years, the Asia-Pacific industrial transmission substation market is expected to exhibit significant growth. This expansion will be driven by several factors, including the increasing adoption of smart grid technologies, rising investments in renewable energy infrastructure, and government initiatives focused on grid modernization and sustainability. As countries in the region, particularly China and India, seek to reduce transmission losses and improve energy efficiency, the demand for advanced substation technologies, such as gas-insulated and hybrid substations, will continue to grow. Moreover, the region's industrial expansion and urbanization trends are expected to support the development of high-voltage and extra-high voltage substations.

Opportunities

- Adoption of Smart Grid Technologies: The adoption of smart grid technologies in the Asia-Pacific region presents a significant opportunity for the transmission substation market. According to the IEA, China and India alone invested over $50 billion in smart grid technologies between 2022 and 2024. Smart grid initiatives require the modernization of substations, integrating automation, IoT, and digital control systems. In India, smart grid deployment is expected to cover over 500 million consumers by 2024, necessitating extensive substation upgrades to manage energy flow, monitor grid health, and integrate renewable energy sources effectively.

- Government Funding and Public-Private Partnerships: Governments in the Asia-Pacific region are increasingly turning to public-private partnerships (PPPs) to fund transmission infrastructure projects. In 2023, the Indian government announced $8 billion in PPP projects for energy infrastructure, focusing on substation upgrades and grid expansion. China has also adopted PPPs to fund rural electrification and grid modernization projects, with over $12 billion allocated to such initiatives by 2024. These partnerships enable faster project execution, leveraging private sector expertise while reducing the financial burden on governments.

Scope of the Report

|

Substation Type |

Gas Insulated Substations (GIS) Air Insulated Substations (AIS) Hybrid Substations Underground Substations |

|

Voltage Level |

Extra High Voltage (220 kV & Above) High Voltage (66 kV to 220 kV) Medium Voltage (33 kV to 66 kV) |

|

End User |

Industrial Commercial Utilities Residential |

|

Technology |

Conventional Substation Technology Smart Substation Technology |

|

Region |

China India Japan South Korea ASEAN (Indonesia, Vietnam, Thailand) Australia & New Zealand |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Transmission System Operating Companies

Electric Utility Companies

Government and Regulatory Bodies (e.g., National Energy Administration, State Grid Corporation)

Renewable Energy Industries

Energy Service Companies

Grid Equipment Manufacturing Companies

Investor and Venture Capitalist Firms

Smart Grid Solution Industries

Companies

Players Mentioned in the Report

ABB Ltd.

Siemens AG

Schneider Electric SE

General Electric

Mitsubishi Electric Corporation

Hitachi Energy

Toshiba Corporation

Eaton Corporation

CG Power and Industrial Solutions Ltd.

Hyosung Heavy Industries

Table of Contents

1. Asia-Pacific Industrial Transmission Substation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Industrial Transmission Substation Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Industrial Transmission Substation Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Industrialization in Emerging Markets

3.1.2. Rising Investments in Renewable Energy Sources

3.1.3. Aging Infrastructure in Developed Economies

3.1.4. Regional Government Policies for Grid Modernization

3.2. Market Challenges

3.2.1. High Initial Costs of Transmission Substations

3.2.2. Complex Technical Integration and Maintenance

3.2.3. Shortage of Skilled Labor

3.2.4. Environmental and Safety Regulations

3.3. Opportunities

3.3.1. Adoption of Smart Grid Technologies

3.3.2. Government Funding and Public-Private Partnerships

3.3.3. Growing Demand for Electrification in Rural Areas

3.4. Trends

3.4.1. Integration of IoT in Substation Monitoring

3.4.2. Rise of Digital Substations and Automation

3.4.3. Development of High-Voltage Direct Current (HVDC) Transmission

3.5. Government Regulation

3.5.1. Renewable Energy Integration Policies

3.5.2. Transmission Grid Code Compliance

3.5.3. Environmental Impact Assessment (EIA) Requirements

3.5.4. Energy Efficiency Mandates

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia-Pacific Industrial Transmission Substation Market Segmentation

4.1. By Substation Type (In Value %)

4.1.1. Gas Insulated Substations (GIS)

4.1.2. Air Insulated Substations (AIS)

4.1.3. Hybrid Substations

4.1.4. Underground Substations

4.2. By Voltage Level (In Value %)

4.2.1. Extra High Voltage (220 kV & Above)

4.2.2. High Voltage (66 kV to 220 kV)

4.2.3. Medium Voltage (33 kV to 66 kV)

4.3. By End User (In Value %)

4.3.1. Industrial (Manufacturing, Mining, Oil & Gas)

4.3.2. Commercial (Data Centers, Hospitals, Commercial Complexes)

4.3.3. Utilities (Power Generation and Distribution)

4.3.4. Residential (Smart City Projects)

4.4. By Technology (In Value %)

4.4.1. Conventional Substation Technology

4.4.2. Smart Substation Technology

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. ASEAN (Indonesia, Vietnam, Thailand)

4.5.6. Australia & New Zealand

5. Asia-Pacific Industrial Transmission Substation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. Schneider Electric SE

5.1.4. Mitsubishi Electric Corporation

5.1.5. General Electric

5.1.6. Hitachi Energy

5.1.7. Toshiba Corporation

5.1.8. Eaton Corporation

5.1.9. CG Power and Industrial Solutions Ltd.

5.1.10. Hyosung Heavy Industries

5.1.11. Fuji Electric

5.1.12. Hyundai Electric

5.1.13. Alstom Grid

5.1.14. Bharat Heavy Electricals Ltd. (BHEL)

5.1.15. NARI Group Corporation

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Technology Focus, Regional Presence, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific Industrial Transmission Substation Market Regulatory Framework

6.1. Transmission Grid Regulations

6.2. Environmental Compliance

6.3. Health and Safety Standards

6.4. Renewable Energy Integration Requirements

7. Asia-Pacific Industrial Transmission Substation Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Industrial Transmission Substation Future Market Segmentation

8.1. By Substation Type (In Value %)

8.2. By Voltage Level (In Value %)

8.3. By End User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Industrial Transmission Substation Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key stakeholders and variables impacting the Asia-Pacific industrial transmission substation market. This includes conducting extensive desk research from both secondary and proprietary databases, focusing on identifying critical market drivers, challenges, and trends.

Step 2: Market Analysis and Construction

In this step, historical data is gathered and analyzed to determine market size and growth trends. Various indicators such as revenue generation, penetration of smart grid technologies, and investments in grid modernization are used to assess market development.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including engineers, managers, and executives from key market players. These interviews provide valuable operational insights and help refine market data and assumptions.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the findings from both primary and secondary research. This includes reconciling data collected through interviews with historical data to ensure an accurate and comprehensive market analysis.

Frequently Asked Questions

01. How big is the Asia-Pacific Industrial Transmission Substation Market?

The Asia-Pacific industrial transmission substation market is valued at USD 22.8 billion, driven by rapid industrialization, increasing energy demand, and investments in renewable energy infrastructure.

02. What are the challenges in the Asia-Pacific Industrial Transmission Substation Market?

Challenges include high initial costs of infrastructure development, complex technical integration, and a shortage of skilled labor for maintaining and upgrading substations.

03. Who are the major players in the Asia-Pacific Industrial Transmission Substation Market?

Key players include ABB Ltd., Siemens AG, Schneider Electric SE, General Electric, and Mitsubishi Electric Corporation. These companies lead the market due to their strong presence in substation technologies and global market reach.

04. What are the growth drivers of the Asia-Pacific Industrial Transmission Substation Market?

Key growth drivers include increasing investments in grid modernization, rising demand for smart grid technologies, and expanding industrial activities across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.