Asia-Pacific Internet of Things (IoT) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4123

October 2024

97

About the Report

Asia-Pacific IoT Market Overview

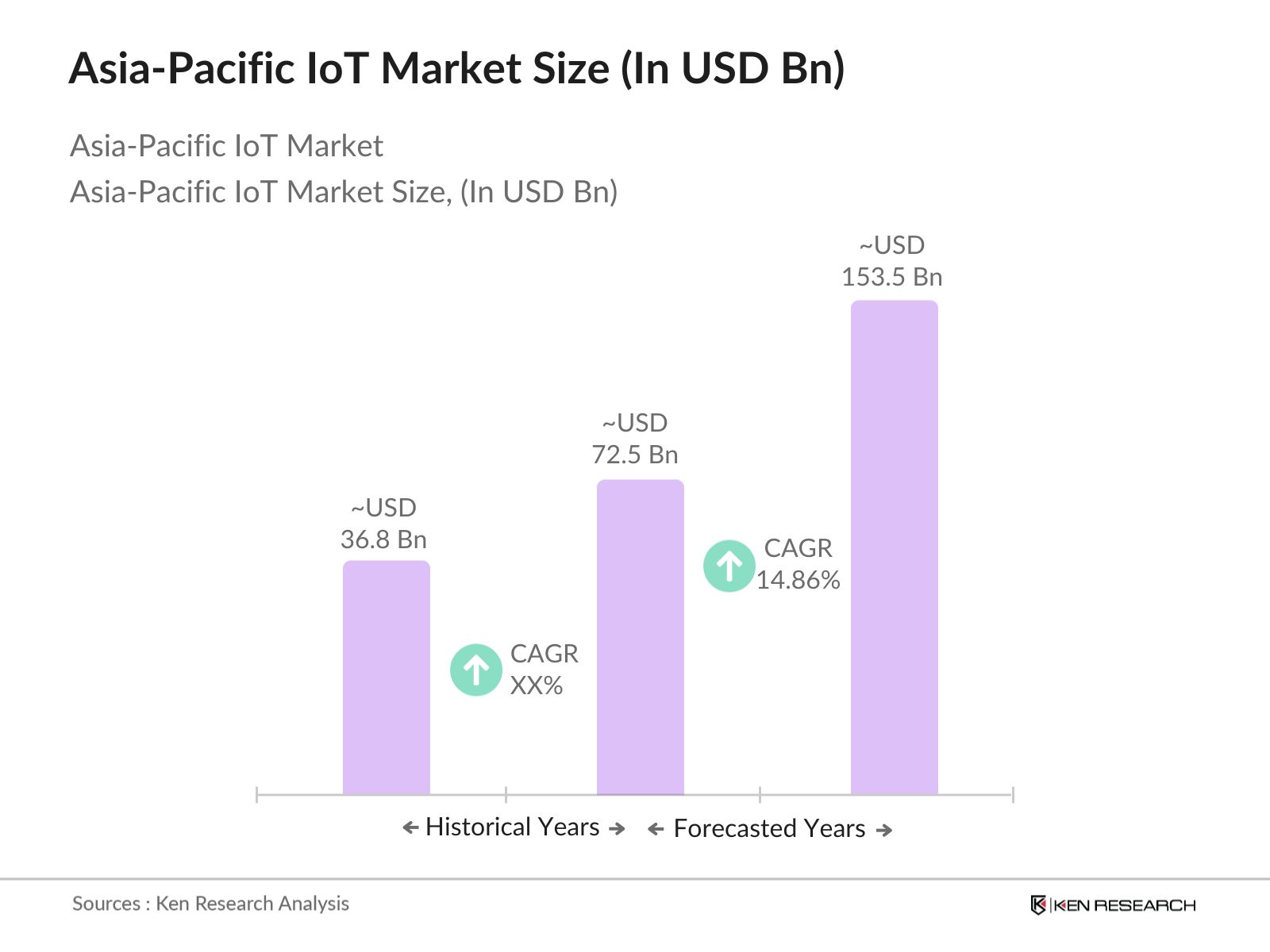

- The Asia-Pacific Internet of Things (IoT) market is valued at USD 72.5 billion, driven by rapid urbanization and industrial digitization. Governments across the region are heavily investing in IoT infrastructure, particularly in smart cities and 5G networks, propelling market growth. Countries such as China, India, and Japan are at the forefront, benefiting from their robust manufacturing industries and large-scale adoption of IoT solutions in healthcare, automotive, and smart home sectors. Key developments in artificial intelligence (AI) integration and advancements in sensor technologies are further accelerating the adoption of IoT across the region.

- Countries such as China, India, and Japan dominate the Asia-Pacific IoT market due to their technological advancements and infrastructure. China, in particular, leads the region with government-backed initiatives, such as the Made in China 2025 plan, which emphasizes the adoption of IoT in manufacturing. India’s digital transformation efforts and Japan’s focus on industrial automation have also contributed to their leadership in this market, creating an ecosystem ripe for IoT innovation and deployment.

- Governments across the Asia-Pacific region are implementing strict data protection and privacy regulations to address concerns around IoT device usage. In 2023, Japan enacted amendments to its Act on the Protection of Personal Information, imposing higher compliance requirements on IoT device manufacturers. Similarly, South Korea’s Personal Information Protection Act mandates that IoT data collectors implement stronger security measures. These regulations are critical for ensuring consumer trust in IoT technologies, particularly in sectors like healthcare and smart home devices, where data privacy is a top priority.

Asia-Pacific IoT Market Segmentation

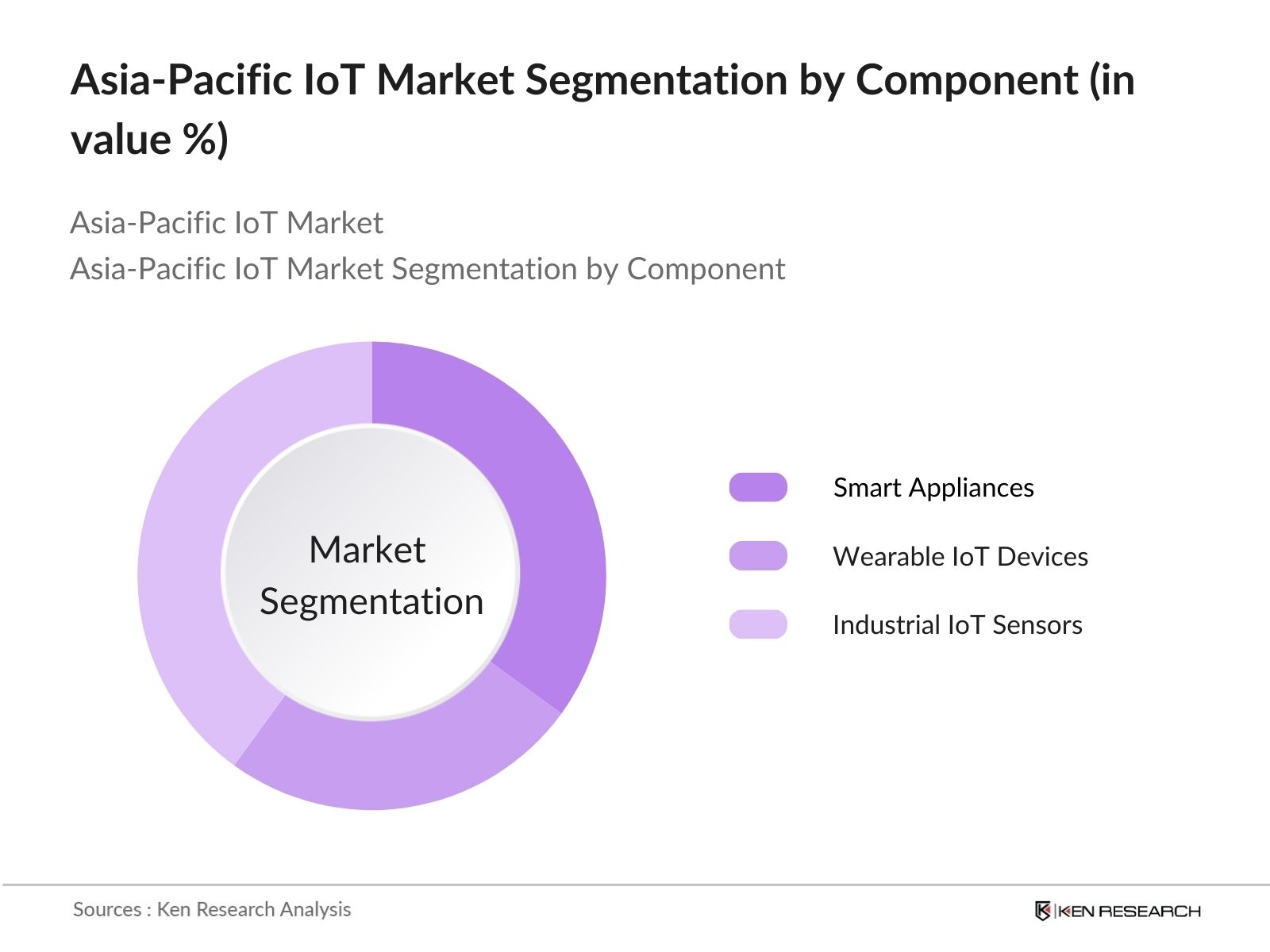

- By Component: The Asia-Pacific IoT market is segmented by components into IoT Devices, IoT Software, Connectivity Solutions, and IoT Platforms. IoT Devices dominate the market share, largely due to the increasing demand for smart appliances and wearable devices. Consumers and businesses alike are adopting these devices for their ability to provide real-time data and improve operational efficiency. The growing trend toward home automation and the integration of smart devices into healthcare and retail applications have further strengthened the position of IoT devices within the market.

- By Application: The market is also segmented by application into Industrial IoT, Consumer IoT, Healthcare IoT, and Retail IoT. Industrial IoT leads the market due to its extensive use in manufacturing, logistics, and smart factory initiatives. Companies are increasingly using IoT solutions for predictive maintenance, asset tracking, and automation, which helps in reducing downtime and improving operational efficiency. Industrial IoT is also being integrated with AI and machine learning to enhance decision-making processes across industries.

Asia-Pacific IoT Market Competitive Landscape

The Asia-Pacific IoT market is characterized by competition from both global and regional players. Major companies are focusing on partnerships, product innovations, and large-scale deployments to maintain a competitive edge. The competition is fierce among hardware manufacturers, platform providers, and service integrators, leading to a consolidated market landscape. The market is dominated by leading global players such as Cisco Systems and Huawei Technologies, alongside regional players like Samsung Electronics and Hitachi Vantara. These companies have established strong market positions through heavy investments in R&D, innovative product portfolios, and extensive partnerships. Companies such as Intel Corporation and IBM Corporation are also pushing forward with AI-driven IoT solutions, making the market highly competitive.

| Company | Established Year | Headquarters | R&D Investment | IoT Patents |

IoT Solutions Portfolio |

Global Revenue | Market Presence |

|---|---|---|---|---|---|---|---|

| Cisco Systems | 1984 | San Jose, USA | - | - | - | - | - |

| Huawei Technologies | 1987 | Shenzhen, China | - | - | - | - | - |

| Samsung Electronics | 1969 | Suwon, South Korea | - | - | - | - | - |

| Intel Corporation | 1968 | Santa Clara, USA | - | - | - | - | - |

| Hitachi Vantara | 2017 | Santa Clara, USA | - | - | - | - | - |

Asia-Pacific IoT Market Analysis

Asia-Pacific IoT Market Growth Drivers

- Expansion of 5G Networks: The deployment of 5G networks across the Asia-Pacific region has accelerated IoT adoption. By 2024, countries like South Korea and China have rolled out extensive 5G infrastructure, with China alone installing over 2 million 5G base stations. These networks enhance connectivity, supporting real-time data processing for IoT applications across industries, from smart cities to healthcare. 5G-enabled IoT applications in manufacturing are expected to drive efficiency gains, reducing downtime in industrial production by over 40%. This infrastructure is critical for enabling seamless machine-to-machine communication and supporting the digital transformation of industries.

- Smart Cities Initiatives: Governments across the Asia-Pacific region are investing in smart city initiatives to enhance urban infrastructure through IoT technology. For example, India's Smart Cities Mission has allocated $7.5 billion to implement IoT-enabled solutions for traffic management, energy efficiency, and public safety. Over 100 cities in India are undergoing transformation, integrating IoT-based sensors for waste management and water monitoring. Singapore's Smart Nation program has also pioneered the adoption of IoT for efficient urban planning, deploying IoT sensors across transportation networks to reduce congestion and improve air quality monitoring systems.

- Industrial Automation and IoT Integration: The industrial sector in the Asia-Pacific region is increasingly adopting IoT for automation and efficiency gains. Japan's industrial IoT implementation, known as Society 5.0, promotes the use of IoT in manufacturing, logistics, and supply chain optimization. The country's industrial IoT spending reached $25 billion in 2023, driving a surge in connected devices across factories. In Australia, the mining industry has adopted IoT to monitor equipment and optimize operations, saving up to 10% in operating costs by reducing downtime and energy consumption. These initiatives highlight the integration of IoT into industrial processes.

Asia-Pacific IoT Market Challenges

- Cybersecurity and Data Privacy Risks: The increasing number of connected IoT devices has heightened cybersecurity risks in the Asia-Pacific region. In 2023, China reported a 27% increase in IoT-related data breaches, primarily targeting smart home devices and industrial IoT systems. Countries like Japan and Singapore have introduced stringent data privacy laws to address these concerns, including Japan's Act on the Protection of Personal Information, which mandates stricter data handling procedures for IoT device manufacturers. These cybersecurity risks remain a critical challenge for IoT adoption, particularly in sensitive sectors like healthcare and finance, where data breaches can result in economic losses.

- Fragmentation in Connectivity Standards: One of the key challenges hindering the widespread adoption of IoT in the Asia-Pacific region is the fragmentation of connectivity standards. Different countries use various communication protocols, creating interoperability issues. In 2024, nearly 40% of IoT devices in the region faced challenges with cross-border compatibility, especially in sectors like logistics and transportation, where connected devices need to function seamlessly across international supply chains. Efforts are being made to standardize protocols, with organizations like the Asia IoT Alliance pushing for harmonized regulations, but the fragmented landscape continues to delay large-scale IoT deployments.

Asia-Pacific IoT Market Future Outlook

Over the next five years, the Asia-Pacific IoT market is expected to show growth, driven by ongoing government initiatives, technological advancements in AI and edge computing, and the rising demand for smart city infrastructure. The rapid deployment of 5G networks across major cities is also set to further enhance IoT capabilities, allowing for better connectivity and real-time data processing. Additionally, the increasing application of IoT in healthcare, agriculture, and manufacturing is projected to open up new avenues for growth and innovation across the region.

Asia-Pacific IoT Market Opportunities

- Growth in IoT-enabled Smart Appliances: The market for IoT-enabled smart appliances is expanding rapidly in the Asia-Pacific region. In 2023, over 40 million smart home devices were sold across China, Japan, and South Korea, driven by rising consumer demand for energy-efficient products. Countries like Japan have seen the adoption of smart refrigerators, washing machines, and home security systems, which use IoT to optimize energy usage and improve convenience. These devices are increasingly integrated with AI assistants, allowing users to control them remotely via smartphones. The growing penetration of smart homes presents a lucrative opportunity for IoT appliance manufacturers.

- Rising Demand for AI-powered IoT Solutions: The convergence of artificial intelligence (AI) with IoT is creating new opportunities for businesses in the Asia-Pacific region. By 2024, AI-powered IoT solutions are expected to be integrated across industries, with over 300,000 AI-enabled devices operational in China’s manufacturing sector. These systems use AI algorithms to analyze IoT-generated data in real time, optimizing production processes and reducing waste. In agriculture, AI-powered IoT devices are being used to monitor soil conditions and automate irrigation systems, enhancing crop yields by up to 15%. This integration is expected to drive the next phase of IoT growth in the region.

Scope of the Report

| By Component |

IoT Devices IoT Software Connectivity Solutions IoT Platforms |

| By Deployment Type |

Cloud-Based On-Premises Hybrid |

| By Application |

Industrial IoT Consumer IoT Healthcare IoT Retail IoT Smart Cities IoT |

| By Connectivity |

5G LPWAN Wi-Fi Bluetooth Zigbee |

| By Region |

China India Japan South Korea Australia |

Products

Key Target Audience

IoT Device Manufacturers

IoT Platform Providers

Connectivity Solutions Providers

Banks And Financial Institutions

Smart City Project Developers

Government and Regulatory Bodies (National IoT Policy Makers)

Investors and Venture Capital Firms

Industrial Automation Companies

Telecom Operators and 5G Infrastructure Providers

Companies

Cisco Systems

Huawei Technologies

IBM Corporation

Amazon Web Services

Microsoft Corporation

Samsung Electronics

Intel Corporation

Google Cloud

Oracle Corporation

Siemens AG

Hitachi Vantara

Bosch IoT

PTC Inc.

Dell Technologies

Ericsson

Table of Contents

1. Asia-Pacific IoT Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific IoT Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific IoT Market Analysis

3.1. Growth Drivers (IoT Adoption, Connectivity Infrastructure, Industrial Digitization)

3.1.1. Expansion of 5G Networks

3.1.2. Smart Cities Initiatives

3.1.3. Industrial Automation and IoT Integration

3.1.4. Rising Adoption of IoT in Healthcare

3.2. Market Challenges (Data Security, High Initial Costs, Integration Complexity)

3.2.1. Cybersecurity and Data Privacy Risks

3.2.2. Fragmentation in Connectivity Standards

3.2.3. Lack of Skilled Workforce for IoT Implementation

3.3. Opportunities (Emerging Technologies, IoT in New Markets, Edge Computing)

3.3.1. Growth in IoT-enabled Smart Appliances

3.3.2. Rising Demand for AI-powered IoT Solutions

3.3.3. Expanding IoT Applications in Agriculture and Manufacturing

3.4. Trends (Artificial Intelligence, Edge Computing, IoT Device Miniaturization)

3.4.1. Integration of AI in IoT Devices

3.4.2. IoT-driven Predictive Maintenance Solutions

3.4.3. Increase in Wearable IoT Devices

3.5. Government Regulations (IoT Standardization, Privacy Laws, Regulatory Frameworks)

3.5.1. Data Protection and Privacy Regulations

3.5.2. National IoT Policies and Guidelines

3.5.3. Support for Smart City Development

3.5.4. Public-Private Partnerships for IoT Adoption

3.6. SWOT Analysis

3.7. Stake Ecosystem (IoT Device Manufacturers, Service Providers, Solution Integrators)

3.8. Porter’s Five Forces Analysis

3.9. Competitive Ecosystem (IoT Platform Providers, Cloud Service Providers, Hardware Suppliers)

4. Asia-Pacific IoT Market Segmentation

4.1. By Component (In Value %)

4.1.1. IoT Devices

4.1.2. IoT Software

4.1.3. Connectivity Solutions

4.1.4. IoT Platforms

4.2. By Deployment Type (In Value %)

4.2.1. Cloud-Based

4.2.2. On-Premises

4.2.3. Hybrid

4.3. By Application (In Value %)

4.3.1. Industrial IoT

4.3.2. Consumer IoT

4.3.3. Healthcare IoT

4.3.4. Retail IoT

4.3.5. Smart Cities IoT

4.4. By Connectivity (In Value %)

4.4.1. 5G

4.4.2. LPWAN

4.4.3. Wi-Fi

4.4.4. Bluetooth

4.4.5. Zigbee

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia-Pacific IoT Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cisco Systems

5.1.2. Huawei Technologies

5.1.3. IBM Corporation

5.1.4. Amazon Web Services

5.1.5. Microsoft Corporation

5.1.6. Samsung Electronics

5.1.7. Intel Corporation

5.1.8. Google Cloud

5.1.9. Oracle Corporation

5.1.10. Siemens AG

5.1.11. Hitachi Vantara

5.1.12. Bosch IoT

5.1.13. PTC Inc.

5.1.14. Dell Technologies

5.1.15. Ericsson

5.2. Cross Comparison Parameters (No. of Employees, Global Revenue, IoT Patents, Market Share, IoT Solutions Portfolio, R&D Investment, Strategic Partnerships, Global Footprint)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Acquisitions, New Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Support for IoT Projects

5.9. Private Equity Investments in IoT Startups

6. Asia-Pacific IoT Market Regulatory Framework

6.1. National IoT Strategies

6.2. Data Privacy Laws Affecting IoT

6.3. Compliance and Certification Requirements

6.4. Security Standards for IoT Devices

7. Asia-Pacific IoT Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific IoT Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Application (In Value %)

8.4. By Connectivity (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific IoT Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, a comprehensive ecosystem map of the Asia-Pacific IoT market was constructed, identifying key stakeholders such as IoT device manufacturers, service providers, and platform developers. The focus was on gathering information from secondary databases to pinpoint critical variables driving the market, including technological advancements and government policies.

Step 2: Market Analysis and Construction

Historical data on the Asia-Pacific IoT market was collected and analyzed to assess revenue generation trends, IoT solutions penetration, and adoption rates across industries. Key data was validated using service quality metrics and industry benchmarks to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through interviews with IoT experts and stakeholders from prominent companies. These consultations provided deeper insights into operational challenges and opportunities, particularly regarding emerging technologies like edge computing.

Step 4: Research Synthesis and Final Output

The final phase involved consolidating the data through consultations with IoT platform providers and manufacturers. The synthesis process ensured market statistics aligned with real-world industry dynamics, resulting in a comprehensive and reliable market analysis.

Frequently Asked Questions

01. How big is the Asia-Pacific IoT market?

The Asia-Pacific IoT market is valued at USD 72.5 billion, driven by government initiatives, advancements in 5G technology, and the increasing integration of IoT in industrial sectors.

02. What are the challenges in the Asia-Pacific IoT market?

Key challenges in the Asia-Pacific IoT market include data security concerns, fragmentation in connectivity standards, and the high initial cost of IoT infrastructure deployment. Additionally, a shortage of skilled professionals to implement and maintain IoT solutions poses a challenge.

03. Who are the major players in the Asia-Pacific IoT market?

Major players in the Asia-Pacific IoT market include Cisco Systems, Huawei Technologies, IBM Corporation, Samsung Electronics, and Hitachi Vantara. These companies dominate due to their extensive product portfolios, technological expertise, and strong partnerships.

04. What are the growth drivers of the Asia-Pacific IoT market?

Growth in the Asia-Pacific IoT market is propelled by advancements in 5G, increasing smart city projects, and the rising demand for industrial automation. Additionally, the integration of AI and edge computing in IoT solutions is driving market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.