Asia Pacific Interventional Cardiology Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD9500

December 2024

80

About the Report

Asia Pacific Interventional Cardiology Market Overview

- The Asia Pacific Interventional Cardiology Market is valued at USD 1.4 billion, driven by increasing healthcare expenditure and the rising prevalence of cardiovascular diseases across major economies. Rapid advancements in minimally invasive technologies, coupled with government initiatives to reduce the burden of heart diseases, play a crucial role in driving market growth. These factors have enabled healthcare providers to adopt advanced cardiovascular interventions, increasing patient access to necessary treatments and fueling market expansion.

- Countries like China, India, and Japan dominate the Asia Pacific interventional cardiology market due to their large patient populations and robust healthcare infrastructures. China and India have shown rapid increases in cardiovascular cases, necessitating better healthcare interventions. Additionally, Japans advanced healthcare system and early adoption of innovative medical technologies allow it to be a leader in this field, while Indias vast urban-rural disparity drives increased demand for accessible interventional cardiology solutions.

- The Asia-Pacific region is implementing various health policies to improve access to advanced cardiovascular care. In 2024, ASEAN member states ratified a new health policy aimed at enhancing regional collaboration on healthcare delivery. The policy focuses on harmonizing medical device regulations, reducing trade barriers for medical equipment, and improving access to affordable healthcare across the region. This is particularly important for interventional cardiology, as it allows for easier introduction of new devices and treatments across multiple markets.

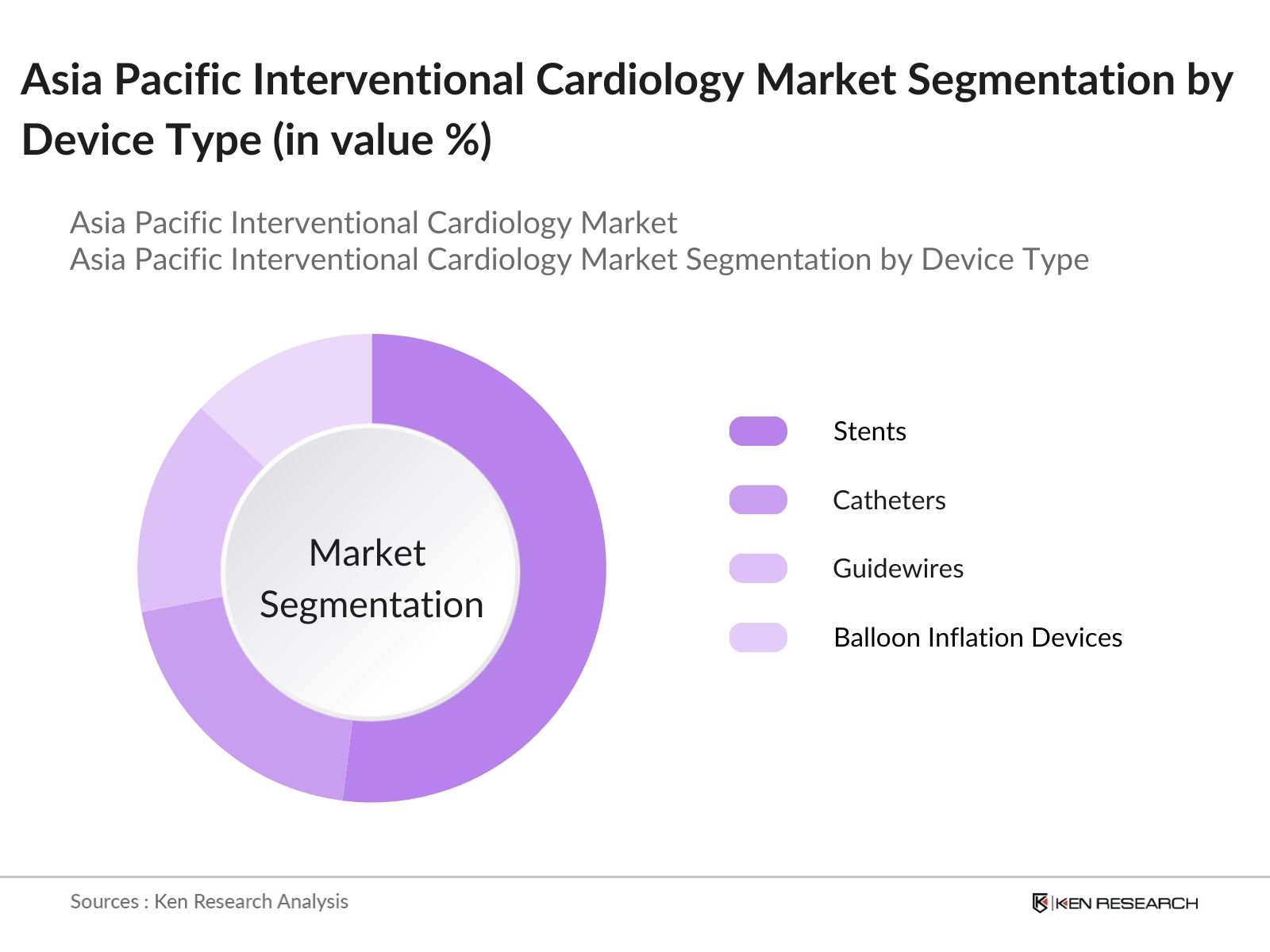

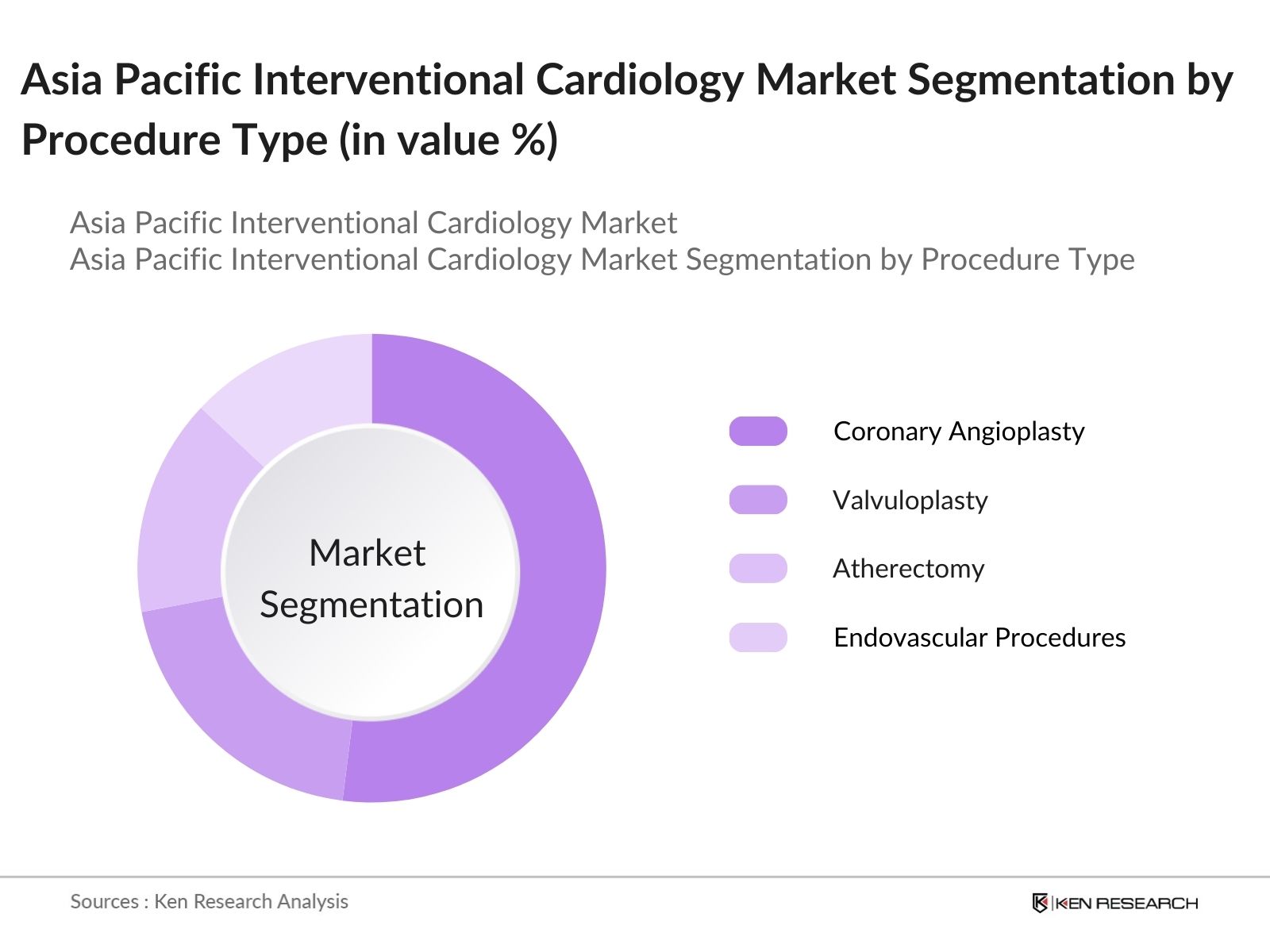

Asia Pacific Interventional Cardiology Market Segmentation

By Device Type: The Asia Pacific Interventional Cardiology market is segmented by device type into stents, catheters, guidewires, and balloon inflation devices. The Stents have been dominating the device type segmentation due to their critical role in treating narrowed arteries, thus preventing heart attacks and other cardiac complications. Advanced stents, such as drug-eluting stents (DES), are in high demand because of their ability to reduce the risk of restenosis. Technological advancements in stent designs and materials, coupled with strong clinical outcomes, have cemented their place as the leading device category.

By Procedure Type: The Asia Pacific Interventional Cardiology market is segmented by procedure type into coronary angioplasty, valvuloplasty, atherectomy, and endovascular procedures. Coronary angioplasty is the dominant procedure type, accounting for the majority of interventional procedures in the region. This dominance is attributed to the growing incidence of coronary artery diseases, particularly in aging populations. Coronary angioplasty is minimally invasive, reducing hospital stays and recovery times, making it a preferred choice for both patients and healthcare providers.

Asia Pacific Interventional Cardiology Market Competitive Landscape

The market is dominated by major global and regional players. These companies have been driving innovation, engaging in partnerships, and expanding their geographical presence to strengthen their foothold in the market. The competitive landscape highlights the importance of technological advancements, clinical success rates, and geographical diversification in maintaining market leadership.

|

Company Name |

Establishment Year |

Headquarters |

Specialty |

Annual Revenue (USD) |

Key Products |

R&D Investment |

Employee Strength |

Global Presence |

Recent M&A Activity |

|

Boston Scientific Corporation |

1979 |

Marlborough, USA |

|||||||

|

Medtronic PLC |

1949 |

Dublin, Ireland |

|||||||

|

Abbott Laboratories |

1888 |

Illinois, USA |

|||||||

|

Terumo Corporation |

1921 |

Tokyo, Japan |

|||||||

|

Biosensors International Group |

1990 |

Singapore |

Asia Pacific Interventional Cardiology Industry Analysis

Growth Drivers

- Aging Population: The aging population in the Asia-Pacific region is a significant driver for interventional cardiology. In 2024, approximately 29.3% of Japan's total population is projected to be aged 65 or older. These demographic shifts are leading to a higher incidence of age-related cardiovascular conditions. As a result, the demand for interventional cardiology procedures like angioplasty and stenting is surging, contributing to a significant boost in market demand.

- Technological Advancements in Imaging & Catheter Systems: Technological innovations in imaging and catheter systems are bolstering the interventional cardiology market. Advanced imaging techniques like Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) are becoming more prevalent, enabling precise navigation during procedures. For instance, Japan and South Korea are actively integrating robotics into interventional cardiology, increasing precision and patient outcomes. These advancements are essential to managing the growing patient volumes across the Asia-Pacific region.

- Increased Incidence of Cardiovascular Diseases: The growing burden of cardiovascular diseases (CVDs) in the region is a key market driver. In China, cardiovascular diseases are estimated to affect over 330 million people in 2024. This increase is fueled by lifestyle changes, urbanization, and risk factors such as hypertension, diabetes, and smoking, leading to higher demand for interventional cardiology services.

Market Challenges

- High Cost of Interventional Procedures: Despite various government initiatives aimed at improving healthcare accessibility, the cost of interventional cardiology procedures remains a significant challenge in the Asia-Pacific region. Procedures such as coronary angioplasty and stent placement involve advanced medical technologies, including drug-eluting stents and state-of-the-art imaging equipment, which contribute to the overall cost. This high cost can place a financial burden on patients, particularly in countries with limited healthcare coverage or underdeveloped insurance systems.

- Limited Skilled Workforce for Complex Procedures: The shortage of skilled healthcare professionals, specifically interventional cardiologists, is another critical challenge in the Asia-Pacific interventional cardiology market. Many countries within the region face a deficit of specialists who are trained to perform complex cardiovascular interventions. This shortage is particularly pronounced in rural and underserved areas, where the availability of qualified professionals is even more limited.

Asia Pacific Interventional Cardiology Market Future Outlook

Over the next five years, the Asia Pacific Interventional Cardiology market is expected to see significant growth driven by technological advancements in interventional procedures, growing government initiatives aimed at reducing the burden of cardiovascular diseases, and increasing patient awareness. The demand for minimally invasive procedures is likely to fuel the growth of advanced products such as bioresorbable stents and drug-coated balloons. Furthermore, expanding healthcare access in developing economies and increased investment in research and development (R&D) are poised to elevate market growth.

Market Opportunities

- Expansion in Emerging Markets (Access to Affordable Care): Emerging markets like Vietnam and Thailand offer substantial growth opportunities for interventional cardiology in the Asia-Pacific region. Government initiatives focusing on healthcare infrastructure improvements and affordable care are increasing access to cardiovascular services, especially in rural areas. This creates new avenues for medical device manufacturers and service providers to meet the rising demand, enhancing their presence in these expanding markets.

- Advancements in Robotic-Assisted Interventions: Robotic-assisted interventions are gaining traction in the Asia-Pacific interventional cardiology market. Countries such as South Korea are leading in the adoption of robotic systems for cardiovascular procedures, benefiting from increased precision and faster recovery times. This growing trend presents significant opportunities for market players, driving technological advancements and expanding the scope of minimally invasive cardiovascular treatments across the region.

Scope of the Report

|

Device Type |

Stents Catheters Guidewires Balloon Inflation Devices |

|

Procedure |

Coronary Angioplasty Valvuloplasty Atherectomy Endovascular Procedures |

|

End-User |

Hospitals Ambulatory Surgical Centers Cardiac Catheterization Labs |

|

Disease Type |

Coronary Artery Disease (CAD) Heart Valve Disease Peripheral Artery Disease (PAD) |

|

Region |

China India Japan Australia South Korea |

Products

Key Target Audience

Medical Tourism Companies

Medical Device Manufacturers

Healthcare Insurance Companies

Telemedicine and Remote Monitoring Companies

Government and Regulatory Bodies (China Food and Drug Administration, India Ministry of Health and Family Welfare)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Boston Scientific Corporation

Medtronic PLC

Abbott Laboratories

Terumo Corporation

Biosensors International Group

Cardinal Health

B. Braun Melsungen AG

MicroPort Scientific Corporation

C. R. Bard, Inc.

Asahi Intecc Co., Ltd.

Table of Contents

1. Asia Pacific Interventional Cardiology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Procedure Volume, Device Penetration, Hospital Adoption)

1.4. Market Segmentation Overview

2. Asia Pacific Interventional Cardiology Market Size (In USD Bn)

2.1. Historical Market Size (Hospital Adoption Rates, Patient Pool)

2.2. Year-On-Year Growth Analysis (Interventional Procedures, Cardiovascular Disease Incidence)

2.3. Key Market Developments and Milestones (New Device Launches, Regulatory Approvals)

3. Asia Pacific Interventional Cardiology Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population

3.1.2. Increased Incidence of Cardiovascular Diseases

3.1.3. Technological Advancements in Imaging & Catheter Systems

3.1.4. Government Health Initiatives

3.2. Market Challenges

3.2.1. High Cost of Interventional Procedures

3.2.2. Limited Skilled Workforce for Complex Procedures

3.2.3. Stringent Regulatory Pathways

3.3. Opportunities

3.3.1. Expansion in Emerging Markets (Access to Affordable Care)

3.3.2. Advancements in Robotic-Assisted Interventions

3.3.3. Public-Private Partnerships in Healthcare

3.4. Trends

3.4.1. Increasing Use of Drug-Eluting Stents (DES)

3.4.2. Growth in Minimally Invasive Procedures

3.4.3. Emergence of Bioabsorbable Stents

3.5. Government Regulation

3.5.1. Asia-Pacific Regional Health Policy

3.5.2. FDA and CE Marking for Medical Devices

3.5.3. National Health Insurance Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Hospitals, Device Manufacturers, Insurance Providers)

3.8. Porters Five Forces Analysis (Buyer Power, Supplier Power, Industry Rivalry, etc.)

3.9. Competitive Ecosystem

4. Asia Pacific Interventional Cardiology Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Stents

4.1.2. Catheters

4.1.3. Guidewires

4.1.4. Balloon Inflation Devices

4.2. By Procedure (In Value %)

4.2.1. Coronary Angioplasty

4.2.2. Valvuloplasty

4.2.3. Atherectomy

4.2.4. Endovascular Procedures

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Ambulatory Surgical Centers

4.3.3. Cardiac Catheterization Laboratories

4.4. By Disease Type (In Value %)

4.4.1. Coronary Artery Disease (CAD)

4.4.2. Heart Valve Disease

4.4.3. Peripheral Artery Disease (PAD)

4.5. By Country (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

5. Asia Pacific Interventional Cardiology Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Boston Scientific Corporation

5.1.2. Medtronic PLC

5.1.3. Abbott Laboratories

5.1.4. Terumo Corporation

5.1.5. B. Braun Melsungen AG

5.1.6. Cardinal Health

5.1.7. Asahi Intecc Co., Ltd.

5.1.8. Biosensors International Group, Ltd.

5.1.9. Biotronik SE & Co. KG

5.1.10. MicroPort Scientific Corporation

5.1.11. C. R. Bard, Inc.

5.1.12. Cook Medical Incorporated

5.1.13. SMT (Sahajanand Medical Technologies)

5.1.14. Lepu Medical Technology (Beijing) Co., Ltd.

5.1.15. W. L. Gore & Associates, Inc.

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Geographic Presence, Technological Expertise, Regulatory Approvals, Revenue, Employee Strength, Strategic Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Interventional Cardiology Market Regulatory Framework

6.1. Compliance Requirements for Medical Devices

6.2. Healthcare Access Regulations

6.3. Certification Processes (ISO, CE Marking, FDA Approvals)

7. Asia Pacific Interventional Cardiology Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Rising Adoption, Technological Advancements, Increased Patient Pool)

8. Asia Pacific Interventional Cardiology Future Market Segmentation

8.1. By Device Type

8.2. By Procedure

8.3. By End-User

8.4. By Disease Type

8.5. By Country

9. Asia Pacific Interventional Cardiology Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, we identified key market variables, such as the number of interventional procedures, device penetration rates, and disease prevalence, through extensive desk research. Our proprietary databases and secondary sources, including market studies and government reports, provided crucial insights for constructing a market map.

Step 2: Market Analysis and Construction

The data collected were analyzed to understand the past market trends, device adoption rates, and evolving procedure techniques. We performed both top-down and bottom-up analyses to verify revenue estimates and the adoption of specific devices, such as drug-eluting stents.

Step 3: Hypothesis Validation and Expert Consultation

In this step, we consulted with leading cardiologists, healthcare providers, and device manufacturers through interviews to validate our findings. These interviews provided practical insights into market trends and evolving technological preferences.

Step 4: Research Synthesis and Final Output

Finally, we synthesized all the collected data and expert insights to produce a comprehensive report on the Asia Pacific Interventional Cardiology Market. The final output was thoroughly reviewed for accuracy, reliability, and completeness before being presented to the target audience.

Frequently Asked Questions

01. How big is the Asia Pacific Interventional Cardiology Market?

The Asia Pacific Interventional Cardiology Market is valued at USD 1.4 billion, driven by the increasing prevalence of cardiovascular diseases and technological advancements in interventional procedures.

02. What are the challenges in the Asia Pacific Interventional Cardiology Market?

Challenges in the Asia Pacific Interventional Cardiology Market include high procedure costs, a shortage of skilled professionals, and stringent regulatory processes for medical devices.

03. Who are the major players in the Asia Pacific Interventional Cardiology Market?

Key players in the Asia Pacific Interventional Cardiology Market include Boston Scientific, Medtronic, Abbott Laboratories, Terumo Corporation, and Biosensors International Group. These companies dominate due to their extensive product portfolios and strong R&D investments.

04. What are the growth drivers of the Asia Pacific Interventional Cardiology Market?

The Asia Pacific Interventional Cardiology Market growth is driven by an aging population, increased cardiovascular disease cases, and the rising adoption of minimally invasive technologies in healthcare settings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.