Asia Pacific Jewelry Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD7099

December 2024

80

About the Report

Asia Pacific Jewellery Market Overview

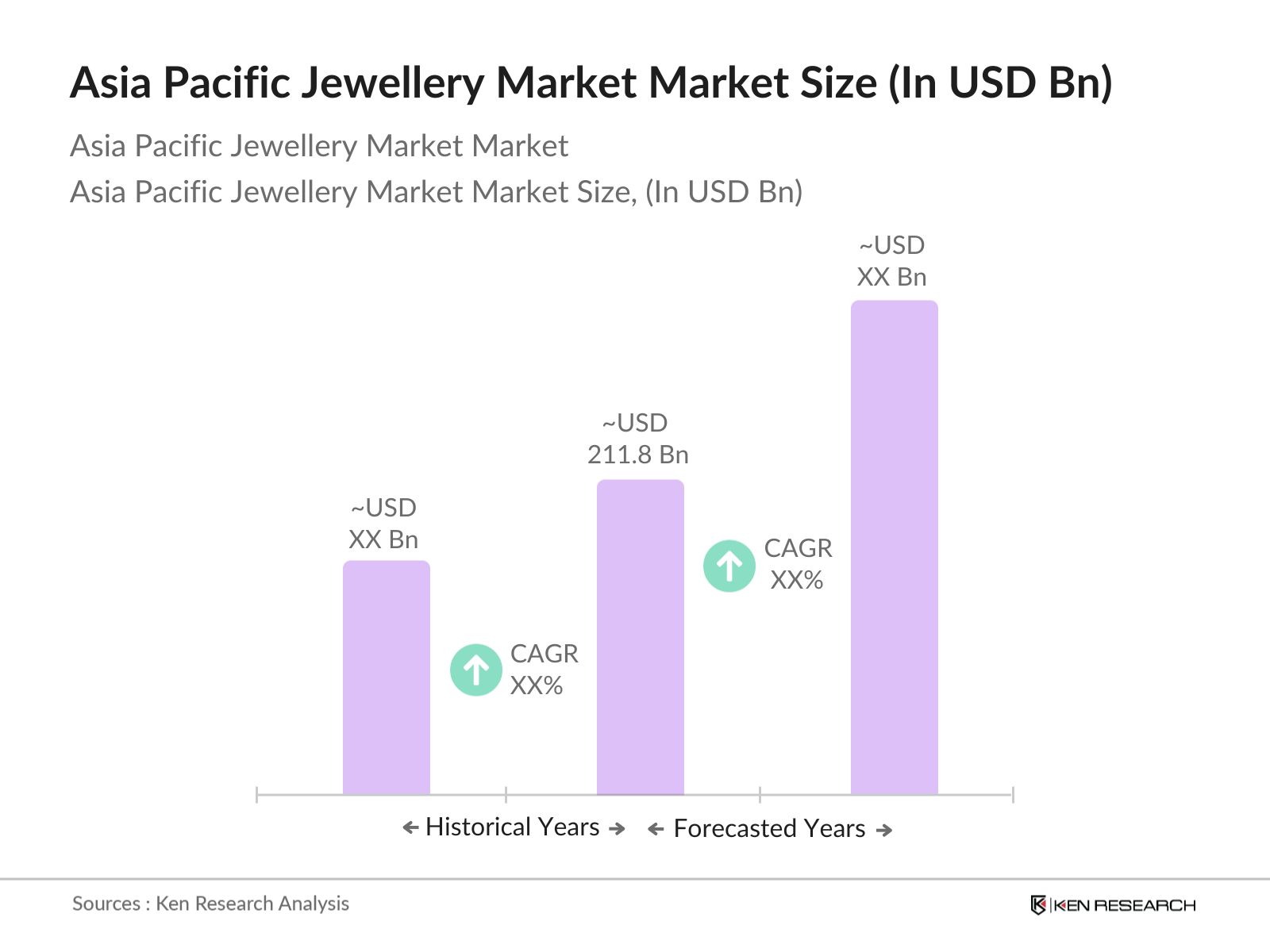

- The Asia Pacific Jewellery market is valued at USD 211.8 billion based on a five-year historical analysis. The markets growth is driven by increasing disposable income, evolving consumer preferences for personalized and sustainable Jewellery, and the growing popularity of online platforms. Demand for luxury Jewellery, in particular, is surging due to the region's expanding affluent population and high-net-worth individuals.

- Countries like China, India, and Japan dominate the Asia Pacific Jewellery market. China leads due to its massive population base and rapidly growing middle class, while Indias cultural affinity for gold makes it a major player. Japans dominance stems from its advanced craftsmanship and high demand for luxury and premium Jewellery brands.

- The Jewellery industry in Asia Pacific faces stringent import and export duties that impact trade dynamics. According to the World Trade Organization (WTO), countries like India and China impose import duties ranging from 10% to 15% on gold and diamond imports. Additionally, in 2023, ASEAN countries introduced new tariff regulations to streamline intra-regional Jewellery trade, which helps reduce export duties among member nations. Understanding these trade policies is crucial for Jewellery brands looking to expand their footprint across borders.

Asia Pacific Jewellery Market Segmentation

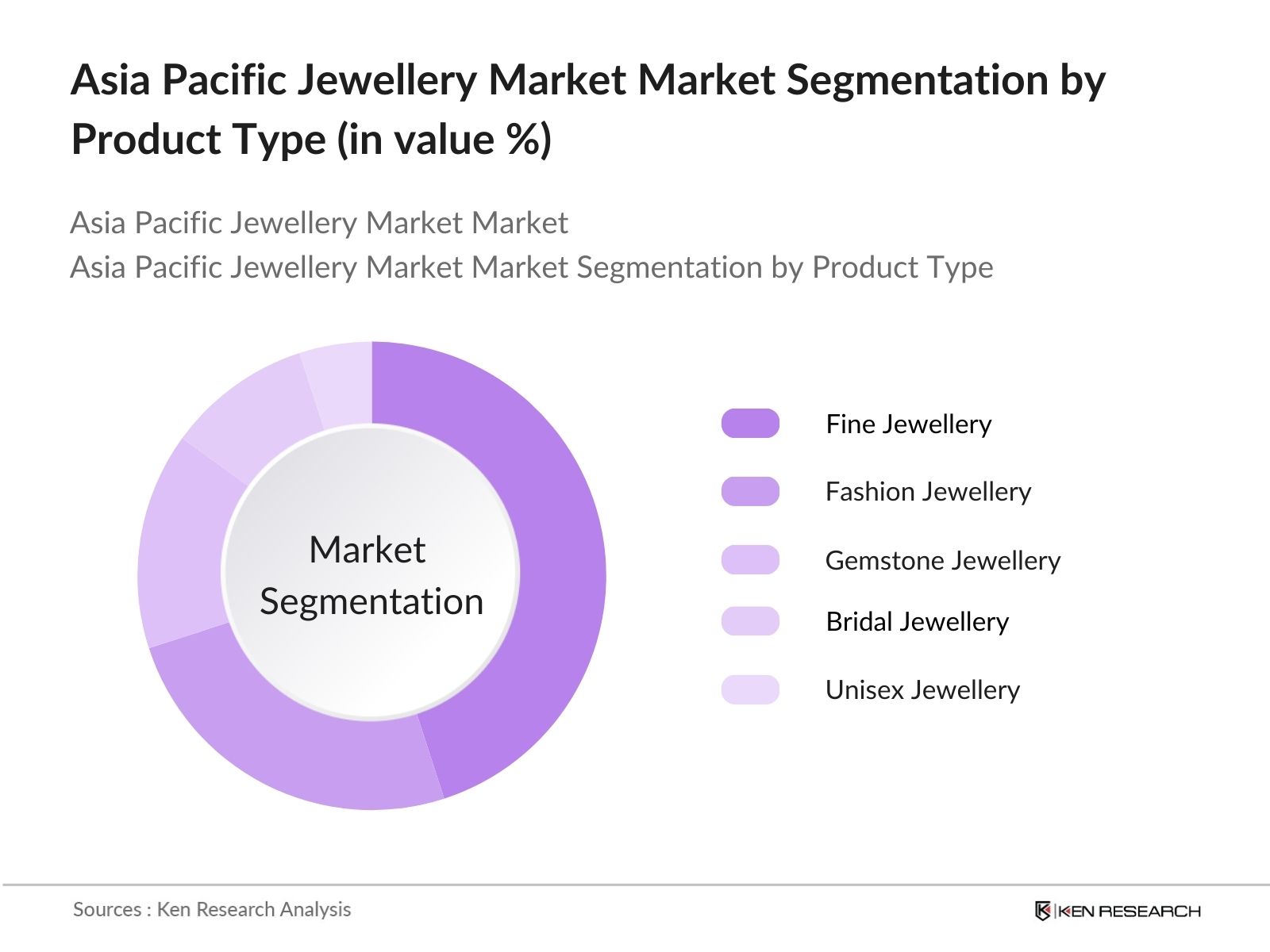

- By Product Type: The Asia Pacific Jewellery market is segmented by product type into fine Jewellery, fashion Jewellery, gemstone Jewellery, bridal Jewellery, and unisex Jewellery. Fine Jewellery, which includes gold, platinum, and diamond products, holds a dominant market share due to its high value and strong demand in countries like India and China. The preference for gold in cultural and traditional events further strengthens this segment, making it the largest contributor to market revenue.

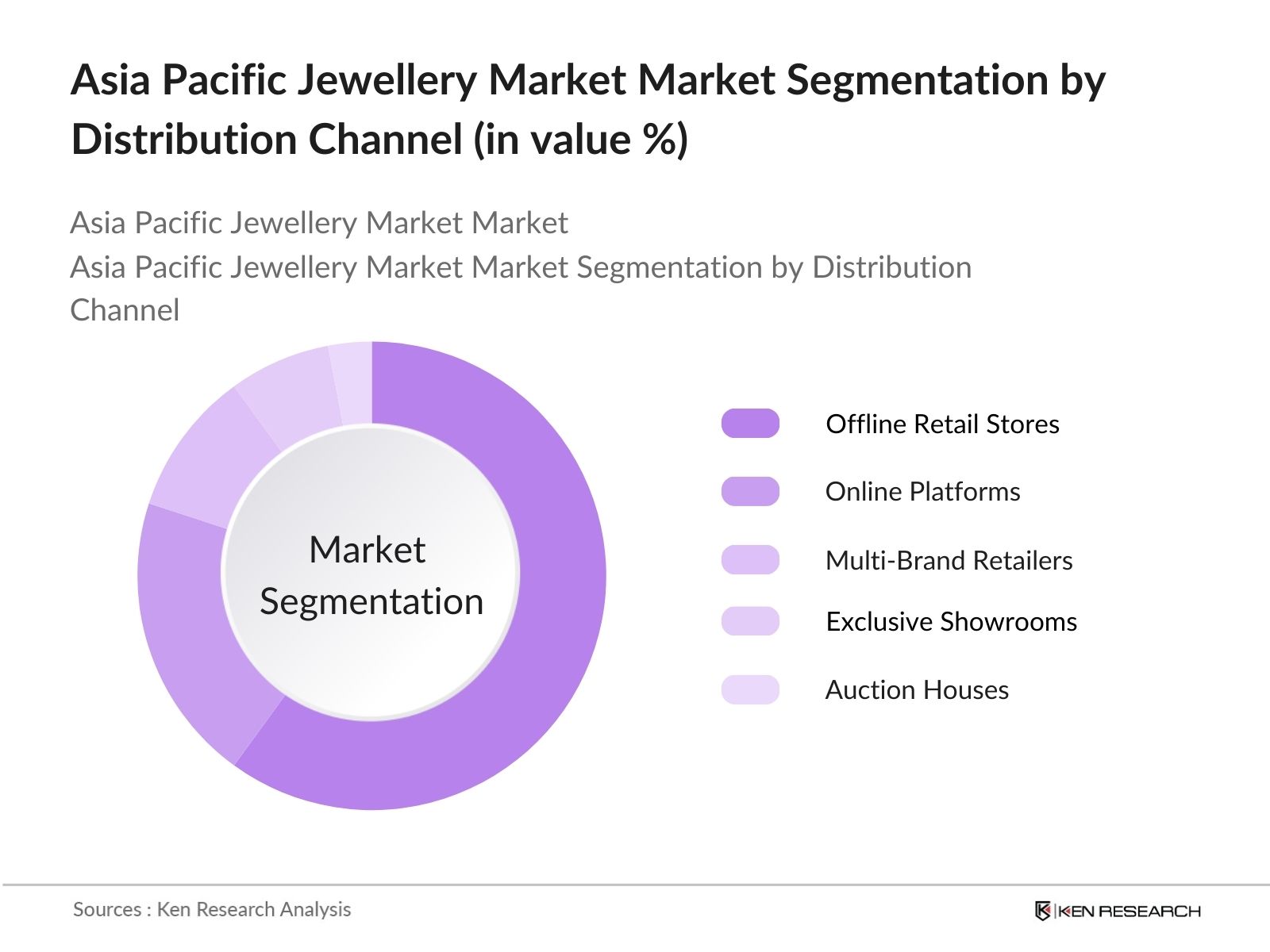

- By Distribution Channel: The market is segmented by distribution channels into offline retail stores, online platforms, multi-brand retailers, exclusive showrooms, and auction houses. Offline retail stores dominate the market due to the personalized shopping experience they offer, especially for high-value purchases such as bridal and gemstone Jewellery. Additionally, trust and transparency play a major role in purchases of fine Jewellery, further driving customers to physical retail outlets.

Asia Pacific Jewellery Market Competitive Landscape

The Asia Pacific Jewellery market is dominated by both global and regional players, with major brands leveraging their brand equity, extensive distribution networks, and diversified product offerings. The market is highly competitive, with key players continually innovating to meet evolving consumer preferences and demand for customization. Companies such as Chow Tai Fook, Titan, and Swarovski dominate due to their strong presence in the region, ability to adapt to local trends, and commitment to ethical sourcing.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Retail Outlets |

Product Categories |

Sustainability Initiatives |

E-commerce Presence |

Brand Equity |

|

Chow Tai Fook Jewellery Group |

1929 |

Hong Kong |

- |

- |

- |

- |

- |

- |

- |

|

Titan Company Limited |

1984 |

Bangalore, India |

- |

- |

- |

- |

- |

- |

- |

|

Pandora A/S |

1982 |

Copenhagen, Denmark |

- |

- |

- |

- |

- |

- |

- |

|

Malabar Gold & Diamonds |

1993 |

Kerala, India |

- |

- |

- |

- |

- |

- |

- |

|

Swarovski AG |

1895 |

Wattens, Austria |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Jewellery Market Analysis

Asia Pacific Jewellery Market Growth Drivers

- Rise in Disposable Income: The Asia Pacific region has witnessed an increase in disposable income over the past few years, leading to higher spending on luxury goods, including Jewellery. According to the World Bank, Chinas disposable income per capita reached USD 7,715 in 2023, up from USD 6,774 in 2021. Similarly, India's per capita disposable income rose to USD 2,325 in 2023. These rising income levels are driving the demand for premium and customized Jewellery across the region, particularly in countries like China, India, and Japan. Additionally, the growing middle class across Southeast Asia further supports this demand.

- Changing Fashion Trends: Consumers in the Asia Pacific are increasingly aligning their fashion preferences with global trends. The rise of influencers and social media platforms like Instagram and TikTok has accelerated the spread of fashion-forward Jewellery choices. According to a 2022 report by the Asian Development Bank, urbanization rates in Asia Pacific exceeded 60%, with major cities like Tokyo, Seoul, and Shanghai becoming trend hubs. The influence of global fashion capitals has increased the adoption of modern Jewellery designs, driving demand for contemporary styles. This is particularly notable in younger demographics who are gravitating towards minimalistic and lightweight Jewellery pieces.

- Increasing Demand for Customization: Customization in Jewellery is becoming a critical factor in consumer decision-making, driven by a desire for personalized and unique pieces. According to Statista, 25% of Jewellery buyers in the Asia Pacific region expressed a preference for customized products in 2023, with this trend particularly strong in countries like China and Japan. This shift is also influenced by technological advancements such as 3D printing, allowing jewelers to offer a higher degree of personalization. The rise in bespoke Jewellery offerings is further spurred by higher spending capacity among affluent consumers in the region.

Asia Pacific Jewellery Market Challenges

- High Competition Among Local and Global Brands: The Asia Pacific Jewellery market is characterized by intense competition from both local and international players. According to the Ministry of Commerce, China has over 6,500 registered Jewellery companies as of 2023. This saturation, coupled with the presence of global luxury brands like Cartier and Tiffany, has led to fierce price competition and challenges in brand differentiation. In markets like India, where there are over 500,000 small-scale jewelers, competition is particularly stiff, making it difficult for brands to maintain loyalty and market share.

- Fluctuations in Raw Material Prices: The volatility in the prices of raw materials like gold, diamonds, and gemstones presents a major challenge for Jewellery manufacturers. According to the World Bank, gold prices averaged USD 1,950 per ounce in the first half of 2024, fluctuating due to global economic conditions. Similarly, diamond prices saw an increase of 7% in 2023, as reported by the World Diamond Council. These price fluctuations directly affect the cost of production, making it difficult for Jewellery brands to maintain consistent pricing and profitability.

Asia Pacific Jewellery Market Future Outlook

Over the next five years, the Asia Pacific Jewellery market is expected to experience growth driven by a rising middle-class population, increasing adoption of e-commerce, and growing demand for sustainable and customized Jewellery. As online platforms become more prevalent, market players will invest in technology to enhance consumer experience, including virtual try-ons and augmented reality (AR) tools. Additionally, the expansion of the unisex Jewellery segment is likely to open up new opportunities for brands aiming to tap into evolving fashion trends.

Asia Pacific Jewellery Market Opportunities

- Expansion into Emerging Markets: Emerging markets in Asia Pacific, such as Vietnam, Thailand, and the Philippines, offers growth opportunities for Jewellery brands. According to the International Monetary Fund (IMF), Vietnams GDP grew by 6.5% in 2023, reflecting rising consumer spending power. Jewellery consumption in these markets is expected to increase as middle-class populations grow. Additionally, Southeast Asian countries have relatively low Jewellery market penetration compared to China and India, making them attractive targets for expansion.

- Adoption of E-commerce Platforms: With e-commerce gaining momentum across Asia Pacific, Jewellery brands have a substantial opportunity to tap into this growing digital retail landscape. According to the Asia Internet Coalition, e-commerce sales in Asia Pacific grew by 12% in 2023, accounting for over USD 2.3 trillion in sales across various sectors, including Jewellery. The rising adoption of secure payment gateways, combined with improving logistics infrastructure, makes online channels a lucrative opportunity for Jewellery brands, particularly in urban centers.

Scope of the Report

|

By Product Type |

Fine Jewellery Fashion Jewellery Gemstone Jewellery Bridal Jewellery Unisex Jewellery |

|

By Material Type |

Gold Platinum Diamonds Silver Others |

|

By Distribution Channel |

Offline Retail Stores Online Platforms Multi-Brand Retailers Exclusive Showrooms Auction Houses |

|

By Customer Demographic |

Millennials Gen Z HNWIs |

|

By Region |

China India Japan Australia South Korea |

Products

Key Target Audience

Jewellery Manufacturers

Luxury Retailers

E-commerce Platforms

Gemstone Suppliers

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (BIS, ISO)

Export-Import Traders

Ethical Sourcing and Sustainability Agencies

Companies

Players Mentioned in the Report

Chow Tai Fook Jewellery Group

Titan Company Limited

Pandora A/S

Malabar Gold & Diamonds

Tanishq

Luk Fook Holdings

LVMH Mot Hennessy Louis Vuitton SE

Swarovski AG

Cartier

Gitanjali Gems

Table of Contents

1. Asia Pacific Jewellery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Jewellery Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Jewellery Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Disposable Income

3.1.2. Changing Fashion Trends

3.1.3. Increasing Demand for Customization

3.1.4. Rising Online Sales Channels

3.2. Market Challenges

3.2.1. High Competition Among Local and Global Brands

3.2.2. Fluctuations in Raw Material Prices (Gold, Diamonds, Gemstones)

3.2.3. Regulatory Compliance and Certifications (Jewellery Hallmarking)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Adoption of E-commerce Platforms

3.3.3. Growth in Sustainable Jewellery (Ethically Sourced Materials)

3.4. Trends

3.4.1. Shift Towards Lightweight Jewellery

3.4.2. Adoption of Smart Jewellery (Wearable Technology)

3.4.3. Increasing Popularity of Unisex Jewellery

3.5. Regulatory Framework

3.5.1. Import/Export Duties and Regulations

3.5.2. Compliance with Jewellery Quality Standards (ISO, BIS, etc.)

3.5.3. Certifications for Ethical and Conflict-Free Sourcing

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competition Ecosystem

4. Asia Pacific Jewellery Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fine Jewellery (Gold, Platinum, Diamonds)

4.1.2. Fashion Jewellery (Costume, Imitation)

4.1.3. Gemstone Jewellery (Emeralds, Rubies, Sapphires)

4.1.4. Bridal Jewellery

4.1.5. Unisex Jewellery

4.2. By Material Type (In Value %)

4.2.1. Gold

4.2.2. Platinum

4.2.3. Diamonds

4.2.4. Silver

4.2.5. Others (Pearls, Semi-Precious Stones)

4.3. By Distribution Channel (In Value %)

4.3.1. Offline Retail Stores

4.3.2. Online Platforms

4.3.3. Multi-Brand Retailers

4.3.4. Exclusive Showrooms

4.3.5. Auction Houses

4.4. By Customer Demographic (In Value %)

4.4.1. Millennials

4.4.2. Gen Z

4.4.3. High-Net-Worth Individuals (HNWIs)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

5. Asia Pacific Jewellery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Chow Tai Fook Jewellery Group

5.1.2. Titan Company Limited

5.1.3. Pandora A/S

5.1.4. Malabar Gold & Diamonds

5.1.5. Tanishq

5.1.6. Luk Fook Holdings

5.1.7. LVMH Mot Hennessy Louis Vuitton SE

5.1.8. Swarovski AG

5.1.9. Gitanjali Gems

5.1.10. Damas International

5.1.11. Blue Nile

5.1.12. Cartier

5.1.13. Tiffany & Co.

5.1.14. Richemont

5.1.15. Signet Jewelers

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Regional Presence, Market Share, Sustainability Initiatives, E-commerce Integration, Brand Strength, Innovation Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. New Product Launches

6. Asia Pacific Jewellery Market Regulatory Framework

6.1. Compliance with Precious Metal Assay Standards

6.2. Ethical Sourcing Regulations

6.3. Export/Import Restrictions on Precious Metals

7. Asia Pacific Jewellery Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Jewellery Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Customer Demographic (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Jewellery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Target Customer Segmentation Strategy

9.3. Expansion into Untapped Regions

9.4. Brand Positioning and Marketing Strategy

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders across the Asia Pacific Jewellery market, drawing from primary and secondary sources. This step identifies market drivers, consumer trends, and critical performance metrics shaping the industry.

Step 2: Market Analysis and Construction

In this step, historical market data is assessed to evaluate growth trends and key performance indicators (KPIs) for various Jewellery segments. The analysis focuses on revenue generation and distribution strategies across offline and online channels.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by consulting industry experts through computer-assisted interviews. These insights provide a deeper understanding of consumer behaviour and the competitive landscape, ensuring the accuracy of our market analysis.

Step 4: Research Synthesis and Final Output

In the final phase, the gathered insights are synthesized to create a comprehensive and data-driven report, validated by industry practitioners and corroborated by reliable data sources. This ensures the most accurate representation of market conditions and future projections.

Frequently Asked Questions

01. How big is the Asia Pacific Jewellery Market?

The Asia Pacific Jewellery market is valued at USD 211.8 billion, driven by rising disposable income, increasing demand for luxury products, and the growing influence of online retail channels.

02. What are the challenges in the Asia Pacific Jewellery Market?

The key challenges in the Asia Pacific Jewellery market include high competition among global and regional players, fluctuating raw material prices, and regulatory compliance in different countries regarding precious metals and gemstones.

03. Who are the major players in the Asia Pacific Jewellery Market?

Major players in the Asia Pacific Jewellery market include Chow Tai Fook, Titan Company Limited, Pandora, Malabar Gold & Diamonds, and Swarovski AG, each leveraging strong brand presence and extensive distribution networks.

04. What are the growth drivers of the Asia Pacific Jewellery Market?

Growth drivers of the Asia Pacific Jewellery market include rising disposable income, increasing consumer preferences for personalized Jewellery, the expansion of online sales channels, and growing demand for ethical and sustainable products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.