Asia Pacific Juices Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6043

December 2024

81

About the Report

Asia Pacific Juices Market Overview

- The Asia Pacific juices market is valued at USD 33 billion, driven by a growing preference for healthy, natural beverages and an increasing demand for fruit-based juices. This trend is largely due to rising health consciousness and an increasing middle-class population in countries like China, India, and Japan. Additionally, product innovations, such as organic and cold-pressed juices, are supporting market growth by appealing to health-conscious consumers.

- Dominant countries in the Asia Pacific juices market include China, Japan, and India. These countries lead due to their large populations, economic growth, and increasing consumer awareness of the health benefits of fruit and vegetable juices. Moreover, China and Japan have high urbanization rates, creating a market ripe for premium and functional juice products that appeal to urban lifestyles.

- Several countries in Asia Pacific are implementing sugar taxes to reduce sugar consumption. In 2024, Thailand imposed a sugar tax of $0.02 per gram on beverages exceeding the sugar threshold, affecting around 500 juice producers. These taxes are designed to discourage excessive sugar intake, reshaping the product formulations for juice manufacturers.

Asia Pacific Juices Market Segmentation

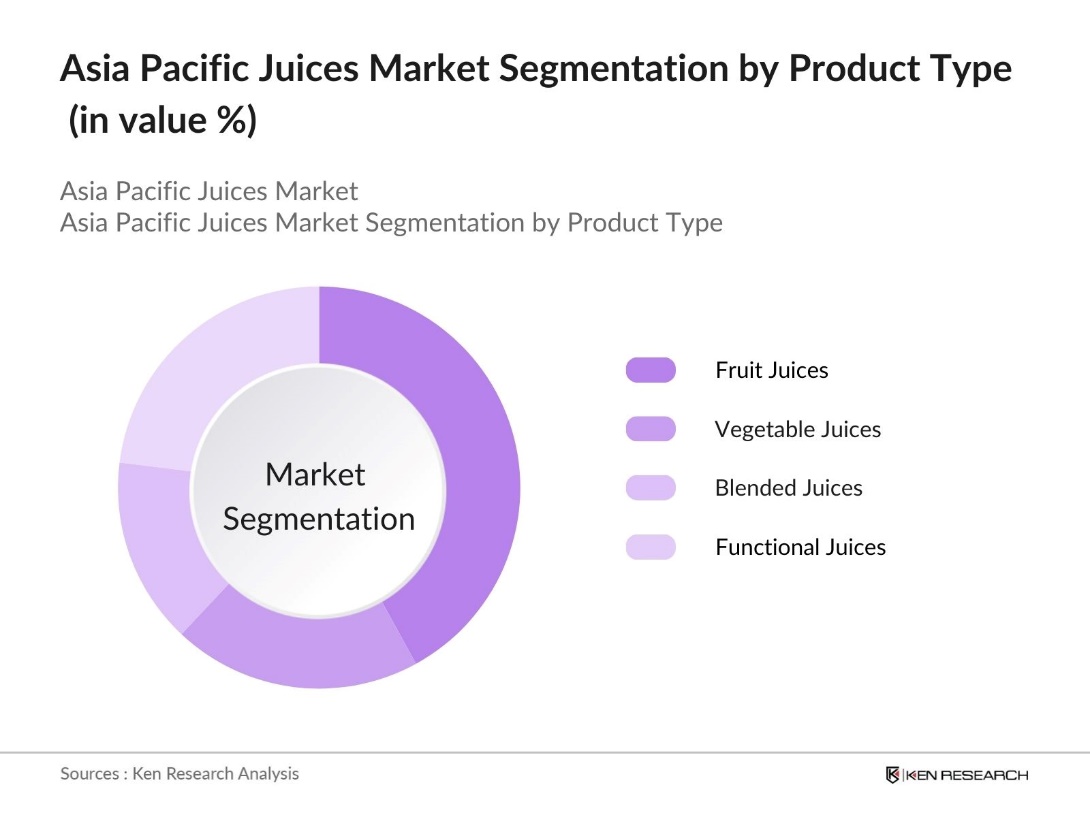

By Product Type: The market is segmented by product type into fruit juices, vegetable juices, blended juices, and functional juices. Fruit juices dominate this segment, owing to their established popularity and nutritional appeal. Key brands in fruit juices, such as Tropicana and Minute Maid, have successfully built strong consumer loyalty over the years, contributing to the segment's dominance.

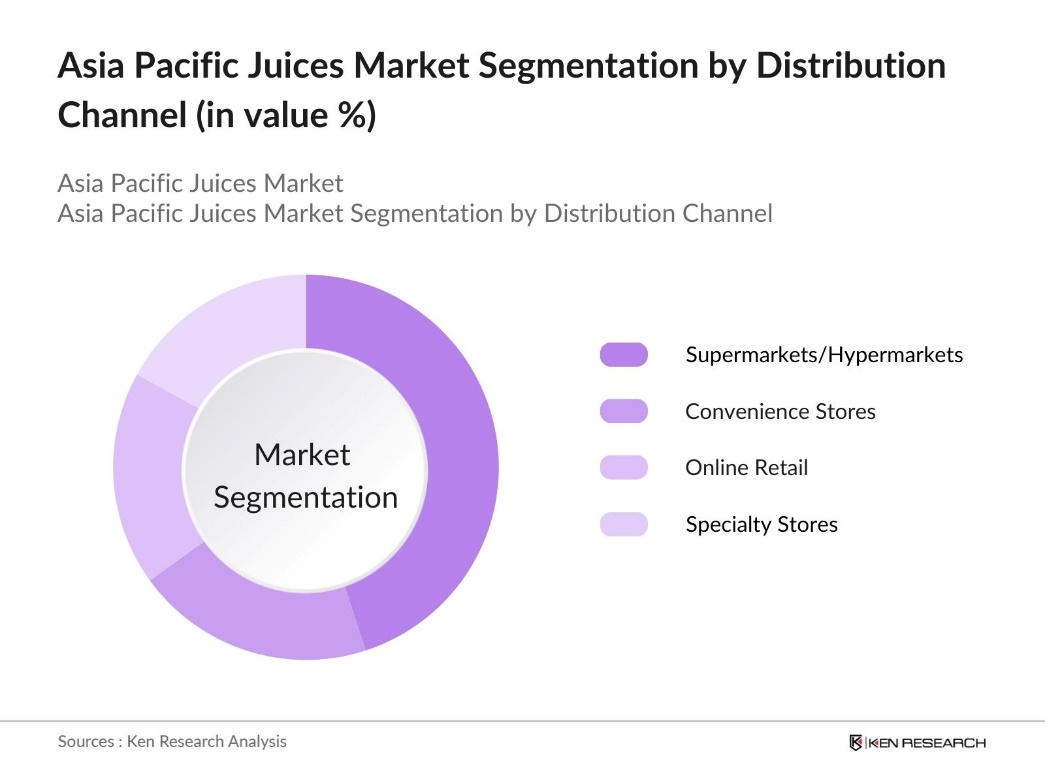

By Distribution Channel: The market is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets/hypermarkets hold the largest market share within this segment due to the widespread availability of juices in these stores, particularly in urban areas. The convenience of bulk shopping and the availability of varied product ranges in supermarkets further contribute to this segments strong performance.

Asia Pacific Juices Market Competitive Landscape

The Asia Pacific juices market is characterized by the presence of both local and global brands. Major players include Coca-Cola, PepsiCo, and Nestle, who dominate due to their extensive distribution networks and established brand reputation. These companies have a competitive advantage owing to economies of scale and product diversity, allowing them to cater to various consumer segments.

Asia Pacific Juices Industry Analysis

Growth Drivers

- Increasing Health Awareness: Health awareness across the Asia Pacific region is on the rise, with increased emphasis on nutrition and wellness. For example, in Japan, people aged 65 and above (representing 28.7% of the population) are prioritizing health-conscious food choices, leading to a shift toward juice consumption for natural health benefits. This trend is reshaping demand in the juice market toward healthier, nutrient-rich options.

- Rise in Demand for Natural & Organic Beverages: Consumer preferences in the Asia Pacific region are increasingly shifting towards natural and organic products. For instance,

- In 2021, F&N Fruit Tree Fresh introduced a no-sugar-added prune and mixed fruit juice drink, providing fiber from prune juice and added vitamin C. The juice also bears the Healthier Choice Symbol from the Health Promotion Board (HPB). The shift is creating opportunities for producers of organic juices and fostering a more competitive market.

- Strategic Product Innovations (Organic Juice, Cold-Pressed Juice): Product innovation, especially in organic and cold-pressed juices, is significantly impacting the Asia Pacific juice market by aligning with consumer preferences for nutrient-rich and health-focused options. In response to rising health awareness, juice producers are developing organic and cold-pressed variants to meet demand for beverages that retain natural flavors and nutritional integrity. These innovations, which emphasize minimal processing and high-quality ingredients, resonate strongly with health-conscious consumers across the region.

Market Challenges

- High Production and Sourcing Costs: The juice market encounters significant challenges due to rising production and sourcing costs. Fluctuations in energy prices and logistical expenses directly affect the overall cost structure for juice production. Additionally, weather-related disruptions often impact the availability and pricing of essential raw ingredients, creating further cost pressures. These factors influence pricing strategies and profit margins, making it challenging for producers to maintain competitive prices without compromising on quality.

- Regulatory Standards on Ingredients (Additives, Sugar Content): Strict regulatory standards on juice ingredients present a challenge for producers, especially concerning additives and sugar content. Regulatory bodies in various countries are implementing stricter controls to reduce sugar levels and limit artificial additives in juices, aimed at promoting healthier consumer choices. These regulations often require companies to reformulate products, which involves additional compliance costs and adjustments in production processes.

Asia Pacific Juices Market Future Outlook

Over the next five years, the Asia Pacific juices market is expected to grow significantly, fueled by an increased focus on health and wellness, particularly in urban areas. Innovations such as organic, low-sugar, and functional juices will play a central role in appealing to health-conscious consumers. Additionally, online retail is likely to gain momentum as e-commerce platforms expand their offerings and reach, providing consumers with more convenient access to premium juice products.

Market Opportunities

- Growth in E-commerce Sales Channels: E-commerce has become a vital sales channel for the juice market in Asia Pacific, as it provides convenience and wider accessibility for consumers. Online grocery platforms and direct-to-consumer models have changed purchasing behaviors, allowing juice brands to reach consumers more effectively. This shift towards digital shopping presents valuable growth opportunities for juice companies to expand their reach and engage with tech-savvy and convenience-oriented consumers through various online platforms.

- Investment in Emerging Markets (Southeast Asia): Emerging markets in Southeast Asia, such as Vietnam and the Philippines, are attracting significant investments in the juice industry. Growing consumer demand for juice products, combined with economic growth in these regions, makes them attractive for both local and international investors. Investment in infrastructure, production facilities, and supply chain networks is driving the development of these markets, creating substantial growth prospects for juice producers looking to expand their footprint.

Scope of the Report

|

By Product Type |

Fruit Juices Vegetable Juices Blended Juices |

|

By Processing Method |

Cold-Pressed Pasteurized Fresh-Squeezed |

|

By Flavor |

Citrus-Based Juices Berry-Based Juices Tropical Juices |

|

By Distribution Channel |

Retail Stores Supermarkets/Hypermarkets Online Retail |

|

By Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience

Juice Manufacturers

Health and Wellness Companies

Beverage Ingredient Industry

Packaging Industry

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Coca-Cola Company

PepsiCo Inc.

Nestle S.A.

Dabur India Ltd.

Del Monte Foods Inc.

Asahi Group Holdings Ltd.

Suntory Holdings Limited

Tropicana Products Inc.

Parle Agro Pvt Ltd.

Nongfu Spring Co. Ltd.

Table of Contents

1. Asia Pacific Juices Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Juices Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Juices Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Health Awareness

3.1.2 Rise in Demand for Natural & Organic Beverages

3.1.3 Expanding Middle-Class Population

3.1.4 Strategic Product Innovations (Organic Juice, Cold-Pressed Juice)

3.2 Market Challenges

3.2.1 High Production and Sourcing Costs

3.2.2 Regulatory Standards on Ingredients (Additives, Sugar Content)

3.2.3 Competition from Alternative Beverages (Smoothies, Energy Drinks)

3.3 Opportunities

3.3.1 Growth in E-commerce Sales Channels

3.3.2 Investment in Emerging Markets (Southeast Asia)

3.3.3 Expansion of Premium Juice Segment

3.4 Trends

3.4.1 Popularity of Functional Juices (Added Vitamins, Probiotics)

3.4.2 Rise in Single-Serve Packaging

3.4.3 Growing Interest in Plant-Based and Vegan Juices

3.5 Government Regulation

3.5.1 Labeling and Additive Standards

3.5.2 Sugar Tax Implementation

3.5.3 Import-Export Regulations

3.6 SWOT Analysis

3.7 Value Chain Analysis (Raw Materials, Production, Distribution)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Juices Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fruit Juices (Single-Flavor, Blends)

4.1.2 Vegetable Juices

4.1.3 Functional Juices (With Added Health Ingredients)

4.1.4 Cold-Pressed Juices

4.2 By Packaging Type (In Value %)

4.2.1 Bottles (Glass, PET)

4.2.2 Cartons

4.2.3 Cans

4.2.4 Pouches

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets/Hypermarkets

4.3.2 Convenience Stores

4.3.3 Online Stores

4.3.4 Specialty Stores

4.4 By Flavor Type (In Value %)

4.4.1 Single-Fruit Flavors

4.4.2 Mixed Fruit and Vegetable Blends

4.4.3 Exotic and Unique Flavors

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Australia

4.5.5 Rest of Asia Pacific

5. Asia Pacific Juices Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Coca-Cola Co.

5.1.2 PepsiCo Inc.

5.1.3 Nestl S.A.

5.1.4 Dabur India Ltd.

5.1.5 Tropicana Products Inc.

5.1.6 Parle Agro Pvt. Ltd.

5.1.7 Del Monte Pacific Ltd.

5.1.8 Kagome Co. Ltd.

5.1.9 ITC Limited

5.1.10 Hain Celestial Group Inc.

5.1.11 Suntory Holdings Ltd.

5.1.12 Fresh Del Monte Produce Inc.

5.1.13 Lotte Chilsung Beverage Co.

5.1.14 Nongfu Spring Co. Ltd.

5.1.15 Marico Ltd.

5.2 Cross-Comparison Parameters (Revenue, Market Share, Geographical Presence, Product Range, R&D Expenditure, Sustainability Initiatives, Brand Recognition, Distribution Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Subsidies and Grants

5.9 Private Equity Investments

6. Asia Pacific Juices Market Regulatory Framework

6.1 Quality Standards and Certifications

6.2 Food Safety and Health Regulations

6.3 Packaging and Labeling Requirements

6.4 Import/Export Regulations

7. Asia Pacific Juices Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Growth

8. Asia Pacific Juices Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Packaging Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Flavor Type (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Juices Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior and Preference Analysis

9.3 Marketing and Branding Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase includes building a comprehensive ecosystem of stakeholders in the Asia Pacific juices market. Extensive desk research is conducted through secondary sources and proprietary databases, focusing on defining critical variables like consumer demand trends and product types.

Step 2: Market Analysis and Construction

This phase involves aggregating historical data to analyze the growth trends within the Asia Pacific juices market. Various parameters, such as consumer preferences, distribution channels, and product innovation, are assessed to gauge market behavior and estimate revenue growth accurately.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are formed and validated through in-depth interviews with industry experts and major market players. This step allows for acquiring detailed financial and operational insights, which help in refining the market analysis.

Step 4: Research Synthesis and Final Output

Engagement with manufacturers and distributors is performed to validate statistics and gain insights into the consumer response toward different juice products. This step ensures the final analysis is accurate, with a well-rounded perspective on market trends.

Frequently Asked Questions

01 How big is the Asia Pacific Juices Market?

The Asia Pacific juices market is valued at USD 33 billion, with growth driven by increasing consumer demand for health-conscious beverage options.

02 What are the challenges in the Asia Pacific Juices Market?

Key challenges in Asia Pacific juices market include high production costs due to premium ingredient sourcing and regulatory hurdles associated with labeling and additive use.

03 Who are the major players in the Asia Pacific Juices Market?

Prominent players in the Asia Pacific juices market include Coca-Cola Company, PepsiCo, Nestle, Dabur India, and Del Monte, owing to their strong distribution networks and diverse product portfolios.

04 What are the growth drivers of the Asia Pacific Juices Market?

The Asia Pacific juices market is propelled by rising health consciousness, increased availability of premium juice options, and a growing middle-class population that demands natural and organic beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.