Asia Pacific Kimchi Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD10405

November 2024

85

About the Report

Asia Pacific Kimchi Market Overview

- The Asia Pacific Kimchi market is valued at 358 thousand, with steady growth observed due to a rising interest in probiotic and fermented foods, which promote digestive health and immune support. Demand is especially high among health-conscious consumers in urban centers who value traditional foods with nutritional benefits. The popularity of Korean cuisine across the Asia Pacific region has further fueled the market growth, making kimchi a prominent staple beyond its native country.

- South Korea, China, and Japan are the dominant countries in the Asia Pacific Kimchi market due to their cultural affinity for fermented foods and the widespread incorporation of kimchi into traditional cuisine. South Korea leads the market, supported by robust production infrastructure and a strong domestic consumption base. The dominance of these nations can be attributed to established production capabilities and a large consumer base familiar with kimchi.

- Various Asia-Pacific countries impose tariffs on imported food products, impacting the kimchi market. China, for example, levies a 10% tariff on imported kimchi to support local production, according to the Ministry of Commerce of China. Import restrictions create additional barriers, affecting pricing and distribution, particularly for foreign kimchi brands trying to penetrate these markets.

Asia Pacific Kimchi Market Segmentation

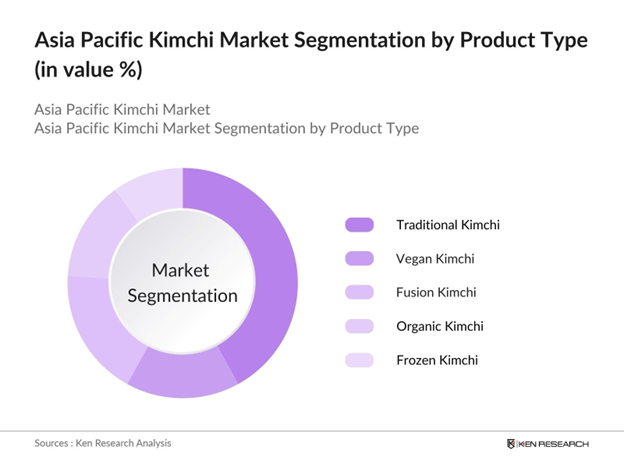

By Product Type: The Asia Pacific Kimchi market is segmented by product type into traditional kimchi, vegan kimchi, fusion kimchi, organic kimchi, and frozen kimchi. Traditional kimchi holds a dominant market share due to its cultural significance and established consumer demand across multiple generations. The traditional recipe of napa cabbage and radish, seasoned with chili peppers and garlic, is well-loved for its authentic taste, which appeals to consumers looking for conventional flavors. This segment benefits from high loyalty among both older and newer consumers in countries like South Korea and Japan.

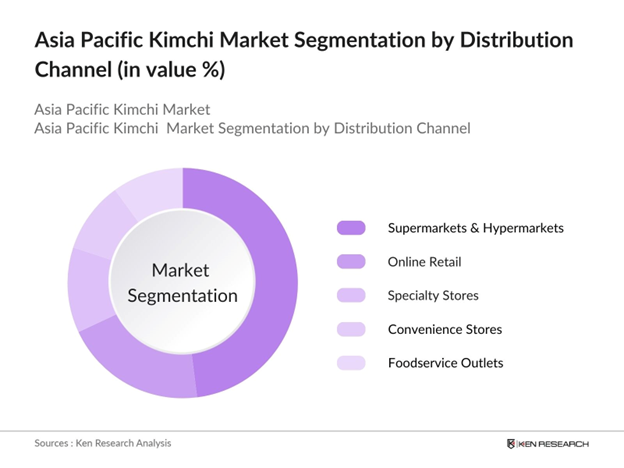

By Distribution Channel: The market is segmented by distribution channel into supermarkets & hypermarkets, online retail, specialty stores, convenience stores, and foodservice outlets. Supermarkets & hypermarkets are the leading distribution channel, with a significant market share attributed to their accessibility and the availability of a wide variety of kimchi products. This channel attracts regular buyers who prefer to see and select products firsthand. Supermarkets also often feature promotions that encourage bulk purchases, catering to family-oriented buyers in urban areas.

Asia Pacific Kimchi Market Competitive Landscape

The Asia Pacific Kimchi market is dominated by a mix of local and international players who leverage strong distribution networks, diverse product portfolios, and strategic marketing efforts. South Koreas CJ CheilJedang and Daesang Corporation lead in production capabilities and brand loyalty, while international brands like Sinto Gourmet capitalize on the growing popularity of Korean cuisine. These companies have established a foothold through innovative product offerings and extensive market reach, highlighting their influence in the Asia Pacific Kimchi market.

Asia Pacific Kimchi Market Analysis

Growth Drivers

- Increasing Health Awareness: In South Korea, surveys report that 84 out of every 100 individuals now actively seek food with health benefits, driven by the benefits of probiotics, vitamin C, and antioxidants found in kimchi. Additionally, Japan has reported a 60% rise in the consumption of fermented foods, attributed to health benefits. According to the World Bank, South Korea and Japan have some of the highest life expectancy rates in the region, at 83.5 years and 84.4 years respectively, underscoring the demand for health-focused foods like kimchi.

- Rising Popularity of Fermented Foods: The Asia Pacific region has experienced a notable uptick in the popularity of fermented foods, bolstered by a 1.3 billion-strong consumer base in China where traditional and fermented foods are deeply embedded in dietary culture. According to a study from Japans Ministry of Health, nearly 40% of the population consumes fermented foods daily, supporting a strong foundation for kimchis market penetration. Furthermore, increased imports and exports in this sector are observed across Asia, adding economic weight to the popularity of fermented products.

- Expansion of Korean Cuisine: Korean cuisine, largely popularized through cultural exports, saw an increase in Asian restaurants serving Korean dishes by 17% over three years. This culinary expansion is evident as Korean food festivals gain traction, such as events in Singapore drawing over 5,000 attendees in 2023. Additionally, South Koreas trade statistics show a rise in kimchi exports across Asia by nearly 22,000 metric tons annually, illustrating the broad appeal of Korean foods in the region.

Challenges

- Costly Raw Materials: The cost of fresh vegetables, a core ingredient for kimchi, is increasingly volatile across the region. In South Korea, cabbage prices rose by 9.4% in 2023 due to unpredictable weather and reduced crop yields. Additionally, currency fluctuations in Asia, especially in Thailand and Malaysia, have further contributed to increased costs of imported ingredients, posing a challenge for cost-effective production. According to the FAO, vegetable prices are expected to remain high, affecting the production costs of kimchi in the region.

- Limited Cold Chain Infrastructure: Cold chain limitations in the Asia Pacific region hinder the effective distribution of kimchi, particularly in rural areas. Data from the Asian Development Bank shows that only 18 out of 100 rural areas in developing Asia have efficient cold chain systems. This lack of infrastructure leads to high spoilage rates, constraining kimchis distribution, especially to countries with humid climates. Consequently, businesses face challenges in maintaining product quality and extending shelf life without extensive refrigeration networks.

Asia Pacific Kimchi Market Future Outlook

The Asia Pacific Kimchi market is poised for significant growth in the coming years, driven by increasing consumer awareness of health benefits, expansion in vegan and organic kimchi options, and rising popularity of Korean cuisine. As the market develops, producers are expected to focus on enhancing supply chains to meet the demand in urban and suburban markets while leveraging e-commerce to reach a broader audience.

Market Opportunities

- Online Distribution Growth: E-commerce platforms across Asia, especially in China, which reports a 32.4% online retail penetration, offer significant growth potential for kimchi distribution. Online retail giants such as Alibaba report substantial sales of packaged kimchi, with demand increasing by over 21% year-over-year. This digital shift provides brands direct access to a wider audience and more effective delivery options, overcoming traditional retail limitations and expanding the market reach across urban and semi-urban areas.

- Product Diversification with Vegan Options: The demand for vegan products is rising across Asia, with a 15% growth in vegan food sales reported in India. Kimchi producers are leveraging this trend by introducing vegan kimchi, aligning with increasing dietary restrictions. As per the FAO, over 20% of the Asia Pacific population now adopts flexible or vegan diets, making vegan kimchi a relevant market addition, particularly in countries like Australia, where plant-based food consumption has seen notable growth.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Traditional Kimchi Vegan Kimchi Fusion Kimchi Organic Kimchi Frozen Kimchi |

|

Ingredient Type |

Cabbage-Based Radish-Based Cucumber-Based Mixed Vegetables Seaweed-Based |

|

Distribution Channel |

Supermarkets & Hypermarkets Online Retail Specialty Stores Convenience Stores Foodservice Outlets |

|

Packaging Type |

Bottled Pouched Canned Jarred Bulk Packaging |

|

Country |

South Korea Japan China India Australia |

Products

Key Target Audience

Kimchi Manufacturers

Food and Beverage Distributors

Supermarkets & Hypermarkets

Online Retailers

Specialty Food Stores

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Food Safety and Standards Authority, Ministry of Agriculture)

Restaurant Chains and Foodservice Providers

Companies

Players Mentioned in the Report

Daesang Corporation

CJ CheilJedang Corporation

Pulmuone Co., Ltd.

Wang Korea

Sinto Gourmet LLC

Tazaki Foods Limited

Kings Kimchi

Real Pickles

Wildbrine

Lucky Foods

Table of Contents

1. Asia Pacific Kimchi Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Segmentation Overview

1.4 Market Growth Rate

2. Asia Pacific Kimchi Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Kimchi Market Analysis

3.1 Growth Drivers (Urbanization, Health Trends, Cultural Influence, Consumer Demand)

3.1.1 Increasing Health Awareness

3.1.2 Rising Popularity of Fermented Foods

3.1.3 Expansion of Korean Cuisine

3.1.4 Growing Demand for Probiotic Foods

3.2 Market Challenges (High Production Costs, Short Shelf Life, Competition from Other Fermented Products)

3.2.1 Costly Raw Materials

3.2.2 Limited Cold Chain Infrastructure

3.2.3 Price Sensitivity in Key Markets

3.3 Opportunities (E-commerce Expansion, Vegan Kimchi, Innovation in Flavor Profiles)

3.3.1 Online Distribution Growth

3.3.2 Product Diversification with Vegan Options

3.3.3 Unique Flavor and Packaging Innovations

3.4 Trends (Organic Kimchi, Private Label, Increased Household Penetration)

3.4.1 Rise in Organic Kimchi Demand

3.4.2 Growth of Private Labels in Supermarkets

3.4.3 Surge in Household Consumption

3.5 Government Regulation (Labeling Standards, Import Restrictions, Health Regulations)

3.5.1 Food Safety and Labeling Compliance

3.5.2 Import Tariffs and Restrictions

3.5.3 Regulations for Probiotic Claims

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Kimchi Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Traditional Kimchi

4.1.2 Vegan Kimchi

4.1.3 Fusion Kimchi

4.1.4 Organic Kimchi

4.1.5 Frozen Kimchi

4.2 By Ingredient Type (In Value %)

4.2.1 Cabbage-Based

4.2.2 Radish-Based

4.2.3 Cucumber-Based

4.2.4 Mixed Vegetables

4.2.5 Seaweed-Based

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets & Hypermarkets

4.3.2 Online Retail

4.3.3 Specialty Stores

4.3.4 Convenience Stores

4.3.5 Foodservice Outlets

4.4 By Packaging Type (In Value %)

4.4.1 Bottled

4.4.2 Pouched

4.4.3 Canned

4.4.4 Jarred

4.4.5 Bulk Packaging

4.5 By Country (In Value %)

4.5.1 South Korea

4.5.2 Japan

4.5.3 China

4.5.4 India

4.5.5 Australia

5. Asia Pacific Kimchi Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Daesang Corporation

5.1.2 CJ CheilJedang Corporation

5.1.3 Pulmuone Co., Ltd.

5.1.4 Wang Korea

5.1.5 Sinto Gourmet LLC

5.1.6 Tazaki Foods Limited

5.1.7 Kings Kimchi

5.1.8 Real Pickles

5.1.9 Wildbrine

5.1.10 Lucky Foods

5.2 Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Product Portfolio, Market Share, Innovation Rate, Price Positioning, Distribution Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Venture Capital Funding

5.9 Private Equity Investments

6. Asia Pacific Kimchi Market Regulatory Framework

6.1 Food Safety Standards

6.2 Labeling and Packaging Regulations

6.3 Import and Export Restrictions

6.4 Certification and Compliance Requirements

7. Asia Pacific Kimchi Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Kimchi Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Ingredient Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific Kimchi Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves constructing an in-depth analysis of the Asia Pacific Kimchi Markets stakeholder ecosystem, utilizing secondary research databases and reputable market sources. Key variables identified include consumer demographics, cultural influences, and health trends impacting demand.

Step 2: Market Analysis and Construction

Historical data on the Asia Pacific Kimchi Market is compiled to evaluate market penetration, demand in urban and rural areas, and sales revenue across various segments. Key metrics for segment growth and product performance are established through this analysis.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through expert interviews and industry consultations with top players in the Asia Pacific Kimchi Market. This process helps refine and verify key insights, providing an accurate understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final stage synthesizes collected data and insights, involving direct engagement with kimchi manufacturers and distributors to validate findings on product trends, distribution efficiency, and consumer preferences. This stage ensures a holistic, accurate, and validated market analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Kimchi Market?

The Asia Pacific Kimchi market is valued at 358 thousand, driven by increasing consumer demand for fermented and probiotic foods across major economies.

02. What are the challenges in the Asia Pacific Kimchi Market?

Challenges in Asia Pacific Kimchi market include high production costs, limited shelf life, and competition from other fermented foods, which pose risks to profitability and distribution efficiency.

03. Who are the major players in the Asia Pacific Kimchi Market?

Key players in Asia Pacific Kimchi market include Daesang Corporation, CJ CheilJedang, Pulmuone Co., Ltd., and Tazaki Foods Limited, noted for their extensive distribution networks and strong brand presence.

04. What are the growth drivers of the Asia Pacific Kimchi Market?

Asia Pacific Kimchi market is driven by factors such as health-conscious consumer trends, the rising popularity of Korean cuisine, and increased disposable income among urban populations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.