Asia Pacific Kitchen Appliances Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD8965

November 2024

98

About the Report

Asia Pacific Kitchen Appliances Market Overview

- The Asia Pacific kitchen appliances market is valued at USD 103.8 billion, driven by the region's growing middle class, rapid urbanization, and increased disposable income levels. As consumers prioritize convenience, the adoption of smart and energy-efficient appliances is on the rise. In particular, appliances like refrigerators, microwaves, and dishwashers are becoming household essentials, backed by the increasing influence of modern lifestyles and the trend of modular kitchens across the region. Government initiatives promoting energy-efficient products further support this growth, particularly in countries like China and India.

- China and India dominate the Asia Pacific kitchen appliances market due to their large population bases and increasing urbanization rates. China's robust manufacturing infrastructure, coupled with its leadership in technology-driven innovation, places it as a key player in the region. India, on the other hand, benefits from a rapidly expanding middle class, high demand for household products, and significant growth in urban centers such as Mumbai and Bangalore, making it a vital contributor to market growth. Japan and South Korea are also influential players, owing to their advanced technological development in smart appliances.

- Several governments in the region are collaborating with private sector players to develop and promote smart kitchen appliances. The South Korean government, for instance, has committed $150 million towards fostering innovation in the smart appliance market by 2025. These partnerships are expected to drive technological advancements and broaden the adoption of smart kitchen products across the region.

Asia Pacific Kitchen Appliances Market Segmentation

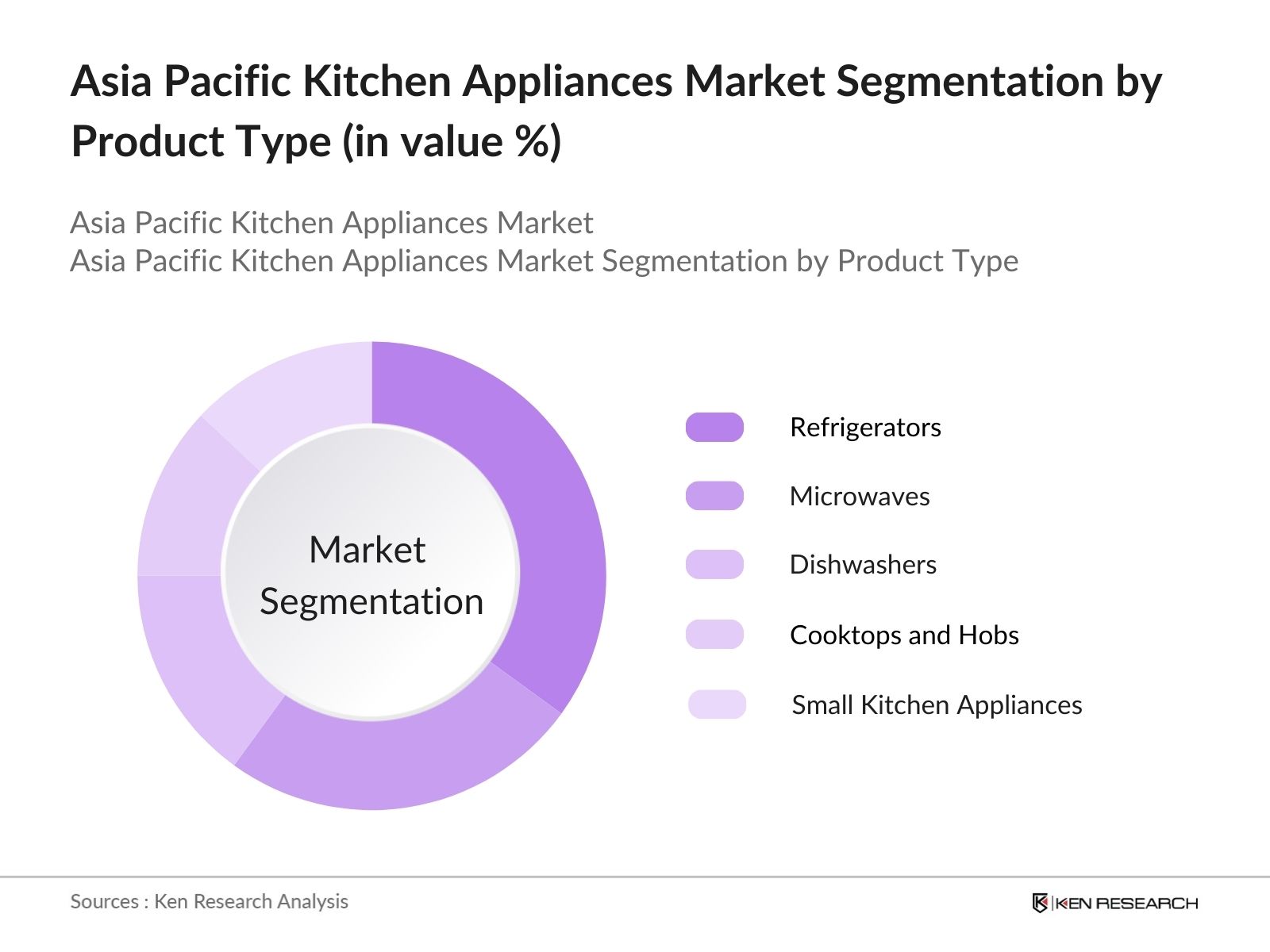

By Product Type:

The Asia Pacific kitchen appliances market is segmented by product type into refrigerators, microwaves, dishwashers, cooktops and hobs, and small kitchen appliances like toasters and blenders. Refrigerators continue to hold a dominant market share due to their essential role in preserving food and the increasing preference for energy-efficient models. The rising disposable income in countries like China and India, along with the increased focus on food storage in modern kitchens, has further fueled the demand for refrigerators. Additionally, technological advancements in cooling systems and smart refrigerators have contributed to this segment's continued dominance.

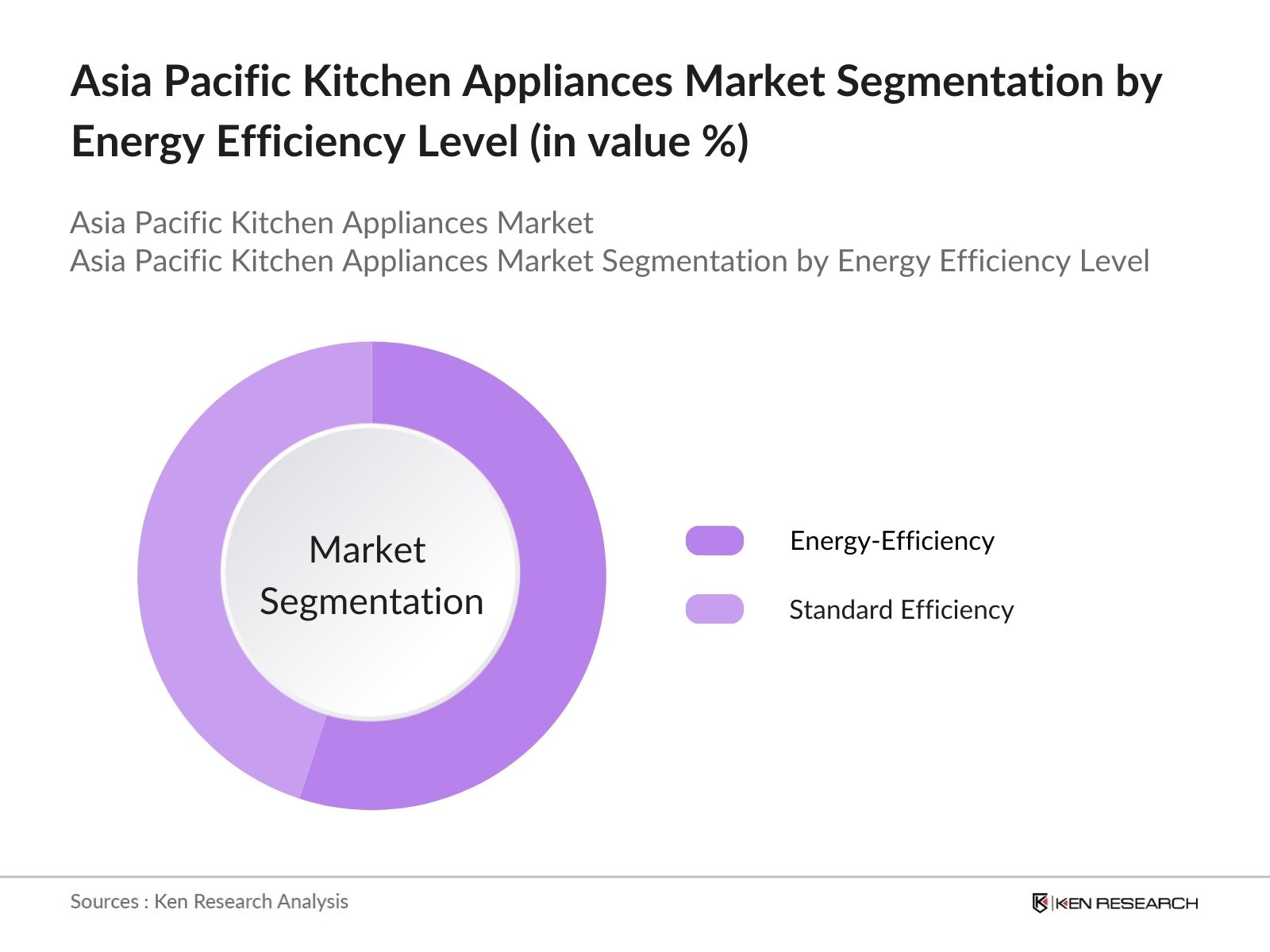

By Energy Efficiency Level:

The market is also segmented by energy efficiency level into standard efficiency and energy-efficient (Energy Star certified) products. Energy-efficient appliances are increasingly dominating the market, driven by government regulations that promote sustainability and consumer demand for reduced electricity bills. Countries like Japan, South Korea, and Australia have implemented stringent energy efficiency standards, which have accelerated the adoption of energy-efficient products. These appliances are particularly favored in urban regions, where energy conservation is a major concern due to high population density and environmental awareness.

Asia Pacific Kitchen Appliances Market Competitive Landscape

The Asia Pacific kitchen appliances market is dominated by a combination of global and regional players, with intense competition shaping the market landscape. Companies such as LG Electronics and Samsung are known for their wide range of energy-efficient products and innovative designs. Meanwhile, local manufacturers in China and India are capturing market share through affordable, high-quality products that cater to their home markets. Key players are also expanding their online distribution channels to meet the growing demand for e-commerce in the region.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Range |

R&D Investment |

Regional Presence |

Sustainability Initiatives |

Employee Count |

Market Share |

|---|---|---|---|---|---|---|---|---|---|

|

LG Electronics |

1958 |

South Korea |

- |

- |

- |

- |

- |

- |

- |

|

Samsung Electronics |

1969 |

South Korea |

- |

- |

- |

- |

- |

- |

- |

|

Panasonic Corporation |

1918 |

Japan |

- |

- |

- |

- |

- |

- |

- |

|

Haier Group |

1984 |

China |

- |

- |

- |

- |

- |

- |

- |

|

Whirlpool Corporation |

1911 |

USA |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Kitchen Appliances Market Analysis

Growth Drivers

- Rising Demand for Energy-Efficient Appliances

The demand for energy-efficient kitchen appliances is significantly increasing across the Asia-Pacific region. In 2024, this shift is primarily driven by stringent government regulations on energy consumption and the rising cost of electricity in countries like Japan and South Korea. For example, South Korea has set a goal to reduce household electricity consumption by 1.8 billion kilowatt-hours annually by 2026, fueling the demand for energy-efficient appliances. The market saw over 2.5 million units of energy-efficient refrigerators sold in 2023 alone, indicating the strong demand for these appliances. - Growing Middle-Class Population Impacting Consumer Purchasing Power

The Asia-Pacific middle class is expected to grow to over 1.2 billion people by 2024, according to regional economic data, which directly boosts purchasing power for premium kitchen appliances. In India and Southeast Asia, for instance, household income growth has resulted in a surge in demand for advanced kitchen products like convection ovens and smart microwaves, with appliance purchases in these categories increasing by 15 million units in 2023 compared to 2020. - Government Initiatives on Energy Conservation

Various governments in the region have rolled out programs encouraging energy conservation, which have bolstered demand for energy-efficient kitchen appliances. Australias government, for example, incentivized energy-saving purchases through the "GreenPower" initiative, where 400,000 households are expected to upgrade their appliances by the end of 2024. This will drive sales of certified energy-efficient kitchen products such as induction cooktops and high-efficiency dishwashers.

Market Challenges

- High Initial Costs of Smart and Energy-Efficient Appliances

One of the significant barriers to market expansion is the high cost of smart and energy-efficient kitchen appliances. For instance, the price of a high-efficiency induction stove in Australia is often two to three times higher than conventional alternatives, with average prices exceeding $1,200 per unit. This limits mass adoption, especially in price-sensitive markets like India, where such costs remain prohibitive for many households. - Supply Chain Disruptions (Raw Material Shortages)

Global supply chain disruptions, particularly in sourcing raw materials like semiconductors and steel, have significantly impacted appliance manufacturing. By mid-2024, several companies across China and Southeast Asia reported production delays due to shortages, contributing to a backlog of nearly 500,000 units of refrigerators and ovens that were delayed for shipping. This has led to extended delivery times and an overall rise in production costs.

Asia Pacific Kitchen Appliances Market Future Outlook

Over the next five years, the Asia Pacific kitchen appliances market is expected to witness significant growth, fueled by increasing demand for smart appliances, energy-efficient products, and modern kitchen setups. As governments continue to promote sustainability and energy conservation, the market is likely to see a surge in demand for appliances that meet these standards. Moreover, the growing trend of e-commerce will enable manufacturers to reach a broader audience, particularly in emerging markets like India and Southeast Asia. The rise of smart homes, coupled with consumer preferences for advanced technologies, will also contribute to the market's upward trajectory.

Market Opportunities

- Growth in E-commerce Channels Impacting Appliance Sales

The rapid expansion of e-commerce channels is significantly boosting the sale of kitchen appliances across Asia-Pacific. In 2023, over 80 million kitchen appliances were sold through online platforms, a figure projected to grow by an additional 15% by 2025. The shift toward digital marketplaces is particularly strong in countries like China and India, where major platforms are reporting year-on-year growth in kitchen appliance sales, reducing reliance on traditional brick-and-mortar stores. - Development of Smart and Connected Kitchen Appliances

The development of smart kitchen appliances offers significant growth potential, especially in tech-savvy markets like Japan and South Korea. By 2024, over 5 million smart refrigerators and ovens are expected to be sold annually in the Asia-Pacific region. This trend is fueled by consumer interest in automation and energy-saving features, as well as government initiatives supporting smart home ecosystems. Companies investing in R&D for AI-driven kitchen appliances are poised for strong growth in the coming years.

Scope of the Report

|

By Product Type |

Refrigerators Microwaves Dishwashers Cooktops and Hobs Small Kitchen Appliances (Toasters, Blenders) |

|

By Application |

Residential Commercial |

|

By Energy Efficiency Level |

Standard Efficiency Energy-Efficient |

|

By Distribution Channel |

Online Offline Brand-Owned Stores |

|

By Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Kitchen Appliance Manufacturers

Distributors and Wholesalers

E-Commerce Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Energy Efficiency Standards Organizations)

Residential Real Estate Developers

Commercial Kitchen Equipment Suppliers

Environmental Agencies (Green Building Councils)

Companies

Players Mentioned in the report:

LG Electronics

Samsung Electronics

Panasonic Corporation

Haier Group

Whirlpool Corporation

Midea Group

Bosch Home Appliances

Hitachi Appliances

Toshiba

Electrolux AB

Table of Contents

1. Asia Pacific Kitchen Appliances Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Kitchen Appliances Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Kitchen Appliances Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Energy-Efficient Appliances

3.1.2 Growing Middle-Class Population (Impact on Consumer Purchasing Power)

3.1.3 Urbanization and Shift Towards Smart Homes

3.1.4 Government Initiatives on Energy Conservation

3.2 Market Challenges

3.2.1 High Initial Costs of Smart and Energy-Efficient Appliances

3.2.2 Supply Chain Disruptions (Raw Material Shortages)

3.2.3 Low Product Penetration in Rural Areas

3.2.4 Regulatory Compliance Costs (Energy Labeling Requirements)

3.3 Opportunities

3.3.1 Growth in E-commerce Channels (Impact on Appliance Sales)

3.3.2 Development of Smart and Connected Kitchen Appliances

3.3.3 Expansion into Emerging Markets (India, Southeast Asia)

3.3.4 Sustainable Appliance Manufacturing (Low-Carbon Footprint)

3.4 Trends

3.4.1 Adoption of Smart Appliances with IoT Integration

3.4.2 Increasing Use of Energy Star Rated Products

3.4.3 Consumer Preference for Modular Kitchen Setups

3.4.4 Multi-Functional and Compact Appliances

3.5 Government Regulation

3.5.1 Energy Efficiency Standards and Labels (Country-Specific)

3.5.2 Environmental Policies (Eco-friendly Product Regulations)

3.5.3 Import and Export Tariffs (Impact on Appliance Costs)

3.5.4 Smart Home Initiatives (Public-Private Partnerships)

3.6 Competitive Landscape

3.6.1 Major Companies' Market Share (In % Value)

3.6.2 Key Competitive Strategies (Product Differentiation, Pricing)

3.6.3 Impact of Regional Players on Market Dynamics

3.6.4 Barriers to Entry for New Players

3.7 SWOT Analysis

3.8 Stakeholder Ecosystem (Manufacturers, Distributors, Consumers)

3.9 Porters Five Forces Analysis

4. Asia Pacific Kitchen Appliances Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Refrigerators

4.1.2 Microwave Ovens

4.1.3 Dishwashers

4.1.4 Cooktops and Hobs

4.1.5 Small Kitchen Appliances (Toasters, Blenders)

4.2 By Application (In Value %)

4.2.1 Residential

4.2.2 Commercial (Hotels, Restaurants)

4.3 By Distribution Channel (In Value %)

4.3.1 Online

4.3.2 Offline (Retail Stores, Supermarkets)

4.3.3 Brand-Owned Stores

4.4 By Energy Efficiency Level (In Value %)

4.4.1 Standard Efficiency

4.4.2 Energy-Efficient (Energy Star Certified)

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Australia

4.5.5 Southeast Asia

5. Asia Pacific Kitchen Appliances Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 LG Electronics

5.1.2 Samsung Electronics

5.1.3 Panasonic Corporation

5.1.4 Haier Group

5.1.5 Electrolux AB

5.1.6 Bosch Home Appliances

5.1.7 Whirlpool Corporation

5.1.8 Midea Group

5.1.9 Philips

5.1.10 Hitachi Appliances

5.1.11 Beko

5.1.12 Morphy Richards

5.1.13 Siemens AG

5.1.14 Toshiba

5.1.15 Faber Appliances

5.2 Cross Comparison Parameters (Revenue, Number of Employees, Market Share, Product Range, Sustainability Initiatives, Digital Transformation, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Product Launches, Expansion)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (R&D Investments)

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Kitchen Appliances Market Regulatory Framework

6.1 Energy Efficiency and Environmental Standards

6.2 Compliance Requirements (Safety, Emission Levels)

6.3 Certification Processes (Energy Star, IEC)

7. Asia Pacific Kitchen Appliances Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Kitchen Appliances Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Energy Efficiency Level (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Kitchen Appliances Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Marketing Initiatives (Digital Marketing, E-Commerce Growth)

9.3 Customer Cohort Analysis

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map covering all major stakeholders within the Asia Pacific Kitchen Appliances Market. Extensive desk research is carried out using secondary and proprietary databases to identify and define key variables affecting market dynamics, including consumer trends and regulatory frameworks.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data related to the Asia Pacific kitchen appliances market. Key metrics such as market penetration, product sales volume, and revenue generation are evaluated. A comprehensive analysis of energy-efficient product adoption rates is also conducted.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the data and validated through interviews with industry experts and representatives from leading companies. These consultations offer valuable insights into the competitive landscape, technological advancements, and consumer behavior.

Step 4: Research Synthesis and Final Output

The final phase consolidates insights gained through direct engagement with key manufacturers and suppliers, combined with data collected through bottom-up research. This ensures a comprehensive, accurate, and validated analysis of the Asia Pacific kitchen appliances market.

Frequently Asked Questions

01. How big is the Asia Pacific Kitchen Appliances Market?

The Asia Pacific kitchen appliances market is valued at USD 103.8 billion, driven by the increasing demand for energy-efficient and smart appliances across the region. The market's growth is supported by urbanization and rising disposable incomes in countries like China and India.

02. What are the challenges in the Asia Pacific Kitchen Appliances Market?

Challenges in the Asia Pacific kitchen appliances market include high initial costs for smart appliances, supply chain disruptions, and low penetration in rural areas. Additionally, compliance with energy efficiency regulations adds to the production costs.

03. Who are the major players in the Asia Pacific Kitchen Appliances Market?

Key players in the Asia Pacific kitchen appliances market include LG Electronics, Samsung Electronics, Panasonic Corporation, Haier Group, and Whirlpool Corporation. These companies dominate the market due to their extensive product portfolios, technological advancements, and global presence.

04. What are the growth drivers of the Asia Pacific Kitchen Appliances Market?

The market is driven by increasing consumer demand for convenience, energy-efficient appliances, and the growing trend of smart homes. Government initiatives to promote energy conservation and sustainability further fuel market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.