Asia Pacific Kosher Beef Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD4693

December 2024

81

About the Report

Asia Pacific Kosher Beef Market Overview

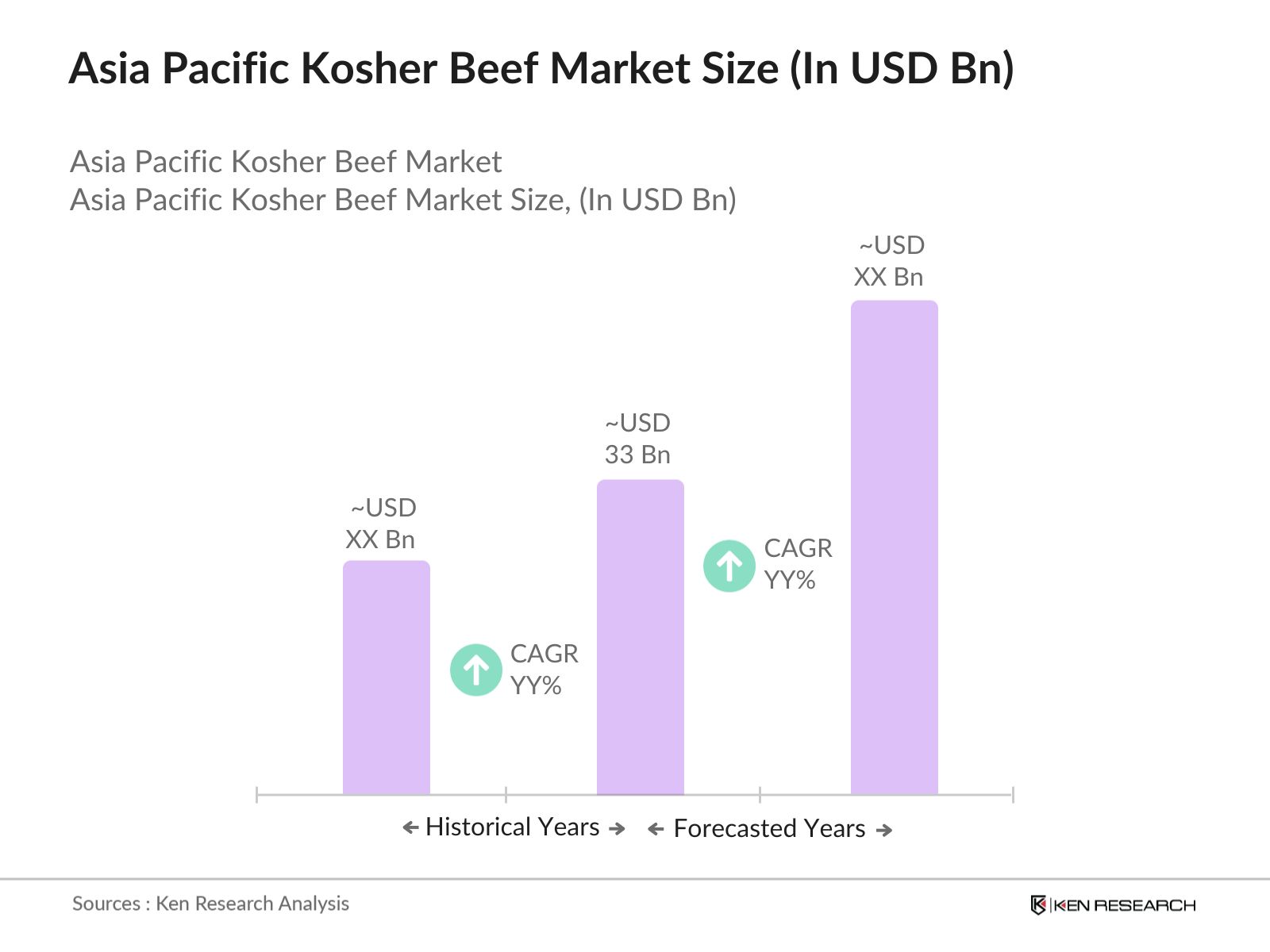

- The Asia Pacific Kosher Beef Market is valued at USD 33 billion, driven by an increasing demand for ethically sourced and religiously compliant food products. Consumer awareness of kosher certification standards, associated with strict hygiene and quality standards, has fueled growth in the market. Expanding dietary preferences and health-conscious consumer segments have also contributed, encouraging market demand for certified products that align with cultural and ethical values.

- Countries like Australia and China dominate the market. Australia is a major player due to its advanced cattle farming practices, quality certifications, and strict compliance with export standards. Chinas dominance is driven by the growing middle class, with consumers seeking premium, ethical, and certified beef options.

- The Australian government in 2024 launched export incentives worth $10 million aimed at enhancing kosher beef exports to Israel, the U.S., and other kosher-prevalent regions. These initiatives aim to foster the kosher meat sector, facilitating expansion and improving supply chain logistics.

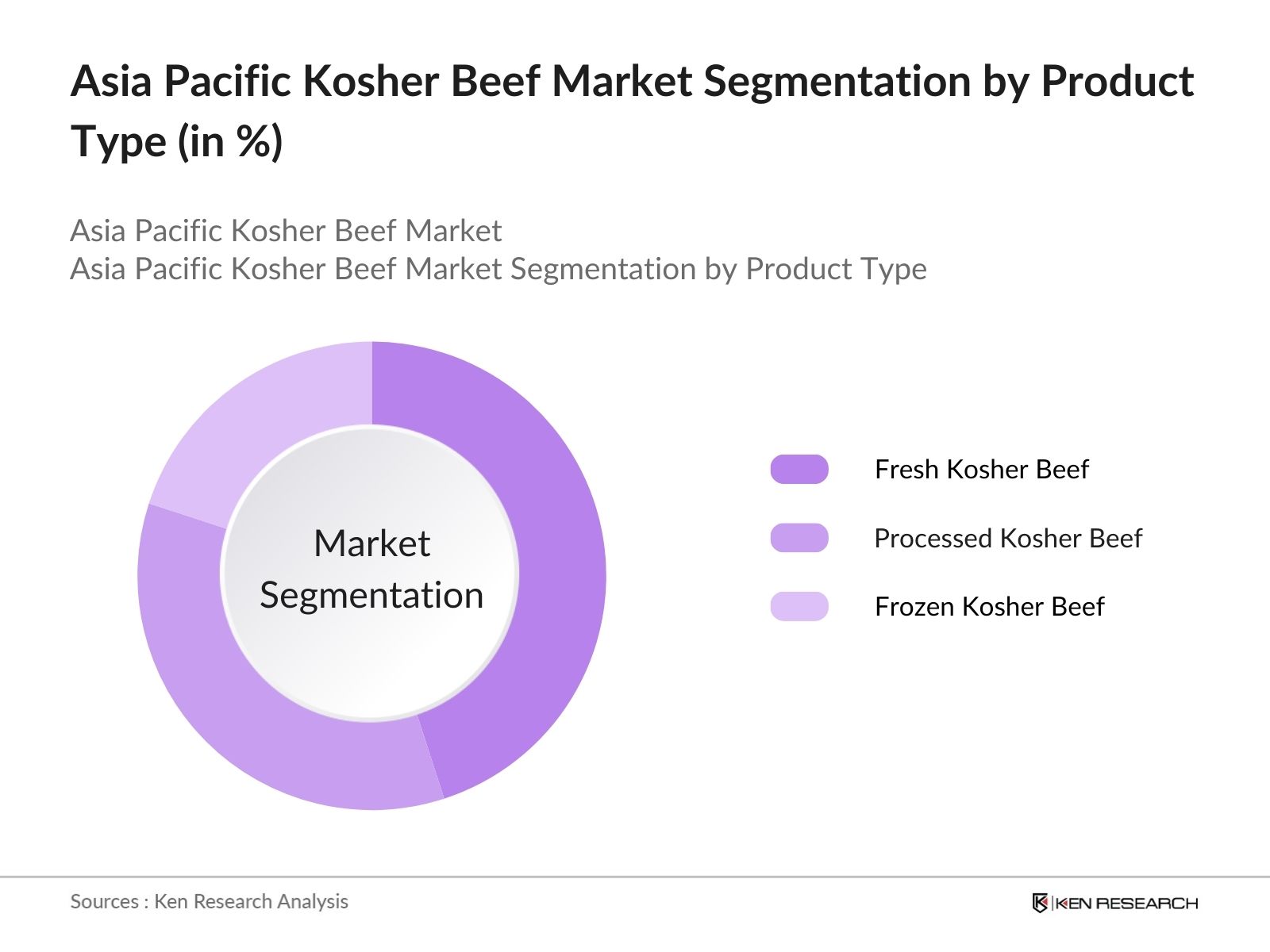

Asia Pacific Kosher Beef Market Segmentation

By Product Type: The market is segmented by product type into fresh kosher beef, processed kosher beef, and frozen kosher beef. Recently, fresh kosher beef has a dominant market share due to consumer preference for minimally processed products that retain natural flavors. Consumers associate fresh beef with higher quality, while demand in foodservice sectors, including restaurants and specialty stores, further contributes to the growth of this segment.

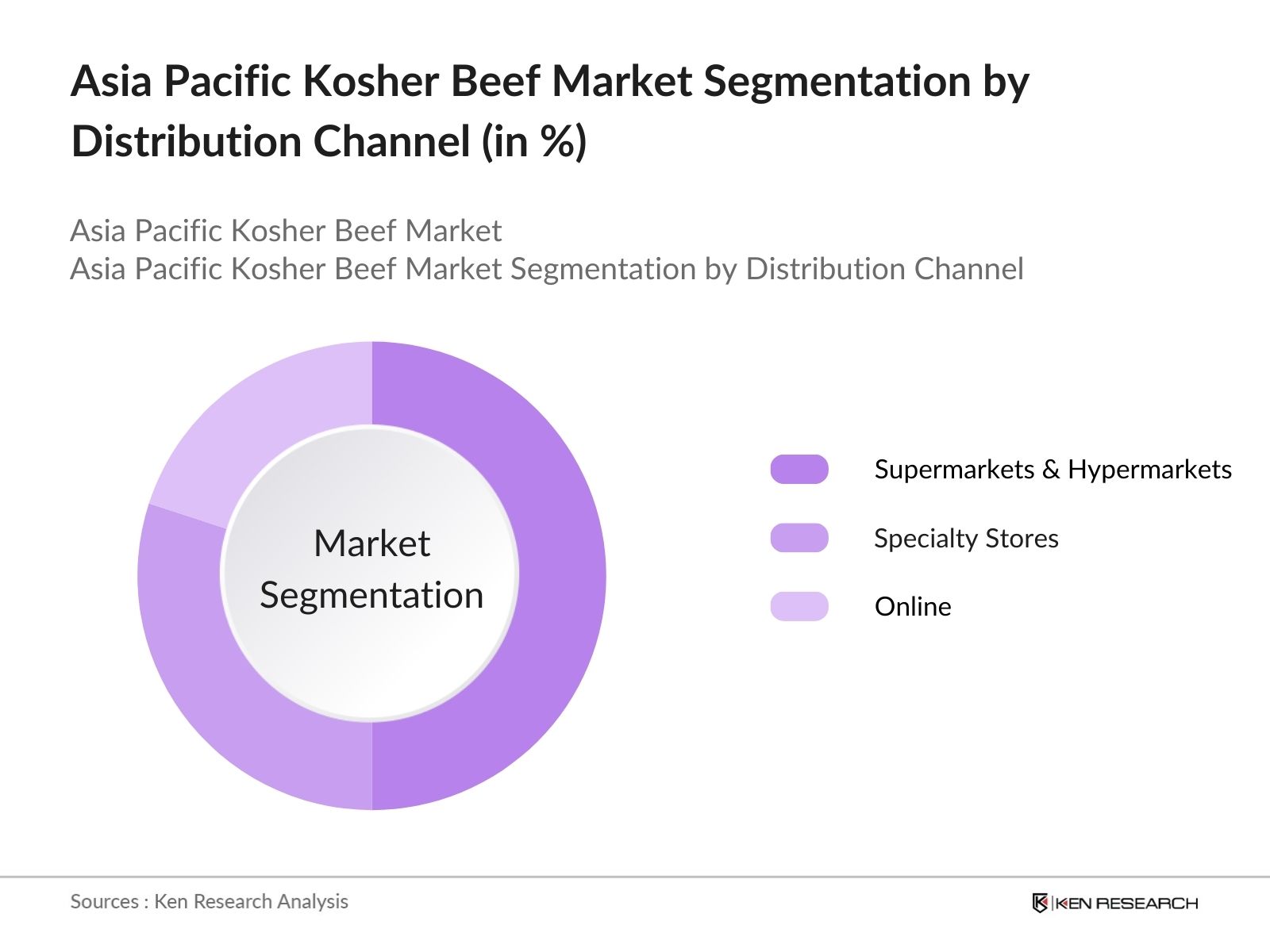

By Distribution Channel: The market is segmented by distribution channel into online, supermarkets & hypermarkets, and specialty stores. Supermarkets & hypermarkets dominate the distribution channels due to their vast reach, accessibility, and consistent demand from urban consumers. These retail chains provide consumers with a wide range of kosher beef options and trusted certifications, solidifying their dominance.

Asia Pacific Kosher Beef Market Competitive Landscape

The market is characterized by the presence of both global and regional players. These companies offer a range of certified kosher beef products and maintain strict adherence to religious standards, which appeals to various consumer segments in the Asia Pacific region.

Asia Pacific Kosher Beef Market Analysis

Market Growth Drivers

- Increasing Religious Adherence to Kosher Diets: The Asia Pacific region has seen an influx of Jewish populations in urban areas of countries like Australia, China, and Singapore, creating a specific demand for kosher-certified food products. In Australia alone, the Jewish population has grown to around 120,000 in 2024, significantly driving kosher beef consumption, as they require specific dietary standards. Additionally, kosher compliance in various meat products aligns with the dietary preferences of Muslims and others seeking stricter food quality standards, making kosher beef an attractive choice.

- Growing Tourism Industry Promoting Kosher Offerings: With the Asia Pacific tourism industry drawing around 300 million international tourists in 2024, there is a surge in demand for specialty foods, including kosher products, in destinations like Thailand, Japan, and Indonesia. Tourist-specific demand, particularly from Jewish tourists, supports the expansion of kosher food products in restaurants and hotels, fueling the kosher beef market growth.

- Rising Export Potential to Global Markets: Australia and New Zealand, known for their robust meat industries, exported over 20,000 tons of kosher beef to international markets in 2024, a significant increase driven by rising demand in the Middle East and North America. This export trend strengthens the market, especially as kosher-certified processing plants continue to scale production for export-ready kosher beef.

Market Challenges

- High Production Costs Due to Certification Requirements: The cost of kosher certification for beef processing can reach up to $20,000 annually per facility, adding to the overall production costs. These additional expenses often lead to higher prices for kosher beef products, creating affordability challenges for price-sensitive consumers and potentially limiting demand in cost-competitive markets.

- Limited Availability of Certified Kosher Slaughterhouses: The scarcity of certified kosher slaughterhouses in countries such as India and China constrains kosher beef production, restricting the market's ability to meet rising demand. As of 2024, only 10 certified facilities operate across the Asia Pacific region, with limited capacity, creating supply chain bottlenecks for kosher beef.

Asia Pacific Kosher Beef Market Future Outlook

Over the next five years, the Asia Pacific Kosher Beef industry is expected to experience steady growth, driven by increasing consumer interest in ethically sourced foods, stringent food safety regulations, and rising disposable incomes.

Future Market Opportunities

- Growth of the Kosher Beef Market in Tourist Destinations: Over the next five years, the demand for kosher beef in tourist-heavy regions such as Thailand and Singapore is projected to increase as these countries aim to attract Jewish and other international tourists seeking kosher dietary options. By 2029, these countries are expected to witness a rise in kosher beef sales across tourist-centric dining establishments.

- Rising Export Demand from Middle Eastern and North American Markets: Export volumes of kosher beef from the Asia Pacific to Middle Eastern and North American markets are anticipated to surpass 30,000 tons by 2029, fueled by government initiatives promoting halal and kosher-certified meat. This trend will drive investments in export facilities, enhancing Asia Pacific's position as a leading kosher beef exporter.

Scope of the Report

|

Type |

Fresh Kosher Beef |

|

End-Use |

Foodservice & HoReCa |

|

Distribution Channel |

Online |

|

Certification Level |

Strictly Kosher Certified |

|

Region |

China |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Beef Producers and Suppliers

Retail Chains and Supermarket Operators

Foodservice and Hospitality Providers

Kosher Certification Bodies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Kosher and Halal Certification Authorities)

Processed Meat Manufacturers

Health and Wellness Retailers

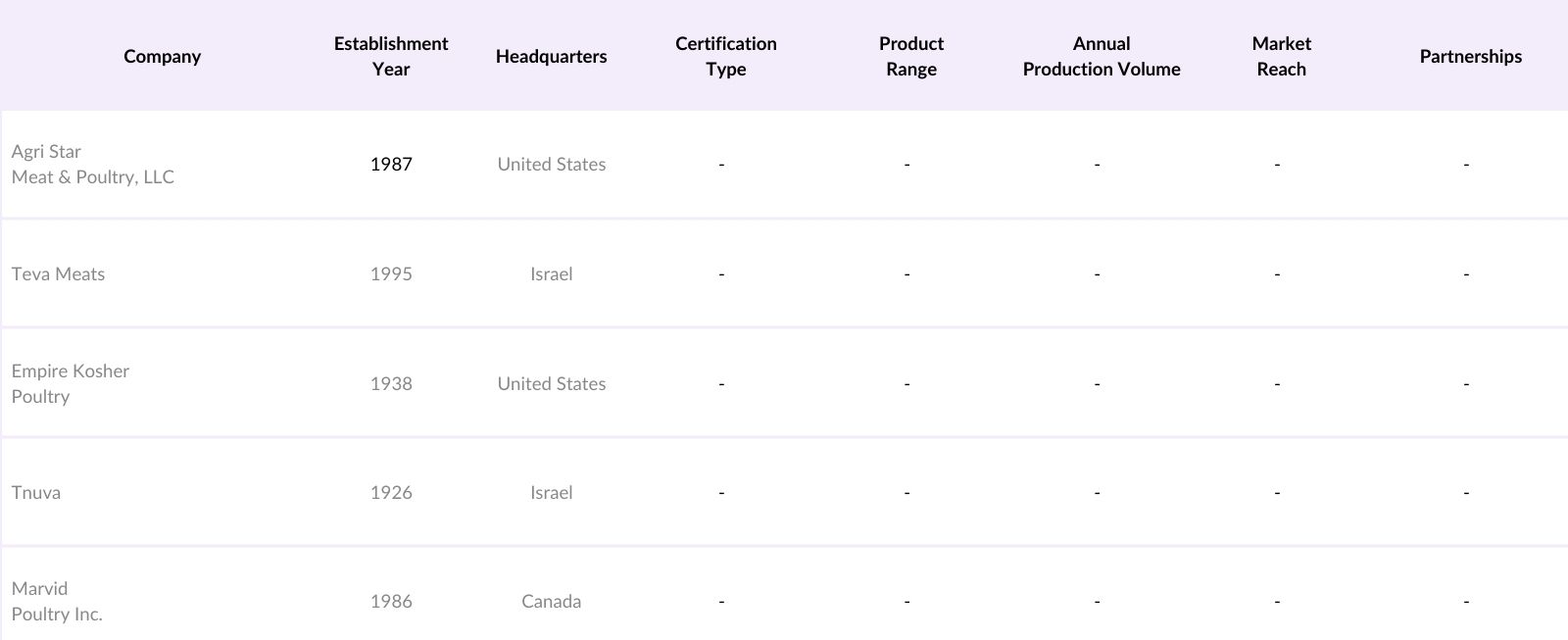

Companies

Players Mentioned in the Report:

Agri Star Meat & Poultry, LLC

Teva Meats

Empire Kosher Poultry

Tnuva

Marvid Poultry Inc.

Solomon Kosher Meat

A.D. Rosenblatt & Co.

Wise Organic Pastures

Glatt Organics

Alle Processing Corp.

Table of Contents

1. Asia Pacific Kosher Beef Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Kosher Beef Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Kosher Beef Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand in Religious Communities

3.1.2 Increasing Awareness of Ethical Meat Sourcing

3.1.3 Government Regulations Supporting Kosher Standards

3.1.4 Export Potential to Middle Eastern Markets

3.2 Market Challenges

3.2.1 Limited Certified Processing Facilities

3.2.2 High Certification and Compliance Costs

3.2.3 Limited Consumer Awareness in Non-Religious Communities

3.3 Opportunities

3.3.1 Expansion of Kosher Beef Products in Retail

3.3.2 Increasing Demand from Health-Conscious Consumers

3.3.3 Growth in Halal and Kosher Co-Certification

3.4 Trends

3.4.1 Premiumization of Kosher Beef Products

3.4.2 Integration of Blockchain for Traceability

3.4.3 Rise in E-Commerce Channels for Kosher Foods

3.5 Regulatory Landscape

3.5.1 Kosher Certification Standards

3.5.2 Government Import-Export Regulations

3.5.3 Religious and Cultural Compliance

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Processors, Distributors, Certification Bodies)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Kosher Beef Market Segmentation

4.1 By Type (In Value %)

4.1.1 Fresh Kosher Beef

4.1.2 Processed Kosher Beef

4.1.3 Frozen Kosher Beef

4.2 By End-Use (In Value %)

4.2.1 Foodservice & HoReCa

4.2.2 Retail Consumers

4.2.3 Institutional Buyers

4.3 By Distribution Channel (In Value %)

4.3.1 Online

4.3.2 Supermarkets & Hypermarkets

4.3.3 Specialty Stores

4.4 By Certification Level (In Value %)

4.4.1 Strictly Kosher Certified

4.4.2 Co-Certified (Kosher-Halal)

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 Australia

4.5.4 India

4.5.5 South Korea

5. Asia Pacific Kosher Beef Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Agri Star Meat & Poultry, LLC

5.1.2 Teva Meats

5.1.3 Empire Kosher Poultry

5.1.4 Tnuva

5.1.5 Solomon Kosher Meat

5.1.6 A.D. Rosenblatt & Co.

5.1.7 Suri Meats

5.1.8 Marvid Poultry Inc.

5.1.9 Wise Organic Pastures

5.1.10 Glatt Organics

5.1.11 Midamar Corporation

5.1.12 Alle Processing Corp.

5.1.13 JBS

5.1.14 Tyson Foods, Inc.

5.1.15 Kiryas Joel Meat Market

5.2 Cross Comparison Parameters (Annual Production Volume, Processing Capacity, Certification Types, Market Share, Country of Operation, Product Range, Supply Chain Strength, Distribution Channels)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Partnerships

5.8 Private Equity Investments

6. Asia Pacific Kosher Beef Market Regulatory Framework

6.1 Certification Standards and Protocols

6.2 Regional Compliance Requirements

6.3 Import-Export Guidelines

6.4 Industry-Specific Environmental and Animal Welfare Regulations

7. Asia Pacific Kosher Beef Future Market Segmentation

7.1 By Type

7.2 By End-Use

7.3 By Distribution Channel

7.4 By Certification Level

7.5 By Region

8. Asia Pacific Kosher Beef Future Market Size (In USD Bn)

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. Asia Pacific Kosher Beef Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Profile Analysis

9.3 Marketing and Positioning Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying and defining the key variables within the Asia Pacific Kosher Beef Market. This includes assessing consumer demand, certification standards, and the distribution network. These variables form the foundation for understanding market dynamics and are derived from a combination of secondary data sources and proprietary databases.

Step 2: Market Analysis and Construction

In this stage, historical data and market trends are analyzed to develop an in-depth view of market growth, revenue generation, and segment dominance. The analysis involves evaluating production volumes, regional market penetration, and distribution trends, providing a holistic view of the market structure.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are developed and validated through expert consultations with representatives from the kosher beef industry. These consultations provide critical insights into market operations, consumer preferences, and regulatory requirements, ensuring accurate market assessment.

Step 4: Research Synthesis and Final Output

In the final phase, data is synthesized to compile the overall market insights. This includes direct engagement with major kosher beef producers and distributors, ensuring the validation and accuracy of all data points, thereby providing a comprehensive market analysis for the Asia Pacific Kosher Beef Market.

Frequently Asked Questions

1. How big is the Asia Pacific Kosher Beef Market?

The Asia Pacific Kosher Beef Market is valued at USD 33 billion, driven by demand for ethically sourced, certified products, supported by regulatory standards and rising consumer health consciousness.

2. What are the major challenges in the Asia Pacific Kosher Beef Market?

Challengesin the Asia Pacific Kosher Beef Market include high certification costs, limited processing facilities, and lower consumer awareness in non-religious communities, impacting market growth and penetration.

3. Who are the major players in the Asia Pacific Kosher Beef Market?

Key players in the Asia Pacific Kosher Beef Market include Agri Star Meat & Poultry, Empire Kosher Poultry, and Tnuva, among others, due to their strong compliance with kosher standards and extensive distribution networks.

4. What drives the demand in the Asia Pacific Kosher Beef Market?

The demand is driven by a rise in ethical consumerism, religious compliance, and the growing preference for high-quality, certified food products, especially in urban centers and among health-focused consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.