Asia Pacific Lactic Acid Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD7211

November 2024

89

About the Report

Asia Pacific Lactic Acid Market Overview

- The Asia Pacific lactic acid market is valued at USD 300 million, driven by the increasing demand for biodegradable plastics and rising applications in food and beverages, pharmaceuticals, and personal care industries. Key growth drivers include the shift towards sustainable and eco-friendly alternatives, as well as government support for green chemicals. Additionally, innovations in fermentation technology have enhanced the production efficiency of lactic acid, propelling the market's steady growth, especially in high-demand sectors.

- China and India are leading the lactic acid market in the Asia Pacific due to their robust manufacturing infrastructure and availability of raw materials. China's dominance is attributed to its large-scale production of biodegradable plastics, while India is experiencing significant growth due to the rising adoption of lactic acid in pharmaceuticals and personal care products. These countries benefit from a strong industrial base, favorable regulatory environments, and growing investments in green technology.

- Governments in the Asia Pacific region are implementing policies aimed at reducing plastic waste and promoting bioplastics. In 2024, China's Ministry of Ecology and Environment introduced a plan to ban all non-degradable plastics by 2030, with intermediate targets set for 2025. Similarly, India launched a national initiative to reduce plastic waste by banning single-use plastics by 2025. These initiatives are driving demand for lactic acid, which is a key component of biodegradable bioplastics, positioning it as a preferred solution for eco-friendly packaging.

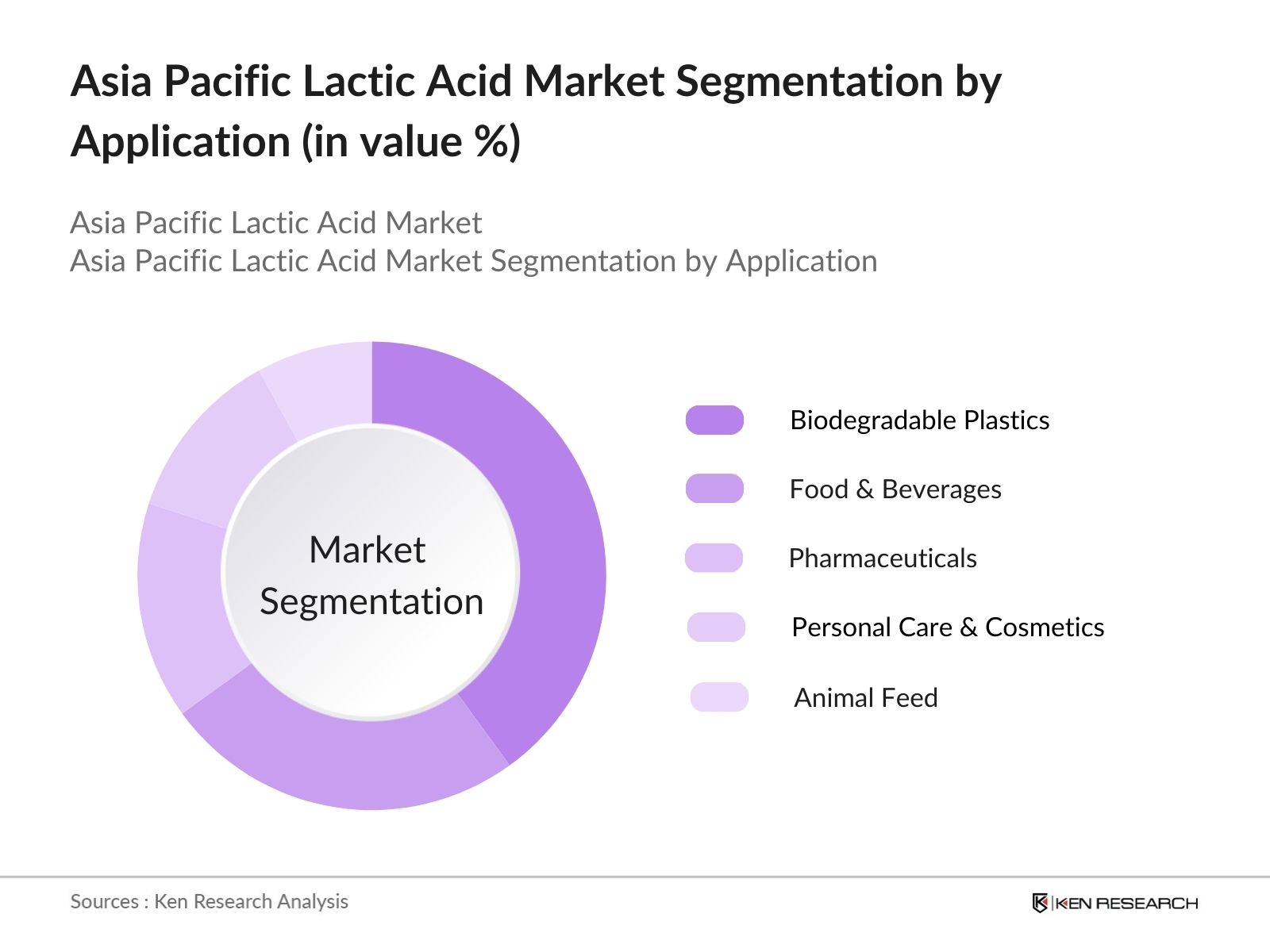

Asia Pacific Lactic Acid Market Segmentation

- By Application The Asia Pacific lactic acid market is segmented by application into biodegradable plastics, food and beverages, pharmaceuticals, personal care and cosmetics, and animal feed. Recently, biodegradable plastics hold a dominant market share within the application segmentation. This is due to stringent government regulations on plastic usage and the growing consumer preference for sustainable packaging. Biodegradable plastics made from lactic acid are increasingly used in packaging, agricultural films, and disposable products, as governments push for eco-friendly solutions to combat plastic waste.

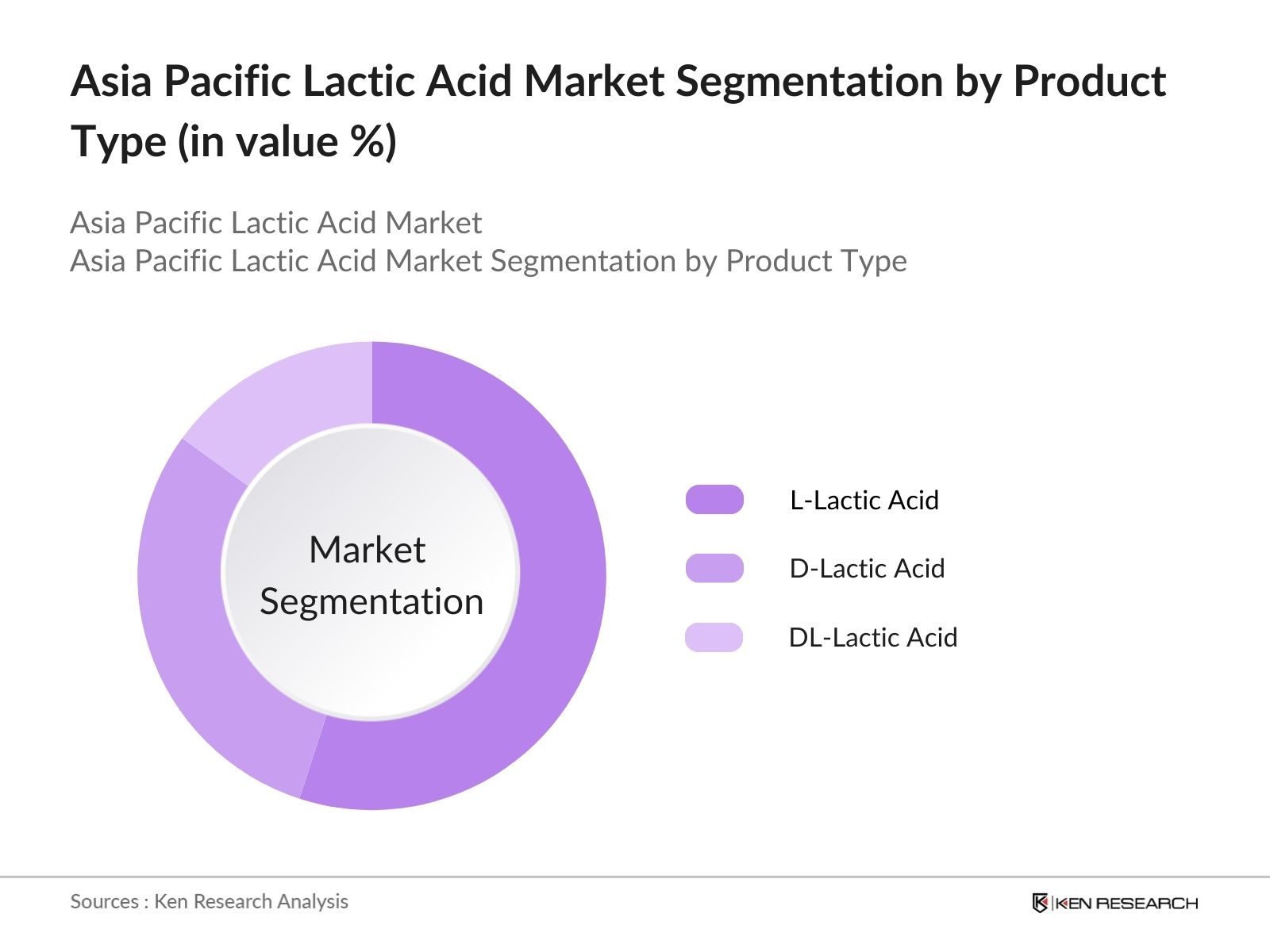

- By Product Type The lactic acid market is also segmented by product type into L-lactic acid, D-lactic acid, and DL-lactic acid. L-lactic acid is the leading sub-segment due to its extensive use in the food, beverage, and pharmaceutical industries. Its high purity level and compatibility with human consumption make it the preferred choice for food preservation and medical applications. Additionally, L-lactic acids usage in biodegradable plastics enhances its demand, especially as the focus on sustainable products continues to grow in the Asia Pacific region.

Asia Pacific Lactic Acid Market Competitive Landscape

The Asia Pacific lactic acid market is primarily dominated by global manufacturers with strong production capabilities, advanced fermentation technologies, and extensive distribution networks. These companies focus on sustainable production and continuous innovation to maintain their competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity (Tons) |

R&D Investment (USD Mn) |

Sustainability Initiatives |

Product Portfolio |

Regional Presence |

Strategic Partnerships |

|

Corbion N.V. |

1919 |

Amsterdam, Netherlands |

||||||

|

BASF SE |

1865 |

Ludwigshafen, Germany |

||||||

|

NatureWorks LLC |

1997 |

Minnesota, USA |

||||||

|

Cargill, Incorporated |

1865 |

Minnesota, USA |

||||||

|

Henan Jindan Lactic Acid |

1984 |

Henan, China |

Asia Pacific Lactic Acid Industry Analysis

Market Growth Drivers

- Rising Demand for Biodegradable Plastics (Demand for eco-friendly alternatives): The Asia Pacific lactic acid market has been significantly driven by the growing demand for biodegradable plastics. Lactic acid is a key component in producing polylactic acid (PLA), a biodegradable plastic widely used in packaging, agriculture, and disposable items. For instance, countries like China and India are actively promoting the use of biodegradable plastics to combat plastic waste pollution, with China alone producing over 40 million metric tons of plastic waste annually. The demand for lactic acid for bioplastics is expected to continue increasing due to stricter plastic waste management regulations. Governments across the region are implementing these regulations to decrease non-biodegradable plastic production, which directly boosts the lactic acid market for PLA production.

- Increased Adoption in Food & Beverage Industry (Functional additives in food products): The food and beverage industry in Asia Pacific has seen increased adoption of lactic acid as a functional additive. Lactic acid is used as a preservative, pH regulator, and flavoring agent in a wide variety of products, including baked goods, dairy products, and beverages. With the region's food sector generating an estimated $4 trillion annually, the demand for natural additives like lactic acid has surged. Japan and South Korea have seen a sharp increase in the consumption of processed food, further boosting the lactic acid market. As consumer preferences shift towards organic and clean-label products, the demand for lactic acid as a natural preservative continues to rise.

- Government Initiatives Promoting Green Chemicals (Regulations on plastic reduction): Governments across Asia Pacific are launching initiatives to reduce the use of conventional plastics and promote green chemicals like lactic acid. India, for example, has committed to eliminating single-use plastics by 2025, leading to increased demand for lactic acid-based bioplastics. In 2024, China further strengthened its environmental policies, aiming to reduce non-biodegradable plastic consumption by 30 million metric tons by 2025. Such stringent regulations are propelling the demand for lactic acid, as it is used to produce eco-friendly alternatives to traditional plastics.

Market Challenges

- High Production Costs (Fermentation process cost constraints): One of the primary challenges facing the lactic acid market is the high cost of production. The fermentation process used to produce lactic acid is resource-intensive, requiring significant investment in feedstock and energy. For example, the cost of industrial fermentation in Asia Pacific regions such as China has been estimated to be around $1,500 per metric ton, with rising energy costs contributing to the overall increase in production expenses. These high production costs may hinder the widespread adoption of lactic acid, especially for small and medium-sized manufacturers.

- Limited Raw Material Availability (Feedstock sourcing issues): Lactic acid production relies heavily on natural feedstocks such as corn and sugarcane, and fluctuations in the availability of these raw materials pose a significant challenge to the market. In 2024, Asia Pacific witnessed several climate-related disruptions affecting corn and sugarcane production, leading to a shortage of feedstocks in countries like Thailand and India. This limitation in raw material availability constrains the capacity of lactic acid production facilities and raises concerns about the sustainability of the supply chain.

Asia Pacific Lactic Acid Market Future Outlook

Over the next five years, the Asia Pacific lactic acid market is expected to show significant growth, driven by increasing applications in bioplastics, pharmaceuticals, and food processing. Governments across the region are focusing on reducing plastic waste and encouraging sustainable production processes, which will further boost the market. Innovations in fermentation technology, coupled with expanding demand for biodegradable products, will contribute to the rising consumption of lactic acid across diverse industries.

Market Opportunities

- Advancements in Fermentation Technology (Cost-effective production methods): The development of more efficient fermentation technologies offers significant opportunities for reducing the production costs of lactic acid. In 2024, research institutions in Japan introduced a breakthrough in continuous fermentation, which reduces energy consumption by 30% compared to traditional batch fermentation methods. This technological advancement enables producers to lower operational costs and scale up production. The adoption of such cost-effective methods is expected to expand the market for lactic acid, particularly in the bioplastics sector.

- Growth in Cosmetics Industry (Increasing use of lactic acid in skincare): The cosmetics industry in Asia Pacific is witnessing robust growth, with lactic acid emerging as a popular ingredient in skincare products. In 2024, the regional cosmetics market was valued at $163 billion, with an increasing demand for products containing natural and organic ingredients. Lactic acid is widely used for its exfoliating and anti-aging properties, particularly in Japan and South Korea, where consumers favor beauty products that offer both functionality and sustainability. The rising awareness of the benefits

Scope of the Report

|

By Raw Material |

Corn-Based Sugarcane-Based Other Plant-Based Sources |

|

By Application |

Biodegradable Plastics Food & Beverage Pharmaceuticals Personal Care & Cosmetics Animal Feed |

|

By Process Type |

Fermentation Chemical Synthesis |

|

By Product Type |

L-Lactic Acid D-Lactic Acid DL-Lactic Acid |

|

By Region |

China India Japan Australia ASEAN Countries |

Products

Key Target Audience

Lactic Acid Manufacturers

Biodegradable Plastics Producers

Food & Beverage Companies

Pharmaceutical Companies

Personal Care & Cosmetic Brands

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agency, Ministry of Industry and Trade)

Raw Material Suppliers

Companies

Major Players

Corbion N.V.

BASF SE

NatureWorks LLC

Cargill, Incorporated

Henan Jindan Lactic Acid Technology Co., Ltd.

Galactic

Futerro S.A.

Teijin Limited

Chongqing Bofei Biochemical Products Co., Ltd.

Zhejiang Hisun Biomaterials Co., Ltd.

Table of Contents

1. Asia Pacific Lactic Acid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Lactic Acid Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Lactic Acid Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Biodegradable Plastics (Demand for eco-friendly alternatives)

3.1.2. Increased Adoption in Food & Beverage Industry (Functional additives in food products)

3.1.3. Government Initiatives Promoting Green Chemicals (Regulations on plastic reduction)

3.1.4. Expansion of Pharmaceutical Applications (Medical and pharmaceutical uses)

3.2. Market Challenges

3.2.1. High Production Costs (Fermentation process cost constraints)

3.2.2. Limited Raw Material Availability (Feedstock sourcing issues)

3.2.3. Environmental Impact of Corn-Based Lactic Acid (Criticism over crop-based inputs)

3.2.4. Competition from Synthetic Alternatives (Growth of cheaper synthetic substitutes)

3.3. Opportunities

3.3.1. Advancements in Fermentation Technology (Cost-effective production methods)

3.3.2. Growth in Cosmetics Industry (Increasing use of lactic acid in skincare)

3.3.3. Potential in Bioplastics (Growth of biodegradable packaging solutions)

3.3.4. Adoption in Animal Feed Industry (Use as an antimicrobial in feed)

3.4. Trends

3.4.1. Increasing Usage in Personal Care Products (Skin and hair care product formulation)

3.4.2. Rising Popularity of Plant-Based Ingredients (Demand for plant-derived lactic acid)

3.4.3. Shift Toward Sustainable Packaging (Growing bioplastic application in packaging)

3.4.4. Integration with Circular Economy Principles (Resource efficiency and recycling practices)

3.5. Government Regulation

3.5.1. Environmental Policies Encouraging Biodegradable Plastics (Plastic ban policies)

3.5.2. Safety Regulations for Food-Grade Lactic Acid (Food safety compliance)

3.5.3. Certifications for Organic and Plant-Based Products (Organic certification requirements)

3.5.4. Government Subsidies for Green Chemicals (Financial support for sustainable chemicals)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Lactic Acid Market Segmentation

4.1. By Raw Material (In Value %)

4.1.1. Corn-Based

4.1.2. Sugarcane-Based

4.1.3. Other Plant-Based Sources

4.2. By Application (In Value %)

4.2.1. Biodegradable Plastics

4.2.2. Food & Beverages

4.2.3. Pharmaceuticals

4.2.4. Personal Care & Cosmetics

4.2.5. Animal Feed

4.3. By Process Type (In Value %)

4.3.1. Fermentation

4.3.2. Chemical Synthesis

4.4. By Product Type (In Value %)

4.4.1. L-Lactic Acid

4.4.2. D-Lactic Acid

4.4.3. DL-Lactic Acid

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. ASEAN Countries

5. Asia Pacific Lactic Acid Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Corbion N.V.

5.1.2. BASF SE

5.1.3. Galactic

5.1.4. Cargill, Incorporated

5.1.5. Henan Jindan Lactic Acid Technology Co., Ltd.

5.1.6. Musashino Chemical (China) Co., Ltd.

5.1.7. NatureWorks LLC

5.1.8. Chongqing Bofei Biochemical Products Co., Ltd.

5.1.9. Futerro S.A.

5.1.10. Zhejiang Hisun Biomaterials Co., Ltd.

5.1.11. Teijin Limited

5.1.12. Jungbunzlauer Suisse AG

5.1.13. Vigon International, Inc.

5.1.14. Danimer Scientific

5.1.15. ThyssenKrupp AG

5.2. Cross Comparison Parameters

5.2.1. Product Portfolio

5.2.2. Production Capacity

5.2.3. Market Presence (Regional and Global)

5.2.4. Sustainability Initiatives

5.2.5. Pricing Strategy

5.2.6. Research & Development Investments

5.2.7. Partnerships & Collaborations

5.2.8. Technology Adoption

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Lactic Acid Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Lactic Acid Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Lactic Acid Future Market Segmentation

8.1. By Raw Material (In Value %)

8.2. By Application (In Value %)

8.3. By Process Type (In Value %)

8.4. By Product Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Lactic Acid Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map for the Asia Pacific lactic acid market, identifying key variables such as production capacity, raw material availability, and consumption trends. Extensive desk research and proprietary databases are utilized to gather market data.

Step 2: Market Analysis and Construction

Historical data is analyzed to evaluate market trends, penetration rates in different industries, and revenue generation. The focus is on assessing demand from key sectors like biodegradable plastics and pharmaceuticals, and ensuring accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses derived from the data are validated through interviews with industry experts from leading lactic acid producers and end-users in various applications. These consultations offer insights into operational challenges, market dynamics, and future trends.

Step 4: Research Synthesis and Final Output

The final phase involves compiling and cross-verifying the data with multiple manufacturers and stakeholders in the value chain, ensuring a robust and accurate analysis of the Asia Pacific lactic acid market. The output includes verified data on market size, segment performance, and competitive positioning.

Frequently Asked Questions

01. How big is the Asia Pacific Lactic Acid Market?

The Asia Pacific lactic acid market is valued at USD 300 million, driven by the growing demand for biodegradable plastics, pharmaceuticals, and food applications. Sustainable production practices and government support have accelerated the markets expansion.

02. What are the challenges in the Asia Pacific Lactic Acid Market?

Challenges in the market include high production costs, limited availability of raw materials, and competition from synthetic alternatives. Additionally, the environmental impact of corn-based lactic acid has led to criticism and a push for more sustainable production practices.

03. Who are the major players in the Asia Pacific Lactic Acid Market?

Key players in the Asia Pacific lactic acid market include Corbion N.V., BASF SE, NatureWorks LLC, Cargill, Incorporated, and Henan Jindan Lactic Acid Technology Co., Ltd. These companies lead the market due to their production capacity, innovation, and sustainability initiatives.

04. What are the growth drivers of the Asia Pacific Lactic Acid Market?

The market is driven by rising demand for biodegradable plastics, increasing applications in food and pharmaceuticals, and favorable government policies supporting green chemistry. Innovations in fermentation technologies also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.