Asia Pacific Laser Printer Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD8262

November 2024

89

About the Report

Asia Pacific Laser Printer Market Overview

The Asia Pacific Laser Printer Market, valued at USD 3.7 billion, has witnessed consistent growth driven by technological advancements and a surge in demand from both corporate and small-to-medium enterprises (SMEs). The demand is attributed to the cost-efficiency, high-quality output, and reduced maintenance needs of laser printers compared to traditional printing technologies. This trend is supported by the region's shift towards digital transformation, with increased adoption across sectors seeking reliable and quick printing solutions for both black-and-white and color outputs. Government support for domestic production and enhanced manufacturing capabilities further contribute to this robust market foundation.

Within the Asia Pacific, China and Japan stand out as dominant players due to their strong manufacturing bases, advanced technology infrastructure, and significant demand from both commercial and industrial sectors. Chinas laser printer market benefits from its extensive manufacturing ecosystem, making it a hub for both production and consumption. Japan's leadership in technology and innovation reinforces its high-quality output and long-standing presence in the laser printing sector, allowing it to maintain dominance in this market. Additionally, countries like India are emerging due to growing office spaces and increasing numbers of SMEs.

Regulations across Asia Pacific impose strict waste manageces for electronic devices. In Singapore, the Environmental Public Health Act enforces guidelines for e-waste management, impacting printer manufacturers regarding toner and cartridge disposal. Compliance with these regulations adds operational costs, pushing manufacturers toward sustainable practices.

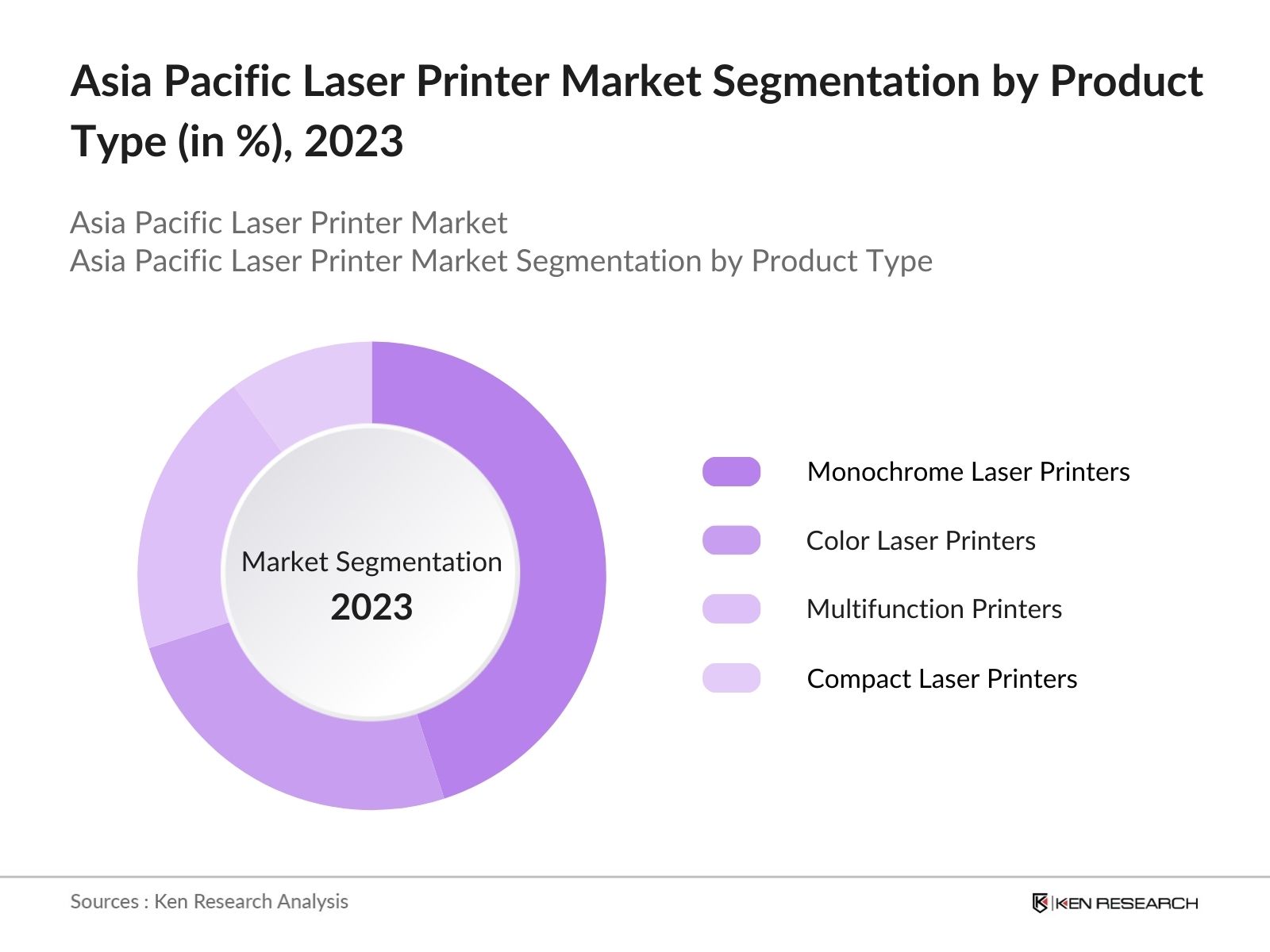

Asia Pacific Laser Printer Market Segmentation

By Product Type: The Market is segmented by product type into monochrome laser printers, color laser printers, multifunction laser printers, and compact laser printers. Recently, monochrome laser printers hold a significant market share in the Asia Pacific under this segment due to their cost-effectiveness, speed, and widespread usage in business and government offices. Monochrome printers are especially popular for tasks requiring high-volume document printing, which is a common requirement across the commercial and educational sectors in developing countries like India and Indonesia.

By Application: The market is segmented by application into office and business, commercial printing services, educational institutions, and home use. Office and business applications have a dominant market share due to the high demand for reliable and high-speed printing solutions. These printers are essential in various business environments for regular documentation, contracts, and record-keeping. The flexibility and scalability of laser printers make them particularly valuable in corporate offices where consistent performance is crucial.

Asia Pacific Laser Printer Market Competitive Landscape

The Asia Pacific Laser Printer Market is dominated by a few key players who control a significant portion of the market due to their established manufacturing capabilities, extensive distribution networks, and innovative product lines. The competitive landscape is further characterized by a focus on R&D investments, partnerships, and technology integration to maintain a competitive edge.

|

Company |

Establishment Year |

Application |

Market Share (2023) |

Headquarters |

Revenue (USD) |

Product Range |

Regional Presence |

Market Strategy |

|

HP Inc. |

1939 |

Office and Business |

40% |

Palo Alto, USA |

||||

|

Canon Inc. |

1937 |

Commercial Printing Services |

30% |

Tokyo, Japan |

||||

|

Brother Industries, Ltd. |

1908 |

Educational Institutions |

20% |

Nagoya, Japan |

||||

|

Xerox Corporation |

1906 |

Home Use |

10% |

Norwalk, USA |

||||

|

Ricoh Company, Ltd. |

1936 |

Tokyo, Japan |

Asia Pacific Laser Printer Industry Analysis

Growth Drivers

Increased Demand from Small and Medium Enterprises: SMEs in the Asia Pacific region have seen significant growth, now accounting for over 98% of all enterprises across the area, employing 50% of the total workforce according to the Asia-Pacific Economic Cooperation (APEC) datausinesses increasingly require efficient, high-quality printing solutions to support operations, creating demand for laser printers, which are valued for their durability and lower total cost of ownership. Countries like Japan and South Korea, where SMEs are a driving force of the economy, demonstrate substantial investments in office equipment, supporting this demand trend for cost-effective, long-term solutions offered by laser printers.

Utilization and Document Management Needs: The Asia Pacific region has accelerated digital transformation with government-backed initiatives like Singapores Smart Nation and Indias Digital India. These initiatives support digital document management to improve workflow efficiency. Laser printers, which facilitate document management through rapid and high-volume printing, are aligned with these needs. According to the World Bank, digital infrastructure investments in the Asia Pacific region reached around USD 340 billion by 2023, underscoring the trend toward integrated digital and physical documentation tools.

Expane Automation Sector: Office automation in Asia Pacific, projected to grow robustly in the coming years, is bolstered by the increasing adoption of productivity-boosting tools. Laser printers, essential for automated workflows, support these advancements. According to data from the International Trade Administration, office equipment imports in markets like China reached approximately USD 80 billion by 2023, reflecting a substantial investment in office automation tools, including advanced printing solutions that integrate with modern digital workflows.

Market Challenges

High Initial Cost and Maintenance: Laser printers typically entail a higher upfront cost compared to inkjet alternatives, which can deter smaller enterprises. For instance, data from Australias Small Business and Family Enterprise Ombudsman indicates that nearly 45% of small businesses operate on limited capital, emphasizing the challenge of investing in high-cost equipment. Additionally, maintenance costs, especially in regions with high import duties on parts, further impact overall expenses. In economies such as India, where office equipment maintenance costs are increasing, this presents a substantial challenge to market growth.

Environmental Regulations on Price: Environmental standards across the Asia Pacific, including Japan's Waste Electrical and Electronic Equipment (WEEE) directive, enforce strict guidelines on e-waste disposal and recycling. Laser printers, with their toner cartridges and e-waste implications, face regulatory pressure to comply with such mandates. According to Japans Ministry of the Environment, e-waste from electronic devices reached over 2 million tons in 2022, with strict guidelines on disposal and recycling that impact the printer market due to associated compliance costs.

Asia Pacific Laser Printer Market Future Outlook

The Asia Pacific Laser Printer Market is anticipated to evolve further as sectors continue to adopt digital transformation strategies, requiring efficient and high-quality printing solutions. Increased investment in environmentally friendly and energy-efficient printer technologies is likely to influence the market, supported by regional government regulations favoring sustainable practices. Additionally, the expansion of cloud-enabled printing solutions and advancements in wireless printing technologies are expected to shape the market trajectory.

Future Market Opportunities

Advancements in Energy Printing Technology: The Asia Pacific region has shown a strong shift toward energy efficiency, especially in large economies like China and Japan, where government incentives support eco-friendly technologies. For example, Japans Ministry of Economy, Trade, and Industry has initiated subsidies for energy-efficient office equipment, resulting in increased demand for printers with reduced power consumption. As of 2023, the energy-saving office equipment market in Japan alone was valued at approximately USD 1 billion, highlighting opportunities for laser printers with advanced energy-efficient features.

Rise of Smart Printers with Wireless and Cloud Integration: Office solutions have gained traction across Asia Pacific, with wireless and cloud-enabled devices supporting remote and hybrid work models. Laser printers featuring cloud connectivity, security, and wireless functions are well-suited to this market. According to the Asia IoT Business Platform, 54% of businesses in the region were already leveraging cloud technology in 2023, creating a natural integration pathway for smart printers, which are expected to complement cloud-based document management.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Product Type |

Monochrome Laser Printers Color Laser Printers Multifunction Laser Printers Compact Laser Printers |

|

By Application |

Office and Business Commercial Printing Services Educational Institutions Home Use |

|

By Connectivity |

Wired Laser Printers Wireless Laser Printers Cloud-Enabled Laser Printers |

|

By End-User |

Corporate Enterprises Small and Medium Enterprises (SMEs) Government and Public Sector Individual Consumers |

|

By Region |

China India Japan South Korea Southeast Asia |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology)

Large Enterprises with Extensive Office Needs

SMEs Expanding Digital Infrastructure

Commercial Printing Services Providers

Educational Institutions with High Document Needs

E-commerce Platforms for Office Supplies

Retailers and Office Equipment Distributors

Companies

Major Players

HP Inc.

Canon Inc.

Brother Industries, Ltd.

Xerox Corporation

Ricoh Company, Ltd.

Epson Corporation

Konica Minolta, Inc.

Kyocera Corporation

Samsung Electronics Co., Ltd.

Dell Technologies Inc.

Oki Electric Industry Co., Ltd.

Pantum International Limited

Lexmark International, Inc.

Fuji Xerox Co., Ltd.

Sharp Corporation

Table of Contents

1. Asia Pacific Laser Printer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics and Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Laser Printer Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Milestones and Developments

3. Asia Pacific Laser Printer Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements in Printing Efficiency

3.1.2. Increased Demand from SMEs

3.1.3. Rising Focus on Digital Transformation

3.1.4. Government Support for Manufacturing Sector

3.2. Market Challenges

3.2.1. High Maintenance and Replacement Costs

3.2.2. Environmental Concerns Related to E-Waste

3.2.3. Limited Scalability in Specific Sectors

3.3. Opportunities

3.3.1. Shift Towards High-Quality Printing

3.3.2. Expansion of Managed Print Services (MPS)

3.3.3. Integration with Smart Devices

3.4. Trends

3.4.1. Adoption of Cloud Printing Solutions

3.4.2. Rise in Portable and Compact Laser Printers

3.4.3. Eco-friendly and Energy-Efficient Printing Solutions

3.5. Government Regulations

3.5.1. Electronic Waste Management Policies

3.5.2. Energy Efficiency Standards

3.5.3. Import and Export Tariffs on Printing Equipment

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Laser Printer Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Monochrome Laser Printers

4.1.2. Color Laser Printers

4.1.3. Multifunction Laser Printers

4.1.4. Compact Laser Printers

4.2. By Application (in Value %)

4.2.1. Office and Business

4.2.2. Commercial Printing Services

4.2.3. Educational Institutions

4.2.4. Home Use

4.3. By Connectivity (in Value %)

4.3.1. Wired Laser Printers

4.3.2. Wireless Laser Printers

4.3.3. Cloud-Enabled Laser Printers

4.4. By End-User (in Value %)

4.4.1. Corporate Enterprises

4.4.2. Small and Medium Enterprises (SMEs)

4.4.3. Government and Public Sector

4.4.4. Individual Consumers

4.5. By Region (in Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Southeast Asia

5. Asia Pacific Laser Printer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. HP Inc.

5.1.2. Canon Inc.

5.1.3. Brother Industries, Ltd.

5.1.4. Xerox Corporation

5.1.5. Ricoh Company, Ltd.

5.1.6. Epson Corporation

5.1.7. Konica Minolta, Inc.

5.1.8. Kyocera Corporation

5.1.9. Samsung Electronics Co., Ltd.

5.1.10. Dell Technologies Inc.

5.1.11. Oki Electric Industry Co., Ltd.

5.1.12. Pantum International Limited

5.1.13. Lexmark International, Inc.

5.1.14. Fuji Xerox Co., Ltd.

5.1.15. Sharp Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Presence, Product Portfolio, R&D Investment, Regional Focus, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Grants and Support Programs

6. Asia Pacific Laser Printer Market Regulatory Framework

6.1. Environmental and Safety Standards

6.2. Compliance and Certification Requirements

6.3. Import Regulations and Trade Policies

7. Asia Pacific Laser Printer Future Market Size (in USD Mn)

7.1. Projected Market Size

7.2. Key Growth Factors Driving Future Demand

8. Asia Pacific Laser Printer Future Market Segmentation

8.1. By Product Type

8.2. By Application

8.3. By Connectivity

8.4. By End-User

8.5. By Region

9. Asia Pacific Laser Printer Market Analysts' Recommendations

9.1. Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map of major stakeholders within the Asia Pacific Laser Printer Market was developed. Secondary and proprietary sources provided insights to identify critical variables such as market size, revenue, and geographic reach.

Step 2: Market Analysis and Construction

Historical data from 2018 to 2023 was compiled to analyze penetration, sector-specific applications, and revenue generation. This phase also reviewed technological advancements in printing and their impact on demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through CATI consultations with industry experts, providing insights on market dynamics, competitive factors, and revenue growth patterns from key industry stakeholders.

Step 4: Research Synthesis and Final Output

The final analysis included feedback from leading manufacturers on segment-specific performance, usage preferences, and consumer demand patterns, ensuring a comprehensive and validated market overview.

Frequently Asked Questions

How big is the Asia Pacific Laser Printer Market?

The Asia Pacific Laser Printer Market was valued at USD 3.7 billion, reflecting a growth trend propelled by demand across office and commercial sectors.

What are the major challenges in the Asia Pacific Laser Printer Market?

Major challenges in the Asia Pacific Laser Printer Market include high initial costs and environmental concerns associated with e-waste management, as well as limited scalability in certain markets due to cost factors.

Who are the key players in the Asia Pacific Laser Printer Market?

Key players in the Asia Pacific Laser Printer Market include HP Inc., Canon Inc., Brother Industries, Xerox Corporation, and Ricoh Company, who hold significant influence through their extensive distribution networks and strong brand presence.

What drives growth in the Asia Pacific Laser Printer Market?

Growth in the Asia Pacific Laser Printer Market is driven by increasing demand for efficient office solutions, rising adoption of digital transformation strategies, and government support for domestic manufacturing sectors.

What are the dominant regions in the Asia Pacific Laser Printer Market?

Dominant regions in the Asia Pacific Laser Printer Market include China, due to its robust manufacturing infrastructure, and Japan, known for technological advancements in printing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.